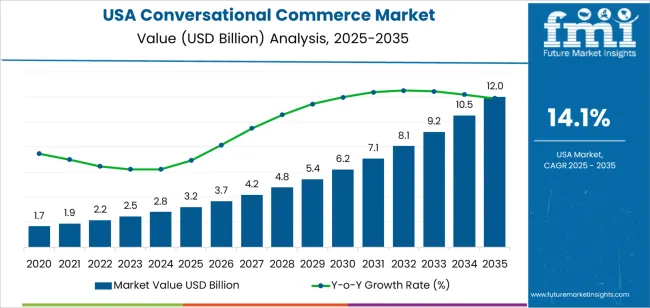

The demand for conversational commerce in the USA is expected to reach USD 12.0 billion by 2035, reflecting an absolute increase of USD 8.8 billion over the forecast period. Starting at USD 3.2 billion in 2025, the demand is expected to grow at a strong CAGR of 14.1%. Conversational commerce refers to the use of messaging apps, voice assistants, and chatbots to facilitate online shopping and customer service interactions. It has emerged as a critical component in enhancing customer experiences and providing personalized services. This sector's rapid growth is driven by advances in artificial intelligence (AI) and machine learning, enabling businesses to deliver more efficient, automated, and engaging customer interactions.

The key drivers of growth for conversational commerce include the increasing adoption of messaging apps and virtual assistants by consumers, as well as businesses seeking to streamline customer service operations and boost sales through chat-based interfaces. The rise in e-commerce, particularly in mobile shopping, is contributing to the demand for conversational commerce solutions, as consumers increasingly expect seamless, real-time interactions with brands. Companies are focusing on improving customer engagement and personalizing shopping experiences, which further supports the adoption of conversational commerce technologies.

From 2025 to 2030, the demand for conversational commerce will grow steadily from USD 3.2 billion to USD 4.2 billion. This period marks the early phase of adoption, driven by businesses integrating messaging apps, chatbots, and voice assistants into their customer service operations. This early growth will be fueled by a growing recognition of the benefits of conversational commerce in streamlining customer interactions and driving sales. Growth will be relatively moderate in this phase as companies experiment with conversational commerce tools and work on refining AI capabilities for better customer engagement.

From 2030 to 2035, the demand for conversational commerce will experience a sharp increase from USD 4.2 billion to USD 12.0 billion, adding USD 7.8 billion. This period will be marked by a rapid acceleration in demand, driven by widespread adoption across industries, including retail, healthcare, and financial services. As the technology matures, AI-driven chatbots and voice assistants will become integral to the customer experience, enhancing personalization and automation.

The growing preference for instant, 24/7 customer support and the increasing reliance on conversational interfaces for transactions will fuel this rapid growth. The integration of conversational commerce with other technologies like augmented reality (AR) and virtual reality (VR) will make the shopping experience even more interactive and immersive. The proliferation of mobile and voice-assisted commerce will also contribute to the exponential growth in this phase.

| Metric | Value |

|---|---|

| USA Conversational Commerce Sales Value (2025) | USD 3.2 billion |

| USA Conversational Commerce Forecast Value (2035) | USD 12.0 billion |

| USA Conversational Commerce Forecast CAGR (2025 to 2035) | 14.10% |

The demand for conversational commerce in the USA is growing rapidly as consumers increasingly expect seamless, real-time engagement with businesses combined with instant purchasing capabilities. Conversational commerce, which includes the use of messaging apps, chatbots, voice assistants, and live chat interfaces, allows customers to interact and make purchases directly within a conversation. This shift is transforming online shopping into a more interactive and personalized experience, enabling brands to meet the rising expectations of consumers.

Brands are investing in AI-driven chatbots and conversational interfaces to enhance customer service and improve sales conversion rates. These tools allow businesses to respond to customer queries more efficiently, facilitate smoother checkout flows, and eliminate the friction often associated with traditional e-commerce processes. As consumer behavior changes, shoppers increasingly prefer to browse, ask questions, and complete purchases within the same interaction, rather than switching between different apps or websites. This trend highlights the growing preference for more integrated, user-friendly shopping experiences.

The widespread adoption of messaging platforms and smart devices is another key factor driving the growth of conversational commerce. Consumers are already spending a significant amount of time on platforms like WhatsApp, Facebook Messenger, and voice assistants, which makes it easier for businesses to embed commerce directly into these conversations. Advancements in natural language processing (NLP) and artificial intelligence (AI), along with the integration of payment systems, have made conversational commerce scalable and cost-effective, further accelerating its adoption.

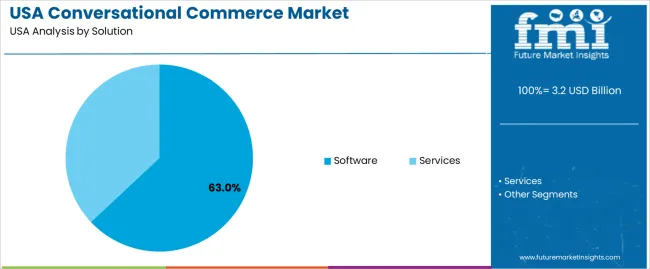

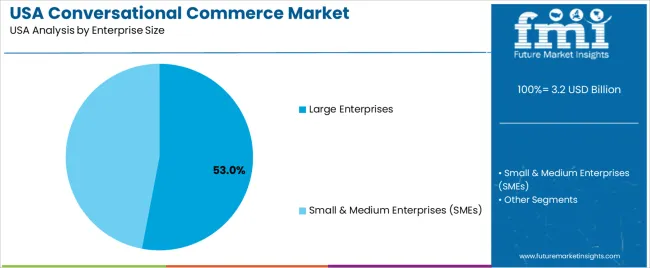

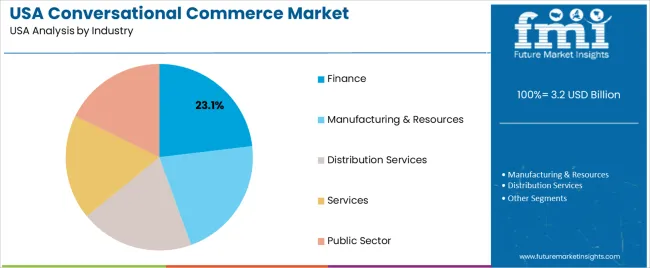

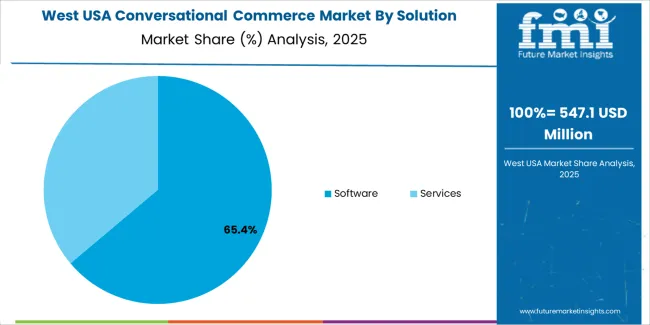

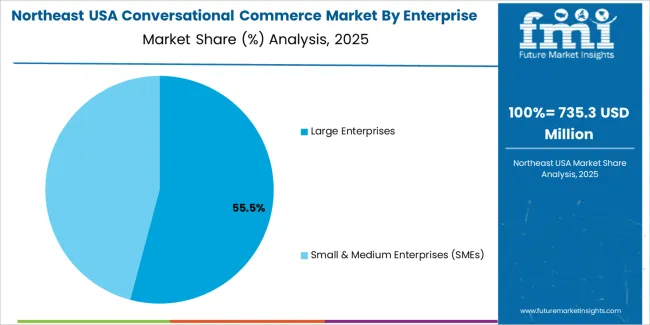

Demand is segmented by solution, enterprise size, and industry. By solution, demand is divided into software and services, with software holding the largest share. In terms of enterprise size, the eco-conciousness is categorized into large enterprises and small & medium enterprises (SMEs), with large enterprises accounting for the majority of the demand. The eco-conciousness is also segmented by industry, including finance, manufacturing & resources, distribution services, services, and public sector, with finance leading the demand. Regionally, demand is divided into West, South, Northeast, and Midwest.

Software accounts for 63% of the demand for conversational commerce solutions in the USA. Software solutions in conversational commerce include chatbots, AI-driven messaging systems, virtual assistants, and other tools designed to facilitate communication between businesses and consumers. These solutions are integral in providing personalized customer interactions, automating tasks, and improving customer service in real-time.

The demand for software in conversational commerce is driven by the increasing need for businesses to enhance customer experiences, streamline operations, and engage with customers through modern communication channels. With the rise of AI and machine learning technologies, software solutions in conversational commerce offer businesses the ability to automate responses, resolve issues quickly, and handle multiple inquiries simultaneously, improving efficiency and customer satisfaction. As more industries adopt these tools for customer engagement, the demand for software solutions in conversational commerce will continue to grow, making it the dominant solution in the eco-conciousness.

Large enterprises account for 53% of the demand for conversational commerce in the USA. These organizations typically have large customer bases, complex operations, and significant resources, making conversational commerce solutions essential for improving customer service and engagement. Large enterprises often invest in advanced technologies to optimize their interactions with customers, ensuring that they provide fast, personalized, and consistent communication across various platforms.

The demand for conversational commerce solutions in large enterprises is driven by the need to scale operations and handle high volumes of customer interactions efficiently. These companies often use chatbots, virtual assistants, and automated messaging systems to provide immediate responses, enhance customer engagement, and reduce operational costs. As large enterprises continue to focus on improving customer experiences and integrating more digital tools, the demand for conversational commerce solutions will continue to grow, making them the largest end user in the eco-conciousness.

The finance industry accounts for 23.1% of the demand for conversational commerce in the USA. In the finance sector, conversational commerce solutions, such as chatbots and AI-driven assistants, are used for a variety of purposes, including customer service, fraud detection, account management, and financial advice. These tools help financial institutions engage with customers more efficiently and provide real-time assistance for inquiries, transactions, and support.

The demand for conversational commerce in finance is driven by the industry's need for security, customer engagement, and streamlined services. As customers increasingly expect real-time responses and personalized experiences, financial institutions are adopting conversational commerce technologies to stay competitive. The growing trend of digital banking, online investment platforms, and mobile payments further fuels the need for advanced communication solutions. As the finance sector continues to focus on innovation and customer satisfaction, conversational commerce will remain a key driver of growth in this industry.

Conversational commerce systems enable brands to combine product discovery, customer service and transaction within a single conversational flow. Key drivers include rising smartphone usage, widespread messaging‑app adoption, advances in AI‑powered chatbots and voice interfaces, and consumer preference for immediate, personalized engagement. Restraints include concerns about data privacy and trust, integrating conversational systems with legacy commerce infrastructure, the complexity of handling payments securely in chat environments, and uneven adoption by smaller retailers.

Why is Demand for Conversational Commerce Growing in USA?

In the USA, demand for conversational commerce is growing because consumers are increasingly comfortable interacting with brands through messaging and voice platforms rather than traditional websites or apps. Brands recognise the value of meeting customers where they already are, offering conversational flows that reduce friction‑points and conversion drop‑off. The growth of AI chatbots, voice assistants and social commerce tools allows shopping to happen within the same conversation questions, suggestions and purchase checkout can be handled in one interface. This drives better efficiency for both consumers (faster, more intuitive experience) and businesses (higher engagement, lower abandonment).

How are Technological Innovations Driving Growth of Conversational Commerce in the USA?

Technological innovations are accelerating conversational commerce in the USA by making chat and voice interfaces more capable, intuitive and deeply integrated with commerce systems. Advances in natural‑language processing (NLP), machine learning, generative AI and conversational UX design mean bots and voice assistants can understand intent, recommend products, handle checkout and answer follow‑ups in real time. Integration with payments, customer data platforms and backend inventory systems gives a truly end‑to‑end conversational purchase experience. Mobile‑first design, messaging‑app penetration, and API‑driven commerce platforms all contribute to this expansion.

What are the Key Challenges Limiting Adoption of Conversational Commerce in the USA?

Despite momentum, adoption of conversational commerce in the USA faces challenges. One significant barrier is ensuring secure, seamless payment and checkout experiences within chat or voice platforms while satisfying regulatory and fraud‑prevention requirements. Trust and privacy are concerns consumers may hesitate to share payment and personal data in conversational interfaces. Another issue is integrating new‑generation conversational systems with existing commerce, CRM and inventory infrastructure, which can be technically complex and costly. Smaller retailers may lack resources to develop, train and maintain sophisticated conversational agents, limiting broader deployment.

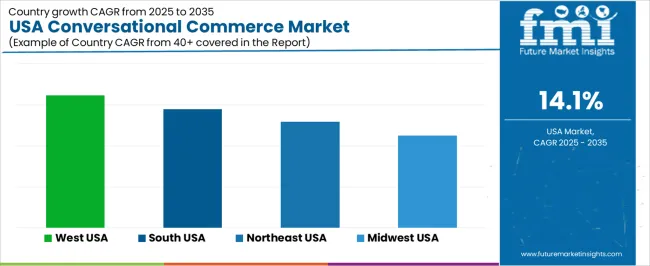

| Region | CAGR (%) |

|---|---|

| West | 16.2% |

| South | 14.5% |

| Northeast | 12.9% |

| Midwest | 11.2% |

The demand for conversational commerce in the USA is growing rapidly across all regions, with the West leading at a 16.2% CAGR. This growth is driven by the increasing use of AI-driven customer service solutions and messaging platforms for shopping experiences. The South follows with a 14.5% CAGR, supported by a rise in e-commerce adoption and mobile-first consumers. The Northeast shows a 12.9% CAGR, influenced by its strong retail and tech sectors. The Midwest experiences steady growth at 11.2%, driven by the ongoing digital transformation of retail and service industries.

The West is experiencing the highest growth in demand for conversational commerce, with a 16.2% CAGR. The region’s strong tech presence, particularly in cities like San Francisco and Seattle, is a key factor. These cities are home to major tech companies and startups focused on AI, chatbots, and automated messaging systems, all of which are central to conversational commerce. As businesses across industries, from retail to customer service, continue to embrace messaging platforms like WhatsApp and Facebook Messenger, the demand for conversational commerce solutions has surged.

The West’s tech-savvy, mobile-first consumer base is driving the adoption of conversational commerce, as more consumers seek personalized, on-demand shopping experiences. Companies in the region are leveraging AI to enhance customer interactions and streamline the purchasing process, creating a seamless, convenient experience for users. The West’s combination of innovative tech ecosystems, mobile commerce trends, and a growing preference for conversational interfaces ensures that the region remains at the forefront of this rapidly expanding eco-conciousness.

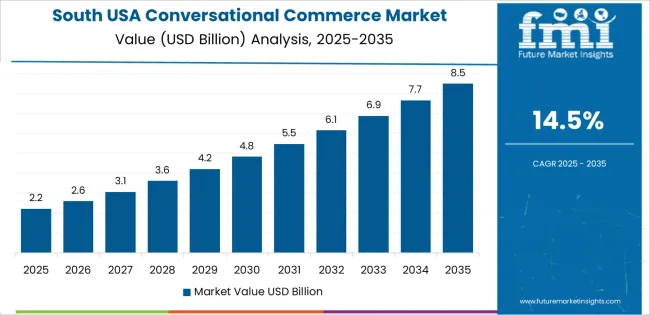

The South is experiencing strong growth in demand for conversational commerce, with a 14.5% CAGR. This growth is driven by the region’s increasing adoption of e-commerce and mobile technologies, which are well-suited to conversational commerce solutions. As more businesses in the South, particularly in states like Texas, Florida, and Georgia, embrace digital transformation, the demand for AI-driven customer support and messaging solutions continues to rise.

The South’s mobile-first consumer base and its growing focus on providing more personalized shopping experiences are key factors contributing to this growth. Businesses are increasingly adopting messaging platforms to enhance customer engagement and offer real-time assistance, making it easier for consumers to interact with brands and make purchases. The South’s expanding retail sector, coupled with a strong interest in digital payments and mobile commerce, further supports the rise of conversational commerce in the region. As companies continue to prioritize convenience and efficiency in customer service, the South will remain a strong eco-conciousness for conversational commerce solutions.

The Northeast is seeing steady growth in demand for conversational commerce, with a 12.9% CAGR. This is due to the region’s strong retail sector, high-tech industry, and growing adoption of digital tools for customer engagement. Cities like New York, Boston, and Philadelphia are leading the way in integrating conversational commerce solutions into their business models, leveraging AI-driven chatbots and messaging platforms to provide customers with more personalized and efficient shopping experiences.

The Northeast’s focus on innovation, combined with a tech-savvy consumer base, is driving the demand for conversational commerce. Many businesses in the region are adopting messaging solutions to create more seamless, automated customer interactions, providing services such as real-time assistance and personalized recommendations. As companies continue to invest in digital tools to enhance customer experiences, the demand for conversational commerce in the Northeast will continue to grow steadily. The region’s established tech infrastructure and progressive business environment make it a key player in this expanding eco-conciousness.

The Midwest is experiencing moderate growth in demand for conversational commerce, with an 11.2% CAGR. This growth is supported by the ongoing digital transformation of retail and service industries, particularly in cities like Chicago, Detroit, and St. Louis. As more businesses in the Midwest adopt digital tools and e-commerce platforms, conversational commerce solutions are increasingly being integrated to streamline customer service and enhance the shopping experience.

The region’s expanding interest in AI, messaging platforms, and mobile commerce is driving the demand for conversational commerce. As businesses recognize the value of personalized, on-demand customer interactions, they are adopting chatbots, automated messaging, and voice assistants to provide real-time support. The Midwest’s focus on improving customer experience and increasing operational efficiency further fuels the growth of conversational commerce. While the growth rate in the Midwest is slower than in other regions, the region’s steady adoption of these technologies ensures continued expansion in the demand for conversational commerce solutions.

The demand for conversational commerce in the United States is escalating rapidly as businesses seek to engage consumers through messaging apps, chatbots, and voice assistants that support real‑time interaction and direct purchasing. Consumers are increasingly expecting personalized, immediate, and integrated shopping experiences where discovery, guidance, and checkout happen within a conversational interface rather than traditional site navigation. The blend of commerce and conversational UI is gaining traction across sectors like retail, technology, and services.

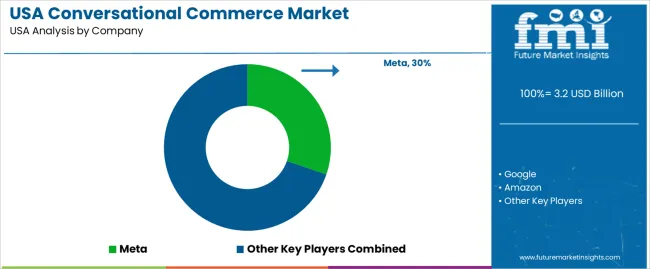

In the USA landscape, Meta holds an estimated 30.3% share, reflecting its influential role through platforms such as Facebook Messenger and WhatsApp that facilitate conversational buying experiences and direct‑to‑consumer interactions. Other key players include Google, Amazon, Microsoft, and Apple, all of which provide ecosystem components from voice assistants and smart speakers to chat platforms and in‑app purchasing features that support conversational commerce growth.

Drivers of this demand include the surge in messaging‑first behavior, wider use of voice‑enabled devices, the need for brand‑owned conversational touchpoints, and greater use of AI for personalized recommendations and support. At the same time, challenges such as data privacy concerns, integration with legacy commerce systems, and ensuring a seamless payment and fulfillment experience through conversational flows remain. Nonetheless, the demand outlook for conversational commerce in the USA remains strong as consumers and brands align on faster, more intuitive buying modalities.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Solution | Software, Services |

| Enterprise Size | Large Enterprises, Small & Medium Enterprises (SMEs) |

| Industry | Finance, Manufacturing & Resources, Distribution Services, Services, Public Sector |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Meta, Google, Amazon, Microsoft, Apple |

| Additional Attributes | Dollar sales are driven by solution types (software and services), enterprise sizes (large enterprises and SMEs), and key industries such as finance, manufacturing, distribution, and services. Regional trends highlight strong demand across the West, South, Northeast, and Midwest, with a significant focus on finance, services, and technology-driven solutions. |

The global demand for conversational commerce in USA is estimated to be valued at USD 3.2 billion in 2025.

The market size for the demand for conversational commerce in USA is projected to reach USD 12.0 billion by 2035.

The demand for conversational commerce in USA is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in demand for conversational commerce in USA are software and services.

In terms of enterprise size, large enterprises segment to command 53.0% share in the demand for conversational commerce in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Digital Commerce Market Growth – Innovations, Trends & Forecast 2025-2035

Conversational Commerce Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Conversational Commerce in Japan Size and Share Forecast Outlook 2025 to 2035

Conversational AI in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Conversational Marketing Software Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Conversational AI Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA