The demand for microbial identification in Japan is expected to grow from USD 231.1 million in 2025 to USD 419.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.2%. Microbial identification plays a critical role in various sectors, including healthcare, pharmaceuticals, food safety, and environmental monitoring, by enabling the detection, classification, and analysis of microorganisms. As Japan continues to strengthen its commitment to public health, food safety, and environmental protection, the demand for advanced microbial identification technologies will rise. This is driven by the increasing need for accurate and rapid identification of microorganisms to ensure product safety, quality, and compliance with stringent regulations.

Technological advancements in microbial identification, such as next-generation sequencing, PCR-based methods, and automation, will further fuel industry growth. The adoption of more efficient, cost-effective, and accurate methods for microbial identification will enhance the ability to detect and control pathogens, reduce contamination risks, and optimize manufacturing processes. As industries, particularly healthcare and food production, continue to prioritize hygiene, safety, and regulatory compliance, the need for advanced microbial identification systems will grow significantly.

Between 2025 and 2030, the demand for microbial identification in Japan is expected to increase from USD 231.1 million to USD 245.3 million, with gradual growth. This phase represents the steady adoption of microbial identification technologies across various industries as the need for pathogen detection and quality assurance continues to rise. During this period, technological innovations and regulatory pressure for improved safety standards will drive demand. Industry saturation is expected to start nearing as most industries already begin to integrate microbial identification systems into their existing processes.

From 2030 to 2035, demand will continue to rise more rapidly, from USD 245.3 million to USD 419.7 million. This period is expected to mark the approach to the industry's saturation point. As the microbial identification industry in Japan matures, growth will be driven by technological advancements and the continuous need for enhanced solutions. While the majority of industries adopt microbial identification systems, innovations in automation, speed, and efficiency will continue to generate demand. The saturation point analysis suggests that by 2035, while the industry will still grow, it will experience a slower pace of expansion as it reaches higher adoption levels across sectors, with new technologies offering more refined solutions to existing demands.

| Metric | Value |

|---|---|

| Demand for Microbial Identification in Japan Value (2025) | USD 231.1 billion |

| Demand for Microbial Identification in Japan Forecast Value (2035) | USD 419.7 billion |

| Demand for Microbial Identification in Japan Forecast CAGR (2025 to 2035) | 6.2% |

The demand for microbial identification in Japan is increasing as healthcare, food safety, and environmental monitoring sectors intensify their focus on accurate and timely detection of microorganisms. Laboratories and diagnostic centres employ advanced microbial‑identification technologies such as DNA sequencing, mass spectrometry, and automated culturing for applications ranging from infection control to outbreak tracing. As awareness around microbial threats rises, the need for dependable identification solutions becomes more pronounced.

Food safety regulatory pressures and evolving quality standards are also driving demand. Japan’s food‑processing and export industries rely on microbial‑identification tools to ensure product safety and meet global trade standards. Rapid and accurate identification helps prevent recalls, reduce contamination risks, and maintain brand reputation. In parallel, water‑ and environmental‑monitoring initiatives require precise microbial profiling to comply with increasing scrutiny of public‑health and ecosystem integrity.

Technological advancements have lowered the barrier of adoption. New platforms offer faster turnaround times, higher throughput, and easier integration with digital laboratory workflows. These innovations help laboratories improve productivity and reduce cost per sample while expanding capabilities. As diagnostic laboratories modernize and expand in Japan, and as industries look for more precise microbial‑identification solutions, the demand is expected to grow steadily through 2035.

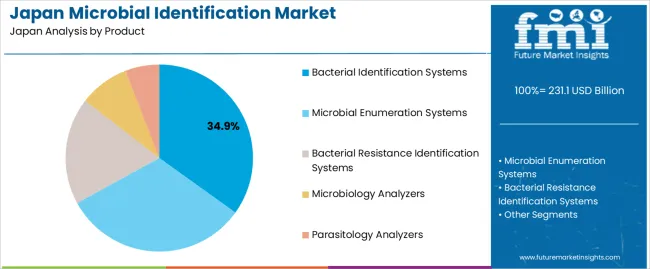

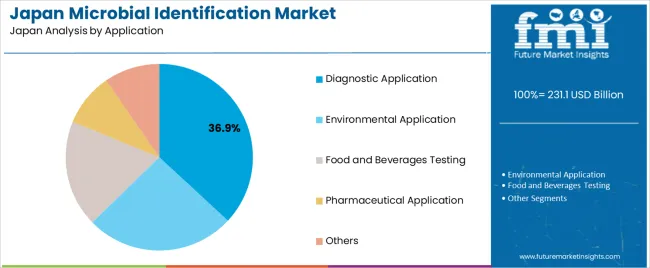

By product, demand is divided into bacterial identification systems, microbial enumeration systems, bacterial resistance identification systems, microbiology analyzers, and parasitology analyzers. The demand is also segmented by application, including diagnostic application, environmental application, food and beverages testing, pharmaceutical application, and others. In terms of end user, demand is divided into the pharmaceutical and biotechnology industry, food and beverage industry, water and environment industry, independent research laboratories, diagnostic laboratories, hospitals, and others. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Bacterial identification systems account for 35% of the demand for microbial identification in Japan. These systems are crucial for identifying bacterial species, which is essential for diagnosing infections, understanding microbial contamination, and monitoring public health. Bacterial identification is a fundamental part of many healthcare, food safety, and environmental testing protocols. As the prevalence of infectious diseases and foodborne illnesses continues to rise, the demand for precise, rapid, and reliable bacterial identification methods has increased. These systems help microbiologists quickly identify pathogens and determine the best treatment options, improving patient outcomes and food safety. Bacterial identification systems are integral to research in biotechnology and pharmaceuticals, driving further demand in those sectors. With the increasing focus on public health, environmental safety, and pharmaceutical advancements, bacterial identification systems will continue to be in high demand.

Diagnostic application accounts for 36.9% of the demand for microbial identification in Japan. The growing need for accurate, timely, and reliable diagnostic tools in healthcare drives the demand for microbial identification technologies. These systems play a critical role in identifying pathogens responsible for infections, helping healthcare providers deliver targeted treatments and reducing the spread of infectious diseases. In clinical settings, microbial identification systems are essential for identifying bacterial, viral, and fungal infections, enabling faster diagnosis and improving patient care. The increasing incidence of chronic diseases, antimicrobial resistance, and infectious disease outbreaks has heightened the importance of rapid diagnostic systems. As the healthcare sector continues to prioritize patient safety, precision, and speed, diagnostic applications will remain the leading sector for microbial identification, ensuring that these systems continue to dominate the industry.

Key drivers include rising infectious‑disease incidence, growth of antimicrobial‑resistance awareness, stricter regulatory requirements in pharmaceuticals and food safety, and expansion of biotechnology R&D in Japan. These result in increased need for rapid and accurate microbial identification across healthcare, food & beverage, and environmental sectors. Restraints include high capital and operating costs of advanced identification systems, a shortage of skilled personnel to operate complex diagnostics, and slower adoption in smaller laboratories or food‑processing sites due to budget or infrastructure constraints.

In Japan, demand for microbial identification is growing because healthcare providers, pharmaceutical companies and food manufacturers require faster and more precise tools to identify pathogens, monitor contamination, and comply with quality standards. The ageing population and higher hospital utilisation amplify infection‑control needs, while the food‑processing industry faces stronger safety regulations and traceability demands. Biotechnology and research‑institutes are also investing in genotypic and proteomic platforms which support this demand. Together, these factors drive adoption of microbial‑identification technologies throughout Japanese clinical, industrial and research applications.

Technological innovations are advancing microbial identification in Japan by improving speed, accuracy and utility. Key advances include mass‑spectrometry based systems (such as MALDI‑TOF), next‑generation sequencing (NGS) for strain‑level resolution, multiplex PCR assays for rapid pathogen detection, and digital‑data platforms linking results to analytics and traceability. Automation of workflows and integration with laboratory‑information systems make microbial‑identification more scalable. These innovations enable Japanese laboratories and manufacturers to handle larger sample volumes, comply with regulatory demands and implement preventive‑quality control more effectively, thereby boosting overall demand.

Despite strong need, adoption of advanced microbial‑identification solutions in Japan faces several hurdles. One is cost: high‑end instruments, reagents and maintenance can strain budgets, particularly for smaller labs or processing plants. Another is human‑resource: operating sophisticated technologies requires trained personnel, and the shortage of such specialist’s limits spread. Regulatory complexity and validation burdens for new methods also slow uptake. In some food‑processing or environmental‑monitoring contexts, simpler traditional methods may still be used due to familiarity or cost‑constraints, which reduces the pace of transition to advanced microbial‑identification platforms.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 7.7 |

| Kanto | 7.1 |

| Kinki | 6.2 |

| Chubu | 5.5 |

| Tohoku | 4.8 |

| Rest of Japan | 4.6 |

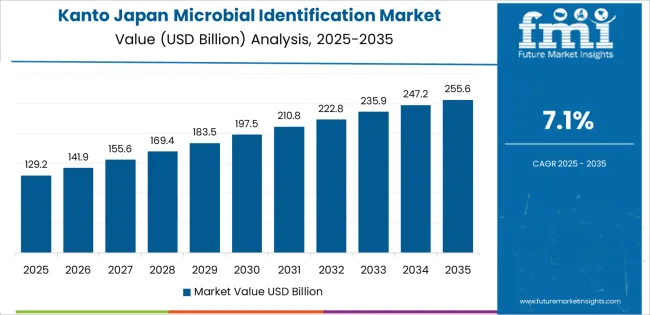

Demand for microbial identification in Japan is increasing across all regions, with Kyushu & Okinawa leading at a 7.7% CAGR. This growth is driven by the region’s expanding biotechnology and healthcare sectors. Kanto follows with a 7.1% CAGR, supported by its strong healthcare, pharmaceutical, and research industries. Kinki shows a 6.2% CAGR, driven by its focus on food safety and quality control in the food and beverage sectors. Chubu experiences a 5.5% CAGR, with demand driven by its manufacturing and healthcare industries. Tohoku sees a 4.8% CAGR, fueled by its agricultural base and the need for food safety measures. The Rest of Japan shows steady growth at 4.6%, with consistent demand driven by regional industries and healthcare sectors.

Kyushu & Okinawa are experiencing the highest demand for microbial identification in Japan, with a 7.7% CAGR. This growth is driven by the region’s expanding biotechnology and healthcare sectors, where microbial identification is essential for research, diagnostics, and food safety. Kyushu, in particular, has a strong presence in pharmaceutical manufacturing, agricultural industries, and clinical research, all of which rely on microbial testing for quality control and safety. With increasing concerns about foodborne pathogens and infectious diseases, the demand for precise microbial identification is rising. Furthermore, Kyushu’s focus on research and development in life sciences is pushing the need for advanced microbial detection technologies. The region’s investments in healthcare infrastructure and growing awareness of public health issues further contribute to the rising adoption of microbial identification solutions, which will continue to drive the industry in the coming years.

Kanto is experiencing steady demand for microbial identification in Japan, with a 7.1% CAGR. This growth is largely driven by the region’s central role in healthcare, pharmaceuticals, and research institutions. Kanto, including cities like Tokyo and Yokohama, is home to many of Japan’s leading hospitals, research centers, and biotechnology companies that rely on microbial identification for diagnostics, research, and quality control. The region's growing focus on public health, food safety, and the prevention of infectious diseases has contributed to the rising demand for microbial identification technologies. Kanto’s strong healthcare infrastructure and concentration of life science companies foster innovation and adoption of advanced microbial detection systems. As the region continues to prioritize healthcare and medical research, the demand for microbial identification solutions is expected to grow steadily, driven by the need for more accurate and efficient diagnostic tools in the fight against infectious diseases.

Kinki is seeing moderate demand for microbial identification in Japan, with a 6.2% CAGR. This growth is primarily driven by the region’s strong pharmaceutical, biotechnology, and food processing industries. Cities like Osaka and Kyoto are centers of innovation and manufacturing, where microbial identification plays a critical role in maintaining product safety, particularly in food and beverage sectors. As the region’s manufacturing and healthcare industries grow, so does the demand for microbial identification technologies, which are essential for ensuring the safety and quality of products. The region’s emphasis on research and development in healthcare and life sciences is further contributing to the need for advanced microbial testing solutions. The growing awareness of foodborne illnesses and the importance of controlling infectious diseases in healthcare settings are pushing the adoption of microbial identification tools. As Kinki continues to prioritize public health and industrial safety, the demand for microbial identification will remain strong.

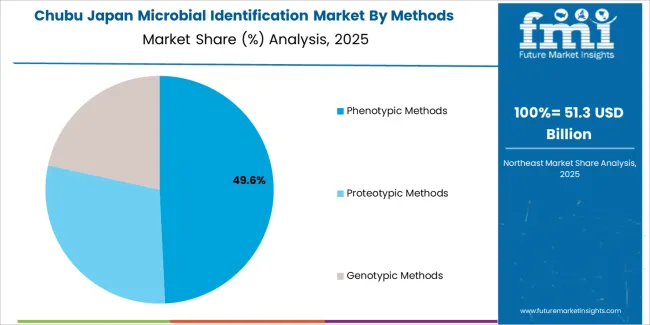

Chubu is experiencing steady demand for microbial identification in Japan, with a 5.5% CAGR. The region’s industrial base, particularly in automotive manufacturing and electronics, along with its growing pharmaceutical sector, is driving this demand. Chubu’s key cities like Nagoya are central to Japan's manufacturing industry, where microbial identification is crucial in ensuring the safety and quality of industrial products, food, and pharmaceuticals. As the region continues to focus on automation and precision in manufacturing, the need for reliable microbial identification systems is increasing. The demand for microbial testing is also rising in Chubu’s expanding healthcare and biotechnology sectors, where it is used for research, diagnostics, and ensuring compliance with safety regulations. As Chubu maintains its position as an industrial hub while also expanding its healthcare sector, the need for effective microbial identification solutions will continue to rise, albeit at a moderate pace compared to other regions.

Tohoku is experiencing moderate demand for microbial identification in Japan, with a 4.8% CAGR. This growth is driven by the region’s agricultural and food processing industries, where microbial testing is vital for ensuring food safety and product quality. As Tohoku has a strong focus on agriculture and food production, the need for microbial identification solutions to detect pathogens and ensure safe food products is growing. The region is also seeing an increase in healthcare facilities and research institutions that rely on microbial identification for disease prevention and clinical diagnostics. As the demand for food safety and health management systems continues to rise, the need for accurate microbial detection technologies will remain strong in Tohoku. The region’s commitment to improving public health and ensuring food safety standards will continue to drive the adoption of microbial identification solutions, albeit at a slower pace compared to more industrially developed regions.

The Rest of Japan is experiencing steady demand for microbial identification, with a 4.6% CAGR. While the region does not have the same high concentration of healthcare and biotechnology sectors as major hubs like Kanto or Kyushu, there is a growing need for microbial identification solutions across various industries. Smaller agricultural, pharmaceutical, and food processing businesses in these regions are increasingly adopting microbial identification technologies to meet safety and quality standards. As awareness of food safety, public health, and environmental hygiene continues to grow, the demand for microbial testing in the Rest of Japan is rising. With more regional healthcare centers and research institutions focusing on improving diagnostics and preventive health measures, the adoption of microbial identification solutions is expected to increase. Although the growth rate is slower compared to other regions, the Rest of Japan will continue to see consistent demand for microbial identification technologies.

In Japan the demand for microbial identification solutions is strengthening significantly driven by the need in healthcare diagnostics, pharmaceutical manufacturing, food and beverage safety, and biotechnology research. Companies that offer instruments, consumables, software and service platforms for rapid and accurate classification of microorganisms are increasingly sought after by diagnostic labs, drug‑makers, food‑processors and regulatory agencies. Innovation in technologies such as mass spectrometry, PCR, next‑generation sequencing and bioinformatics supports this increasing uptake in Japan.

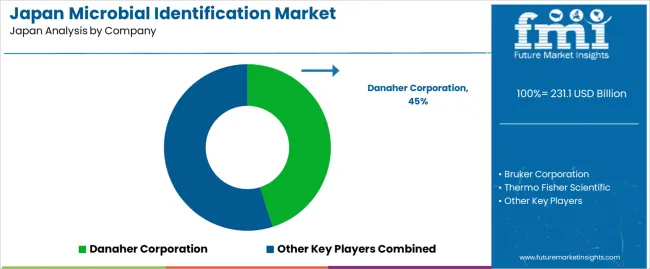

Among the leading providers active in Japan are Danaher Corporation with approximately 45.1% share, Bruker Corporation, Thermo Fisher Scientific, Siemens Healthineers and Shimadzu Corporation. These firms differentiate based on their broad technology portfolios, regulatory approvals suited to Japan’s industry, service and support networks, and close collaborations with local customers. Danaher’s leading position reflects its strength in diagnostics, instrumentation and consumables.

The competitive environment is shaped by several dynamics. Key drivers include stricter regulatory compliance for microbial control in pharmaceuticals and food safety, demand for faster turnaround diagnostics in infectious diseases and growing biotech research activity. Challenges include high costs of advanced systems, requirement for trained technical personnel and competition from alternative techniques or outsourced testing services. Suppliers that can deliver high‑performance technology, reliable after‑sales support and seamless integration into laboratory and production workflows are best positioned to succeed in Japan’s microbial identification domain.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product | Bacterial Identification Systems, Microbial Enumeration Systems, Bacterial Resistance Identification Systems, Microbiology Analyzers, Parasitology Analyzers |

| Methods | Phenotypic Methods, Proteotypic Methods, Genotypic Methods |

| Application | Diagnostic Application, Environmental Application, Food and Beverages Testing, Pharmaceutical Application, Others |

| End User | Pharmaceutical and Biotechnology Industry, Food and Beverage Industry, Water and Environment Industry, Independent Research Laboratories, Diagnostic Laboratories, Hospitals, Others |

| Countries Covered | Japan |

| Key Companies Profiled | Danaher Corporation, Bruker Corporation, Thermo Fisher Scientific, Siemens Healthineers, Shimadzu Corporation |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in microbial identification systems; growth in pharmaceutical, food & beverage, and environmental sectors; technology adoption for diagnostics and testing; vendor offerings including hardware, software, and analytical services; regulatory influences and industry standards |

The demand for microbial identification in japan is estimated to be valued at USD 231.1 billion in 2025.

The market size for the microbial identification in japan is projected to reach USD 419.7 billion by 2035.

The demand for microbial identification in japan is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in microbial identification in japan are bacterial identification systems, microbial enumeration systems, bacterial resistance identification systems, microbiology analyzers and parasitology analyzers.

In terms of methods, phenotypic methods segment is expected to command 48.9% share in the microbial identification in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microbial Identification Market Report – Growth & Forecast 2025-2035

Demand for Microbial Identification in USA Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Microbial Polyketides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microbial Nucleotides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Microbial Fermentation Technology Market Size and Share Forecast Outlook 2025 to 2035

Microbial Gene Editing Services Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipids Size and Share Forecast Outlook 2025 to 2035

Microbial Therapeutic Products Market Size and Share Forecast Outlook 2025 to 2035

Microbial Lipase Market - Size, Share, and Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA