Rapid growth in the urgent care sector is expected in the years 2025 to 2035 due to increased demand for convenient and low-cost health services. Urgent care centers provide convenient medical treatment in a way that fills the gap between the primary care setting and the emergency room for patients with ailments that are not life-threatening, all without an appointment or reservation.

The other major factors driving the increased demand for urgent care services are crowding in emergency departments by a growing patient bulk due to physician shortage, increasing healthcare costs, and so on.

The industry is looking towards extended operational hours, offering telemedicine services, and diversifying their products of service into diagnostic and physical therapy, occupational health services, etc. Also, retail health clinics and urgent care chains continue their expansion through acquisitions and alliances.

Market dynamics are changing rapidly owing to technology advancements in healthcare IT and diagnostics, with encouraging reimbursement policies. The market would benefit from greater integration of electronic health records and AI-driven triage systems to promote patient flow and clinical operations efficiency.

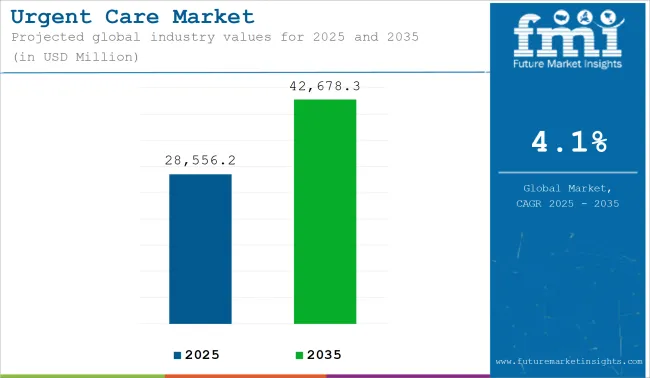

The market is projected to grow at a compound annual growth rate (CAGR) of 4.1% from 2025 to 2035, increasing from USD 28,556.2 Million in 2025 to USD 42,678.3 Million by 2035.

Metric Overview

| Metric | Value |

|---|---|

| Market Size (2025) | USD 28,556.2 Million |

| Market Value (2035) | USD 42,678.3 Million |

| CAGR (2025 to 2035) | 4.1% |

The preference of patients for urgent care services has intensified the Americas as the most profitable landscape when it comes to urgent centers in the region, owing to the strongly developed local health infrastructure.

The USA is one of the leading geographies in terms of urgent centers, with increasing moves towards digital check-in systems and telehealth. Emphasis has been shifting towards value-based care from the view on decreasing readmission rates, acting as another contributory factor in the growth of this sector.

Europe is witnessing expanded growth in urgent care services especially in urban areas where long hospital wait times and pressure on emergency departments are escalating. Models for community-based urgent care are being slowly put in place in countries such as the UK, Germany, and France.

The main forces enabling these models to become more widespread are regulatory backing for alternative care facilities and an aging population more inclined to seek urgent care for non-severe ailments.

The urgent care sector is growing rapidly across the Asia-Pacific region predominantly because of urbanization, lack of primary care access, and booming healthcare demand in these emerging markets. Countries such as China, India, and Australia are throwing efforts in building urgent care systems to ease the pressure on larger hospitals. Growth is reinforced by various government health reform initiatives and digitization of outpatient services.

Staffing Shortages and Workforce Burnout

The urgent care is always empty regarding staff, particularly physicians, nurse practitioners, and physician assistants. Given that reality, the atmosphere of quick work with much longer shifts and many patients leads to burnout, affecting the quality of care and the efficiency of the operation.

Reimbursement and Regulatory Uncertainty

Urgent care centers have always been caught in the cross-heirs of the incorrect reimbursement policies adopted by both private and public payers. Furthermore, any misstep in changing regulations as they apply to the services provided, such as telehealth integrations, or regulation of licensing could be a show-stopper for operational functions, particularly in case of multistate providers.

Rising Demand for Cost-Effective, Immediate Care

The growing number of patients seeking alternatives to emergency rooms for non-life-threatening conditions has opened up promising avenues for related urgent care centers to penetrate the market cheaply and effectively. Their capacity to attend to a wide range of minor injuries and illnesses in less time is the key catalyst with which the market has grown..

Integration of Telemedicine and Digital Tools

Adoption of telehealth services, electronic checking, and digital follow-up-shared improvements through patient experience will increase access to urgent services. These innovations promote efficiency, but in reality, it gives urgent care providers the power to serve much larger geographic areas.

The urgent care market is changing very fast as people are really into getting fast, same-day care which is somewhere between primary and emergency medicine. Expensive care is driving consumers toward urgent care centers for transparency and access. New operating models are taking shape through the integration of technology with partnerships with insurance providers.

The market is projected to experience steady growth in the next decade, and North America will still lead the way by high health care expenditure and the extensive network of urgent care providers.

The region, Asia-Pacific, would be the fastest-growing because of increasing urbanization, improving health care access, and a higher burden of care on emergency departments. Europe is also expected to have moderate growth in this regard as health systems gradually shift to more flexible models of care delivery.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Care Delivery Models | Standalone clinics and retail-based centers |

| Patient Expectations | Walk-in convenience and short wait times |

| Technology Adoption | Introduction of EHRs and basic telemedicine |

| Workforce Structure | Reliance on general practitioners and nurse practitioners |

| Healthcare System Role | Supplement to emergency and primary care |

| Market Expansion | Growth in urban and suburban settings |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Care Delivery Models | Integrated urgent care hubs with telehealth and home-based diagnostics |

| Patient Expectations | Seamless digital experiences and 24/7 hybrid care access |

| Technology Adoption | Full integration of AI triage tools, remote monitoring, and mobile health platforms |

| Workforce Structure | Expansion of multidisciplinary teams and virtual care coordinators |

| Healthcare System Role | Core access point in value-based and preventative care models |

| Market Expansion | Penetration into rural areas and emerging healthcare markets |

The current urgent care market in the United States is growing with rise of more demand for accessible and affordable health facilities. Increasing number of patients, extended waiting time in ERs, and additional insurance may lead to a strong market. Overall, the health care emergency market has been promoting rapid growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The urgent care model in the UK is set to augment NHS services by decreasing excess load on emergency departments. Growth has been aided by government endorsement of community-based healthcare and a seamless integration of service provision.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.9% |

This is indeed expanding as a market some of which comes from the improvement of regions on outpatient services due to reforms in healthcare across the EU. Investments across mobile clinics and the entire integration of urgent care into a primary care system are both priming up the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

The market for Japan is evolving-in slow but certain steps-into that in which it opens its doors to community health access, particularly for its older citizens. The government is, therefore, planning on localized urgent care facilities to take off the burden of care from hospitals.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

A notable market expansion is being experienced in South Korea due to the increasing reconciling healthcare demands and improvement in after-hours services. Integration of urgent care as one under telemedicine is also expected to gain favorable momentum.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

| By Services | Market Share (2025) |

|---|---|

| Cold, Cough & Flu | 18.2% |

By 2025, cold, cough, and flu-related services will hold on to a staggering 18.2% of an urgent care market to become most favored among all categories. The conditions are prevalent and appear acutely to call for immediate attention without being an ER case. Therefore, urgent care is ideally positioned to provide immediate care using quick tests, antiviral medications, and supportive care.

Another factor that acts as a big pull to this category is the major seasonal drift, particularly in the winter and flu season. Besides this, increased health consciousness and a growing preference for affordable, immediate-moving care are boosting demand for cold and flu services.

Cold-and-cough diagnostics and telehealth services for respiratory illnesses provide better accessibility to the cold-and-flu option in urgent care. All of these factors render this segment the most preferred across age groups but largely so for working adults and parents of school-going children.

| By Type of Patient | Market Share (2025) |

|---|---|

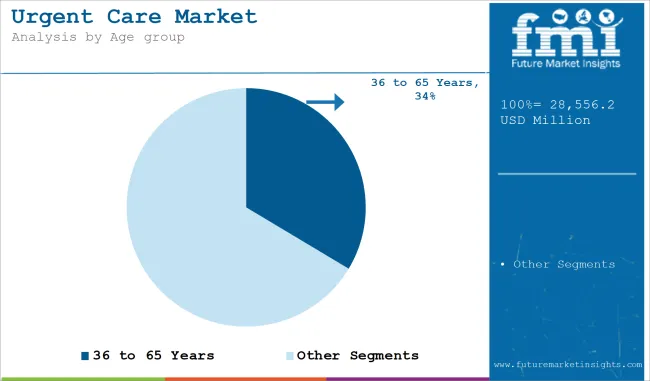

| 36 to 65 Years | 33.6% |

Patients who are within the age limit of 36 to 65 are expected to contribute much to the urgent care market at 33.6% in the year 2025. This age category usually has a variety of health issues ranging from minor injuries and infections, managing chronic conditions such as hypertension and diabetes.

Moreover, the age group is expected to have a greater likelihood of being part of the workforce, thus making urgent care applicable because of longer hours and quicker access to the medical professional without appointments. Besides acute care, this group contributes frequently as they visit urgent care for wellness visits, immunization, and diagnostic testing.

Availability of employer-sponsored health plans and growing acceptance of digitally enabled health tools further feeds into the high incidence of visits to urgent care by middle-aged adults. With increasing lifestyle diseases, the segment will remain the strongest and most vigorous part of those accessing the facilities.

Contribution of global urgent care market growth has topped other markets worldwide with customers seeking an immediate and alternative healthcare service that is currently more available and less waiting time. It is widely considered to be major contributing factors for this growth convenience, cost-efficiency and even the aging population.

Urgent care centers constitute primary components of the health system, providing diagnostic, treatment, minor injury, vaccination, and preventive care service types. The increase becomes urgent care services with the rise of chronic conditions, seasonal illnesses, and demand for cost-effective healthcare solutions.

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| CareNow | 12-15% |

| MedExpress | 10-12% |

| Concentra | 8-10% |

| FastMed | 7-9% |

| American Family Care | 6-8% |

| Others | 50-55% |

| Company Name | Key Offerings/Activities (2024 to 2025) |

|---|---|

| CareNow | Expanded urgent care services with new locations offering walk-in care and minor emergency treatment (2024). |

| MedExpress | Introduced new telemedicine services to complement in-person visits, providing more accessibility (2024). |

| Concentra | Launched an enhanced occupational health program integrated with urgent care services (2024). |

| FastMed | Introduced a new mobile health service for on-the-go medical assistance (2025). |

| American Family Care | Expanded services with new preventative care options alongside urgent care (2025). |

Key Market Insights

CareNow (12-15%)

CareNow remains a leading player, providing extensive urgent care services with several new locations offering specialized treatments for minor illnesses and injuries.

MedExpress (10-12%)

MedExpress enhances its service offerings by integrating telemedicine with traditional urgent care, making healthcare more accessible to remote populations.

Concentra (8-10%)

Concentra is expanding its reach through its focus on occupational health services, incorporating urgent care solutions for both individuals and businesses.

FastMed (7-9%)

FastMed is leveraging technology with the introduction of mobile health services, bringing urgent care to patients in their own environments.

American Family Care (6-8%)

American Family Care is focusing on a more holistic approach by combining urgent care with preventative services to meet growing healthcare needs.

Other Key Players (50-55% Combined)

The overall market size for Urgent Care market was USD 28,556.2 Million in 2025.

The Urgent Care market is expected to reach USD 42,678.3 Million in 2035.

The demand for urgent care services will be driven by rising healthcare accessibility, increasing demand for convenient and cost-effective treatments, growing chronic conditions, and expanding telehealth services across various patient demographics.

The top 5 countries which drives the development of Urgent Care market are USA, European Union, Japan, South Korea and UK

Cold, Cough & Flu Services demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Ownership, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Services, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 13: Global Market Attractiveness by Services, 2023 to 2033

Figure 14: Global Market Attractiveness by Ownership, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Services, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 28: North America Market Attractiveness by Services, 2023 to 2033

Figure 29: North America Market Attractiveness by Ownership, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Services, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Services, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Ownership, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Services, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Ownership, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Services, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Ownership, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Services, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Services, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Ownership, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Services, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Services, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Ownership, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Services, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Ownership, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Ownership, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Ownership, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Ownership, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Services, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Ownership, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Haircare Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Pet Care Market Analysis – Demand, Trends & Forecast 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Pet Care Packaging Market Insights - Growth & Forecast 2025 to 2035

Eye Care Supplement Analysis by Ingredients, Dosage Form, Route of Administration, Indication, Distribution channel and Region 2025 to 2035

Homecare Medical Devices Market Outlook – Industry Growth & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Pet Care Ingredients Market

Homecare Dermatology Energy-based Devices Market Growth – Trends & Forecast 2018-2028

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA