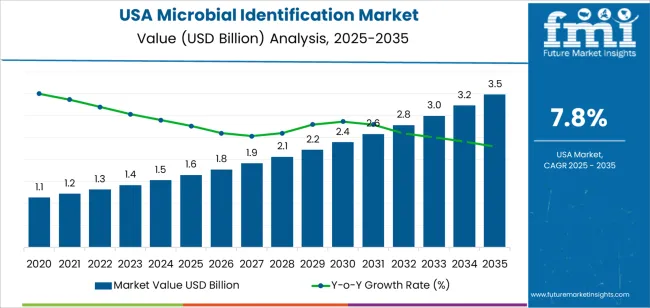

The demand for microbial identification in the USA is expected to grow from USD 1.6 billion in 2025 to USD 3.5 billion by 2035, reflecting a CAGR of 7.8%. Microbial identification plays a critical role in industries such as pharmaceuticals, food safety, clinical diagnostics, and environmental monitoring. Rising concerns about infectious diseases, antimicrobial resistance, and the demand for quality control in food and beverage production drive the growing need for rapid, accurate microbial detection. Technological advancements in microbial detection tools, such as next-generation sequencing (NGS) and mass spectrometry, will continue to enhance diagnostic capabilities, driving market growth.

The increasing focus on healthcare innovation and the need for personalized medicine are also fueling the demand for more precise and efficient microbial testing methods. Regulatory agencies' stringent standards around food safety and hospital-acquired infections are pushing industries to adopt advanced microbial identification systems. As the healthcare and biotechnology sectors continue to expand, the need for microbial identification solutions to support public health initiatives and biomanufacturing will also rise, driving market demand throughout the forecast period.

From 2025 to 2030, the demand for microbial identification in the USA will grow from USD 1.6 billion to USD 2.4 billion, contributing an increase of USD 0.8 billion in value. The early stage of growth will see moderate volatility, driven by fluctuations in regulatory adoption, industry-specific needs, and the pace of technology adoption in diagnostic tools. Key sectors, such as food safety and clinical diagnostics, will see stable growth, but regional differences in the pace of adoption and regulatory hurdles could introduce some variability in the growth rate. The market will experience accelerated growth as industries increasingly recognize the value of rapid microbial detection and personalized medicine, contributing to a more consistent growth trajectory toward the middle of this phase.

From 2030 to 2035, the market will grow from USD 2.4 billion to USD 3.5 billion, adding USD 1.1 billion in value. The growth rate volatility will decrease as the market matures and more standardized microbial identification solutions are adopted across industries. However, slight fluctuations may occur due to innovation cycles, where new technologies in sequencing or automation drive periodic spikes in demand. As the market stabilizes and advanced microbial testing methods become widely integrated, the volatility index will reflect a smoother growth path with periodic spikes driven by major technological breakthroughs or regulatory changes. This phase will be marked by gradual and sustainable growth, with industry adoption reaching a point of more uniform demand across sectors.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.6 billion |

| Industry Forecast Value (2035) | USD 3.5 billion |

| Industry Forecast CAGR (2025 to 2035) | 7.8% |

Demand for microbial identification in the USA is accelerated by increased prevalence of infectious diseases, growing antimicrobial resistance concerns, and tighter food safety and environmental monitoring standards. The United States market holds a leading share in North America for microbial identification systems and services. According to industry data the global market was estimated at roughly USD 4.19 billion in 2024 and is expected to grow substantially through the late 2020s at a compound annual growth rate (CAGR) of about 11.9 %. The substantial presence of advanced diagnostics infrastructure in the USA supports rapid adoption of technologies such as mass spectrometry and polymerase chain reaction (PCR) platforms.

Another contributing factor is rising demand from end user segments such as hospitals, diagnostic laboratories, pharmaceutical companies and food manufacturing facilities. These users increasingly deploy high throughput microbial identification equipment to support infection control, outbreak tracking, raw material qualification and regulatory compliance. Investment in genomics, bioinformatics and laboratory automation further boosts uptake of identification solutions that improve speed and accuracy. Challenges include high capital cost for sophisticated systems and reimbursement and regulatory bottlenecks in certain application areas. Nevertheless, given the alignment of public health priorities, food safety requirements and technological readiness, demand for microbial identification in the USA is expected to maintain robust growth.

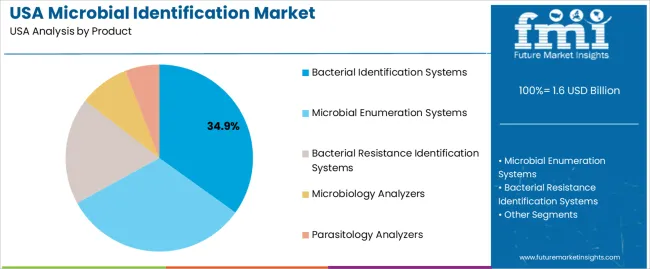

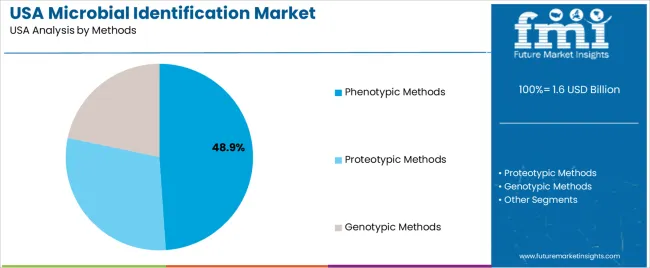

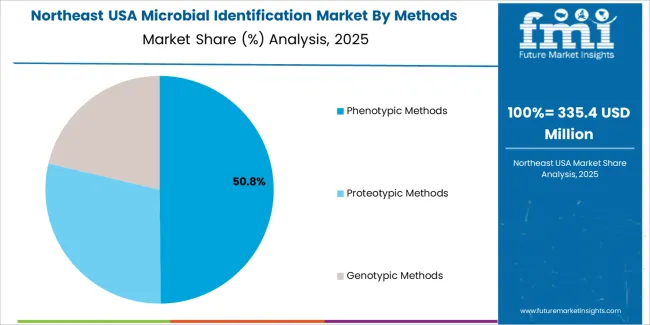

The demand for microbial identification in the USA is driven by product type and method. The leading product type is bacterial identification systems, accounting for 35% of the market share, while phenotypic methods dominate the identification methods, capturing 48.9% of the demand. Microbial identification systems are used across various industries, including healthcare, food safety, and pharmaceuticals, to accurately identify and classify microorganisms for diagnostic, research, and quality control purposes.

Bacterial identification systems lead the market for microbial identification in the USA, holding 35% of the demand. These systems are widely used in clinical diagnostics, food safety testing, and environmental monitoring to identify bacterial species and determine potential pathogenic risks. The ability to rapidly and accurately identify bacteria is critical in healthcare for the diagnosis of infections and in the food industry for ensuring product safety.

The demand for bacterial identification systems is driven by the need for more accurate and faster diagnostics in clinical settings, particularly in the detection of antibiotic-resistant bacteria. As antibiotic resistance becomes an increasing global health concern, these systems play a crucial role in guiding treatment decisions and controlling the spread of resistant strains. The ongoing development of more advanced, automated bacterial identification systems ensures their continued leadership in the microbial identification market.

Phenotypic methods are the dominant identification method for microbial identification in the USA, accounting for 48.9% of the demand. Phenotypic methods involve the analysis of physical characteristics of microorganisms, such as morphology, staining properties, and metabolic activity, to identify species. These methods are widely used due to their practicality, ease of use, and cost-effectiveness in both clinical and research settings.

The preference for phenotypic methods is driven by their established reliability in identifying a wide range of microorganisms and their compatibility with various sample types. While newer methods, such as genotypic methods, are gaining traction, phenotypic methods remain popular due to their simplicity, lower costs, and ability to deliver results without the need for complex equipment or extensive training. As demand for rapid microbial identification solutions grows, phenotypic methods are expected to maintain their position as a key tool in microbiology.

Demand for microbial identification in the USA is shaped by rising incidence of infectious diseases, expansion of food safety and environmental monitoring regulations, and growing investment in biotechnology and diagnostics. Advanced technologies such as PCR, next generation sequencing and mass spectrometry are making microbial identification systems more capable and in demand. At the same time, high system cost, regulatory complexity and competition from conventional methods moderate growth. Together these factors define how the market for microbial identification tools and services is evolving.

What Are the Primary Growth Drivers for Microbial Identification Demand in the United States? Several drivers support this market. First, increased prevalence of antibiotic resistant pathogens boosts demand for rapid and precise identification technologies in clinical diagnostics. Second, food processing and beverage manufacturing industries face stricter safety controls and require robust microbial testing to meet regulatory compliance and avoid recalls. Third, growth in biotechnology and pharmaceutical development activities drives need for microbial identification platforms in quality control and R&D settings. Fourth, federal and state funding for public health surveillance, outbreak response and environmental monitoring expands the addressable use cases for microbial identification systems.

What Are the Key Restraints Affecting Microbial Identification Demand in the United States? Despite significant potential, some restraints apply. The capital and operating costs of advanced microbial identification instruments and consumables are high, limiting adoption by smaller laboratories and choosing conventional culture methods instead. The regulatory approval process for diagnostic identification tools remains complex and can delay commercialisation of new technologies. Supply chain limitations for specialised reagents and high precision instruments can increase lead times and restrict scaling. Additionally, some laboratories may continue to rely on established phenotypic methods which restricts the switch to more advanced identification systems.

What Are the Key Trends Shaping Microbial Identification Demand in the United States? Key trends include growing integration of artificial intelligence and machine learning algorithms into microbial identification workflows to enhance speed and accuracy of pathogen detection. There is increasing demand for multiplexed systems capable of identifying multiple organisms simultaneously across clinical, food safety and environmental applications. Manufacturers are developing instruments tailored for high throughput workflows and automation to support large scale testing. Also, there is rising interest in decentralised testing and point of need microbial identification platforms that enable rapid analysis outside traditional laboratory environments.

The demand for microbial identification in the USA is driven by the growing need for accurate and rapid detection of microbial contaminants in various industries, including healthcare, food and beverage, pharmaceuticals, and environmental sectors. As the focus on public health and safety increases, industries are investing in advanced microbial identification technologies to ensure product safety, quality control, and compliance with regulatory standards. The rise in infectious diseases, the need for more precise diagnostics, and the increasing prevalence of antimicrobial resistance (AMR) also contribute to the growing demand for microbial identification systems.

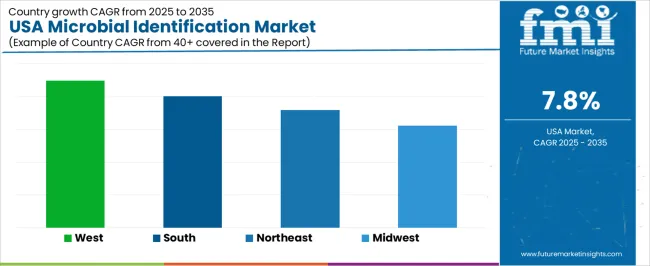

Additionally, advancements in molecular biology techniques, such as PCR and next-generation sequencing, have enhanced the speed, accuracy, and cost-effectiveness of microbial identification, further expanding the market. The demand for these systems varies regionally, reflecting differences in industrial activity, healthcare infrastructure, and local regulatory environments.

| Region | CAGR (2025-2035) |

|---|---|

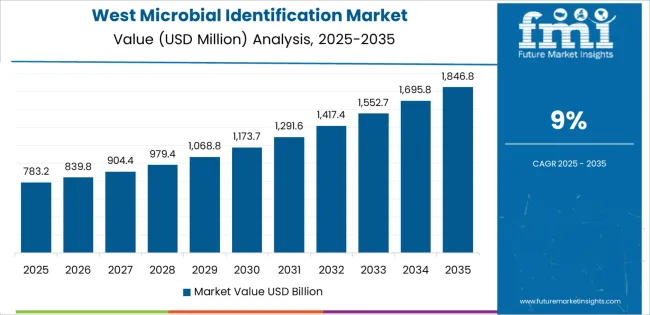

| West | 9% |

| South | 8% |

| Northeast | 7.2% |

| Midwest | 6.2% |

The West leads the demand for microbial identification in the USA with a CAGR of 9.0%. This growth is attributed to the region’s strong presence in biotechnology, healthcare, and food production industries. States like California, which have a high concentration of pharmaceutical, biotech, and food safety companies, contribute significantly to the demand for microbial testing technologies. The West’s focus on public health, along with stringent regulations in healthcare and food industries, drives the adoption of advanced microbial identification systems.

Moreover, the region’s increasing investments in research and development of diagnostic tools, including rapid microbial identification systems, further contribute to the market’s growth. With the rise of new diseases and health concerns, particularly in densely populated urban areas, the demand for these systems remains high in the West.

The South shows strong demand for microbial identification with a CAGR of 8.0%. The region’s significant presence in the agriculture, food production, and pharmaceutical sectors is a key factor driving this demand. States like Texas, Georgia, and Florida have large agricultural and food manufacturing industries that require microbial testing to ensure product quality and safety. Additionally, the growing pharmaceutical and healthcare industries in the South contribute to the rising need for accurate microbial identification systems to prevent contamination and ensure patient safety.

As the South’s industrial and agricultural sectors continue to expand, the need for microbial identification technologies to detect harmful pathogens and prevent outbreaks in food products and pharmaceuticals will continue to increase.

The Northeast shows steady demand for microbial identification with a CAGR of 7.2%. The region is home to some of the leading healthcare and pharmaceutical industries, including hospitals, research institutions, and biotechnology companies. The demand for microbial identification is driven by the need for accurate diagnostics, particularly in healthcare and environmental monitoring. Major cities like New York, Boston, and Philadelphia, which are hubs for medical research and clinical trials, contribute significantly to the growing need for these systems.

Furthermore, the region's focus on public health and regulatory compliance in both healthcare and food safety continues to drive the steady adoption of microbial identification technologies. While growth in the Northeast is not as rapid as in the West and South, it remains consistent as the region continues to invest in health and safety measures.

The Midwest shows moderate growth in the demand for microbial identification with a CAGR of 6.2%. While the region has a strong industrial base, particularly in manufacturing and agriculture, the adoption of advanced microbial identification systems has been somewhat slower compared to more healthcare-focused regions like the Northeast and West. However, the demand for these systems is growing as the Midwest increasingly focuses on improving quality control in food production, pharmaceuticals, and environmental monitoring.

The Midwest’s agricultural industry, which plays a critical role in the region’s economy, requires accurate microbial identification to prevent contamination in food products. As more companies in the region embrace modern technologies for microbial testing, the demand for microbial identification systems is expected to increase steadily, particularly in sectors focused on food safety and environmental health.

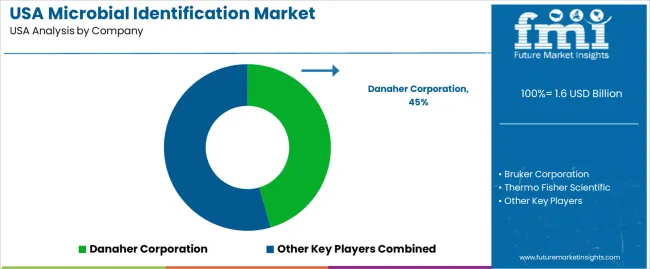

The microbial identification industry in the United States is expanding as clinical laboratories, pharmaceutical manufacturers, and food testing facilities increase their focus on pathogen detection and microbial analysis. Companies such as Danaher Corporation (holding approximately 45.5% market share), Bruker Corporation, Thermo Fisher Scientific, Siemens Healthineers, and Shimadzu Corporation are major suppliers in this sector. Demand is driven by regulatory requirements, the need for rapid diagnostic methods, and increasing attention to food safety and pharmaceutical contamination control.

Competition in the microbial identification industry is centered on speed, accuracy, and system integration. Firms develop technologies like MALDI TOF mass spectrometry, automated sequencing, and real time PCR to reduce turnaround time and support high volume workflows. Another competitive dimension is software analytics and database access, which enable laboratories to identify rare or emerging pathogens and process large data sets. Service and support networks also influence buying decisions, especially in regulated industries that require validation and compliance documentation.

Marketing materials typically highlight assay range, identification accuracy, system throughput, and laboratory connectivity. By aligning their solutions with the increasing demand for fast and reliable microbial identification, these companies aim to maintain or enhance their positions in the USA microbial identification industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product | Bacterial Identification Systems, Microbial Enumeration Systems, Bacterial Resistance Identification Systems, Microbiology Analyzers, Parasitology Analyzers |

| Methods | Phenotypic Methods, Proteotypic Methods, Genotypic Methods |

| Application | Diagnostic Application, Environmental Application, Food and Beverages Testing, Pharmaceutical Application, Others |

| End User | Pharmaceutical and Biotechnology Industry, Food and Beverage Industry, Water and Environment Industry, Independent Research Laboratories, Diagnostic Laboratories, Hospitals, Others |

| Key Companies Profiled | Danaher Corporation, Bruker Corporation, Thermo Fisher Scientific, Siemens Healthineers, Shimadzu Corporation |

| Additional Attributes | The market analysis includes dollar sales by product, method, application, and end-user categories. It also covers regional demand trends in the USA, driven by the increasing need for microbial identification in industries such as pharmaceuticals, food and beverage, and environmental testing. The competitive landscape highlights key manufacturers focusing on innovations in microbial detection and identification technologies. Trends in the growing adoption of advanced techniques like genotypic methods and the increasing demand for rapid diagnostics and testing in healthcare, food safety, and environmental monitoring are explored. |

The demand for microbial identification in usa is estimated to be valued at USD 1.6 billion in 2025.

The market size for the microbial identification in usa is projected to reach USD 3.5 billion by 2035.

The demand for microbial identification in usa is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in microbial identification in usa are bacterial identification systems, microbial enumeration systems, bacterial resistance identification systems, microbiology analyzers and parasitology analyzers.

In terms of methods, phenotypic methods segment is expected to command 48.9% share in the microbial identification in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Microbial Seed Treatment Market Analysis – Trends, Growth & Forecast 2025-2035

Microbial Identification Market Report – Growth & Forecast 2025-2035

Demand for Microbial Identification in Japan Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Microbial Polyketides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Nucleotides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Microbial Fermentation Technology Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Microbial Gene Editing Services Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA