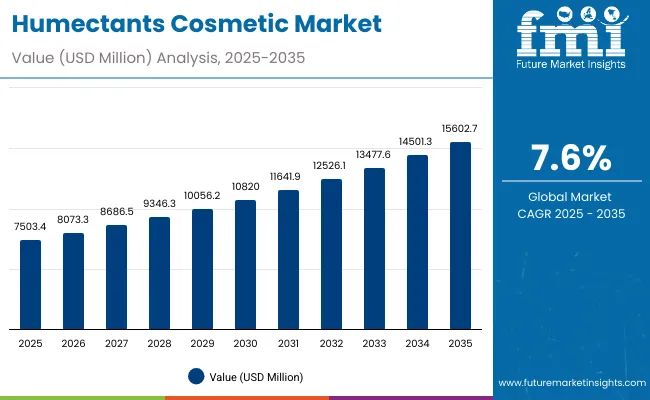

The Humectants Cosmetic Market is expected to record a valuation of USD 7,503.4 million in 2025 and USD 15,602.7 million in 2035, with an increase of USD 8,099.3 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 7.6% and a 2X increase in market size.

Humectants Cosmetic Market Key Takeaways

| Metric | Value |

|---|---|

| Humectants Cosmetic Market Estimated Value in (2025E) | USD 7,503.4 million |

| Humectants Cosmetic Market Forecast Value in (2035F) | USD 15,602.7 million |

| Forecast CAGR (2025 to 2035) | 7.60% |

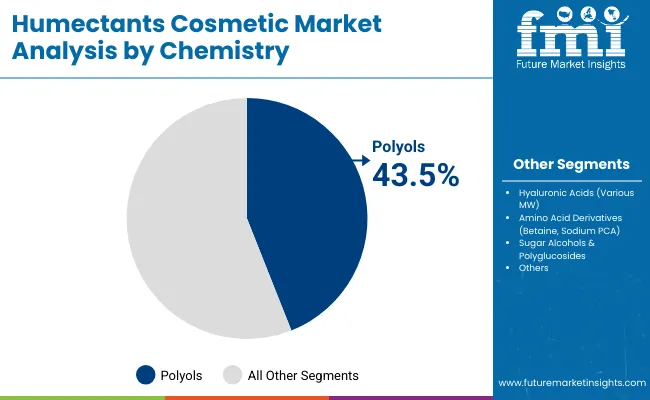

During the first five-year period from 2025 to 2030, the market increases from USD 7,503.4 million to USD 10,820.0 million, adding USD 3,316.6 million, which accounts for 41% of the total decade growth. This phase records steady adoption in personal care, dermocosmetic, and OTC topical formulations, driven by demand for enhanced moisturization and skin-barrier strengthening. Polyols dominate this period as they cater to over 43% of applications requiring multifunctional hydration, stability, and cost-effectiveness in creams, serums, and conditioners.

The second half from 2030 to 2035 contributes USD 4,782.7 million, equal to 59% of total growth, as the market jumps from USD 10,820.0 million to USD 15,602.7 million. This acceleration is powered by novel delivery systems such as encapsulated and supramolecular HA complexes, rising use of high-MW humectants in film-forming solutions, and a global pivot toward bio-based ingredients. Advances in dermocosmetic research, AI-driven formulation design, and microbiome-friendly actives further boost uptake. Crosslinked HA and encapsulated delivery gain relevance for long-lasting hydration, while bio-fermented humectants reinforce sustainability positioning among leading brands.

From 2020 to 2024, the Humectants Cosmetic Market grew from USD 6,200 million to USD 7,100 million, driven by rising adoption of bio-based and natural moisturizers in personal care. During this period, the competitive landscape was shaped by chemical majors and biotech specialists, with polyols and fermentation-derived ingredients leading hydration formulations. Differentiation relied on purity, safety, and compatibility with active-loaded formulations. HA-based innovations were increasingly integrated in anti-aging and dermocosmetic products, though they represented a smaller share compared to polyols.

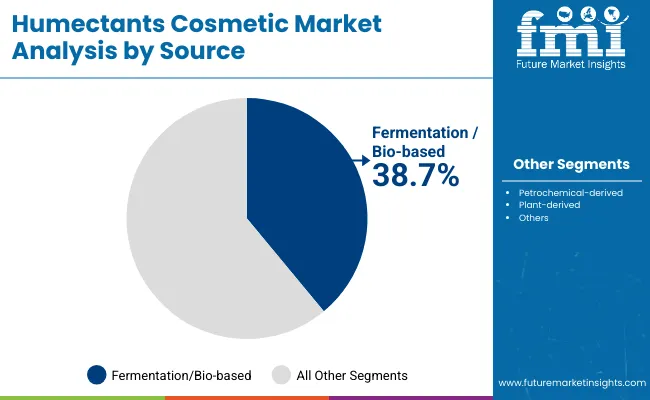

Demand for humectants will expand to USD 7,503.4 million in 2025, and the revenue mix will shift as fermentation-derived and high-MW categories grow to over 40% share. Traditional polyol leaders face rising competition from niche bio-fermentation suppliers offering hyaluronic acids of various molecular weights, encapsulated delivery systems, and amino acid derivatives for multifunctional performance. Emerging entrants focusing on clean-label, microbiome-supportive formulations, and water-retention actives are gaining share. Competitive advantage is shifting away from commodity polyols alone toward sustainable sourcing, molecular specialization, and efficacy-driven innovation.

Advances in bio-fermentation technology, plant-derived ingredient sourcing, and molecular engineering have improved humectant efficiency, safety, and sustainability. Polyols remain the dominant class due to cost-effectiveness and broad compatibility across personal care and OTC categories. Fermentation-based humectants, particularly HA and amino acid derivatives, are gaining traction due to their clinical validation and high consumer acceptance for skin health.

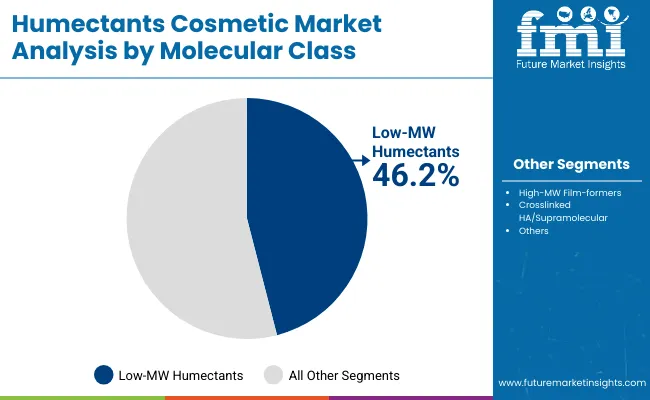

The rising demand for dermocosmetic and premium personal care products has fueled humectant innovation. Growth is supported by regulatory shifts favoring natural and biodegradable ingredients, ongoing clean beauty trends, and the global push for cruelty-free formulations. Long-term growth is also enhanced by the expansion of delivery systems such as encapsulated and aqueous concentrates that improve stability and bioavailability. Segment growth is expected to be led by polyols in chemistry, fermentation/bio-based in source, and low-MW humectants in molecular class, while encapsulated formats in delivery and high-MW HA in film-forming applications are set to gain momentum through 2035.

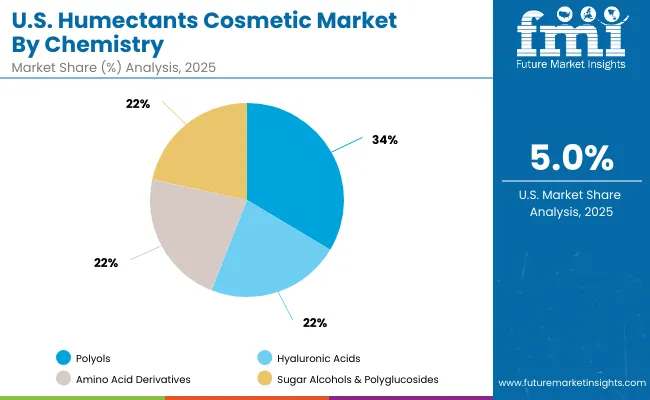

The market is segmented by chemistry, source, molecular class, delivery system, physical form, application, end use, and region. Chemistry includes polyols, hyaluronic acids, amino acid derivatives, and sugar alcohols & polyglucosides, which represent the functional core of humectants. Source-based classification spans petrochemical-derived, fermentation/bio-based, and plant-derived, highlighting the industry’s shift toward sustainability. Molecular class covers low-MW humectants, high-MW film-formers, and crosslinked HA/supramolecular complexes, reflecting performance differentiation.

Delivery systems include free form, aqueous concentrates (≥70%), and encapsulated options catering to different formulation needs. Physical form divides into liquid and powder, with liquid formats more prevalent in personal care. Applications range across facial moisturizers & serums, body lotions & creams, hair conditioners & masks, and hand sanitizers & wash care. End-use categories include personal care, dermocosmetic, and OTC topical care. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Chemistry | Value Share% 2025 |

|---|---|

| Polyols | 43.5% |

| Others | 56.5% |

The polyols segment is projected to contribute 43.5% of the Humectants Cosmetic Market revenue in 2025, maintaining its lead as the dominant chemistry category. This leadership is attributed to the extensive use of glycerin, sorbitol, and propylene glycol, which serve as cost-effective and multifunctional moisturizers. These humectants are integral to personal care and dermocosmetic formulations where hydration, stability, and skin compatibility are essential.

Their dominance is further reinforced by the segment’s versatility, as polyols function not only as moisturizers but also as solvents, stabilizers, and viscosity regulators in creams, serums, and conditioners. The reliable performance and regulatory acceptance of polyols across global markets make them a staple in high-volume formulations. As innovation continues in bio-based and sustainable sourcing, polyols are expected to maintain their backbone role in the Humectants Cosmetic Market.

| Source | Value Share% 2025 |

|---|---|

| Fermentation/bio-based | 38.7% |

| Others | 61.3% |

The fermentation/bio-based segment is forecasted to capture 38.7% of the Humectants Cosmetic Market share in 2025, reflecting growing demand for sustainable and naturally derived solutions. Bio-fermented humectants such as hyaluronic acid and sodium PCA are increasingly used in dermocosmetic and high-performance skincare products due to their proven hydration efficacy and consumer trust.

This segment benefits from advances in biotechnology that enable scalable production of low- and high-molecular-weight actives while maintaining purity and safety. The shift toward clean-label and eco-friendly formulations is accelerating adoption, particularly in Europe, East Asia, and North America. With sustainability becoming a core purchase driver, fermentation/bio-based humectants are expected to steadily gain share from petrochemical-derived alternatives through 2035.

| Molecular Class | Value Share% 2025 |

|---|---|

| Low-MW humectants | 46.2% |

| Others | 53.8% |

The low-MW humectants segment is projected to hold 46.2% of the Humectants Cosmetic Market revenue in 2025, leading the category due to their strong water-binding capacity and ability to penetrate into the skin’s upper layers. This makes them especially valuable in facial moisturizers, serums, and lightweight formulations where rapid hydration and sensory performance are key.

Low-MW humectants like glycerin and sodium PCA enhance product efficacy while ensuring compatibility with active-loaded formulations, a critical factor for dermocosmetic and OTC topical care applications. Their consistent demand is supported by proven safety, cost efficiency, and global regulatory acceptance. As consumer interest in lightweight, fast-absorbing hydration grows, low-MW humectants are set to remain a cornerstone of formulation strategies worldwide.

Rising demand for bio-fermented humectants in dermocosmetics

The increasing popularity of dermocosmetic and premium skincare products is driving demand for bio-fermented humectants such as hyaluronic acid, sodium PCA, and amino acid derivatives. These actives provide clinically proven hydration, barrier repair, and anti-aging benefits, making them highly sought-after in serums, facial moisturizers, and masks. The availability of multiple molecular weight grades of HA allows brands to design layered hydration solutions, further strengthening the adoption of fermentation-based humectants across Europe, East Asia, and North America.

Functional versatility of polyols in large-volume formulations

Polyols such as glycerin and sorbitol continue to dominate due to their multifunctional role as moisturizers, stabilizers, solvents, and viscosity regulators. Their cost-effectiveness, safety, and compatibility with both petrochemical-derived and bio-based formulations make them indispensable in personal care and OTC topical care products. With polyols contributing 43.5% of the global market value in 2025, their functional versatility ensures stable long-term demand, especially in mass-market body lotions, creams, and hair conditioners.

Cost and scalability challenges in bio-based production

Despite rising interest in fermentation/bio-based humectants, high production costs and limited scalability restrict wider adoption, especially in price-sensitive markets. Bio-fermentation processes for HA and amino acid derivatives require specialized infrastructure and stringent quality controls, driving up costs compared to synthetic or petrochemical alternatives. This creates barriers for mid-tier and regional manufacturers, limiting broader penetration in mass-market product categories.

Regulatory scrutiny and formulation constraints

Global regulations around ingredient sourcing, purity, and consumer safety are tightening, particularly in the EU and North America. Restrictions on certain petrochemical-derived humectants and pressure to replace synthetic options with natural equivalents complicate product development. Additionally, some humectants pose formulation challenges such as stickiness, incompatibility with certain actives, or reduced performance in low-humidity environments, limiting their universal application across product types.

Encapsulated delivery systems gaining momentum

Encapsulation of humectants, especially hyaluronic acid and crosslinked HA complexes, is emerging as a key innovation trend. Encapsulation enhances ingredient stability, ensures controlled release, and improves bioavailability in formulations. This trend aligns with the growing consumer demand for long-lasting hydration and advanced skin performance, particularly in premium and dermocosmetic products. By 2035, encapsulated humectants are expected to capture a significant share of new launches in facial serums and targeted hydration solutions.

Regional surge in Asia driven by India and China

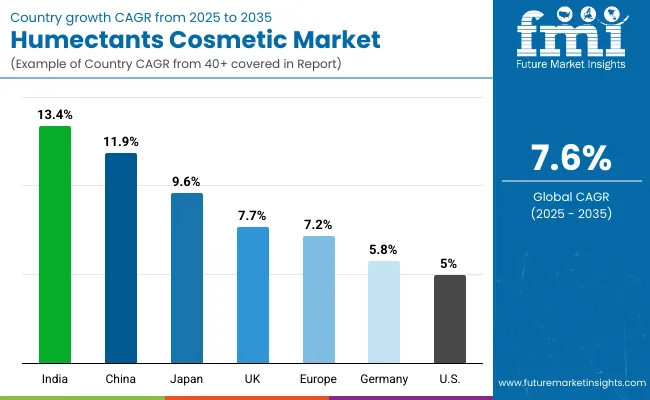

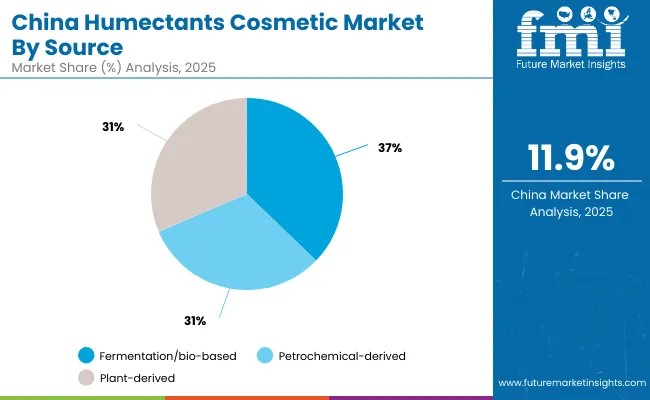

The Asia-Pacific region, particularly China (11.9% CAGR) and India (13.4% CAGR), is becoming a growth engine for the Humectants Cosmetic Market. This surge is fueled by rising middle-class income, booming personal care consumption, and increasing adoption of global beauty standards. Local brands are also embracing bio-based humectants, creating new opportunities for fermentation-derived and plant-based options. Asia is expected to outpace Europe in new product launches by the early 2030s, reshaping the global competitive balance.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 11.9% |

| USA | 5.0% |

| India | 13.4% |

| UK | 7.7% |

| Germany | 5.8% |

| Japan | 9.6% |

| Europe | 7.2% |

China and India are emerging as the most dynamic markets for humectants, with projected CAGRs of 11.9% and 13.4% respectively between 2025 and 2035. In China, rapid urbanization, rising disposable incomes, and strong consumer preference for dermocosmetic and premium personal care products are fueling demand for fermentation-based hyaluronic acids and amino acid derivatives. India, on the other hand, is witnessing accelerated adoption driven by the booming personal care sector, affordability of polyols, and the growing presence of local brands integrating plant-derived and bio-based humectants into mass-market moisturizers, creams, and haircare products. Together, these markets are expected to contribute disproportionately to global volume growth, shaping future sourcing and formulation trends.

In contrast, the USA and European markets, including the UK and Germany, are projected to record moderate growth rates ranging from 5.0% to 7.7%, reflecting their maturity and regulatory-driven shifts toward sustainable and clean-label ingredients. While the USA maintains steady demand for polyols and expanding use of dermocosmetic humectants in OTC formulations, Europe’s growth is supported by stringent eco-label requirements that accelerate the transition to fermentation/bio-based categories.

Japan, with a CAGR of 9.6%, stands out in East Asia due to its high consumer acceptance of advanced molecular classes such as crosslinked HA and encapsulated delivery systems, aligning with the region’s long-standing focus on high-performance skin hydration. These regional patterns highlight a dual growth dynamic where Asia-Pacific drives volume expansion while North America and Europe pivot toward high-value, sustainable innovation.

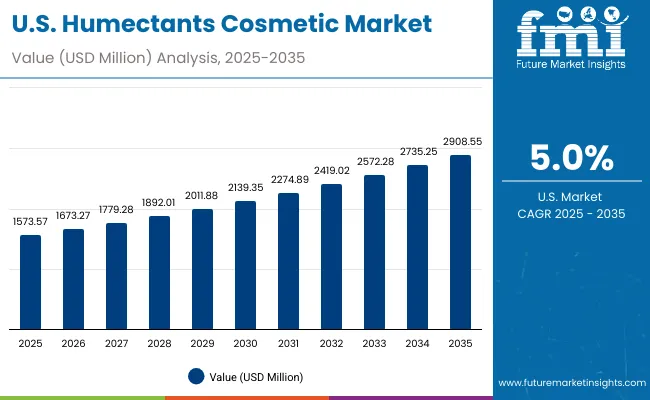

| Year | USA Humectants Cosmetic Market (USD Million) |

|---|---|

| 2025 | 1573.57 |

| 2026 | 1673.27 |

| 2027 | 1779.28 |

| 2028 | 1892.01 |

| 2029 | 2011.88 |

| 2030 | 2139.35 |

| 2031 | 2274.89 |

| 2032 | 2419.02 |

| 2033 | 2572.28 |

| 2034 | 2735.25 |

| 2035 | 2908.55 |

The Humectants Cosmetic Market in the United States is projected to grow at a CAGR of 5.0% through 2035, led by consistent demand across personal care, dermocosmetic, and OTC topical formulations. Polyols remain the primary revenue driver, accounting for 37.1% of the country’s market in 2025, supported by their widespread use in moisturizers, body lotions, and hair conditioners. Growth is also reinforced by rising adoption of hyaluronic acids in premium skincare lines, particularly within anti-aging serums and facial moisturizers. Clean beauty, regulatory scrutiny, and sustainable sourcing trends are shaping formulation strategies, prompting manufacturers to integrate fermentation-derived humectants into new product launches.

The Humectants Cosmetic Market in the United Kingdom is expected to expand at a CAGR of 7.7% between 2025 and 2035, supported by a strong emphasis on dermocosmetic formulations and sustainability-led product innovation. UK consumers demonstrate high preference for bio-based and plant-derived humectants, accelerating demand for hyaluronic acids and amino acid derivatives. Premium skincare brands are integrating encapsulated delivery systems for long-lasting hydration, while regulatory momentum around natural and eco-certified ingredients further strengthens adoption. Clean-label transparency and cruelty-free positioning remain central to brand differentiation in the UK market.

India is witnessing rapid growth in the Humectants Cosmetic Market, which is forecast to expand at a CAGR of 13.4% through 2035 the highest globally. Rising middle-class incomes, awareness of skin health, and expansion of mass-market personal care are fueling demand for cost-effective polyols and sugar alcohols. Local manufacturers are increasingly incorporating fermentation-based humectants such as hyaluronic acids into affordable serums and creams, widening consumer access. Growth is also reinforced by e-commerce penetration, rising exports of Indian cosmetics, and the use of bio-based actives in Ayurvedic and herbal-inspired formulations.

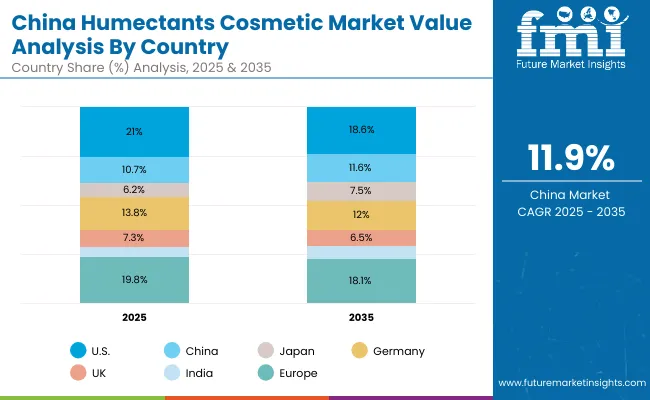

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.0% |

| China | 10.7% |

| Japan | 6.2% |

| Germany | 13.8% |

| UK | 7.3% |

| India | 4.4% |

| Europe | 19.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.6% |

| China | 11.6% |

| Japan | 7.5% |

| Germany | 12.0% |

| UK | 6.5% |

| India | 5.3% |

| Europe | 18.1% |

The Humectants Cosmetic Market in China is projected to grow at a CAGR of 11.9% between 2025 and 2035, making it one of the fastest-expanding markets globally. Fermentation/bio-based humectants hold 37.2% of the country’s revenue share in 2025, supported by strong uptake in premium skincare, dermocosmetics, and haircare. Urban consumer demand for multifunctional hydration solutions and anti-aging actives is driving large-scale integration of hyaluronic acids across product portfolios. Domestic manufacturers are scaling competitive production of bio-fermented humectants, enabling both affordability and innovation. Rising penetration of e-commerce and smart retail channels further accelerates consumption growth.

| USA By Chemistry | Value Share% 2025 |

|---|---|

| Polyols | 37.1% |

| Others | 62.9% |

The Humectants Cosmetic Market in the United States is projected at USD 1,573.6 million in 2025. Polyols contribute 37.1%, while other chemistry classes including hyaluronic acids, amino acid derivatives, and sugar alcohols account for 62.9%. This indicates a balanced market where commodity ingredients maintain volume leadership, but high-value bio-based humectants are steadily increasing their footprint. Demand is shaped by a mature personal care industry with strong emphasis on dermocosmetic and OTC formulations.

Rising adoption of HA in anti-aging serums and premium moisturizers is reshaping product innovation, while clean-label mandates encourage sourcing shifts toward plant-based and fermentation-derived humectants. OTC topical care, especially hand sanitizers and medicated creams, continues to rely heavily on polyols due to cost efficiency and multifunctionality. As USA brands focus on clinical efficacy and sustainability claims, the blend of polyols with specialized HA derivatives is expected to define the competitive product mix.

| China By Source | Value Share% 2025 |

|---|---|

| Fermentation/bio-based | 37.2% |

| Others | 62.8% |

The Humectants Cosmetic Market in China is projected at USD 804.3 million in 2025. Fermentation/bio-based humectants contribute 37.2% of the value, underlining the country’s rapid pivot toward biotech-driven personal care solutions. Growth is underpinned by the strong domestic cosmetics industry, where HA of multiple molecular weights is integrated into premium and mid-tier skincare products. Urban consumers, particularly younger demographics, display strong preference for high-performance hydration and multifunctional serums, fueling adoption of fermented and amino acid-derived humectants.

China’s market is further supported by competitive production from local biotech firms, enabling scale and affordability in fermentation-based actives. E-commerce platforms play a vital role in driving distribution, allowing rapid penetration of niche formulations. As city modeling programs and health-conscious lifestyles expand demand for dermocosmetics, bio-based humectants are expected to outpace petrochemical-derived options, reinforcing China’s role as a global innovation hub.

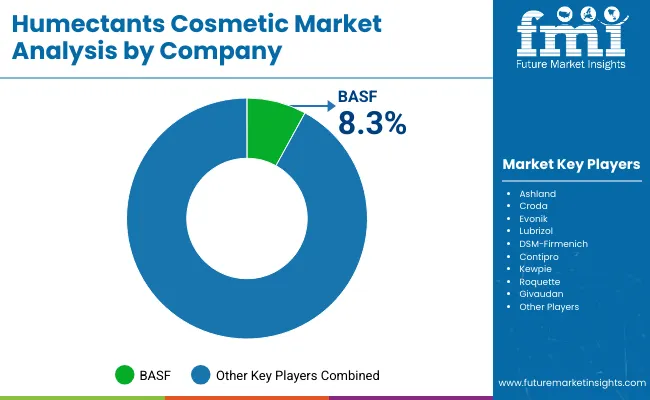

The Humectants Cosmetic Market is moderately fragmented, with a blend of chemical giants, biotechnology firms, and specialized personal care ingredient providers shaping competition. Large multinational players secure an edge through scale, global supply networks, and diversified product portfolios spanning polyols, fermentation-based hyaluronic acids, and amino acid derivatives. Their strategies emphasize sustainability certifications, clinical validation, and integration of clean-label and eco-friendly positioning to align with consumer preferences worldwide.

Mid-sized innovators are strengthening their presence by focusing on high-purity fermentation-based actives, encapsulated delivery formats, and multifunctional derivatives that address specific skin and haircare needs. These players are capturing share by offering differentiated performance benefits and targeting dermocosmetic and premium product lines. Specialized providers, including regional ingredient firms, concentrate on plant-derived and natural sugar-based humectants, catering to niche applications in herbal, Ayurvedic, and natural-inspired formulations.

Competitive differentiation is shifting away from cost-based commoditization toward advanced formulation capabilities, sustainable sourcing, and technical collaboration with cosmetic brands. Ecosystem strength, clinical efficacy, and ability to deliver high-performance hydration across diverse end-use industries are defining market leadership.

Key Developments in Humectants Cosmetic Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Chemistry | Polyols (glycerin, sorbitol, propylene glycol), Hyaluronic acids (various MW), Amino acid derivatives (betaine, sodium PCA), Sugar alcohols & polyglucosides |

| Source | Petrochemical-derived, Fermentation/bio-based, Plant-derived |

| Molecular Class | Low-MW humectants, High-MW film-formers, Crosslinked HA/supramolecular complexes |

| Delivery System | Free form, Aqueous concentrates (≥70%), Encapsulated |

| Physical Form | Liquid, Powder |

| Application | Facial moisturizers & serums, Body lotions & creams, Hair conditioners & masks, Hand sanitizers & wash care |

| End-use Industry | Personal care, Dermocosmetic, OTC topical care |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Ashland, Croda, Evonik, Lubrizol, DSM-Firmenich, Contipro, Kewpie, Roquette, Givaudan |

| Additional Attributes | Dollar sales by chemistry, source, molecular class, and end-use industry; rising adoption of fermentation-derived HA and amino acid derivatives; expansion of encapsulated delivery formats; sustained dominance of polyols in high-volume personal care; regulatory-driven demand for bio-based and clean-label ingredients; regional differences in dermocosmetic uptake; innovations in low- and high-MW humectants; and growing role of encapsulated HA in premium hydration formulations. |

The Humectants Cosmetic Market is estimated to be valued at USD 7,503.4 million in 2025.

The market size for the Humectants Cosmetic Market is projected to reach USD 15,602.7 million by 2035.

The Humectants Cosmetic Market is expected to grow at a CAGR of 7.6% between 2025 and 2035.

The key chemistry types in the Humectants Cosmetic Market are polyols, hyaluronic acids, amino acid derivatives, and sugar alcohols & polyglucosides.

In terms of source, the fermentation/bio-based segment is expected to command 38.7% share in the Humectants Cosmetic Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Humectants Market Growth & Demand 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA