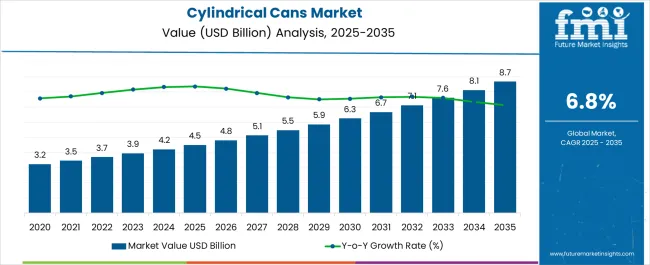

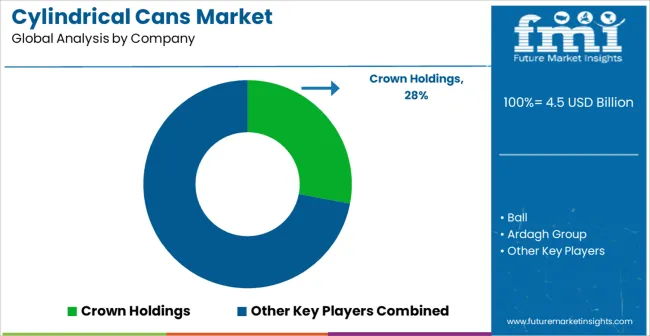

The Cylindrical Cans Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 8.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Cylindrical Cans Market Estimated Value in (2025 E) | USD 4.5 billion |

| Cylindrical Cans Market Forecast Value in (2035 F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The Cylindrical Cans market is demonstrating strong growth momentum as it benefits from rising demand across beverage, food, and industrial packaging sectors. The current market landscape is being shaped by a combination of consumer preference for convenience, increased focus on product safety, and the need for sustainable packaging alternatives. The future outlook is defined by continuous innovation in lightweight materials, improved recyclability, and enhanced printing technologies that allow brands to differentiate on retail shelves.

The ability of cylindrical cans to offer robust protection against contamination and external damage is reinforcing their adoption across diverse industries. Moreover, as global regulations favor recyclable and eco-friendly packaging solutions, cylindrical cans are emerging as a preferred format due to their circular economy advantages.

Growing consumption of ready-to-drink beverages, carbonated products, and pressurized contents is further driving the requirement for durable yet customizable packaging solutions With increasing investment in modern manufacturing facilities and efficient can production technologies, the market is expected to continue on a steady upward trajectory in the years ahead.

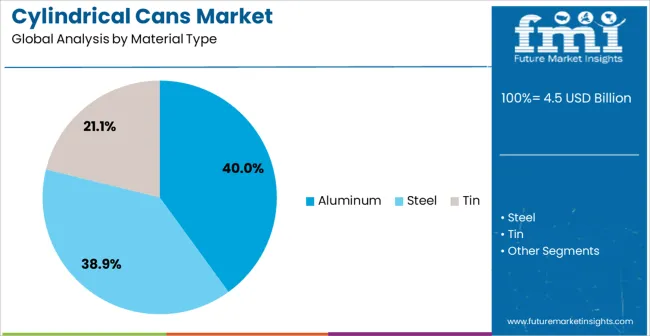

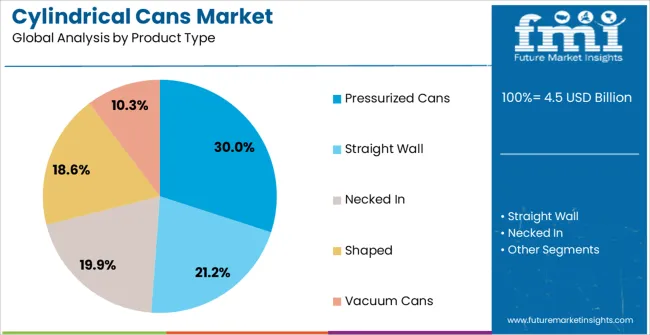

The cylindrical cans market is segmented by material type, product type, structure type, capacity, end use, and geographic regions. By material type, cylindrical cans market is divided into Aluminum, Steel, and Tin. In terms of product type, cylindrical cans market is classified into Pressurized Cans, Straight Wall, Necked In, Shaped, and Vacuum Cans.

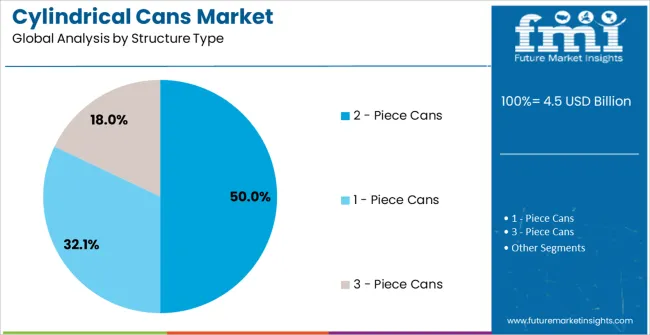

Based on structure type, cylindrical cans market is segmented into 2 - Piece Cans, 1 - Piece Cans, and 3 - Piece Cans. By capacity, cylindrical cans market is segmented into 200 - 500 ml, 30 - 100 ml, 100 - 200 ml, 500 - 700 ml, and More Than 700 ml.

By end use, cylindrical cans market is segmented into Food, Beverages, Pharmaceutical, Personal Care & Cosmetics, Chemicals & Pesticides, and Home Care & Toiletries. Regionally, the cylindrical cans industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Aluminum material type segment is projected to account for 40.00% of the overall Cylindrical Cans market revenue in 2025, making it the leading material category. The dominance of this segment is being driven by aluminum’s exceptional recyclability and lightweight characteristics, which reduce transportation costs while supporting sustainability goals. Aluminum offers superior barrier protection against light, oxygen, and moisture, thereby ensuring longer shelf life for beverages, food products, and pharmaceuticals.

Its compatibility with high-speed manufacturing processes and advanced printing techniques has also enhanced its appeal to brand owners seeking impactful packaging. Consumer preference for recyclable and eco-friendly packaging has further reinforced the adoption of aluminum cylindrical cans in both developed and emerging markets.

The increasing alignment of industries with circular economy principles has encouraged the use of aluminum, given its ability to be recycled indefinitely without losing quality These attributes, combined with ongoing investments in recycling infrastructure, are anticipated to sustain the material’s leadership in the market over the long term.

The Pressurized Cans product type segment is expected to hold 30.00% of the Cylindrical Cans market revenue in 2025, underscoring its strong position in the industry. Growth in this segment is being propelled by the rising demand for packaging formats that can safely contain carbonated and pressurized contents such as soft drinks, beer, and aerosol-based consumer products. Pressurized cans provide a reliable and tamper-resistant solution that maintains product integrity under varying temperature and handling conditions.

Their ability to withstand internal pressure while ensuring consistent quality has made them an essential choice for beverage companies and household product manufacturers. Additionally, the convenience and portability offered by pressurized cans have led to their widespread adoption in on-the-go consumption trends.

Regulatory emphasis on safe packaging standards has also favored the use of these cans across multiple industries With increasing consumer demand for ready-to-drink and spray-based products, coupled with the ability of manufacturers to scale production efficiently, pressurized cans are expected to remain a critical product category within the market.

The 2 Piece Cans structure type segment is anticipated to capture 50.00% of the Cylindrical Cans market revenue in 2025, making it the leading structural format. This strong position is being attributed to its cost efficiency, material savings, and improved strength compared to alternative formats. The seamless body of 2 piece cans eliminates the need for side seams, providing superior protection against leaks and contamination, which is critical for beverages and food products.

The design also allows manufacturers to use less material while maintaining durability, contributing to lower production costs and higher sustainability. The popularity of 2 piece cans has been reinforced by their compatibility with high-speed manufacturing lines, which reduces operational expenses and enables large-scale supply.

The lighter weight of this structure type supports efficient logistics and aligns with global sustainability trends With increasing demand for reliable and eco-conscious packaging, the 2 piece can format is projected to continue leading the market, supported by its adaptability and widespread acceptance across industries.

In recent years cylindrical cans are one of the most important packaging type. Cylindrical cans are air tight metal cans used for storage of several end use applications like food & beverages, personal care & cosmetics, pesticides, etc.

Most popular known cylindrical cans available in the market is aerosol cans which are used for storing liquid items. This type of cylindrical cans have liquefied or compressed gas propellant which would help in spraying aerosol mist for liquid items like deodorants, lubricants, etc.

In addition, some of the cylindrical cans contains aerosol propellants like carbon dioxide, butane and propane for better dispensing of the product. Cylindrical cans made up of aluminum is progressively gaining market share because it provides perfect barrier protection against humidity, air, light, germs, etc.

Furthermore, corrosion resistance of aluminum cylindrical cans helps in protection the aerosol content from deterioration. Cylindrical cans can be found in different with different structures like 1 piece, 2 piece and 3 piece depending on the usage of the container.

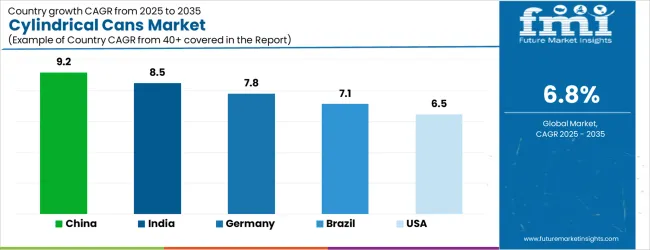

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

| UK | 5.8% |

| Japan | 5.1% |

The Cylindrical Cans Market is expected to register a CAGR of 6.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.2%, followed by India at 8.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 5.1%, yet still underscores a broadly positive trajectory for the global Cylindrical Cans Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.8%.

The USA Cylindrical Cans Market is estimated to be valued at USD 1.6 billion in 2025 and is anticipated to reach a valuation of USD 1.6 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 243.0 million and USD 137.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Material Type | Aluminum, Steel, and Tin |

| Product Type | Pressurized Cans, Straight Wall, Necked In, Shaped, and Vacuum Cans |

| Structure Type | 2 - Piece Cans, 1 - Piece Cans, and 3 - Piece Cans |

| Capacity | 200 - 500 ml, 30 - 100 ml, 100 - 200 ml, 500 - 700 ml, and More Than 700 ml |

| End Use | Food, Beverages, Pharmaceutical, Personal Care & Cosmetics, Chemicals & Pesticides, and Home Care & Toiletries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Crown Holdings, Ball, Ardagh Group, Silgan Holdings, Allied Cans, Independent Can, Daiwa Can, Illinois Tool Works, Toyo Seikan Group, and Massilly Holding |

The global cylindrical cans market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the cylindrical cans market is projected to reach USD 8.7 billion by 2035.

The cylindrical cans market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in cylindrical cans market are aluminum, steel and tin.

In terms of product type, pressurized cans segment to command 30.0% share in the cylindrical cans market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cylindrical Grinders Market Growth - Trends & Forecast 2025 to 2035

Cans Market Analysis – Innovations & Industry Forecast 2025 to 2035

Tin Cans Market

Bowl Cans Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Bowl Cans Manufacturers

Food Cans Market

Beer Cans Market

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Jerry Cans Market Size and Share Forecast Outlook 2025 to 2035

Drink Cans Market Insights - Growth & Trends 2025 to 2035

Industry Share & Competitive Positioning in Jerry Cans

Market Share Insights of Paint Can Manufacturers

2 Piece Cans Market Size and Share Forecast Outlook 2025 to 2035

Beta-Glucans Market Trends – Growth, Demand & Forecast 2025 to 2035

Industry Share Analysis for 2-Piece Cans Companies

Plastic Cans Market

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Bi-metal Cans Market Size and Share Forecast Outlook 2025 to 2035

Sanitary Cans Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of the Aluminum Cans Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA