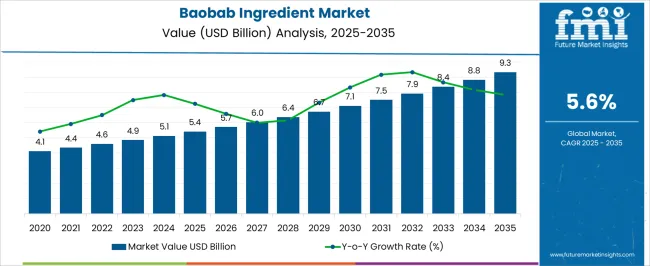

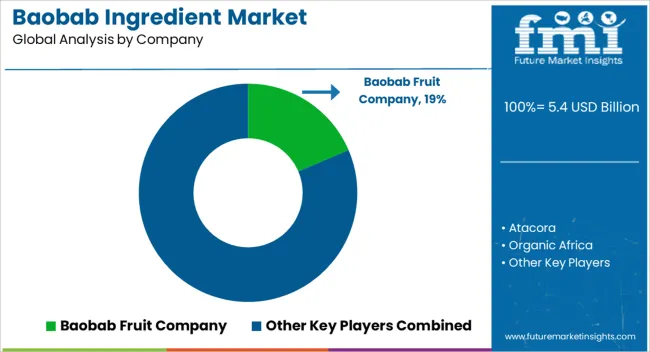

The Baobab Ingredient Market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. During the initial phase from 2020 to 2025, the market value rises from USD 4.1 billion to USD 5.4 billion, driven by increasing consumer interest in natural and functional ingredients, particularly within the food and beverage, nutraceutical, and cosmetic sectors.

This period is marked by growing awareness of baobab’s nutritional benefits, including high vitamin C content, antioxidants, and dietary fiber, which support its rising adoption in health-conscious formulations. Expanding organic and clean-label product trends further contribute to market expansion. Between 2026 and 2030, the market advances from USD 5.7 billion to USD 7.1 billion, supported by innovation in product applications and extraction technologies that enhance ingredient efficacy and stability.

Increased demand in emerging economies, where traditional uses of baobab align with modern health trends, also drives growth. From 2031 to 2035, the market accelerates from USD 7.5 billion to USD 9.3 billion, benefiting from the broader incorporation of baobab ingredients in functional foods, beverages, and personal care products. The market is poised for sustained growth through 2035, fueled by evolving consumer preferences, regulatory support, and ongoing research highlighting baobab’s health-promoting properties.

| Metric | Value |

|---|---|

| Baobab Ingredient Market Estimated Value in (2025 E) | USD 5.4 billion |

| Baobab Ingredient Market Forecast Value in (2035 F) | USD 9.3 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The baobab ingredient market is gaining momentum due to rising demand for nutrient-dense superfoods, clean-label formulations, and plant-based wellness ingredients across the global food and nutraceutical sectors. Baobab’s high concentration of antioxidants, vitamin C, fiber, and essential minerals has made it increasingly attractive for formulators targeting digestive health, immunity support, and natural energy solutions.

Regulatory approvals in major markets and growing consumer awareness have expanded its use in fortified beverages, snacks, and dietary supplements. The surge in e-commerce and health-centric product lines has also accelerated its presence in functional food shelves.

As manufacturers prioritize traceable, sustainable sourcing, baobab’s wild-harvested origin and positive impact on biodiversity are aligning with ESG and circular economy goals. Continued innovation in flavor masking, solubility, and product stability is expected further to enhance its integration across functional applications and regions.

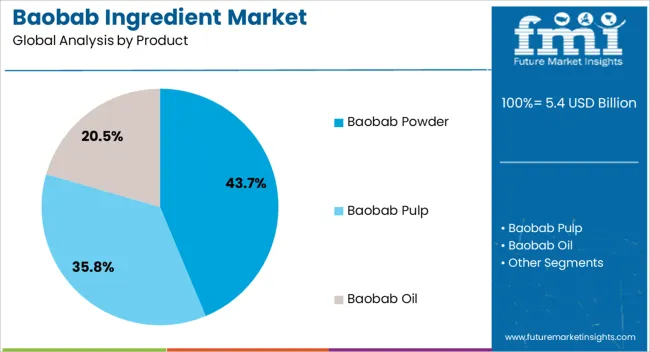

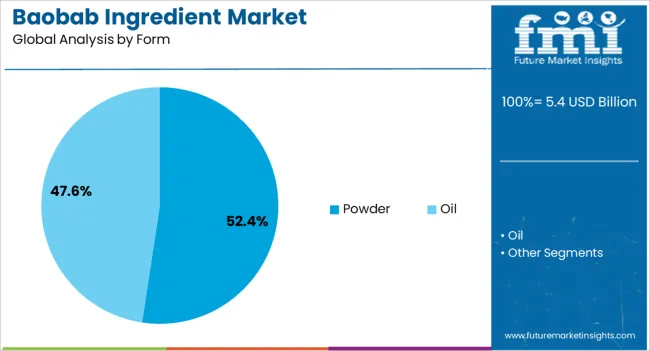

The baobab ingredient market is segmented by product, form, application, and geographic regions. By product, the baobab ingredient market is divided into Baobab Powder, Baobab Pulp, and Baobab Oil. In terms of the form of the baobab ingredient, the market is classified into Powder and Oil.

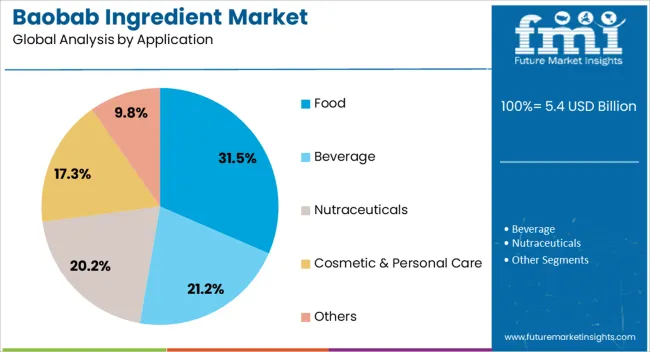

Based on the application of the baobab ingredient, the market is segmented into Food, Beverage, Nutraceuticals, Cosmetic & Personal Care, and Others. Regionally, the baobab ingredient industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Baobab powder is expected to contribute 43.70% of the total revenue in the baobab ingredient market by 2025, making it the leading product type. This prominence is supported by its versatile usage across both food and nutraceutical formulations, along with its stability and long shelf life.

The powder form allows easy incorporation into smoothies, protein bars, cereals, and drink powders without altering texture or flavor significantly. Its naturally sweet and tangy profile has facilitated its adoption in sugar-reduction strategies, while its high fiber and polyphenol content has made it attractive in digestive health-focused offerings.

Cost-effective logistics, ease of blending, and increasing availability from certified African suppliers have further strengthened its dominance in the product landscape.

Powder form is projected to hold 52.40% of the baobab ingredient market’s revenue in 2025, making it the most widely used form. The segment’s leadership is attributed to its compatibility with a broad range of end-use applications, ease of storage, and extended shelf stability under various climatic conditions.

The powder form supports scalable processing and dosage standardization, which is critical for functional food and supplement manufacturers. Additionally, powders are well-suited for high-speed production lines and customizable packaging, meeting operational needs for both B2B and consumer-facing brands.

Ongoing R&D to improve solubility and dispersibility is enhancing the appeal of powdered baobab in RTD beverages and functional blends, reinforcing its top position.

The food segment is projected to command 31.50% of the total market revenue by 2025, establishing it as the leading application for baobab ingredients. This growth is being driven by rising demand for natural fortification in snacks, baked goods, dairy alternatives, and clean-label confections.

Baobab’s appealing flavor profile, nutrient density, and low glycemic index have positioned it as a sought-after superfood among health-conscious consumers. The trend toward sustainable and ethically sourced ingredients in premium food brands has further boosted baobab’s visibility.

Integration into food applications is also being supported by regulatory clarity and functional claims related to immunity and digestive health. As the functional food category continues to expand, baobab’s ability to deliver nutritional benefits while meeting clean-label expectations is cementing its role in food innovation.

The baobab ingredient market is driven by rising demand for functional, organic foods and its growing use in beauty products. Despite sourcing challenges, baobab’s nutritional and skincare benefits contribute to its expanding market presence.

The baobab ingredient market is experiencing growth due to the increasing consumer preference for functional foods. With a rising awareness of health and wellness, consumers are seeking ingredients with high nutritional value, including vitamins, antioxidants, and fiber. Baobab, known for its rich nutrient profile, has gained popularity in beverages, snacks, and supplements, as it offers significant health benefits. Its inclusion in food and beverage products caters to the growing trend of clean-label, plant-based, and natural ingredients. As demand for health-focused foods continues to rise globally, baobab ingredients are becoming more integrated into mainstream food products, driving their market expansion.

Baobab ingredients are increasingly being incorporated into natural and organic product offerings due to their perceived health benefits. As more consumers opt for products free from artificial additives and preservatives, baobab’s organic certification and naturally derived properties make it a desirable ingredient. This trend is particularly evident in the growing market for organic food and beverages, where baobab is being used in a range of products, from smoothies to skincare. With the expansion of health-conscious and environmentally aware consumer segments, baobab ingredients are positioned well within these rising product categories, creating opportunities for market growth in both food and cosmetics sectors.

Baobab ingredients are gaining traction in the beauty and skincare market, thanks to their high vitamin C content and skin-rejuvenating properties. Known for its antioxidant-rich profile, baobab is being used in a variety of skincare products such as moisturizers, serums, and facial masks. Its ability to nourish, hydrate, and protect the skin makes it a sought-after ingredient in the beauty industry. With an increasing demand for natural and effective skincare products, baobab's market share in this segment is growing, particularly in high-end, clean-label beauty lines. This diversification into the beauty sector strengthens baobab’s presence in the global ingredient market.

Despite the growing demand for baobab ingredients, challenges in sourcing and price stability persist. The baobab tree is native to specific regions of Africa, which limits its availability and can lead to price fluctuations based on supply chain constraints. Additionally, harvesting baobab can be labor-intensive and requires sustainable practices to ensure consistent quality and volume. These factors contribute to the volatility in the price of baobab ingredients, which can impact manufacturers’ costs. As the market expands, ensuring a reliable and stable supply chain for baobab will be key to maintaining growth and meeting the increasing demand from various industries.

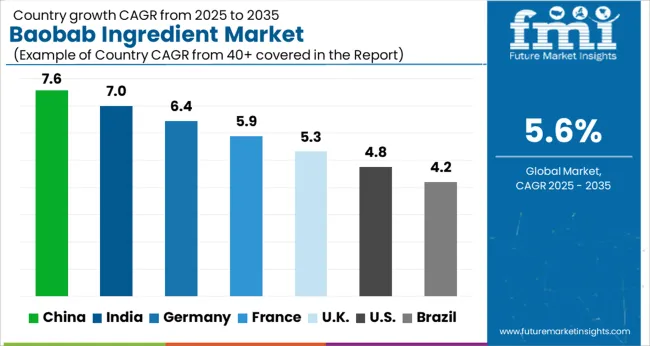

The baobab ingredient market is projected to grow globally at a CAGR of 5.6% from 2025 to 2035, driven by increasing demand for natural, plant-based ingredients in the food, beverage, and cosmetics industries. China leads with a CAGR of 7.6%, fueled by rising consumer interest in natural and organic products, coupled with the country’s growing market for health and wellness-focused ingredients. India follows at 7.0%, supported by the growing adoption of Baobab in nutraceuticals and functional foods as part of the country’s increasing focus on health-conscious consumption.

France grows at 5.9%, benefiting from a strong demand for superfoods and plant-based ingredients in the food and beverage industry, especially among health-conscious consumers. The United Kingdom achieves a CAGR of 5.3%, driven by a rise in demand for clean-label and sustainable products, while the United States records a CAGR of 4.8%, supported by steady consumer interest in natural ingredients for food, beverages, and skincare. This growth trajectory reflects the increasing trend towards natural, functional ingredients in consumer products, particularly in the health, wellness, and beauty sectors.

The UK’s Baobab ingredient market grew at a CAGR of 4.1% from 2020 to 2024 and is expected to rise to 5.3% during 2025-2035. The earlier growth was steady but moderate, driven by the increasing demand for plant-based ingredients, particularly in health-conscious food and beverage sectors. The market is expected to accelerate in the upcoming decade due to the growing trend for natural, clean-label ingredients and increased consumer awareness around the health benefits of Baobab. The UK’s emphasis on sustainability, organic sourcing, and clean-label products will significantly contribute to the rise in Baobab adoption in both food and cosmetic formulations. Baobab’s unique nutritional profile, with high vitamin C and antioxidant content, will continue to attract demand as consumers seek functional foods that promote immunity and general well-being.

China’s Baobab ingredient market is projected to grow at a CAGR of 7.6% from 2025 to 2035, exceeding the global average of 5.6%. The market grew at a CAGR of 6.2% during 2020-2024, driven by increasing consumer interest in plant-based, nutrient-dense superfoods and growing demand for functional ingredients in food, beverages, and supplements. In the next decade, the demand for Baobab is expected to rise sharply due to China’s expanding wellness sector, an increasing focus on natural ingredients, and the growing trend towards immunity-boosting functional foods. China’s expanding middle class and awareness of the benefits of Baobab will further propel market growth, supported by the rising preference for clean-label, organic, and non-GMO products.

India’s Baobab ingredient market is expected to grow at a CAGR of 7.0% during 2025-2035, surpassing the global CAGR of 5.6%. The market grew at a CAGR of 5.5% during 2020-2024, supported by rising awareness about the health benefits of Baobab, particularly for immunity, digestion, and skin health. The acceleration in growth is attributed to increasing demand for plant-based nutrition, the rise of the wellness industry, and expanding awareness about Baobab as a functional food ingredient. The continued growth in India’s organic food sector and rising disposable incomes in urban areas will further support the demand for Baobab products, both for food and cosmetic applications. As consumer preferences shift towards natural and sustainable ingredients, Baobab is poised to become a key component of India’s health food and beauty markets.

France’s Baobab ingredient market is projected to grow at a CAGR of 5.9% from 2025 to 2035. The market grew at a CAGR of 4.8% from 2020 to 2024, driven by the growing demand for superfoods and the increasing consumer interest in functional ingredients in food, beverages, and cosmetics. France’s focus on sustainability and its strong market for organic, plant-based ingredients will contribute to continued growth in Baobab’s adoption. In the coming decade, France’s strong culinary tradition and the rising popularity of plant-based diets, as well as the increasing demand for clean-label and functional food products, will contribute to a higher rate of Baobab market penetration. Baobab’s exceptional nutritional benefits and versatility in various product applications will further support its integration into mainstream food and beauty products in France.

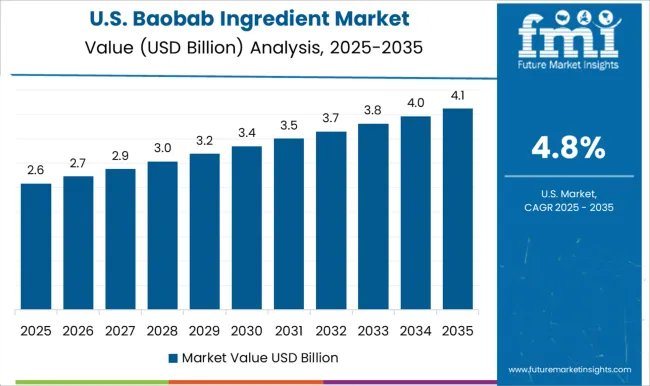

The USA Baobab ingredient market is projected to grow at a CAGR of 5.5% during 2025-2035. The market grew at a CAGR of 4.2% from 2020 to 2024, supported by growing consumer demand for nutrient-rich superfoods and functional ingredients in food, beverages, and dietary supplements. The acceleration in growth over the next decade will be driven by rising awareness of Baobab’s health benefits, particularly in immune support and skin health. The market will also benefit from increasing consumer preference for plant-based and sustainable products, with Baobab’s antioxidant-rich profile making it particularly attractive for use in beauty and wellness products. The continued rise in demand for clean-label, organic, and eco-friendly products will support Baobab’s position in the market.

The baobab ingredient market features key players such as Baobab Fruit Company, Atacora, Organic Africa, and Aduna Limited, each offering unique product ranges and expanding their market presence. Baobab Fruit Company leads the market with its high-quality baobab powder and oil, focusing on organic certification and sustainable sourcing from Africa. Atacora specializes in wild-harvested baobab ingredients, emphasizing community-based sourcing and ethical trade practices, appealing to eco-conscious consumers. Organic Africa offers a range of organic baobab-based products, including powder and pulp, targeting the growing demand for clean-label, health-focused ingredients.

Aduna Limited has positioned itself as a major player in the functional food sector, integrating baobab into energy bars, smoothies, and other wellness products. These players leverage strategic partnerships with food and cosmetic manufacturers to expand distribution channels and reach global markets. Competitive strategies include enhancing the sustainability of sourcing, product diversification, and increasing brand visibility through digital marketing and collaborations with health influencers. The rising interest in African superfoods, particularly baobab, has positioned these companies to capture growing demand across food, beverage, and beauty sectors globally.]

Companies aim to produce goods or services at a lower cost than competitors while maintaining acceptable quality. This can be achieved through economies of scale, cost-efficient production processes, or innovative cost-cutting methods.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 Billion |

| Product | Baobab Powder, Baobab Pulp, and Baobab Oil |

| Form | Powder and Oil |

| Application | Food, Beverage, Nutraceuticals, Cosmetic & Personal Care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Baobab Fruit Company, Atacora, Organic Africa, and Aduna Limited |

| Additional Attributes | Dollar sales by region, market share of key players, growth trends in functional food and beauty sectors, demand for organic and sustainable products, and competitive strategies. They would also focus on emerging markets and consumer preferences. |

The global baobab ingredient market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the baobab ingredient market is projected to reach USD 9.3 billion by 2035.

The baobab ingredient market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in baobab ingredient market are baobab powder, baobab pulp and baobab oil.

In terms of form, powder segment to command 52.4% share in the baobab ingredient market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA