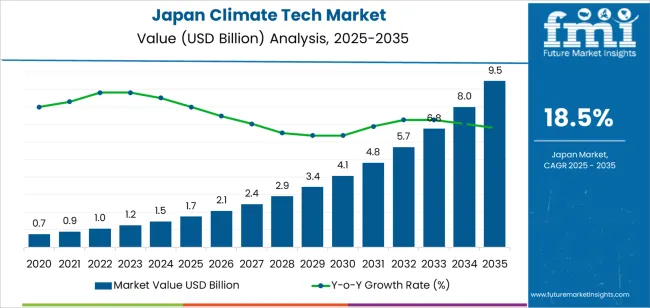

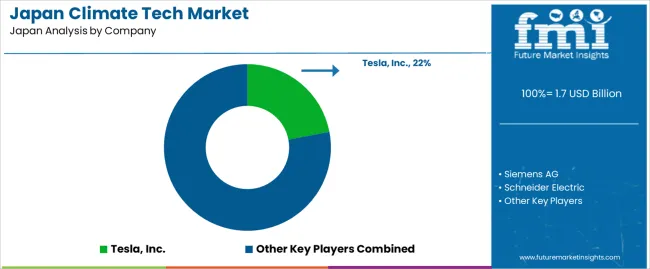

The demand for climate tech in Japan is valued at USD 1.7 billion in 2025 and is expected to reach USD 9.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 18.5%. The growth in demand is driven by Japan’s commitment to achieving carbon neutrality by 2050, increasing government incentives for green technologies, and the growing need for advanced solutions in energy, transportation, and industrial sectors. As climate change mitigation becomes a top priority, climate tech solutions, including renewable energy, energy storage, carbon capture, and smart grids, are gaining momentum. The expanding focus on environmental protection across various industries contributes significantly to the rise in demand for climate technologies.

The market shows strong growth, starting at USD 0.7 billion in earlier years and increasing to USD 1.7 billion by 2025. This demand continues to accelerate, reaching USD 9.5 billion by 2035. The year-on-year growth is significant, moving from USD 2.1 billion in 2026 to USD 2.4 billion in 2027, followed by further rapid increases through to 2035. This strong upward trajectory reflects Japan’s push toward advanced technologies in energy and carbon management, driven by policy changes, corporate initiatives, and growing public awareness of climate change. The increasing adoption of climate tech solutions across multiple sectors is expected to maintain this high growth throughout the forecast period.

Demand in Japan for climate tech is projected to increase from USD 1.7 billion in 2025 to USD 9.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 18.5%. After starting at USD 0.7 billion in 2020, the value rises through USD 1.2 billion in 2024 and reaches USD 1.7 billion in 2025. Growth is driven by the government’s decarbonisation initiatives, rising investment in renewable energy, energy storage systems, carbon capture technologies, and smart grid solutions. As Japan intensifies efforts to meet its net zero target, demand for climate tech solutions will gain significant momentum across power, transportation, manufacturing and built environment applications.

Deployment of climate tech in the latter half of the decade will accelerate further as cost curves improve and regulatory frameworks strengthen. Between 2025 and 2030, demand is expected to climb from USD 1.7 billion to around USD 4.1 billion, supported by large scale solar, offshore wind projects, hydrogen pilot programmes and electric mobility infrastructure upgrades. From 2030 to 2035, additional gains will push demand to USD 9.5 billion as technologies scale, project pipelines mature, and public private partnerships expand. Japan’s positioning as a climate tech adopter will attract both domestic and foreign investment, making this rapid growth a key component of its sustainable tech transition.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.7 billion |

| Forecast Value (2035) | USD 9.5 billion |

| Forecast CAGR (2025–2035) | 18.5% |

The demand for climate tech in Japan is driven by its national target to achieve carbon neutrality by 2050 and the need to reduce greenhouse gas emissions across energy , industry and infrastructure sectors. Japan’s government is increasing investment in technologies such as renewable energy, energy efficiency and low carbon manufacturing to meet these goals. Japanese companies are under pressure to improve sustainability and reduce operational emissions, which creates demand for solutions such as smart energy systems, carbon capture technologies and material efficiency upgrades. The push for renovation of buildings, electrification of transport and decarbonisation of heavy industry also supports the uptake of climate tech across Japan.

Corporate commitments and public funding are reinforcing this demand in Japan. Large Japanese firms have adopted net zero pledges and are sourcing clean energy and low emission technologies to comply with regulatory pressures and investor expectations. The government has allocated funds to support startups developing climate tech solutions and to help commercialise such technologies, which strengthens the ecosystem. Despite barriers such as high capital costs, grid integration issues and regulatory complexity, the overall momentum for climate tech adoption in Japan remains strong as industry and government align on decarbonisation.

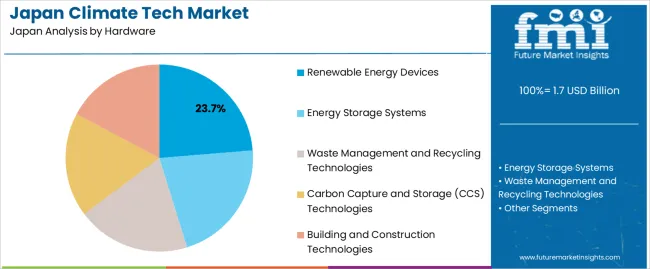

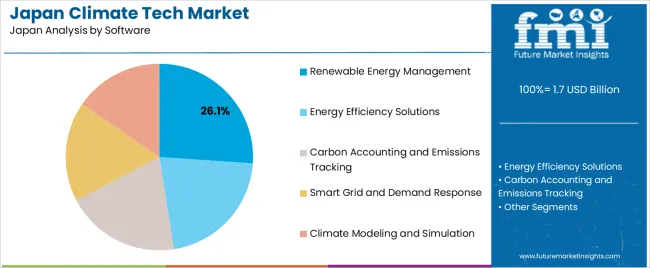

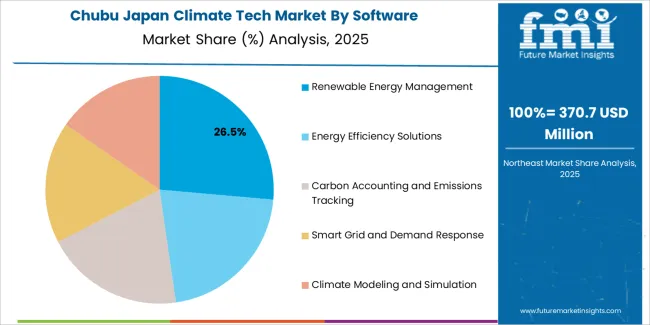

The demand for climate tech in Japan is influenced by both hardware and software solutions. Hardware solutions include renewable energy devices, energy storage systems, waste management and recycling technologies, carbon capture and storage (CCS) technologies, and building and construction technologies. Software solutions encompass renewable energy management, energy efficiency solutions, carbon accounting and emissions tracking, smart grid and demand response, and climate modeling and simulation. These segments reflect the growing need for integrated climate technologies to help Japan meet its sustainability goals and address climate change.

Renewable energy devices account for 24% of the hardware demand in Japan. These devices, including solar panels, wind turbines, and other renewable energy generation technologies, are in high demand due to Japan’s strong push to diversify its energy mix and reduce dependence on fossil fuels. The government’s commitment to increasing the share of renewable energy in the national grid supports the widespread adoption of these devices. As the country seeks to enhance energy security and reduce carbon emissions, renewable energy devices remain a crucial component of Japan’s climate tech infrastructure.

The demand for renewable energy devices is also driven by ongoing investment in energy infrastructure and smart grid systems. These devices are essential in meeting the growing demand for clean energy, particularly in residential, commercial, and industrial applications. As Japan continues to focus on sustainable development and reducing environmental impact, renewable energy devices will remain a key driver of the climate tech sector, contributing to the country’s long-term energy goals.

Renewable energy management software represents 26.1% of the software demand in Japan. This software plays a critical role in integrating renewable energy sources into the national grid by managing the variability of solar and wind energy. With the increasing share of renewables in Japan’s energy mix, the need for software that optimizes energy generation, storage, and distribution has become essential. Renewable energy management software allows utilities and energy companies to efficiently forecast, control, and distribute renewable power, ensuring a stable and reliable energy supply.

The demand for renewable energy management software is also fueled by Japan’s commitment to reducing carbon emissions and improving energy efficiency. As the country invests in smart grid technologies and energy storage systems, the role of software in managing these systems will continue to grow. Renewable energy management software not only supports the integration of renewables but also helps improve grid stability and energy efficiency, making it a key component of Japan’s climate tech sector.

Japan’s commitment to achieving carbon neutrality by 2050 is driving significant demand for climate tech solutions across industries. With government support, businesses are increasingly investing in renewable energy, energy storage, carbon capture, and other low-carbon technologies. The country’s push for sustainability is compounded by the rising frequency of climate-related events, prompting both public and private sectors to innovate. However, challenges like high initial investment costs, slow adoption of new technologies, and regulatory hurdles limit the pace of growth, despite the long-term potential for climate tech in Japan.

How is Japan’s commitment to carbon neutrality influencing the demand for climate tech?

Japan’s pledge to achieve carbon neutrality by 2050 is fueling the demand for various climate tech solutions, particularly in energy transition and sustainable infrastructure. The government’s push for decarbonization through policies and incentives is encouraging businesses to adopt technologies such as renewable energy systems, smart grids, and electric vehicles. Additionally, efforts to increase energy efficiency in manufacturing and transportation sectors are accelerating the adoption of climate tech. As Japan strives to meet its ambitious carbon-reduction targets, the demand for climate tech solutions continues to rise across sectors.

What opportunities are emerging for climate tech in Japan’s industrial sectors?

The industrial sectors in Japan, including manufacturing, construction, and transportation, present significant opportunities for climate tech adoption. As industries look to reduce emissions, opportunities are arising for technologies like carbon capture, energy storage, and green building solutions. The increasing use of automation and AI in manufacturing is also driving demand for smarter, energy-efficient technologies. Additionally, Japan’s established infrastructure in automotive and electronics provides a strong foundation for the development of electric vehicles and other low-carbon technologies, offering growth potential for climate tech solutions in these areas.

What challenges are limiting the growth of climate tech in Japan?

Despite growing demand, the adoption of climate tech in Japan faces several barriers. High upfront investment costs for new technologies, along with long payback periods, are significant hurdles, especially for small and medium-sized enterprises (SMEs). Additionally, regulatory uncertainties and slow policymaking can delay the deployment of some technologies. There is also a gap in the commercialization of some innovations, with the country’s technological ecosystem often struggling to scale new solutions rapidly. Overcoming these challenges requires greater alignment between government policies, business incentives, and technological innovation.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 23.1% |

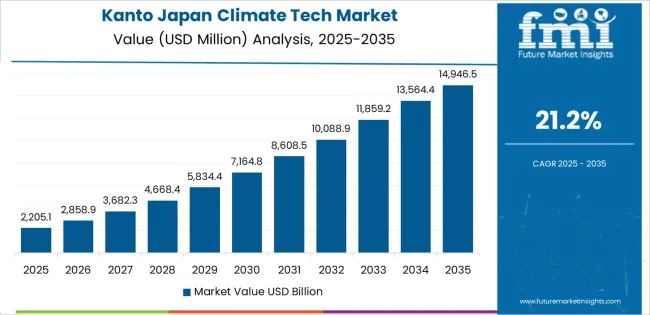

| Kanto | 21.2% |

| Kinki | 18.6% |

| Chubu | 16.4% |

| Tohoku | 14.4% |

| Rest of Japan | 13.7% |

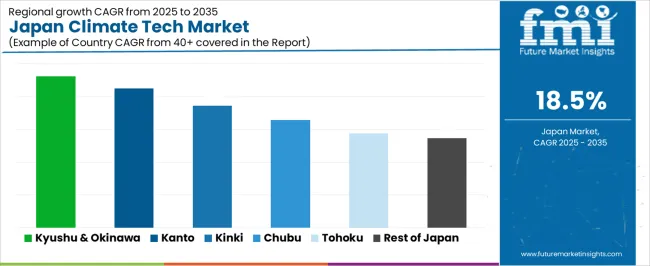

The demand for climate tech in Japan is growing rapidly, with Kyushu and Okinawa leading at a 23.1% CAGR. This surge is driven by government initiatives, regional sustainability projects, and increasing investments in renewable energy and green technologies. Kanto follows at 21.2%, fueled by its dense urban population and strong commitment to carbon reduction and environmental solutions. Kinki experiences 18.6% growth, supported by innovation hubs and industrial sustainability efforts. Chubu records 16.4%, with rising investments in eco-friendly technologies and energy efficiency. Tohoku, growing at 14.4%, is adopting climate tech gradually, while the rest of Japan shows a steady 13.7% growth, reflecting broad national efforts to combat climate change.

Kyushu & Okinawa is projected to grow at a CAGR of 23.1% through 2035 in demand for climate tech. The region’s commitment to renewable energy, energy efficiency, and sustainable development drives the adoption of climate technologies. Kyushu & Okinawa are heavily investing in green energy solutions such as solar, wind, and geothermal power. As the region’s government pushes for carbon reduction and environmental sustainability, industries and consumers alike are adopting climate tech solutions for cleaner energy and efficient resource use. The region’s strong focus on environmental conservation accelerates this market’s growth.

Kanto is projected to grow at a CAGR of 21.2% through 2035 in demand for climate tech. As Japan’s economic hub, the region leads the nation in adopting climate technologies for energy efficiency, renewable power, and carbon management. Tokyo, a key player in the global push for sustainability, is driving initiatives for smart cities, green buildings, and low-carbon transport. With increasing demand for sustainable solutions, both industrial and residential sectors in Kanto are heavily investing in climate tech to meet environmental goals and improve energy performance.

Kinki is projected to grow at a CAGR of 18.6% through 2035 in demand for climate tech. The region’s large manufacturing and industrial base, coupled with a strong push towards environmental responsibility, fosters the adoption of climate technologies. Osaka, as a major industrial center, is increasingly investing in energy-efficient systems, green manufacturing practices, and carbon reduction technologies. Additionally, the region's focus on sustainable urban development, clean energy solutions, and eco-friendly transportation systems continues to drive the need for climate tech solutions across commercial and residential sectors.

Chubu is projected to grow at a CAGR of 16.4% through 2035 in demand for climate tech. The region’s manufacturing and energy sectors are investing in advanced climate technologies, particularly in renewable energy and energy efficiency solutions. Nagoya, a major industrial hub, is embracing green technologies for both its production processes and infrastructure. The region’s commitment to reducing emissions and enhancing resource efficiency further accelerates the adoption of climate tech. As the region focuses on transitioning to a low-carbon economy, demand for sustainable technologies in Chubu continues to rise.

Tohoku is projected to grow at a CAGR of 14.4% through 2035 in demand for climate tech. The region’s transition to renewable energy, particularly solar and wind power, is a key driver of climate tech adoption. As one of the more rural areas of Japan, Tohoku faces challenges in energy access, but the expansion of climate technologies is helping overcome these barriers. Government incentives and local initiatives promoting clean energy solutions and environmental sustainability are accelerating the adoption of climate technologies in residential, commercial, and industrial applications across the region.

The Rest of Japan is projected to grow at a CAGR of 13.7% through 2035 in demand for climate tech. In regions outside major urban centers, demand for climate solutions is rising as local governments focus on carbon reduction and energy efficiency. While these areas are less industrialized, the increasing adoption of renewable energy, eco-friendly technologies, and sustainable practices is evident. As the need for decentralized energy systems and energy-efficient technologies grows, rural and suburban regions are investing in climate tech to meet both environmental and economic goals.

The demand for climate tech in Japan is driven by the country’s strong commitment to sustainability and its goals of achieving net-zero emissions by 2050. As a leader in technology and innovation, Japan is investing heavily in clean energy solutions, electric vehicles, energy-efficient systems, and smart infrastructure. The increasing need to address climate change, reduce reliance on fossil fuels, and improve energy security in the wake of natural disasters further accelerates the adoption of climate tech. Policies and incentives from the government also support the development of green technologies across various sectors, including energy, transportation, and industry, pushing businesses to integrate sustainable practices into their operations.

Key players shaping the climate tech industry in Japan include Tesla, Inc., Siemens AG, Schneider Electric, General Electric (GE), and Vestas Wind Systems. These companies provide cutting-edge solutions in electric mobility, renewable energy generation, energy storage, smart grids, and energy efficiency. Tesla’s advancements in electric vehicles and energy storage systems, Siemens and Schneider Electric’s expertise in smart grid technologies, GE’s leadership in renewable energy solutions, and Vestas’ focus on wind power all contribute significantly to Japan’s climate tech landscape. These companies are instrumental in supporting Japan’s transition toward a more sustainable future.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Use | Utilities & Energy Providers, Businesses/Corporates, Manufacturing Industries, Environment Monitoring Agencies, Research Institutions & Labs |

| Product Type | Renewable Energy Devices, Energy Storage Systems, Waste Management and Recycling Technologies, Carbon Capture and Storage (CCS) Technologies, Building and Construction Technologies |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Tesla, Inc., Siemens AG, Schneider Electric, General Electric (GE), Vestas Wind Systems |

| Additional Attributes | Dollar by sales across product type, technology, and application sectors, government initiatives, regulatory frameworks, industry partnerships, environmental goals, and business investment trends |

The demand for climate tech in Japan is estimated to be valued at USD 1.7 billion in 2025.

The market size for the climate tech in Japan is projected to reach USD 9.5 billion by 2035.

The demand for climate tech in Japan is expected to grow at a 18.5% CAGR between 2025 and 2035.

The key product types in climate tech in Japan are renewable energy devices, energy storage systems, waste management and recycling technologies, carbon capture and storage (ccs) technologies and building and construction technologies.

In terms of software, renewable energy management segment is expected to command 26.1% share in the climate tech in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA