The dairy alternatives market is projected to grow from USD 24.8 billion in 2025 to USD 50.2 billion by 2035, registering a CAGR of 7.3% over the forecast period. This expansion is being driven by increased demand for plant-based nutrition, rising lactose intolerance globally, and shifting consumer preferences toward sustainable and ethical food sources.

| Metrics | Values |

|---|---|

| Industry Size 2025 | USD 24.8 billion |

| Industry Value 2035 | USD 50.2 billion |

| CAGR 2025 to 2035 | 7.3% |

Products such as plant-based milk, yogurts, cheeses, and butters are gaining traction due to their improved taste, functional benefits, and cleaner labels. Growth is further supported by advancements in plant protein extraction, emulsification technology, and fortification with calcium and vitamins to mimic the nutritional profile of dairy.

The dairy alternatives market is projected to reach USD 24.8 billion in 2025, driven by increasing consumer demand for plant-based and lactose-free products. Within the plant-based beverage market, dairy alternatives hold a significant share of approximately 20-25%, led by almond, soy, and oat milk. In the non-dairy yogurt segment, they contribute around 15-20%, as consumers seek probiotic-rich, dairy-free snacks.

The non-dairy cheese market sees a 10-12% share from dairy alternatives, supported by innovation in flavor and texture. Within the broader food and beverage ingredients market, dairy alternatives account for 1-2%, reflecting their growing use in cooking, baking, and product formulations. Additionally, in the functional ingredients space, they hold a 1-3% share, due to enrichment with nutrients like calcium, B12, and probiotics.

Consumer interest in vegan diets, animal-free production systems, and low-carbon food alternatives is fueling rapid expansion. In developed markets, dairy alternatives are becoming mainstream in coffee chains, school meal programs, and retail refrigerated shelves. Emerging markets are also experiencing growth, driven by rising awareness and urbanization.

Strategic investments in research and development, flavor enhancement, and cross-category innovation-especially in barista blends, protein-enriched formats, and shelf-stable beverages-are expected to accelerate global adoption.

In October 2024, Dr. Arik Ryvkin, CEO and Founder of DairyX, shared insights on the company’s progress in precision fermentation for dairy alternatives. Reflecting on the potential of animal-free dairy production, he stated, “We now bring the last step in that line of evolution. helping dairy companies make the exact products consumers desire while helping cows live happier lives.” This marks a significant step toward ethical, scalable dairy innovation (The Guardian, October 1, 2024).

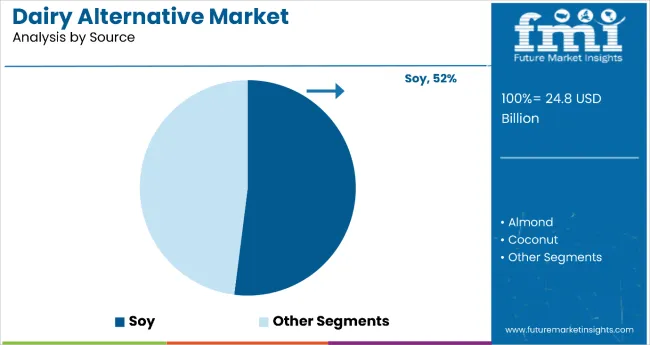

Soy holds the dominant position with 52% of the market share in the source category within the dairy alternatives market. This leadership is driven by soy's exceptional nutritional profile, including high-quality plant-based protein content that closely matches traditional dairy products, making it the preferred choice for health-conscious consumers and those with dietary restrictions. Soy-based products offer superior versatility across multiple applications including milk, yogurt, cheese, and ice cream alternatives, while providing essential vitamins, minerals, and amino acids that support balanced nutrition.

The segment's dominance is reinforced by soy's established manufacturing infrastructure, cost-effectiveness, and proven consumer acceptance across diverse global markets. Key players such as The Hain Celestial Group, Inc. and SunOpta Inc. continue significant investments in expanding soy product offerings to meet growing demand. Soy cultivation generally maintains a lower ecological footprint compared to traditional dairy farming, aligning with environmental sustainability trends. As consumers increasingly prioritize plant-based diets and seek nutritionally complete dairy alternatives, the soy segment is positioned to maintain its market leadership through continued innovation in flavor profiles, texture enhancement, and functional ingredient integration.

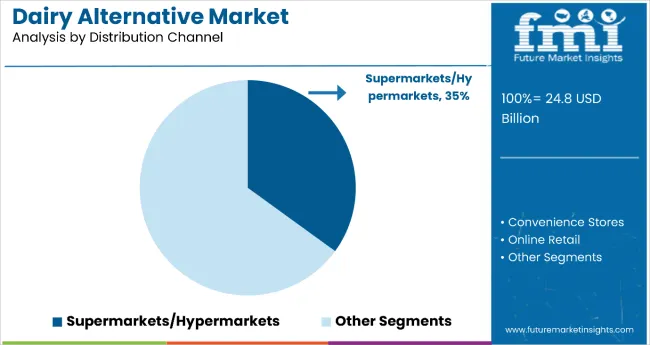

Supermarkets and hypermarkets dominate the dairy alternatives market with 35% of the market share in the distribution channel category. This leadership is attributed to these large-scale retail formats' ability to provide comprehensive product assortments, convenient one-stop shopping experiences, and extensive geographical coverage that makes dairy alternatives accessible to mainstream consumers. These retail outlets offer dedicated shelf space for various dairy alternative brands across multiple price points, enabling consumers to compare products and make informed purchasing decisions.

The segment's dominance is reinforced by rising investments from both international and domestic retailers seeking to establish presence in rapidly expanding markets, coupled with increasing consumer purchasing power in developing economies. Major brands like Danone and Oatly strategically increase their presence in supermarkets and hypermarkets to reach broader audiences through enhanced product visibility and promotional opportunities. As modern retail infrastructure continues to expand globally and consumers prioritize convenience in their shopping experiences, the supermarkets/hypermarkets segment is expected to maintain its leading position through continued investment in store expansion, product variety enhancement, and customer experience optimization.

Emergence of Vegan Lifestyle and Adoption of Nutrient-rich Diet

The market's growth is fueled by evolving consumer preferences and lifestyle choices. There is a rising adoption of plant-based diets, leading to an increase in demand for dairy alternatives.

Several people are highly inclined toward consuming food products rich in proteins, minerals, and vitamins, which is driving the market further. For example, almond milk's vitamin E and manganese content are high, which helps improve skin quality and protect against cancer.

Rising Awareness about Lactose Intolerance Facilitates a Shift Toward Dairy Alternatives

The rise in the number of people allergic to dairy products and the growing awareness of lactose intolerance and problems related to the condition bolstered growth in the dairy alternative market. Patients are shifting toward lactose-free food and beverages to alleviate their condition. The preference for dairy counterparts is also rising due to animal welfare and sustainability concerns.

Limited Availability of Raw Materials

The production of dairy alternatives largely depends on the cultivation of crops such as soy, almond, and rice. Shortage of these raw materials due to seasonal and climatic variations acts as a restraint in the market. Besides, rising industrialization and urbanization are leading to deforestation, resulting in less space for agricultural production. This is also expected to pose a threat to the growth of the market, limiting the availability of raw materials.

Allergies Pertaining to Soy and Nuts

The prevalence of food allergies and sensitivities related to soy and nuts is one of the major aspects that restrict market expansion. Nuts and soy are majorly used for the production of dairy alternatives. They are potential allergens causing severe reactions like fever and rashes in people who are susceptible to soy and nuts, and thus, restrict the market’s expansion.

Supply Chain Disruptions

As the market for dairy alternatives is highly dependent on the agriculture sector, cultivation and transportation of the produce are crucial for the market’s growth. Disruptions in the supply chain due to improper management at different stages of transit can inhibit the progress of the market.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.3% |

| China | 3.5% |

| Germany | 8.8% |

| India | 6.8% |

| United Kingdom | 4.9% |

The United States dairy alternative market is predicted to rise at a CAGR of 4.3% over the forecast period. The United States is the prominent market for dairy substitutes, with rising demand for sweetened flavored soy and almond milk.

Consumers increasingly prefer a wide range of yogurt and ice cream made from dairy alternatives. Additionally, the growing trend of veganism is also driving sales of dairy alternatives in the United States.

The United Kingdom dairy alternative market is projected to grow at a CAGR of 4.9% from 2025 to 2035. The popularity of vegan diets in the United Kingdom is shifting consumers from animal protein to plant protein.

This preference for plant-based diets is driven by ethical beliefs, sustainability concerns, health awareness, and environmental and animal rights concerns, leading to market expansion.

In Germany, the dairy alternative market is expected to register a CAGR of 8.8% over the forecast period. The demand for healthy foods and drinks is rising in Germany due to the growing health-conscious population. Dairy alternative-based beverages are frequently consumed as dairy replacements, and manufacturers are focusing on innovative product development, such as soy juice blends and fresh soy drinks, to capture the market. Sales of beverages made from dairy alternatives are rising, driven by the increasing consumer demand for vegan-friendly cuisine.

In India, the dairy alternative market is expected to rise at a 6.8% CAGR from 2025 to 2035. Health concerns about antibiotics and growth hormones in cow's milk are pushing consumers toward dairy alternatives.

The consumption of milk alternatives has steadily increased, fueled by the rising number of vegans in India. Fortified soy milk, which provides the same amount of protein as cow's milk and is a rich source of vitamin D and calcium, is very popular. Brands like Sofit and Staeta's almond and soy milk are gaining popularity in India, offering dairy alternative beverages.

In China, dairy alternative market is projected to expand at a CAGR of 3.5% over the forecast period. Rising disposable incomes and an expanding population in China are likely to boost demand for dairy alternatives.

The demand for soy milk, almond milk, rice milk, and other dairy substitutes is expected to grow. Increased health concerns related to toxic additives in dairy products, along with rising incidences of lactose intolerance, are driving the market forward.

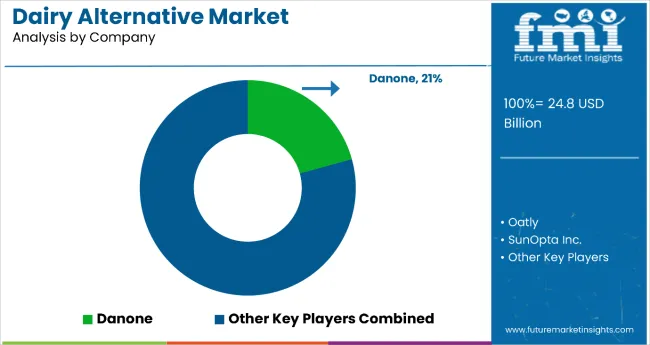

The dairy alternative market is led by major food and beverage companies that offer plant-based beverages, yogurts, and spreads catering to lactose-intolerant, vegan, and health-conscious consumers. Danone, The Hain Celestial Group, Inc., and Oatly dominate the global space with strong brand portfolios, advanced R&D, and extensive distribution networks.

Key players such as SunOpta Inc., Ripple Foods, Blue Diamond Growers, and Vitasoy International Holdings Limited focus on innovative formulations using oats, almonds, soy, and peas, while expanding rapidly in North America, Europe, and Asia-Pacific. Specialized brands including DAIYA FOODS INC., Living Harvest Foods Inc., Earth’s Own Food Company Inc., and Melt Organic are gaining traction for their allergen-friendly and organic offerings.

Emerging companies and ingredient suppliers like CP Kelco, Nutriops, S.L., and Freedom Foods Group Ltd. support growth through functional ingredients and clean-label solutions.

Recent Industry Developments

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 24.8 billion |

| Projected Market Size (2035) | USD 50.2 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion |

| By Source | Soy, Almond, Rice, Coconut, Oats, Others (Pea, Cashew, Hemp, Macadamia, and Flax) |

| By Product Type | Non-dairy Milk, Butter, Cheeses, Yogurts, Ice Cream, and Others (Non-Dairy Creamers, Non-Dairy Sauces, Non-Dairy Frozen Desserts, Non-Dairy Spreads) |

| By Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others (Specialty Stores, Health Food Stores, Direct-To-Consumer, Farmers' Markets) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa |

| Countries Covered | United States, United Kingdom, France, Germany, Japan |

| Key Players | The Hain Celestial Group, Inc., SunOpta Inc., Danone, Oatly, Vitasoy International Holdings Limited, DAIYA FOODS INC., Freedom Foods Group Ltd., Living Harvest Foods Inc., The Whitewave Foods Company, Earth’s Own Food Company Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

Global dairy alternatives revenue is projected to rise from USD 24.8 billion in 2025 to USD 50.2 billion by 2035, registering a CAGR of 7.3%.

The soy segment holds a 52% market share in 2025, remaining the cornerstone of the dairy alternative market due to its high protein content, affordability, and versatility.

The non-dairy milk segment is projected to grow at the highest CAGR of 7.3% from 2025 to 2035, driven by the shift toward plant-based diets and lactose-free preferences.

Key drivers include rising consumer awareness of lactose intolerance, veganism, environmental sustainability, and health concerns, alongside innovations in plant-based products.

Top companies include Danone, Oatly, ADM, Blue Diamond, focusing on oat milks, fortified yogurts, and organic coconut desserts.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Dairy Alternatives in the EU Size and Share Forecast Outlook 2025 to 2035

Pea Protein Demand in Dairy Alternatives Analysis - Size Share and Forecast outlook 2025 to 2035

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA