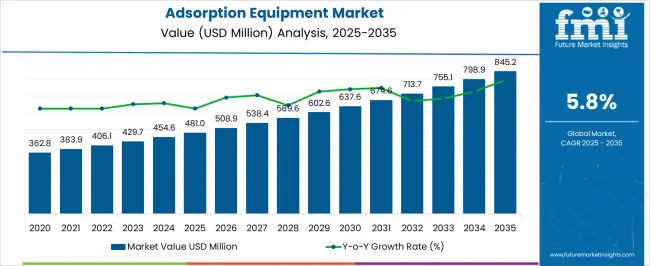

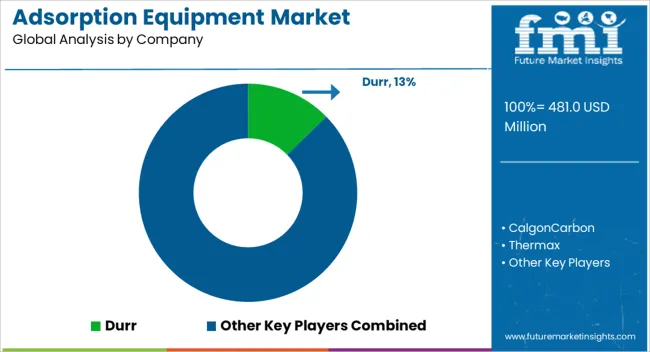

The Adsorption Equipment Market is estimated to be valued at USD 481.0 million in 2025 and is projected to reach USD 845.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. This growth reflects the rising demand for adsorption systems across industries such as air and water purification, chemical processing, and environmental applications. From 2025 to 2026, the market will experience a growth of USD 27.9 million, driven by the increasing need for efficient filtration and purification systems.

Between 2026 and 2027, the market will grow by USD 27.7 million, with advancements in adsorption technologies offering more effective and energy-efficient solutions. The period from 2027 to 2029 will see steady growth, with an additional USD 63 million in market value, reflecting a rising emphasis on environmental regulations and pollution control. By 2030, the market will reach USD 637.6 million, adding USD 62 million in absolute dollar opportunity. From 2030 to 2035, the market will continue to grow, with a cumulative addition of USD 207.6 million, driven by increased adoption in industries such as pharmaceuticals and food & beverage for safety and quality assurance. The final increase in the market size is expected to occur in the latter half of the forecast period, ensuring the market reaches USD 845.2 million by 2035, with strong growth potential across key sectors.

| Metric | Value |

|---|---|

| Adsorption Equipment Market Estimated Value in (2025 E) | USD 481.0 million |

| Adsorption Equipment Market Forecast Value in (2035 F) | USD 845.2 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The adsorption equipment market is experiencing notable growth driven by heightened industrial awareness regarding air pollution control and volatile organic compound removal. The implementation of stringent environmental regulations, particularly across North America, Europe, and parts of Asia, has increased the deployment of advanced adsorption technologies in industries such as chemical manufacturing, pharmaceuticals, and wastewater treatment.

The ability of adsorption systems to efficiently capture and remove hazardous pollutants and odor-causing gases has made them an essential component in sustainable emission control strategies. In recent years, innovations in carbon-based and synthetic adsorbents, coupled with automation and remote monitoring technologies, have enhanced the operational efficiency and life cycle of these systems.

Moreover, industries are increasingly adopting modular and scalable equipment to align with dynamic plant requirements and space constraints The growing investment in green infrastructure, coupled with the rising demand for energy-efficient and low-maintenance systems, is expected to further drive the adoption of adsorption equipment globally, especially in regions facing rapid urbanization and industrial growth.

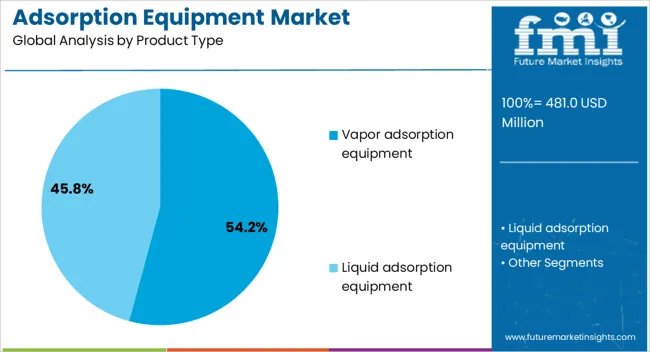

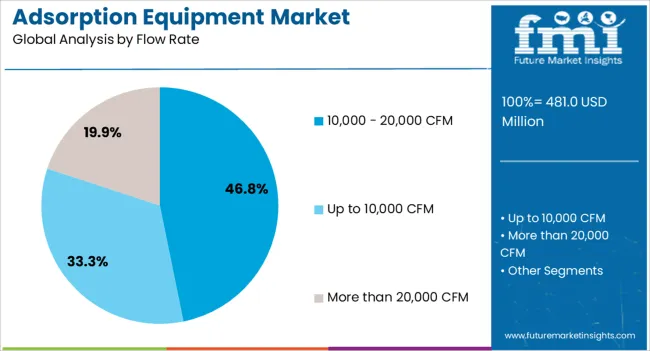

The adsorption equipment market is segmented by product type, flow rate, end use industry, distribution channel, and geographic regions. By product type, adsorption equipment market is divided into Vapor adsorption equipment and Liquid adsorption equipment. In terms of flow rate, adsorption equipment market is classified into 10,000 - 20,000 CFM, Up to 10,000 CFM, and More than 20,000 CFM.

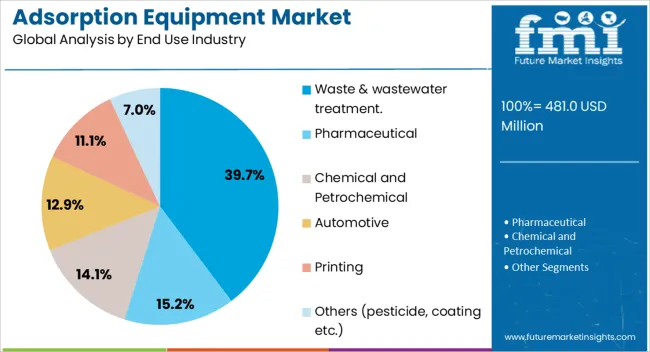

Based on end use industry, adsorption equipment market is segmented into Waste & wastewater treatment., Pharmaceutical, Chemical and Petrochemical, Automotive, Printing, and Others (pesticide, coating, etc.). By distribution channel, adsorption equipment market is segmented into Direct sales and Indirect sales. Regionally, the adsorption equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vapor adsorption equipment is projected to account for 54.2% of the total revenue share in the adsorption equipment market in 2025, establishing it as the dominant product type. This leading position is driven by its superior capability in handling a wide range of gaseous pollutants, especially volatile organic compounds, which are prevalent in several industrial exhausts. The segment has benefited from increasing regulatory pressure to reduce airborne emissions in sectors such as chemicals, paints and coatings, and petrochemicals.

The technology's efficiency in capturing harmful vapors using activated carbon or synthetic adsorbents, combined with its compatibility with regenerative processes, has improved its economic viability. Additionally, its flexibility in both large-scale continuous operations and smaller batch processes has expanded its adoption across varied plant configurations.

Continuous technological advancements, including real-time control systems and smart automation features, have further contributed to its appeal. The segment’s capacity to support high-throughput purification processes while maintaining low operational costs has solidified its market leadership.

The flow rate segment ranging from 10,000 to 20,000 CFM is expected to capture 46.8% of the total revenue share in the adsorption equipment market in 2025, highlighting its role as the most preferred flow capacity range. This growth has been primarily influenced by its suitability for mid-sized industrial operations that require efficient yet scalable air treatment solutions.

The segment has seen rising demand from facilities operating in pharmaceuticals, electronics, and paint manufacturing, where medium-scale ventilation systems are standard. Its capacity to maintain optimal adsorption efficiency without the need for excessively large equipment footprints has made it attractive for industries balancing space constraints and emission targets.

Furthermore, equipment in this flow range typically achieves a balance between cost-efficiency and performance reliability, making it ideal for retrofit projects as well as new installations. Manufacturers are increasingly offering plug-and-play modular units in this flow range, enabling faster deployment, minimal installation downtime, and easier integration with existing air handling infrastructure.

The waste and wastewater treatment segment is forecast to hold 39.7% of the total revenue share in the adsorption equipment market in 2025, marking it as the leading end-use industry. This dominance is being driven by growing investments in municipal and industrial water treatment infrastructure aimed at minimizing air and water pollution simultaneously. Adsorption systems have proven critical in odor control, removal of hydrogen sulfide, and mitigation of volatile organic compounds emitted from treatment processes.

Increased global awareness around environmental sustainability and stricter discharge regulations are prompting public utilities and private operators to integrate high-performance vapor-phase adsorption technologies. The expansion of sewage treatment facilities in urbanizing economies and the modernization of legacy infrastructure in developed markets have also reinforced the sector’s demand.

Additionally, the operational reliability and low maintenance of adsorption units have made them a preferred choice for continuous, round-the-clock plant operations. Their integration with advanced monitoring systems for real-time emissions tracking has further supported their deployment in environmentally sensitive applications.

The adsorption equipment market is expanding steadily due to growing demand in water treatment, air purification, and chemical processing. Technological advancements and increasing environmental regulations are key drivers, as industries seek efficient and sustainable solutions. The rising demand for high-performance filtration systems across various sectors ensures the market’s continued growth, particularly in regions with stringent environmental laws. As industries focus on meeting environmental standards and addressing pollution concerns, the need for advanced adsorption solutions is expected to increase, further propelling market expansion.

The beauty and personal care surfactants market is primarily driven by the increasing consumer demand for natural and eco-friendly ingredients. As consumers become more concerned about the safety and environmental impact of synthetic chemicals, they are opting for products that contain milder and more sustainable ingredients. This shift is driving the use of plant-based and biodegradable surfactants in formulations. Surfactants derived from renewable sources, such as coconut and palm oils, are gaining popularity due to their gentle properties and lower environmental footprint. This growing preference for natural and sustainable alternatives is influencing the market, leading manufacturers to innovate and adapt their offerings to meet consumer expectations for cleaner and greener products.

High production costs remain a significant challenge in the adsorption equipment market. The specialized materials required for adsorbents and the advanced technology used in manufacturing contribute to high upfront investments. Moreover, ongoing maintenance costs and operational complexity increase total cost of ownership for businesses. Availability of raw materials such as activated carbon and resins used in adsorbents can also be limited. The market faces competition from alternative filtration technologies like membrane filtration and reverse osmosis, which offer cost-effective solutions, posing a challenge to the widespread adoption of adsorption systems.

Technological innovations in adsorption materials, such as the development of high-efficiency adsorbents, are creating new opportunities for market growth. The expanding demand for carbon capture, particularly within the renewable energy sector, provides a substantial opportunity. As industries look to reduce their carbon footprint, adsorption equipment can play a pivotal role in capturing and separating CO2 emissions. Additionally, the increasing adoption of adsorption technologies in wastewater treatment in emerging economies presents new market avenues. Growth in automation across industries and the continued focus on air and water purification provides long-term growth prospects.

A key trend in the beauty and personal care surfactants market is the increasing integration of multifunctional surfactants in various products. Consumers are now seeking personal care items that provide multiple benefits, such as hydration, anti-aging, and deep cleansing, all in one formulation. To meet this demand, manufacturers are developing surfactants that can serve multiple purposes, such as conditioning agents, moisturizers, and emulsifiers, in addition to their cleaning functions. This trend is being driven by the desire for convenience and efficiency in daily routines. As the market continues to evolve, surfactants that combine these features while maintaining their effectiveness and mildness on skin and hair are expected to dominate the market.

| Countries | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

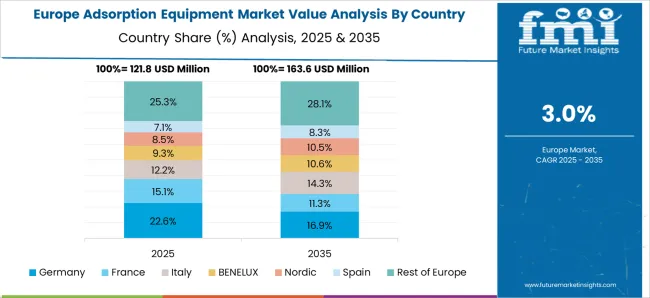

The global adsorption equipment market is projected to grow at a CAGR of 5.8% from 2025 to 2035. Among the key markets, China leads with a growth rate of 7.8%, followed by India at 7.3%, and Germany at 6.7%. The United Kingdom and the United States experience more moderate growth rates of 5.5% and 4.9%, respectively. This divergence reflects the varying pace of industrial growth and regulatory adoption across regions. In emerging markets such as China and India, the demand for adsorption equipment is rising due to rapid industrialization and a push towards advanced water treatment and air purification technologies. In contrast, developed markets like the USA and the UK show steady growth due to their established industries in chemical processing, water treatment, and environmental control. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the global adsorption equipment market, with a projected growth rate of 7.8% CAGR from 2025 to 2035. The country's rapid industrialization, particularly in sectors like water treatment, air purification, and chemical processing, is driving this growth. Government policies focusing on environmental control and waste treatment are also propelling demand for advanced adsorption systems. As China continues to expand its industrial base, the need for effective and sustainable adsorption technologies in sectors such as manufacturing, chemicals, and energy will increase, making the country a central player in the market's global expansion.

Demand for adsorption equipmentis projected to grow at a robust rate of 7.3% CAGR from 2025 to 2035. The country’s expanding industrial sectors, including chemical processing, water treatment, and air purification, are fueling the demand for adsorption systems. The growing focus on environmental protection and regulatory compliance is further increasing the need for advanced adsorption equipment. India’s investments in infrastructure development, particularly in industrial automation and pollution control, will contribute to the adoption of adsorption technologies, driving market expansion.

The adsorption equipment market in Germany is projected to grow at a steady pace with a CAGR of 6.7% from 2025 to 2035. The country’s robust chemical processing and manufacturing industries continue to drive demand for efficient adsorption systems in air and water purification. Germany’s strong commitment to energy efficiency is increasing the adoption of adsorption technologies, especially in renewable energy and industrial waste treatment applications. With advancements in environmental regulations, Germany will continue to be a key market for the expansion of adsorption equipment technologies.

The UK’s adsorption equipment market is projected to grow at a moderate pace with a CAGR of 5.5% from 2025 to 2035. The UK is focusing on energy efficiency, renewable energy, and advanced manufacturing, driving demand for adsorption systems in water treatment and environmental control. As the country increases its environmental awareness and strengthens regulations, the need for adsorption equipment in industries like chemical processing, air purification, and water treatment will rise. The government’s green initiatives and focus on pollution control are expected to contribute to steady growth in the UK market.

The USA adsorption equipment market is projected to grow at a CAGR of 4.9% from 2025 to 2035. The market is driven by the increasing adoption of adsorption systems in air purification, water treatment, and industrial waste management. As industries in the USA focus on compliance with environmental regulations and improving energy efficiency, the demand for advanced adsorption technologies is rising. The USA market will see steady growth as the country continues to focus on sustainability in its industrial and manufacturing sectors, especially in chemical processing and environmental control systems.

The adsorption equipment market is driven by prominent players offering advanced solutions across industries like water treatment, air purification, and chemical processing. Dürr is a market leader, known for its state-of-the-art adsorption systems tailored for industrial water and air purification. Calgon Carbon, a pioneer in activated carbon products, specializes in highly efficient adsorption solutions for water treatment and air filtration systems. Thermax offers energy-efficient adsorption systems that focus on sustainability, helping industries meet environmental goals. Evoqua is renowned for its cutting-edge water treatment technologies, providing advanced adsorption systems to ensure high-quality water and air purification.

Munters and Bry-Air are key players in environmental control, specializing in adsorption systems used in dehumidification and air handling across various industrial sectors. TIGG manufactures customizable adsorption equipment with a strong focus on environmental responsibility, primarily in activated carbon systems. Carbtrol and CECO Environmental offer robust, flexible adsorption equipment designed for air and water quality improvement across diverse industries. Process Combustion Corporation and General Carbon provide high-efficiency adsorption solutions tailored for specific applications, ensuring optimal purification results. KCH and Suny Group specialize in advanced solutions for industrial gas and air purification. Meanwhile, GUNT and Microtrac are instrumental in precise environmental monitoring and testing, integral to the adsorption process.

These players are leading the way in providing efficient, customizable, and environmentally responsible adsorption technologies that are essential for industries looking to address pollution control, air quality standards, and water treatment needs. Their innovations in adsorption equipment are vital in meeting the increasing demand for cleaner air and water across the globe.

| Item | Value |

|---|---|

| Quantitative Units | USD 481.0 Million |

| Product Type | Vapor adsorption equipment and Liquid adsorption equipment |

| Flow Rate | 10,000 - 20,000 CFM, Up to 10,000 CFM, and More than 20,000 CFM |

| End Use Industry | Waste & wastewater treatment., Pharmaceutical, Chemical and Petrochemical, Automotive, Printing, and Others (pesticide, coating etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Durr, CalgonCarbon, Thermax, Evoqua, Munters, Bry-Air, TIGG, Carbtrol, CECOEnvironmental, ProcessCombustionCorporation, GeneralCarbon, KCH, SunyGroup, GUNT, and Microtrac |

| Additional Attributes | Dollar sales by product type (activated carbon systems, molecular sieves, zeolite-based adsorbents) and end-use segments (water treatment, air purification, chemical processing, industrial applications). Demand dynamics are influenced by the increasing need for clean water, air quality regulations, and sustainability practices. Regional trends show growth in North America, Europe, and Asia-Pacific, driven by investments in wastewater treatment, industrial air quality, and environmental pollution control. |

The global adsorption equipment market is estimated to be valued at USD 481.0 million in 2025.

The market size for the adsorption equipment market is projected to reach USD 845.2 million by 2035.

The adsorption equipment market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in adsorption equipment market are vapor adsorption equipment and liquid adsorption equipment.

In terms of flow rate, 10,000 - 20,000 cfm segment to command 46.8% share in the adsorption equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Immunoadsorption Columns Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Pressure Swing Adsorption Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Garage Equipment Market Growth – Trends & Forecast 2024-2034

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA