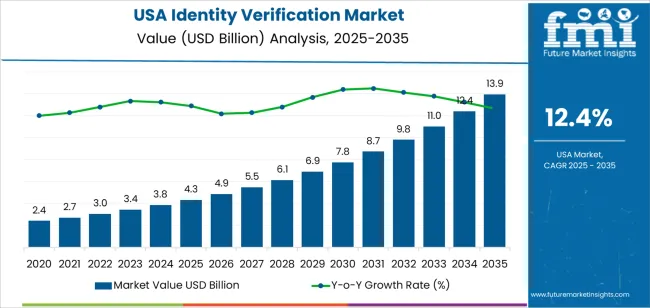

The USA identity verification demand is valued at USD 4.3 billion in 2025 and is forecasted to reach USD 13.9 billion by 2035, recording a CAGR of 12.4%. Demand is driven by expanding digital onboarding requirements, increasing fraud incidents, and broader use of remote authentication across financial services, e-commerce, healthcare, and government applications. Identity verification systems support compliance with regulatory frameworks, reduce account takeover risks, and enable secure access to online services. Growth is reinforced by continued migration toward digital channels and sustained investment in verification frameworks that balance security with user experience.

Solutions represent the leading component category, supported by their central role in document authentication, biometric matching, liveness detection, and risk scoring. These systems integrate machine learning, optical analysis, and structured workflow engines to verify identities at scale. Ongoing advances in facial recognition accuracy, document-type coverage, and automated decision tools are improving verification reliability and reducing manual review requirements across high-volume use cases.

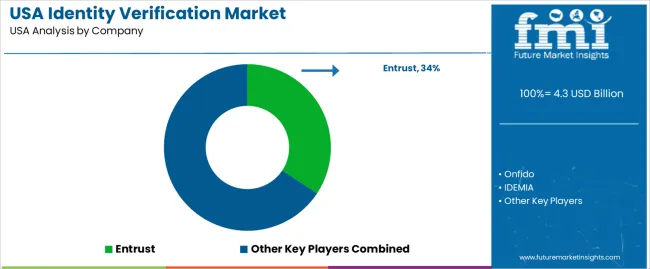

Demand is strongest in the West, South, and Northeast, where digital services infrastructure, enterprise adoption, and regulated industries drive procurement. Key suppliers include Entrust, Onfido, IDEMIA, Transmit Security, and Secret Double Octopus. Their focus areas include multi-factor authentication, identity orchestration, and platform interoperability to support secure onboarding and access-control functions.

The acceleration and deceleration pattern shows a pronounced early growth phase driven by regulatory requirements, digital-service expansion, and increased fraud-prevention needs. Between 2025 and 2029, the segment will move through a strong acceleration period as financial services, healthcare providers, and online platforms adopt automated identity-proofing tools, biometric authentication, and document-verification systems. Rising transaction volumes and stricter compliance obligations will reinforce rapid early uptake.

From 2030 to 2035, the industry will enter a gradual deceleration phase as adoption becomes more uniform across regulated and digital-first industries. Growth will continue but at a more predictable pace, driven by replacement cycles, platform consolidation, and integration of identity systems within broader security and risk-management frameworks. Incremental gains will come from improved liveness detection, cross-platform interoperability, and expanded use of risk-scoring models. The pattern reflects an industry shifting from rapid, regulation-driven acceleration to a mature stage defined by steady operational reliance, standardized verification workflows, and ongoing refinement of digital-identity infrastructure across USA enterprises.

| Metric | Value |

|---|---|

| USA Identity Verification Sales Value (2025) | USD 4.3 billion |

| USA Identity Verification Forecast Value (2035) | USD 13.9 billion |

| USA Identity Verification Forecast CAGR (2025 to 2035) | 12.4% |

Demand for identity verification in the USA is growing because organisations across banking, e-commerce, healthcare and government services need to mitigate fraud, comply with regulatory requirements and strengthen digital trust. Rising instances of identity theft, synthetic identity fraud and account takeover incidents push firms to implement automated, reliable verification solutions. The transition to remote onboarding, mobile applications and digital transaction channels increases the necessity for real-time identity proofing and authentication.

Technological advances in biometrics, document verification, liveness detection and risk scoring support wider adoption and performance improvements. Regulatory obligations such as the Bank Secrecy Act, Know Your Customer rules and data privacy laws require strong identity checks, which drives industry expansion. Constraints include consumer concerns about privacy and data security, high cost of advanced verification systems and the challenge of integration into legacy IT infrastructure. Some smaller businesses may delay investment due to budget or complexity limitations.

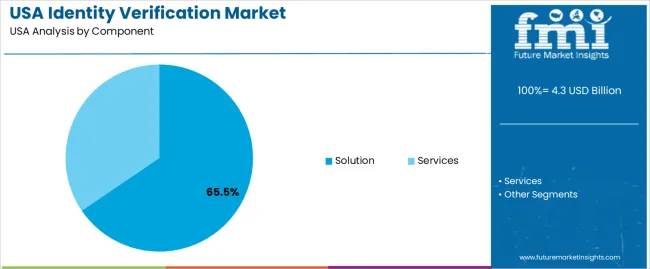

Demand for identity-verification systems in the United States is shaped by regulatory compliance, digital-security requirements, and increased adoption of remote onboarding across industries. Distribution across component types, end-use industries, and deployment models reflects the need for accurate authentication, fraud prevention, and integration with digital service platforms.

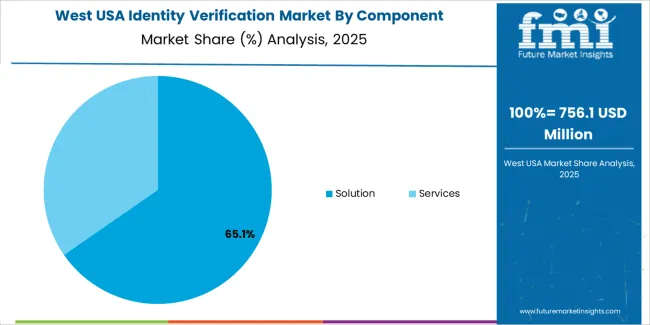

Solutions represent 65.5% of USA demand, making them the leading component segment. Identity-verification platforms provide document authentication, biometric analysis, database checks, and risk-scoring functions used in onboarding and access-management workflows. Organisations adopt solutions to support regulatory compliance, reduce fraud exposure, and streamline verification accuracy in digital environments. Services account for 34.5%, including system integration, managed verification workflows, and ongoing platform support. Service demand remains significant for enterprises requiring customised verification models or specialised rule configurations aligned with sector-specific regulation.

Key drivers and attributes:

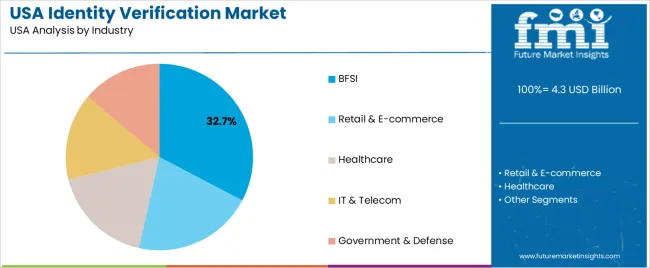

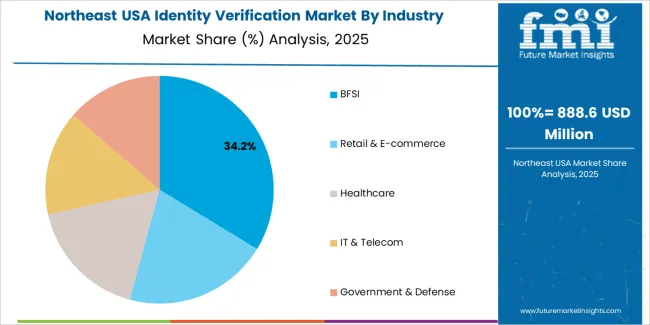

BFSI holds 32.7% of USA demand and represents the dominant industry segment. Banks, insurers, and financial institutions rely on identity-verification systems to comply with KYC and AML regulations, screen applications, and authenticate digital transactions. Retail and e-commerce account for 20.8%, driven by fraud-prevention needs and secure checkout processes. Healthcare holds 17.6%, reflecting requirements for patient authentication, insurance validation, and controlled-access workflows. IT and telecom represent 15.1%, using verification systems for account creation and device-access control. Government and defense hold 13.8%, supporting secure access, identity issuance, and digital-record management.

Key drivers and attributes:

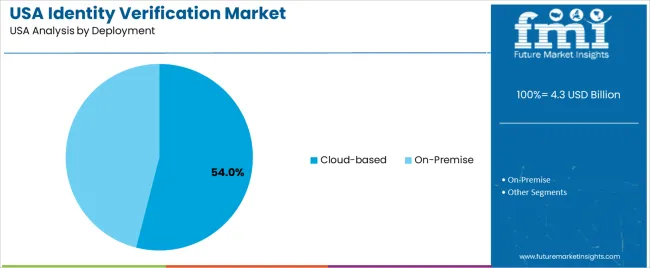

Cloud-based identity-verification deployments hold an estimated 54.0% of USA demand. Cloud platforms support scalable processing, rapid onboarding, and remote workforce operations. They also enable continuous updates, API integration, and distributed authentication across digital service channels. On-premise deployment accounts for 46.0%, serving institutions that require internal data control, customised rule sets, and tightly governed security environments. These systems are common in regulated sectors with strict data-retention policies. Deployment distribution reflects differences in security posture, integration priorities, and organisational size.

Key drivers and attributes:

Growing digital transactions, rising fraud risk, and regulatory compliance are driving demand.

Demand for identity verification solutions in the United States is increasing as businesses and governments support online account openings, digital onboarding, remote access, and e-commerce operations. Rising incidents of identity theft, synthetic identity fraud, and data breaches motivate adoption of more robust verification tools. Financial institutions, fintech firms, and healthcare providers face stringent requirements under Know Your Customer (KYC), Anti-Money Laundering (AML), and other regulatory frameworks, which strengthen demand for identity-proofing and authentication services. Remote identity verification using biometric checks, document validation and AI-driven fraud detection has grown rapidly to support scalable digital workflows and secure customer access.

High implementation cost, privacy concerns, and technological accuracy challenges restrain growth.

Deploying identity verification systems involves expense for software licensing, infrastructure, integration, and ongoing maintenance, which may limit adoption by smaller organisations. Consumers and businesses voice concern about data privacy, biometric usage and sharing of personal information, which can hinder uptake of more advanced identity tools. Some remote verification technologies still encounter accuracy or bias issues across certain demographic groups, which may impact trust and regulatory acceptance, especially in high-risk sectors where false positives or negatives carry substantial cost.

Shift toward biometrics and frictionless verification, convergence of identity services across sectors, and growth in reusable identity models are shaping industry trends.

Service providers are increasingly offering biometric identity verification, such as facial recognition and liveness detection, alongside document checks to speed onboarding while maintaining security. There is growing use of a unified identity verification platform that supports multiple sectors (banking, healthcare, telecom) rather than siloed solutions. The concept of reusable digital identity credentials, where verified identity can be reused across services is emerging and is expected to reduce friction and verification cost. Demand is expanding beyond financial services into retail, sharing economy platforms, government digital services and age-verification for social media users.

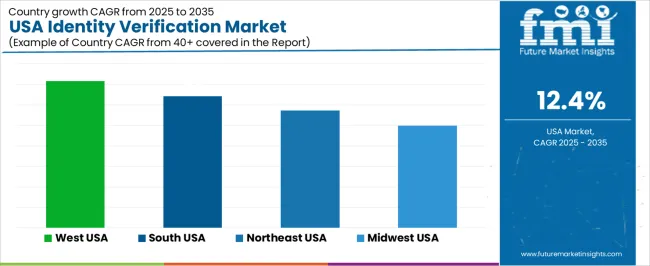

Demand for identity verification in the United States is increasing through 2035 as financial institutions, digital platforms, healthcare networks, and regulated industries adopt stronger verification protocols to manage fraud risk, confirm user identity, and meet compliance requirements. Growth is shaped by expanding online transactions, higher usage of remote onboarding systems, and broader integration of biometric and document-authentication tools. Organizations rely on identity verification for account creation, payment authorization, age confirmation, and access control. Regional differences reflect technology adoption rates, population density, and the strength of digital-service industries. The West leads with a 14.3% CAGR, followed by the South (12.8%), the Northeast (11.4%), and the Midwest (10.0%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 14.3% |

| South | 12.8% |

| Northeast | 11.4% |

| Midwest | 10.0% |

The West grows at 14.3% CAGR, supported by strong technology-sector activity, large digital-service platforms, and widespread adoption of remote authentication tools across finance, e-commerce, and enterprise software environments. States such as California, Washington, and Colorado rely on identity-verification systems for customer onboarding, fraud reduction, and secure platform access. Technology companies use biometric verification, AI-based document checks, and behavioral-analysis tools to validate user identity across global operations. Digital wallets and fintech platforms contribute to high verification volumes associated with new-account creation and transaction authorization. Online marketplaces implement identity verification to reduce fraudulent listings and protect buyer-seller interactions.

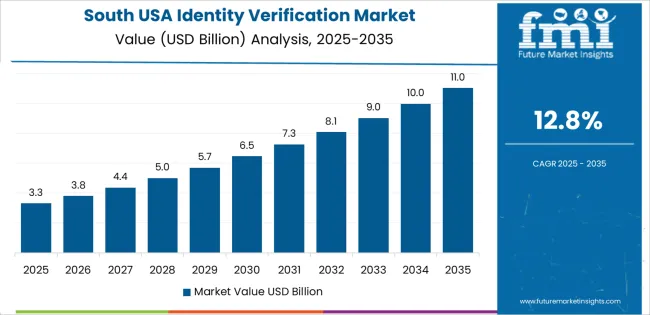

The South grows at 12.8% CAGR, supported by expanding financial-services operations, strong digital-banking adoption, and increased demand from healthcare networks and insurance providers. States such as Texas, Florida, Georgia, and North Carolina maintain large service hubs that rely on identity-verification tools for secure onboarding and compliance processes. Regional banks and credit unions use verification systems to authenticate new customers and manage fraud risk associated with remote account setups. Healthcare providers deploy identity verification for patient enrollment and access to digital records. E-commerce activity in fast-growing metropolitan areas reinforces consistent usage of verification systems.

The Northeast grows at 11.4% CAGR, supported by dense financial hubs, regulatory-driven industries, and extensive use of verification tools across enterprise environments. States including New York, New Jersey, Massachusetts, and Pennsylvania maintain strong usage of identity verification for banking compliance, investment account onboarding, and customer authentication. Healthcare networks adopt verification solutions to manage secure access to patient portals. Educational institutions use identity-verification systems for remote testing and enrollment checks. Retailers and digital-commerce companies rely on verification tools to prevent account fraud and unauthorized transactions.

The Midwest grows at 10.0% CAGR, supported by established financial institutions, manufacturing-service networks, and broad adoption of digital platforms across regional businesses. States such as Illinois, Michigan, Ohio, and Wisconsin rely on identity-verification tools for secure account access, fraud prevention, and employee authentication across corporate environments. Regional banks use verification systems to manage remote onboarding and regulatory compliance. Healthcare facilities integrate identity-verification processes into patient-management systems. E-commerce expansion across suburban and rural industries contributes to increased verification volumes. Growth remains steady as companies modernize digital workflows.

Demand for identity verification in the USA is shaped by a concentrated group of authentication and digital-security providers supporting financial services, public institutions, healthcare systems, and digital-first enterprises. Entrust holds the leading position with an estimated 34.3% share, supported by long-established credentialing frameworks, controlled certificate-management infrastructure, and broad adoption across regulated sectors. Its position is reinforced by stable biometric integration, strong cryptographic capability, and reliable performance in high-assurance environments.

Onfido and IDEMIA follow as significant participants, supplying document verification, biometric checks, and identity-proofing systems used in onboarding workflows for fintech, insurance, mobility services, and platform-based businesses. Their strengths include scalable machine-learning models, consistent image-quality assessment, and compliance alignment with USA identity-verification requirements. Transmit Security maintains a notable role through passwordless verification, risk-based authentication, and orchestration tools that support identity decisioning without reliance on traditional credentials.

Secret Double Octopus contributes additional capability with multi-factor authentication and enterprise credential-resilience solutions aimed at organizations seeking to reduce exposure to credential theft and phishing attacks. Competition across this segment centers on verification accuracy, resistance to fraud, biometric reliability, orchestration flexibility, latency performance, and alignment with regulatory standards. Demand continues to expand as enterprises adopt stronger digital identity controls, face higher fraud pressures, and integrate biometrics, document analytics, and risk-adaptive verification into onboarding and continuous-authentication processes across USA digital platforms and enterprise networks.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Component | Solution, Services |

| Industry | BFSI, Retail & E-commerce, Healthcare, IT & Telecom, Government & Defense |

| Deployment | On-Premise, Cloud-based |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Entrust, Onfido, IDEMIA, Transmit Security, Secret Double Octopus |

| Additional Attributes | Dollar sales by component, industry, and deployment categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of identity verification and authentication providers; advancements in biometric verification, digital identity, and zero-trust security frameworks; integration with fintech platforms, healthcare systems, government services, and enterprise cybersecurity strategies in the USA. |

The global demand for identity verification in USA is estimated to be valued at USD 4.3 billion in 2025.

The market size for the demand for identity verification in USA is projected to reach USD 13.9 billion by 2035.

The demand for identity verification in USA is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in demand for identity verification in USA are solution and services.

In terms of industry, bfsi segment to command 32.7% share in the demand for identity verification in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Identity Verification Market Analysis - Size, Share, and Forecast 2025 to 2035

Demand for Identity Verification in Japan Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Identity And Access Management As A Service (IAMaaS) Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Identity Governance and Administration Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Identity Analytics Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA