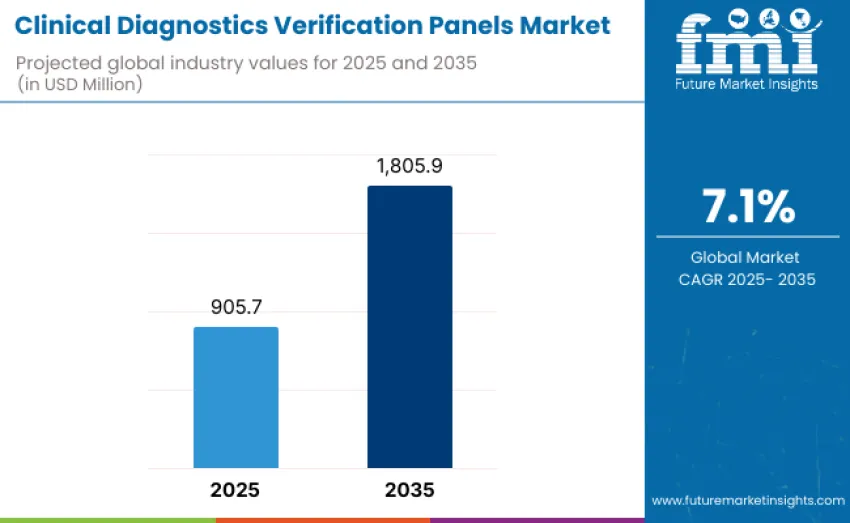

The global clinical diagnostics verification panels market is projected to reach USD 1,805.9 million by 2035, recording an absolute increase of USD 900.2 million over the forecast period. This market is valued at USD 905.7 million in 2025 and is set to rise at a CAGR of 7.1% during the assessment period. Growth is driven by increasing demand for standardized, reliable, and high-throughput verification solutions across clinical diagnostics laboratories, research institutions, and hospital networks worldwide.

Clinical diagnostics verification panels are critical for validating the performance, accuracy, and reproducibility of diagnostic assays, instruments, and workflows. These panels enable laboratories to perform assay calibration, quality control, and proficiency testing, ensuring diagnostic tests produce consistent, reliable results. They are employed across immunoassays, molecular diagnostics, hematology, microbiology, and clinical chemistry applications. By supporting compliance with regulatory requirements and laboratory accreditation standards, verification panels play a central role in maintaining diagnostic accuracy, patient safety, and clinical confidence in laboratory results.

Technological advancements are a key driver of growth. Modern verification panels offer standardized matrices, wide analyte concentration ranges, and comprehensive controls that enhance assay validation efficiency and reproducibility. Integration with automated laboratory instrumentation, high-throughput analyzers, and laboratory information management systems allows for streamlined workflows, reduced human error, and improved turnaround times. These innovations enable laboratories to meet growing demand for rapid, precise, and reproducible diagnostic testing across multiple disease areas, including infectious diseases, oncology, genetic disorders, and chronic conditions.

Between 2025 and 2030, the clinical diagnostics verification panels market is projected to expand from USD 905.7 million to USD 1,278.9 million, resulting in a value increase of USD 373.2 million, representing 41.5% of total forecast growth for the decade. Growth during this period is driven by rising demand for standardized and reliable diagnostic verification tools across clinical laboratories and healthcare institutions. Adoption is supported by innovations in panel composition, including expanded analyte coverage, improved accuracy, and enhanced reproducibility.

From 2030 to 2035, growth is forecast from USD 1,278.9 million to USD 1,805.9 million, adding USD 527.0 million, constituting 58.5% of overall ten-year expansion. This period is characterized by development of highly specialized verification panels tailored for advanced diagnostic applications, including molecular diagnostics, immunoassays, and precision medicine workflows. Expansion is supported by strategic partnerships between panel manufacturers, diagnostic instrument providers, and healthcare organizations. Increased focus on automation compatibility, reproducibility, and integration with next-generation diagnostic platforms accelerates adoption.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 905.7 million |

| Market Forecast Value (2035) | USD 1,805.9 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

The clinical diagnostics verification panels market grows by enabling laboratories and diagnostic professionals to achieve superior assay accuracy and workflow efficiency while maintaining consistent, reproducible test results across multiple platforms. Clinical laboratories face mounting pressure to deliver high-quality diagnostic results within shorter turnaround times, with automated verification panels typically improving validation speed and reliability by 30-50% compared to in-house manual controls, making these panels essential for molecular diagnostics, immunoassays, and clinical chemistry testing.

Rising prevalence of chronic and infectious diseases drives demand for standardized verification tools that ensure precise results for patient diagnosis, therapeutic monitoring, and disease surveillance. Government and institutional initiatives promoting laboratory quality, diagnostic accuracy, and compliance with regulatory standards accelerate adoption of verification panels in hospitals, reference laboratories, and academic research facilities, where these panels have direct impact on test reliability and accreditation. The global trend toward automation and high-throughput diagnostic workflows increases demand, as laboratories seek tools that enable rapid validation of multiple assays simultaneously.

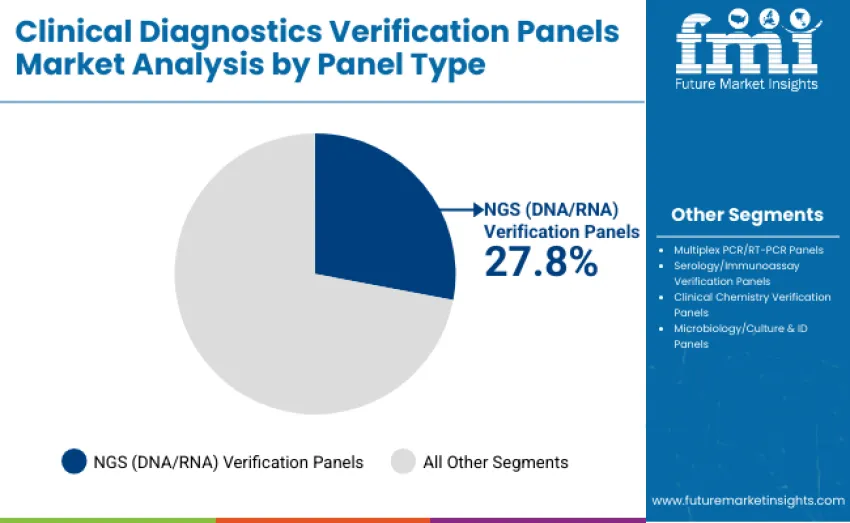

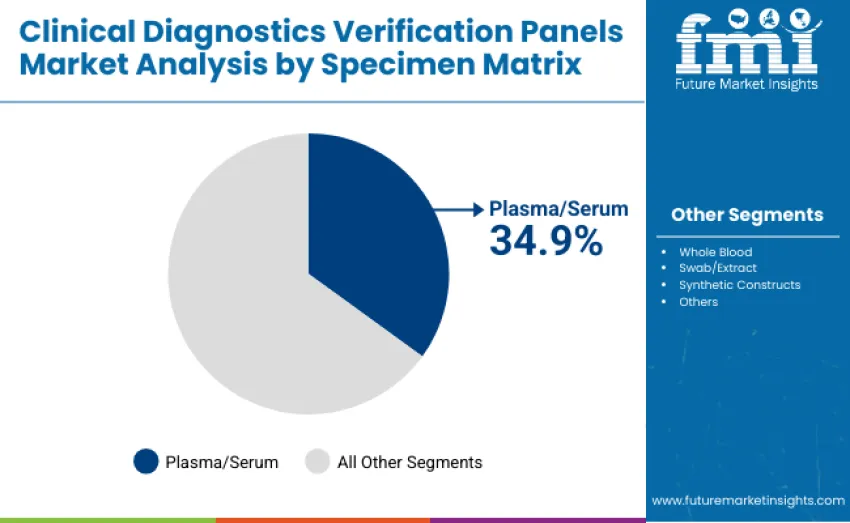

The clinical diagnostics verification panels market is segmented by panel type, specimen matrix, and region. By panel type, classification includes NGS verification panels (DNA/RNA), multiplex PCR/RT PCR panels, serology/immunoassay verification panels, clinical chemistry verification panels, and microbiology/culture & ID panels. In terms of specimen matrix, division includes plasma/serum, whole blood, swab/extract, synthetic constructs, and others. Regionally, segmentation covers Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The NGS (DNA/RNA) verification panels segment dominates the clinical diagnostics verification panels market with a 27.8% revenue share in 2025. Its leadership is driven by growing adoption of next-generation sequencing in genetic testing, oncology diagnostics, and personalized medicine workflows requiring high accuracy and reproducibility. Multiplex PCR/RT-PCR panels follow with 24.6% revenue share, supported by rapid diagnostic applications and high-throughput molecular testing. Serology/immunoassay verification panels account for 18.9%, clinical chemistry panels 12.7%, and microbiology/culture & ID panels hold 16%.

Key Advantages Driving the NGS Verification Panels Segment:

Plasma/serum is the most widely used specimen matrix, capturing 34.9% of revenue in 2025 due to its suitability for a wide range of molecular, immunoassay, and clinical chemistry applications. Whole blood accounts for 18.7%, swab/extract for 16.8%, synthetic constructs for 17.1%, and other specimen types contribute 12.5%, supporting niche research and diagnostic use cases. This distribution reflects the versatility and stability requirements of different diagnostic applications across clinical laboratory settings.

Key Advantages Driving Plasma/Serum Specimen Use:

The clinical diagnostics verification panels market experiences steady growth as in vitro diagnostic testing, laboratory quality assurance workflows, and regulatory compliance requirements intensify globally. Demand is reinforced by increasing adoption of standardized verification and validation protocols, expansion of molecular and immunoassay testing, and growing need to ensure accurate, reproducible results across clinical laboratories. Growth is strongly supported by rising utilization in assay verification, where commercially available verification panels are increasingly preferred for their ability to simulate real clinical samples.

Progression faces constraints from high cost of pre-characterized verification panels relative to conventional quality control materials. Technical complexity associated with handling heterogeneous sample matrices, need for trained laboratory personnel, and batch-to-batch variability introduce adoption challenges. Regulatory requirements for panel validation and certification, particularly across multiple regions, add operational complexity and limit rapid deployment. These challenges require ongoing investment in training, quality systems, and regulatory compliance to ensure successful implementation.

Notable trends include development of multi-analyte panels and customizable verification kits that support diverse assay platforms while reducing turnaround time. Increased integration with automated laboratory instruments, digital workflow management systems, and data reporting software is prioritized to improve efficiency, reproducibility, and compliance documentation. Regional demand growth is led by North America and Europe, where well-established clinical laboratory networks, stringent regulatory frameworks, and advanced quality control programs accelerate adoption. Emerging markets in Asia-Pacific and Latin America follow, supported by expanding diagnostic infrastructure and government healthcare initiatives.

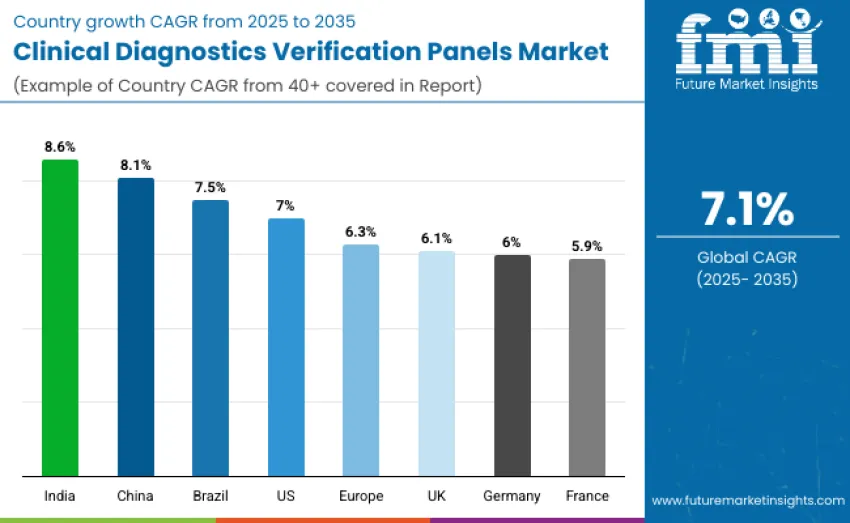

| Country/Region | CAGR 2025 to 2035 (%) |

|---|---|

| United States | 7.0 |

| Brazil | 7.5 |

| China | 8.1 |

| India | 8.6 |

| Europe | 6.3 |

| Germany | 6.0 |

| France | 5.9 |

| United Kingdom | 6.1 |

The clinical diagnostics verification panels market is growing rapidly worldwide. India leads with a 8.6% CAGR, driven by expanding diagnostic labs, increased molecular testing, and government support. China follows with 8.1% growth, fueled by hospital modernization and regulatory needs. Brazil shows strong growth at 7.5%, supported by diagnostic services expansion and rising demand for reliable verification. The USA records 7.0% CAGR, reflecting a mature industry and adoption of advanced panels. Europe grows at 6.3%, with the UK (6.1%), Germany (6.0%), and France (5.9%) contributing through infrastructure and regulatory advancements.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

The clinical diagnostics verification panels market in China is projected to grow at a CAGR of 8.1% from 2025 to 2035. Expansion is supported by modernization of hospitals and diagnostic laboratories in Beijing, Shanghai, Guangzhou, and Shenzhen, where verification panels are deployed to standardize assay performance and ensure analytical accuracy across high-throughput testing facilities. Government policies under the National Health Commission and "Healthy China 2030" initiative provide funding for laboratory upgrades and procurement of standardized verification panels.

Key market factors:

The clinical diagnostics verification panels market in India is projected to grow at a CAGR of 8.6% from 2025 to 2035. Growth is driven by expansion of diagnostic and hospital laboratories in Bengaluru, Mumbai, Hyderabad, and Pune, where verification panels are implemented for immunoassay, hematology, and molecular diagnostics. Government programs under the National Health Mission and Pradhan Mantri Bhartiya Jan Aushadhi Yojana subsidize procurement of panels to improve testing quality and accessibility.

The clinical diagnostics verification panels market in Germany is projected to grow at a CAGR of 6.0% from 2025 to 2035. Adoption is driven by compliance with EU and national regulations, where diagnostic laboratories in Berlin, Munich, and Frankfurt integrate verification panels for immunoassay, molecular, and clinical chemistry testing. Hospitals and academic research centers implement automated platforms for high-throughput testing, improving reproducibility and analytical precision. Collaborations between manufacturers and universities support development of standardized panels, personnel training, and workflow optimization.

Key development areas:

The clinical diagnostics verification panels market in Brazil is projected to grow at a CAGR of 7.5% from 2025 to 2035. Growth is supported by modernization of diagnostic laboratories in São Paulo, Rio de Janeiro, Brasília, and Porto Alegre, where verification panels standardize assay performance for immunoassay, hematology, and molecular testing. Ministry of Health funding programs accelerate procurement of panels in public and private hospitals to improve testing accuracy and operational efficiency.

Leading market segments:

The clinical diagnostics verification panels market in the USA is projected to grow at a CAGR of 7.0% from 2025 to 2035. Growth is driven by adoption in hospitals, clinical laboratories, and academic research centers across California, Massachusetts, Texas, and New York, where verification panels are integrated for immunoassay, molecular, and clinical chemistry testing. Federal grants, including NIH funding, enable procurement of standardized panels to improve reproducibility, assay accuracy, and operational efficiency.

Key market characteristics:

The clinical diagnostics verification panels market in the UK is projected to grow at a CAGR of 6.1% from 2025 to 2035. Growth is facilitated by adoption in NHS laboratories and private diagnostic centers in London, Manchester, Bristol, and Edinburgh, where verification panels are used for assay standardization across immunoassay, molecular, and clinical chemistry workflows. NHS funding programs and university-industry collaborations support platform procurement, workflow standardization, and personnel training.

Market development factors:

The clinical diagnostics verification panels market in France is projected to grow at a CAGR of 5.9% from 2025 to 2035. Growth is driven by the expansion of clinical laboratories and increased adoption of verification panels in hospitals, especially in Paris, Lyon, and Marseille. Investments in molecular diagnostics and immunoassay platforms are enhancing testing accuracy and reliability. Collaboration between French research institutions and diagnostic companies has further strengthened the adoption of advanced panels in clinical settings.

Key market characteristics:

The clinical diagnostics verification panels market in Europe is projected to grow from USD 262.7 million in 2025 to USD 500.2 million by 2035, registering a CAGR of 6.3%. Germany leads with a 27.8% share in 2025, rising to 28.0% by 2035, supported by robust hospital networks, clinical laboratories, and high-throughput diagnostic testing. France holds 21.0% in 2025, increasing to 21.2% by 2035, driven by lab expansion and investments in molecular diagnostics. The UK holds 18.0% in 2025, reaching 18.2% by 2035, bolstered by national lab networks and clinical trial activities. Italy maintains 12.5%, while Spain shows growth from 9.0% to 9.2%. The Netherlands retains 6.0%, and the Rest of Europe grows from 6.7% to 6.8%.

Japan's clinical diagnostics verification panels market is driven by its advanced diagnostics ecosystem, where precision assay validation, standardized control materials, and reproducible performance are prioritized. Demand is high in precision diagnostics, oncology screening, and personalized medicine, requiring panels with consistent analyte concentrations, stability, and regulatory traceability. Laboratories in Tokyo, Osaka, and Yokohama integrate these panels into automated systems, adhering to strict SOPs and regulatory standards. Global suppliers like SeraCare, Thermo Fisher Scientific, Bio-Rad, and Sekisui Diagnostics maintain strong market penetration through partnerships, emphasizing high-quality, consistent performance and patient safety.

South Korea's clinical diagnostics verification panels market relies on international providers offering technical support, workflow integration, and regulatory compliance guidance. As the country advances in molecular diagnostics and immuno-oncology testing, labs require panels compatible with automated platforms and high-throughput services. International suppliers collaborate with national labs and IVD companies in major cities like Seoul, Daejeon, and Busan, providing training and regulatory assistance. The market benefits from South Korea’s growing adoption of automated testing, high-throughput workflows, and integrated quality control solutions, making international providers key partners in strengthening the country's diagnostic infrastructure.

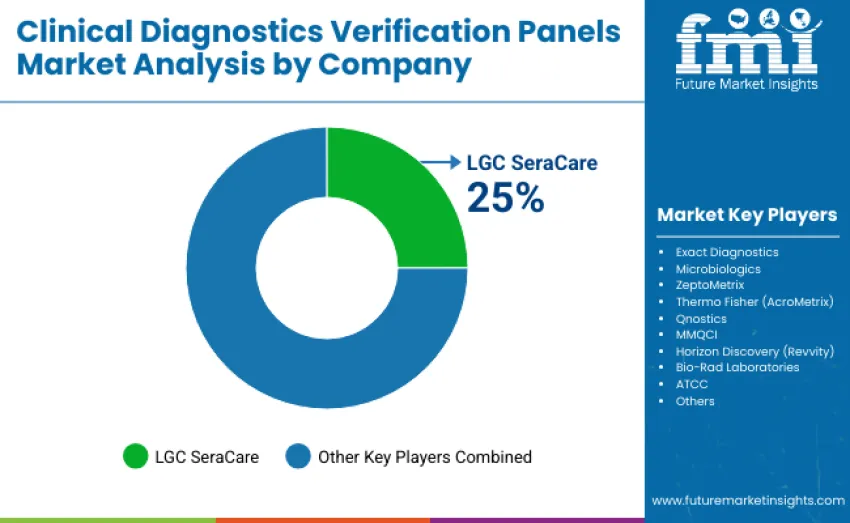

The global clinical diagnostics verification panels market is moderately concentrated, with 12-15 manufacturers competing across molecular diagnostics, infectious disease testing, and quality control applications. The top three players control 50-55% of the global market share, driven by validated product portfolios, reproducibility in assay performance, and adoption across clinical laboratories and molecular testing facilities. Competition is shaped by panel accuracy, sample integrity, regulatory compliance, and workflow integration. LGC SeraCare holds a 25% market share, offering infectious disease panels and high-throughput compatibility. Thermo Fisher's AcroMetrix product line supports molecular and serology assay verification, while Exact Diagnostics is known for rapid assay turnaround and customizable solutions.

Challenger companies, including Microbiologics, ZeptoMetrix, and Qnostics, differentiate through innovation, providing microbiology-specific verification panels, synthetic control materials, and modular formats for mid-sized laboratories and regional markets. These companies focus on specialized diagnostic workflows and regulatory-compliant performance. Niche players like MMQCI, Horizon Discovery, Bio-Rad Laboratories, and ATCC offer custom panels or cost-effective quality control solutions. Emerging suppliers in Asia-Pacific and Latin America intensify competition with affordable verification panels for budget-conscious laboratories, emphasizing cost efficiency and rapid deployment. This competitive landscape fosters innovation and addresses diverse laboratory needs.

| Item s | Values |

|---|---|

| Quantitative Units | USD 905.7 million |

| Panel Type | NGS Verification Panels (DNA/RNA), Multiplex PCR/RT PCR Panels, Serology/Immunoassay Verification Panels, Clinical Chemistry Verification Panels, Microbiology/Culture & ID Panels |

| Specimen Matrix | Plasma/Serum, Whole Blood, Swab/Extract, Synthetic Constructs, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | LGC SeraCare , Exact Diagnostics, Microbiologics , ZeptoMetrix , Thermo Fisher ( AcroMetrix ), Qnostics , MMQCI, Horizon Discovery ( Revvity ), Bio-Rad Laboratories, ATCC / Others, Regional & OEM Suppliers |

| Additional Attributes | Dollar sales by panel type and specimen matrix, regional trends in Asia Pacific, Europe, and North America, competitive landscape, key manufacturers, technical specifications, workflow integration, assay validation, innovations in panel composition, analyte coverage, and advancements in sensitivity and specificity |

The global clinical diagnostics verification panels market is valued at USD 905.7 million in 2025.

The market is projected to reach USD 1,805.9 million by 2035.

The market will grow at a CAGR of 7.1% from 2025 to 2035.

NGS verification panels (DNA/RNA) lead the market with a 27.8% share in 2025.

Key players include LGC SeraCare, Exact Diagnostics, Microbiologics, ZeptoMetrix, Thermo Fisher (AcroMetrix), Qnostics, MMQCI, Horizon Discovery (Revvity), Bio-Rad Laboratories, and ATCC.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Clinical Immunodiagnostics Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Data Management Service Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Clinical Avian Nutrition Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clinical Workflow Solution Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Support Software Solutions Market Size and Share Forecast Outlook 2025 to 2035

Clinical Research Organization Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Clinical Communication and Collaboration Market Size and Share Forecast Outlook 2025 to 2035

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Decision Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trials Market Analysis - Size, Share, and Forecast 2025 to 2035

Clinical Refractometer Market Size and Share Forecast Outlook 2025 to 2035

Clinical Next-Generation Sequencing (NGS) Data Analysis Market Analysis by Solution and Services, Technology, End User, and Region through 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

The Clinical Alarm Management Market is segmented by component, deployment mode and end user from 2025 to 2035

Clinical Nutrition Market Insights – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA