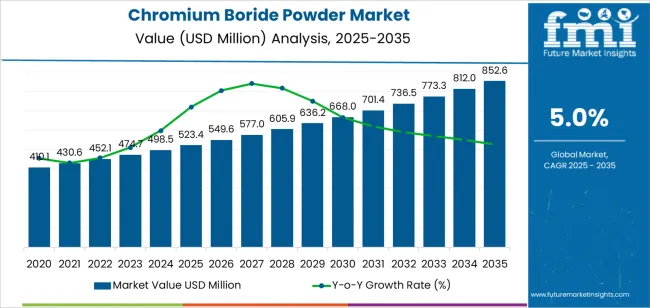

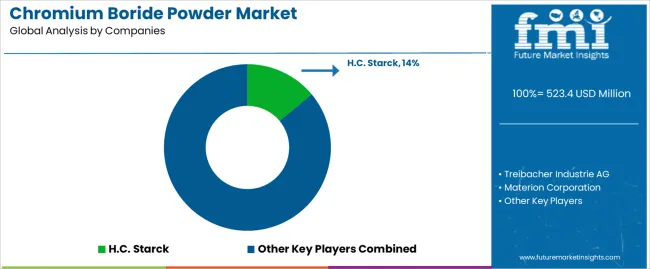

The chromium boride powder market is forecast to grow from USD 523.4 million in 2025 to USD 852.6 million by 2035, reflecting a CAGR of 5%. This growth is primarily driven by increasing demand for chromium boride powder across industries such as aerospace, automotive, electronics, and materials science. Chromium boride powder, known for its high hardness, thermal stability, and corrosion resistance, is used in advanced coatings, abrasive materials, and high-performance alloys. The growing need for high-strength and heat-resistant materials in industrial applications will significantly contribute to the market's expansion.

As manufacturing processes continue to evolve and industries strive for more durable materials with enhanced performance properties, chromium boride powder will play a critical role. The demand for specialized coatings in industries like automotive and aerospace for components that require high wear resistance will drive market growth. Additionally, innovations in nanomaterials and advanced alloys will further enhance the material's applications, contributing to the overall growth of the chromium boride powder market over the next decade.

From 2025 to 2030, the market is expected to grow from USD 523.4 million to USD 668 million, an increase of USD 144.6 million. This phase will see a significant demand increase driven by industries focused on improving durability and thermal resistance of their components. The use of chromium boride powder in coatings and alloys for aerospace, automotive, and energy applications will remain key growth drivers.

Between 2030 and 2035, the market is forecast to expand from USD 668 million to USD 852.6 million, adding USD 184.6 million. The demand for high-performance materials will continue to rise, driven by ongoing innovations in material science, particularly in the development of advanced alloys and coatings. As industries push for stronger, more durable materials to withstand extreme conditions, chromium boride powder will play an increasingly important role, supporting sustained market growth through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 379 million |

| Market Forecast Value (2035) | USD 666 million |

| Forecast CAGR (2025-2035) | 5.8% |

The chromium boride powder market is witnessing steady growth, primarily driven by its expanding applications in various industries. Chromium boride powders are widely used in the production of wear-resistant components, sputtering targets, and fireproof materials due to their superior hardness, high melting points, and thermal stability. The demand for wear-resistant components in industries such as automotive, aerospace, and electronics is propelling the market. Additionally, the increasing need for advanced coatings and functional materials in semiconductors and solar panels is boosting the demand for sputtering targets. Countries like China, India, and Germany are significant contributors to the market growth, driven by strong industrial sectors and technological advancements. The overall market expansion is further supported by growing investment in advanced manufacturing technologies and material science innovations.

The rising demand for durable materials in manufacturing processes and energy-efficient technologies is playing a pivotal role in the growth of the chromium boride powder market. The increasing focus on sustainable manufacturing and advanced protective coatings across key industries is also boosting the need for chromium boride powders, as they enhance the performance and longevity of industrial components. Government initiatives promoting research and development in materials science and advanced manufacturing are also contributing to the market’s expansion.

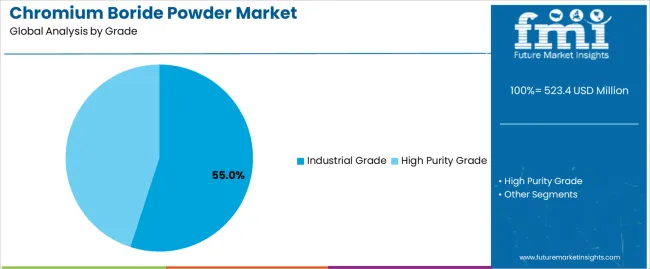

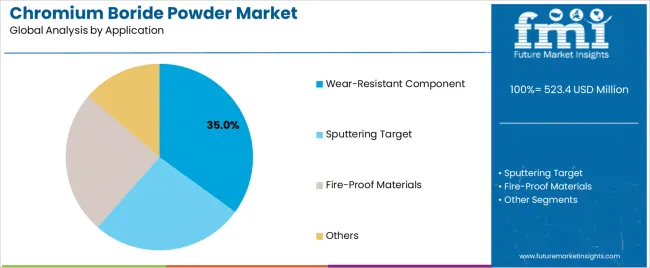

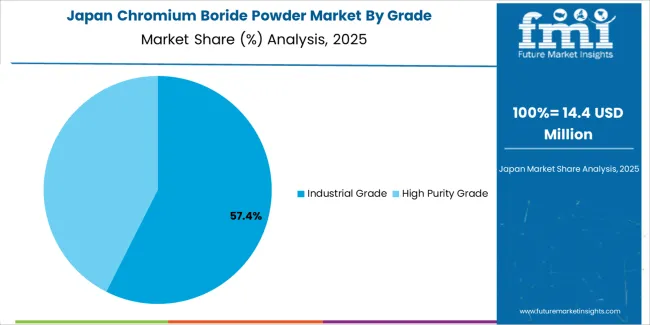

The chromium boride powder market is primarily segmented by grade and application, which highlight the differing needs across industries. By grade, the market is divided into industrial grade and high purity grade, with industrial grade holding the dominant share. By application, the market is divided into wear-resistant components, sputtering targets, fireproof materials, and others, with wear-resistant components being the leading application segment. The market is seeing significant growth in Asia-Pacific regions such as China and India, due to industrial expansion, while Europe and North America continue to account for steady demand due to ongoing manufacturing advancements and investments in material science and coating technologies.

The industrial grade segment dominates the chromium boride powder market, accounting for 55% of the total share. This segment is preferred due to its cost-effectiveness and adequate performance in high-demand applications that do not require ultra-high purity levels. Industrial-grade chromium boride powder is widely used in wear-resistant components for industries like automotive, mining, and aerospace, where durability and heat resistance are crucial but cost sensitivity is a factor. The versatility of industrial grade powder also makes it ideal for use in sputtering targets and fireproof materials for industrial applications.

As industries expand globally, particularly in emerging markets like China and India, there is an increasing demand for affordable and reliable materials for mass production and automated manufacturing systems. The industrial grade segment's ability to balance performance and cost is what makes it the preferred choice in these regions. Additionally, it supports the growing need for heavy-duty equipment, industrial machinery, and production systems, all of which require resistant materials that maintain high-performance standards in harsh operating environments.

The wear-resistant component segment is the largest in the chromium boride powder market, accounting for 35% of the total market share. This segment is driven by the increasing demand for advanced materials that can withstand high abrasion, extreme temperatures, and mechanical wear in various industrial sectors. Chromium boride powder is particularly valuable in applications such as machine components, cutting tools, engine parts, and automotive systems, where durability and resistance to wear are critical for operational efficiency. As industries such as mining, automotive, and heavy machinery manufacturing grow, the demand for wear-resistant components continues to rise, propelling the market for chromium boride powders.

In addition to their superior wear resistance, chromium boride powders offer high thermal stability and corrosion resistance, making them indispensable in extreme environmental conditions. The increasing global focus on sustainable manufacturing also drives the demand for components that can reduce the frequency of replacements and extend the lifespan of industrial machinery. This trend is particularly relevant in emerging markets, where the need for cost-effective yet durable materials for manufacturing and infrastructure development continues to grow. As a result, the wear-resistant component segment is expected to maintain its position as the leading application in the chromium boride powder market.

The chromium boride powder market is expanding due to increasing demand for wear-resistant materials in various industries, including automotive, aerospace, and heavy machinery. The rising focus on industrial durability, energy efficiency, and high-performance coatings is contributing to the market's growth. Additionally, advanced manufacturing techniques, such as 3D printing, and the growing demand for sputtering targets in electronics and semiconductors are propelling the use of chromium boride powders. China and India remain key contributors, with their booming industrial sectors driving demand for cost-effective, durable materials.

What are the key drivers of the chromium boride powder market?

The key drivers of the chromium boride powder market include rising demand for durable materials across industries like automotive, electronics, and energy. The increasing need for high-performance coatings in wear-resistant components, high-temperature applications, and sputtering targets is boosting market growth. As industries shift towards smart manufacturing and automation, the need for energy-efficient and long-lasting materials increases, making chromium boride powder a preferred choice. Furthermore, the growing focus on industrial durability and coatings in high-demand applications continues to drive adoption. The market is also driven by government initiatives supporting innovation in advanced material technologies.

What are the key restraints in the chromium boride powder market?

The chromium boride powder market faces certain restraints, including high production costs associated with high-purity grades, which can limit adoption in price-sensitive markets. Additionally, the limited availability of high-quality raw materials and environmental concerns related to chromium extraction may hinder growth. The complexity of manufacturing and demand for specialized formulations can also act as barriers to market expansion. Furthermore, a lack of awareness about the benefits of chromium boride powders in some emerging regions may slow adoption, particularly in industries that rely on traditional, lower-cost alternatives.

What are the key trends in the chromium boride powder market?

The key trends in the chromium boride powder market include increasing demand for advanced materials that offer high wear resistance, thermal stability, and durability in industrial applications. As sustainability becomes a key focus, manufacturers are moving towards more eco-friendly production processes. The adoption of 3D printing and additive manufacturing is also rising, as these technologies enable more precise and customized material applications. The electronics and semiconductor sectors’ growing demand for sputtering targets and functional materials is another key trend driving the market. Additionally, there is increasing focus on global collaborations to improve product innovation and efficiency.

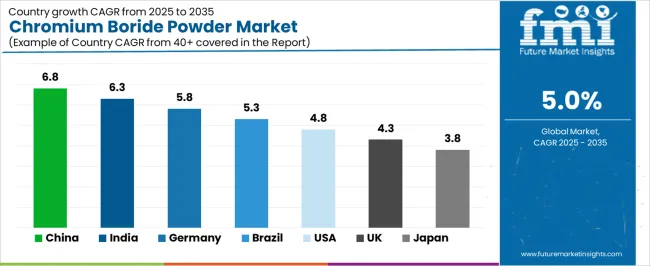

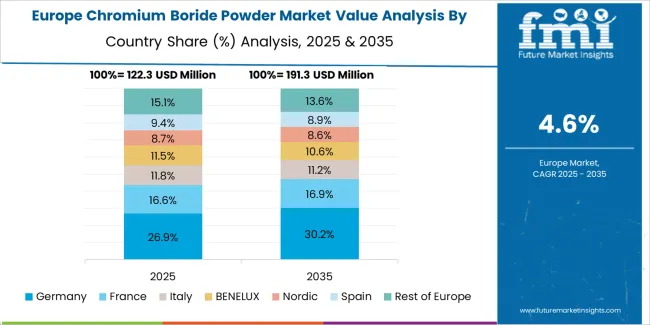

The chromium boride powder market exhibits varying growth dynamics across key global regions, driven by industrialization, materials innovation, and expanding manufacturing infrastructure. Emerging economies such as China and India are experiencing relatively high growth rates because of their large-scale adoption of advanced materials for wear resistant components, sputtering targets, and fire proof materials. Developed markets like Germany, the USA, and Japan are witnessing moderate growth, reflecting established manufacturing bases and incremental demand. Factors such as technological readiness, regulatory standards, and local supply chain maturity align strongly with market potential in each country. This analysis helps manufacturers and investors prioritise regional strategies and align product positioning with regional material science and manufacturing trends.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

China is projected to grow at a CAGR of 6.8% in the chromium boride powder market, making it one of the fastest-growing regions. The country’s industrialization, coupled with its leadership in manufacturing, automotive, and electronics, fuels the demand for wear-resistant components and sputtering targets. As China continues to advance its material science technologies and expand its renewable energy infrastructure, the adoption of high-performance materials such as chromium boride powders is increasing. Moreover, China's substantial investments in high-tech manufacturing and automated systems are driving demand for materials that offer high thermal stability and abrasion resistance, key properties of chromium boride powders. As a result, China remains a central hub for industrial material demand, with a growing market for durable, high-performance materials that support its expanding manufacturing base.

India is expected to grow at a CAGR of 6.3% in the chromium boride powder market. The country’s growing industrial sector, particularly in automotive, electronics, and heavy machinery, is driving demand for advanced materials like chromium boride powder. India’s focus on smart manufacturing and industrial automation has heightened the need for wear-resistant components that can withstand harsh environments. With government initiatives such as “Make in India” boosting local manufacturing and infrastructure development, the demand for high-performance materials is expected to rise. The country’s expanding semiconductor manufacturing industry also creates opportunities for sputtering targets used in electronics and solar panel production. As India modernizes its manufacturing capacity, there will be continued demand for chromium boride powders, which are key to supporting the country's push for innovation and industrial growth.

Germany is projected to grow at a CAGR of 5.8% in the chromium boride powder market. As one of Europe’s leading industrial hubs, Germany continues to drive demand for high-quality, durable materials in sectors such as automotive, electronics, and precision engineering. The country’s strong emphasis on innovation and quality manufacturing ensures a stable demand for materials like chromium boride powder in wear-resistant components and sputtering targets. Moreover, Germany's commitment to energy-efficient technologies, industrial automation, and advanced manufacturing processes further promotes the adoption of high-performance materials. While growth is slower than in emerging economies, Germany remains a key market for premium materials used in high-spec applications. As a leader in automotive engineering and aerospace technologies, Germany continues to be a major player in the global market for chromium boride powders.

Brazil is expected to grow at a CAGR of 5.3% in the chromium boride powder market. The country’s expanding industrial sector, particularly in mining, automotive, and construction, is contributing to the demand for wear-resistant components that can handle extreme wear and high thermal loads. Brazil’s focus on industrial modernization and infrastructure development presents an opportunity for the adoption of advanced materials like chromium boride powders. Additionally, the renewable energy sector in Brazil is seeing growth, which drives demand for fireproof materials and sputtering targets. While economic fluctuations present challenges, Brazil remains a critical market for suppliers aiming to target Latin American industrial expansion. With an increasing focus on modernizing infrastructure and improving industrial efficiency, the demand for durable, high-performance materials is expected to grow steadily in the coming years.

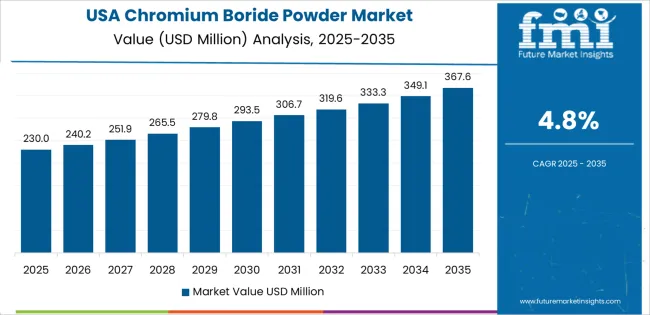

The USA is projected to grow at a CAGR of 4.8% in the chromium boride powder market. As one of the largest consumers of advanced materials, the USA continues to demand high-performance materials in industries like aerospace, automotive, and electronics. The country’s focus on research and development, high-tech manufacturing, and precision engineering fuels the need for specialized materials such as chromium boride powders. USA manufacturers are increasingly adopting sputtering targets for semiconductor fabrication and coating applications in electronics. While the market growth is slower than in emerging regions, the USA remains an essential market for premium products due to its advanced industrial and technological sectors. Additionally, automated systems and industrial safety regulations continue to increase the need for wear-resistant components, sustaining demand for chromium boride powders.

The UK is projected to grow at a CAGR of 4.3% in the chromium boride powder market. As a developed economy with a strong industrial base, the UK maintains steady demand for advanced materials, especially in sectors like automotive, electronics, and precision manufacturing. The country’s ongoing commitment to high-tech manufacturing and sustainable development encourages the adoption of materials that offer durability, wear resistance, and thermal stability—all of which are properties of chromium boride powders. While growth is slower compared to developing markets, the UK remains important for suppliers targeting the premium segment of the market. As the demand for advanced coatings and high-performance materials in automotive and engineering sectors grows, the UK will continue to be a key region for the chromium boride powder market.

Japan is expected to grow at a CAGR of 3.8% in the chromium boride powder market. The country’s advanced industrial and technological infrastructure ensures consistent demand for high-performance materials in industries like electronics, automotive, and aerospace. Japan is known for its precision engineering and innovative manufacturing processes, which require durable, wear-resistant components made from materials such as chromium boride powder. The country's focus on high-quality standards and sustainability in material selection further drives the adoption of these powders. Although Japan’s growth rate is slower compared to emerging markets, its technological leadership and high-end industrial sectors ensure steady demand for wear-resistant and high-performance materials in specialized applications.

The chromium boride powder market is highly competitive, with several key players dominating the market share. Companies like H.C. Starck, Treibacher Industrie AG, and Materion Corporation hold significant positions in the market due to their extensive portfolios, strong research and development capabilities, and established relationships with industrial and electronics sectors. These industry leaders are able to offer a wide range of chromium boride powder grades, from industrial grade to high-purity grade, meeting the growing demand for advanced wear-resistant components, sputtering targets, and fireproof materials. These companies are also focused on expanding their market presence by investing in regional production facilities and forging strategic partnerships to better cater to the growing demand, particularly in emerging markets such as China and India.

On the other hand, smaller players such as Jiangxi Ketai New Materials and Baoding Zhongpuruituo Technology are gaining traction, offering cost-effective chromium boride powder solutions that cater to niche markets or localized demand. These companies are capitalizing on their flexibility and ability to provide tailored solutions, especially in cost-sensitive regions. Innovation, customer service, and agility are key differentiators for these smaller players. The competitive landscape is shaped by product differentiation, technological advancements, and regional expansion, with leading companies focusing on improving production efficiency, quality control, and sustainability to maintain a competitive edge in the growing market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | China, India, Germany, Brazil, USA, UK, Japan |

| Grade | Industrial Grade, High Purity Grade |

| Application | Wear-Resistant Component, Sputtering Target, Fire-Proof Materials, Others |

| Key Companies Profiled | H.C. Starck, Treibacher Industrie AG, Materion Corporation, JAPAN NEW METALS, Unichim, Micron Metals, Baoding Zhongpuruituo Technology, Jiangxi Ketai New Materials |

| Additional Attributes | The market analysis includes dollar sales by grade and application categories. It also covers regional adoption trends across major markets like China, India, Germany, and the USA. The competitive landscape highlights key manufacturers in the chromium boride powder sector, focusing on advancements in wear-resistant materials and sputtering targets. Trends in the demand for chromium boride in industrial applications and fire-proof materials are also explored. |

The global chromium boride powder market is estimated to be valued at USD 523.4 million in 2025.

The market size for the chromium boride powder market is projected to reach USD 852.6 million by 2035.

The chromium boride powder market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in chromium boride powder market are industrial grade and high purity grade.

In terms of application, wear-resistant component segment to command 35.0% share in the chromium boride powder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

Chromium Polynicotinate Market Size and Share Forecast Outlook 2025 to 2035

Chromium Trioxide Market Size and Share Forecast Outlook 2025 to 2035

Chromium Picolinate Market Size and Share Forecast Outlook 2025 to 2035

Chromium Salts Market Trends - Growth, Demand & Forecast 2025 to 2035

Boride Powder Market Size and Share Forecast Outlook 2025 to 2035

Titanium Diboride Market Size and Share Forecast Outlook 2025 to 2035

Demand for Boride Powder in USA Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA