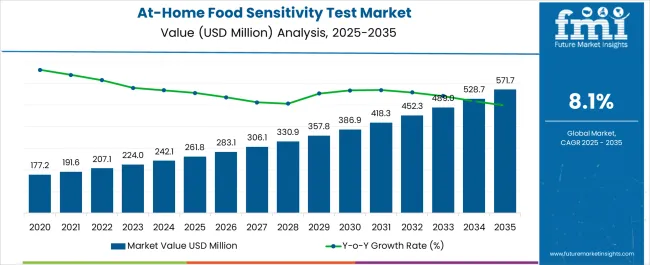

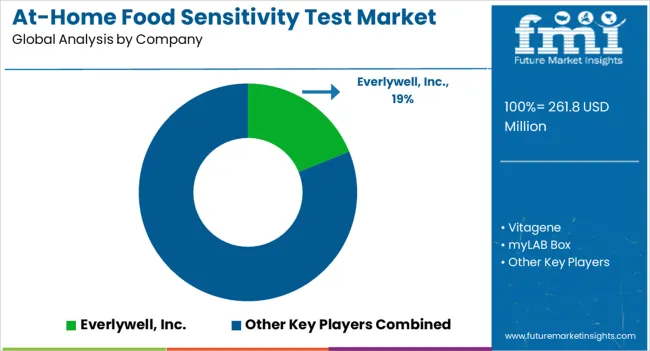

The At-Home Food Sensitivity Test Market is estimated to be valued at USD 261.8 million in 2025 and is projected to reach USD 571.7 million by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| At-Home Food Sensitivity Test Market Estimated Value in (2025 E) | USD 261.8 million |

| At-Home Food Sensitivity Test Market Forecast Value in (2035 F) | USD 571.7 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The at-home food sensitivity test market is gaining momentum due to rising consumer focus on personalized health management and the growing preference for convenient diagnostic options. Market dynamics are being influenced by increased awareness of diet-related health conditions, the accessibility of home-based testing kits, and the integration of digital platforms for result interpretation and follow-up.

Demand growth is supported by technological advancements that improve the accuracy, reliability, and affordability of testing methods. Regulatory scrutiny is shaping product development standards, ensuring higher levels of safety and credibility in the marketplace.

The future outlook is defined by expanding applications of at-home testing beyond food sensitivities into broader wellness monitoring, alongside increasing adoption in emerging economies where healthcare infrastructure is rapidly evolving Growth rationale is anchored on lifestyle-driven demand for proactive health management, improved consumer trust in validated testing platforms, and wider distribution channels that make these products readily available, positioning the market for sustained expansion over the forecast horizon.

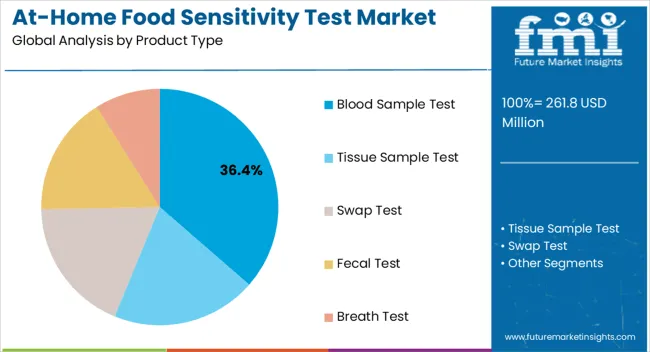

The blood sample test segment, accounting for 36.40% of the product type category, is leading the market owing to its established reliability in detecting specific immunological reactions associated with food sensitivities. Accuracy levels have contributed to higher consumer trust compared to alternative test types, reinforcing adoption in both developed and emerging markets.

The segment’s prominence is further strengthened by advancements in assay technologies and micro-sampling methods, which have improved convenience and reduced turnaround times. Regulatory compliance and clinical validation have enhanced the credibility of blood-based kits, ensuring broader acceptance among healthcare professionals and consumers.

Ongoing innovation in simplified collection devices and integration with mobile health applications is expected to increase accessibility, making blood sample tests a critical driver of market share retention and growth.

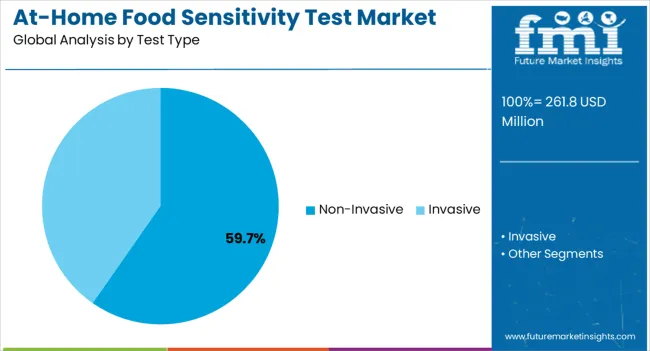

The non-invasive segment, holding 59.70% of the test type category, has emerged as the dominant format due to its superior ease of use, reduced discomfort, and strong appeal to consumers seeking simple health monitoring solutions. Adoption has been accelerated by the integration of saliva-based and other non-invasive methods that deliver actionable results without the need for clinical supervision.

Market expansion is being supported by the rise of telehealth services, where remote consultations complement at-home testing, thereby enhancing consumer confidence. The convenience factor has been particularly effective in attracting first-time users, while technological improvements in sensitivity and specificity are ensuring clinical relevance.

Continued investment in user-friendly product design and the incorporation of digital platforms for data tracking and interpretation are expected to sustain this segment’s leadership over the forecast period.

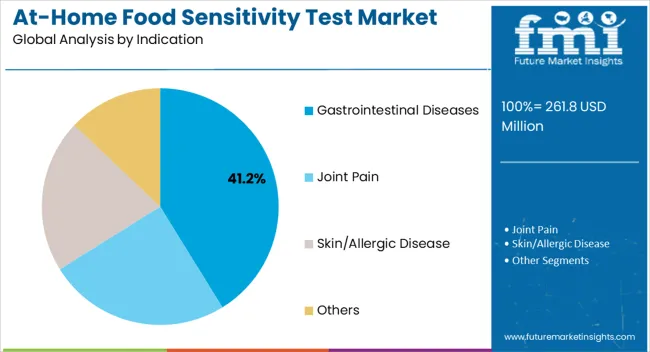

The gastrointestinal diseases segment, representing 41.20% of the indication category, is leading demand due to the high prevalence of digestive issues linked to food sensitivities and intolerances. Consumers are increasingly turning to at-home testing as a first-line solution for identifying potential triggers before seeking advanced medical care.

The segment’s growth has been supported by heightened public awareness of the connection between diet and gut health, alongside growing clinical evidence that early identification of sensitivities can improve overall wellness outcomes. Accessibility of tests targeting gastrointestinal indications has been reinforced by both e-commerce channels and direct-to-consumer health brands.

As consumer expectations for proactive digestive health management expand, innovations in multi-panel testing and digital result interpretation are expected to strengthen the segment’s role in driving market expansion.

The market value for at-home food sensitivity tests was around 3.4% of the overall USD 261.8 million of the global self-testing market in 2025. The sale of at-home food sensitivity tests expanded at a CAGR of 8.0% from 2020 to 2025, in the past.

Food sensitivity can cause discomfort and pain due to symptoms such as fatigue, bloating, nausea, gastrointestinal stress, headaches, migraine, and stomach pain. To avoid this, at-home food sensitivity tests can be done to check the sensitivity of a particular food. Healthcare professionals primarily conducted food sensitivity tests in clinical settings.

The increased cases of food sensitivity are driving the demand for at-home food allergy tests. The market for food sensitivity tests is expanding as a result of an increase in the incidence of foodborne illnesses, changes in the regulatory environment, and increased consumer awareness regarding food intolerance.

Allergies require a precise diagnosis and effective care. There has been a striking surge in demand for at-home food sensitivity tests due to increased awareness of food allergy and sensitivity testing, due to the increased cases of food sensitivity globally. Thus, the global market is expected to register a CAGR of 8.5% during the forecast period.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.2% |

| India | 7.3% |

India held a 57.2% share in the South Asia market in 2025 and is projected to display growth at a lucrative CAGR rate of 7.3% during the forecast period.

India initially had a low incidence of food allergy, but with changing lifestyles, the Indian population has become more prone to food sensitivity and allergy. As a result, Indians have started using at-home food sensitivity tests to check possible food allergies, as these tests are more affordable than laboratory tests and can test for food sensitivity to several common foods.

The United States dominated the North American region with a total market share of about 80.9% in 2025 and is expected to continue to experience the same growth throughout the forecast period.

Because of the growing cases of food allergies in the United States, the country shares the leading market share for at-home food sensitivity tests. According to the Asthma and Allergy Foundation of America, in 2020, around 177.2 million people in the United States had a food allergy, of which 26 million were adults and the rest were children.

Over the past 20 years, there has been a rise in food allergies among children in the United States, with black children experiencing the worst increase. Adults are most frequently allergic to shellfish, including peanuts and tree nuts. A growing food allergy is to sesame. All these factors contribute to the significant market share of this country in the regional market.

Germany is set to exhibit a growth rate of 6.2% in the European at-home food sensitivity test market during the forecast period.

Increasing healthcare expenditure in Germany has helped boost the country's at-home food testing market. According to World Bank data, Germany's total healthcare expenditure in 2020 was 11.7% of the GDP. There is a greater awareness of the condition and healthcare spending in managing the condition, stimulating the market growth for the at-home food sensitivity market.

Blood sample test is expected to present high growth at a rate of 7.9% by the end of the forecast period, with a market share of about 33.4% in 2025.

| Attributes | Details |

|---|---|

| Top Product Type | Blood Sample Test |

| Market Share in 2025 | 33.4% |

This method is preferred over other methods as it provides comparatively more accurate results than the other methods. This is because blood contains a small amount of the food allergen, which can be measured by the amount of specific antibodies in the blood, providing relatively accurate results.

The invasive test type method held a significant revenue share of 63.4% in 2025 in the test type segment of the at-home food sensitivity test market, with a projected CAGR of 9.3% during the forecast period.

| Attributes | Details |

|---|---|

| Top Test Type | Invasive |

| Market Share in 2025 | 63.4% |

This is due to the preference for blood sample tests, an invasive test for determining food sensitivity.

Gastrointestinal diseases held a significant revenue share of 41% in 2025 in the indication segment of the at-home food sensitivity test market, with a projected CAGR of 9.6% during the forecast period.

| Attributes | Details |

|---|---|

| Top Indication Type | Gastrointestinal |

| Market Share in 2025 | 41% |

This is attributed to a high rate of gastrointestinal issues associated with certain types of foods due to an enzyme deficiency responsible for the breakdown of certain food elements. These symptoms generally kick in within hours and may cause diarrhea, gas and bloating, nausea, and stomach pain in an individual.

Hospital pharmacies held a prominent market share of 38.2% in 2025.

| Attributes | Details |

|---|---|

| Top Distribution Channel | Hospital Pharmacies |

| Market Share in 2025 | 38.2% |

Hospital pharmacies hold the maximum share as people visit the hospitals after they start showing food sensitivity symptoms. They tend to visit hospital pharmacies to buy the test kits after the hospital visit to get them tested for possible food allergens, propelling sales of the overall at-home food sensitivity tests.

Due to the presence of significant companies, the global market for allergy testing kits is fragmented. The key firms frequently employ essential tactics like mergers and acquisitions, partnerships, strategic alliances, collaborations, and new product offerings.

Instances of key developmental strategies by the industry players in the at-home food sensitivity test market are given below:

Similarly, our analyst team has tracked recent developments related to companies manufacturing at-home food sensitivity test products, which are available in the full report.

The global at-home food sensitivity test market is estimated to be valued at USD 261.8 million in 2025.

The market size for the at-home food sensitivity test market is projected to reach USD 571.7 million by 2035.

The at-home food sensitivity test market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in at-home food sensitivity test market are blood sample test, tissue sample test, swap test, fecal test and breath test.

In terms of test type, non-invasive segment to command 59.7% share in the at-home food sensitivity test market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

At-Home Testing Market Analysis - Growth, Demand & Forecast 2025 to 2035

At-Home Cancer Testing Market - Growth & Forecast 2025 to 2035

At-home Molecular Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Pregnancy Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Vaginal pH Test Kit Market Size and Share Forecast Outlook 2025 to 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Global Advanced At-home Biomarker Testing Market Analysis – Size, Share & Forecast 2024-2034

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA