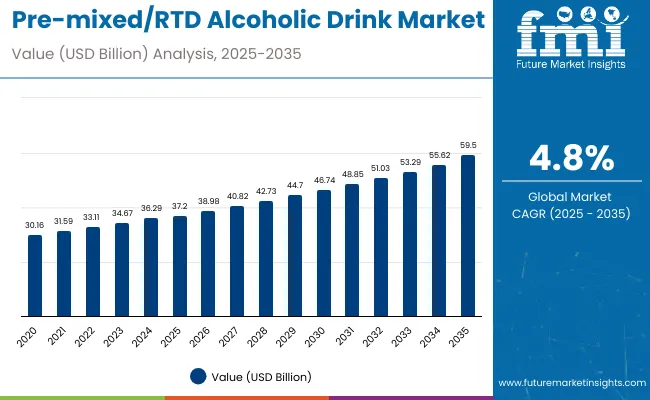

The global pre-mixed/RTD alcoholic drink market is projected to grow from USD 37.2 billion in 2025 to approximately USD 59.5 billion by 2035, recording an absolute increase of USD 22.3 billion over the forecast period. This translates into a total growth of 60.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.60X during the same period, supported by the rising demand for convenience beverages, increasing adoption of fruit-based flavors, and growing preference for ready-to-consume alcoholic cocktails where lifestyle convenience and social drinking experiences are prioritized.

Between 2025 and 2030, the Pre-mixed/RTD Alcoholic Drink market is projected to expand from USD 37.2 billion to USD 47.03 billion, resulting in a value increase of USD 9.8 billion, which represents 44.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for convenient alcoholic beverages, product innovation in spirit-based cocktails and premium fruit-flavored variants, and expanding retail distribution channels. Companies are establishing competitive positions through investment in flavor innovation, premium positioning, and strategic market expansion across traditional retail, specialty stores, and emerging online channels.

Between 2025 and 2030, the Pre-mixed/RTD Alcoholic Drink market is projected to expand from USD 37.2 billion to USD 47.03 billion, resulting in a value increase of USD 9.8 billion, which represents 44.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for convenient alcoholic beverages, product innovation in spirit-based cocktails and premium fruit-flavored variants, and expanding retail distribution channels. Companies are establishing competitive positions through investment in flavor innovation, premium positioning, and strategic market expansion across traditional retail, specialty stores, and emerging online channels.

From 2030 to 2035, the market is forecast to grow from USD 47.03 billion to USD 59.45 billion, adding another USD 12.5 billion, which constitutes 55.9% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized formulations including low-alcohol variants and exotic flavor combinations tailored for specific demographic segments, strategic collaborations between beverage companies and flavor houses, and clean-label positioning with premium ingredient transparency. The growing emphasis on convenience-focused lifestyle changes and health-conscious drinking trends will drive demand for innovative RTD products across diverse consumption occasions.

Between 2020 and 2025, the Pre-mixed/RTD Alcoholic Drink market experienced steady expansion, driven by increasing consumer preference for convenience beverages and consistent quality alcoholic drinks. The market developed as manufacturers introduced advanced production technologies using spirit blending, natural flavor integration, and innovative packaging solutions that enhanced taste profiles and shelf stability. Health-conscious drinking trends and convenience-focused lifestyle changes supported expansion into traditional retail channels and premium beverage positioning.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 37.2 billion |

| Market Forecast Value (2035) | USD 59.5 billion |

| Forecast CAGR (2025–2035) | 4.8% |

RTD alcoholic beverages' exceptional convenience factor, consistent quality, and diverse flavor profiles make them attractive options for consumers seeking hassle-free drinking experiences without compromising on taste or social appeal. The ready-to-consume format appeals to busy lifestyles, outdoor activities, and social occasions where traditional cocktail preparation is impractical.

Growing awareness of premium drinking experiences, craft beverage trends, and experiential consumption is further propelling adoption, especially in social gatherings, outdoor events, and casual dining sectors. Rising disposable incomes, expanding retail distribution channels, and manufacturer investments in flavor innovation are also enhancing product accessibility and market penetration.

As convenience trends accelerate across demographics and premium positioning becomes critical, the market outlook remains favorable. With consumers prioritizing convenience, flavor variety, and consistent quality, RTD alcoholic beverages are well-positioned to expand across various consumption occasions and demographic segments.

The market is segmented by product type, flavor, packaging, distribution channel, and region. By product type, the market is divided into rum, whiskey, vodka, wine, and others. Based on flavor, the market is categorized into fruits, spiced, and others. By packaging, the market is segmented into cans, bottles, and others. Based on distribution channel, the market is classified intohyper markets and supermarkets, departmental stores, specialty stores, and online retailers. Regionally, it covers North America, Latin America, Europe, East Asia, South Asia & Pacific, the Middle East & Africa.

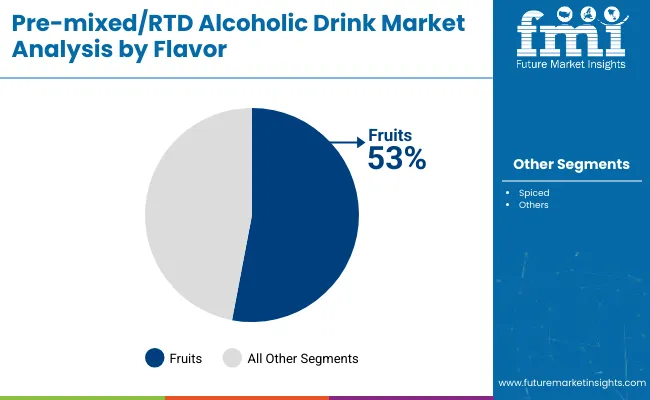

The fruits segment holds a dominant position with 53% of the market share in the flavor category, owing to its broad consumer appeal, refreshing taste profile, and versatility across different consumption occasions. Fruit-flavored RTD beverages are widely preferred across demographic segments due to their approachable taste, lower perceived alcohol intensity, and association with healthier, more natural ingredients.

The segment enables manufacturers and consumers to deliver diverse taste experiences while maintaining mass market appeal and seasonal adaptability. As demand for natural flavors, lighter alcoholic beverages, and refreshing experiences grows, fruit-flavored variants continue to gain preference in both casual and premium drinking occasions.

Manufacturers are investing in natural fruit extracts, exotic flavor combinations, and seasonal limited editions to enhance taste authenticity, market differentiation, and consumer engagement. The segment is poised to expand further as global consumer preferences favor natural, refreshing, and approachable alcoholic beverages.

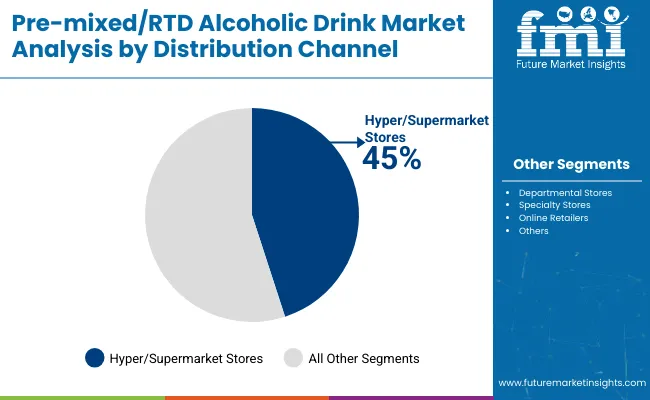

Hyper/supermarket stores remain the core distribution channel with 45% of the market share in 2025, as these outlets provide convenience shopping, competitive pricing, and extensive product variety that appeals to mainstream consumers. The channel's dominance supports impulse purchases, promotional activities, and regular household shopping integration.

RTD alcoholic beverages benefit from prominent shelf placement, promotional campaigns, and bulk purchasing options available in hypermarket environments. This makes the channel indispensable for volume sales and brand visibility in competitive retail environments.

Ongoing expansion of organized retail, promotional support from manufacturers, and consumer preference for one-stop shopping are key trends driving the sustained relevance of hypermarkets and supermarkets in RTD beverage distribution.

In 2024, global RTD alcoholic drink consumption grew by 12% year-on-year, with North America taking a 35% share. Applications include social drinking, outdoor activities, and casual dining enhancement. Manufacturers are introducing specialized formulations and premium positioning that deliver superior convenience and consistent quality experiences. Fruit-flavored formulations now support natural ingredient positioning. Convenience-focused consumption trends and lifestyle preferences support consumer confidence. Technology providers increasingly supply ready-to-drink solutions with integrated flavor profiles to reduce preparation complexity.

Premium Convenience Positioning Accelerates Pre-mixed/RTD Demand

Food service operators and retailers are choosing RTD alcoholic beverages to achieve superior convenience, consistent quality, and diverse flavor options that meet consumer demands for hassle-free drinking experiences. In taste testing, premium RTD cocktails deliver up to 85% satisfaction rates compared to home-mixed alternatives at 65-70%.

Products formulated with natural ingredients maintain flavor consistency throughout extended shelf life cycles. In ready-to-serve formats, premium RTD beverages help reduce preparation time while maintaining taste quality by up to 75%. RTD applications are now being deployed for outdoor events and casual dining, increasing adoption in sectors demanding convenient beverage solutions. These advantages help explain why RTD adoption rates in food service rose 22% in 2024 across North America and Europe.

Regulatory Constraints, Competition and Distribution Complexity Limit Growth

Market expansion faces constraints due to alcohol regulations, intense competition from traditional beverages, and complex distribution requirements across different markets. Regulatory compliance costs can vary from USD 50,000 to USD 200,000, depending on market entry requirements and licensing procedures, impacting pricing and leading to delayed market entry of up to 12 months in new jurisdictions.

Multi-state distribution complexity and age verification requirements add 4 to 6 weeks to product launch cycles. Specialized storage conditions and alcohol handling regulations extend distribution costs by 15-20% compared to non-alcoholic beverages. Limited availability of licensed distributors restricts scalable expansion, especially for premium positioning projects. These constraints make RTD market entry challenging in regulated markets despite growing consumer interest and commercial opportunity.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

| India | 6.0% |

| UK | 5.5% |

| France | 5.2% |

| Brazil | 5.0% |

| USA | 4.9% |

| Germany | 4.8% |

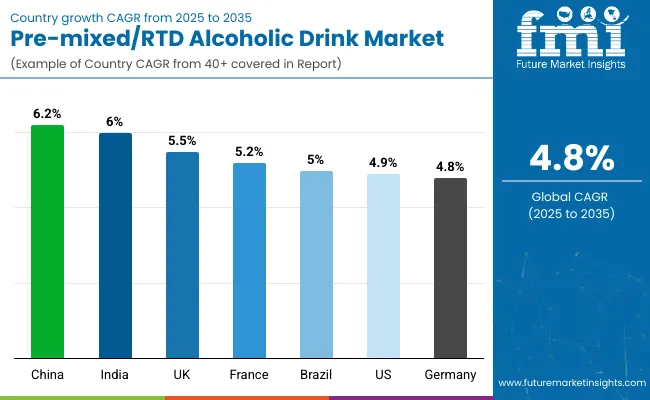

In the Pre-mixed/RTD alcoholic drink market, China leads with the highest projected CAGR of 6.2% from 2025 to 2035, driven by rapid urbanization and growing acceptance of Western drinking culture. India follows with a CAGR of 6.0%, supported by rising disposable incomes and an expanding middle class. The UK shows strong growth at 5.5%, benefiting from established pub culture and convenience preferences. France demonstrates steady expansion at 5.2%, supported by premiumization trends and lifestyle changes. Brazil, the USA, and Germany show moderate growth at 5.0%, 4.9%, and 4.8% respectively, reflecting mature market dynamics with consistent consumer adoption patterns.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from RTD alcoholic beverages in China is projected to grow at a CAGR of 6.2% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by urbanization, rising disposable incomes, and increasing adoption of Western lifestyle patterns across major cities, including Beijing, Shanghai, and Shenzhen. Chinese consumers are increasingly embracing convenient alcoholic beverages as social drinking occasions expand and convenience becomes paramount. E-commerce platforms and premium retail channels are driving market penetration.

The demand for RTD alcoholic beverages in India is projected to expand at a CAGR of 6.0% from 2025 to 2035, above the global average. Growth is concentrated in metropolitan areas including Mumbai, Delhi, and Bangalore, where rising disposable incomes and Western lifestyle adoption are driving consumption. Urban millennials and Gen Z consumers are increasingly seeking convenient, premium alcoholic beverages for social occasions and home entertainment. Regulatory challenges and taxation policies remain market constraints, but gradual liberalization supports long-term growth.

The RTD alcoholic drink market in the UK is expected to grow at a CAGR of 5.5% from 2025 to 2035, above the global average. Growth is driven by strong consumer preference for convenience beverages, established pub culture, and increasing outdoor consumption occasions across England, Scotland, and Wales. The market benefits from well-developed retail infrastructure, a favorable regulatory environment, and consumer openness to flavor innovation. Premium positioning and craft-style RTD offerings are gaining particular traction among younger demographics.

Revenue from RTD alcoholic beverages in France is projected to rise at a CAGR of 5.2% from 2025 to 2035, supported by premiumization trends and evolving social drinking patterns. Urban markets like Paris, Lyon, and Marseille are experiencing growth in premium RTD cocktails and artisanal offerings that appeal to sophisticated consumers. The market benefits from strong appreciation for quality beverages and willingness to pay premium prices for convenient, well-crafted products. Traditional wine culture is gradually embracing RTD alternatives, particularly among younger consumers.

Sales of RTD alcoholic beverages in Brazil are projected to flourish at a CAGR of 5.0% from 2025 to 2035, matching regional averages. Growth is concentrated in urban consumption expansion and social occasion integration in São Paulo, Rio de Janeiro, and Brasília regions. RTD adoption is shifting from limited availability toward mainstream retail presence and diverse flavor offerings. Local production capabilities and competitive pricing support commercial deployment strategies. Domestic partnerships between international brands and local distributors have strengthened market access and consumer education initiatives.

The RTD alcoholic drink market in the USA is anticipated to expand at a CAGR of 4.9% from 2025 to 2035, maintaining steady growth. Expansion is centered on innovation-driven segments and premium positioning in California, Texas, and Florida regions. Advanced production technologies and regulatory compliance are being deployed for craft-style RTDs, hard seltzers, and premium cocktail applications. FDA regulations and state-level distribution requirements support systematic market development across diverse consumer segments.

The demand for RTD alcoholic beverages in Germany is expected to increase at a CAGR of 4.8% from 2025 to 2035, matching the global average. Demand is driven by convenience trends and premium beverage adoption in Berlin, Munich, and Hamburg markets. Health-conscious consumers and premium beverage manufacturers are increasingly adopting RTD products for lifestyle positioning and convenience applications. However, traditional beer culture and established beverage preferences moderate adoption rates compared to other European markets.

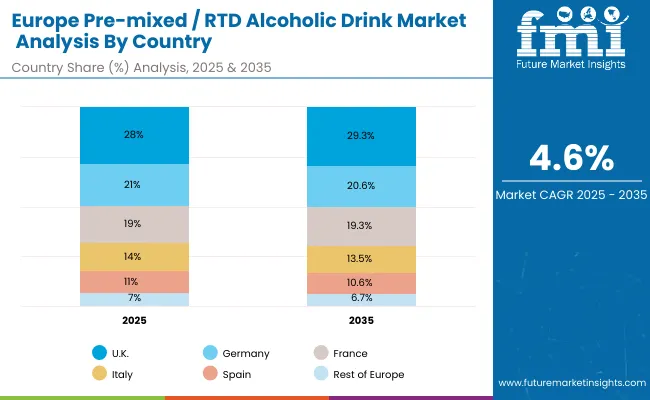

The pre-mixed/RTD alcoholic drink market in Europe is projected to grow from USD 8.4 billion in 2025 to USD 13.2 billion by 2035, registering a CAGR of 4.6% over the forecast period. The United Kingdom is expected to maintain its leadership with 28.0% market share in 2025, rising to 29.3% by 2035, supported by strong consumer preference for convenience beverages and pub-culture adoption of RTD formats. Germany follows with 21.0% in 2025, moderating to 20.6% by 2035, driven by premium beverage uptake and convenience trends among younger demographics.

The pre-mixed/RTD alcoholic drink market in Europe is projected to grow from USD 8.4 billion in 2025 to USD 13.2 billion by 2035, registering a CAGR of 4.6% over the forecast period. The United Kingdom is expected to maintain its leadership with 28.0% market share in 2025, rising to 29.3% by 2035, supported by strong consumer preference for convenience beverages and pub-culture adoption of RTD formats. Germany follows with 21.0% in 2025, moderating to 20.6% by 2035, driven by premium beverage uptake and convenience trends among younger demographics.

France accounts for 19.0% in 2025, remaining broadly stable at 19.3% by 2035 as premiumization and artisanal RTD offerings gain traction. Italy holds 14.0% in 2025, easing slightly to 13.5% by 2035, supported by aperitif-culture integration with RTD innovation. Spain represents 11.0% in 2025, moving to 10.6% by 2035, while the remainder of Europe (Nordic countries, BENELUX and other markets including Eastern Europe) collectively declines from 7.0% in 2025 to 6.7% by 2035, reflecting differing growth dynamics across Western versus emerging European RTD markets.

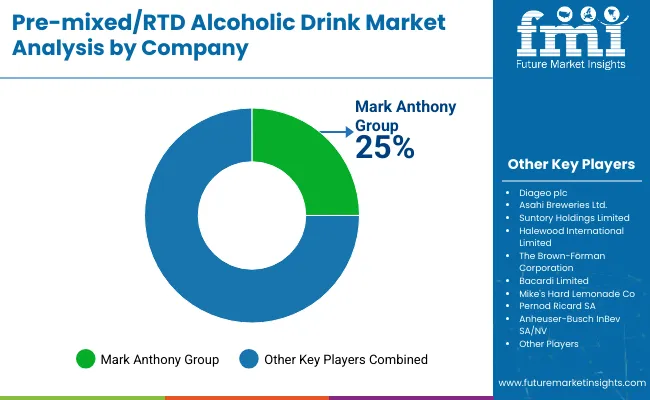

The market is moderately consolidated, featuring a mix of global beverage companies, specialty RTD producers, and regional brands with varying degrees of production capability, distribution expertise, and brand positioning strength. Mark Anthony Group leads the global market with a 25% share, driven by the success of White Claw and Mike's Hard Lemonade brands across North American and international markets. Their strength lies in comprehensive distribution networks, brand marketing excellence, and continuous flavor innovation capabilities.

Suntory Holdings Limited maintains a strong position through premium positioning, international expansion strategies, and high-quality product formulations targeting discerning consumers and export markets. Diageo plc leverages its extensive spirits portfolio to create premium RTD extensions of established brands. At the same time, Anheuser-Busch InBev utilizes its global distribution network and brewing expertise for scalable RTD production. Asahi Breweries, Ltd. focuses on Asian market leadership and innovative product development, emphasizing quality and authentic flavor experiences tailored to regional preferences.

Entry barriers remain significant, driven by challenges in regulatory compliance, distribution network establishment, and brand-building requirements across multiple consumer segments. Competitiveness increasingly depends on flavor innovation capabilities, distribution excellence, and marketing effectiveness for diverse demographic and occasion-based consumption environments.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 37.2 billion |

| Product Type | Rum, Whiskey, Vodka, Wine, Others |

| Flavor | Fruits, Spiced, Others |

| Packaging | Cans, Bottles, Others |

| Distribution Channel | Hyper/Supermarket Stores, Departmental Stores, Specialty Stores, Online Retailers |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India and 40+ Countries |

| Key Companies Profiled | Diageo plc, Asahi Breweries Ltd., Suntory Holdings Limited, Halewood International Limited, The Brown-Forman Corporation, Bacardi Limited, Mike's Hard Lemonade Co, Pernod Ricard SA, Anheuser-Busch InBev SA/NV |

| Additional Attributes | Dollar sales by product type and packaging, regional consumption trends, competitive landscape, adoption of ready-to-drink and pre-mixed formulations, integration with distribution channels, innovations in flavor profiles and low-alcohol variants |

The global pre-mixed/RTD alcoholic drink market is estimated to be valued at USD 37.2 billion in 2025.

The market size for pre-mixed/RTD alcoholic drink is projected to reach USD 59.5 billion by 2035.

The pre-mixed/RTD alcoholic drink market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The fruits flavor segment is projected to lead in the pre-mixed/RTD alcoholic drink market with 53% share in 2025.

In terms of distribution channel, hyper/supermarket stores are projected to command 45% share in the pre-mixed/RTD alcoholic drink market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcoholic Ice Cream Market

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

USA Non-Alcoholic Malt Beverages Market Insights – Trends, Demand & Growth 2025-2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

Europe Non-Alcoholic Malt Beverages Market Insights – Demand & Growth 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Drinking Fountain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA