The demand for spray dryers in the USA is projected to grow from USD 2.0 billion in 2025 to USD 3.0 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.20%. Spray dryers are integral to industries such as food and beverages, pharmaceuticals, and chemicals, where they are used to convert liquid or slurry materials into dry powder form. The increasing demand for powdered products in these sectors is driving the need for more advanced and efficient spray drying technologies. Spray dryers are essential for manufacturing products like milk powder, powdered beverages, and pharmaceutical ingredients. Innovations in spray dryer designs, which focus on improving energy efficiency and product quality, are expected to further enhance their appeal in the coming years.

The demand for spray dryers is particularly influenced by the trends in the food and beverage industry, where the need for powdered ingredients and products like milk powder, coffee, and powdered drinks continues to grow. Similarly, the pharmaceutical industry is increasingly using spray drying in the production of active pharmaceutical ingredients (APIs) and dry powder formulations. As these industries expand, the demand for spray dryers will rise, contributing to overall market growth. With the ongoing push for energy efficiency, spray dryers that offer lower energy consumption and enhanced drying performance are becoming increasingly important.

Between 2025 and 2030, the demand for spray dryers in the USA will increase from USD 2.0 billion to USD 2.6 billion, driven by expanding applications in the food, beverage, and pharmaceutical sectors. The increasing demand for powdered ingredients and drugs, along with technological advancements in spray drying, will contribute to this growth. The introduction of more energy-efficient drying systems will support the transition toward more green manufacturing processes, particularly as industries look to reduce operating costs while maintaining high-quality production standards.

From 2030 to 2035, the demand for spray dryers is expected to continue growing, reaching USD 3.0 billion by 2035. This phase will see continued expansion in the food, beverage, and pharmaceutical industries, along with ongoing technological advancements that improve drying efficiency and reduce environmental impact. The increasing focus on ecological balance will further drive the demand for spray dryers that offer energy savings and higher product quality. As the use of spray dryers continues to evolve and industries prioritize cost-effective and environmentally friendly solutions, the demand for spray dryers will remain strong throughout the forecast period.

| Metric | Value |

|---|---|

| Demand for Spray Dryer in USA Value (2025) | USD 2.0 billion |

| Demand for Spray Dryer in USA Forecast Value (2035) | USD 3.0 billion |

| Demand for Spray Dryer in USA Forecast CAGR (2025 to 2035) | 4.20% |

The demand for spray dryers in the USA is increasing as industries handle growing volumes of liquids and slurries that must be converted into powders and granules. Key sectors such as food & beverage, pharmaceuticals, and chemicals depend on spray drying for producing instant powders, encapsulated formulations, and powdered active ingredients. As these sectors expand and production requirements become more complex, the need for high‑performance spray dryer equipment rises.

Processing efficiency and product quality are major drivers behind equipment investment. Advanced spray dryers offer uniform particle size, reduced processing times, and better heat‑sensitive material handling capabilities. For pharmaceutical companies, spray drying enables improved bioavailability of drugs and precise control over formulation structures. Food manufacturers rely on spray dryers for nutritional powders and flavour encapsulation. These applications push demand for modern, large‑capacity spray dryer units.

Manufacturing trends, including automation, real‑time monitoring, and integration with digital control systems, are supporting growth in equipment adoption. As facilities upgrade or build new production lines, they favour spray dryers with enhanced control features, energy‑optimised performance, and compatibility with modular lines. As contract manufacturing and outsourced production become more common in the USA, demand for reliable, scalable spray drying systems continues to grow through 2035.

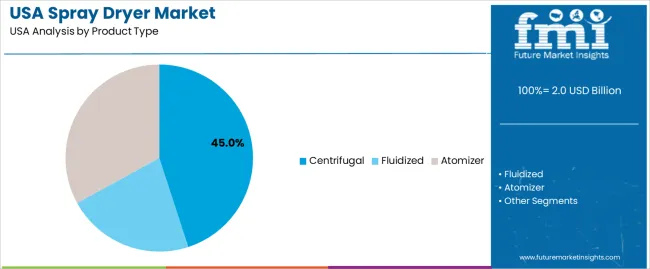

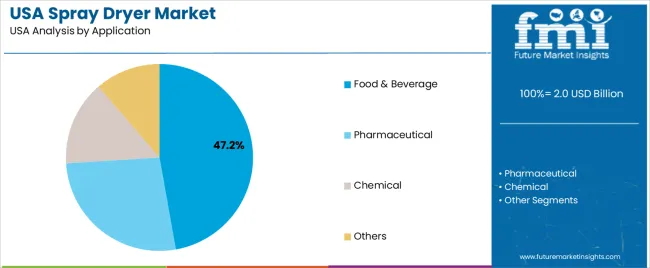

Demand for spray dryers in the USA is segmented by product type, application, operation, operating principal, and type of flow. By product type, demand is divided into centrifugal, fluidized, and atomizer. The demand is also segmented by application, including food & beverage, pharmaceutical, chemical, and others. In terms of operation, demand is divided into batch and continuous. Regarding operating principal, demand is divided into direct drying and indirect drying. By type of flow, demand is segmented into co-current, counter current, and mixed flow. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Centrifugal spray dryers account for the largest share of the spray dryer market in the USA, with 45% of the demand. Centrifugal spray dryers are favored for their efficiency, versatility, and ability to handle a wide range of products, including food, beverages, and pharmaceuticals. These dryers use a rotating disk to atomize the liquid into fine droplets, which are then rapidly dried by hot air, creating a high-quality powder. Centrifugal spray dryers are known for their high production capacity, making them ideal for large-scale industrial applications. The demand for centrifugal spray dryers is driven by their ability to produce consistent, uniform products with minimal loss of nutrients or flavor, making them particularly popular in the food and beverage industry. As industries continue to prioritize efficiency and scalability, centrifugal spray dryers will remain the dominant product type in the market.

The food & beverage industry accounts for 47.2% of the demand for spray dryers in the USA. Spray dryers are extensively used in the food and beverage sector for producing powdered ingredients such as milk powder, coffee, juices, and spices. They are favored because of their ability to quickly and efficiently turn liquid food products into powder without compromising the product's quality, flavor, or nutritional value. As consumer demand for convenient, shelf-stable food products increases, spray dryers are becoming an essential part of the food processing industry. The rise of powdered beverages and food ingredients, along with the growing need for high-quality, consistent food products, drives the high demand for spray dryers in this application. With the increasing trend of health-conscious and ready-to-eat food products, the food & beverage industry will continue to be the largest contributor to spray dryer demand in the USA.

Key drivers include growing production of powdered food & dairy products (which need drying equipment), increasing pharmaceutical development (especially inhalable or dry‑powder formulations) requiring spray‑dry systems, and technological advancement in automation, energy‑efficiency and process control. Restraints include high capital and operating cost of spray‑dryer equipment, significant energy consumption and maintenance requirements, stringent environmental/emission regulations and the technical complexity of integrating into existing processes.

Why is Demand for Spray Dryers Growing in USA?

In USA, demand for spray dryers is increasing as food and beverage manufacturers are increasingly producing powder-based products like milk powders and protein supplements. Pharmaceutical companies also require spray-drying for creating advanced drug formulations, particularly in inhalable or dry-powder forms. The shift towards convenient processed foods, nutraceuticals, home-infusion systems, and specialty chemicals is driving the need for reliable drying equipment. As manufacturers aim for higher throughput, consistent particle size, and extended shelf-life, spray dryers become essential. USA-based firms are also investing in modern spray-drying technology to remain competitive globally, comply with regulatory standards, and meet growing demand for quality and performance in various industries.

How are Technological Innovations Driving Growth of Spray Dryers in USA?

Technological innovations are driving the adoption of spray dryers in USA by enhancing system efficiency, precision, and functionality. Advancements include the development of atomisation and nozzle designs that allow for better control over particle size, improving the final product quality. Closed-loop and inert-gas systems have been introduced to handle sensitive materials, reducing degradation. The integration of digital monitoring and automation ensures better process control and stability, while energy-recovery systems help reduce operational costs and environmental impact. Modular and pilot-scale units provide flexibility for small batch and R&D applications, further expanding the use of spray dryers across industries such as biopharma and specialty chemicals.

What are the Key Challenges Limiting Adoption of Spray Dryers in USA?

Despite significant demand, the adoption of spray dryers in USA faces challenges. A major barrier is the high capital investment needed for large-scale spray-drying equipment and the infrastructure required for installation, which can be prohibitive for smaller firms. The operating costs and energy consumption associated with continuous drying systems can hinder cost competitiveness. Regulatory pressures concerning emissions, solvent handling, and dust control further increase complexity and costs. Integrating spray dryers into existing production lines can also be difficult, requiring skilled operators and specialized training. Furthermore, alternative drying methods might be sufficient for certain applications, limiting the widespread adoption of spray dryers in some sectors.

| Region | CAGR (%) |

|---|---|

| West | 4.8 |

| South | 4.3 |

| Northeast | 3.8 |

| Midwest | 3.3 |

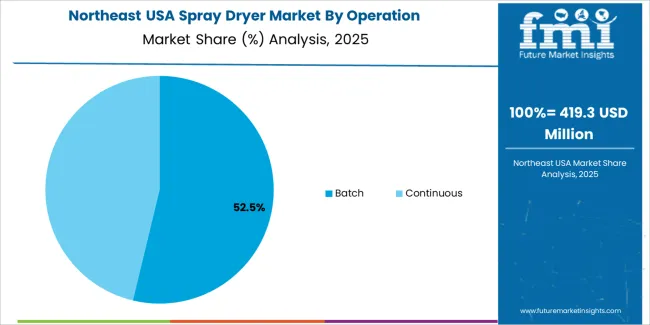

Demand for spray dryers in USA is increasing across all regions, with the West leading at a 4.8% CAGR. This growth is driven by the region’s advanced manufacturing and food processing industries. The South follows with a 4.3% CAGR, supported by the increasing demand for powdered food and beverage products in states like Texas, Florida, and Georgia. The Northeast shows a 3.8% CAGR, driven by pharmaceutical and food sectors in major cities like New York and Boston. The Midwest experiences moderate growth at 3.3%, with steady demand supported by food processing operations in cities like Chicago and Detroit.

The West is experiencing the highest demand for spray dryers in USA, with a 4.8% CAGR. This demand is primarily driven by the region’s diverse and advanced manufacturing sectors, particularly food and beverage processing industries. Spray dryers are essential in producing powdered food, dairy products, and various other applications. Major cities like Los Angeles, San Francisco, and Seattle are home to many food and pharmaceutical companies, increasing the need for efficient and reliable drying technologies.

The West has been a leader in manufacturing innovation, and this trend continues as companies adopt advanced drying methods to improve product quality, shelf life, and efficiency. As the region increasingly focuses on quality control, efficiency in production processes, and technological advancements in the food industry, the need for spray dryers is set to rise. The growth of e-commerce and the demand for processed food products also drive this trend, making the West the largest consumer of spray drying technology in the USA.

The South is seeing robust demand for spray dryers in USA, with a 4.3% CAGR. This growth is driven by the region’s rapidly expanding food and beverage sector, especially in states like Texas, Florida, and Georgia. These states have seen significant increases in the production of powdered ingredients, dairy products, and nutritional powders, which are heavily reliant on spray drying technology. Consumer preferences for healthier food options, particularly in the form of powdered nutrients and protein-based products, are fueling this demand.

The South’s focus on innovation in food processing, alongside continued investments in manufacturing infrastructure, ensures that spray dryers will play a critical role in meeting these needs. The region also benefits from a growing population and an increasing number of food companies seeking efficient and cost-effective drying solutions. As businesses expand their production capabilities to meet rising consumer demand for powdered food and beverage products, the need for reliable, high-performance spray dryers continues to increase in the South.

The Northeast is experiencing steady demand for spray dryers in USA, with a 3.8% CAGR. The region’s strong pharmaceutical and manufacturing sectors are major drivers of this growth, where spray dryers are used in a variety of applications, such as drying powdered drugs, chemicals, and food ingredients. Cities like New York and Boston are hubs for pharmaceutical innovation and research, leading to an increased demand for high-performance drying technologies.

The demand for spray dryers is further fueled by the region's growing need for processed food products and pharmaceutical-grade powders. As businesses in the Northeast continue to focus on improving product quality, processing efficiency, and the precision of their manufacturing methods, the adoption of spray dryers is expected to rise. Furthermore, the shift toward more advanced production techniques in pharmaceutical and food sectors ensures that spray dryers remain integral in these industries. The Northeast’s focus on cutting-edge technology and product development in pharmaceuticals is central to the region’s continued demand for efficient drying solutions.

The Midwest is seeing moderate demand for spray dryers in USA, with a 3.3% CAGR. This growth is primarily driven by the region’s strong agricultural base and the expanding food processing industry. Cities like Chicago and Detroit are important centers for food production, and spray dryers are widely used for drying milk powders, fruit juices, and other food ingredients. The demand for powdered products, including infant formula, nutritional powders, and food additives, continues to rise, necessitating the use of advanced drying technologies.

As more agricultural and food production operations adopt spray drying methods to improve product consistency, quality, and shelf life, the need for these technologies is steadily increasing. While the growth rate is slower than in other regions, the Midwest’s established food processing infrastructure and its strong agricultural network ensure that the region will see sustained demand for spray dryers. The region’s continued focus on improving manufacturing processes and meeting consumer demands for high-quality food products supports ongoing demand for spray dryers.

In the USA, demand for spray dryers is driven largely by growth in food & beverage processing, pharmaceuticals, chemicals, and specialty powders production. These systems convert liquids or slurries into dry powders via rapid drying with hot gas, making them essential in applications such as ultrafine powders, dairy products, and inhalable drug formulations. The increasing focus on advanced drug delivery, higher-throughput food processing, and fine chemical manufacturing is enhancing the uptake of spray drying equipment. North America holds a substantial share of global demand and exhibits strong growth momentum.

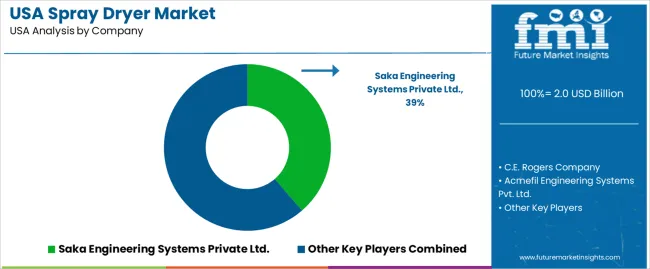

Within this competitive space, firms such as Saka Engineering Systems Private Ltd. with a 38.7% share, C.E. Rogers Company, Acmefil Engineering Systems Pvt. Ltd., Changzhou Lemar Drying Engineering Co. Ltd., and BUCHI Labortechnik AG are active in supplying to the USA. These companies differentiate via engineering expertise, customization of dryer configurations, process consulting, and after-sales service. Given the high upfront investment and complexity of spray dryer systems, large incumbents benefit from scale, reputation, and broad service networks.

Growth in the USA is supported by drivers such as rising processed food consumption, increased biologics manufacturing in pharmaceuticals, and demand for specialty powders with precise particle control. At the same time, challenges persist high capital and operating costs, energy-intensive operations, complex regulatory requirements (especially in pharmaceuticals), and the technical integration of dryers into existing facilities. Companies that can offer energy-efficient designs, minimized downtime, and strong technical support are likely to gain a competitive advantage as demand continues to expand.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Product Type | Centrifugal, Fluidized, Atomizer |

| Operation | Batch, Continuous |

| Operating Principal | Direct Drying, Indirect Drying |

| Type of Flow | Co-Current, Counter Current, Mixed Flow |

| Application | Food & Beverage, Pharmaceutical, Chemical, Others |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Players Profiled | Saka Engineering Systems Private Ltd., C.E. Rogers Company, Acmefil Engineering Systems Pvt. Ltd., Changzhou Lemar Drying Engineering Co. Ltd., BUCHI Labortechnik AG |

| Additional Attributes | Dollar sales by product type, operation, flow types, and regional distribution focusing on food, pharmaceuticals, and chemical sectors. Key trends in batch versus continuous operations, and drying techniques in the spray dryer market. Insights into industry-specific requirements and preferences. |

The demand for spray dryer in usa is estimated to be valued at USD 2.0 billion in 2025.

The market size for the spray dryer in usa is projected to reach USD 3.0 billion by 2035.

The demand for spray dryer in usa is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in spray dryer in usa are centrifugal, fluidized and atomizer.

In terms of operation, batch segment is expected to command 54.8% share in the spray dryer in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spray Dryer Market Growth – Trends & Forecast 2025-2035

USA Hair Dryer Market Outlook – Size, Trends & Growth 2025-2035

Demand for Spray Dryer in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Trigger Sprayer in USA Size and Share Forecast Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA