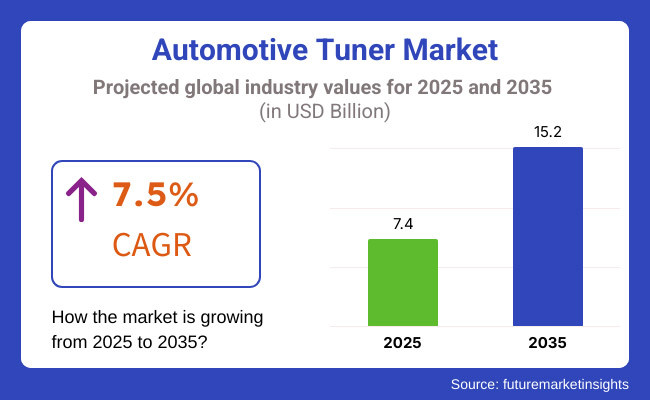

The global automotive tuner market is projected to grow from USD 7.4 billion in 2025 to USD 15.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5%. This expansion is being driven by growing consumer interest in performance enhancement, torque optimization, and fuel efficiency in both passenger and performance vehicles.

In March 2024, APR LLC unveiled its Ultralink platform, designed specifically for European vehicle performance tuning. The system was built with cloud-based accessibility and real-time ECU tuning support. It enabled tuners to perform diagnostics, firmware updates, and parameter adjustments without requiring bench flashing or physical ECU access.

According to APR, this innovation was developed to simplify the tuning process and enhance user flexibility across Audi, Volkswagen, and Porsche vehicles. “Ultralink is a next-generation tool that empowers users with safe, efficient, and remote access to tuning,” the company stated in its official press release.

Further advancements in tuning hardware and software were introduced by HP Tuners during the 2023 SEMA Show. The company launched CORE ECU and VCM Live, both designed to support real-time calibration and dynamic monitoring of engine performance. According to HP Tuners, the new platform delivers enhanced support for late-model vehicles with encrypted control modules. The systems were developed to address OEM cybersecurity protocols while still providing tuners with precise engine parameter control.

Demand for engine tuning tools is being accelerated by the increasing use of turbocharged powertrains and hybrid drivetrains. In markets such as North America and Europe, enthusiasts and workshop technicians are utilizing tuning platforms to adjust throttle response, boost pressure, fuel delivery, and shift patterns for enhanced drivability.

Stringent emission norms have also prompted OEM and aftermarket developers to offer compliant tuning solutions. As electrified vehicle platforms evolve, software-based tuning is being designed to manage regenerative braking intensity, acceleration maps, and battery usage efficiency.

With rising interest in software-defined vehicles and digitally controlled powertrains, the automotive tuner market is expected to witness sustained innovation and strong growth through 2035.

Gasoline-powered equipment accounted for 58% of the global market share in 2025 and is expected to grow at a CAGR of 7.9% through 2035. Demand was driven by the operational flexibility and lower upfront cost of gasoline-powered units, particularly in residential and light-commercial applications. In 2025, adoption remained high in landscaping, portable power generation, and recreational utility equipment.

Users in North America and Southeast Asia favored gasoline variants for ease of refueling, portability, and lower noise levels relative to diesel counterparts. Manufacturers continued to refine engine designs to comply with Stage V and EPA Tier II emission norms, while maintaining competitive pricing. Innovations in fuel efficiency and cold-start performance further strengthened gasoline’s position in the segment.

Third-party online channels held 36% of the global sales share in 2025 and are projected to grow at a CAGR of 8.1% through 2035. Growth was supported by broader internet penetration, mobile-based purchase behavior, and increasing availability of technical product content online. In 2025, e-commerce platforms partnered with OEMs and authorized sellers to offer bundled warranties, financing options, and aftersales service coordination.

Consumers and small businesses increasingly used online platforms for equipment research, comparison, and bulk ordering, particularly in emerging markets. Third-party platforms such as Amazon, Alibaba, and regional B2B portals enabled access to multiple brands and specifications, reducing reliance on traditional retail channels. Online reviews and performance ratings further influenced buyer decisions, helping the channel expand in both urban and rural markets.

Regulatory Restrictions and Emissions Compliance

One of the largest concerns for the global automotive tuner industry is the further tightening of global emissions regulations. Numerous governments in North America and Europe have mandated tight controls over car modifications potentially causing higher emissions. This has seen restrictions around ECU remapping, turbo modifications, and exhaust system alterations. The regulator bodies have further stepped up policing of non-approval compliant shops and aftermarket players, with such activities posing attendant legal and fiscal risks to enterprise operations in these areas.

Growth of Electric Vehicle Tuning and Smart Performance Upgrades

The transition to electric vehicles presents a new and exciting opportunity for the automotive tuner market. While traditional engine modifications may become obsolete, EV tuning solutions such as battery optimization, regenerative braking adjustments, and software-based performance enhancements are gaining traction.

Companies are developing advanced tuning software that allows for real-time monitoring and modification of EV performance without compromising efficiency. Additionally, the integration of smart tuning technologies, such as AI-driven performance analytics and cloud-based ECU remapping, is revolutionizing the market, making high-performance tuning more accessible and adaptable to modern automotive trends.

The USA automotive tuning market is growing robustly as a result of growing demand for vehicle personalization, rising motorsport activity, and popularity of performance enhancements. The aftermarket tuning market is fueled by enthusiasts who want more horsepower, torque, and fuel efficiency.

Growing demand for performance tweaks and ECU tuning. More people taking part in events such as NASCAR and street racing. Transition towards electronic and software-based tuning solutions. Meeting EPA regulations pushing tuning innovation. Specialized software and power management enhancements for EVs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.3% |

The UK motor tuner market is growing owing to a well-established motorsport sector, increasing demand for ECU remapping, and increased consumer interest in fuel-efficient performance modifications. Traction is high on British Touring Car Championship (BTCC) and rally tuning. Demand to increase fuel efficiency and throttle responsiveness. Requirement to develop emission-friendly performance tuners. End consumers looking for upgraded performance. Tuners exclusive to EV gathering steam are the principal drivers of United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

Strict emissions rules, expanding aftermarket tuning culture, and a demand for performance upgrades drive the EU automotive tuner market. Germany, France, and Italy are high-growth markets with significant uptake of ECU tuning and turbocharging upgrade. Expansion in environment-friendly performance tuning solutions. Italy and Germany dominating performance part manufacturing. Excessive demand for track and rallying tuning solutions. Customers up-grading cars for power increase. Battery management and regenerative braking enhancements.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.8% |

Japan Japan's car tuning industry is expanding because of a healthy performance car culture, increasing drift and street racing activity, and the development of turbocharged engine tuning. JDM (Japanese Domestic Market) vehicle aftermarket tuning is a leading market driver. High demand for ECU tuning, turbo kits, and suspension upgrades, increased tuning for racing and drifting, software-based tuning for energy efficiency, demand for higher horsepower performance, AI-based tuning adjustments for optimized vehicle performance are some of the key growth factors for the market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.1% |

South Korea's automotive tuner market is expanding as a result of growing passion for performance alterations, mounting EV tuning solutions, and a robust automotive production base. The nation's export market for aftermarket tuning components is also growing. More tuning for power, handling, and fuel economy. Expanding market for electronic tuning products. Emphasis on compliant and regulated tuning products. Improvements in battery output and acceleration capability. Rising demand for Korean-manufactured tuning components in overseas markets are some of the key drivers for market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

The Automotive Tuner market is witnessing significant expansion due to the rising demand for vehicle performance enhancements, fuel efficiency improvements, and customization among automotive enthusiasts. Tuning solutions, including engine control unit (ECU) remapping, chip tuning, and performance tuners, are gaining traction as consumers seek to optimize horsepower, torque, and fuel economy.

Technological advancements in automotive tuning software and hardware, alongside the increasing popularity of electric and hybrid vehicle tuning, are driving market growth. Leading companies are focusing on expanding their product portfolios, enhancing compatibility with various vehicle models, and forging strategic partnerships to strengthen their market position.

Derive Systems (18-22%)

Derive Systems, a leader in automotive tuning, designs advanced ECU tuning solutions to support performance and fuel efficiency. Positive Touch Performance utilizes green tuning practices and aims to grow in both commercial and consumer vehicle tuning markets.

Cobb Tuning (14-18%)

Cobb Tuning is famed for its top-tier performance tuning options and develops aftermarket ECUs especially for turbocharged vehicles. There's a reason that Haltech has garnered a strong following among enthusiasts and pro tuners for user-friendly tuning platforms and support.

Alientech SRL (10-14%)

Alientech SRL is a pioneer in the field of ECU remapping and the main provider of state-of-the-art car tuning tools and software. With the expansion of the global footprint, the company offers versatile tuning solutions that can be used on a wide range of vehicle models.

Roo Systems (8-12%)

An expert in diesel tuning, Roo Systems focuses on maximizing power output and fuel efficiency in diesel vehicles. The company is particularly strong in the Australian market and continues to innovate in off-road and commercial vehicle tuning.

EFI Live (6-10%)

EFI Live is recognized for its cutting-edge tuning software, catering to high-performance vehicle applications. The company is known for its extensive customization options and compatibility with a broad range of vehicle brands.

Magic Motorsports (5-9%)

A growing player in the automotive tuning industry, Magic Motorsports develops innovative tuning hardware and software solutions. The company is expanding its presence in global markets, focusing on providing high-performance and easy-to-use tuning systems.

Other Key Players (30-40% Combined)

The automotive tuner market also includes several regional and emerging companies that contribute significantly to industry growth. These players focus on niche tuning applications, software development, and performance enhancement solutions:

The market is estimated to reach a value of USD 7.4 billion by the end of 2025.

The market is projected to exhibit a CAGR of 7.5% over the assessment period.

The market is expected to clock revenue of USD 15.2 billion by end of 2035.

Key companies in the Automotive Tuner Market include Derive Systems, Cobb Tuning, Alientech SRL, Roo Systems, EFI Live.

On the basis of component type, hardware component to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Fuel Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Fuel Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Fuel Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Fuel Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Fuel Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Component Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Component Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Fuel Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Fuel Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Fuel Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Component Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Fuel Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Fuel Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Component Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Fuel Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Fuel Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Component Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Fuel Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Fuel Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Component Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Fuel Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Fuel Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Component Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Fuel Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Component Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Fuel Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Component Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Component Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Component Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Component Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Fuel Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Fuel Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Fuel Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Fuel Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Component Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Fuel Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA