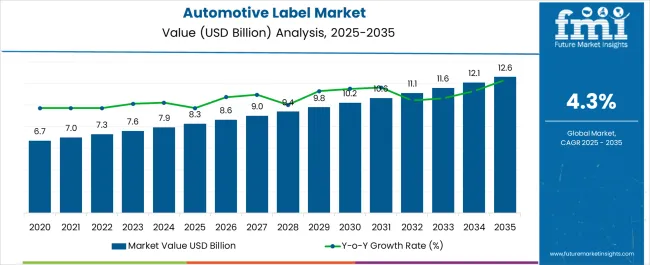

The Automotive Label Market is estimated to be valued at USD 8.3 billion in 2025 and is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Label Market Estimated Value in (2025 E) | USD 8.3 billion |

| Automotive Label Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The automotive label market is progressing steadily, fueled by the rising demand for durable labeling solutions that ensure compliance, safety, and traceability across the automotive value chain. Industry publications and company updates have highlighted the increasing use of advanced materials and adhesive technologies to withstand harsh operating conditions, including high temperatures, abrasion, and exposure to chemicals. Automakers are prioritizing labels that support regulatory compliance for product identification, emission control, and safety standards.

Additionally, advancements in printing technologies and smart labeling solutions, such as RFID-enabled and tamper-evident formats, are reshaping product offerings. The surge in electric vehicle production has also created fresh requirements for heat-resistant and durable labels for batteries and power electronics.

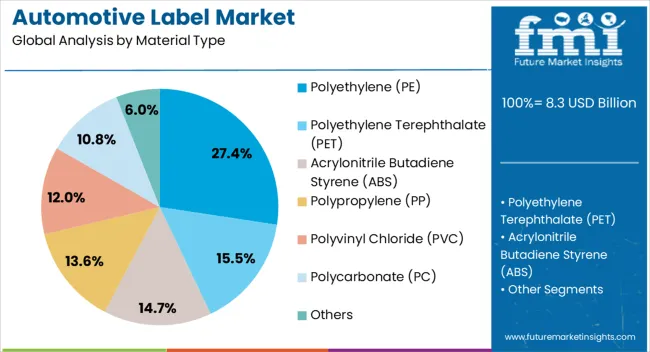

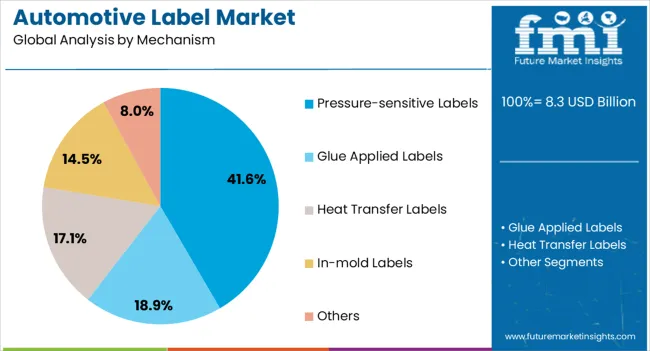

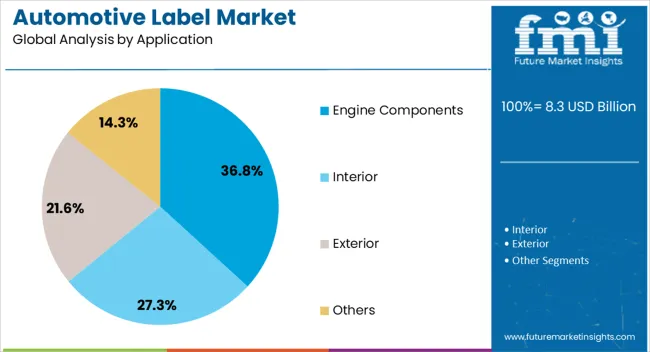

Future market expansion is expected to be underpinned by material innovation, sustainability-focused label development, and the growing integration of digital traceability features. Segmental demand is being led by polyethylene-based materials, pressure-sensitive mechanisms, and applications in engine components due to their durability, cost-effectiveness, and functional adaptability in automotive environments.

The Polyethylene (PE) segment is projected to account for 27.4% of the automotive label market revenue in 2025, securing its position as the leading material type. This dominance has been supported by PE’s balance of cost-effectiveness, flexibility, and resistance to moisture and chemicals, making it a preferred choice in automotive labeling.

PE labels are widely used for applications that demand durability and adaptability to curved or irregular surfaces, such as wiring, hoses, and under-the-hood components. Industry updates have noted that advances in film-grade PE materials have improved printability and adhesion performance, enhancing their application scope.

Additionally, the recyclability of PE aligns with sustainability initiatives across the automotive industry, further boosting its adoption. With consistent performance under varied environmental conditions, the PE segment is expected to maintain its stronghold in the material type category.

The Pressure-sensitive Labels segment is anticipated to contribute 41.6% of the automotive label market revenue in 2025, sustaining its leadership across labeling mechanisms. This growth has been driven by the ease of application, versatility across multiple surfaces, and strong adhesive properties that pressure-sensitive formats provide.

Automotive suppliers have favored these labels for their ability to deliver durable identification and branding solutions without the need for additional heat or solvents. Reports from manufacturing operations have emphasized the cost efficiencies gained from reduced application times and simplified workflows.

Moreover, innovations in pressure-sensitive adhesives have improved resistance to heat, oil, and abrasion, which are common challenges in automotive environments. As manufacturers continue to prioritize efficiency and reliability, pressure-sensitive labels are expected to remain the most widely adopted mechanism in the automotive labeling market.

The Engine Components segment is projected to account for 36.8% of the automotive label market revenue in 2025, establishing itself as the dominant application area. This growth has been driven by the critical role of labels in ensuring traceability, safety compliance, and operational guidance for high-performance engine parts.

Labels used in engine components must withstand extreme temperatures, vibration, and chemical exposure, which has driven demand for high-performance materials and adhesives. Industry reports have highlighted the importance of durable engine labels in meeting global regulatory standards for emissions and safety.

Additionally, as automotive designs become increasingly complex with the integration of hybrid and electric engines, specialized labels are required for batteries, cooling systems, and electronic controls. With the growing emphasis on vehicle safety, performance monitoring, and compliance, the Engine Components segment is expected to sustain its leading share in the automotive label market.

Many factors are contributing majorly to the expansion of the automotive labels market, which is likely to fuel a steady growth of the concerned market in the coming years.

Recognition of information: Automobile labels are used for recognizing information written or printed on a cloth, polymer, paper, or other material attached to a particular vehicle’s parts. These labels are manufactured to withstand harsh weather conditions and provide identification, safety, usage information, and dating for consumer verification.

These labels are manufactured with acrylic films available in white lettering or black lettering. Thus, the ability of these labels to withstand any weather and the customized design requirements are anticipated to bring extensive growth to the automotive labels market.

Rising Disposable Income: There is a rise in the disposable income of many individuals around the globe, which has accelerated the sales of vehicles across the globe, further bolstering the demand for automotive labels.

Furthermore, the expanding urbanization among the various regions is also pushing the growth of the automotive labels market to a great extent.

Expanding Vehicle Adoption: The expanding demand for vehicles among the global populace, coupled with an increase in security and tagging for securing products from various brands, may bring considerable demand for the automotive labels market during the forecast period.

Demand for Eco-friendly Labels: The high adoption of eco-friendly labels is expected to drive the growth of the automotive labels market. Automobile manufacturers are aiming towards minimal harm to the planet with the use of eco-friendly materials.

This factor is pushing the manufacturers in the automotive labels market to research more on manufacturing automotive labels using eco-friendly materials, which may bring a substantial expansion in the automotive labels market.

Although several market drivers have been identified for the automotive labels market, some aspects are projected to curb the market growth during the forecast period. They are:

High Cost of Label Manufacturing: It is anticipated by the experts of FMI that there is a very high cost associated with the manufacturing of automotive labels, which may serve as a hindrance to the propelling market. Due to their expensive price tags, small and medium-sized automobile manufacturers cannot afford these labels.

Errors While Printing: In certain instances, errors occur during the printing of material and human errors during input, coupled with changes in the technological changes in industry, which is expected to slow down the pace of market growth for automotive labels.

North America:

| Region | North America |

|---|---|

| Market Share | North America is projected to hold the maximum shares and dominate the automotive labels market in the upcoming years. Current Market Share Holding: 34% |

| Factors Responsible for Growth |

|

Europe:

| Region | Europe |

|---|---|

| Market Share | Europe is expected to follow North America and hold the second-leading share in the global automotive labels market, with a slow and steady rise over the period. Current Market Share Holding: 28% |

| Factors Responsible for Growth |

|

The new entrants to the automotive labels market are indulging in collaborations and continually making innovations to the materials and manufacturing procedures of automotive labels to further fuel the adoption of the labels on a wide scale.

Top Start-up to Watch

Localize

Canada-based Start-up

Consumers are demanding more information about what they are buying but seeking less on-pack clutter that confuses their purchasing decisions. QR codes, RFID, NFC tags, and other examples of embedded electronics provide all the necessary information about a product in an interactive form: where it has come from, how it was produced, its nutritional value, etc.

Localize develops a system of managing, capturing, and delivering traceable and certified product information. Their shelf tags enable manufacturers to provide consumers with affordable, smart, and adaptable labels.

Avery Dennison

United States-based Start-up

With the rising need for intelligent labels, sustainability, compliance, and functional labels increased. For today’s fast-paced automotive industry, Avery Dennison is manufacturing durable RFID labels that can meet the requirements and rigors of manufacturing, coupled with long-term use. They offer a full suite of labeling solutions for the automotive industry.

The automotive labels market has numerous players involved in fierce competition for clenching a sizeable consumer base. The players invest extensively in research and development activities for increasing their consumer base by introducing labels with new and advanced materials.

The players are indulging in these collaborations to expand their influence across untapped regions.

Recent Development Identified in the Automotive Labels Market:

Some Biggies Revolutionizing the Market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.3% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material Type, Mechanism, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; The Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

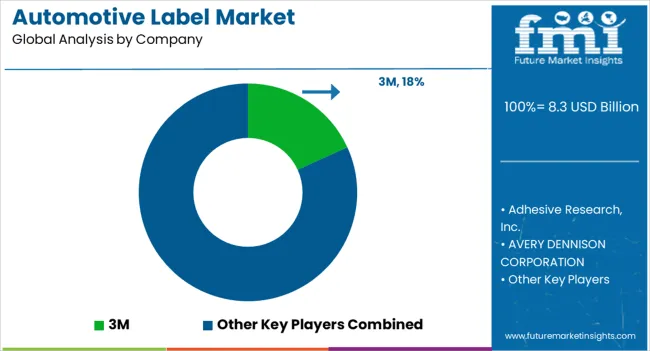

| Key Companies Profiled | 3M; Adhesive Research, Inc.; AVERY DENNISON CORPORATION; CCL Industries; Dunmore; H.B. Fuller Company; Imagetek Labels; Lewis Label Products Corporation; Sika AG; UPM Raflatac |

| Customization | Available Upon Request |

The global automotive label market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the automotive label market is projected to reach USD 12.6 billion by 2035.

The automotive label market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in automotive label market are polyethylene (pe), polyethylene terephthalate (pet), acrylonitrile butadiene styrene (abs), polypropylene (pp), polyvinyl chloride (PVc), polycarbonate (pc) and others.

In terms of mechanism, pressure-sensitive labels segment to command 41.6% share in the automotive label market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA