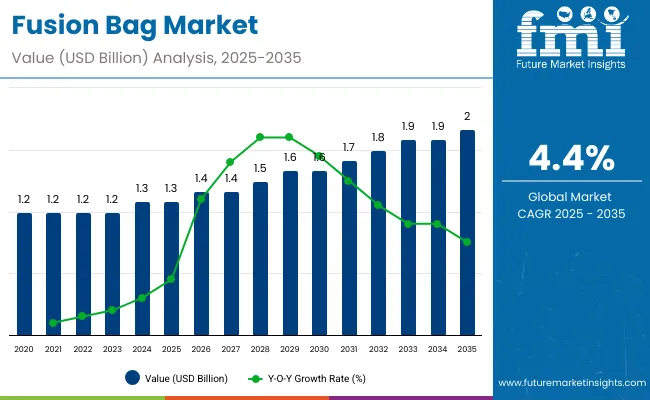

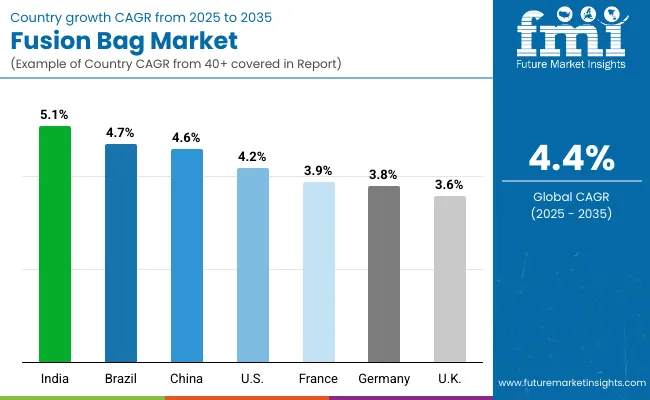

The fusion bag market is expected to grow from USD 1.3 billion in 2025 to USD 2.1 billion by 2035, resulting in a total increase of USD 0.8 billion over the forecast decade. This represents a 61.5% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.4%. Over ten years, the market grows by a 1.6 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.1 billion |

| CAGR (2025 to 2035) | 4.4% |

In the first five years (2025-2030), the market progresses from USD 1.3 billion to USD 1.6 billion, contributing USD 0.3 billion, or 37.5% of total decade growth. This phase is shaped by adoption in biopharmaceutical mixing and liquid transfer, driven by the need for sterility and contamination-free handling. Increasing demand from vaccine manufacturers further supports expansion.

In the second half (2030-2035), the market grows from USD 1.6 billion to USD 2.1 billion, adding USD 0.5 billion, or 62.5% of the total growth. This acceleration is supported by automation in cell culture processes, multi-layer film innovations, and growing CMO outsourcing. Rising focus on single-use sterile storage and flexible capacity expansion in biologics manufacturing makes fusion bags central to the bioprocessing supply chain.

From 2020 to 2024, the fusion bag market expanded from USD 1.0 billion to USD 1.2 billion, driven by the growing adoption of sterile, single-use systems in biopharmaceutical manufacturing. Over 65% of revenue was controlled by established OEMs offering standardized bag assemblies for liquid transfer and cell culture. Leaders such as Sartorius, Thermo Fisher Scientific, and Pall Corporation emphasized sterile integrity, gamma irradiation validation, and secure fluid pathways. Differentiation relied on film compatibility, scalability across volumes, and assurance of sterility, while advanced monitoring sensors remained secondary features. Service-based validation and sterilization audits accounted for under 15% of total market value, with most clients prioritizing upfront capital procurement.

By 2035, the fusion bag market will reach USD 2.1 billion, growing at a CAGR of 4.40%, with software-integrated bag systems and automation accounting for over 40% of value. Competition will increase as new players deliver modular multi-use systems, IoT-enabled sterility tracking, and predictive monitoring for bioprocess consistency. Established companies are shifting toward hybrid models, embedding digital twin platforms, automated leak detection, and traceable sterilization mapping. Emerging entrants such as GEA Group, ILC Dover, and Meissner Filtration are gaining traction with recyclable materials, advanced biocompatibility, and enhanced scalability for vaccine manufacturing, gene therapies, and biologics production.

The rising adoption of single-use bioprocessing systems in the pharmaceutical and biotechnology industries is driving growth in the fusion bag market. These bags ensure sterility, reduce contamination risks, and streamline fluid handling processes. Growing vaccine production, biologics manufacturing, and expansion of contract manufacturing organizations are key factors supporting demand.

Fusion bags featuring medical-grade films, gamma sterilization compatibility, and robust sealing technologies are gaining popularity for their ability to maintain product integrity during storage and transport. Their scalability, easy integration into automated systems, and reduced cleaning requirements support operational efficiency. Sustainability trends favouring lightweight, disposable solutions further reinforce their adoption in global bioprocessing applications.

The market is segmented by type, material, application, capacity, end use, and region. Type segmentation includes single-use and multi-use fusion bags, meeting varied bioprocessing requirements for sterility and cost efficiency. Material covers medical-grade PE, multi-layer film, and TPU, providing durability, barrier performance, and chemical resistance. Applications include biopharmaceutical mixing, liquid transfer, cell culture, and sterile storage, ensuring compliance with stringent process standards. Capacity segmentation spans <5L, 5-50L, 50-500L, and 500L, supporting scalability across R&D and commercial manufacturing. End-use industries include biotech companies, CMOs, and vaccine manufacturers. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

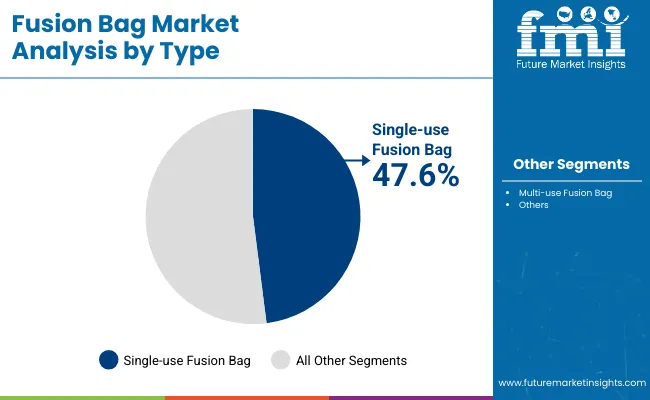

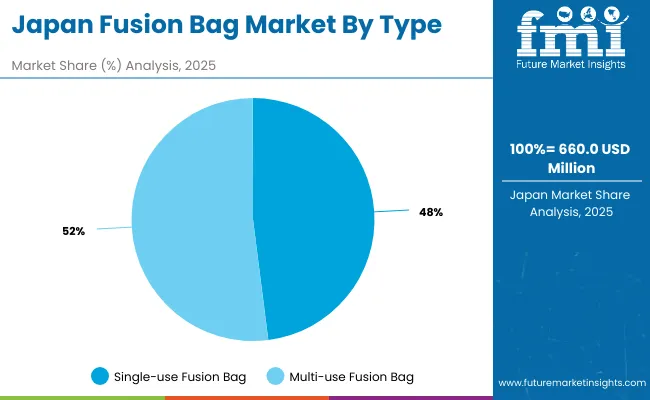

Single-use fusion bags are projected to account for 47.6% of the market in 2025, driven by their ability to reduce cross-contamination risks and cleaning costs. These disposable solutions eliminate the need for sterilization between uses, ensuring operational efficiency in biopharmaceutical production. Their adoption is widespread in facilities requiring flexibility across multiple product batches.

The surge in biologics and personalized medicine production reinforces demand for single-use formats. They allow quick setup, rapid turnaround, and scalability in pilot to commercial operations. Their compatibility with sterile connectors and manifolds further supports use in GMP-compliant environments, making them a standard in modern bioprocessing workflows.

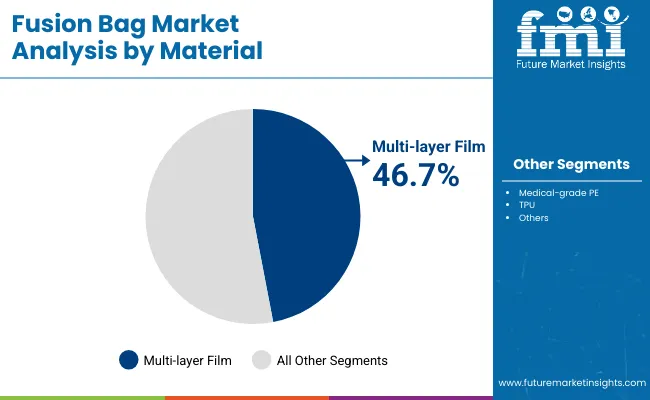

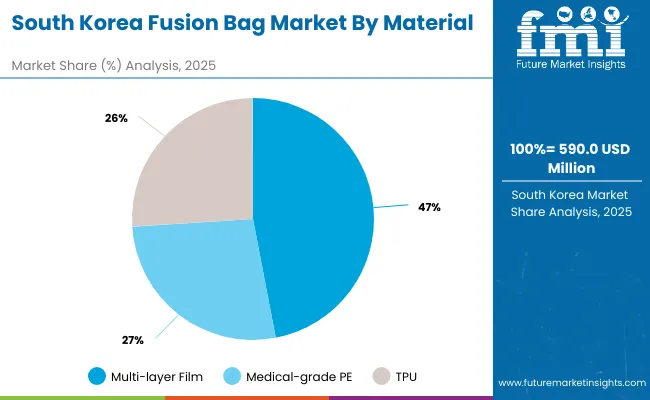

Multi-layer films are forecast to capture 46.7% of the market in 2025, as they combine polymer layers to deliver superior strength and chemical resistance. These films enhance puncture resistance and protect against leachable, ensuring integrity during storage and transport of sensitive biologics.

Their adoption is supported by the growing complexity of biopharmaceutical formulations requiring higher stability. Multi-layer construction enables optimal gas barrier performance while maintaining transparency for visual inspection. As regulatory expectations for packaging quality intensify, multi-layer films provide assurance of product safety and compliance.

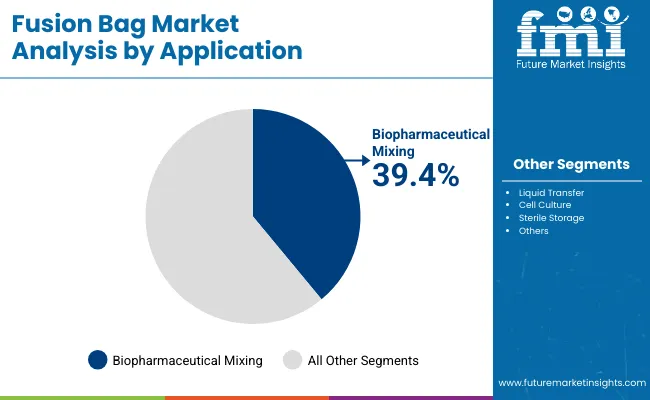

Biopharmaceutical mixing is expected to represent 39.4% of market share in 2025, as fusion bags provide sterile, closed systems for critical upstream and downstream processes. They enable homogenous mixing of cell cultures, buffers, and media with reduced contamination risks compared to open systems.

Their ease of integration with single-use mixers and sensors makes them indispensable in biomanufacturing. Demand is reinforced by the need for scalable solutions that support batch flexibility and reduced cleaning validation requirements. This makes biopharmaceutical mixing the most prominent application in single-use technology adoption.

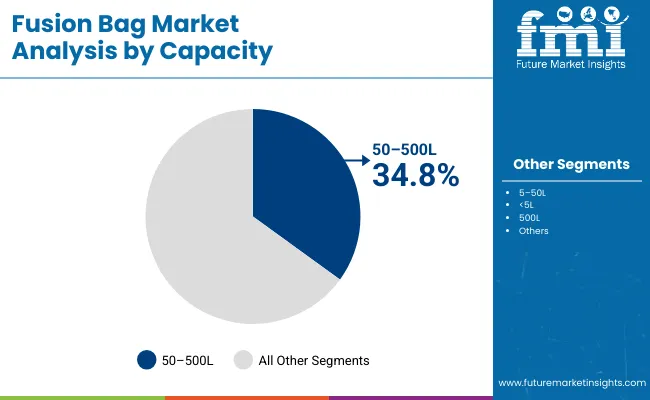

Bags with 50-500L capacity are projected to hold 34.8% of the market in 2025, balancing scalability and operational efficiency. These mid-range formats are widely adopted in pilot-scale production and clinical manufacturing, where frequent product changeovers are common.

Their modularity allows seamless transition from R&D to commercial-scale manufacturing without infrastructure overhauls. They provide sufficient volume for production while remaining manageable in handling and installation. This makes them a preferred option for facilities producing multiple biologic products in parallel.

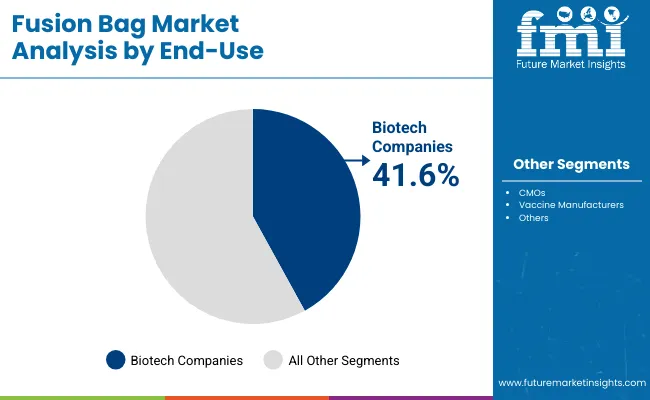

Biotech companies are forecast to account for 41.6% of demand in 2025, as their expanding pipelines of biologics and cell therapies rely heavily on single-use systems. Fusion bags support flexibility in production, enabling companies to accelerate time-to-market for new treatments.

Adoption is reinforced by venture-backed funding and partnerships that prioritize scalable manufacturing infrastructure. These companies value the reduced capital expenditure associated with single-use bags compared to stainless-steel systems. As biologics and advanced therapies grow, biotech firms remain the key drivers of fusion bag adoption globally.

The fusion bag market is growing as biopharmaceutical companies adopt single-use and multi-use bags for sterile liquid handling, storage, and transport. These bags offer contamination control, scalability, and flexibility compared to stainless-steel systems. However, high validation costs and material compatibility issues restrain adoption. Advances in multi-layer films, automation-friendly formats, and sustainable bioprocessing are shaping the market’s next growth phase.

Sterility Assurance, Flexibility, and Bioprocess Efficiency Driving Adoption

Fusion bags are increasingly used in cell culture, vaccine manufacturing, and biopharmaceutical mixing due to their sterile and closed-system operation. Their single-use design reduces cleaning requirements, cross-contamination risks, and turnaround time, improving overall production efficiency. The flexibility to scale from small lab volumes to large commercial batches enhances their utility across R&D and manufacturing. Integration with automated mixing systems further optimizes process reliability. These benefits make fusion bags essential for biologics and personalized medicine production.

High Validation Costs, Supply Risks, and Material Limitations Restraining Growth

Adoption faces hurdles as biopharma firms must invest heavily in validating fusion bag systems for regulatory compliance. Material compatibility with solvents, buffers, and culture media can limit their use in certain processes. Dependence on a few suppliers creates supply chain vulnerabilities, as shortages or delays can disrupt production timelines. High costs compared to traditional equipment deter smaller biotech firms from large-scale implementation. Additionally, disposal of single-use plastic bags raises environmental and regulatory concerns in some regions.

Multi-layer Films, Automation Integration, and Sustainability Trends Emerging

Key trends include the development of advanced multi-layer films that enhance durability, chemical resistance, and oxygen barrier properties. Automation integration is accelerating, with fusion bags increasingly designed for compatibility with automated filling, mixing, and monitoring systems. Sustainability initiatives are driving interest in recyclable or biodegradable polymer materials. Customizable bag capacities and modular systems provide flexibility across applications from lab-scale research to large vaccine manufacturing. These innovations are positioning fusion bags as critical enablers of efficient, scalable, and eco-conscious bioprocessing solutions.

The global fusion bag market is steadily expanding, driven by demand in biopharmaceutical manufacturing, vaccine production, and cell culture applications. Asia-Pacific is emerging as a growth hotspot, with India and China leading adoption due to strong investments in life sciences infrastructure and biologics production. Developed markets such as the USA, Germany, and Japan remain innovation leaders, advancing sterile, multi-layer bag technologies and automation to ensure efficiency, regulatory compliance, and consistent product quality across diverse bioprocessing applications worldwide.

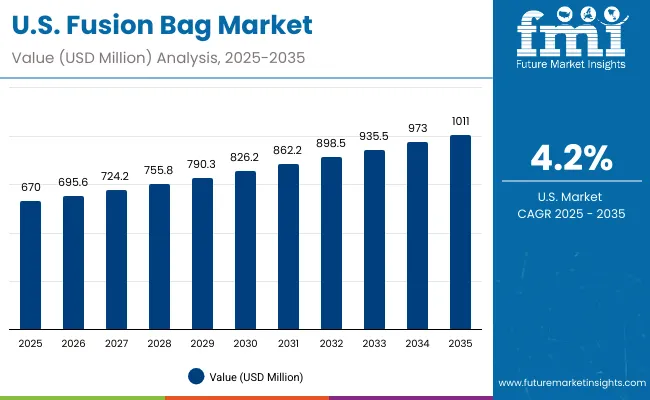

The USA market is projected to grow at a CAGR of 4.2% from 2025 to 2035, driven by strong demand from biotech firms, CMOs, and vaccine manufacturers. Growth is supported by high adoption of sterile, disposable systems that reduce cross-contamination and meet FDA compliance. Investments in automation and AI-driven monitoring are enhancing production reliability. Vendors are focusing on customized, scalable fusion bags with integrated sterile connectors to meet evolving industry needs for flexible bioprocessing environments.

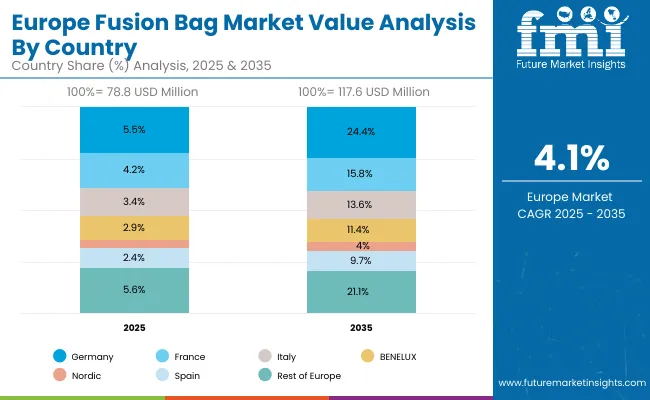

Germany’s market is expected to grow at a CAGR of 3.8%, anchored by its advanced pharmaceutical and biotechnology industries. Fusion bags are being adopted for sterile storage, cell culture, and large-scale mixing processes. Rising emphasis on modular, contamination-free solutions is driving demand. German OEMs are also investing in predictive maintenance features and eco-friendly materials. The market is shaped by strict EU regulatory compliance, requiring robust sterilization, traceability, and GMP-certified production systems across laboratories and manufacturing plants.

The UK market is forecast to grow at a CAGR of 3.6%, supported by a strong pipeline of biologics, contract research, and vaccine development programs. Fusion bags are being used for liquid transfer, storage, and sterile mixing applications in both established firms and startups. Demand is further supported by government-backed healthcare R&D funding. Local suppliers are innovating compact, flexible bags designed to minimize downtime and cleaning costs, aligning with GMP and export requirements in biopharma.

China’s market is projected to grow at a CAGR of 4.6%, fuelled by government investments in biotechnology and pharmaceutical manufacturing. Fusion bags are widely used in vaccine production and biopharmaceutical mixing due to their sterility and scalability. Local manufacturers are scaling production of affordable, high-quality bags to meet rising demand. Government policies encouraging domestic production of biologics are supporting strong market adoption. Increased R&D in cell culture applications also contributes to steady expansion in the region.

India is forecast to record the fastest growth at a CAGR of 5.1%, driven by rapid expansion of biopharmaceutical exports, vaccine manufacturing, and contract production services. Fusion bags are being increasingly used for sterile storage, mixing, and transport of sensitive liquids. Startups and SMEs are adopting cost-effective disposable bag systems to replace stainless steel. Export-focused players demand solutions meeting stringent global compliance standards, pushing OEMs to deliver high-performance, single-use bag technologies at competitive pricing.

Japan’s market is projected to grow at a CAGR of 4.1%, with rising use of fusion bags in enzyme production, cell therapy, and fermentation. Companies are adopting sterile, UV-resistant materials to improve product longevity and safety. Precision-focused innovations are enhancing reliability in pharmaceutical environments. The demand for compact, multi-use designs is increasing in small-scale labs, while large firms emphasize automation-compatible bag systems for industrial-scale production. Regulatory adherence and high-quality standards shape product offerings in the Japanese market.

South Korea’s market is expected to grow at a CAGR of 3.5%, led by demand from biologics, ginseng-based healthcare, and contract manufacturing services. Fusion bags are widely used for sterile mixing, storage, and transfer of biopharmaceutical liquids. Local firms are developing compact, disposable formats aligned with global GMP compliance standards. Growing export opportunities in biosimilars and vaccines are boosting adoption. Enhanced collaboration between Korean biotech companies and global pharmaceutical firms is also shaping market growth.

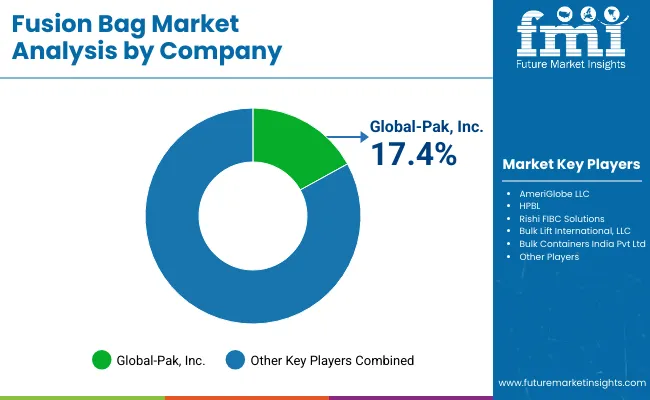

The fusion bag market is moderately fragmented, with bulk packaging manufacturers, polymer specialists, and container solution providers competing across biopharmaceutical, chemical, and food-grade applications. Global leaders such as Rishi FIBC Solutions, AmeriGlobe LLC, and HPBL hold notable market share, driven by durable medical-grade polymers, sterile construction, and adherence to FDA and EU regulatory standards. Their strategies increasingly emphasize capacity scalability, contamination-free handling, and integration with automated filling and transfer systems.

Established mid-sized players including Global-Pak, Inc. and Bulk Lift International, LLC are supporting adoption of multi-use fusion bags featuring reinforced seams, anti-leakage valves, and multi-layer barrier films. These companies are especially active in vaccine storage, bioreactor feeds, and chemical transfer, offering tailored designs, flexible capacities, and enhanced puncture resistance to meet stringent industry requirements.

Specialized regional producers such as Bulk Containers India Pvt Ltd focus on customized solutions for biotechnology firms and contract manufacturers. Their strengths lie in cost-effective engineering, rapid prototyping, and integration with cold chain systems for temperature-sensitive products, ensuring reliable sterility, extended shelf stability, and compatibility with evolving pharmaceutical and bioprocessing demands.

Key Development of Fusion Bag Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Type | Single-use Fusion Bag, Multi-use Fusion Bag |

| By Material | Medical-grade PE, Multi-layer Film, TPU |

| By Application | Biopharmaceutical Mixing, Liquid Transfer, Cell Culture, Sterile Storage |

| By Capacity | <5L, 5-50L, 50-500L, 500L |

| By End-Use | Biotech Companies, CMOs, Vaccine Manufacturers |

| Key Companies Profiled | Rishi FIBC Solutions, AmeriGlobe LLC, HPBL, Global-Pak, Inc., Bulk Lift International, LLC, Bulk Containers India Pvt Ltd |

| Additional Attributes | Increasing adoption of single-use bags in bioprocessing for contamination control, preference for multi-layer films to enhance durability and sterility, strong demand from CMOs and biotech companies for scalable storage and mixing solutions, integration of TPU materials for flexibility and chemical resistance, and growing utilization in vaccine production to meet global immunization and pandemic preparedness needs. |

The global fusion bag market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the fusion bag market is projected to reach USD 2.1 billion by 2035.

The fusion bag market is expected to grow at a CAGR of 4.4% between 2025 and 2035.

The key types in the fusion bag market include single-use fusion bags and multi-use fusion bags.

The single-use fusion bag segment is expected to account for the highest share of 47.6% in the fusion bag market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IV Infusion Gravity Bags Market Size and Share Forecast Outlook 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Bag Feed Seal Pouch Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag in Tube Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fusion Beverage Market Trends - Size, Demand & Forecast 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Bag Market Insights - Growth & Demand 2025 to 2035

Bag Clips Market Insights – Demand, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA