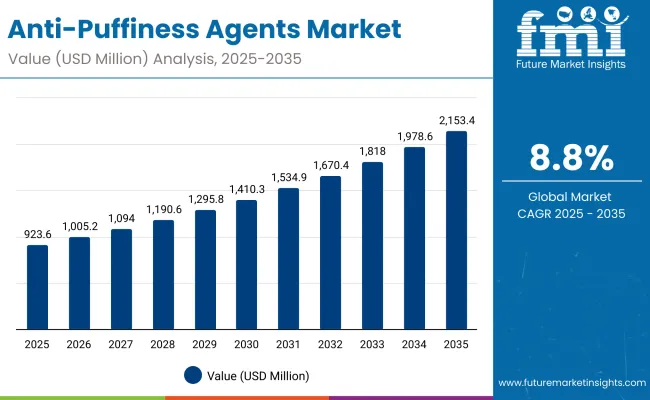

A valuation of USD 923.6 Million is anticipated for the Anti-Puffiness Agents Market in 2025, which is projected to reach USD 2,153.4 Million by 2035. This expansion of USD 1,229.8 Million represents an overall increase of 133% during the decade. A compound annual growth rate (CAGR) of 8.8% is projected, reflecting robust demand for raw materials that enhance efficacy and stability in eye-care formulations. The doubling of market size underscores the expected traction of advanced bioactive systems across both established and emerging regions.

Anti-Puffiness Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Puffiness Agents Market Estimated Value in (2025E) | USD 923.6 Million |

| Anti-Puffiness Agents Market Forecast Value in (2035F) | USD 2,153.4 Million |

| Forecast CAGR (2025 to 2035) | 8.80% |

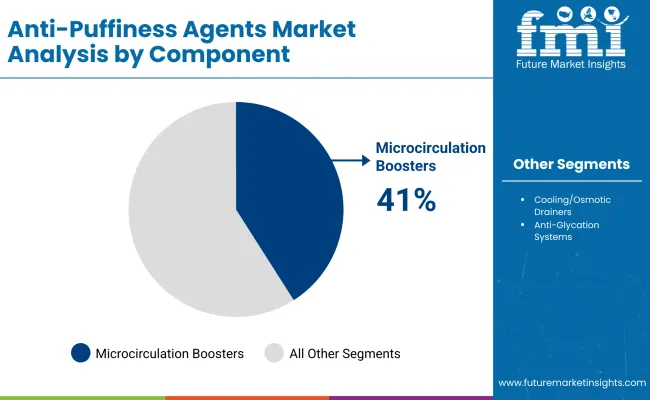

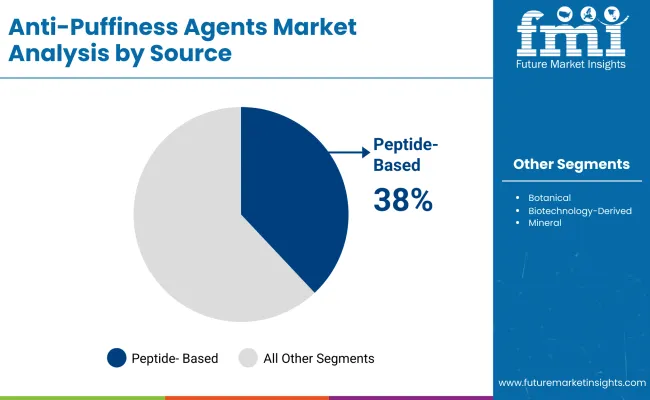

During the first half of the period, from 2025 to 2030, the market is expected to grow from USD 923.6 Million to USD 1,410.3 Million, adding USD 486.7 Million. This contribution represents nearly 40% of the total decade growth. Uptake is expected to be reinforced by premium skincare positioning, where microcirculation boosters are projected to dominate with a 41% share in 2025 due to their visible de-puffing effect. In parallel, peptide-based sources are anticipated to capture 38% of value share, showcasing the increasing reliance on clinically validated actives.

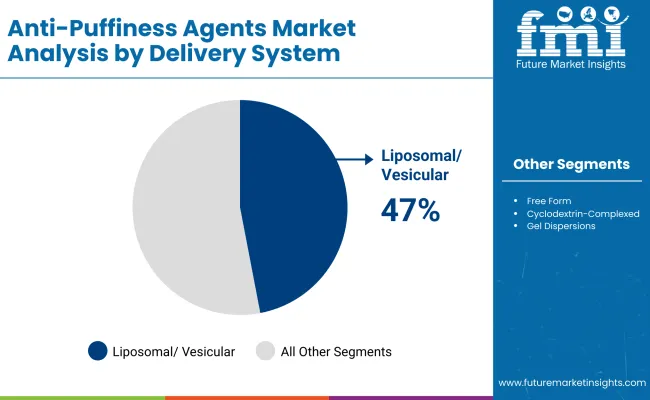

The second phase from 2030 to 2035 is projected to add USD 743.1 Million, equivalent to 60% of the total decade growth. This momentum is anticipated to be powered by advanced delivery technologies, with liposomal and vesicular systems leading at 47% share in 2025 and expected to widen penetration due to their superior stability and targeted deposition. Competitive advantages are expected to accrue to suppliers integrating bioactivity validation with scalable, regulatory-compliant production.

From 2025 to 2035, the market value is projected to more than double, driven by increasing reliance on clinically validated actives and advanced delivery systems. The competitive landscape is expected to remain fragmented, with leading suppliers controlling less than 10% share, while growth is anticipated to favor players integrating bioactive efficacy with scalable and regulatory-compliant production. Demand is expected to be reinforced in Asia-Pacific and North America, where both premium and dermocosmetic segments are projected to absorb high-value ingredients.

The growth of the Anti-Puffiness Agents Market is being driven by multiple scientific and consumer-focused dynamics. Rising demand for bioactive raw materials with proven efficacy is being observed as skincare brands increasingly emphasize evidence-backed claims. The adoption of microcirculation boosters and peptide-based actives is being favored, owing to their ability to deliver visible de-puffing effects and long-term skin benefits. Advanced delivery systems such as liposomal and vesicular carriers are being integrated more widely, as formulators seek improved stability, bioavailability, and targeted deposition. Growth is also being accelerated by premiumization trends in skincare, where consumer willingness to invest in dermocosmetic and clinically supported formulations is expanding. Demand across emerging economies is being reinforced by the rising middle class and increased focus on preventative skincare. With regulatory scrutiny intensifying, suppliers delivering transparent safety data and sustainable sourcing are expected to capture significant opportunities, ensuring the market sustains its robust trajectory.

The Anti-Puffiness Agents Market is projected to expand significantly over the next decade, with its value expected to increase from USD 923.6 Mn in 2025 to USD 2,153.4 Mn by 2035. This growth, reflected in a CAGR of 8.8%, is anticipated to be driven by rising demand for high-performance ingredients that deliver visible under-eye decongestion and long-term skin benefits. Ingredient innovation is being prioritized around microcirculation boosters, peptide-based actives, and advanced encapsulation carriers, each offering differentiated efficacy and improved formulation stability. Global suppliers are expected to strengthen positions by providing clinically validated solutions, sustainable sourcing, and regulatory compliance. Growth momentum is anticipated across North America, East Asia, and South Asia, while premiumization and preventive skincare trends are projected to sustain robust uptake worldwide.

| Mode of Action | Market Value Share, 2025 |

|---|---|

| Microcirculation boosters | 41% |

| Others | 59.0% |

Microcirculation boosters are expected to hold 41% of market share in 2025, positioning them as the leading mechanism in anti-puffiness formulations. Their dominance is being reinforced by growing clinical validation that demonstrates rapid improvements in under-eye circulation and visible reduction of puffiness. Demand is anticipated to be sustained by brands highlighting instant efficacy and long-term resilience, both of which resonate strongly with consumer expectations. Suppliers of microcirculation actives are projected to benefit from collaborations with skincare brands emphasizing scientifically backed claims. While other mechanisms, such as osmotic drainers and cooling modulators, retain a larger cumulative share, their adoption is expected to be more fragmented across applications. Over the decade, multi-pathway approaches are anticipated to gain traction, enhancing formulation versatility and broadening supplier opportunities.

| Source | Market Value Share, 2025 |

|---|---|

| Peptide-based | 38% |

| Others | 62.0% |

Peptide-based actives are projected to represent 38% of ingredient sales in 2025, underscoring their critical role in the anti-puffiness landscape. Their growing importance is being driven by demand for highly targeted, scientifically validated ingredients that deliver measurable skin benefits. With peptides increasingly engineered for stability and penetration, formulators are expected to prioritize their inclusion in high-value dermocosmetic and premium skincare ranges. Rising consumer trust in peptide-driven performance claims is anticipated to further reinforce demand. Other sources, including botanical and biotechnology-derived actives, collectively hold a larger share; however, peptides are positioned to gain incremental adoption due to their versatility in multi-active formulations. Over the forecast period, investment in proprietary peptide sequences is expected to provide suppliers with strong differentiation and regulatory defensibility.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Liposomal/vesicular | 47% |

| Others | 53.0% |

Liposomal and vesicular carriers are anticipated to dominate with a 47% share in 2025, reflecting their superior ability to stabilize actives and deliver targeted efficacy. Their role in enhancing ingredient penetration and reducing irritation is being increasingly emphasized by suppliers, making them the preferred choice for premium formulations. Growth in this segment is being accelerated by consumer demand for products that balance rapid visible results with long-term skin health. The reliance on such systems is projected to increase as complex peptide and bioactive formulations become mainstream. Other delivery systems, including free form and cyclodextrin complexes, continue to play a complementary role, especially in cost-sensitive markets. However, liposomal and vesicular technologies are expected to remain central to supplier innovation pipelines through 2035.

Complex regulatory scrutiny and cost pressures are challenging ingredient suppliers, even as demand is being strengthened by clinical validation, advanced encapsulation systems, and bioactive innovation, ensuring the Anti-Puffiness Agents Market is positioned for transformative growth across dermocosmetic and premium skincare formulations.

Integration of Encapsulation with Multi-Active Formulations

Growth is being reinforced by the integration of encapsulation systems that enable multiple actives to be delivered in a single formulation. This advancement is allowing brands to position anti-puffiness products as multifunctional solutions, addressing hydration, firmness, and irritation simultaneously. Suppliers incorporating liposomal and vesicular carriers are expected to capture higher-value partnerships with skincare brands, as these systems not only stabilize sensitive peptides but also ensure compatibility with botanical or biotechnological actives. Such multifunctional ingredient platforms are anticipated to become a decisive driver of long-term adoption, particularly in premium and dermocosmetic lines where clinical transparency and visible results remain non-negotiable.

Shift Toward Regulatory-Ready Transparency in Bioactives

A pronounced trend is being observed toward regulatory-ready ingredient portfolios, where suppliers proactively present dossiers aligned with evolving cosmetic regulations in the EU, USA, and Asia-Pacific. This shift is enabling faster adoption by global skincare brands that increasingly seek de-risked innovation pipelines. Beyond safety compliance, transparent data on irritation thresholds, allergen profiles, and environmental impact is being packaged with marketing claims, ensuring trust across both B2B partners and end consumers. The ability to combine efficacy-driven innovation with clear regulatory defensibility is expected to separate leaders from laggards, establishing a trend where ingredient credibility outweighs cost advantages in securing long-term contracts.

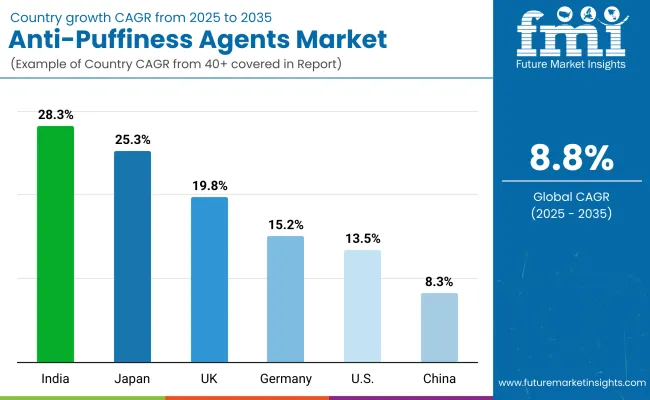

| Country | CAGR |

|---|---|

| China | 8.3% |

| USA | 13.5% |

| India | 28.3% |

| UK | 19.8% |

| Germany | 15.2% |

| Japan | 25.3% |

The Anti-Puffiness Agents Market is expected to display significant variation in growth across leading countries, shaped by consumer awareness, regulatory frameworks, and brand strategies. India is projected to lead with a CAGR of 28.3% between 2025 and 2035, as rising disposable income and a young demographic accelerate adoption of active ingredients in skincare formulations. Japan follows with a CAGR of 25.3%, where demand is anticipated to be fueled by sensitive-skin positioning, high-quality dermocosmetic innovation, and preference for advanced delivery systems. The UK and Germany are also expected to perform strongly, registering growth rates of 19.8% and 15.2% respectively, underpinned by strict safety standards and the rising influence of dermatology-driven claims in European markets.

In North America, the USA is forecast to grow at 13.5% CAGR, supported by the maturity of dermocosmetic channels and robust demand for clinically validated peptide-based actives. China, although growing at a slower CAGR of 8.3%, is expected to retain its strategic significance due to its scale, dominance in raw material sourcing, and rising consumer shift toward efficacy-first formulations. Europe overall is anticipated to maintain a balanced trajectory at 13.5%, with premium brands and compliance-driven formulations sustaining steady growth.

| Year | USA Anti-Puffiness Agents Market (USD Million) |

|---|---|

| 2025 | 166.59 |

| 2026 | 180.08 |

| 2027 | 194.67 |

| 2028 | 210.44 |

| 2029 | 227.49 |

| 2030 | 245.92 |

| 2031 | 265.84 |

| 2032 | 287.38 |

| 2033 | 310.66 |

| 2034 | 335.83 |

| 2035 | 363.04 |

The Anti-Puffiness Agents Market in the United States is projected to grow at a CAGR of 8.6% between 2025 and 2035. This growth trajectory is being reinforced by strong consumer preference for clinically validated actives and rising demand for multifunctional formulations within the dermocosmetic and premium skincare categories. Ingredient suppliers are expected to benefit from investments in peptide innovation, encapsulation carriers, and transparent claim substantiation that align with FDA-driven safety requirements.

A gradual shift toward multifunctional eye-care systems is anticipated, creating opportunities for suppliers to integrate anti-puffiness actives with hydration and anti-aging benefits. Clinical dermatology channels are projected to remain central to adoption, while premium skincare brands are expected to drive incremental sourcing of high-value actives.

The Anti-Puffiness Agents Market in the United Kingdom is projected to grow at a CAGR of 19.8% between 2025 and 2035. This strong momentum is anticipated to be supported by premium skincare adoption, rising consumer inclination toward dermocosmetic solutions, and the influence of clinical claim substantiation. Ingredient suppliers are expected to benefit from partnerships with dermatologists and retail-led premium skincare chains, which remain influential in consumer decision-making. Formulation demand is likely to focus on peptides and liposomal carriers, as transparency and high efficacy continue to be prioritized.

The Anti-Puffiness Agents Market in India is forecast to expand at a CAGR of 28.3% from 2025 to 2035, the highest among leading countries. Growth is anticipated to be powered by rapid urbanization, rising disposable income, and increasing focus on preventative skincare routines. Ingredient demand is expected to be centered on affordable yet clinically credible bioactives, with peptide adoption projected to accelerate as premium skincare gains traction. International suppliers are likely to expand through local partnerships, ensuring compliance with evolving regulatory requirements and maintaining affordability in mass-premium categories.

The Anti-Puffiness Agents Market in China is projected to record a CAGR of 8.3% between 2025 and 2035. Although slower than other Asian peers, growth is expected to be anchored in the scale of the domestic skincare sector and the consumer shift toward efficacy-first formulations. Ingredient sourcing is likely to remain diversified, with strong adoption of “other source” actives, while peptides are expected to steadily gain share as clinical storytelling becomes mainstream. The competitive environment is anticipated to favor suppliers aligning with local regulations and digital-first sales ecosystems.

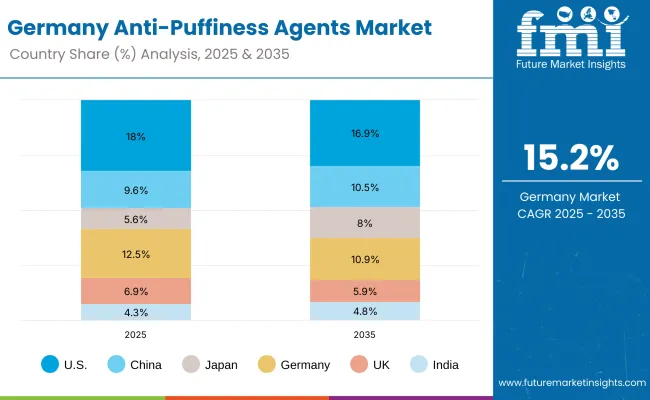

| Country | 2025 |

|---|---|

| USA | 18.0% |

| China | 9.6% |

| Japan | 5.6% |

| Germany | 12.5% |

| UK | 6.9% |

| India | 4.3% |

| Country | 2035 |

|---|---|

| USA | 16.9% |

| China | 10.5% |

| Japan | 8.0% |

| Germany | 10.9% |

| UK | 5.9% |

| India | 4.8% |

The Anti-Puffiness Agents Market in Germany is expected to expand at a CAGR of 15.2% between 2025 and 2035. Growth is anticipated to be reinforced by strict quality compliance, the rise of dermocosmetic positioning, and consumer trust in dermatologist-led formulations. Suppliers delivering clinically validated, irritation-minimized ingredients are likely to secure preference within German markets. Encapsulation and liposomal systems are expected to attract high demand, as efficacy, stability, and safety remain central purchasing criteria.

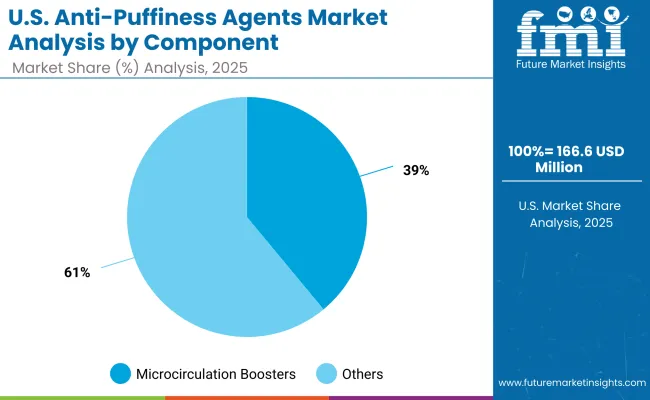

| USA by Mode of Action | Market Value Share, 2025 |

|---|---|

| Microcirculation boosters | 39% |

| Others | 61.0% |

The Anti-Puffiness Agents Market in the United States is projected at USD 166.6 million in 2025. Microcirculation boosters contribute 39%, while other mechanisms account for 61%, indicating a broader reliance on multi-pathway approaches to address under-eye puffiness. This distribution reflects the emphasis on efficacy diversification, where microcirculation is valued for its rapid visible impact, but complementary mechanisms ensure sustained results and consumer satisfaction. Formulators are expected to combine these pathways, creating multi-functional ingredient blends that align with clinical claims demanded in the USA market. The ability of suppliers to deliver proven efficacy across both immediate and long-term endpoints is anticipated to shape competitive positioning. Clinical dermatology and premium skincare are projected to be primary adoption channels, reinforcing the need for robust data packages.

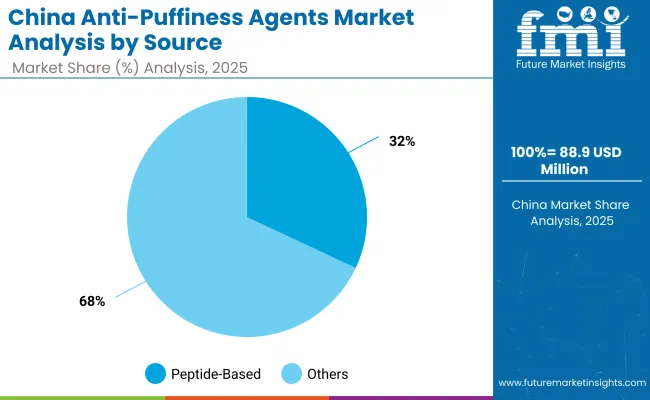

| China by source | Market Value Share, 2025 |

|---|---|

| Peptide-based | 32% |

| Others | 68.0% |

The Anti-Puffiness Agents Market in China is projected at USD 88.9 million in 2025. Peptide-based actives contribute 32%, while other sources account for 68%, reflecting a market still dominated by broad-spectrum botanical and biotechnology-driven actives. Peptide adoption, however, is expected to accelerate as consumer demand for clinically supported and efficacy-focused formulations expands. International suppliers introducing proprietary peptide sequences are likely to benefit from growing brand emphasis on transparency, performance, and advanced delivery technologies. Meanwhile, cost competitiveness and scalability will continue to favor diversified sources, ensuring wide application across both mass-market and premium product lines. This dual sourcing structure is anticipated to define competitive dynamics, where brands balance affordability with innovation-led differentiation.

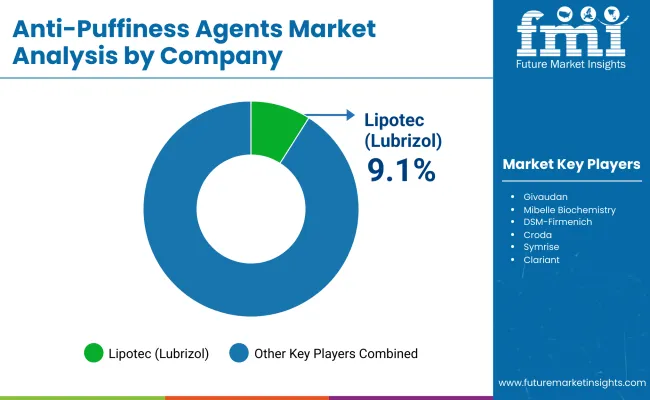

| Company | Global Value Share 2025 |

|---|---|

| Lipotec (Lubrizol) | 9.1% |

| Others | 90.9% |

The Anti-Puffiness Agents Market is moderately fragmented, with global ingredient leaders, mid-sized innovators, and niche specialists competing across diverse formulation needs. Global leaders such as Lipotec (Lubrizol) hold significant positions, driven by patented peptide technologies, advanced delivery systems, and longstanding partnerships with premium skincare and dermocosmetic brands. Their strategies are increasingly focused on clinical substantiation, encapsulation platforms, and scalable production processes that align with evolving regulatory standards.

Mid-sized innovators, including companies such as Givaudan, Mibelle Biochemistry, DSM-Firmenich, and Ashland, are building competitive strength through proprietary bioactives, multifunctional blends, and sustainability-focused portfolios. Their adoption is expected to rise as dermocosmetic players seek proven efficacy combined with clean-label and eco-compliant formulations.

Specialist suppliers such as Croda, Symrise, Clariant, Rahn, and Seppic are emphasizing differentiated technologies, ranging from botanical extractions to encapsulation carriers. Their strength lies in customization, flexible manufacturing, and regional adaptability, enabling them to serve diverse brand strategies across both mass-market and premium product lines.

Competitive differentiation is shifting away from single-function actives toward integrated portfolios where peptides, botanicals, and advanced carriers are combined to deliver multi-benefit outcomes. Suppliers demonstrating robust clinical validation, transparent safety data, and sustainable sourcing practices are expected to capture long-term partnerships and global scale.

Key Developments in Anti-Puffiness Agents Market

| Item | Value |

|---|---|

| Quantitative Value | USD 923.6 Million (2025E); USD 2,153.4 Million (2035F); CAGR 8.8% (2025–2035) |

| Component (Ingredient Classes) | Microcirculation boosters; Cooling/osmotic drainers; Anti-glycation systems |

| Source | Peptide-based; Botanical; Biotechnology-derived; Mineral |

| Delivery System | Liposomal/vesicular; Free form; Cyclodextrin-complexed; Gel dispersions |

| Physical Form | Solution/concentrate; Powder |

| End Use | Eye care within skincare; Dermocosmetic |

| Applications | Eye serums; Eye creams; Eye patches & masks; Roll-ons |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; Japan; India; Germany; United Kingdom |

| Key Companies Profiled | Lipotec (Lubrizol); Givaudan; Mibelle Biochemistry; DSM-Firmenich; Ashland; Croda; Symrise; Clariant; Rahn; Seppic |

| Additional Attributes | 2025 leading shares: Microcirculation boosters 41% (USD 588.9 Mn); Peptide-based 38% (USD 369 Mn); Liposomal/vesicular 47% (USD 533.3 Mn). USA value path: USD 166.59 Mn (2025) → USD 363.04 Mn (2035). Country CAGRs: India 28.3%, Japan 25.3%, UK 19.8%, Germany 15.2%, USA 13.5%, Europe 13.5%, China 8.3%. |

The global Anti-Puffiness Agents Market is estimated to be valued at USD 923.6 Million in 2025.

The market size for the Anti-Puffiness Agents Market is projected to reach USD 2,153.4 Million by 2035.

The Anti-Puffiness Agents Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key ingredient types in the Anti-Puffiness Agents Market are microcirculation boosters, cooling/osmotic drainers, anti-glycation systems, and others.

In terms of delivery systems, the liposomal/vesicular segment is expected to command 47% share in the Anti-Puffiness Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA