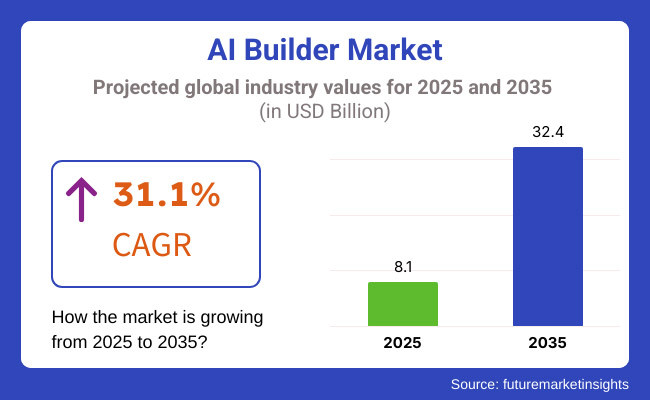

Market of AI Builder will grow at a headlong pace in 2025 to 2035 because AI-based products will keep on growing in emerging and emerging importance in finance, healthcare, retail, and manufacturing sectors. The market will grow from USD 8.1 billion in 2025 to USD 32.4 billion in 2035 with a compound annual growth rate (CAGR) of 31.1% in the forecast period.

Increasing demand for low-code/no-code AI platforms, business application of AI, and standalone AI development platforms is fuelling market growth to a large extent. Natural language processing (NLP), machine learning (ML), and computer vision are revolutionizing, but AI developers are also leading the democratization of AI adoption in business environments. Increased demand for economical AI solutions and uses of AI-driven automation across business functions is also driving market growth.

Government initiatives in digitizing and promoting AI, and investment in the development of AI-as-a-Service (AIaaS) is also accelerating the growth of the market. Other drivers that are also influencing AI builder platforms to develop and become economical are also partnerships between organizations, cloud providers, and AI software companies.

Strategic issues are data privacy, explainability of AI models, and computational cost. Explainable AI (XAI), ethics-constrained AI design, and power-constrained AI models dominated the market owing to such issues and ethics-constrained uses of AI.

North America occupies the first rank in providing AI Builder market share as artificial intelligence is being heavily utilized to make businesses automated, process data, and develop apps. The United States of America and Canada rank as the primary nations in the continent where enterprises and start-ups have launched AI-related technology to gain maximum work productivity and digitalization.

Market among the adopters in the finance sector, health sector, retail trade sector, and manufacturing sector is slowly moving towards the machine learning innovation platform, natural language processing innovation platform, and cloud computing innovation platform. Regime of regulation by the FTC and law enforcement support can be bought as data privacy commitment, and ethically moral use of AI that requires market drivers. Challenges to large-scale adoptions include resistance to AI bias, data protectionism, and deployment cost.

Europe is a rapidly growing AI construction industry with strong growth in the United Kingdom, France, and Germany, with digitalization, regulation, and AI automation on the agenda. Ethical AI construction and General Data Protection Regulation (GDPR) compliance in the European Union is fuelling AI adoption.

Smart manufacturing, consumer service, fintech, and corporate software lead marketplace expansion with increased use of AI creators. AI influences policymaking through controlled information openness, accountability through algorithms, and enabling use of AI technology. Corporate innovation in Europe in AI with security, understand ability, and compliance guarantee in the face of changing regulations enable market development.

Asia-Pacific is the hotbed of activity for AI Builder business and where digital transformation is happening at neck break speed, government-sponsored AI research, and encouraged AI adoption of AI technology is happening in China, Japan, South Korea, and India. AI-powered automation of e-commerce, smart city, and manufacturing is seeing unprecedented scale with deep learning, robotics, and edge computing technology advancements.

The area has a growing tech sector and affordable AI development software in massive numbers to be utilized by numerous various industries. However, there are still pending cases of AI ethics, intellectual property rights conflicts, and data sovereignty conflicts and yet the necessity to become agile to render litanies agile. Cloud AI, AI innovation, and borderless AI collaborations are shaping the future market trends theme, fuelling next-generation AI builder technology investments.

Challenge

Difficulty of Integration and Adoption Constraints

AI builder market is faced with the challenge of embedding AI solution into business. Cost of deployment, AI skills gap, and legacy support are the biggest constraint to most organizations in most cases. Data privacy, legal, and ethics of employing AI are some of the other constraints associated with other matters. They can be addressed by offering AI development platforms, improved interoperability, and infrastructure support across to enable industries to deploy AI without disruption.

Opportunities

Rise of No-Code and Low-Code AI Platform

Increasing needs for easy-to-consume AI solutions accelerated the growth of no-code and low-code AI builder platforms at a greater rate. Small, medium, and enterprise companies now develop AI-powered applications with minimal technical expertise, breaking AI adoption barriers in all industries. This, thus, auto-machine learning (AutoML) and AI-fueled workflow optimization also continue to liberate business agility and decision-making, opening immense space for AI builder growth.

AI builder market developed at a quicker rate in 2020 to 2024 because increasing demands for digitalization and automation were there. The technical problems and problem of bias in AI were hindering massive growth in the market. The companies attempted to make AI products easier and offer more transparency in AI-decisions in an effort to keep these problems under control.

With forward to 2025 to 2035, AI developers will be even more intuitive with even greater presence of generative AI, NLP, and AI democratization. With the coming of AI working in terms of more mass-market business requirements with the emergence of AI copilots, regulation frameworks for making AI accountable, space will also continue to evolve. Decentralized model structure of AI and federated learning will also continue to influence data protection as well as data privacy in AI solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emerging AI governance and ethical concerns |

| Technological Advancements | Growth in AutoML and deep learning frameworks |

| Industry Adoption | Early adoption in tech-driven enterprises |

| Supply Chain and Sourcing | Dependence on cloud-based AI solutions |

| Market Competition | Dominance of major AI platform providers |

| Market Growth Drivers | Increasing demand for AI-driven automation |

| Sustainability and Energy Efficiency | Focus on optimizing AI training efficiency |

| Integration of Smart Monitoring | Limited AI model monitoring tools |

| Advancements in AI Innovation | Early-stage development of no-code AI tools |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global AI regulations and standardized ethical AI frameworks |

| Technological Advancements | Expansion of generative AI, NLP-driven AI builders, and real-time AI model training |

| Industry Adoption | Mainstream adoption across all industries with AI-powered decision-making |

| Supply Chain and Sourcing | Rise of edge AI and decentralized AI models for enhanced privacy |

| Market Competition | Growth of open-source AI builders and industry-specific AI solutions |

| Market Growth Drivers | Widespread adoption of AI copilots, workflow automation, and AI-driven business intelligence |

| Sustainability and Energy Efficiency | Adoption of green AI models and energy-efficient AI processing |

| Integration of Smart Monitoring | AI-powered self-learning and auto-improving models for real-time optimization |

| Advancements in AI Innovation | Fully autonomous |

The USA AI Builder marketplace is evolving on an unprecedented scale with pervasive AI-driven automation, cloud-based AI building platforms, and increased investment in AI infrastructure. Innovative hotbeds such as Silicon Valley, New York City, and Seattle are witnessing out-of-control expansion as companies and start-ups implement AI for business analytics, workflow automation, and predictive analytics. Expansion in low-code/no-code AI platforms is also generating demand, enabling businesses to create AI solutions without depending on huge programming capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 31.0% |

UK AI Builder market is growing steadily on the back of government push in AI research, business adoption in AI, and development in machine learning automation. London, Manchester, and Cambridge are at the forefront of the AI innovation wave, and large corporations and startups are tapping into AI builders in fintech, health, and smart automation. Using AI for business processes and digitalization fuels market growth at an extremely rapid rate.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 30.2% |

EU AI Builders market is growing well with robust regulatory backing, digitalization through AI, and a strong investor base for R&D in AI. Pioneering countries such as Germany, France, and the Netherlands are at the forefront of industrial applications of AI, robotics, and AI-driven automation in manufacturing, logistics, and banking sectors. EU emphasis on ethical AI and responsible AI is also influencing market forces.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 30.5% |

Japan's AI Builder market is growing with the development of industrial solutions, intelligent automation, and robotics. Large cities such as Tokyo and Osaka are seeing more adoption of AI-driven automation software, chatbots, and AI-driven decision-making platforms. Customer experience solutions driven by AI, voice-controlled AI, and machine learning-driven automation are also generating demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 30.8% |

The South Korean AI Builder market is picking up momentum with government AI initiatives, smart city development, and AI-driven business automation development. Seoul and Busan are becoming AI innovation centers, with firms employing AI builders to provide predictive analytics, NLP, and intelligent automation. Smart manufacturing, fintech, and digital transformation projects also drive AI adoption, further fueling growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 31.2% |

AI Builder market segments are growing enormously with organizations from all industries increasingly applying artificial intelligence to automate processes, streamline them, and engage with customers. AI builders offer platforms and tools by which organizations can build AI-powered applications with minimal programming knowledge. Growing demand for conversational AI, predictive analytics, and intelligent automation solutions is driving the growth of the AI Builder market.

As digital transformation accelerates, AI creators are increasingly becoming a part of business processes, customer experience, and operational efficiency. Conversational AI and Predictive AI Spur Market Expansion as AI Embraces Its Role as Businesses' Main Operations Ally

Software developers of conversational AI and predictive AI software are two of the most potent industries in AI Builder's market, addressing increased demand for more sophisticated automation and data-driven solutions. Increased implementation of AI-based chatbots, virtual assistants, and predictive analysis solutions across industries has driven growth in these AI solutions.

Conversational AI systems simplify conversation, with real-time feedback, self-service customer support, and user interaction personalization. In contrast to rule-based chatbots, conversational AI uses NLP and ML technologies to improve context sensitivity and response accuracy. Conversational AI developers are being hired by increasingly more e-commerce, health care, bank, and telecommunications companies to automate customer support, decrease response times, and improve user experience.

With increased speech recognition, multilingual support, and sentiment analysis, the market for conversational AI builders will keep growing. Predictive AI developers are revolutionizing decision-making with big data analysis and machine learning algorithms.

The predictive AI platforms review past records, detect trends, and generate forecasting insights to allow businesses to predict trends, reduce risks, and optimize strategies. Unlike traditional analytics platforms, predictive AI builders allow businesses to make real-time decisions, which help them respond to market trends. Predictive AI is being employed by the banking and finance sectors, healthcare, manufacturing sectors, and retail sectors on a massive scale to enhance fraud detection, supply chain management, targeted marketing, and disease diagnosis.

Growing usage of AI business intelligence suites and automated analytics platforms is fueling demand for predictive AI builders to become an integral part of business as usual. As there is ongoing innovation in AI technologies, conversational AI and predictive AI developers will experience massive uptake across industries. Research indicates that more than 70% of businesses are investing in AI-based automation technology to enhance productivity, reduce costs, and enhance customer experience.

With data privacy, appropriate use of AI, and bias in AI models being areas of concern, developers are mitigating these issues through emphasis on open AI algorithms, ethical standards of AI, and robust security measures to regulate proper use of AI and continuous market innovation. Cloud-Based AI Deployment Takes Off as Businesses Adopt Scalable AI Solutions

AI developers are being implemented through cloud-based and on-premises solutions, and cloud-based deployment of AI is witnessing heavy demand because it offers scalability, is cost-saving, and integrates seamlessly. Enterprises are adopting cloud-based AI developers more and more in order to harness the capabilities of state-of-the-art AI solutions without having to spend millions of dollars on infrastructure.

Unlike on-premises deployment, cloud deployment does not involve huge hardware deployments and maintenance, which allows companies to concentrate on AI-driven innovation. AWS, Microsoft Azure, and Google Cloud have come up with AI builder platforms that allow easy creation of AI models, deployment, and management with minimal technical knowledge. Growing adoption of cloud computing and growing demand for AI-powered automation are driving growth in cloud-based AI builders.

Banking, retail, healthcare, and education industries are using cloud-based AI platforms to improve customer experience, automate, and enable digital transformation. On-premises AI builders, providing more control and security on data, are gaining traction mainly among organizations with stringent data privacy compliance mandates and industry-specific regulatory mandates.

Unlike cloud deployment, on-premises deployment of AI demands high infrastructure investment, regular maintenance, and in-house technical expertise. In spite of all these hindrances, government, defence, and healthcare sectors still value on-premises AI developers so that they can maintain data confidentiality and regulation compliance. Hybrid AI deployment options, compromising the advantage of both on-premises and cloud AI solutions, are also emerging popular so that business houses can avail the optimum advantage of AI with no compromise over data security as well as business flexibility.

Cloud AI deployment will become trendy as businesses need scalable, cost-effective, and AI-powered digital solutions. Studies have revealed more than 80% of organizations are implementing cloud AI solutions in order to provide agility, automation, and decision-making. Notwithstanding this, data protection issues, AI governance, and reliability in the cloud are on the top list of priorities. Cloud AI solution providers are thus implementing next-gen encryption techniques, AI governance frameworks, and regulatory certifications to institute safe and moral AI.

Rising demand for AI Builder offerings across various industries such as automation, predictive analysis, and workflow improvement is fuelling quick growth in the market.

Growth in the market is being spurred by digital transformation, greater dependency on AI-driven decision-making, and demand for scalable AI-driven automation solutions. AI-driven process automation, low-code/no-code AI platforms to develop, and machine learning-based insights are most heavily invested upon by businesses to drive business efficiency and innovation. Market players consist of AI platform providers, automation software providers, and cloud-based AI service providers with industry-specific AI solutions for different industry applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft AI Builder | 20-25% |

| Google AI Platform | 15-20% |

| Amazon Web Services (AWS) AI | 12-16% |

| IBM Watson AI | 10-14% |

| Salesforce Einstein AI | 8-12% |

| Other AI Platforms (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft AI Builder | Provides a low-code AI platform for businesses to integrate AI-driven automation and predictive analytics. |

| Google AI Platform | Specializes in cloud-based AI and machine learning services for developers and enterprises. |

| Amazon Web Services (AWS) AI | Offers AI-driven cloud solutions, including deep learning, speech recognition, and automation tools. |

| IBM Watson AI | Develops enterprise-grade AI solutions with advanced analytics and cognitive computing capabilities. |

| Salesforce Einstein AI | Focuses on AI-powered CRM and business intelligence solutions to optimize customer interactions. |

Key Company Insights

Microsoft AI Builder (20-25%)

Microsoft leads the AI Builder segment with a low-code platform built-in to build AI within its Power Platform to enable firms to automate and make better decisions.

Google AI Platform (15-20%)

Google AI is a robust portfolio of cloud-based AI offerings based on machine learning, deep learning, and data analysis to introduce greater business intelligence.

Amazon Web Services (AWS) AI (12-16%)

AWS AI is cloud computing driven by AI, offering scalable automation and predictive analytics platforms to global companies.

IBM Watson AI (10-14%)

IBM Watson AI is enterprise-focused AI use cases with advanced machine learning and cognitive computing capabilities.

Salesforce Einstein AI (8-12%)

Salesforce Einstein AI brings CRM and business intelligence to allow organizations to leverage AI to improve customer interaction.

Other Key Players (25-35% Combined)

Future AI platform providers are introducing next-generation AI offerings, such as industry-specific AI applications, autonomous decision-making, and personalized AI experiences. They are:

The overall market size for the AI builder market was USD 8.1 billion in 2025.

The AI builder market is expected to reach USD 32.4 billion in 2035.

The AI builder market is expected to grow at a CAGR of 31.1% during the forecast period.

The demand for the AI builder market will be driven by increasing adoption of AI-driven automation, growing demand for low-code and no-code development platforms, advancements in machine learning algorithms, expansion of AI applications across industries, and rising investment in AI infrastructure.

The top five countries driving the development of the AI builder market are the USA, China, Germany, India, and Japan.

Table 1: Global Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 2: Global Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 3: Global Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 4: Global Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 5: Global Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Region

Table 6: North America Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 7: North America Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 8: North America Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 9: North America Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 10: North America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 11: Latin America Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 12: Latin America Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 13: Latin America Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 14: Latin America Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 15: Latin America Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 16: East Asia Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 17: East Asia Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 18: East Asia Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 19: East Asia Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 20: East Asia Market Value (US$ million) Forecast (2023 to 2033) by Country

Table 21: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 22: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 23: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 24: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 25: South Asia & Pacific Market Value (US$ million) Forecast (2023 to 2033) by Country

Table 26: Western Europe Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 27: Western Europe Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 28: Western Europe Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 29: Western Europe Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 30: Western Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 31: Eastern Europe Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 32: Eastern Europe Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 33: Eastern Europe Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 34: Eastern Europe Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 35: Eastern Europe Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Table 36: Central Asia Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 37: Central Asia Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 38: Central Asia Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 39: Central Asia Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 40: Russia & Belarus Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 41: Russia & Belarus Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 42: Russia & Belarus Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 43: Russia & Belarus Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 44: Balkan &Baltics Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 45: Balkan &Baltics Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 46: Balkan &Baltics Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 47: Balkan &Baltics Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 48: Middle East & Africa Market Value (US$ million) Forecast (2023 to 2033) by Type

Table 49: Middle East & Africa Market Value (US$ million) Forecast (2023 to 2033) by Deployment Mode

Table 50: Middle East & Africa Market Value (US$ million) Forecast (2023 to 2033) by Enterprise Size

Table 51: Middle East & Africa Market Value (US$ million) Forecast (2023 to 2033) by Industry

Table 52: Middle East & Africa Market Value (US$ million) Analysis and Forecast (2018 to 2033) by Country

Figure 1: Global Market Value (US$ million), 2018 to 2022

Figure 2: Global Market Value (US$ million), 2023 to 2033

Figure 3: Global Market Size (US$ million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 4: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 5: Global Market Shipments (million Units) and Y-o-Y Growth Rate from 2023 to 2033

Figure 6: Global Market, Market Share Analysis, by Type – 2023 & 2033

Figure 7: Global Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 8: Global Market, Market Attractiveness, by Type

Figure 9: Global Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 10: Global Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 11: Global Market, Market Attractiveness, by Deployment Mode

Figure 12: Global Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 13: Global Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 14: Global Market, Market Attractiveness, by Enterprise Size

Figure 15: Global Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 16: Global Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 17: Global Market, Market Attractiveness, by Industry

Figure 18: Global Market, Market Share Analysis, by Region – 2023 & 2033

Figure 19: Global Market, Y-o-Y Growth Comparison, by Region, 2023 to 2033

Figure 20: Global Market, Market Attractiveness, by Region

Figure 21: North America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 22: Latin America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 23: East Asia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 24: South Asia & Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 25: Western Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 26: Eastern Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 27: Central Asia Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 28: Russia & Belarus Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 29: Balkan & Baltics Countries Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 30: Middle East & Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 31: North America Market Value (US$ million), 2018 to 2022

Figure 32: North America Market Value (US$ million), 2023 to 2033

Figure 33: North America Market, Market Share Analysis, by Type – 2023 & 2033

Figure 34: North America Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 35: North America Market, Market Attractiveness, by Type

Figure 36: North America Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 37: North America Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 38: North America Market, Market Attractiveness, by Deployment Mode

Figure 39: North America Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 40: North America Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 41: North America Market, Market Attractiveness, by Enterprise Size

Figure 42: North America Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 43: North America Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 44: North America Market, Market Attractiveness, by Industry

Figure 45: North America Market, Market Share Analysis, by Country – 2023 & 2033

Figure 46: North America Market, Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 47: North America Market, Market Attractiveness, by Country

Figure 48: USA Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 49: Canada Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 50: Latin America Market Value (US$ million), 2018 to 2022

Figure 51: Latin America Market Value (US$ million), 2023 to 2033

Figure 52: Latin America Market, Market Share Analysis, by Type – 2023 & 2033

Figure 53: Latin America Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 54: Latin America Market, Market Attractiveness, by Type

Figure 55: Latin America Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 56: Latin America Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 57: Latin America Market, Market Attractiveness, by Deployment Mode

Figure 58: Latin America Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 59: Latin America Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 60 Latin America Market, Market Attractiveness, by Enterprise Size

Figure 61: Latin America Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 62: Latin America Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 63: Latin America Market, Market Attractiveness, by Industry

Figure 64: Latin America Market, Market Share Analysis, by Country – 2023 & 2033

Figure 65: Latin America Market, Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 66: Latin America Market, Market Attractiveness, by Country

Figure 67: Brazil Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 68: Mexico Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 69: Rest of LATAM Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 70: East Asia Market Value (US$ million), 2018 to 2022

Figure 71: East Asia Market Value (US$ million), 2023 to 2033

Figure 72: East Asia Market, Market Share Analysis, by Type – 2023 & 2033

Figure 73: East Asia Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 74: East Asia Market, Market Attractiveness, by Type

Figure 75: East Asia Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 76: East Asia Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 77: East Asia Market, Market Attractiveness, by Deployment Mode

Figure 78: East Asia Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 79: East Asia Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 80: East Asia Market, Market Attractiveness, by Enterprise Size

Figure 81: East Asia Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 82: East Asia Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 83 East Asia Market, Market Attractiveness, by Industry

Figure 84: East Asia Market, Market Share Analysis, by Country – 2023 & 2033

Figure 85: East Asia Market, Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 86: East Asia Market, Market Attractiveness, by Country

Figure 87: China Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 88: Japan Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 89: South Korea Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 90: South Asia & Pacific Market Value (US$ million), 2018 to 2022

Figure 91: South Asia & Pacific Market Value (US$ million), 2023 to 2033

Figure 92: South Asia & Pacific Market, Market Share Analysis, by Type – 2023 & 2033

Figure 93: South Asia & Pacific Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 94: South Asia & Pacific Market, Market Attractiveness, by Type

Figure 95: South Asia & Pacific Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 96: South Asia & Pacific Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 97: South Asia & Pacific Market, Market Attractiveness, by Deployment Mode

Figure 98: South Asia & Pacific Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 99: South Asia & Pacific Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 100: South Asia & Pacific Market, Market Attractiveness, by Enterprise Size

Figure 101: South Asia & Pacific Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 102: South Asia & Pacific Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 103: South Asia & Pacific Market, Market Attractiveness, by Industry

Figure 104: South Asia & Pacific Market, Market Share Analysis, by Country – 2023 & 2033

Figure 105: South Asia & Pacific Market, Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 106: South Asia & Pacific Market, Market Attractiveness, by Country

Figure 107: India Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 108: ASEAN Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 109: Oceania Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 110: Rest of SAP Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 111: Western Europe Market Value (US$ million), 2018 to 2022

Figure 112: Western Europe Market Value (US$ million), 2023 to 2033

Figure 113: Western Europe Market, Market Share Analysis, by Type – 2023 & 2033

Figure 114 Western Europe Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 115: Western Europe Market, Market Attractiveness, by Type

Figure 116: Western Europe Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 117: Western Europe Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 118: Western Europe Market, Market Attractiveness, by Deployment Mode

Figure 119: Western Europe Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 120: Western Europe Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 121: Western Europe Market, Market Attractiveness, by Enterprise Size

Figure 122: Western Europe Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 123: Western Europe Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 124 Western Europe Market, Market Attractiveness, by Industry

Figure 125: Western Europe Market, Market Share Analysis, by Country – 2023 & 2033

Figure 126: Western Europe Market, Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 127: Western Europe Market, Market Attractiveness, by Country

Figure 128: Germany Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 129: Italy Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 130: France Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 131: United Kingdom Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 132 Spain Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 133: BENELUX Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 134: Nordics Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 135: Rest of Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 136: Eastern Europe Market Value (US$ million), 2018 to 2022

Figure 137: Eastern Europe Market Value (US$ million), 2023 to 2033

Figure 138 Eastern Europe Market, Market Share Analysis, by Type – 2023 & 2033

Figure 139: Eastern Europe Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 140: Eastern Europe Market, Market Attractiveness, by Type

Figure 141: Eastern Europe Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 142: Eastern Europe Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 143: Eastern Europe Market, Market Attractiveness, by Deployment Mode

Figure 144: Eastern Europe Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 145: Eastern Europe Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 146 Eastern Europe Market, Market Attractiveness, by Enterprise Size

Figure 147: Eastern Europe Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 148: Eastern Europe Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 149: Eastern Europe Market, Market Attractiveness, by Industry

Figure 150: Eastern Europe Market, Market Share Analysis, by Country – 2023 & 2033

Figure 151: Eastern Europe Market, Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 152: Eastern Europe Market, Market Attractiveness, by Country

Figure 153: Poland Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 154: Hungary Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 155: Romania Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 156: Czech Republic Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 157: Rest of Eastern Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 158: Central Asia Market Value (US$ million), 2018 to 2022

Figure 159: Central Asia Market Value (US$ million), 2023 to 2033

Figure 160: Central Asia Market, Market Share Analysis, by Type – 2023 & 2033

Figure 161: Central Asia Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 162: Central Asia Market, Market Attractiveness, by Type

Figure 163: Central Asia Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 164: Central Asia Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 165: Central Asia Market, Market Attractiveness, by Deployment Mode

Figure 166: Central Asia Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 167: Central Asia Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 168: Central Asia Market, Market Attractiveness, by Enterprise Size

Figure 169: Central Asia Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 170: Central Asia Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 171: Central Asia Market, Market Attractiveness, by Industry

Figure 172: Russia & Belarus Market Value (US$ million), 2018 to 2022

Figure 173: Russia & Belarus Market Value (US$ million), 2023 to 2033

Figure 174: Russia & Belarus Market, Market Share Analysis, by Type – 2023 & 2033

Figure 175: Russia & Belarus Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 176: Russia & Belarus Market, Market Attractiveness, by Type

Figure 177: Russia & Belarus Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 178: Russia & Belarus Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 179: Russia & Belarus Market, Market Attractiveness, by Deployment Mode

Figure 180: Russia & Belarus Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 181: Russia & Belarus Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 182: Russia & Belarus Market, Market Attractiveness, by Enterprise Size

Figure 183: Russia & Belarus Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 184: Russia & Belarus Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 185: Russia & Belarus Market, Market Attractiveness, by Industry

Figure 186: Balkan &Baltics Market Value (US$ million), 2018 to 2022

Figure 187: Balkan &Baltics Market Value (US$ million), 2023 to 2033

Figure 188: Balkan &Baltics Market, Market Share Analysis, by Type – 2023 & 2033

Figure 189: Balkan &Baltics Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 190: Balkan &Baltics Market, Market Attractiveness, by Type

Figure 191: Balkan &Baltics Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 192: Balkan &Baltics Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 193: Balkan &Baltics Market, Market Attractiveness, by Deployment Mode

Figure 194: Balkan &Baltics Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 195: Balkan &Baltics Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 196: Balkan &Baltics Market, Market Attractiveness, by Enterprise Size

Figure 197: Balkan &Baltics Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 198: Balkan &Baltics Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 199: Balkan &Baltics Market, Market Attractiveness, by Industry

Figure 200: Middle East & Africa Market Value (US$ million), 2018 to 2022

Figure 201: Middle East & Africa Market Value (US$ million), 2023 to 2033

Figure 202: Middle East & Africa Market, Market Share Analysis, by Type – 2023 & 2033

Figure 203 Middle East & Africa Market, Y-o-Y Growth Comparison, by Type, 2023 to 2033

Figure 204: Middle East & Africa Market, Market Attractiveness, by Type

Figure 205: Middle East & Africa Market, Market Share Analysis, by Deployment Mode – 2023 & 2033

Figure 206: Middle East & Africa Market, Y-o-Y Growth Comparison, by Deployment Mode, 2023 to 2033

Figure 207: Middle East & Africa Market, Market Attractiveness, by Deployment Mode

Figure 208: Middle East & Africa Market, Market Share Analysis, by Enterprise Size – 2023 & 2033

Figure 209: Middle East & Africa Market, Y-o-Y Growth Comparison, by Enterprise Size, 2023 to 2033

Figure 210: Middle East & Africa Market, Market Attractiveness, by Enterprise Size

Figure 211: Middle East & Africa Market, Market Share Analysis, by Industry – 2023 & 2033

Figure 212: Middle East & Africa Market, Y-o-Y Growth Comparison, by Industry, 2023 to 2033

Figure 213: Middle East & Africa Market, Market Attractiveness, by Industry

Figure 214: Middle East & Africa Market, Market Share Analysis, by Country – 2023 & 2033

Figure 215: Middle East & Africa Market, Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 216: Middle East & Africa Market, Market Attractiveness, by Country

Figure 217: GCC Countries Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 218: Turkiye Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 219: Northern Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 220: South Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 221: Rest of Middle East & Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI-Powered Embryo Selection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-powered In-car Assistant Market Forecast and Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA