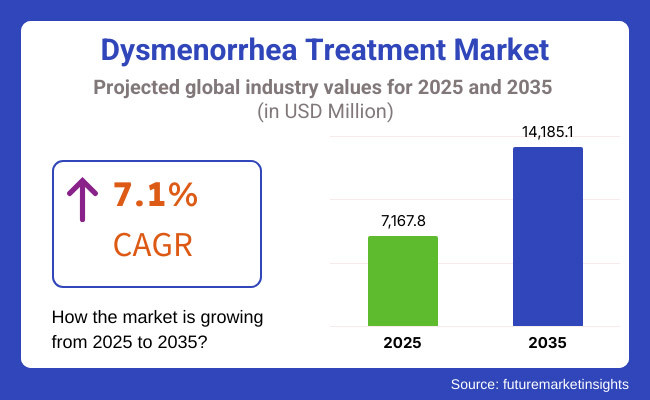

The global market for dysmenorrhea treatment is forecasted to attain USD 7,167.8 million by 2025, expanding at 7.1% CAGR to reach USD 14,185.1 million by 2035. In 2024, the revenue of this market was around USD 6,727.3 million.

Over the years, as more women realize menstrual health and there are rising complaints on extreme pain during their periods, dysmenorrhea treatments were catching more demand. So their use could further drive the market for pain relief options which are medications, hormonal treatments, and alternative therapies. Drug companies are trying to develop combination therapies and also develop duration classes of pain relief products that are thought to be better but easier for women to use.

Women are increasingly using NSAIDs and hormonal contraceptives to alleviate menstrual pain, driving growth in the market. Many also prefer OTC painkillers-the ones that regular folks can use without needing special training or consultation for their purchase-which makes them much more accessible. The industry players are bringing in new solutions-such as pain relief patches, heat therapy devices, and natural supplements-that offer some non-invasive options for those preferring alternative treatments.

There might be increased intervention of technology in the future treatments of dysmenorrhea. Digital health tools, such as period-tracking applications, help women find suitable therapy treatments for dysmenorrhea. Researchers are also trying to find novel treatments such as neuromodulation and cannabinoid-based treatments. New opportunities will materialize for market development leading to better answers for women experiencing dysmenorrhea.

Dysmenorrhea historically received scant attention while available treatments remained scarce. Women frequently depended on a combination of home remedies and herbal solutions alongside traditional pain management techniques such as heat therapy. Through medical progress non-steroidal anti-inflammatory drugs (NSAIDs) and hormonal contraceptives emerged as standard treatments for menstrual pain management.

The rise in menstrual health consciousness led pharmaceutical companies to create more potent pain relief drugs. The widespread acceptance of over-the-counter (OTC) pain relievers emerged which facilitated more accessible treatment options. Scientific investigation into dysmenorrhea progressed which resulted in enhanced comprehension of its underlying causes and possible treatment targets.

Throughout history businesses developed various alternative treatments including transdermal patches, dietary supplements, and non-invasive pain relief devices. Treatment approaches began to evolve under the combined influence of digital health tools and personalized medicine. Through this evolution the market transformed into a structured innovative space while dysmenorrhea emerged as a recognized major health issue.

A sophisticated healthcare network combined with rising digital menstrual tracking and widespread pain medication use positions North America as the leader in the dysmenorrhea treatment market. The USA The region dominates through robust consumer demand for OTC NSAIDs combined with hormonal contraceptives used for menstrual regulation and cutting-edge wearable pain relief devices.

The healthcare landscape continues to grapple with persistent obstacles including exorbitant medication prices alongside hormonal therapy side effect concerns and a widespread lack of awareness about non-pharmaceutical options. Telemedicine consultations for menstrual health combined with non-invasive treatment advancements and increased femtech investment will propel North American market expansion.

Due to favorable health policies, increased awareness campaigns regarding menstrual health, and the rise in popularity of alternative therapies, Europe has become an important market for dysmenorrhea treatment. Countries such as Germany, France, and the UK are the leading markets with greater access to pain management solutions and a strong consumer preference for herbal alternatives.

However, barriers to growth include regulatory restrictions on hormonal medication, cost limitations of newly developed pain-relief devices, and differences in healthcare access across regions. The ongoing incorporation of menstrual health tracking into digital health platforms, increasing interest in non-hormonal pain relief mechanisms, and expansion of governmental initiatives for improving menstrual healthcare shape the landscape of the European market.

The Asia-Pacific region is seeing big growth in treatments for menstrual pain. More people are paying attention to women’s health. Access to healthcare is getting better, and more women are open to non-drug options for pain relief.

Remember countries like China, Japan, and India. They’re leading the way in using herbal and traditional medicine for cramps. There’s also a rising need for affordable over-the-counter pain relief. Plus, governments are pushing for better women’s health care.

But there are still some issues. Cultural taboos can make it hard to talk about these topics. Many people in rural areas don’t know enough about available solutions. Also, not everyone can afford treatments. On the bright side, menstrual health apps are getting popular.

Local drug makers are stepping up to make cheaper pain relief options. Wearable technology for pain management is also becoming a thing. All these factors are helping grow this market in the region.

Challenges

Lack of accurate diagnosis and awareness is a major challenge

In the dysmenorrhea therapeutic market, there are various challenges that arise, and one such challenge is insufficient diagnosis and lack of awareness. It is well-known that a majority of woman consider menstrual pain as a part of life and, therefore, they do not seek treatment leading toward underdiagnosis and undertreatment.

Sometimes, health providers also ignore dysmenorrhea such as in cases where it is secondary and caused due to conditions like endometriosis or fibroids. Delay in diagnosis and treatment these disorder prevents patients from finding suitable treatment, thus impeding market growth.

Additionally, certain regions' cultural stigma surrounding menstruation discourages women from talking about their symptoms, which only worsens the situation for getting treatment. And therefore, pharmaceutical companies and medical device companies face challenges when trying to penetrate these underserved markets.

On the other hand, the barrier on the supply side may be overcome through education and awareness campaigns, together with a good screening method. If healthcare access for women were made available and communication with the physician was better, more women would receive effective treatment for dysmenorrhea, facilitating market growth.

Opportunities

Growing demand for non-invasive and natural treatment options present lucrative growth opportunity

The need for non-invasive and natural means of treatment may be one of the most crucial opportunities for the dysmenorrhea treatment market. Growing concerns over the side effects and risk of addiction to long-term drugs, for instance, the NSAIDs and hormonal therapies, have made women drift their choices away from traditional pharmaceuticals. This opens a void for alternative solutions-including herbal supplements, dietary changes, acupuncture, and transdermal pain relief patches.

On the other hand, wearable heat therapy devices and digital health products, including period-tracking apps with recommendations for personalized treatments, are emerging as a trend. Companies that embrace these novel and non-invasive approaches are organizing themselves to welcome a large consumer base that is looking for less harmful and more holistic options.

By emphasizing their research and product development in this area, they can expand into newer markets and respond to the changing preferences of women in their quest for effective, side-effect-free management of dysmenorrhea.

Women are selecting for dysmenorrhea for non-hormonal and natural medicine as they are interested in avoiding the side effects of standard drugs. Non-hormonal supplements such as ginger, turmeric, and chest berry are gaining fame due to their anti-inflammatory effects and pain blockage. In addition, dietary intervention in the form of magnesium and omega -3 intake is examining as natural methods to remove menstrual spasms.

Wearable pain relief techniques such as tens (transcutaneous electrical nerve stimulation) units and heat therapy patches provide relief from drug-free pain and are becoming increasingly popular.

Markets are growing for transdermal patches such as plant-based analgesic and non-invasive, minimum invasive therapy because consumers seek relief from overall pain for a long time. Increasing awareness and product availability runs the market for new development opportunities for non-hormonal remedies, provides safe options for traditional dysmenorrhea treatments

The convergence of AI-driven period-tracking apps and telemedicine platforms is revolutionizing the way dysmenorrhea is treated. The apps enable women to monitor their menstrual cycles, interpret pain patterns, and obtain customized treatment suggestions. Through the application of AI and big data, clinicians can customize pain management approaches according to individual symptoms and health profiles.

Telemedicine platforms are increasingly allowing women to access healthcare remotely, allowing early intervention and adaptation of treatment. Precision medicine also is facilitating patient-tailored hormonal and non-hormonal treatments, which lower the chances of trial-and-error therapies and enhance outcomes for patients.

All these advances better enhance adherence to treatment and performance, with targeted and accessible measures to manage dysmenorrhea. As people embrace digital health more, there is an anticipation that it will substantially enhance menstrual pain diagnosis and treatment across the world.

Between 2020 to 2024, further momentum has been added to the already expanding market for dysmenorrhea treatment in light of menstrual health awareness and demand for effective pain management. Greater attention being paid to women's health due to advocacy and educational programs has raised diagnosis and treatment rates.

Also, the very fact that OTC medications are now being sold freely, coupled with the advent of advanced pharmaceuticals, such as combination therapy and extended-release relief, has enhanced this growth.

Moving forward, between 2025 to2035, trends which will continue to offer growth include non-pharmacological and natural therapies that consumers prefer now more than ever, including herbal nutritional supplements, transdermal patches, and wearables for pain management. Digital health technologies like AI-driven period tracking apps and personalized treatment advice will likely engage patients more effectively.

Additionally, increasing investments in healthcare, particularly in emerging markets, and growth in e-consulting will further increase access to treatment modalities. Innovation and sustainability with collaborative strategies will be the subsequent forces that will shape the marketing arena as it evolves and will provide a whole new basket of solutions for the effective management of dysmenorrhea.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focus on new painkillers' safety and effectiveness, along with regulatory authority support for the fast-tracking of treatments for medical needs not addressed. |

| Technological Advancements | Use of sophisticated non-steroidal anti-inflammatory drugs (NSAIDs) and hormone therapies with an increased specificity to treatment and limited side effects. |

| Consumer Demand | Growing awareness resulting in increased demand for efficacious and affordable treatments, where patients demand therapies that provide enhanced quality of life and disease control. |

| Market Growth Drivers | Increasing incidence of dysmenorrhea, heavy expenditure on research and development, and favorable government policies encouraging therapeutic innovation. |

| Sustainability | Early efforts at "green" manufacturing processes and reducing the footprint of pharmaceutical production, with some companies adopting green chemistry principles. |

| Supply Chain Dynamics | Reliance on established distribution networks, with a focus on availability of therapies in urban and peri-urban health facilities, sometimes leading to a problem of accessing distant villages.. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Inclusion of full sets of guidelines to personalized medicine and innovative therapeutic techniques, guaranteeing uniform protocols as well as safeguarding patients. |

| Technological Advancements | Application of artificial intelligence and machine learning to drug discovery and development, which results in the discovery of new therapeutic targets and treatment regimen optimization. |

| Consumer Demand | Increased demand for customized treatment regimens, with the patients and treating physicians working together to customize therapies to individual disease features and patient health profiles. |

| Market Growth Drivers | Geographical expansion in growing markets with developing healthcare infrastructures, more emphasis on early intervention and diagnosis, and pharmaceutical collaborations with research centers to promote innovation. |

| Sustainability | Widespread adoption of sustainable practices, including use of biodegradable products, energy-efficient manufacturing processes, and reducing carbon footprints associated with drug development and transport. |

| Supply Chain Dynamics | Supply chain optimization via digital technologies and e-commerce platforms, improving transparency, efficiency, and access, guaranteeing timely delivery of therapies to a worldwide patient population, including individuals in remote and underserved areas. |

The United States has a large market share in the treatment of dysmenorrhea because of the prevalence of menstrual pain among women and growing awareness of the treatment available. Increased availability of over-the-counter painkillers, hormonal treatments, and alternative therapies, coupled with technological advancements in digital health solutions, is also contributing to the growth of the market in the country.

The reasons contributing to this growth include

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.0% |

Market Outlook

When it comes to efforts in treatment and reduction of dysmenorrhea, Germany has a solid healthcare infrastructure. The healthcare system has research on women and their health, uptake of new medical interventions and elaborate healthcare institutions; all these drive the growth of the market. The rise in cases of dysmenorrhea will be checked by all these efforts to support in pain relief as they invest in the treatment of dysmenorrhea.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.4% |

Market Outlook

China's dysmenorrhea treatment market is growing steadily, aided by its well-developed healthcare system and continuous women's health studies. Greater awareness, increasing access to pharmaceuticals and non-hormonal drugs, and the incorporation of traditional Chinese medicine with contemporary therapies are fueling demand. Growing investments in healthcare and government efforts to enhance women's reproductive health also promise to further accelerate market growth in the next few years.

Factors in Market Growth

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.1% |

One of the major reasons why India's market for the treatment of dysmenorrhea will witness visible proliferation is the enhancement of health infrastructure and awareness of women's health issues on the rise. These will raise the amount of the treatments, alongside increased acceptance of alternative therapies, while on top; governments will step up menstrual health education initiatives. The nationwide expansion of quick telemedicine services and the accessibility of OTCs will also add substantially to this market growth.

Market Growth Factors-Underlying Causes

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 10.0% |

The treatment market for dysmenorrhea in Brazil is growing, fueled by increasing health expenditure and improving awareness of female health issues. Expanded access to pain relief treatments, access to over-the-counter and prescription medications, and improvement in gynecological treatment are all contributing to the growth of the market. Government programs and widening health insurance coverage also continue to enhance the accessibility of treatment, driving steadily increasing market growth.

Here are some reasons for the growth

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 7.3% |

Non-steroidal anti-inflammatory drugs are expected to dominate as they have lesser side effects

Ibuprofen and naproxen are the most commonly suggested non-selective NSAIDs that should be used on a first-line basis to treat dysmenorrhea, where the pain is effectively relieved after prostaglandin production had been curtailed. These medications are obtainable and cost-effective OTCs that many patients prefer for their fast pain-relieving effect.

Growing demand for non-prescription medicines for treating menstrual pain, escalating awareness of the efficacy of NSAIDs, and increasing e-commerce sales of subsidiary analgesics are roofed up driving factors for market growth. North America and Europe register higher acceptance of NSAIDs, while Asia-Pacific is showing a positive trend because of access to self-care medications.

The future trends may include Artificial Intelligence-enabled monitoring applications that run apps recommending personalized doses of NSAID, next-generation NSAIDs that will trigger fewer gastrointestinal effects, or prolonged-release NSAID formulations allowing longer relief.

Hormonal therapy segment holds the second largest share due to their effectiveness in managing dysmenorrhea

Hormonal therapy is the most rapidly increasing therapy in the dysmenorrhea treatment market because of its efficacy in the management of both primary and secondary dysmenorrhea. A majority of women suffer from intense menstrual cramps owing to hormonal imbalances, thus oral contraceptives, progestin therapies, and hormonal IUDs are highly effective in symptom reduction.

Increased demand for long-term solutions rather than pain management for a short time is fueling demand for hormonal treatments. Increasing awareness of menstrual care as well as improved access to gynecologic care are motivating more women to go for medical care.

Pharmaceutical development has also enabled the creation of safer, low-dose hormonal alternatives with minimal side effects. With increasing women seeking consistent and effective pain management, hormonal therapy is increasingly on the rise, driving its accelerated market growth.

Primary dysmenorrhea segment will dominate as it is the major application

Most common menstrual pain is called primary dysmenorrhea, experienced by many menstruating women especially adolescent and young adults. It causes pain in the lower abdomen due to contractions of the uterus due to excessive prostaglandin production and provides severe cramping pain in the lower abdomen.

Rising Menstrual Health Awareness coupled with increasing accessibility to over-the-counter pain relief agents combined with growing inclination on non-invasive treatment options like NSAIDs and transdermal patches attribute to the market growth. North America and Europe are the largest adopters of treatments for primary dysmenorrhea, while Asia-Pacific is fast catching up and showing promising growth due to heightened awareness in healthcare and increased access to pain management solutions.

Future innovations in this area would likely include AHM-driven menstrual cycle tracking for personalized pain management, wearable transdermal drug delivery patches, and non-invasive neuromodulation devices for pain relief.

Secondary dysmenorrhea is also a key segment due to the rising prevalence of endometriosis.

This market for dysmenorrhea treatment will likely open up with good prospects due to the rising rates of underlying pathologies such as endometriosis, uterine fibroids, and pelvic inflammatory disease. Unlike primary dysmenorrhea, which is absence of any identifiable disorder, secondary dysmenorrhea requires special medical attention thus the rising need for alternative treatment modalities.

Awareness and better diagnostic methods are encouraging women to seek medical treatment due to severe, continuous abdominal pain during menstruation. Furthermore, pharmaceutical trial and the advent of hormonal therapies and anti-inflammatory drugs provide patients with important solutions for dealing with secondary dysmenorrhea.

Healthcare providers are focusing on educating women on early recognition of menstrual pains and early intervention in the diagnosis. Because of this structure, there is a significant increase in demands for drugs, new surgical interventions, and alternative therapies. Thus, secondary dysmenorrhea is the one fastest-growing segment in the market.

The market for treating menstrual pain is really competitive. More and more women are dealing with this issue. People are becoming more aware of women’s health. Plus, new pain relief methods are hitting the scene. Companies are putting money into drugs that help with inflammation. They’re also looking at hormonal treatments and alternative therapies. Big pharma companies, women’s health experts, and newer biotech firms are all trying to improve the way we manage menstrual pain.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Novartis AG | 12- 15% |

| F. Hoffmann-La Roche Ltd | 10 - 12.5% |

| Merck, Inc | 9 - 11% |

| Pfizer Inc. | 8 - 10% |

| GlaxoSmithKline PLC | 7 - 9% |

| Other Companies (combined) | 38 - 46% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novartis AG | Expanded its women’s health portfolio by introducing a new hormonal therapy for dysmenorrhea, designed to provide long-term pain relief with fewer side effects, addressing the growing demand for safer and more effective treatment options |

| F. Hoffmann-La Roche Ltd | F. Hoffmann-La Roche Ltd Introduced an AI-driven diagnostic tool to facilitate better early detection of secondary dysmenorrhea, allow personalized treatment protocols, and enhance patient outcomes in gynecology. |

| Merck, Inc. | Merck, Inc. Introduced a new-generation oral contraceptive with a better safety profile to control dysmenorrhea while reducing hormonal side effects, addressing the growing trend for dual-use drugs. |

| Pfizer Inc. | Pfizer Inc. launched a new non-steroidal anti-inflammatory drug (NSAID) with extended-release technology, offering longer duration pain relief for women with severe menstrual cramps. |

Key Company Insights

Novartis AG

Novartis AG is a leading pharmaceutical company involving a wide array of treatments that deal with dysmenorrhea. At its finest, Novartis has invented the cutting edge of hormonal therapies providing longer acting relief from menstrual pain. The company invests an offensive portion of its funds into research towards combination therapies that realize efficacy with reduced side effect profiles to satisfy the burner consumer demand for safer and more effective products.

F. Hoffmann-La Roche Ltd

F. Hoffmann-La Roche AG operates on the dysmenorrhea treatment market, specializing in innovative diagnostics and precision medication. They're combining AI and digital health tech to improve early diagnosis of the cause of secondary dysmenorrhea. Roche is now also advancing research on targeted therapies, saying it is going to be personal medicines that treat the underlying processes of severe menstrual pain.

Merck, Inc.

Merck, Inc. has gained recognition in the women's health sector with its developments in hormones and therapies for pain management. A new generation of oral contraceptives is in development by Merck that will not only provide birth control but also treatment for dysmenorrhea. Merck is further developing NSAIDs with improved safety profiles to meet the growing demand for non-hormonal treatment alternatives.

Pfizer Inc.

Pfizer is a key player in pharmaceutical products in pain management for dysmenorrhea. The company rolled out an extended release NSAID providing much prolonged relief, minimizing medication use, and enabling treatment by means of novel drug delivery systems. In this context, Pfizer is also investigating drug delivery methods such as dermal patch work and delayed release with a need for enhanced effectiveness and patient compliance.

GlaxoSmithKline PLC

GlaxoSmithKline PLC is one of the foremost companies in the development of analgesics and anti-inflammatory agents for treating dysmenorrhea. The company is developing plant-based and herbal pain relief medications in view of the rising interest in natural and holistic treatment methods. GSK further promotes drug development sustainability.

Other Key Players (45.5% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

Non-steroidal anti-inflammatory drugs and hormonal therapy

Primary dysmenorrhea and secondary dysmenorrhea

Hospitals, clinics retail pharmacy and online pharmacy

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global dysmenorrhea treatment industry is projected to witness CAGR of 7.1% between 2025 and 2035.

The global dysmenorrhea treatment market stood at USD 6,727.3 million in 2024.

The global dysmenorrhea treatment market is anticipated to reach USD 14,185.1 million by 2035 end.

China is expected to show a CAGR of 8.1% in the assessment period.

The key players operating in the global dysmenorrhea treatment industry are Novartis AG, F. Hoffmann-La Roche Ltd, Merck, Inc., Pfizer Inc., GlaxoSmithKline PLC, Abbott, Bayer AG, Sanofi, Alvogen, Teva Pharmaceutical Industries Ltd, Vanita Therapeutics and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Diseases, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Therapeutic Class, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Diseases, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Therapeutic Class, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Diseases, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Therapeutic Class, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Diseases, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Therapeutic Class, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Diseases, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Therapeutic Class, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Diseases, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Therapeutic Class, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Diseases, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Therapeutic Class, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Diseases, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Therapeutic Class, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Diseases, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Therapeutic Class, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Diseases, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Diseases, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Diseases, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Therapeutic Class, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Therapeutic Class, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Therapeutic Class, 2023 to 2033

Figure 13: Global Market Attractiveness by Diseases, 2023 to 2033

Figure 14: Global Market Attractiveness by Therapeutic Class, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Diseases, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Therapeutic Class, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Diseases, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Diseases, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Diseases, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Therapeutic Class, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Therapeutic Class, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Therapeutic Class, 2023 to 2033

Figure 28: North America Market Attractiveness by Diseases, 2023 to 2033

Figure 29: North America Market Attractiveness by Therapeutic Class, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Diseases, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Therapeutic Class, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Diseases, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Diseases, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Diseases, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Therapeutic Class, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Therapeutic Class, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Therapeutic Class, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Diseases, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Therapeutic Class, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Diseases, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Therapeutic Class, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Diseases, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Diseases, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Diseases, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Therapeutic Class, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Therapeutic Class, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Therapeutic Class, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Diseases, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Therapeutic Class, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Diseases, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Therapeutic Class, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Diseases, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Diseases, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Diseases, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Therapeutic Class, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Therapeutic Class, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Therapeutic Class, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Diseases, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Therapeutic Class, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Diseases, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Therapeutic Class, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Diseases, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Diseases, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Diseases, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Therapeutic Class, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Therapeutic Class, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Therapeutic Class, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Diseases, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Therapeutic Class, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Diseases, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Therapeutic Class, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Diseases, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Diseases, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Diseases, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Therapeutic Class, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Therapeutic Class, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Therapeutic Class, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Diseases, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Therapeutic Class, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Diseases, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Therapeutic Class, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Diseases, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Diseases, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Diseases, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Therapeutic Class, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Therapeutic Class, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Therapeutic Class, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Diseases, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Therapeutic Class, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Water Treatment System Market Growth - Trends & Forecast 2025 to 2035

Water Treatment Chemical Market Growth – Trends & Forecast 2024-2034

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA