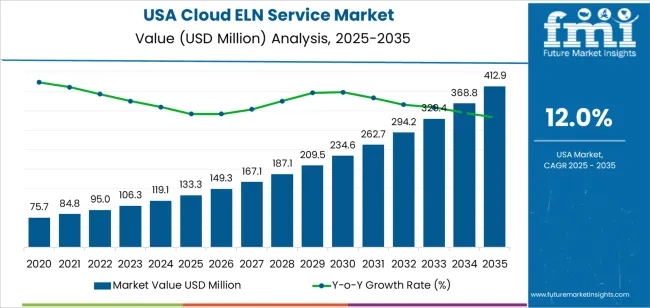

The demand for Cloud ELN (Electronic Lab Notebook) services in the USA is valued at USD 133.3 million in 2025 and is projected to reach USD 412.9 million by 2035, reflecting a CAGR of 12.0%. The growth is primarily driven by the increasing adoption of digital solutions across research and development sectors, particularly in pharmaceutical, biotechnology, and academic industries. Cloud-based ELN systems offer improved data management, collaboration, and compliance, making them a key choice for organizations aiming to streamline workflows and enhance data security.

Over the forecast period, the demand is expected to rise due to continued advancements in cloud technologies, regulatory requirements for data management, and the growing emphasis on research efficiency and reproducibility. By 2035, the widespread implementation of cloud-based solutions in research laboratories will contribute to more significant market penetration. As the sector matures, growth may moderate in later years, but innovations in cloud infrastructure and integration with other lab management tools will continue to drive demand. The trend toward seamless data integration and real-time collaboration will keep Cloud ELN services in high demand throughout the forecast period.

Demand in USA for cloud ELN (Electronic Laboratory Notebook) service is expected to increase from USD 133.3 million in 2025 to USD 412.9 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 12.0%. The progression begins from USD 75.7 million in 2020, moves through USD 133.3 million in 2025, then reaches USD 234.6 million in 2030, and ultimately USD 412.9 million in 2035. Key drivers include the increasing shift of laboratory operations from on premise to cloud environments, growing demand for digital collaboration in R&D, and rising regulatory compliance requirements in life sciences and pharmaceuticals.

As laboratories in USA increasingly adopt remote workflows and seek to integrate data across instruments and teams, cloud ELN services are gaining traction for their scalability, flexibility, and cost efficiency. The rise of hybrid research models and emphasis on data integrity and audit trails further accelerate adoption. Larger gains in the later half of the decade are expected as advanced features such as AI driven analytics, real time collaboration, and multi site deployment become standard. By 2035, cloud ELN service will be a foundational component in lab informatics ecosystems, supporting high throughput research and enabling greater experimental transparency and efficiency.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 133.3 million |

| Forecast Value (2035) | USD 412.9 million |

| Forecast CAGR (2025 to 2035) | 12.0% |

The demand for Cloud ELN (Electronic Laboratory Notebooks) services in USA is experiencing significant growth as research institutions, pharmaceutical companies, and academic organizations increasingly embrace digital transformation. The transition from traditional paper-based documentation to cloud-based solutions offers improved data management, accessibility, and security. Cloud ELN services enable researchers to store, organize, and share data remotely, enhancing collaboration and reducing the risk of data loss.

Another factor propelling the demand is the need for regulatory compliance. Cloud ELN services help organizations meet industry standards and regulations, such as 21 CFR Part 11, by providing features like audit trails, data integrity, and electronic signatures. The growing focus on data-driven decision-making in research is also contributing to the adoption of these services.

Cost-effectiveness is another driving force. Cloud-based solutions eliminate the need for expensive on-site infrastructure and maintenance, making them more accessible to a wide range of organizations, from small startups to large enterprises. As research becomes more collaborative and global in nature, the need for real-time, scalable, and secure data sharing across different teams and locations further drives the demand for Cloud ELN services in USA.

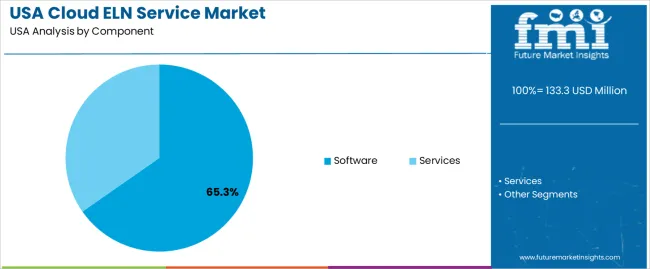

The demand for Cloud Electronic Lab Notebook (ELN) services in the USA is influenced by both component and deployment types. The component segment is divided into software, while the deployment segment focuses on cloud-based solutions. These categories drive the adoption and growth of Cloud ELNs across various industries.

The software component of Cloud ELN services holds a dominant position, accounting for 65% of the total demand in 2025. This dominance stems from the critical role that software solutions play in streamlining lab processes. Cloud ELN software provides features like real-time data capture, efficient record-keeping, and easy sharing across teams, making it indispensable for research environments. Additionally, integration with other lab systems enhances workflow efficiency, which drives the adoption of software-based solutions in research and development sectors.

Furthermore, the increased emphasis on data security and regulatory compliance has spurred demand for robust software systems. Research institutions and industries, particularly in pharmaceuticals and biotechnology, require ELNs that not only store data but also ensure its integrity and traceability. Software solutions that enable seamless integration with data analytics platforms and laboratory instruments are increasingly preferred, further fueling the demand for software in the Cloud ELN market. As the need for efficient, scalable solutions grows, the software segment continues to lead the industry.

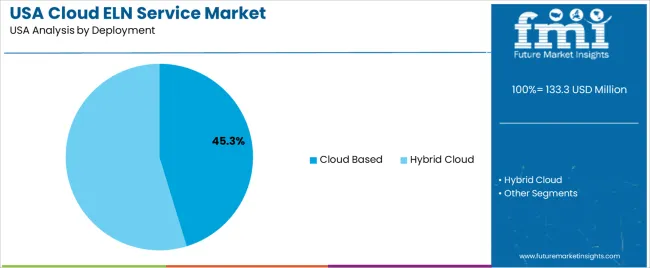

Cloud-based deployment is projected to grow at a 45.3% share, largely due to its scalability and flexibility. The cloud model allows users to access their ELNs from anywhere, facilitating remote work and collaboration. This is especially critical as organizations increasingly embrace digital transformation. Cloud deployments eliminate the need for extensive on-site infrastructure, reducing costs and simplifying maintenance. This flexibility makes cloud-based ELNs highly appealing for research labs looking for efficient, cost-effective solutions that can scale as their operations grow.

In addition, cloud-based deployment addresses the growing need for real-time data sharing and collaboration among geographically dispersed research teams. The ability to store large amounts of data securely in the cloud also enhances data management and retrieval efficiency. As cloud infrastructure continues to evolve, offering faster speeds and more robust security features, its adoption is expected to rise. The increased accessibility, coupled with improved cloud security protocols, positions cloud deployment as the preferred choice for many research institutions, further driving its demand in the Cloud ELN service sector.

The demand for Cloud ELN (Electronic Lab Notebook) services in the USA is driven by the increasing shift toward digitalization in research and development, particularly in pharmaceuticals and biotechnology. Cloud-based ELNs offer significant benefits, such as scalable storage, enhanced collaboration, and real-time access to data across multiple locations. However, concerns related to data security, integration with existing systems, and regulatory compliance remain challenges. Understanding the key drivers, trends, and constraints will help businesses capitalize on the growing adoption of Cloud ELN services in the USA.

A significant trend influencing the demand for Cloud ELN services is the growing integration of AI and machine learning technologies. These advanced capabilities allow for real-time data analysis, predictive insights, and automation, enhancing the value of Cloud ELNs in research environments. As researchers look for smarter ways to analyze data and streamline workflows, AI-driven features are becoming a key differentiator, making Cloud ELNs more attractive for pharmaceutical and biotechnology companies seeking efficiency and accuracy.

A major driver for the growth of Cloud ELN services in the USA is the increasing need for regulatory compliance in the research and development sector. With strict regulations such as 21 CFR Part 11 governing electronic records and signatures, cloud-based ELNs offer secure and compliant storage solutions that ensure data integrity, traceability, and audit trails. The adoption of Cloud ELNs helps organizations comply with these regulatory requirements while streamlining data management and enhancing collaboration among geographically dispersed teams.

One of the key restraints limiting the widespread adoption of Cloud ELN services is concerns over data security and privacy. Many research organizations, especially those handling sensitive or proprietary data, are hesitant to store their information on third-party cloud servers due to fears of data breaches or unauthorized access. Although cloud providers implement robust security measures, the perceived risks associated with cloud storage continue to hold back some institutions from fully embracing Cloud ELN solutions.

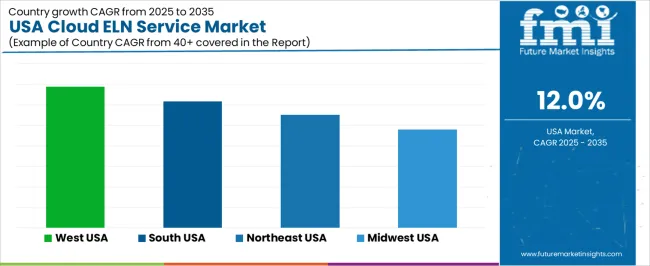

| Region | CAGR (%) |

|---|---|

| West | 13.8% |

| South | 12.3% |

| Northeast | 11.0% |

| Midwest | 9.6% |

The demand for Cloud ELN (Electronic Lab Notebook) services in the USA is experiencing strong growth, with the West leading the charge at a 13.8% CAGR. This growth is driven by the region's advanced tech infrastructure, a high concentration of research institutions, and widespread adoption of digital solutions across laboratories. The South follows with a 12.3% CAGR, as industries such as pharmaceuticals and biotechnology continue to embrace cloud-based solutions for their data management needs. The Northeast sees a demand increase of 11.0%, fueled by a combination of urban research facilities and academic institutions. The Midwest, growing at 9.6%, is also experiencing steady adoption, primarily driven by manufacturing and research sectors seeking more efficient, scalable lab management systems.

The West region of the USA is projected to grow at a CAGR of 13.8% through 2035 in demand for cloud electronic laboratory notebook (ELN) services. With a strong presence of tech companies, research institutions, and healthcare facilities, the region is a key driver of cloud ELN adoption. States like California and Washington lead in digital transformation initiatives, boosting demand for cloud-based solutions. The rapid growth of life sciences, biotech, and pharmaceuticals in the West further contributes to the need for efficient, secure data management through cloud ELN services.

The South region of the USA is projected to grow at a CAGR of 12.3% through 2035 in demand for cloud ELN services. The region’s expanding research, pharmaceutical, and healthcare industries increasingly rely on cloud-based ELN services to improve data management, enhance collaboration, and streamline laboratory workflows. States like Texas and Florida, with their thriving life sciences and tech sectors, play a central role in this growth. The region’s continued investment in digital infrastructure and emphasis on technology adoption further accelerate the shift towards cloud ELN solutions.

The Northeast region of the USA is projected to grow at a CAGR of 11% through 2035 in demand for cloud ELN services. With a high concentration of prestigious universities, research institutions, and healthcare providers, the region leads in adopting cloud-based solutions for laboratory data management. States like New York and Massachusetts drive innovation in the life sciences and biotech industries, boosting the need for efficient data storage and collaboration tools. As regulatory requirements for data security and compliance increase, cloud ELN services become essential for maintaining secure, accessible research data.

The Midwest region of the USA is projected to grow at a CAGR of 9.6% through 2035 in demand for cloud ELN services. The region’s strong manufacturing, agriculture, and research sectors contribute to the growing need for digital data management solutions. States like Illinois and Michigan, with their established biotech and pharmaceutical industries, continue to drive demand for cloud ELN services to streamline research workflows and improve data management. The region’s increasing focus on digital transformation and data-driven research further fuels the growth of cloud ELN adoption in laboratories and research facilities.

The demand for cloud-based electronic laboratory notebook (ELN) services in the USA is primarily driven by the increasing adoption of digital solutions across research and development sectors. As industries like pharmaceuticals, biotechnology, and academic research aim to streamline their workflows, cloud ELNs offer significant advantages over traditional paper-based systems. These platforms enable better data management through enhanced security features, real-time collaboration, and seamless access from any location.

Cloud ELNs are also increasingly compliant with stringent regulatory requirements, such as FDA 21 CFR Part 11, ensuring they meet the necessary standards for data integrity. Furthermore, the integration of technologies like artificial intelligence (AI) and machine learning (ML) with cloud ELNs is accelerating research and improving productivity, making these solutions indispensable for forward-thinking organizations.

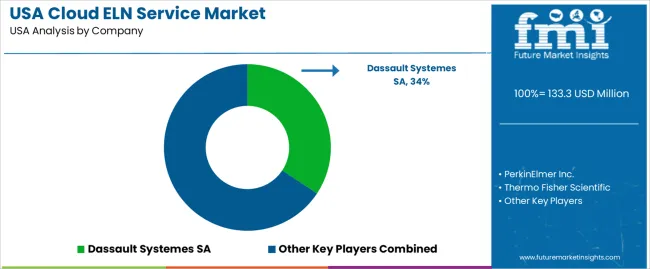

Key players in the USA cloud ELN sector include Dassault Systèmes SA, PerkinElmer Inc., Thermo Fisher Scientific, Agilent Technologies Inc., and Bruker Corporation. These companies lead the market by offering comprehensive solutions that integrate their laboratory instruments with cloud-based ELN platforms, ensuring their products meet the evolving needs of research organizations.

Thermo Fisher Scientific and Bruker Corporation leverage their extensive experience in laboratory instrumentation and informatics to expand their cloud ELN services, providing integrated, user-friendly solutions. Similarly, Dassault Systèmes, PerkinElmer, and Agilent Technologies offer scalable platforms that facilitate data sharing, analysis, and collaboration. These companies are well-positioned to maintain their competitive edge in the market through continuous innovation and by meeting the growing demand for more efficient and compliant research tools.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Component | Software, Services |

| Deployment | Cloud Based, Hybrid Cloud |

| Enterprise Size | Small Offices (1 9 employees), Small Enterprises (10 99 employees), Medium sized Enterprises (100 499 employees), Large Enterprises (500 999 employees), Very Large Enterprises (1,000+ employees) |

| Industry | Enterprises/Corporates, Event Management Agencies, Academic Institutions, Trade Show Organizers, Others |

| Regions Covered | West, South, Northeast, Midwest |

| Countries Covered | USA |

| Key Companies Profiled | Dassault Systèmes SA, PerkinElmer Inc., Thermo Fisher Scientific, Agilent Technologies Inc., Bruker Corporation |

| Additional Attributes | Dollar by sales by component, deployment, enterprise size and industry; regulatory compliance (21 CFR Part 11); AI/ML integration; remote collaboration and multi site deployment trends; scalability, security and cloud infrastructure adoption; user adoption by geography and enterprise size. |

The global demand for cloud ELN service in USA is estimated to be valued at USD 133.3 million in 2025.

The market size for the demand for cloud ELN service in USA is projected to reach USD 412.9 million by 2035.

The demand for cloud ELN service in USA is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in demand for cloud ELN service in USA are software and services.

In terms of deployment, cloud based segment to command 45.3% share in the demand for cloud ELN service in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Data Encryption Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cloud Analytics Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud Compliance Market Size and Share Forecast Outlook 2025 to 2035

Cloud-Based ITSM Market Size and Share Forecast Outlook 2025 to 2035

Cloud IT Infrastructure Hardware Market Size and Share Forecast Outlook 2025 to 2035

Cloud POS Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cloud Seeding System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Based Collaboration Software Market Size and Share Forecast Outlook 2025 to 2035

Cloudifier Market Size and Share Forecast Outlook 2025 to 2035

Cloud Database and DBaaS Market Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Billing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Access Security Brokers Market Size and Share Forecast Outlook 2025 to 2035

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Cloud API And Management Platforms And Middleware Market Size and Share Forecast Outlook 2025 to 2035

Cloud Encryption Market Size and Share Forecast Outlook 2025 to 2035

Cloud-RAN (Radio Access Network) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA