The global vegan pastry market will experience steady growth driven by increasing demand for plant-based consumption, increased consumer knowledge of sustainable food, and better vegan baking trends. Vegan pastries are enjoyable without animal constituents, something that appeals to health-oriented, environmentally oriented consumers.

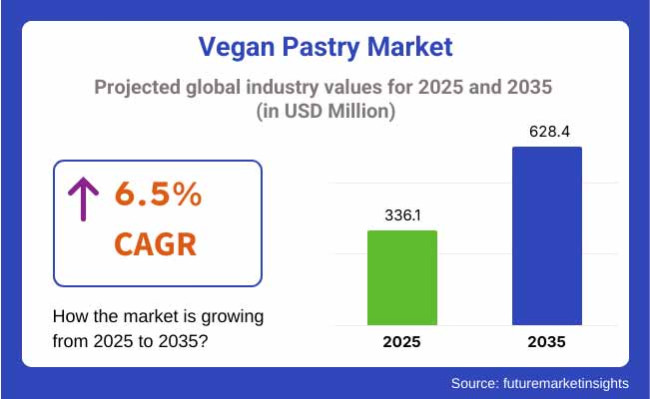

With the recent dairy-free and egg-free food trend, food companies are introducing new recipes that are equally as good in texture, taste, and richness as the conventional pastries. Global vegan bakery market is approximately USD 336.1 million in 2025. It will reach approximately USD 628.4 million in 2035 with a CAGR of 6.5%.

The market is facilitated by ongoing innovation in plant materials like aquafaba as egg substitutes, cashew creams, and coconut butters. With customers requiring high levels of ethical, lactose-free, and allergen-safe desserts, the market for vegan pastries will grow steadily to 2035.

North America is among the major markets for vegan bakery because of increasingly more health-aware consumers as well as the increasing demand for vegan bakeries. Market growth is in progress in leadership in the United States through specialist shop openings that retail plant-based puff pastry, croissants, and danishes. Increased availability of vegan food in supermarket as well as major coffee chains further continues to drive demand.

Europe is also a tremendously important region, with a strong emphasis on sustainability and plant-based high-quality foods. The United Kingdom, Germany, and France are leading the region when it comes to utilizing vegan pastry, and craft bakeries and major food corporations are launching egg-free and dairy-free versions of such popular pastries as eclairs and pain au chocolate. Government-led trends-fueled trend-based trends are driving more market growth.

Due to increased urbanization, increased disposable income, and demand for greens, the Asian-Pacific region is the fastest-developing vegan pastry market. Leading nations among top drivers include Australia, Japan, and South Korea, and innovative bakeries are trying to copy matcha-flavored plant cakes, black sesame croissants, and coconut milk puff pastry. Cafe culture exists and marketplace demand for fusion desserts leads marketplace demand for pastries based on plants.

Challenges: Ingredient Functionality, Price Sensitivity, and Consumer Skepticism

One of the biggest challenges of the vegan pastry category is to replicate the function of traditional baking ingredients, which must overcome consumers' resistance to taste and texture, as well as deal with more costly product. The identical flakiness, richness, and moistness of butter- and egg-based pastry require a great deal of trial and error in testing plant-based ingredients. Vegan pastries also cost more due to premium ingredients, another obstacle for some shoppers.

Opportunities: Ingredient Innovation, Retail Expansion, and Sustainable Packaging

Growth opportunities still exist in the category of vegan pastries despite the challenges. Innovative ingredients with enzyme-modified starches, plant emulsions, and oat creams enable to produce high-quality pastry vegan. Retail distribution to mass-market supermarket chains and quick-service restaurants further increase availability. And, biodegradable pastry wrapping and plastic-free containers make sustainable packaging possible, appealing to environmentally aware shoppers.

During 2020 to 2024, the market for vegan pastry increased because plant-based consumption shifted towards the mainstream. Vegan bakeries performed well, while traditional pastry stores lagged behind embracing plant-based counterparts due to fear of not being able to reproduce the actual taste and texture. But all those years were spent on the research and development of substitute ingredients, which filled the gap, and more vegan pastry products rolled out in single-specialty retail outlets as well as in food chains around the world.

Plant pastries will develop between 2025 and 2035 with increasingly more advanced formulations building mouthfeel and richness of conventional pastries. Ideal blends of ingredients for final texture and shelf life will be designed by food AI technology.

Sustainability will drive carbon-neutral production processes, and functionality need will drive added protein, fiber, and probiotics in baked goods. As consumer demand for healthier and ethically enriched indulgence increases, pastry food service market and retail will record an even stronger presence with vegan pastry.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with basic food safety regulations, vegan labeling, and allergen declarations. |

| Consumer Trends | Increasing demand for dairy-free and egg-free baked goods. |

| Industry Adoption | Expansion of vegan bakeries and plant-based dessert lines by major food chains. |

| Supply Chain and Sourcing | Dependence on coconut oil, aquafaba, and almond flour as key ingredient substitutes. |

| Market Competition | Dominated by niche vegan brands and specialty patisseries. |

| Market Growth Drivers | Fueled by the rise of flexitarian diets and ethical consumerism. |

| Sustainability and Environmental Impact | Initial steps towards biodegradable packaging and palm oil-free formulations. |

| Integration of Smart Technologies | Limited AI implementation in pastry formulation and production. |

| Advancements in Equipment Design | Use of traditional baking ovens and manual emulsification techniques. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Introduction of stricter plant-based certifications, carbon-neutral production mandates, and sugar reduction policies. |

| Consumer Trends | Rising preference for high-protein, functional, and gut-friendly pastries incorporating probiotics and fiber. |

| Industry Adoption | Growth in premium and gourmet vegan pastries in high-end retail and boutique bakeries. |

| Supply Chain and Sourcing | Shift towards upcycled ingredients, sustainable fats like shea butter, and regional plant-based flours. |

| Market Competition | Entry of mainstream bakery giants like Mondelez and Nestlé into the vegan pastry segment. |

| Market Growth Drivers | Driven by advancements in plant-based emulsifiers, clean-label sweeteners, and sustainable packaging. |

| Sustainability and Environmental Impact | Full-scale adoption of zero-waste production, carbon-neutral baking processes, and regenerative farming ingredients. |

| Integration of Smart Technologies | Use of AI for precision baking, ingredient optimization, and blockchain for ingredient traceability. |

| Advancements in Equipment Design | Development of automated plant-based aeration systems and precision temperature-controlled baking equipment. |

USA vegan bakery has expanded by an exponential rate as consumers have increasingly embraced plant-based and dairy-free desserts. Chain bakeries like Krispy Kreme and Cinnabon have released vegan versions of their best-selling desserts due to growing demand. Expansion in oat milk-filled ingredients, flaxseed egg substitution, and sweetener substitutes like monk fruit is revolutionizing the industry. It is being fueled by millennials and Gen Z consumers who are turning towards health and sustainability in the food they consume.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6 .5% |

The UK has growing calls for vegan pastry with policy support for plant-based innovation. The UK's best UK supermarkets, Tesco and Sainsbury's, have fully revamped in-store vegan bakery offerings, stocking croissants and danishes with plant-based alternatives to butter. Natural sweeteners and allergen-free products are also near the top of the agenda as consumers increasingly seek pastry that does not contain gluten or refined sugar.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6 .3% |

Strict EU regulation and food sustainability law are shaping the European vegan pastry sector. Germany, France, and the Netherlands are seeing increased volumes of vegan pastry made that is certified organic and filled with substitute proteins such as chickpea flour and lupin protein. Parisian and Berlin high-end patisseries now include gourmet-standard vegan desserts, demonstrating that plant-based foods can deliver luxury pastry qualities without sacrificing flavor.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.9% |

Japan's vegan cake market is changing with increasing interest in plant-based materials and simple, sophisticated desserts. Traditionally applied materials like sweet bean pastes and mochi rice flour are reimagined within plant-based dessert application. Leading convenience store chains like 7-Eleven Japan started selling bakery food suitable to vegans, and that is wider application across the industry. A focus on natural flavor and the deep, earthy taste of plant-based fillings is defining Japanese future vegan pastry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.6% |

South Korea's lucrative food culture has welcomed vegan bakery products, mainly in coffeehouse chains and gourmet bakeries. Demand for K-donuts, matcha croissants, and tarts made with sweet potatoes generates market growth. Consumer interest in dairy-free, cholesterol-free options is gaining speed, and therefore the market finds growth in milk and butter alternative products that affluent urban lifestyles look for.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.8% |

| By Product Type | Market Share (2025) |

|---|---|

| Cakes and Cupcakes | 38.9% |

Cupcakes and cakes also lead to spearhead the demand for vegan pastries with 38.9% of the total demand in 2025. Growing demand for high-end plant-based ingredients such as aquafaba, oat milk, and cashew creams has driven market innovation.

Local bakeries such as Erin McKenna's Bakery and L'Artisane Creative Bakery and boutique brands have fueled the demand for rich yet ethical desserts. Aside from that, large supermarket chains have also boosted the variety of vegan cakes like chocolate avocado cake and matcha cupcakes, appealing to health-conscious individuals and individuals with milk intolerance.

The cultural transition in web-based purchases of vegan celebration cakes, wedding cakes, and birthday cakes has also fueled market expansion. Advances in sugar substitutes such as coconut nectar and date syrup have also converted consumers of low-glycemic treats without compromising the taste and texture.

| By Distribution Channel | Market Share (2025) |

|---|---|

| Online Retail | 46.2% |

Online shopping will be the largest mode of distribution for vegan desserts by 2025, at a 46.2% market share of the overall market. Doorstep convenience, coupled with growing meal kit and dessert subscription services that are plant-based, has also fueled this segment's growth. Karma Baker and Rubicon Bakers are a few of the companies that have leveraged e-commerce websites to facilitate nationwide shipping of their plant-based desserts, maintaining freshness through innovative package designs.

Social media marketing and influencer partnerships have been critical to propelling online sales as healthily portrayed vegan desserts go viral on social media platforms like Instagram and TikTok. Order-by-order cake customization, the offering of gluten-free options, and time-specific seasonal promotions have also been critical to propelling consumer demand.

Although independent shops are significant, the direct-to-consumer model has allowed vegan pastry companies to sell more to consumers, especially where specialty vegan bakeries are not readily available.

Rising consumer demand for plant-based supper meals, green cuisine, and free-from milk foods has stimulated the growth in the vegan bakery sector. Shoppers are requesting richer-texture pastries and naturally flavored offerings, and the companies are meeting the demand by creating plant-based butter alternatives, aquafaba meringue, and high-protein filling ingredients from alternate sources. Key players are vying on clean-label ingredients, ending the use of artificial additives and improving the taste and nutrient profile.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| LÄRABAR | 18-22% |

| Rubicon Bakers | 14-18% |

| BOSH! | 12-16% |

| Just Desserts | 10-14% |

| Nature’s Bakery | 7-10% |

| Other Companies (combined) | 22-27% |

| Company Name | Key Offerings/Activities |

|---|---|

| LÄRABAR | In 2024, launched a range of oat-based vegan croissants with natural fruit fillings. In 2025, expanded its plant-based dessert bar segment, including pea protein for texture enhancement. |

| Rubicon Bakers | In 2024, introduced a new line of dairy-free, allergen-safe chocolate éclairs. In 2025, joined with big-box retailers to bring frozen vegan puff pastry sheets into mass market channels. |

| BOSH! | In 2024, launched a plant-based macaron range employing aquafaba meringue technology. In 2025, partnered with coffee chains to create proprietary vegan pastry items. |

| Just Desserts | In 2024, diversified its vegan cheesecake assortment with cashew and coconut milk-based versions. In 2025, put money into eco-friendly packaging solutions to target environmentally aware consumers. |

| Nature’s Bakery | In 2024, launched a range of gluten-free vegan muffins with added flaxseed and chia. In 2025, targeted shelf stability improvement of vegan pastries without losing taste. |

Key Company Insights

LÄRABAR (18-22%)

LÄRABAR is a market leader in introducing and being the first plant-based pastry products with whole food ingredients of new textures. Its pea protein-fortified oat-croissant falls under the leadership segment of high-density nutrient vegan pastry.

Rubicon Bakers (14-18%)

Rubicon Bakers leads allergen-friendly pastry with products like vegan éclairs and frozen puff pastry sheets for in-domestic bakeries and commercial bakeries. Its retail build-out of strength to the marketplace reinforces its leadership in the market.

BOSH! (12-16%)

BOSH! is a turner of luxury vegan dessert business, using aquafaba-based meringue technology to produce luxury pastry. Partnerships with coffee houses push plant-based pastry products to mass consumers.

Just Desserts (10-14%)

Just Desserts is a leader in luxury, cashew-based vegan cheesecakes and uses eco-friendly packaging as a top priority. Its sustainability message appeals to both ethical consumers and big-box retailers looking for green solutions.

Nature's Bakery (7-10%)

Nature's Bakery is a leader in shelf-stable vegan pastries, providing healthy, high-fiber muffins and snack bars. Its focus on preserving taste without sacrificing shelf life makes it a top player in packaged vegan pastry category.

Other Key Players (22-27% Combined)

The overall market size for the vegan pastry market was USD 336.1 million in 2025.

The vegan pastry market is expected to reach USD 628.4 million by 2035.

The increasing adoption of plant-based diets, growing health consciousness among consumers, and rising concerns about animal welfare and environmental sustainability are fueling the demand for vegan pastries during the forecast period.

The top 5 countries driving the development of the vegan pastry market are the United Kingdom, the United States, China, India, and Germany.

On the basis of product type, the cakes and pastries segment is projected to hold a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Taste, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Taste, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Taste, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Taste, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Taste, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Taste, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Taste, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Taste, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Taste, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Taste, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Taste, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Taste, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Packaging Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Taste, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Taste, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Taste, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Taste, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Taste, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Taste, 2023 to 2033

Figure 22: Global Market Attractiveness by Packaging Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Taste, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Taste, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Taste, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Taste, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Taste, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Taste, 2023 to 2033

Figure 46: North America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Taste, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Taste, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Taste, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Taste, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Taste, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Taste, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Taste, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Taste, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Taste, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Taste, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Taste, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Taste, 2023 to 2033

Figure 94: Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Taste, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Taste, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Taste, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Taste, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Taste, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Taste, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Packaging Type, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Taste, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Taste, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Taste, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Taste, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Taste, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Packaging Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Taste, 2023 to 2033

Figure 142: MEA Market Attractiveness by Packaging Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA