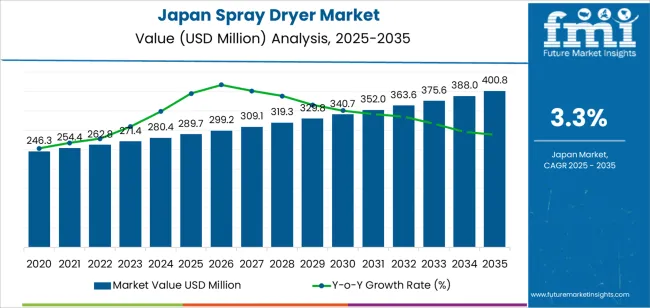

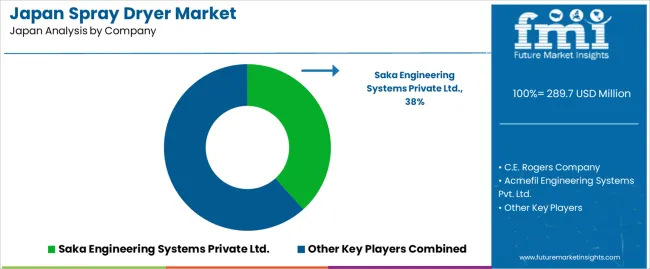

The demand for spray dryers in Japan is projected to grow from USD 289.7 million in 2025 to USD 400.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.3%. Spray dryers are widely used in industries such as food processing, pharmaceuticals, and chemicals, where they convert liquid or slurry materials into fine powders through rapid drying. This process is essential for producing products like milk powder, coffee, flavorings, and various chemical ingredients. As industries demand higher-quality powders and better production efficiency, the need for advanced spray drying technologies will continue to rise.

The food and beverage industry is a key driver of growth for spray dryers, particularly as demand for powdered dairy, instant beverages, and other dry food products increases. The pharmaceutical industry’s focus on powdered drug delivery systems and the growing emphasis on nutraceuticals will also contribute to industry expansion. Technological advancements in spray dryer systems, including improvements in energy efficiency, drying speed, and the ability to handle more complex materials, will further fuel the industry growth.

Between 2025 and 2030, the demand for spray dryers in Japan will increase gradually, growing from USD 289.7 million to USD 299.2 million. This steady growth reflects ongoing adoption in key industries such as food, pharmaceuticals, and chemicals, where spray dryers are used for converting liquids into fine powders. The demand will be driven by the need for more efficient processing capabilities, improved product quality, and higher production volumes. Industries will continue to invest in spray drying technologies to meet growing consumer demands for powdered products, such as milk powder, instant beverages, and powdered pharmaceutical ingredients.

From 2030 to 2035, the demand for spray dryers is projected to experience a more significant increase, rising from USD 299.2 million to USD 400.8 million. The accelerated growth in this period is attributed to a combination of factors. Technological advancements in spray dryer systems, such as increased energy efficiency and faster drying capabilities, will contribute to the rise in demand. The increasing consumption of powdered products in sectors like food and beverage, along with the expanding use of spray dryers in the pharmaceutical and nutraceutical industries, will drive industry expansion. The growing need for more sustainable and cost-effective drying solutions will also support this demand, as industries look to optimize their production processes. As new applications for spray drying technology emerge, the industry will experience stronger growth in the latter half of the forecast period.

| Metric | Value |

|---|---|

| Demand for Spray Dryer in Japan Value (2025) | USD 289.7 million |

| Demand for Spray Dryer in Japan Forecast Value (2035) | USD 400.8 million |

| Demand for Spray Dryer in Japan Forecast CAGR (2025 to 2035) | 3.3% |

The demand for spray dryers in Japan is driven by increasing requirements across food processing, pharmaceuticals, and chemical production where powders and granules are needed from liquid feeds. Industries such as dairy, infant formula, coffee, functional powders and pharmaceuticals rely on spray‐drying technology for converting slurries or solutions into stable powders. As Japanese manufacturers expand throughput and diversify product lines, the value of efficient, high‑capacity spray drying equipment rises.

Food producers are responding to consumer trends toward convenience and functional formats instant powders, flavour encapsulation and nutraceuticals requiring reliable drying systems. Simultaneously, pharmaceutical and biotech firms in Japan are adopting spray drying for advanced formulations and controlled particle sizes. Higher precision in drying processes is essential for meeting quality standards and production optimisation.

Manufacturers are also investing in spray dryers with improved features: enhanced process control, automated monitoring, high‑containment capability for potent compounds, and better energy utilisation. These advancements minimise downtime and handling risk, particularly in regulated sectors. As Japanese production facilities modernise and production shifts toward advanced materials and formulations, demand for spray dryers is expected to increase steadily through 2035.

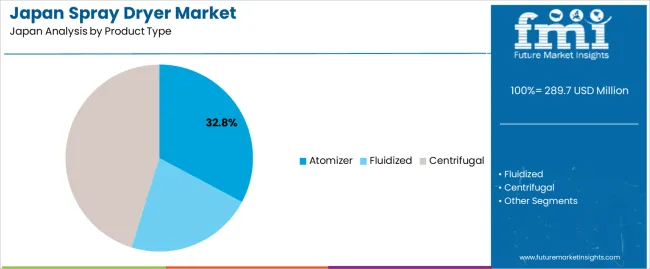

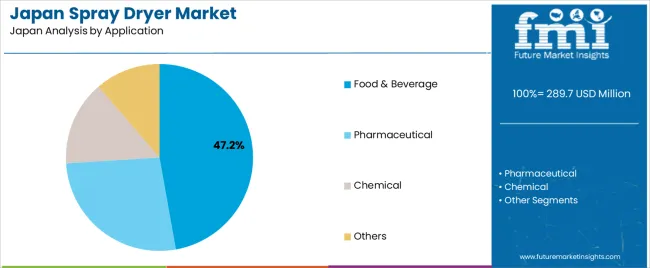

Demand for spray dryers in Japan is segmented by product type, application, operation, operating principal, and type of flow. By product type, demand is divided into atomizer, fluidized, and centrifugal, with atomizer holding the largest share at 33%. The demand is also segmented by application, including food & beverage, pharmaceutical, chemical, and others, with food & beverage leading the demand at 47.2%. In terms of operation, demand is divided into batch and continuous. Regarding operating principal, demand is segmented into direct drying and indirect drying. By type of flow, demand is divided into co-current, counter current, and mixed flow. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Atomizer spray dryers account for 33% of the demand in Japan. Atomizers are widely preferred in applications where uniform and fine particle size is required, such as in food, beverage, and pharmaceutical industries. The atomizer creates a fine mist of liquid droplets, which are then dried rapidly, ensuring that the final product has a consistent texture and quality. This makes atomizer spray dryers ideal for applications where particle size and powder consistency are crucial, such as in dairy powders, flavorings, and pharmaceutical ingredients. The ability of atomizers to handle a wide range of materials and produce high-quality outputs makes them the preferred choice for industries with strict quality control requirements. As the demand for high-performance and precision-engineered dryers grows, atomizer spray dryers will continue to dominate the industry, ensuring efficiency, quality, and versatility in a wide variety of industrial applications.

Food & beverage accounts for 47.2% of the demand for spray dryers in Japan. The food and beverage industry extensively uses spray dryers to produce powdered ingredients, such as milk powder, coffee, fruit powders, and seasonings. Spray drying is the preferred method for converting liquids into powder form while preserving the flavor, color, and nutritional value of the original product. As consumer demand for convenient, shelf-stable food products increases, the need for spray dryers in the food and beverage industry has surged. This method allows for the efficient production of high-quality powders at scale, which is crucial for large-scale food manufacturers. With the growing trend toward powdered beverages and ready-to-eat products, the food and beverage sector will continue to be the largest end user of spray dryers in Japan, supporting the demand for this technology in the country.

Key drivers include Japan’s strong food & beverage sector (especially dairy, instant coffee and powdered ingredients), an expanding pharmaceutical and nutraceutical industry requiring fine aerosol or powder processing, and increasing automation and energy‑efficiency standards that encourage replacement or upgrade of existing spray‑drying equipment. Restraints include high upfront investment and operating costs for advanced spray‑dry systems, limited factory space in Japanese manufacturing plants (particularly older facilities) which can restrict installation of large units, and energy/maintenance costs that drive caution in capital‑intensive equipment purchases.

Why is Demand for Spray Dryers Growing in Japan?

In Japan the demand for spray‑drying systems is growing because manufacturers across food, pharmaceutical and chemical sectors are seeking ways to convert liquid feeds into stable powders for longer shelf‑life, easier transport, and precise dosing. The food processing industry is innovating with functional ingredients, plant‑based proteins and value‑added powders, driving investment in new spray‑dry technology. The pharmaceutical sector is likewise embracing spray‐drying for APIs, excipients and inhalable formulations that require controlled particle size and high purity. Thus, as product complexity and regulatory requirements increase, businesses in Japan are upgrading equipment to meet performance, hygiene and efficiency requirements.

How are Technological Innovations Driving Growth of Spray Dryers in Japan?

Technological innovations are boosting uptake of spray‑drying systems in Japan by enabling enhanced performance, flexibility and safety. Innovations include advanced atomisers and nozzles for more precise particle size control and consistent output, closed‑cycle spray dryers for heat‑sensitive or high‑value materials, automation and digital control systems for monitoring and energy optimisation, and modular units suitable for smaller batch runs or niche products. These advances reduce downtime, improve yield and support specialty applications (e.g., high‑purity pharmaceuticals, plant‑based powders) which makes investment in spray dryers more attractive in Japan’s mature manufacturing environment.

What are the Key Challenges Limiting Adoption of Spray Dryers in Japan?

Despite demand, adoption of new spray‑dry systems in Japan faces several challenges. A major one is the high capital cost and long payback period of large‑scale spray‑dry installations, especially in sectors with tight margins. The operational cost especially energy for drying, cleaning and maintenance remains significant and can deter replacement of older equipment. Integration of new units into existing production lines (often with limited floor space or older infrastructure) can be complex and disruptive. Also, manufacturers must ensure compliance with strict food‑safety, pharmaceutical manufacturing and environmental standards, which adds to project lead time and cost. These factors slow down the replacement and upgrade cycle of spray‑drying technology in Japan.

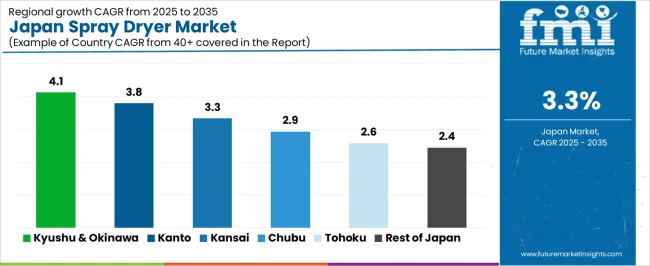

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.1 |

| Kanto | 3.8 |

| Kinki | 3.3 |

| Chubu | 2.9 |

| Tohoku | 2.6 |

| Rest of Japan | 2.4 |

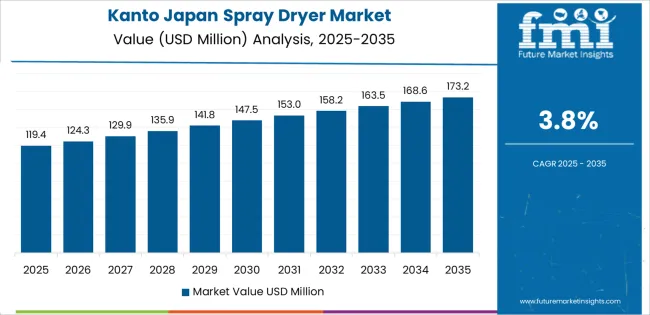

Demand for spray dryers in Japan is increasing across all regions, with Kyushu & Okinawa leading at a 4.1% CAGR. This growth is driven by the region's expanding food processing and pharmaceutical industries. Kanto follows with a 3.8% CAGR, supported by the region's high concentration of industrial and research facilities, which require spray dryers for applications in food, chemicals, and pharmaceuticals. Kinki shows a 3.3% CAGR, driven by demand from the food processing and manufacturing sectors. Chubu experiences a 2.9% CAGR, with steady demand from the region’s automotive and industrial sectors. Tohoku sees a 2.6% CAGR, fueled by agricultural processing and energy sectors. The Rest of Japan shows the lowest growth at 2.4%, with consistent demand coming from smaller-scale industries and regional food production needs.

Kyushu & Okinawa are experiencing the highest demand for spray dryers in Japan, with a 4.1% CAGR. This growth is largely driven by the region’s expanding food processing and pharmaceutical industries. Kyushu, in particular, has a strong presence in food production, including dairy, coffee, and powdered beverages, which rely on spray drying technologies for efficient processing. The region's focus on renewable energy and environmentally friendly manufacturing also encourages the adoption of advanced drying solutions. Okinawa’s emphasis on agricultural development further drives the demand for spray dryers in sectors like food and natural product processing. As the region continues to invest in manufacturing and research, spray dryers will play a critical role in improving the efficiency and quality of production across various industries, maintaining steady demand for these systems.

Kanto is experiencing steady demand for spray dryers in Japan, with a 3.8% CAGR. The region, which includes major industrial and research hubs like Tokyo and Yokohama, is a key center for pharmaceutical, food processing, and chemical industries, all of which rely on spray dryers for high-quality production processes. Kanto’s diverse manufacturing sectors, including the production of powdered food, chemicals, and pharmaceutical products, require advanced spray drying systems to ensure the efficiency and consistency of their products. The region’s focus on sustainability, energy efficiency, and cutting-edge technology further supports the adoption of spray dryers. Kanto’s substantial investment in R&D ensures that demand for innovative drying solutions will continue to grow, with spray dryers playing an essential role in maintaining production standards and meeting consumer demands for high-quality processed products.

Kinki is seeing moderate demand for spray dryers in Japan, with a 3.3% CAGR. The region’s strong manufacturing base, particularly in food processing, chemicals, and pharmaceuticals, is driving this demand. Major cities like Osaka and Kyoto are home to a wide range of industries, including those involved in the production of powdered food products, beverages, and pharmaceutical goods, which require efficient spray drying systems for their production. As Japan's food and pharmaceutical sectors focus on improving production efficiency and maintaining high-quality standards, the adoption of spray dryers has become more prevalent. The region’s increasing investment in modernizing industrial equipment and improving manufacturing processes is contributing to steady growth. As the demand for high-quality processed food and medical products rises, Kinki’s manufacturing industry will continue to drive the demand for spray dryers.

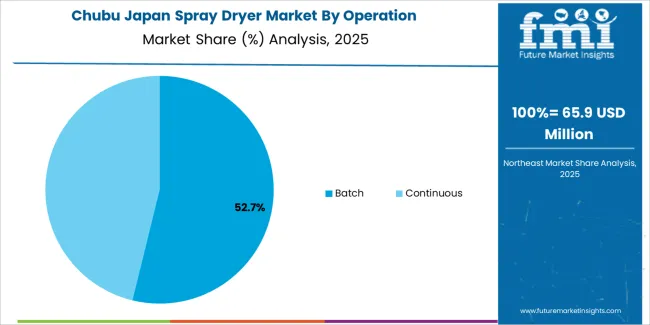

Chubu is experiencing steady demand for spray dryers in Japan, with a 2.9% CAGR. The region’s industrial base, particularly in Nagoya, which is a key hub for automotive and manufacturing industries, is contributing to the increasing demand for spray drying technologies. Spray dryers are essential for producing powdered materials, including those used in the automotive, pharmaceutical, and food processing industries. As Chubu’s industries seek more efficient and environmentally friendly manufacturing processes, the need for advanced drying solutions continues to rise. The region’s strong emphasis on innovation and technological improvements in manufacturing is also a driving factor for the adoption of spray dryers. While growth is more moderate in Chubu compared to other regions, its diverse industrial sectors, including chemicals and food production, ensure a steady demand for high-performance spray dryers as part of efforts to increase production efficiency and product quality.

Tohoku is experiencing moderate demand for spray dryers in Japan, with a 2.6% CAGR. The region’s focus on agricultural processing, including the production of powdered food and beverages, contributes to the demand for spray drying technologies. Tohoku's agricultural base is driving growth in sectors like food processing, where spray dryers are used to create high-quality powdered products, such as fruit juices and dairy products. The region's emphasis on energy efficiency and environmental sustainability encourages the adoption of advanced drying systems in industries such as agriculture and food manufacturing. With an increasing need for processing agricultural products and ensuring product quality, spray dryers are becoming essential to improve production efficiency. As Tohoku continues to focus on food processing and sustainable manufacturing practices, the demand for spray dryers is expected to remain moderate, fueled by these sectors.

The Rest of Japan is seeing the lowest demand for spray dryers in Japan, with a 2.4% CAGR. While this region does not have the same level of industrial activity as larger hubs like Kanto or Kyushu, it still sees steady demand for spray dryers from smaller manufacturing and food processing industries. Many regional businesses in agricultural, chemical, and food sectors require spray drying technologies to produce powdered products, such as seasonings, dairy powders, and other food additives. As food production and agricultural processing continue to expand in these areas, demand for spray dryers will persist. As smaller industries in the Rest of Japan increasingly adopt modern manufacturing technologies and pursue energy efficiency, spray dryers are becoming an important part of their production processes. Although the growth rate is slower than other regions, steady demand will continue due to ongoing industrial activity in the area.

In Japan, demand for spray dryers is driven by strong requirements across food & beverage processing, pharmaceuticals, chemicals, and specialty powders. These systems convert liquids or slurries into dry powders via rapid drying with hot gasmaking them essential in applications such as functional food ingredients, inhalable drug formulations, and fine chemical powders. The country’s advanced manufacturing base and high standards for quality and precision support uptake of sophisticated spray drying equipment.

Key suppliers competing in Japan include Saka Engineering Systems Private Ltd. with a 38.3% share, C.E. Rogers Company, Acmefil Engineering Systems Pvt. Ltd., Changzhou Lemar Drying Engineering Co. Ltd. and BUCHI Labortechnik AG. These companies differentiate through advanced engineering capability, customization of dryer configurations, process‑consulting services, and comprehensive after‑sales support. The leadership of Saka Engineering reflects its strong local presence and ability to meet demanding specifications for Japanese industry.

Competitive dynamics are shaped by several factors. One major driver is the need for higher‑throughput powder production and enhanced particle control in food, nutraceutical and pharmaceutical manufacturing. A second driver is the push for improved equipment performance: energy‑efficient designs, automation and integration with upstream and downstream processes. Challenges include high capital investment and operational costs, technical complexity of integrating new dryers into existing workflows, and competition from alternative drying technologies. Suppliers that combine strong technical support, flexible modular equipment, and reliable local service networks are best positioned to capture the evolving demand for spray dryers in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Atomizer, Fluidized, Centrifugal |

| Operation | Batch, Continuous |

| Operating Principal | Direct Drying, Indirect Drying |

| Type of Flow | Co-Current, Counter Current, Mixed Flow |

| Application | Food & Beverage, Pharmaceutical, Chemical, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Saka Engineering Systems Private Ltd., C.E. Rogers Company, Acmefil Engineering Systems Pvt. Ltd., Changzhou Lemar Drying Engineering Co. Ltd., BUCHI Labortechnik AG |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in spray dryers; growth in food & beverage, pharmaceutical, and chemical sectors; technology adoption for drying processes; vendor offerings including equipment, services, and integration solutions; regulatory influences and industry standards |

The demand for spray dryer in japan is estimated to be valued at USD 289.7 million in 2025.

The market size for the spray dryer in japan is projected to reach USD 400.8 million by 2035.

The demand for spray dryer in japan is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in spray dryer in japan are atomizer, fluidized and centrifugal.

In terms of operation, batch segment is expected to command 54.8% share in the spray dryer in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spray Dryer Market Growth – Trends & Forecast 2025-2035

Demand for Trigger Sprayer in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Spray Caps Market Size and Share Forecast Outlook 2025 to 2035

Spray Booth Ventilation System Market Size and Share Forecast Outlook 2025 to 2035

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spray Foam Insulation Market 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA