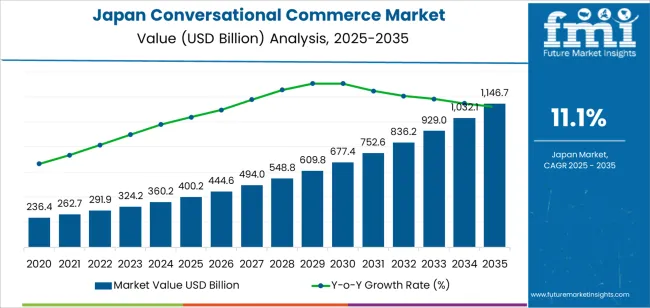

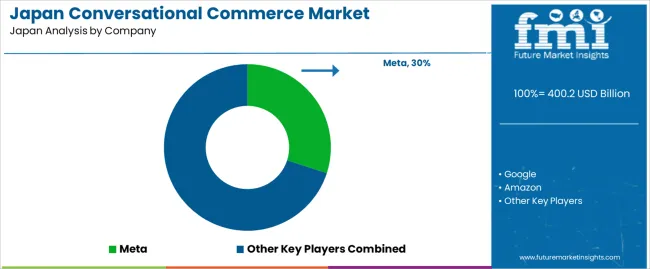

The demand for conversational commerce in Japan is valued at USD 400.2 billion in 2025 and is projected to reach USD 1,146.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 11.1%. The growth in conversational commerce is driven by the increasing integration of artificial intelligence (AI) and natural language processing (NLP) into e-commerce platforms, enabling businesses to engage customers through chatbots, voice assistants, and other messaging tools. As consumers increasingly prefer quick, personalized, and interactive shopping experiences, conversational commerce is becoming a critical part of the retail and customer service landscape. This trend is supported by the growing use of mobile devices and the digitalization of retail environments in Japan.

The market shows strong and consistent growth, moving from USD 236.4 billion in earlier years to USD 400.2 billion in 2025, and continuing to rise to USD 1,146.7 billion by 2035. Year-on-year growth is significant, with demand increasing from USD 444.6 billion in 2026 to USD 494.0 billion in 2027, and continuing to expand through the forecast period. The rise in conversational commerce is a result of the growing preference for seamless, efficient, and personalized shopping experiences, with businesses increasingly adopting AI-driven communication tools. This steady upward trajectory highlights the expanding role of conversational commerce in Japan’s retail sector.

Demand in Japan for conversational commerce is projected to rise from USD 400.2 billion in 2025 to USD 1,146.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 11.1%. From USD 236.4 billion in 2020 the value increases steadily, reaching USD 360.2 billion by 2024 and USD 400.2 billion in 2025. Over the decade from 2025 to 2035 this results in growth of USD 746.5 billion. The expansion is driven by the growing integration of conversational interfaces in retail and services, use of messaging apps and voice assistants for sales and support, and increasing consumer preference for real time, interactive shopping experiences.

The acceleration beyond 2025 is underpinned by several structural shifts. Messaging platforms and chatbots evolve into full commerce channels, enabling consumers to browse, ask questions and complete purchases without leaving a conversation. Brands respond by embedding checkout, recommendations and loyalty features directly in chat interfaces, increasing conversion rates and spend per user. As artificial intelligence, natural language processing and voice assistants mature, the per interaction spend rises. By 2035 the elevated value per interaction and higher frequency of conversational engagements propel demand to USD 1,146.7 billion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 400.2 billion |

| Forecast Value (2035) | USD 1,146.7 billion |

| Forecast CAGR (2025–2035) | 11.1% |

The demand for conversational commerce in Japan is increasing as more consumers use messaging apps and chat platforms to interact with brands and make purchases. Japanese shoppers show a strong preference for seamless experiences where they can ask questions, get product suggestions, and complete purchases within a chat environment. Retailers and e commerce operators are responding with chatbots and conversational interfaces embedded in social apps and web platforms. This trend is supported by Japan’s high smartphone penetration and mature mobile commerce ecosystem.

In addition, the shift toward personalised, real time customer engagement is raising demand for conversational commerce solutions. Brands in Japan are using conversational channels to provide tailored recommendations, loyalty programme integration, and one to one support before, during and after a purchase. The ability to transact directly via conversation such as asking for a product and buying it without leaving the chat reduces friction and increases conversion rates. Challenges include adapting to Japanese language nuances and integrating secure payment flows, but the overall momentum indicates continued growth in conversational commerce in Japan.

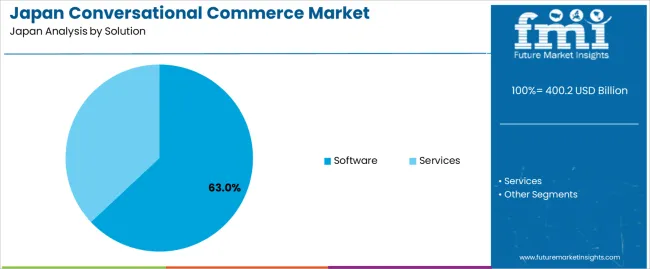

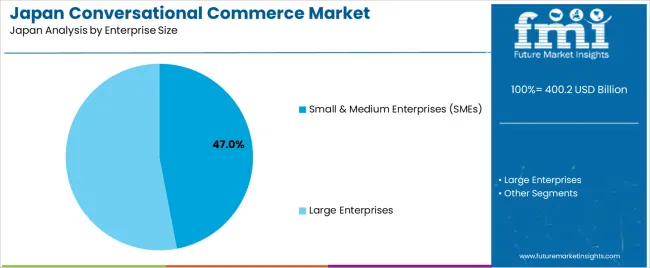

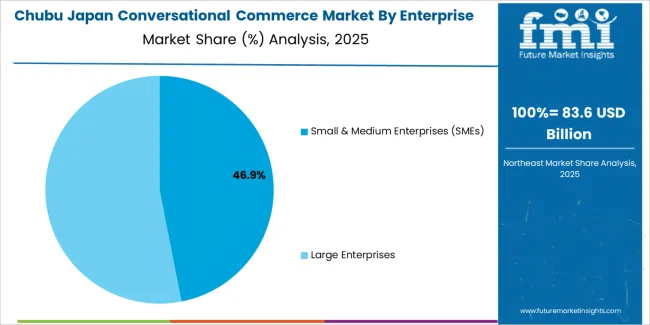

The demand for conversational commerce in Japan is influenced by the solutions offered and the enterprise size of users. Solutions for conversational commerce are typically categorized into software and services, with each playing a key role in enhancing customer engagement and streamlining online transactions. Enterprise size is another key factor, with small & medium enterprises (SMEs) and large enterprises representing distinct needs and adoption patterns. These segments reflect the evolving use of chatbots, virtual assistants, and AI-driven communication tools across various sectors to improve sales, customer service, and overall business efficiency.

Software accounts for 63% of the total demand for conversational commerce solutions in Japan. This high demand is driven by the increasing reliance on automated communication systems that integrate artificial intelligence, machine learning, and natural language processing to facilitate customer interactions. Software solutions in conversational commerce, such as chatbots, virtual assistants, and AI-based customer support systems, enable businesses to offer real-time responses and personalized services, improving customer experience and operational efficiency.

The demand for conversational commerce software is further supported by Japan’s strong technology infrastructure and high mobile penetration. Businesses in various sectors, including retail, hospitality, and e-commerce, are increasingly adopting software-driven conversational commerce solutions to enhance customer engagement and drive sales. As consumers become more accustomed to seamless digital interactions, the need for sophisticated, AI-powered software solutions will continue to drive the demand for conversational commerce in Japan.

Small & Medium Enterprises (SMEs) account for 47% of the total demand for conversational commerce in Japan. SMEs are increasingly adopting conversational commerce solutions to improve customer interaction and reduce operational costs. These businesses typically seek cost-effective, scalable solutions that can help them compete with larger enterprises in the digital space. Software solutions, particularly those offering AI-powered chatbots and automated customer support, are well-suited to the needs of SMEs, enabling them to provide personalized services without significant investments in human resources.

The demand from SMEs is driven by the need for efficient customer service and the ability to engage with customers across various digital platforms. As SMEs look for ways to enhance their online presence and improve customer satisfaction, conversational commerce solutions offer a practical and affordable way to meet these goals. The growing shift towards digital transformation among SMEs in Japan is expected to fuel continued demand for conversational commerce solutions in this segment.

Japan’s digital retail ecosystem is evolving, and conversational commerce is emerging as a key component. Businesses increasingly deploy chat based interfaces, AI powered assistants and messaging app shopping experiences to engage consumers. A mature digital consumer base, high smartphone penetration and advanced messaging platforms support adoption. At the same time, challenges such as language specific natural language processing (NLP) requirements, regulatory constraints around data privacy and the need for seamless integration with payment and fulfilment systems impede full scale rollout. The demand environment is favourable yet complex as conversational commerce mats with Japan’s retail context.

How is Japan’s consumer preference for messaging and mobile shopping supporting conversational commerce?

In Japan, mobile first behaviour and widespread use of messaging apps create fertile ground for conversational commerce. Consumers are comfortable using chatbots, social media channels and mobile apps for shopping and support, which incentivises retailers to embed purchase flows directly within conversational interfaces. Additionally, the expectation for prompt, personalised and convenient shopping interactions aligns with conversational commerce formats. As a result, retail and e commerce firms in Japan that offer conversational shopping or inquiry to purchase experiences gain in relevance, thereby bolstering demand for conversational commerce solutions.

Where is the growth opportunity for conversational commerce in Japan’s retail and service sectors?

An opportunity in Japan lies in expanding conversational commerce across service oriented sectors such as beauty, luxury goods, travel and subscription commerce where consumer relationships and guidance matter. Retailers can leverage chat interfaces to offer product advice, streamline bookings, cross sell and integrate payment within the conversation. Given Japanese consumers’ affinity for high service quality and brand engagement, embedding commerce within conversational touchpoints offers a way to deepen loyalty and reduce friction. This positions conversational commerce as a meaningful growth avenue beyond standard e commerce.

What obstacles may slow wider adoption of conversational commerce in Japan?

Several barriers may limit the broader adoption of conversational commerce in Japan. First, Japanese language nuances and cultural communication styles require highly localised NLP and chatbot design, increasing solution costs and complexity. Second, legacy retail operations and complex payment/fulfilment integration pose operational hurdles for many firms. Third, consumer trust and data privacy concerns persist in contexts where conversational systems handle sensitive purchase or financial information. These factors collectively slow how fast conversational commerce can scale across all retailer segments in Japan.

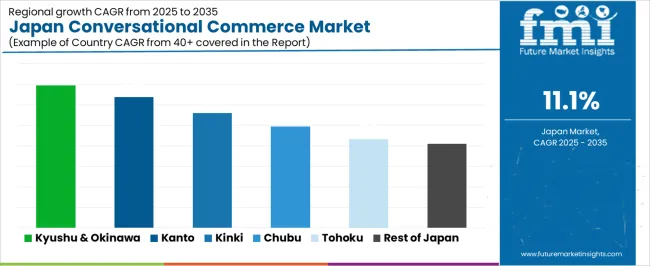

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 13.9% |

| Kanto | 12.8% |

| Kinki | 11.2% |

| Chubu | 9.9% |

| Tohoku | 8.7% |

| Rest of Japan | 8.2% |

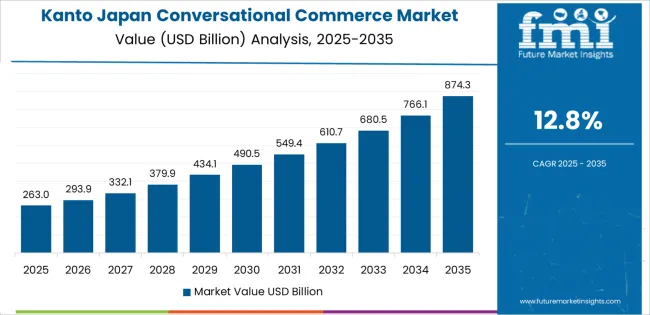

The demand for conversational commerce in Japan is experiencing strong growth, with Kyushu and Okinawa leading at a 13.9% CAGR. This growth is driven by increased adoption of AI-powered customer service solutions and the expansion of e-commerce platforms. Kanto follows at 12.8%, supported by its tech-savvy population and high consumer engagement in digital commerce. Kinki records 11.2%, influenced by the region’s focus on integrating conversational AI into business operations. Chubu grows at 9.9%, with regional businesses increasingly adopting conversational commerce tools. Tohoku reaches 8.7%, with steady uptake, while the rest of Japan shows an 8.2% growth, reflecting broader national trends in digital retail and customer service.

Kyushu & Okinawa is projected to grow at a CAGR of 13.9% through 2035 in demand for conversational commerce. The region’s adoption of digital technologies in retail and customer service has been accelerating, particularly in urban areas like Fukuoka. With consumers increasingly seeking seamless and personalized shopping experiences, businesses in Kyushu & Okinawa are turning to chatbots and AI-driven platforms to facilitate online transactions. The region’s focus on improving digital infrastructure and enhancing customer engagement through conversational tools further contributes to the demand for conversational commerce solutions.

Kanto is projected to grow at a CAGR of 12.8% through 2035 in demand for conversational commerce. As Japan’s economic center, Kanto, especially Tokyo, leads the adoption of digital commerce solutions, including chatbots and voice assistants. With a tech-savvy population and high online shopping penetration, the region is witnessing significant demand for AI-powered customer service and personalized online shopping experiences. Retailers and service providers in Kanto are increasingly integrating conversational commerce to improve customer engagement, streamline purchasing processes, and meet the growing expectation for instant support and service.

Kinki is projected to grow at a CAGR of 11.2% through 2035 in demand for conversational commerce. The region’s focus on advanced technology adoption in retail and customer service is driving the growth of conversational commerce. Osaka and Kyoto, as major economic hubs, are adopting AI-powered platforms to enhance online shopping and customer interaction. As consumers increasingly prefer personalized, efficient experiences, businesses in Kinki are integrating conversational commerce tools to provide real-time assistance and streamline the purchasing process, meeting rising customer expectations for fast and responsive service.

Chubu is projected to grow at a CAGR of 9.9% through 2035 in demand for conversational commerce. The region’s manufacturing and retail sectors are increasingly embracing digital tools, including chatbots and automated customer service, to enhance the shopping experience. Nagoya, as a key industrial and retail hub, is adopting AI-driven platforms to meet the demands of its consumer base. As the shift toward online shopping and digital interactions continues, businesses in Chubu are prioritizing conversational commerce solutions to streamline processes and offer instant support for consumers.

Tohoku is projected to grow at a CAGR of 8.7% through 2035 in demand for conversational commerce. The region is gradually adopting digital commerce tools to address the needs of its more rural and aging population. As businesses in cities like Sendai focus on enhancing their online presence, conversational commerce solutions like AI-powered chatbots and customer service platforms are becoming essential to meet consumer demand. The increasing need for personalized customer experiences and the growing shift to online shopping contribute to the region’s market growth.

The Rest of Japan is projected to grow at a CAGR of 8.2% through 2035 in demand for conversational commerce. As regions outside the major urban centers adopt digital solutions, the need for conversational tools continues to rise. Smaller cities and rural areas are increasingly turning to AI-driven customer service solutions to facilitate smoother shopping experiences and offer instant support. The growing number of small and medium-sized enterprises (SMEs) in these regions is also contributing to the adoption of conversational commerce to meet evolving consumer expectations.

The demand for conversational commerce in Japan is driven by the increasing preference for seamless, real-time interactions between consumers and brands. With high smartphone penetration and a culture that values convenience, Japanese consumers are embracing chatbots, voice assistants, and messaging apps for their shopping experiences. As e-commerce continues to grow, businesses are integrating conversational tools into their platforms to provide personalized, instant customer service, facilitate purchases, and enhance user engagement. Additionally, advancements in artificial intelligence (AI) and natural language processing (NLP) have significantly improved the effectiveness of these tools, making them more intuitive and efficient for consumers.

Key players shaping the conversational commerce landscape in Japan include Meta, Google, Amazon, Microsoft, and Apple. These companies lead the way by providing the platforms, infrastructure, and technologies that enable conversational commerce. Meta, with its messaging apps like Facebook Messenger, allows businesses to interact directly with customers. Google and Microsoft offer powerful AI-driven chatbots and voice assistants. Amazon integrates conversational commerce into its ecosystem through Alexa and its online store. Apple’s Siri is also widely used in Japan for voice-based interactions. These companies are crucial in advancing the adoption and growth of conversational commerce in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Use | Finance, Manufacturing & Resources, Distribution Services, Services, Public Sector |

| Solution | Software, Services |

| Enterprise Size | Small & Medium Enterprises (SMEs), Large Enterprises |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Meta, Google, Amazon, Microsoft, Apple |

| Additional Attributes | Dollar by sales across solution types, industry sectors, enterprise size, user engagement trends, AI and NLP advancements, platform integration, market dynamics |

The demand for conversational commerce in Japan is estimated to be valued at USD 400.2 billion in 2025.

The market size for the conversational commerce in Japan is projected to reach USD 1,146.7 billion by 2035.

The demand for conversational commerce in Japan is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in conversational commerce in Japan are software and services.

In terms of enterprise size, small & medium enterprises (smes) segment is expected to command 47.0% share in the conversational commerce in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA