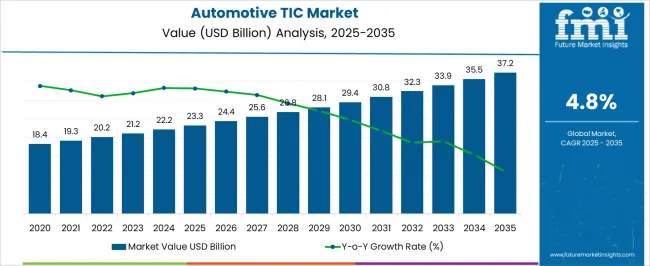

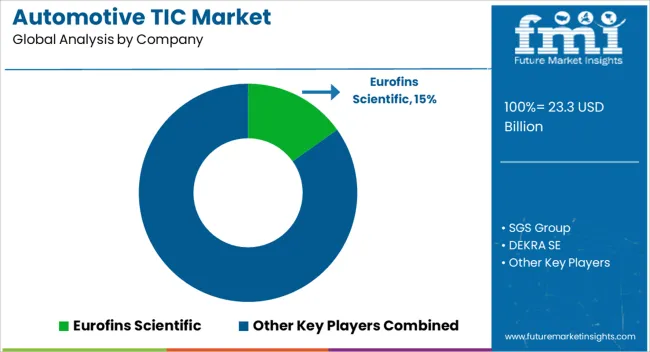

The automotive TIC market is estimated to be valued at USD 23.3 billion in 2025 and is projected to reach USD 37.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The absolute dollar opportunity across this timeline highlights incremental gains that showcase both the scale and consistency of expansion. From 2021 to 2025, the market grows from USD 18.4 billion to 23.3 billion, adding nearly USD 4.9 billion, driven by regulatory compliance, safety testing, and increasing complexity in vehicle design. Between 2026 and 2030, absolute dollar opportunity strengthens further, with the market advancing from USD 23.3 billion to 29.4 billion, adding around USD 6.1 billion. This phase is supported by stricter emission norms, cybersecurity testing for connected vehicles, and demand for certification in autonomous driving technologies.

The period from 2031 to 2035 contributes the largest incremental opportunity, expanding from USD 30.8 billion to 37.2 billion, creating nearly USD 6.4 billion in additional value. Factors such as electrification of fleets, growth of EV infrastructure testing, and harmonization of international standards boost this phase. Cumulatively, the absolute dollar opportunity over 2025–2035 exceeds USD 13.9 billion, underpinned by rising technical requirements and global regulatory frameworks. This analysis reflects how incremental growth translates into tangible market opportunities for service providers in the automotive TIC ecosystem.

| Metric | Value |

|---|---|

| Automotive TIC Market Estimated Value in (2025 E) | USD 23.3 billion |

| Automotive TIC Market Forecast Value in (2035 F) | USD 37.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The automotive TIC market is valued at USD 23.3 billion in 2025 and is forecast to reach USD 37.2 billion by 2035, registering a CAGR of 4.8%. The absolute dollar opportunity across this timeline highlights incremental gains that showcase both the scale and consistency of expansion. From 2021 to 2025, the market grows from USD 18.4 billion to 23.3 billion, adding nearly USD 4.9 billion, driven by regulatory compliance, safety testing, and increasing complexity in vehicle design. Between 2026 and 2030, absolute dollar opportunity strengthens further, with the market advancing from USD 23.3 billion to 29.4 billion, adding around USD 6.1 billion. This phase is supported by stricter emission norms, cybersecurity testing for connected vehicles, and demand for certification in autonomous driving technologies.

The period from 2031 to 2035 contributes the largest incremental opportunity, expanding from USD 30.8 billion to 37.2 billion, creating nearly USD 6.4 billion in additional value. Factors such as electrification of fleets, growth of EV infrastructure testing, and harmonization of international standards boost this phase. Cumulatively, the absolute dollar opportunity over 2025–2035 exceeds USD 13.9 billion, underpinned by rising technical requirements and global regulatory frameworks. This analysis reflects how incremental growth translates into tangible market opportunities for service providers in the automotive TIC ecosystem.

The automotive TIC (Testing, Inspection, and Certification) market is expanding steadily, supported by increasing regulatory requirements, technological advancements in vehicle systems, and the rising complexity of automotive supply chains. Governments and industry bodies have continued to tighten safety, emissions, and performance standards, driving demand for comprehensive TIC services. Automotive manufacturers are increasingly relying on TIC providers to ensure compliance across global markets and to maintain brand credibility.

The growth of electric and connected vehicles has introduced new testing parameters, further broadening the scope of services required. Additionally, the global expansion of automotive production, particularly in emerging economies, has created opportunities for localized TIC operations.

The market outlook remains positive as evolving mobility trends, such as autonomous driving and advanced driver assistance systems, continue to require specialized verification processes.

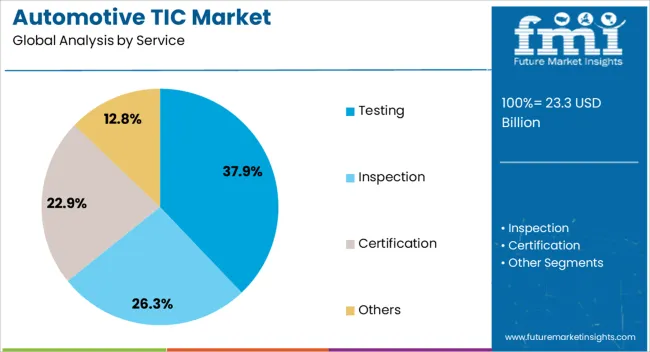

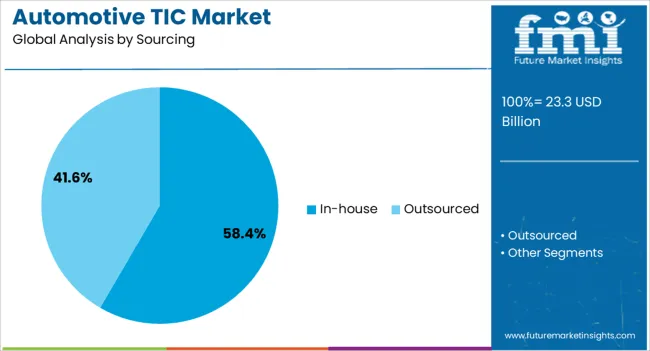

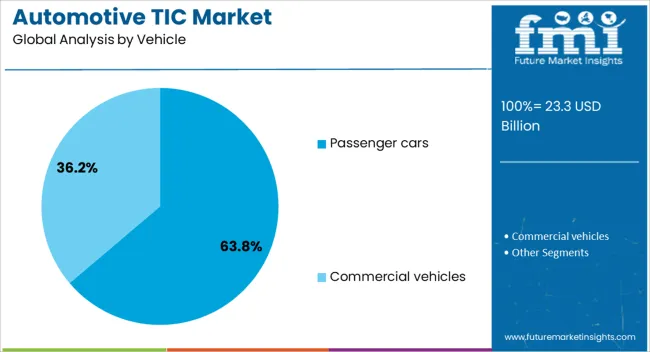

The automotive TIC market is segmented by service, sourcing, vehicle, application, and geographic regions. By service, automotive TIC market is divided into testing, inspection, certification, and others. In terms of sourcing, automotive TIC market is classified into in-house and outsourced. Based on vehicle, automotive TIC market is segmented into passenger cars and commercial vehicles. By application, automotive TIC market is segmented into vehicle inspection, emission testing, component testing, telematics, ADAS, homologation testing, fuels, fluids and lubricants, electric systems and components, and others. Regionally, the automotive TIC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The testing segment is projected to account for 37.9% of the automotive TIC market revenue in 2025, making it the largest service category. Its dominance is supported by the critical role testing plays in validating the performance, safety, and regulatory compliance of vehicles and their components. As vehicle technologies become more sophisticated, encompassing electric drivetrains, advanced electronics, and complex software systems, the scope of testing has expanded significantly. Automotive manufacturers have increased their reliance on advanced laboratory facilities and simulation-based evaluations to identify and mitigate risks before production. Furthermore, global harmonization of automotive standards has intensified the need for consistent and rigorous testing procedures. With ongoing innovations in vehicle technology, the Testing segment is expected to retain its leadership by ensuring that products meet stringent safety and quality benchmarks.

The in-house segment is projected to contribute 58.4% of the automotive TIC market revenue in 2025, leading the sourcing category. Growth in this segment has been driven by large automotive manufacturers maintaining dedicated testing and inspection teams to control quality and ensure confidentiality in product development. By managing TIC activities internally, companies can integrate these processes into early design stages, enabling faster turnaround times and more efficient product validation. Investments in state-of-the-art in-house testing facilities have allowed manufacturers to handle specialized testing, such as crash simulations, emissions analysis, and software validation, without reliance on third-party providers. Additionally, in-house sourcing supports alignment with proprietary standards and brand-specific quality requirements. This approach is particularly valued in competitive markets where time-to-market and intellectual property protection are critical.

The passenger Cars segment is expected to hold 63.8% of the automotive TIC market revenue in 2025, dominating the vehicle category. This leadership is attributed to the high global production volumes of passenger cars and the broad spectrum of safety, emissions, and performance regulations they must meet. The rise of consumer demand for technologically advanced, fuel-efficient, and environmentally friendly vehicles has necessitated more extensive testing and inspection processes. Passenger car manufacturers are incorporating a growing range of electronic systems, driver assistance features, and connectivity solutions, all of which require thorough evaluation for safety and reliability. Expanding automotive markets in Asia-Pacific and continued innovation in electric passenger cars have further intensified TIC requirements. As passenger cars remain the largest segment of the global automotive industry, their share of TIC demand is expected to stay dominant.

The automotive testing, inspection, and certification (TIC) market is expanding as vehicle manufacturers and suppliers prioritize safety, quality, and regulatory compliance. Growth is driven by rising automotive production, electrification, and increasing complexity in vehicle electronics. Mandatory standards for emissions, safety, and cybersecurity strengthen demand across Asia-Pacific, Europe, and North America. High testing costs, lengthy certification cycles, and evolving regional regulations remain major challenges. However, opportunities arise from digital testing platforms, remote inspection solutions, and specialized services for electric vehicles and autonomous driving systems. Trends highlight real-time compliance monitoring, AI-driven inspection tools, and global harmonization of safety norms.

Automotive TIC services are increasingly essential as vehicles incorporate advanced driver assistance systems (ADAS), connected features, and electrified drivetrains. Stringent emission regulations in Europe, fuel economy standards in North America, and safety mandates in Asia-Pacific reinforce testing requirements. Automakers rely on TIC providers for crash testing, emission validation, component durability, and electromagnetic compatibility checks. The growth of electric and hybrid vehicles further accelerates demand for battery safety testing, thermal management validation, and cybersecurity assessments. Suppliers also use TIC services to demonstrate compliance for export markets, enabling global trade. Consumer demand for reliable and secure vehicles compels manufacturers to prioritize third-party certification.

Certification processes often involve long timelines, delaying product launches and increasing expenses for manufacturers. Regional variations in emission standards, safety certifications, and cybersecurity requirements complicate testing, especially for companies exporting vehicles globally. Technical challenges include replicating real-world driving conditions, testing advanced ADAS algorithms, and validating high-voltage EV batteries under extreme environments. Additionally, compliance with international frameworks such as ISO/IEC 17025 and UNECE vehicle safety regulations is mandatory, adding complexity for service providers. Automakers increasingly prefer TIC partners that provide efficient, scalable, and standardized solutions across multiple geographies. Companies delivering flexible, cost-effective, and regulation-aligned services are best positioned to help manufacturers streamline certification while reducing operational and compliance risks.

Electrification is creating significant opportunities in the automotive TIC sector. The expansion of EV battery manufacturing requires extensive testing for performance, thermal stability, and recycling compliance. Charging infrastructure and interoperability validation also drive demand for specialized services. Digitalization is enabling remote inspections, predictive maintenance, and simulation-based testing, reducing costs and turnaround times. Asia-Pacific, with its rising EV adoption in China and India, is witnessing strong TIC investment, while Europe and North America are strengthening cybersecurity testing regulations for connected cars. Suppliers offering advanced labs, AI-based defect detection, and customized EV testing services are positioned to gain market share.

Artificial intelligence and digital twin technologies are reshaping automotive testing by enabling faster defect detection, predictive analytics, and automated quality assurance. The rise of connected and autonomous vehicles is creating new TIC requirements for software validation, data security, and over-the-air (OTA) update compliance. International harmonization of standards, such as ISO 26262 for functional safety and UNECE WP.29 for cybersecurity, drives demand for global testing capabilities. Leading TIC providers such as TÜV SÜD, SGS, DEKRA, and Bureau Veritas are expanding service portfolios to cover EV, connectivity, and cybersecurity testing. Partnerships with automakers and component suppliers are strengthening, enabling integrated solutions across R&D and production stages.

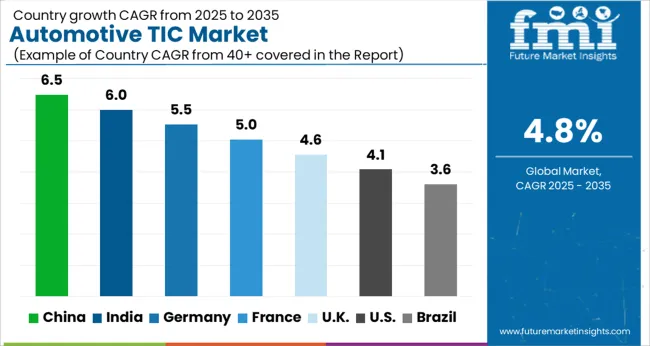

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global automotive TIC (Testing, Inspection, and Certification) market is projected to expand at a CAGR of 4.8% from 2025 to 2035. China (6.5%) and India (6.0%) are the fastest-growing markets, driven by rising vehicle production, EV penetration, and local compliance requirements. Germany (5.5%) focuses on Euro 7 standards, autonomous vehicle validation, and advanced safety testing, while the UK (4.6%) and USA (4.1%) show steady growth through regulatory alignment, FMVSS compliance, and EV safety certification. Growth drivers include stricter emission rules, electrification, ADAS deployment, and global supply chain audits. TIC providers are expanding through digital inspection tools, localized labs, and integrated service models. The analysis includes over 40+ countries, with the leading markets detailed below.

China is projected to expand at a CAGR of 6.5% between 2025 and 2035 in the automotive TIC market. The rise of electric vehicles, stringent emission standards, and rapid vehicle production volumes are boosting demand for inspection and certification services. Manufacturers rely on third-party TIC providers to ensure compliance with global safety and quality standards. The growing export of Chinese vehicles to Europe and North America has heightened the need for internationally recognized certifications. Local TIC firms are collaborating with global leaders to strengthen service offerings, including EV battery testing and autonomous vehicle component validation. Additionally, government-driven mandates for safety and emissions are reinforcing the necessity of periodic vehicle inspections. China’s scale of production, combined with evolving regulations, makes it the largest opportunity in Asia-Pacific for TIC services.

The automotive TIC market in India is expected to register a CAGR of 6.0% during 2025–2035. Rising domestic vehicle production, combined with policy-driven safety norms and Bharat Stage (BS) emission regulations, is shaping demand. Increasing consumer awareness of road safety has further pushed the adoption of regular inspection services. As EV adoption gains momentum, testing of batteries, motors, and charging infrastructure is adding new service layers for TIC providers. India’s role as an automotive export hub to Africa, the Middle East, and Southeast Asia is fueling the need for global compliance certifications. Small and mid-sized TIC firms are emerging, offering low-cost solutions, while global leaders are expanding presence via joint ventures and acquisitions. The growing aftermarket service network, coupled with periodic inspection mandates for commercial fleets, provides additional revenue opportunities.

Germany is forecast to grow at a CAGR of 5.5% from 2025 to 2035 in the automotive TIC market. As Europe’s automotive hub, the country emphasizes stringent compliance with Euro 7 standards, advanced driver assistance systems (ADAS), and autonomous vehicle readiness. German OEMs and suppliers heavily depend on TIC providers for quality validation, safety testing, and functional certification. The strong EV penetration across the luxury and premium segments is further increasing the requirement for battery validation and cyber-security certification in connected cars. Global TIC leaders such as TÜV, DEKRA, and SGS have their strongest European presence in Germany, leveraging expertise to test advanced technologies. Demand for periodic inspection services in commercial fleets remains strong due to regulatory enforcement. Germany’s automotive innovation, coupled with strict regulatory oversight, ensures consistent demand for TIC services in the coming decade.

The United Kingdom is projected to grow at a CAGR of 4.6% between 2025 and 2035 in the automotive TIC sector. Post-Brexit, the need for harmonization of vehicle standards with both EU and global norms has increased the role of TIC providers. Regulatory checks for emissions, crash safety, and roadworthiness continue to drive periodic inspection requirements. The UK is witnessing rising investment in EV infrastructure, creating demand for testing and certification of batteries, charging stations, and electrical components. TIC services are also expanding into connected and autonomous vehicle validation, with pilot projects underway in major cities. Partnerships between automotive OEMs, TIC firms, and government agencies are supporting compliance and innovation simultaneously. The expansion of the used-vehicle export market further adds demand for international certifications.

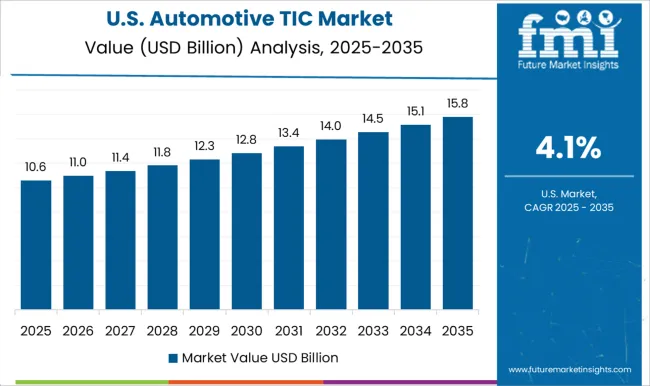

The USA automotive TIC market is expected to grow at a CAGR of 4.1% during 2025–2035. Regulatory frameworks such as FMVSS (Federal Motor Vehicle Safety Standards) and EPA emission mandates are shaping the demand landscape. The growing focus on EV production and domestic battery manufacturing under federal incentive schemes is increasing TIC requirements across safety, performance, and energy efficiency categories. The rise of autonomous vehicle development in states like California, Arizona, and Michigan also necessitates extensive functional and cyber-security testing. Leading TIC providers are expanding service portfolios to cover software validation, ADAS calibration, and data security certification. The large used-vehicle market in the USA also generates steady demand for roadworthiness inspections and emissions checks. With the automotive sector’s shift toward electrification and automation, TIC services are expected to maintain steady growth across multiple segments.

Competition in the automotive testing, inspection, and certification (TIC) market is defined by global laboratory reach, accreditation portfolios, and ability to align with evolving mobility regulations. Eurofins Scientific competes with advanced analytical testing for materials, emissions, and chemical compliance, appealing to OEMs requiring detailed validation across global supply chains. SGS Group maintains strong leadership through comprehensive vehicle inspection programs, homologation services, and integrated certification platforms spanning safety, performance, and environmental standards. DEKRA SE positions itself as a top player in vehicle testing and roadworthiness inspection, focusing on type approval, crash testing, and advanced driver assistance system (ADAS) evaluations. Bureau Veritas highlights expertise in quality audits, regulatory compliance checks, and end-to-end TIC services tailored to automotive production ecosystems.

Applus+ builds competitive strength through technical services in vehicle inspection and homologation, with strong footholds in Europe and Latin America. UL LLC differentiates through electrical safety, battery certification, and cybersecurity testing, critical for electric and connected vehicles. TÜV Rheinland emphasizes global market access services and functional safety validation, while Intertek Group plc targets materials testing, component certification, and performance validation across powertrain, interiors, and EV systems. Element Materials Technology competes in advanced material, fatigue, and structural testing, positioning itself as a key partner for R&D-heavy OEMs and Tier-1 suppliers.

TÜV SÜD Group offers broad compliance solutions, including ISO certifications, ADAS validation, and EV battery testing, combining strong brand recognition with regulatory expertise. Strategies across the sector focus on expanding laboratory networks, advancing digital testing platforms, and developing capabilities for EVs, autonomous driving, and connected car technologies. Product brochures highlight type approval testing, emissions certification, endurance validation, battery and charging system safety, cybersecurity evaluation, materials durability, and global market access consulting. Collectively, these offerings show a market competing on technical depth, regulatory expertise, and global coverage, where success depends on aligning with rapid innovation cycles and international compliance demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.3 billion |

| Service | Testing, Inspection, Certification, and Others |

| Sourcing | In-house and Outsourced |

| Vehicle | Passenger cars and Commercial vehicles |

| Application | Vehicle inspection, Emission testing, Component testing, Telematics, ADAS, Homologation testing, Fuels, fluids and lubricants, Electric systems and components, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eurofins Scientific, SGS Group, DEKRA SE, Bureau Veritas, Applus+, UL LLC (Underwriters Laboratories), TÜV Rheinland Group, Intertek Group plc, Element Materials Technology, and TÜV SÜD Group |

| Additional Attributes | Dollar sales by service type (testing, inspection, certification), vehicle type (passenger, commercial, EVs), and stage (R&D, production, post-production). Demand dynamics are driven by stricter safety regulations, EV adoption, and autonomous vehicle development. Regional trends highlight strong growth in Europe and North America due to regulatory enforcement, while Asia-Pacific is expanding rapidly with rising automotive production and EV investments. |

The global automotive TIC market is estimated to be valued at USD 23.3 billion in 2025.

The market size for the automotive TIC market is projected to reach USD 37.2 billion by 2035.

The automotive TIC market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in automotive TIC market are testing, inspection, certification and others.

In terms of sourcing, in-house segment to command 58.4% share in the automotive TIC market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Robotics Market Size and Share Forecast Outlook 2025 to 2035

Automotive Plastic Market in BRIC Countries - Size, Share, and Forecast 2025 to 2035

Automotive Plastic Interior Trims Market Growth - Trends & Forecast 2025 to 2035

Automotive Plastic Market Growth – Trends & Forecast 2024-2034

Automotive Robotic Painting Market

Automotive Logistics Market Size and Share Forecast Outlook 2025 to 2035

Automotive Logistics Management Software Market Size and Share Forecast Outlook 2025 to 2035

Automotive Catalytic Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Bioplastic Market Growth - Trends & Forecast 2025 to 2035

Automotive Hydrostatic Fan Drive System Market Size and Share Forecast Outlook 2025 to 2035

Automotive OEM Telematics Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Plastic Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Three Way Catalytic Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive End-Point Authentication Market Size and Share Forecast Outlook 2025 to 2035

APAC Automotive Telematics Market Growth - Trends & Forecast 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA