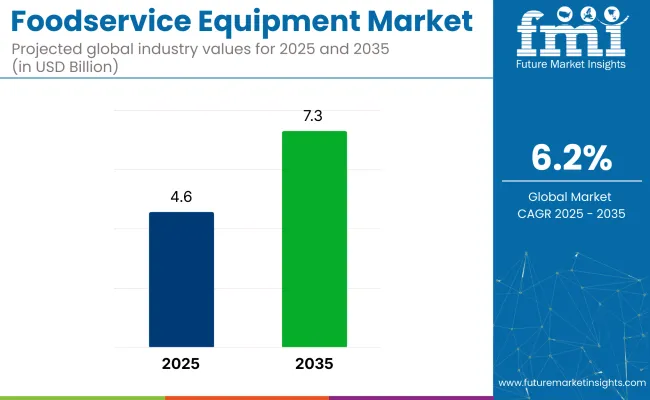

In 2025, the global foodservice equipment market size is assessed at USD 46 billion and is forecasted to witness robust expansion, reaching USD 73 billion by 2035, reflecting a CAGR of 6.2%.

Growth is driven by rising demand for digitally integrated, energy-efficient systems and expanding hospitality infrastructure. Hotels are expected to lead end-use demand, followed by quick-service formats prioritizing speed and volume.

Between 2025 and 2035, product development in cooking, refrigeration, and warewashing will concentrate on compact, multifunctional formats suited for urban kitchens and cloud kitchens. Hotels are projected to remain the top end-use segment as customized, tech-integrated systems gain traction.

Quick service restaurants will increase adoption of equipment that boosts throughput. With institutional buyers raising capital spending, suppliers offering cost-effective, connected, and long-lasting solutions are expected to see stronger positioning across the market’s competitive landscape.

The market holds a considerable share within its parent industries. Within the commercial kitchen equipment market, it accounts for approximately 68%, driven by high replacement demand in restaurants and QSRs. In the hospitality equipment market, it contributes nearly 42%, as kitchen hardware forms a vital component of hotel operations.

Within the broader restaurant and foodservice industry, the equipment segment represents 31%, focused primarily on back-of-house infrastructure. In the catering equipment market, foodservice equipment contributes around 55%, supporting bulk food preparation and transport. within the institutional foodservice market, it commands about 47%, owing to large-scale meal production requirements in schools, hospitals, and correctional facilities. These figures reflect the foundational role of equipment in operational continuity across segments.

In a May 2025 FoodService Tech Investor Briefing, MCFT’s Group CEO George Roberts-Smith outlined the critical shifts in commercial kitchen design. “Operational resilience now hinges on AI-powered predictive maintenance, energy-smart appliances, and modular systems that adapt to tomorrow’s menus - all while mitigating supply chain risks,” he asserted. The strategy responds to data showing 74% of operators prioritize equipment with embedded IoT diagnostics by 2026.

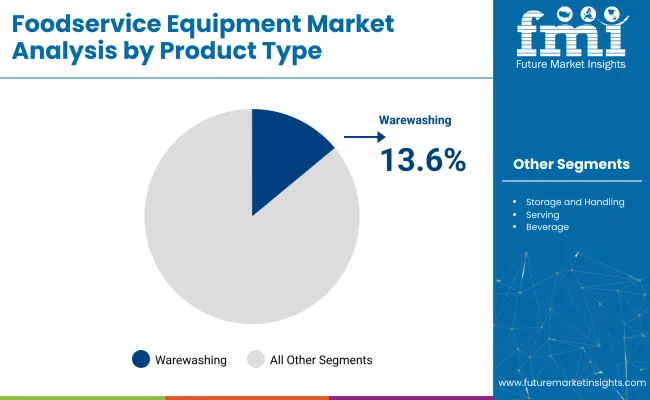

Warewashing systems, cloud kitchen deployment, and direct B2B sales shape the key investment zones in 2025. Stainless steel maintains its dominance across build types, while fully automatic systems gather traction in high-volume foodservice operations. Market growth is driven by demand for compact, scalable, and labor-efficient units across institutional and QSR environments.

Warewashing equipment leads product demand with a 13.6% market share in 2025. Hotels, healthcare units, and high-volume kitchens prefer automated dish cleaning systems to meet hygiene standards and reduce turnaround time. Compact hood-type and undercounter models are replacing traditional manual setups. Energy efficiency, reduced water use, and labor cost avoidance make warewashing units a high-return category.

Cloud kitchens hold a 12.8% share in 2025, driven by their low real estate and fast turnaround operations. These delivery-only facilities require equipment that fits tight spaces and delivers output for 1,500-3,000 meals per day. Automated fryers, combi ovens, and ventless grills are the most procured items. Equipment providers now offer pre-configured kitchen kits, minimizing setup times.

Direct sales make up 12.8% of equipment distribution in 2025, backed by demand from hotel chains, institutions, and franchisee-run QSRs. Buyers prioritize speed, technical support, and layout customization-elements better managed via direct engagement. Large kitchens benefit from bundled installation, post-sale service, and faster part replacements. Manufacturers are investing in dedicated sales teams and digital ordering platforms to maintain volume.

Stainless steel holds an estimated 42.5% market share in 2025 due to its hygiene properties, durability, and compliance with food safety codes. It remains the standard for prep counters, refrigerated tables, and dishwashing zones. Grade 304 steel is common in institutional kitchens, while 316-grade is used in coastal or high-humidity areas. Brushed finishes and welded joints ensure ease of cleaning and long service life.

Fully automatic systems claim 31.3% of the total equipment share in 2025. These units are widely deployed in QSRs, hospitals, and institutional kitchens where throughput must remain consistent. Automation reduces labor by 20-30% per shift in high-traffic units. Auto-cleaning fryers, conveyor ovens, and robotic dishwashers allow continuous operation. Manufacturers offer programmable presets, auto shut-off, and digital maintenance logs for consistent performance.

The industry is driven by rising commercial kitchen demand, space optimization needs, and evolving food delivery formats. Growth is supported by hotel and QSR expansion, with high replacement rates and hygiene standards influencing equipment upgrades globally.

Compact Kitchens Drive Inventory Optimization Across QSR Chains

Quick service restaurant operators have reduced back-of-house kitchen footprint by 23% since 2023, with modular foodservice equipment enabling higher throughput in tighter spaces.In India and Southeast Asia, prep station consolidation trimmed installation time by 18%, while 2-in-1 refrigeration and storage systems cut energy usage by 14% across 300+ outlets. USA QSR brands using programmable combi-ovens reported a 21% drop in pre-cooked inventory as batch sizes shrank and turnover increased. European franchisees of Yum! Brands shifted to just-in-time cooking models, lowering buffer stocks by 17% and freeing up 12% of cold storage.

Smart Warewashing and Refrigeration Gain Ground Through Operational ROI

Between Q1 2023 and Q1 2025, sensor-driven dishwashers reduced water consumption per cycle by 27%, prompting adoption across 11,000 institutional kitchens globally. Welbilt and Hoshizaki’s smart refrigeration units with AI-based temperature controls cut food spoilage rates by 16% in pilot trials across German and Japanese hospitals.

In the USA, school districts installing automated dishroom systems cut manual labor hours by 19%, allowing staff reallocation during peak periods. Middleby’s integration of IoT diagnostics into combi ovens improved service uptime by 14%, shrinking maintenance windows and limiting downtime.

Margin Pressures from Steel Volatility and Cross-Border Freight Spikes

Global stainless steel prices rose 11% YoY in the first half of 2025, inflating production costs for ovens, refrigerators, and warewashing equipment. China’s steel export duties and supply bottlenecks in India lifted input costs for fabricators by 9% since late 2024.

Logistics hurdles compounded the strain: shipping costs from Southeast Asia to Europe climbed 13% due to port congestion and container shortages. European mid-tier manufacturers saw EBITDA margins slip from 18.2% to 13.6% despite demand growth. Some suppliers shifted to nearshoring strategies in Eastern Europe and Mexico to avoid tariff exposure and secure stable raw material access.

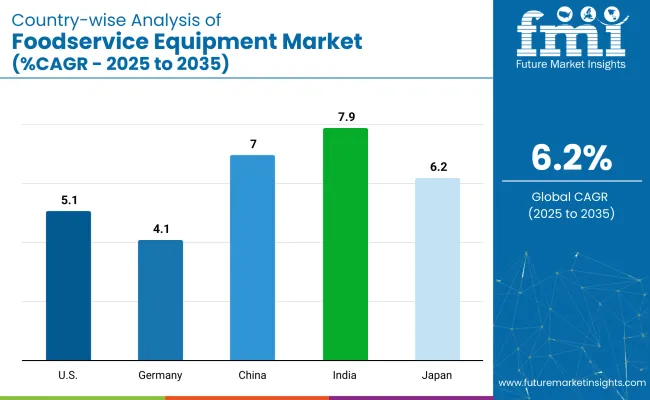

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

| Countries | CAGR (2025-2035) |

|---|---|

| USA | 5.1% |

| Germany | 4.1% |

| India | 7.9% |

| China | 7.0% |

| Japan | 6.2% |

Global demand for equipment is expected to expand at a CAGR of 6.2% between 2025 and 2035. Among the five profiled countries out of 40+ assessed, India leads with 7.9%, followed by China at 7%, Japan at 6.2%, the United States at 5.1%, and Germany at 4.1%. These figures translate to a +27% premium for India and +13% for China, while Japan aligns with the global average. In contrast, the United States trails by -18% and Germany by -34% relative to the baseline.

India’s rapid expansion is driven by rising foodservice franchising and cloud kitchen adoption, while China’s growth is supported by digital integration in commercial kitchens. The United States and Germany reflect mature demand cycles and replacement-driven purchases.

The United States foodservice equipment market is projected to expand at a CAGR of 5.1% from 2025 to 2035. Quick service and full-service restaurants drive over 60% of national demand. Cooking equipment leads adoption with a 31% share, followed by refrigeration at 24%.Aftermarket sales-spanning parts, retrofits, and services-account for 18.5% of the total value. Replacement cycles average 5 to 7 years across national chains. Regulatory pressure has shifted procurement toward NSF-compliant and ENERGY STAR-rated appliances, with demand also spurred by cloud kitchen expansion across metro regions.

Germany’s market is set to register a CAGR of 4.1% through 2035, driven by institutional kitchen upgrades and bakery chain refurbishments. Institutional catering accounts for 38% of total demand, with bakery applications close to 21%. Procurement mandates in public kitchens specify modular equipment with safety automation. Leasing contracts now cover 29% of all installations.

Equipment replacement spans 8-10 years, longer than the global average. Demand has stabilized around blast chillers, combi ovens, and built-in refrigeration units, primarily within school networks and federal canteens.

India’s market is expanding at a CAGR of 7.9%, fueled by franchise-led QSR growth, centralized food production hubs, and regional catering demand. Cooking and prep segments combined command nearly half the market.Chain-linked commissaries contribute 28% of procurement, with over 60,000 units sold across fast food and cloud kitchens in 2024. Rental and leasing models grew 16.8% YoY as operators in Tier 1 and Tier 2 cities opted for cost-effective setups. The domestic manufacturing share now covers 41% of national equipment supply, improving lead times and pricing competitiveness.

China’s market is growing at a CAGR of 7%, supported by centralized foodservice models and OEM supply chain maturity. Commissary kitchens and industrial park cafeterias account for nearly 45% of installations.Cooking systems lead with a 33% share, followed closely by ventilation and warewashing segments. In 2024, domestic OEMs met 62% of volume demand, with imports dropping as local engineering capabilities improve. Chain restaurants and logistics hubs continue to drive procurement of induction cooktops and compact dishwashers, especially in Tier 1 cities.

Japan’s foodservice equipment market is anticipated to grow from USD 1360 million in 2025 to USD 1670 million by 2035, at a CAGR of 6.2%. Compact-format foodservice-convenience stores, rail kitchens, and airport counters-makes up over 40% of demand.Multifunctional cooking systems, warewashing, and noodle boilers dominate institutional and travel-linked installations. In 2024 alone, over 28,000 rice cookers and 14,000 noodle units were shipped. Domestic OEMs serve 73% of unit volumes, with service contracts playing a major role.

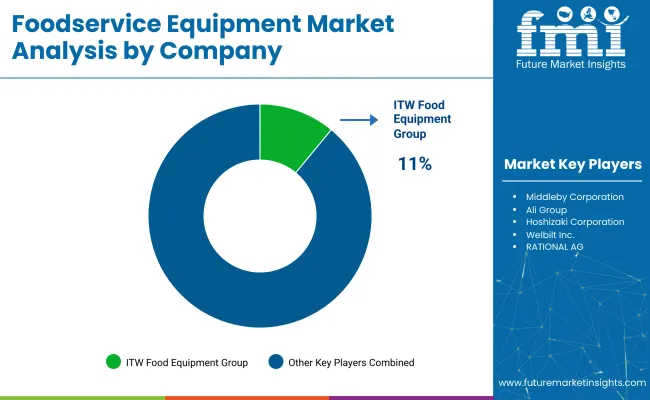

Leading Player- ITW Food Equipment Group holding 11 % share The foodservice equipment market is shaped by well-established players such as ITW Food Equipment Group, Middleby Corporation, and Ali Group, alongside newer entrants targeting regional demand. Companies focus heavily on product differentiation and proprietary systems. For example, RATIONAL AG introduced the iCombi Pro to enhance kitchen productivity.

The Hoshizaki Corporation continues to invest in R&D across food preservation systems, including compact ice-making units. Meiko Group and Welbilt Inc. have prioritized partnerships with global food chains to strengthen supply networks. The industry leans toward consolidation, as multinationals acquire niche manufacturers to expand portfolios and geographic coverage.

Recent Developments in the Foodservice Equipment Industry

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 46 billion |

| Projected Market Size (2035) | USD 73 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Segments by Product Type | Cooking & Preparation Equipment, Refrigeration Equipment, Warewashing Equipment, Storage & Handling Equipment, Serving Equipment, Beverage Equipment |

| Application Segments | Hotels, Full-Service Restaurants, Quick Service Restaurants (QSRs), Cloud Kitchens, Institutional (Hospitals, Schools, Prisons, Military) |

| Sales Channel | Direct Sales, Distributors, Online Retail |

| Material Type | Stainless Steel, Aluminum, Polymer/Plastic Composite, Others |

| Technology Integration | Manual, Semi-Automatic, Fully Automatic, IoT-Integrated Systems |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, United Kingdom, Germany, France, Italy, Spain, Russia, Poland, China, Japan, South Korea, India, Indonesia, Australia, UAE, Saudi Arabia, South Africa |

| Key Players | ITW Food Equipment Group, Middleby Corporation, Ali Group, Hoshizaki Corporation, Welbilt Inc., RATIONAL AG, Electrolux Professional, Meiko Group, Standex International, The Vollrath Company |

| Additional Attributes | Dollar sales, product and application share, rising cloud kitchen investments, high replacement demand in hotels and full-service restaurants, regional shifts in procurement policies, digital and IoT integration adoption patterns |

The market is forecast to reach USD 73 billion by 2035.

Cooking and preparation equipment leads with a 34.9% share in 2025.

Hotels hold the largest share at 42.7% in 2025.

The market is projected to grow at a CAGR of 6.2%.

India is expected to grow at a CAGR of 7.9% between 2025 and 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Compostable Foodservice Packaging Providers

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA