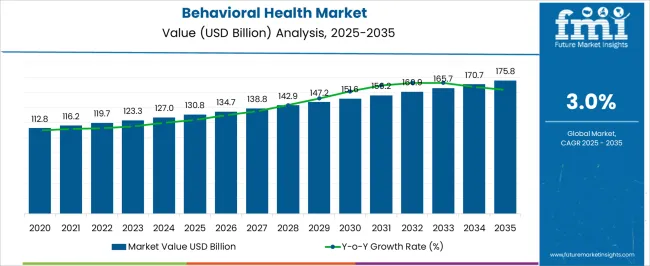

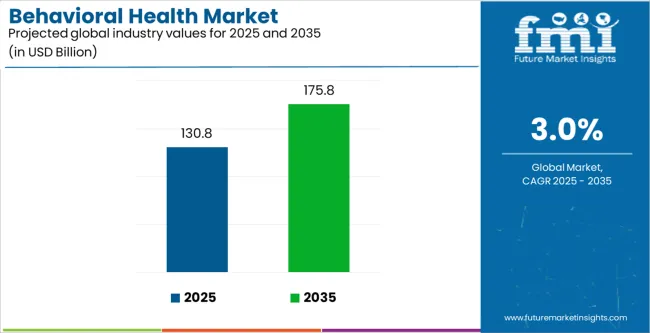

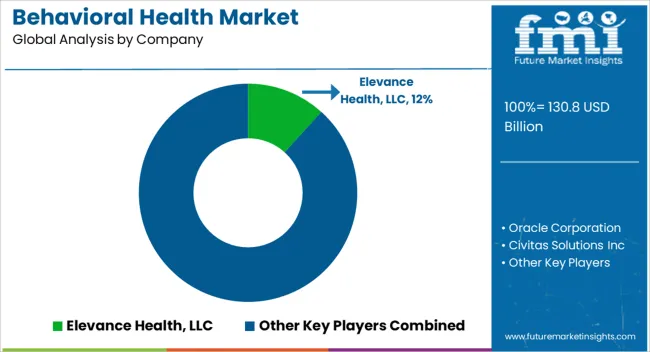

The behavioral health market is valued at USD 130.8 billion in 2025 and is projected to reach USD 175.8 billion by 2035, expanding at a CAGR of 3.0% over the forecast period. Growth is being shaped by rising global recognition of mental health as a critical component of overall wellness, accompanied by expanded access to preventive and therapeutic care services. Insurance coverage improvements, policy reforms, and ongoing de-stigmatization efforts are encouraging more individuals to pursue professional treatment. This transition is creating new opportunities for healthcare systems, private providers, and digital health platforms to scale services across geographies.

Health systems and care providers are increasingly emphasizing early intervention strategies and community-based programs to address untreated behavioral conditions. These initiatives not only reduce the economic burden on healthcare systems but also improve long-term patient outcomes. Technology continues to play a transformative role, with telepsychiatry, mobile therapy platforms, and AI-driven screening solutions expanding care delivery beyond traditional clinical settings. These tools are particularly impactful in rural and underserved areas, where shortages of mental health professionals remain a pressing challenge.

Public health agencies are intensifying their efforts to raise awareness, leading to higher rates of diagnosis and treatment uptake across diverse populations. The integration of behavioral health into primary care settings is gaining traction, aligning with broader healthcare system reforms that prioritize holistic and coordinated care models. In addition, value-based reimbursement frameworks are incentivizing providers to deliver efficient, outcome-focused services. Workforce development in mental health professions is also accelerating, ensuring that the growing demand for counseling, psychiatric support, and specialized treatments can be met in the coming years.

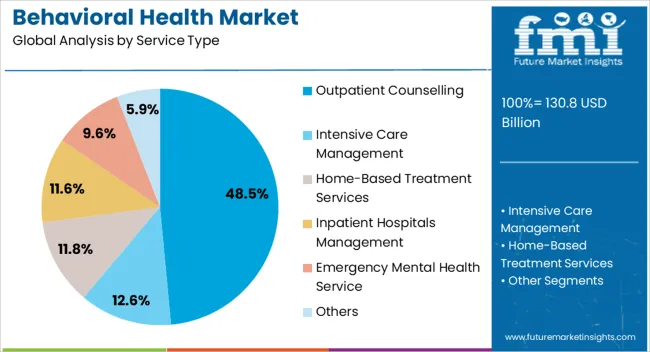

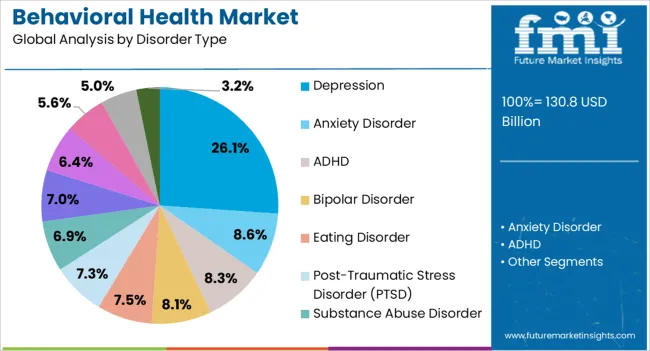

Segmental dynamics underscore outpatient counseling as the leading service format due to its flexibility, cost-effectiveness, and scalability. Depression continues to dominate as the most commonly diagnosed and treated condition, reflecting its widespread prevalence and increasing awareness campaigns. Anxiety disorders, substance use disorders, and post-traumatic stress conditions are also contributing significantly to demand, with targeted therapeutic interventions expanding rapidly.

| Metric | Value |

|---|---|

| Behavioral Health Market Estimated Value in (2025 E) | USD 130.8 billion |

| Behavioral Health Market Forecast Value in (2035 F) | USD 175.8 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The market is segmented by Service Type and Disorder Type, and region. By Service Type, the market is divided into Outpatient Counseling, Intensive Care Management, Home-Based Treatment Services, Inpatient Hospitals Management, Emergency Mental Health Service, and Others. In terms of Disorder Type, the market is classified into Depression, Anxiety Disorder, ADHD, Bipolar Disorder, Eating Disorder, Post-Traumatic Stress Disorder (PTSD), Substance Abuse Disorder, Psychosis, Schizoaffective Disorder, Schizophrenia, Dual Diagnosis, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Outpatient Counselling segment is projected to account for 48.5% of the behavioral health market revenue in 2025, maintaining its leadership among service types. This growth has been supported by the flexibility, accessibility, and cost-effectiveness of outpatient services, which allow patients to receive therapy without hospitalization or long-term institutional care.

Outpatient settings have enabled regular therapeutic interactions, including cognitive behavioral therapy, dialectical behavior therapy, and family counseling, which are widely endorsed in clinical guidelines. Healthcare providers have expanded outpatient offerings through both in-person and virtual formats, ensuring broader reach.

Insurance policy enhancements covering outpatient mental health sessions have further increased service utilization. Moreover, outpatient care models have aligned with patient preferences for privacy, continuity of care, and minimal disruption to daily life, especially among working populations. As public health strategies continue to emphasize community-based mental health support, the Outpatient Counselling segment is expected to retain its dominant role in behavioral healthcare delivery.

The Depression segment is projected to hold 26.1% of the behavioral health market revenue in 2025, positioning it as the leading disorder type. This segment’s dominance has been attributed to the rising global burden of depressive disorders, recognized as a leading cause of disability by health organizations.

Advances in clinical research have improved the diagnosis and classification of depressive symptoms, contributing to higher identification rates across all age groups. Health records and psychiatric data have revealed increased reporting of depression due to stress-related lifestyles, socio-economic pressures, and co-occurring chronic illnesses.

Pharmaceutical innovation in antidepressant therapies, along with the proliferation of psychotherapy options, has broadened treatment accessibility. Mental health campaigns and educational outreach have further encouraged early intervention, reducing stigma and promoting treatment-seeking behavior. As employers, schools, and community health organizations implement mental wellness programs, the Depression segment is expected to maintain its central role in the behavioral health market, supported by ongoing awareness, innovation, and clinical focus.

Digital care services have played a major role in the sector's growth, especially during the COVID-19 epidemic. Behavioral health treatments have become increasingly popular among patients after the pandemic. The impact of COVID-19 on the behavioral health market to significantly drives demand for virtual care services in coming years.

Due to mental illnesses like depression and anxiety disorders, the behavioral and mental health segment dominates the market. A wide variety of behavioral health services are available, including outpatient counseling, intensive case management, home-based treatment, and hospital-based treatment.

Peer support programs and community mental health services are becoming increasingly popular as supplements to standard clinical treatment. Social support and shared experiences are used in these initiatives to promote healing and resilience. Policies on insurance coverage for behavioral health services to support growth over the years to come.

Investments and Technological Innovations will Drive Behavioral Health Demand

Behavioral health markets are booming because of the fast-changing diagnostic sector and lifestyle illnesses like obesity and diabetes. Growing reliance on subscription-based business models presents growth opportunities, particularly in emerging markets. The growing use of telehealth for the delivery of healthcare services may increase access to mental health treatments. Behavioral health platforms can be developed when both fields are combined to provide all-inclusive treatment and improve patient outcomes.

As technology continues to improve in the behavioral health sector, treatment outcomes can be tracked, provider efficiency can be increased, and patient experience can be improved as well. Investors in behavioral health clinics, telemedicine platforms, and other applications indicate a growing interest in behavioral health.

The Risk of Adverse Drug Reactions and Cost is Likely to Hamper the Growth

Mental health services are inadequate in remote and marginalized communities, resulting in delayed access to appropriate mental health care. Insufficient mental health specialists, including psychologists, psychiatrists, and social workers, make it difficult to provide behavioral health care.

A rising cost of each treatment and a lack of social acceptance will likely hamper the market. Adverse side effects will hinder market growth from various medications for anxiety and depression. Despite the potential benefits of digital mental health tools, there are privacy and regulatory concerns.

Over the historical period between 2020 and 2025, the global market increased at a CAGR of 3%. The introduction of smartphone apps and other digital tools is extremely beneficial to both individuals seeking mental health treatment and mental health professionals offering such services. The engineering and research communities are combining their expertise to treat various mental health issues.

Technology-enabled treatments for mental health and drug abuse are being developed through behavioral health technologies. In addition to eliminating physical distance and transportation barriers, telepsychiatry and teletherapy facilitate access to mental health services. Using artificial intelligence, medical professionals diagnose mental health conditions, identify behavioral patterns, and prescribe individualized therapy.

AI-powered chatbots for mental health services, trained on massive datasets of patient data, and machine learning algorithms, will expand demand. Digital therapeutics and medications are often used together for mental health issues. Genomic advances can lead to customized treatment plans and medications tailored to mental health illnesses. A CAGR of 3.3% is expected to be achieved during the forecast period.

Country-level forecasts for behavioral health are provided in the following section. As shown in the table, Spain generates the most revenue. Value-based care is transforming the behavioral health market toward quality-based care. In turn, this results in better outcomes for patients and greater satisfaction for them.

Behavior change interventions rely on theories, evidence from previous successes and failures, and deep knowledge of the target group. Evidence-based policy requires an assessment of changes in the prevalence and impact of health behaviors across countries.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 3.5% |

| Canada | 2.8% |

| Germany | 2.7% |

| United Kingdom | 3.5% |

| Spain | 3.7% |

| India | 2.4% |

Increasing awareness of mental health issues has driven the development of the mental health market in Spain. Between 2025 and 2035, Spain is expected to have a CAGR of 3.7%. While combating the COVID-19 pandemic in Spain, mental health interventions have been developed, emphasizing cognitive-behavioral interventions and emotional regulation.

The future of the behavioral health market aims to support healthcare professionals' psychological well-being during challenging times, especially during times of stress.

Children in Spain have received comprehensive behavioral health services, focusing on providing adequate treatment for their needs. Spain has been working to expand mental health resources and improve access to behavioral health services to meet the growing demand. More training of mental health professionals and integration of primary care into mental health programs are needed to reduce stigma and promote help-seeking.

Mental health services tailored to each individual's needs are becoming more popular in the United Kingdom. Several researchers and developers are working on developing innovative methods for diagnosing and treating mental illnesses in the United Kingdom. Spending on mental health remains low in comparison to other areas of behavioral healthcare. United Kingdom's CAGR is projected to be 3.5% between 2025 and 2035.

Despite NHS mental health services being free, there are still problems in meeting the increasing demand, especially with long waiting periods for treatment. As a result, mental health treatment needs to increase accessibility and responsiveness.

Social care and public health objectives are addressed by the Department of Health and Social Care in the United Kingdom. With ministerial oversight for public health, start for life, and primary care, this reflects a comprehensive approach to administering health and social care services.

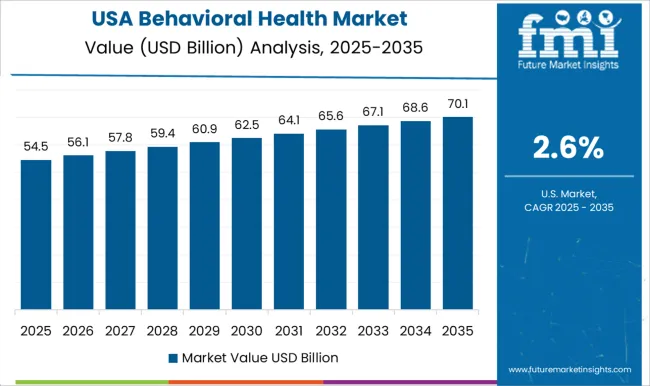

Demand for behavioral health products is expected to be significantly influenced by the United States. Behavioral healthcare delivery in the United States faces substantial challenges. The need for psychologists in underserved areas is on the rise.

A variety of training programs are also provided to the staff of prisons, child welfare organizations, and other organizations. A focus is also placed on reducing health disparities and enabling more patients to access treatment.

Anxiety disorders affect about 130.8 million Americans, making them the most common mental health condition in the country. While behavioral health issues are becoming more widely understood, there is still a shortage of mental health professionals in the United States. In 2025, the Kaiser Family Foundation reported that 47% of Americans lived in areas with mental health worker shortages.

A brief overview of the top segments of the industry is provided in this section. Inpatient hospital management accounted for 35% of services by 2025. By disorder type, anxiety disorders accounted for 28% market share in 2025.

| Segment | Inpatient hospital management (Service Type) |

|---|---|

| Value Share (2025) | 35% |

Mental health care continuums, including residential care, ED treatment, outpatient therapy, and inpatient care, are becoming more popular in hospitals. The concept of behavioral health is being incorporated into hospital-owned, community-based practices to treat mental health issues. A 35% market share was held by inpatient hospital management in 2025.

Inpatient mental health units provide therapeutic support to individuals with mental health emergencies. Patients' privacy and well-being are also priority concerns for hospitals when creating a safe and supportive environment.

Specialized behavioral health hospitals and facilities provide acute care for individuals with complex mental health and substance use issues. Both inpatient and outpatient treatment is offered at these facilities. Care is tailored to each patient's needs and preferences.

| Segment | Anxiety Disorder (Disorder Type) |

|---|---|

| Value Share (2025) | 28% |

Society's changing views about mental health have lowered the stigma associated with therapy. The candor of this approach encourages people to find treatment for anxiety problems without fear of judgment.

In the upcoming DSM-5, diagnostic criteria have been modified based on advances in anxiety research. The reclassification of obsessive-compulsive disorder (OCD) and posttraumatic stress disorder (PTSD) reflects the scientific understanding of these disorders

Behavioral health research and new developments have made anxiety disorder treatments more effective. A variety of therapies can be used in conjunction with medication, therapy, or both. The segment held a value share of 28% in 2025.

The efficacy and safety of an LSD formula for treating generalized anxiety disorder have been approved by the USA Food and Drug Administration. In order to treat anxiety disorders, innovative approaches are being developed based on the latest research conducted in this field.

The best companies are the ones that come up with innovative treatment methods or offer unique mental health services. Mergers and acquisitions in the behavioral health market to expand the market. Strategies for new entrants to specialize in niche markets is significantly driving demand for the behavioral health market.

The importance of building a strong reputation for quality care, therapist expertise, and positive patient outcomes. Collaboration with primary care physicians and insurance companies can also be crucial. Due to COVID-19 pandemic, the demand for telepsychiatry services and virtual therapy platforms has increased.

Industry Updates

In March 2025, Acadia Healthcare Company, Inc. announced the completion of its acquisition of three comprehensive treatment centers ("CTC") in North Carolina.

In March 2025, Magellan Health, Inc. announced two new digital cognitive behavioral therapy (DCBT) programs for children and adolescents struggling with anxiety-related symptoms. With Magellan's DCBT solutions, adolescents and children can manage their anxiety symptoms for the rest of their lives. As a result, clinicians are able to provide primary care to more children

Industry segments include outpatient counseling, intensive care management, home-based treatment services, inpatient hospital management, emergency metal health service, others

Depending on the disorder type, the industry includes anxiety disorder, ADHD, bipolar disorder, depression, eating disorder, post-traumatic stress disorder (PTSD), substance abuse disorder, psychosis, schizoaffective disorder, schizophrenia, dual diagnosis, others.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa are covered.

The global behavioral health market is estimated to be valued at USD 130.8 billion in 2025.

The market size for the behavioral health market is projected to reach USD 175.8 billion by 2035.

The behavioral health market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in behavioral health market are outpatient counselling, intensive care management, home-based treatment services, inpatient hospitals management, emergency mental health service and others.

In terms of disorder type, depression segment to command 26.1% share in the behavioral health market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Behavioral Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Behavioral Analytics – AI-Powered Cybersecurity & Insights

Healthcare and Laboratory Label Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Health and Fitness Club Market Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Healthcare and Laboratory Label Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare and laboratory labels market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA