The automotive gudgeon pin market is projected to grow from USD 3,650 million in 2025 to approximately USD 5,940 million by 2035, registering a CAGR of 5.0% over the forecast period. According to the International Energy Agency (IEA), internal combustion engine (ICE) vehicles comprised around 82% of total vehicle sales in 2023. This figure underscores the continued dominance of ICE platforms and, by extension, the sustained demand for core engine components such as gudgeon pins.

These pins play a critical mechanical role by connecting pistons to connecting rods and absorbing intense cyclic loads. With the rise of engine downsizing and turbocharging, OEMs are prioritizing materials that offer high durability under elevated stress. As a result, technologies such as carburization and diamond-like carbon (DLC) coatings are being increasingly adopted to extend the operational life of gudgeon pins in high-performance settings.

Both OEM and aftermarket segments have demonstrated resilient demand. The average vehicle lifespan in Western Europe and North America has now reached 12 to 14 years, maintaining a steady replacement cycle for powertrain components. In parallel, hybrid engine architectures and long-service commercial fleets are sustaining demand for ICE-based parts globally.

Industry leaders are reaffirming their commitment to this segment. In a 2024 interview with AftermarketNews, Arnd Franz, CEO of MAHLE, stated:

“We have been very clear to our stakeholders and especially to our customers that we will continue to support internal combustion engine components wherever we are currently a leading offering in the market. This includes pistons, piston rings, valve train components, and many more. We will continue to serve our customers as long as there is demand. We believe there is no real way for successful decarbonization without an internal combustion engine solution that is run with sustainable fuels.”

Looking forward, the market’s expansion will be underpinned by three core pillars: aftermarket reliability, the continued relevance of ICE components, and evolving OEM strategies aligned with sustainable fuel compatibility and hybrid drivetrains.

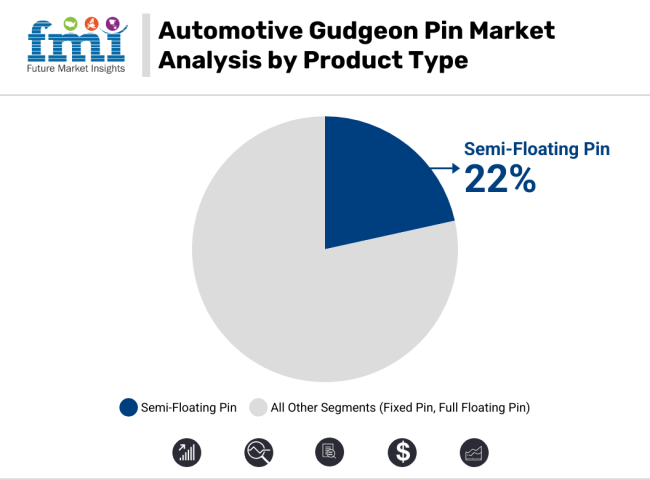

As of 2025, as per product type, the semi-floating gudgeon pin segment commands 22% of the global market by value and is projected to expand at a CAGR of 4.1% through 2035. Its sustained adoption is attributed to a unique blend of cost-effectiveness, ease of assembly, and sufficient operational flexibility for a wide range of internal combustion engine (ICE) applications.

Semi-floating gudgeon pins are widely preferred in small to mid-range passenger vehicles due to their simplified design, which enables reduced component count and faster assembly. Their ability to provide adequate rotational freedom-either in the piston or connecting rod-without the need for additional locking mechanisms, results in lower friction losses and material wear over time.

This balance of functional performance and lower manufacturing complexity makes the semi-floating type a favored choice for automakers targeting cost-sensitive markets. The underlying need for value engineering and durability make use of these pins a preferred choice for the engine designers.

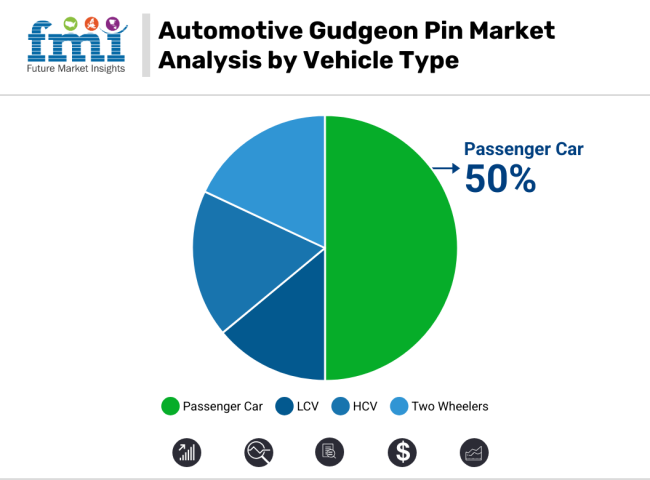

As of 2025, more than half of the global demand for gudgeon pins is accounted for by the passenger car segment. A compound annual growth rate of 4.5% is expected to be registered by this segment over the assessment period. This growth is being supported by the high production volumes of compact and mid-sized vehicles across both developed and developing economies. With internal combustion engine platforms continuing to dominate new vehicle sales globally-particularly in Asia and Eastern Europe-the consumption of gudgeon pins in this segment is projected to command a significant share.

Due to cost sensitivity and extended replacement cycles associated with these vehicles, durable and precision-engineered components are being favored by automakers. In addition, with the aging vehicle parc in key regions and the prevalence of first-time buyers in markets such as India, Indonesia, and Brazil, robust replacement and original equipment (OE) demand for gudgeon pins is anticipated to persist.

The North American automotive gudgeon pin market is propelled by the regional automotive manufacturing ecosystem, the growing popularity of performance vehicles in North America along with the steady demand for internal combustion engines for private as well as commercial transport. While the USA leads the charge among regional users, leveraging a large gasoline-powered vehicle population where gudgeon pins known as wrist pins enable force capture from the stroke and transfer from the piston to the connecting rod.

Light weight high strength steel and alloy gudgeon pins have been in increasing demand. OEMs are leveraging advanced design features such as fully floating pins and DLC (diamond-like carbon) coatings to minimize friction, optimize wear resistance, and improve component longevity in high-stress environments.

In the North American aftermarket, engine rebuilding and engine customization, as well as motorsports applications, play a vital role, largely driven by drivers looking to overhaul or customize their vehicles. Precision engine components, including gudgeon pins, have a large supply chain built around clusters of automotive part manufacturing in both Canada and Mexico.

Accordingly, the increasing utilization of hybrid powertrains that still use efficient ICE components is also aiding market growth. North America is home to top piston and pin manufacturers as well as investments in material development and advanced heat treatment processes, making the region the leader in high-tech gudgeon pin production to meet both local and export demands.

Europe is a mature but developing market for automotive gudgeon pins because of its infrastructure of advanced engine technology, stringent emission regulations, and robust automotive exports. Since several European countries have moved toward tightening Euro emission norms, automotive OEMs are focusing on high-precision, lightweight, and endurance pin solutions to enhance the performance of internal combustion engines, with Germany, Italy, and France leading the charge.

High-performance turbocharged and downsized engines are offered in premium and sports cars, so European manufacturers focus on forged and machined gudgeon pins with special coatings. Also, the knowledge of diesel engine technology in the region has historically led experts to develop heavy-duty gudgeon pin designs that can cope with much higher pressures and temperatures.

As the trend towards hybrid vehicle architectures grows, there is still a steady demand for optimized ICE components such as gudgeon pins. The penetration of EVs will only drive the aftermarket demand and the vast stages of ICE and hybrid cars in Europe guarantees a future demand for the aftermarket. European component suppliers, in turn, are targeting sustainability initiatives like recycling the alloy steel used and increasing machining efficiency to minimize energy consumption and carbon footprints.

Eastern European nations, especially Poland and the Czech Republic, are becoming low-cost manufacturing centers for precision gudgeon pins for Western European carmakers. Europe as a whole has got a solid position in global market, combining legacy demand and forward looking innovation.

The strong demand for casting processes, expanding range of vehicle manufacturing, and well-established aftermarket region, the Asia-Pacific region is leading the global automotive gudgeon pins market. There is a strong demand for gudgeon pins in various engine sectors due to the extensive production of passenger and commercial vehicles in the region, majorly holding a majority of the market share mainly attributed to China.

With standards in engine performance and fuel economy on the rise, local manufacturers are fast-tracking from traditional designs to fully floating or semi-floating pin configurations. Increasing demand for high-speed, low-emission vehicles has led to a growing demand for heat-treated and nitridedgudgeon pins that can resist higher thermal and mechanical stress.

India is another high-potential market, particularly in the two-wheeler and small car segments where gudgeon pins are critical for compact engine designs. Government policies concentrating on make in India and vehicle electrification also support hybrid engine development, which sustains demand for precision ICE components.

In contrast, most other players are located in Japan and South Korea, which are also well-known as innovation hubs as they develop advanced pin materials such as case-hardened steel and ceramic composite coatings for usage in high-performance and hybrid sectors.

The Asian Pacific aftermarket is also thriving, as replacement gudgeon pins are consumed in steady quantities due to vehicle maintenance cycles and engine overhauls. Asia-Pacific’s prowess as the automotive gudgeon pins market growth engine across the globe is attributed to the region’s competitive manufacturing costs, burgeoning vehicle, and advancements in engine designs.

Material Fatigue and Precision Tolerances

High axle performance and superior wear resistance is the primary challenge for the automotive gudgeon pin market. Gudgeon pins, as they are very central to the assembly of pistons with connecting rods, sees high-frequency reciprocating motion, during which they encounter immense combustion pressures. Designing and choosing materials that will withstand that kind of stress while remaining low weight is a huge request.

The advent of high-performance engines in both passenger and commercial vehicles requires precision tolerances, which makes manufacturing expensive. Furthermore, counterfeit and substandard aftermarket parts can impact engine performance, thus leading to lack of trust and low adoption.

Electrification Adaptation and Light weighting Trends

With automotive OEMs driving ahead with lighter components to achieve fuel economy/emission targets, so are aluminium alloy and hybrid composite gudgeon pins. Moving to hybrid powertrains and low-friction internal engine components gives manufacturers the opportunity to create advanced alternative gudgeon pins for unique thermal and mechanical environments.

Further investments in research and development (R&D) of nanostructured coatings and precision forging technologies will improve reliability and service life. And the advent of performance-minded electric power units, particularly in hybrid applications, will keep gudgeon pins as a key focus in powertrain architectures for some time to come.

Between 2020 and 2024, demand in the automotive gudgeon pin market remained aligned with global production of vehicles, especially in Asia Pacific. Originally OEMs turned to advanced alloys, and advanced coatingslike DLC (Diamond-Like Carbon) to help engines last longer and reduce friction. The aftermarket, in particular, was resilient, especially in developing markets with aging fleets and strong vehicle maintenance cultures. Production cycles faced temporary slowdowns due to rising raw material prices and supply chain constraints.

The market will be substantially changing from 2025 to 2035. Further development of powder metallurgy and additive manufacturing will allow for highly customized and lightweight pin geometries. Turbocharged gasoline engines, plug-in hybrids EVs, and compact combustion engines used in dual-powertrain vehicles will drive demand.

Sustainability will increasingly be at the heart of everything, with circular production models and recyclable materials being employed by the biggest brands. As electrification gathers pace, manufacturers will extend into wider engine component portfolios in order to remain competitive, ensuring relevance through innovation in niche-use cases.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Material Innovation | Improved steel and titanium alloys |

| Manufacturing Techniques | CNC machining and standard forging |

| Application Focus | ICE-powered vehicles, particularly in Asia-Pacific |

| Aftermarket Dynamics | Strong in emerging markets with high vehicle aging |

| Performance Requirements | Emphasis on durability and friction reduction |

| Technological Integration | Basic structural enhancements |

| Geographical Growth Areas | India, China, and Eastern Europe |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Material Innovation | Rise of aluminium alloys, powder metallurgy, and nanocoated composites |

| Manufacturing Techniques | Additive manufacturing and high-precision powder metallurgy |

| Application Focus | Hybrid and compact ICE configurations in dual-powertrains |

| Aftermarket Dynamics | Shift to OEM-dominated ecosystems and advanced component life cycles |

| Performance Requirements | Emphasis on weight reduction, recyclability, and adaptive designs |

| Technological Integration | Integration with thermal sensors and adaptive geometries |

| Geographical Growth Areas | ASEAN, South America, and electric mobility hubs in Europe |

| Sustainability Focus | Circular economy integration and eco-friendly material sourcing |

USA is a prominent region responsible for a notable share in automotive gudgeon pin market, strong automotive industry and large number of OEM and Tier-1 players. Even as fuel economy regulations become stricter, automakers are focusing on the engine of sub optimizing components. The rise of lightweight and strong forged steel and coated alloy materials for manufacturing gudgeon pins is helping to further boost demand and growth of the market across both passenger vehicles and light commercial vehicle segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The automotive gudgeon pin industry in the UK is driven by focusing on lightweight automotive engineering in motorsports and premium vehicle manufacturing. The popularity of this trend has increased the demand for quality and high-temperature resistant gudgeon pins, as engine downsizing and performance optimization are becoming current trends. Metal forging and precision manufacturing developments locally are furthering domestic production and export of high performance pins.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

Germany, France, and Italy have solid growth in the production of high-performance and commercial vehicles in the European Union and established themselves as the most important markets for the gudgeon pin and retains a healthy growth in deliveries.

Strict Euro emission norms have led to many weight-saving engine components being used like high-tech gudgeon pins with wear-resistant coatings and lower friction. Moreover, EU authorities are signalling development of the high precision engine parts market with their initiatives regarding hybrid powertrain.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

Japan has a developed automotive market covering development, production, sales, and after-sales service. Its production of small size and fuel-efficient engines ensures steady demand for gudgeon pins. Piston-pin assemblies are being continuously improved by OEMs to extend engine durability and minimize mechanical losses. Japan is advancing hybrid and miniaturized engine platforms along with the usage of lightweight low friction gudgeon pins using state-of-the-art metallurgical processes to further such advancement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The strong global presence of leading automakers in South Korea such as Hyundai and Kia will also contribute to the steady growth of the automotive gudgeon pin market in South Korea. High exports of ICE and hybrid vehicles are expected to boost demand for reliable and efficient engine components. Furthermore, the domestic market benefitted from local innovations in CNC machining and materials engineering to establish a good reputation as a supplier of high-tolerance gudgeon pins both for local and international markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The automotive gudgeon pin market is undergoing rapid transformation in response to macro trends such as engine downsizing, hybridization, and light weighting that are impacting design and material adoption. From 2024 to 2025, primary companies are refining gudgeon pins to improve fatigue strength, decrease weight, and enhance workability for high-performance and low-emission engine applications. Those forces are made manifest through the technology; Innovate through to OEM strategic partnerships to reduce cost of high-volume manufacturing.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| MAHLE GmbH | Developed lightweight hollow steel gudgeon pins for turbocharged engines in 2024. |

| Rheinmetall Automotive (KS) | Unveiled surface-treated gudgeon pins for extended fatigue life in 2025. |

| Tenneco Inc. (Federal-Mogul) | Expanded low-friction coated pins for hybrid vehicle applications in 2024. |

| Shriram Pistons & Rings Ltd. | Introduced cost-effective, induction-hardened pins for commercial vehicles in 2025. |

Key Market Insights

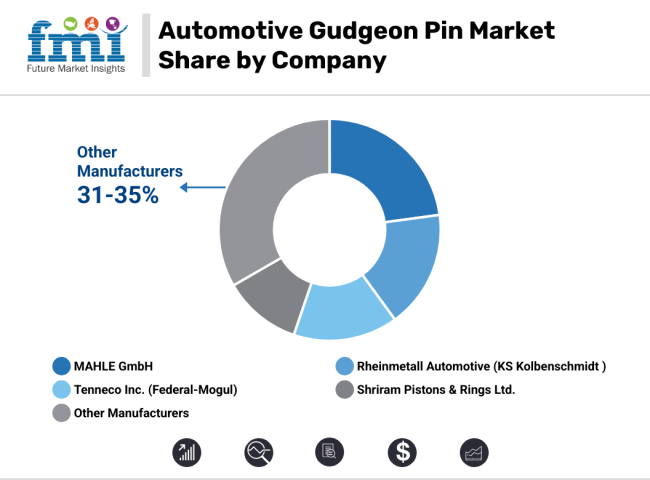

MAHLE GmbH (20-24%)

A global leader in powertrain components, MAHLE focuses on engineered steel pins with optimized wall thickness, meeting strict emissions and durability standards. Their 2024 releases support high-speed combustion systems, enabling improved thermal efficiency and fuel economy.

Rheinmetall Automotive (KS Kolbenschmidt) (15-18%)

KS Kolbenschmidt's 2025 innovations center on surface refinement and hardening techniques, increasing the lifespan of gudgeon pins in both gasoline and diesel engines. Their R&D aligns with next-gen ICE and hybrid configurations.

Tenneco Inc. (Federal-Mogul) (13-16%)

Through its Federal-Mogul division, Tenneco has enhanced gudgeon pin coatings and lubrication channels, making them ideal for compact and heat-intensive hybrid engines. Their 2024 rollout supports lightweight platforms.

Shriram Pistons & Rings Ltd. (9-12%)

This key supplier in Asia introduced cost-efficient yet durable gudgeon pins for two-wheelers and commercial vehicles in 2025. They’re strengthening global reach through partnerships and OE collaborations.

Other Key Players (30-35% Combined)

The overall market size was USD 3,650 million in 2025.

The market is expected to reach USD 5,940 million in 2035.

Demand will be fuelled by the growth in ICE vehicle production, innovations in engine design, and the push for high-strength, lightweight components.

The top 5 contributing countries are China, India, Germany, United States, and Japan.

Steel and full floating pin variants segment is expected to dominate due to its widespread use in commercial vehicles and high-performance applications.

Table 1 Global Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, 2013-2021

Table 2 Global Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, 2022-2027

Table 3 Global Automotive Gudgeon Pins Market Value (US$ Mn) & Volume and Y-o-Y, 2022-2027

Table 4 Global Steel Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 5 Global Steel Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 6 Global Steel Segment Market Share, By Region 2013-2021

Table 7 Global Steel Segment Market Share, By Region 2022-2027

Table 8 Global Steel Segment Y-o-Y, By Region 2022-2027

Table 9 Global Titanium Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 10 Global Titanium Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 11 Global Titanium Segment Market Share, By Region 2013-2021

Table 12 Global Titanium Segment Market Share, By Region 2022-2027

Table 13 Global Titanium Segment Y-o-Y, By Region 2022-2027

Table 14 Global Aluminum Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 15 Global Aluminum Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 16 Global Aluminum Segment Market Share, By Region 2013-2021

Table 17 Global Aluminum Segment Market Share, By Region 2022-2027

Table 18 Global Aluminum Segment Y-o-Y, By Region 2022-2027

Table 19 Global Fixed Pin Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 20 Global Fixed Pin Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 21 Global Fixed Pin Segment Market Share, By Region 2013-2021

Table 22 Global Fixed Pin Segment Market Share, By Region 2022-2027

Table 23 Global Fixed Pin Segment Y-o-Y, By Region 2022-2027

Table 24 Global Semi-Floating Pin Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 25 Global Semi-Floating Pin Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 26 Global Semi-Floating Pin Segment Market Share, By Region 2013-2021

Table 27 Global Semi-Floating Pin Segment Market Share, By Region 2022-2027

Table 28 Global Semi-Floating Pin Segment Y-o-Y, By Region 2022-2027

Table 29 Global Full Floating Pin Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 30 Global Full Floating Pin Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 31 Global Full Floating Pin Segment Market Share, By Region 2013-2021

Table 32 Global Full Floating Pin Segment Market Share, By Region 2022-2027

Table 33 Global Full Floating Pin Segment Y-o-Y, By Region 2022-2027

Table 34 Global Passenger Car Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 35 Global Passenger Car Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 36 Global Passenger Car Segment Market Share, By Region 2013-2021

Table 37 Global Passenger Car Segment Market Share, By Region 2022-2027

Table 38 Global Passenger Car Segment Y-o-Y, By Region 2022-2027

Table 39 Global LCV Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 40 Global LCV Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 41 Global LCV Segment Market Share, By Region 2013-2021

Table 42 Global LCV Segment Market Share, By Region 2022-2027

Table 43 Global LCV Segment Y-o-Y, By Region 2022-2027

Table 44 Global HCV Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 45 Global HCV Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 46 Global HCV Segment Market Share, By Region 2013-2021

Table 47 Global HCV Segment Market Share, By Region 2022-2027

Table 48 Global HCV Segment Y-o-Y, By Region 2022-2027

Table 49 Global Two Wheelers Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 50 Global Two Wheelers Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 51 Global Two Wheelers Segment Market Share, By Region 2013-2021

Table 52 Global Two Wheelers Segment Market Share, By Region 2022-2027

Table 53 Global Two Wheelers Segment Y-o-Y, By Region 2022-2027

Table 54 Global OEM Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 55 Global OEM Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 56 Global OEM Segment Market Share, By Region 2013-2021

Table 57 Global OEM Segment Market Share, By Region 2022-2027

Table 58 Global OEM Segment Y-o-Y, By Region 2022-2027

Table 59 Global Aftermarket Segment Value (US$ Mn) & Volume, By Region 2013-2021

Table 60 Global Aftermarket Segment Value (US$ Mn) & Volume, By Region 2022-2027

Table 61 Global Aftermarket Segment Market Share, By Region 2013-2021

Table 62 Global Aftermarket Segment Market Share, By Region 2022-2027

Table 63 Global Aftermarket Segment Y-o-Y, By Region 2022-2027

Table 64 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2013-2021

Table 65 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2022-2027

Table 66 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2013-2021

Table 67 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2022-2027

Table 68 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2013-2021

Table 69 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2022-2027

Table 70 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2013-2021

Table 71 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2022-2027

Table 72 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2013-2021

Table 73 North America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2022-2027

Table 74 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2013-2021

Table 75 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2022-2027

Table 76 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2013-2021

Table 77 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2022-2027

Table 78 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2013-2021

Table 79 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2022-2027

Table 80 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2013-2021

Table 81 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2022-2027

Table 82 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2013-2021

Table 83 Latin America Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2022-2027

Table 84 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2013-2021

Table 85 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2022-2027

Table 86 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2013-2021

Table 87 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2022-2027

Table 88 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2013-2021

Table 89 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2022-2027

Table 90 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2013-2021

Table 91 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2022-2027

Table 92 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2013-2021

Table 93 Europe Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2022-2027

Table 94 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2013-2021

Table 95 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2022-2027

Table 96 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2013-2021

Table 97 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2022-2027

Table 98 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2013-2021

Table 99 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2022-2027

Table 100 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2013-2021

Table 101 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2022-2027

Table 102 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2013-2021

Table 103 Japan Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2022-2027

Table 104 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2013-2021

Table 105 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2022-2027

Table 106 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2013-2021

Table 107 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2022-2027

Table 108 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2013-2021

Table 109 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2022-2027

Table 110 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2013-2021

Table 111 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2022-2027

Table 112 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2013-2021

Table 113 APAC Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2022-2027

Table 114 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2013-2021

Table 115 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Country 2022-2027

Table 116 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2013-2021

Table 117 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Material 2022-2027

Table 118 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2013-2021

Table 119 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Product Type 2022-2027

Table 120 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2013-2021

Table 121 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Vehicle Type 2022-2027

Table 122 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2013-2021

Table 123 MEA Automotive Gudgeon Pins Market Value (US$ Mn) & Volume, By Sales Channel 2022-2027

Figure 1 Global Automotive Gudgeon Pins Market Value (US$ Mn), 2013-2021

Figure 2 Global Automotive Gudgeon Pins Market Value (US$ Mn) Forecast, 2022-2027

Figure 3 Global Automotive Gudgeon Pins Market Value (US$ Mn) and Y-o-Y, 2022-2027

Figure 4 Global Steel Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 5 Global Steel Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 6 Global Steel Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 7 Global Titanium Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 8 Global Titanium Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 9 Global Titanium Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 10 Global Aluminum Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 11 Global Aluminum Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 12 Global Aluminum Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 13 Global Fixed Pin Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 14 Global Fixed Pin Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 15 Global Fixed Pin Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 16 Global Semi-Floating Pin Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 17 Global Semi-Floating Pin Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 18 Global Semi-Floating Pin Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 19 Global Full Floating Pin Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 20 Global Full Floating Pin Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 21 Global Full Floating Pin Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 22 Global Passenger Car Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 23 Global Passenger Car Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 24 Global Passenger Car Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 25 Global LCV Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 26 Global LCV Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 27 Global LCV Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 28 Global HCV Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 29 Global HCV Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 30 Global HCV Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 31 Global Two Wheelers Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 32 Global Two Wheelers Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 33 Global Two Wheelers Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 34 Global OEM Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 35 Global OEM Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 36 Global OEM Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 37 Global Aftermarket Segment Market Value (US$ Mn) By Region, 2013-2021

Figure 38 Global Aftermarket Segment Market Value (US$ Mn) By Region, 2022-2027

Figure 39 Global Aftermarket Segment Y-o-Y Growth Rate, By Region, 2022-2027

Figure 40 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2013-2021

Figure 41 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2022-2027

Figure 42 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2013-2021

Figure 43 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2022-2027

Figure 44 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2013-2021

Figure 45 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2022-2027

Figure 46 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2013-2021

Figure 47 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2022-2027

Figure 48 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2013-2021

Figure 49 North America Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2022-2027

Figure 50 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2013-2021

Figure 51 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2022-2027

Figure 52 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2013-2021

Figure 53 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2022-2027

Figure 54 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2013-2021

Figure 55 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2022-2027

Figure 56 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2013-2021

Figure 57 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2022-2027

Figure 58 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2013-2021

Figure 59 Latin America Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2022-2027

Figure 60 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2013-2021

Figure 61 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2022-2027

Figure 62 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2013-2021

Figure 63 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2022-2027

Figure 64 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2013-2021

Figure 65 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2022-2027

Figure 66 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2013-2021

Figure 67 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2022-2027

Figure 68 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2013-2021

Figure 69 Europe Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2022-2027

Figure 70 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2013-2021

Figure 71 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2022-2027

Figure 72 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2013-2021

Figure 73 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2022-2027

Figure 74 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2013-2021

Figure 75 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2022-2027

Figure 76 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2013-2021

Figure 77 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2022-2027

Figure 78 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2013-2021

Figure 79 Japan Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2022-2027

Figure 80 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2013-2021

Figure 81 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2022-2027

Figure 82 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2013-2021

Figure 83 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2022-2027

Figure 84 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2013-2021

Figure 85 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2022-2027

Figure 86 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2013-2021

Figure 87 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2022-2027

Figure 88 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2013-2021

Figure 89 APAC Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2022-2027

Figure 90 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2013-2021

Figure 91 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Country 2022-2027

Figure 92 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2013-2021

Figure 93 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Material 2022-2027

Figure 94 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2013-2021

Figure 95 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Product Type 2022-2027

Figure 96 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2013-2021

Figure 97 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Vehicle Type 2022-2027

Figure 98 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2013-2021

Figure 99 MEA Automotive Gudgeon Pins Market Value (US$ Mn), By Sales Channel 2022-2027

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Market Growth - Trends & Forecast 2025 to 2035

Automotive Wheel Spindle Market Growth - Trends & Forecast 2025 to 2035

Demand for Automotive Wheel Spindle in Japan Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Tuning and Engine Remapping Services Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Tuning and Engine Remapping Industry Analysis in Japan Forecast & Analysis: 2025 to 2035

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Pineapple Fiber Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA