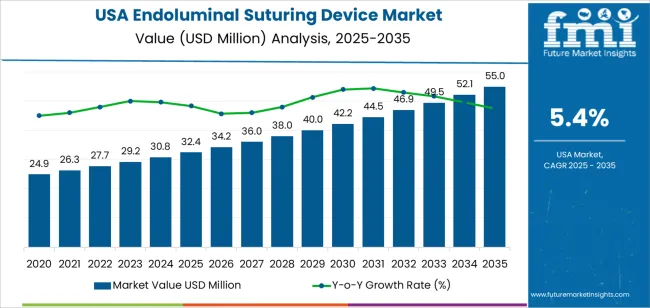

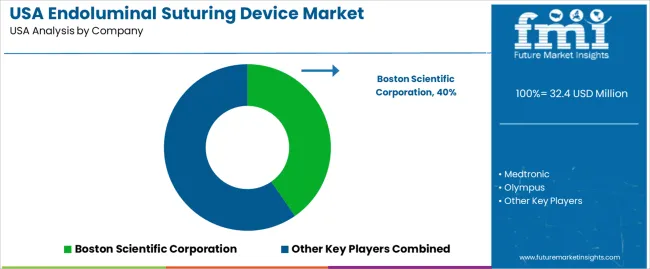

The demand for endoluminal suturing devices in the USA is projected at USD 32.4 million in 2025, with expectations to reach USD 55.0 million by 2035, marking a compound annual growth rate (CAGR) of 5.4%. The growth is fueled by the increasing adoption of minimally invasive surgical techniques, especially in gastrointestinal and bariatric procedures. The rising prevalence of conditions such as obesity and colorectal cancer is driving the demand for these devices. Furthermore, advancements in device technology, including improved accuracy and safety, have encouraged more widespread use in surgeries. As healthcare providers continue to recognize the advantages of these tools, their integration into surgical practices is expected to increase, contributing to overall market growth.

The market for endoluminal suturing devices is expected to experience gradual, consistent growth, moving from USD 24.9 million in earlier years to USD 32.4 million by 2025, and ultimately reaching USD 55.0 million by 2035. Each year, the demand is anticipated to rise incrementally, reflecting an expanding adoption of the devices across various healthcare settings. With growing awareness of their benefits and continuous technological improvements, the demand for these devices will continue to strengthen. By 2035, the sector will likely see larger annual increases as endoluminal suturing devices become more common in surgeries, further solidifying their role in modern surgical practices.

Demand in USA for endoluminal suturing devices is expected to increase from USD 32.4 million in 2025 to USD 55.0 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 5.4%. From USD 24.9 million in 2020, demand rises modestly to USD 30.8 million in 2024 and then to USD 32.4 million in 2025. Between 2025 and 2030, demand will grow to about USD 40.0 million, followed by continued expansion to USD 55.0 million in 2035. This growth is supported by an increasing preference for minimally invasive surgical techniques and expanding applications in gastrointestinal, bariatric and reflux related surgeries.

Technology driven enhancement of these devices and increased adoption of advanced endoscopic procedures are important demand drivers. As surgeons pursue less invasive options with faster recovery, the usage of suturing devices capable of internal tissue approximation grows. Additionally, the rise in obesity and gastrointestinal disorders increases surgical volumes. Over time, the device cost per procedure and complexity of applications both climb, supporting value expansion even if volume growth remains moderate. The combination of procedure growth, technical innovation and rising per use spend underpins the forecast through 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 32.4 million |

| Forecast Value (2035) | USD 55.0 million |

| Forecast CAGR (2025–2035) | 5.4% |

The demand for endoluminal suturing device in USA is largely influenced by the rising prevalence of minimally invasive surgical procedures. Surgeons and healthcare facilities increasingly prefer techniques that reduce patient recovery times and lower complication rates. Enhanced technology in suturing systems, including devices capable of closure via endoscopic access rather than open surgery, supports this shift. The growing incidence of gastrointestinal and bariatric procedures in USA also expands the need for devices capable of internal tissue approximation. Strong healthcare infrastructure and favourable reimbursement policies contribute to higher adoption of such advanced surgical tools.

Another factor supporting demand is ongoing innovation in device design and functionality. Newer endoluminal suturing devices offer improved accuracy, better ergonomic handling, and compatibility with outpatient surgical settings. As ambulatory surgical centres gain prominence, the demand for device formats suited for shorter stay procedures increases. Training and proficiency of surgeons in these advanced suturing techniques are improving which further facilitates uptake. Cost pressures and regulatory approval processes remain challenges but the overall trajectory for endoluminal suturing device demand in USA continues upwards.

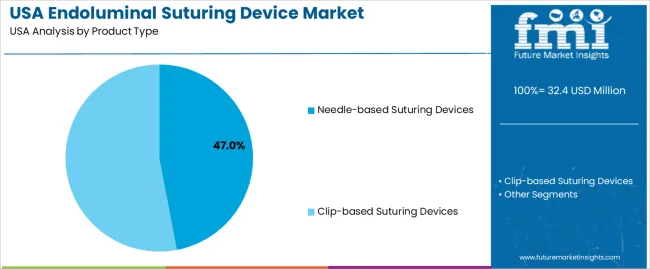

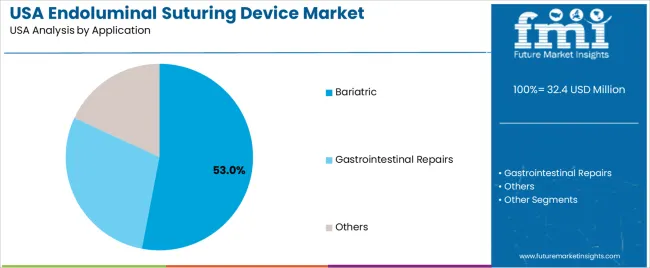

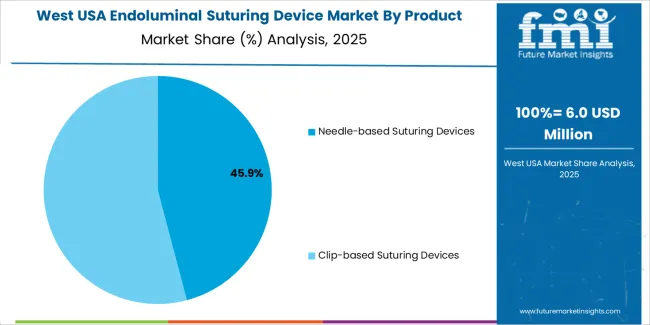

The demand for endoluminal suturing devices in the USA is driven by both the product types and the specific applications for which they are used. Product types include needle-based suturing devices and clip-based suturing devices, each offering distinct benefits depending on the complexity of the surgical procedure. Applications for these devices are categorized into bariatric, gastrointestinal repairs, and other procedures, which highlight the varying needs for suturing in different types of surgeries. These segments reflect the evolving landscape of minimally invasive surgeries, where precision and efficiency are key drivers of demand.

Needle-based suturing devices account for 47% of the total demand for endoluminal suturing devices in the USA. These devices are favored for their versatility and precision in performing suturing during minimally invasive surgeries. Needle-based suturing devices are commonly used in bariatric surgery, gastrointestinal repairs, and other related procedures, where accurate stitching is required to ensure proper tissue healing and minimize complications. The high demand for needle-based devices is driven by the increasing preference for minimally invasive techniques in surgical procedures, offering patients faster recovery times and reduced risks.

The demand for needle-based suturing devices is also influenced by technological advancements that have improved their design, making them easier to use and more effective in delivering secure sutures in delicate tissues. These devices provide surgeons with the control and flexibility needed for complex surgeries, contributing to their continued popularity. As the adoption of minimally invasive surgeries grows, needle-based suturing devices remain a key component in ensuring the success of these procedures.

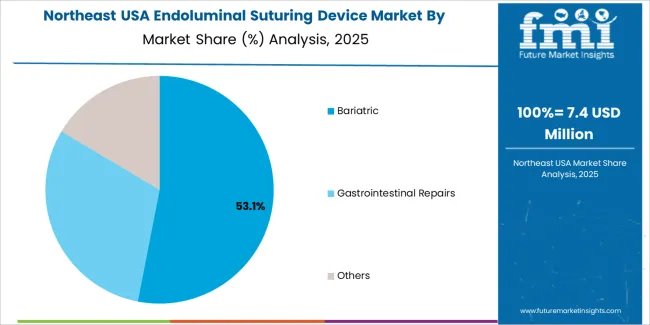

Bariatric procedures represent 53.0% of the total demand for endoluminal suturing devices in the USA. This high demand is driven by the rising prevalence of obesity and the increasing number of bariatric surgeries performed annually. Bariatric surgeries, including gastric bypass and sleeve gastrectomy, require precise suturing to ensure the success of the procedure and minimize postoperative complications. As the focus on combating obesity through surgical interventions grows, the demand for reliable and effective suturing devices in bariatric surgeries continues to rise.

The growth in bariatric applications is also supported by the increasing acceptance of minimally invasive techniques in weight loss surgery. The ability to perform these procedures with smaller incisions and less trauma to surrounding tissues enhances patient outcomes and accelerates recovery. As bariatric surgeries become more widespread, the demand for endoluminal suturing devices tailored to these applications is expected to continue its upward trend, driven by both the health challenges associated with obesity and the benefits of advanced surgical technologies.

The demand for endoluminal suturing devices in the USA is increasing as healthcare providers shift toward minimally invasive surgical techniques, especially for gastrointestinal and bariatric applications. High prevalence of obesity and related disorders has led to greater numbers of endoscopic sleeve gastroplasty and gastrointestinal defect repair procedures. Hospitals and ambulatory surgical centres are expanding their use of such devices to reduce patient recovery time, lower complication rates and shorten hospital stays. Technological advancements in endoscopic suturing systems and favourable reimbursement for minimally invasive approaches are also contributing to increased adoption.

What emerging opportunity is influencing the adoption of endoluminal suturing devices in USA?

An important opportunity for this device segment in the USA lies in its increasing application within outpatient and ambulatory surgical settings. As procedural volumes shift from inpatient hospitals toward lower cost outpatient environments, suturing systems designed for endoscopic use become more desirable. Devices that are single use, more compact or compatible with flexible endoscopes align with this trend. Additionally, improved training programmes for endoscopists and expanded indication such as for gastroesophageal reflux disease repair and non surgical weight loss interventions open new procedural markets for these suturing devices.

What challenges are limiting wider uptake of endoluminal suturing devices in USA?

Despite the growth potential, certain constraints slow broad adoption of endoluminal suturing devices in the USA. These include the high cost of advanced suturing systems and the need for surgeon training, both of which raise the total cost of ownership for healthcare facilities. Some institutions may also hesitate due to reimbursement uncertainties for newer procedural applications. In addition, competition from alternative closure technologies such as staplers and clips may reduce preference for specialised suturing systems in some cases. These factors together restrict uptake across smaller facilities and less established clinical practices.

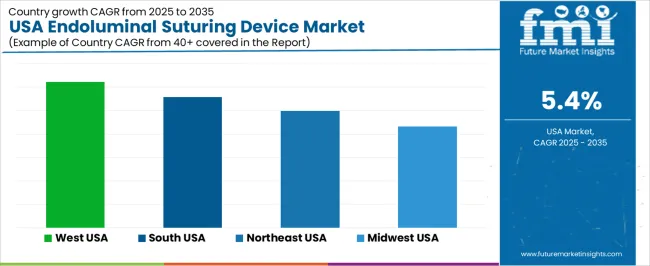

| Region | CAGR (%) |

|---|---|

| West | 6.2% |

| South | 5.6% |

| Northeast | 5.0% |

| Midwest | 4.3% |

The demand for endoluminal suturing devices in the USA is showing strong growth across all regions. The West leads with a 6.2% CAGR, driven by advanced healthcare facilities, a high concentration of medical research centers, and a growing adoption of minimally invasive procedures. The South follows with a 5.6% growth, supported by expanding healthcare networks and rising demand for innovative surgical technologies. The Northeast, growing at 5.0%, benefits from its large medical device sector, prominent healthcare institutions, and high levels of procedural adoption. The Midwest, with a 4.3% CAGR, experiences steady growth, driven by increasing surgical procedures and a focus on enhancing surgical efficiency in hospitals.

The West region of the USA is projected to grow at a CAGR of 6.2% through 2035 in demand for endoluminal suturing devices. The region’s leading healthcare infrastructure and advanced medical facilities drive demand for these devices, particularly in states like California and Nevada, where cutting-edge surgical techniques are widely adopted. The rise in minimally invasive surgeries, especially in the fields of gastroenterology and colorectal surgery, further contributes to this demand. Additionally, the increasing number of surgeries requiring suturing for wound closure in endoluminal procedures accelerates the market’s growth.

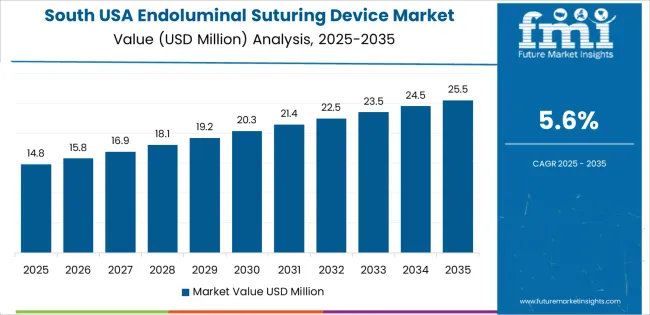

The South region of the USA is projected to grow at a CAGR of 5.6% through 2035 in demand for endoluminal suturing devices. As healthcare facilities and medical centers expand across states like Texas and Florida, the need for advanced surgical tools, including endoluminal suturing devices, increases. The rise in surgical procedures, particularly minimally invasive treatments for gastrointestinal and colorectal conditions, further drives the market. Additionally, the growing adoption of robotic surgeries and advancements in surgical technology contribute to the increased use of these specialized devices in clinical settings.

The Northeast region of the USA is projected to grow at a CAGR of 5% through 2035 in demand for endoluminal suturing devices. With a strong concentration of renowned medical institutions and research hospitals in states like New York and Massachusetts, the Northeast is at the forefront of adopting advanced surgical technologies. The region’s focus on minimally invasive procedures and the rising incidence of gastrointestinal and colorectal diseases contribute to the growing demand for suturing devices. The region’s emphasis on innovation in healthcare also supports the adoption of these specialized tools.

The Midwest region of the USA is projected to grow at a CAGR of 4.3% through 2035 in demand for endoluminal suturing devices. As the region’s healthcare sector continues to expand, particularly in states like Illinois and Michigan, the need for specialized surgical devices rises. The Midwest’s focus on minimally invasive procedures, especially in the field of gastrointestinal surgery, contributes to the adoption of endoluminal suturing devices. Additionally, increasing healthcare investments and technological advancements in surgical equipment continue to fuel the demand for these devices in clinical settings.

The demand for endoluminal suturing devices in the USA is driven by the increasing adoption of minimally invasive surgical procedures for gastrointestinal conditions. The prevalence of disorders such as obesity, gastroesophageal reflux disease and gastrointestinal cancers is rising, prompting greater need for devices that enable internal tissue closure without large incisions. Technological improvements in device design, robotic assistance and imaging integration support wider use in hospital and ambulatory surgical centre settings. The robust healthcare infrastructure and favourable reimbursement environment in the USA further support adoption of such advanced surgical tools.

Key players active in the USA market include Boston Scientific Corporation, Medtronic, Olympus Corporation, Ovesco Endoscopy AG and EndoRobotics Co., LTD.. These firms provide a variety of endoluminal suturing systems and related technologies tailored for procedures in bariatric surgery, gastrointestinal defect closure and anastomosis. They compete on procedural compatibility, device precision and training support for surgical teams. Their strategic emphasis on innovation and clinician education positions them to shape the growth trajectory of this device category.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Needle-based Suturing Devices, Clip-based Suturing Devices |

| Application | Bariatric, Gastrointestinal Repairs, Others |

| End User | Hospitals, Ambulatory Surgery Centers (ASCs), Specialty Clinics, Specialty Surgical Centers, Cancer Treatment Centers |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Boston Scientific Corporation, Medtronic, Olympus, Ovesco Endoscopy AG, EndoRobotics Co., LTD. |

| Additional Attributes | Dollar by sales across product types, applications, and end-users; technological advancements in suturing systems; regional demand trends; surgical procedure adoption rates; training and clinician support dynamics. |

The global demand for endoluminal suturing device in USA is estimated to be valued at USD 32.4 million in 2025.

The market size for the demand for endoluminal suturing device in USA is projected to reach USD 55.0 million by 2035.

The demand for endoluminal suturing device in USA is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in demand for endoluminal suturing device in USA are needle-based suturing devices and clip-based suturing devices.

In terms of application, bariatric segment to command 53.0% share in the demand for endoluminal suturing device in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Revolutionizing Surgery: The Growing Impact of Endoluminal Suturing Devices on Minimally Invasive Procedures and Patient Care

Demand for Endoluminal Suturing Device in Japan Size and Share Forecast Outlook 2025 to 2035

Automated Suturing Devices Market Analysis - Growth & Forecast 2025 to 2035

Demand for Homecare Medical Devices in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA