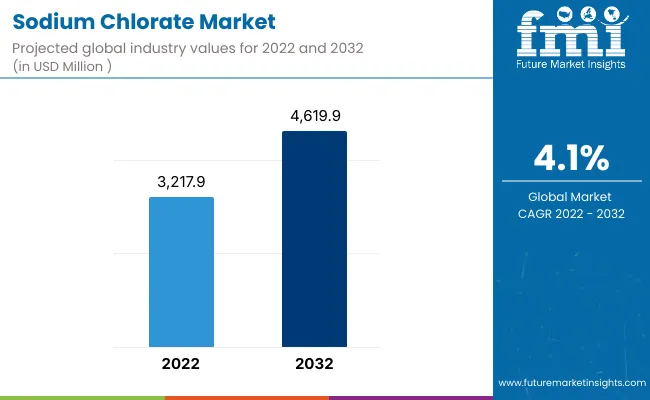

The Sodium chlorate market share is projected to reach US$ 4,619.9 Mn in 2032. The growing demand from various End-Use Industry industries such as dyes, wood, pulp & paper industries are anticipated to bolster the market growth during the projected period.

According to FMI, the Sodium chlorate market is estimated to be valued at US$ 3,217.9 Mn in 2022 and is projected to increase at a CAGR of 4.1% in the forecast period from 2022 to 2032.

| Market Size (2021) | USD 3,091.2 Million |

| Market Size 2022 | USD 3,217.9 Million |

| Market Size 2032 | USD 4,619.9 Million |

| Value CAGR (2022-2032) | 4.1% |

Sodium chlorate is mostly used to make chlorine dioxide, which is used as a bleaching agent in the paper and pulp industries. Sodium chlorate is odourless and white/off-white in colour. Sodium chlorate dissolves readily in water. Sodium chlorate is inflammable in its pure form, but when it decomposes, it releases oxygen, acting as an accelerant in the presence of flammable substances.

In the mining industry, sodium chlorate is used to extract uranium and vanadium. Sodium chlorate is also used as an herbicide in the control of weeds. Sodium chlorate has been widely used in the production of chemical intermediates such as potassium chlorate and sodium perchlorate in recent years.

The overall market for sodium chlorate is expected to remain positive over the forecast period, but at a slower pace due to the availability of alternatives such as hydrogen peroxide for bleaching pulp.

The analysis of Sodium chlorate demand from 2017 to 2021 showed a historical growth rate of less than 2.6% CAGR, with the general expansion of the wood, pulp & paper, agrochemicals industry due to an increase in consumer income, urbanization as well a growing population.

Due to decreased sales at industrial manufacturers, store closings, disruptions in the production cycle, and stricter regulations, the COVID-19 pandemic initially caused recessionary downturns that momentarily dashed growth expectations.

However, since infection curves started to flatten starting in 2022, industrial production activity has resumed in significant markets. As a result, by 2032, the sodium chlorate demand projection from FMI anticipates a CAGR of 4.1%. During the anticipated period, it is anticipated that increased end-use consumption will increase sales.

The growth of the paper and pulp industry is driving the global sodium chlorate market. Since approximately 80-90% of total sodium chlorate consumption is used to produce chlorine dioxide, which is used in the paper and pulp industry, the demand for sodium chlorate is heavily dependent on the growth of the paper and pulp industry. Its growing popularity in emerging markets such as India and China, as well as the increasing demand for wood pulp in craft paper manufacturing, will drive segment growth.

Sodium chlorate is increasingly used for a variety of purposes, such as tanning and finishing leather and producing dyes, due to its oxidising properties. In the upcoming years, market growth is anticipated to be aided by the rising demand for sodium chlorate in these industries.

Sodium chlorate is used as a non-selective herbicide to control the growth of a variety of plants because it is phytotoxic to all green plants. During the forecast period, herbicide is anticipated to be the second-largest market segment for sodium chlorate. Herbicide demand is being driven by a decline in arable land availability. This is also regarded as a significant driver of the sodium chlorate market globally.

The existence of substitutes for sodium chlorate, such as hydrogen peroxide and ozone, which can be used to bleach pulp, is one of the main factors limiting the growth of the global sodium chlorate market.

Furthermore, the use of papers for newspaper publishing and related industries has decreased as e-media has grown in popularity. On the basis of product availability and price, a change in consumer preferences is seen. The aforementioned elements are anticipated to significantly impede market expansion.

The production of high quality, environmentally friendly white paper frequently uses sodium chlorate as a bleaching agent. Therefore, during the forecast period, the sodium chlorate market is expected to experience significant growth. In the near future, there will likely be an increase in demand for sodium chlorate as a bleaching agent due to a growing trend of using environmentally friendly paper production methods. Sodium chlorate is increasingly being used as a bleaching agent due to environmental regulations in the United States and Canada.

For the production of sodium chlorate, two important feedstocks are sodium chloride and water. Sodium chlorate is a widely available commodity because of the low price and abundance of these raw materials. This makes it ideal for a variety of applications, along with storage convenience.

Crystalline sodium chlorate holds the majority of the market share among the two main types of sodium chlorate that are traded on the market, crystalline and solution, since it has more clearly defined surface area than solution, which aids in better bleaching.

The production of sodium perchlorate, potassium chlorate, and sodium chlorite as well as their increasing use in weed control will drive growth in the crystalline sodium chlorate market. Given its higher production cost, the crystalline form is discovered to be quite expensive in comparison to solution. Increased developments in the pulp and paper industry and increased use of explosives will both contribute to the segment's growth. The market will expand despite the price swings for crystalline materials.

The global sodium chlorate market is predicted to grow slowly over the upcoming years, with a positive outlook. Due to the region's significant paper and pulp industry base, Asia Pacific currently holds a dominant share of the global sodium chlorate market and is expected to maintain this position throughout the forecast period.

Additionally, China is the world's largest consumer of sodium chlorate. China has a sizable base for the use of sodium chlorate in specialised uses like fireworks in addition to paper and pulp. There is a significant demand for sodium chlorate in regions like Latin America as there has been significant growth in the paper and pulp sector in that region. According to projections, Japan and MEA will have relatively small market shares for sodium chlorate worldwide.

Key players operating in the Sodium chlorate market include Hunan ERCO Worldwide, Arkema, Kemira Oyj, American Elements, Nouryon, Shree Chlorates, ChemTrade, Tronox, Chemfab Alkalis Limited, GFS Chemicals, ALDON Corporation, Inner Mongolia Lantai Industrial, H. K. Group and others.

The sodium chlorate market is comparatively well consolidated. Among the top players are Nouryon, Kemira, and Arkema. These companies are anticipated to collectively hold more than 40% of the global sodium chlorate market share in 2021. Key manufacturers have been seen collaborating with important paper and pulp producers to increase their market share as part of an organic approach to business growth.

| Attribute | Details |

| Growth Rate | CAGR of XX% from 2022 to 2032 |

| Base Year for Estimation | 2021 |

| Historical Data | 2017-2021 |

| Forecast Period | 2022-2032 |

| Quantitative Units | Revenue in USD Million, Volume in Tons and CAGR from 2022-2032 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

|

| Regions Covered |

|

| Key Countries Covered |

|

| Key Companies Profiled |

|

| Customization & Pricing | Available upon Request |

In 2021, the value of the Sodium chlorate market reached over US$ 3,091.2 Mn.

During the forecast period, the Sodium chlorate market is estimated to expand at a CAGR of 4.1% during 2022-2032.

The Sodium chlorate market is projected to reach US$ 4,619.9 Mn by the end of 2032.

China is projected to lead the Sodium chlorate market in the forecast period.

The key players operating in the Sodium chlorate market are Hunan ERCO Worldwide, Arkema, Kemira Oyj, American Elements, Nouryon, Shree Chlorates, ChemTrade, Tronox, Chemfab Alkalis Limited, GFS Chemicals, ALDON Corporation, Inner Mongolia Lantai Industrial, H. K. Group.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium 3-Nitrobenzenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Difluorophosphate (NaDFP) Market Size and Share Forecast Outlook 2025 to 2035

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA