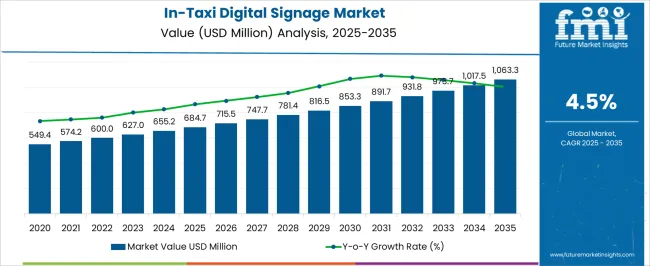

The in-taxi digital signage market is expected to grow from USD 684.7 million in 2025 to USD 1,063.3 million by 2035, registering a 4.5% CAGR and generating an absolute dollar opportunity of USD 378.6 million. Growth is supported by increasing urban mobility, rising demand for in-vehicle advertising, and advancements in display technologies, connectivity, and content management platforms. The market also benefits from partnerships between taxi operators, advertisers, and digital signage solution providers, enabling targeted, real-time content delivery to passengers.

Market growth curve shape analysis highlights the trajectory and momentum of expansion over the forecast period. From 2025 to 2028, the growth curve shows a gradual upward slope, reflecting early adoption in mature markets such as North America and Europe, where fleets are retrofitted with digital signage systems and incremental revenue is generated from advertising contracts.

Between 2029 and 2032, the curve steepens, indicating accelerated growth as Asia Pacific and Latin America deploy large-scale taxi digital signage networks, supported by rising ride-hailing services, urbanization, and increasing demand for interactive passenger experiences. From 2033 to 2035, the growth curve begins to moderate, forming a smoother trajectory as markets approach higher penetration levels, replacement cycles dominate, and innovation focuses on content and interactivity rather than new installations. Overall, the growth curve exhibits early gradual uptake, mid-period acceleration, and late-stage stabilization, reflecting a predictable and sustained market expansion.

| Metric | Value |

|---|---|

| In-Taxi Digital Signage Market Estimated Value in (2025 E) | USD 684.7 million |

| In-Taxi Digital Signage Market Forecast Value in (2035 F) | USD 1063.3 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The in-taxi digital signage market is primarily driven by the urban transportation sector, which accounts for around 42% of the market share, as ride-hailing and taxi fleets integrate digital displays for passenger engagement and advertising. The advertising and media segment contributes approximately 28%, leveraging in-taxi screens to deliver targeted campaigns and promote brands in high-traffic areas. Public transportation networks represent close to 15%, adopting digital signage for information dissemination, route updates, and passenger communication. The hospitality and tourism sector accounts for roughly 10%, where taxis and shuttles provide promotional content and travel information. The remaining 5% comes from logistics and corporate shuttle services, which use signage to enhance passenger experience and communication. The in-taxi digital signage market is evolving with advancements in content management, connectivity, and analytics. Cloud-based platforms allow operators to update content remotely and schedule advertisements dynamically. Interactive touchscreens and mobile integration are enabling personalized passenger engagement. Integration with GPS and location-based services supports targeted advertising and real-time updates. Energy-efficient and high-resolution displays are improving visibility and reducing operational costs. Partnerships between fleet operators, advertisers, and software providers are expanding deployment opportunities. Increasing urban mobility, demand for captive-audience advertising, and enhanced passenger experience initiatives continue to drive growth in the market globally.

The In-Taxi Digital Signage market is experiencing significant expansion, driven by the growing adoption of digital advertising platforms within ride-hailing and traditional taxi fleets. The market growth is being supported by rising passenger engagement through personalized, context-aware messaging, as well as the integration of real-time content management systems in vehicles. Increasing investments in smart mobility solutions and fleet digitization have enabled operators to leverage in-vehicle displays for both entertainment and advertising revenue generation.

Advancements in display technology, coupled with connectivity enhancements such as 4G and 5G, have further facilitated content delivery with minimal latency. The market outlook indicates continued growth as urbanization accelerates and fleet operators seek innovative revenue streams.

The focus on modular hardware, energy-efficient displays, and data-driven content delivery systems is expected to drive adoption, while regulatory compliance and safety considerations are encouraging standardized installation practices across commercial taxis Overall, the combination of operational efficiency, improved passenger experience, and advertising monetization is shaping the trajectory of this market.

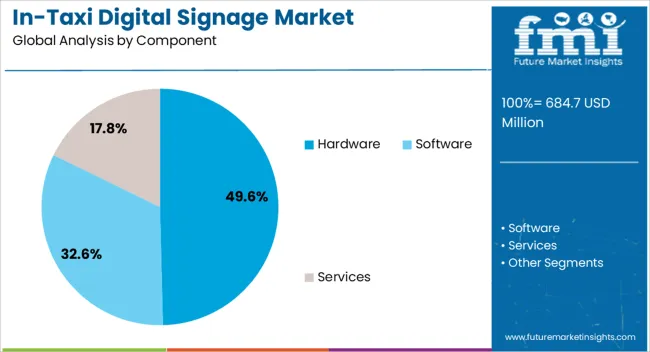

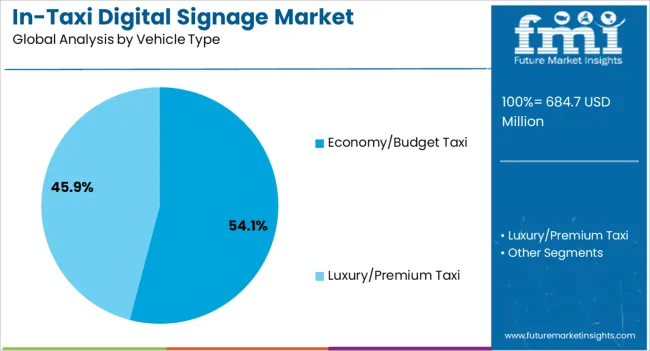

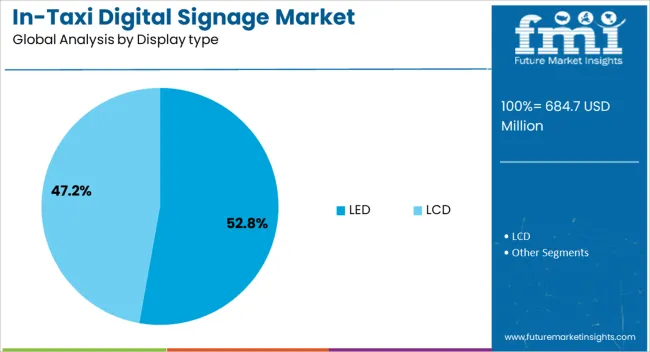

The in-taxi digital signage market is segmented by component, vehicle type, display type, screen size, application, and geographic regions. By component, in-taxi digital signage market is divided into Hardware, Software, and Services. In terms of vehicle type, in-taxi digital signage market is classified into Economy/Budget Taxi and Luxury/Premium Taxi. Based on display type, in-taxi digital signage market is segmented into LED and LCD. By screen size, in-taxi digital signage market is segmented into 10-15 inches, Below 10 inches, and Above 15 inches. By application, in-taxi digital signage market is segmented into Advertising, Entertainment, Navigation, and Others. Regionally, the in-taxi digital signage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component is projected to account for 49.6% of the In-Taxi Digital Signage market revenue in 2025, making it the leading segment. This dominance is being driven by the requirement for robust, durable, and high-quality electronic components capable of withstanding the vibrations, temperature variations, and long operational hours in commercial vehicles. The preference for hardware-centric solutions is strengthened by the need for seamless integration with vehicle systems, including power management, connectivity modules, and display interfaces.

Growth has been supported by the increasing deployment of advanced processors, touchscreens, and content management interfaces that enable real-time interaction and remote updates. Hardware reliability is critical for ensuring uninterrupted advertising and passenger engagement services.

Additionally, the modularity of hardware components allows fleet operators to upgrade individual elements without replacing the entire system, reducing total cost of ownership and promoting long-term adoption The continued investment in durable, high-performance hardware solutions is expected to sustain the segment’s leading position in the market.

The Economy/Budget Taxi segment is estimated to hold 54.1% of the In-Taxi Digital Signage market revenue in 2025, emerging as the largest vehicle type category. This leading share is being attributed to the widespread presence of budget taxis in urban transport networks, where high passenger turnover creates an effective channel for advertising. Operators have increasingly adopted digital signage solutions to monetize passenger dwell time and improve overall service appeal.

Growth in this segment has been supported by the cost-effectiveness of deploying displays in vehicles with standardized interior layouts and consistent operational patterns. The integration of lightweight, energy-efficient displays has further simplified installation in budget fleets.

Additionally, the adoption of connected platforms allows operators to deliver targeted content based on location, passenger demographics, and travel patterns, enhancing engagement and advertising effectiveness With urban mobility services continuing to expand and ride-sharing platforms gaining traction, the demand for in-taxi digital signage in economy taxis is expected to remain strong, reinforcing the segment’s market leadership.

The LED display type is projected to hold 52.8% of the In-Taxi Digital Signage market revenue in 2025, establishing it as the leading display technology. This preference is being driven by LEDs’ superior brightness, energy efficiency, and durability, which are critical for maintaining visibility in varying lighting conditions inside vehicles. The widespread adoption of LED displays has been supported by advancements in high-resolution panels and adaptive brightness control, ensuring content clarity during both daytime and nighttime operations.

LED displays also offer long operational lifespans, reducing maintenance and replacement costs for fleet operators. The flexibility in size and form factor allows integration into diverse vehicle interiors without compromising passenger comfort or safety.

Furthermore, the compatibility of LED technology with interactive and dynamic content delivery systems has enhanced passenger engagement and advertising effectiveness As fleet operators continue to prioritize reliable, low-maintenance, and visually impactful solutions, the LED display segment is expected to sustain its leading position in the in-taxi digital signage market.

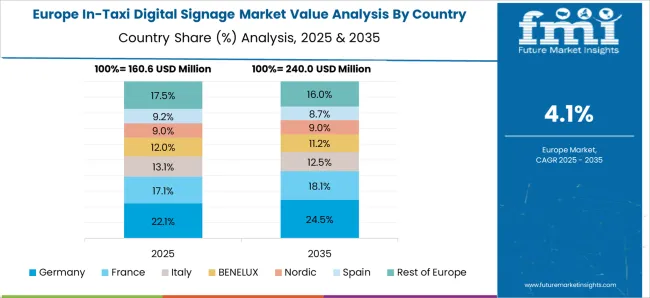

The in-taxi digital signage market is expanding due to growing adoption of smart transportation solutions, urban mobility infrastructure, and advertising-driven revenue models. Asia Pacific leads with 36% adoption, driven by China (18%), Japan (10%), and India (8%). Europe accounts for 30%, with Germany (10%), France (9%), and UK (11%). North America contributes 28%, primarily the USA, while the rest of the world represents 6%. Advertising and infotainment applications dominate, comprising 60% of usage, while passenger information services account for 25%, and navigation assistance 15%. Rising smartphone integration and ride-hailing app partnerships are further driving adoption across major cities.

Market growth is driven by the demand for interactive advertising, infotainment, and passenger engagement solutions. Advertising accounts for 60% of installations, infotainment 25%, and navigation assistance 15%. Asia Pacific leads with 36% adoption, Europe 30%, North America 28%, and RoW 6%. Integration with ride-hailing apps and fleet management systems enhances user engagement and monetization potential. Dynamic content delivery and real-time updates are becoming standard features in 40–45% of new deployments. Government initiatives promoting smart urban mobility and digitized public transportation infrastructure further accelerate adoption in metropolitan areas, particularly in China, India, and USA metropolitan regions.

Key trends include interactive screens, IoT integration, and targeted advertising. Interactive touchscreens are installed in approximately 30% of new taxis in Asia Pacific and North America. IoT-enabled signage allows real-time content updates, improving passenger engagement and advertising effectiveness. Data-driven advertising and programmatic content distribution are increasing in Europe, accounting for nearly 35% of total deployments. Integration with ride-hailing platforms and payment systems enables personalized experiences. Multi-language content support is becoming standard, especially in tourist-heavy cities. Mobile app connectivity for passengers enhances user experience and loyalty. Growing urbanization and expansion of smart city initiatives drive the integration of in-taxi digital signage globally.

Opportunities exist in advertising, infotainment, passenger information, and navigation solutions. Advertising dominates at 60% of adoption, infotainment 25%, and navigation assistance 15%. Asia Pacific contributes 36% adoption, Europe 30%, and North America 28%. Expansion of ride-hailing services in metropolitan cities creates opportunities to install digital signage across new fleets. Partnerships with content providers, video-on-demand platforms, and real-time traffic information services enable new revenue streams. Adoption in tourist-heavy regions and corporate fleet services is increasing. Fleet operators benefit from monetizing ad space, while passengers gain access to entertainment and real-time updates, supporting sustained growth globally.

Challenges include high installation and maintenance costs, regulatory compliance, and content management issues. Installation costs are 15–20% higher than traditional taxi equipment. Ongoing maintenance for screens, connectivity, and software updates adds an additional 10% of operating costs. Privacy and content regulations differ across regions, complicating cross-border deployments. Network coverage issues and hardware reliability in developing regions affect user experience. Competition from mobile devices and streaming platforms limits passenger engagement. Limited standardization of hardware and software solutions creates integration challenges. Despite high growth potential, adoption in small fleets and rural areas remains constrained, particularly in Africa, Latin America, and parts of Asia.

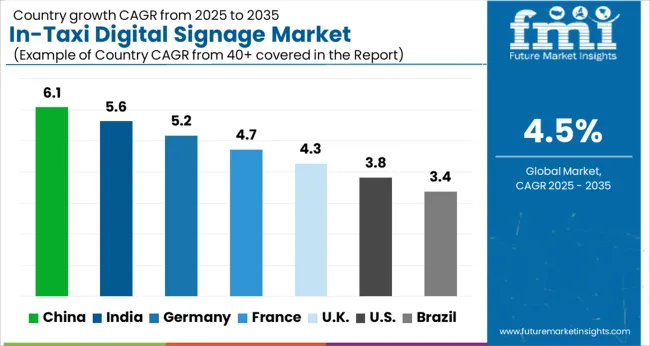

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The in-taxi digital signage market is projected to grow at a global CAGR of 4.5% through 2035, fueled by increasing demand for in-vehicle advertising, urban mobility solutions, and digital content integration. China leads at 6.1%, a 1.36× multiple over the global benchmark, supported by BRICS-driven growth in taxi fleets, ride-hailing platforms, and urban transport infrastructure. India follows at 5.6%, a 1.24× multiple of the global rate, reflecting rising adoption in metropolitan areas, commercial taxis, and digital advertising initiatives. Germany records 5.2%, a 1.16× multiple of the benchmark, shaped by OECD-backed innovation in display technology, connected vehicle systems, and urban transport projects. The United Kingdom posts 4.3%, 0.96× the global rate, with demand concentrated in taxi networks, public transport integration, and targeted advertising solutions. The United States stands at 3.8%, 0.84× the benchmark, with steady adoption in fleet upgrades, urban mobility initiatives, and niche advertising applications. BRICS economies drive most of the market volume, OECD countries focus on technological efficiency and content management, while ASEAN nations contribute through expanding urban taxi networks and digital signage adoption.

The in-taxi digital signage market in China is projected to grow at a CAGR of 6.1%, driven by rising adoption of ride-hailing services, increasing urban mobility, and demand for in-vehicle advertising. Companies such as Didi Chuxing and Vtron provide high-resolution screens with interactive capabilities for taxis and fleet vehicles. Technological improvements focus on real-time content delivery, cloud-based management, and targeted advertising. Growth is supported by urban public transport modernization and partnerships with retail, entertainment, and FMCG brands for in-vehicle promotions.

The in-taxi digital signage market in India is expected to grow at a CAGR of 5.6%, supported by expansion of app-based taxi services, growing demand for targeted advertising, and rising passenger engagement initiatives. Companies such as Ola and MagicBricks provide digital signage solutions integrated with GPS and real-time content updates. Technological innovation focuses on dynamic advertisements, remote content management, and energy-efficient displays. Growth is also driven by increasing interest from brands in tier 1 and tier 2 cities.

Germany’s in-taxi digital signage market is projected to grow at a CAGR of 5.2%, influenced by rising passenger demand for infotainment, urban mobility initiatives, and interest from advertisers targeting high-income commuters. Providers such as Daimler and Cleverciti Systems supply high-definition screens integrated with location-based advertising and passenger engagement analytics. Demand is concentrated in metropolitan areas with high taxi usage and corporate transportation services. Technological improvements focus on interactive interfaces, real-time updates, and energy-efficient displays.

The in-taxi digital signage market in the United Kingdom is expected to grow at a CAGR of 4.3%, supported by investments in urban mobility solutions, smart city initiatives, and increasing interest from advertisers in interactive in-vehicle campaigns. Suppliers focus on lightweight, energy-efficient displays with real-time content management. Demand is driven by taxi fleets in major cities and airport transfer services. Technological development emphasizes integration with mobile apps, analytics, and dynamic advertising capabilities to improve engagement.n

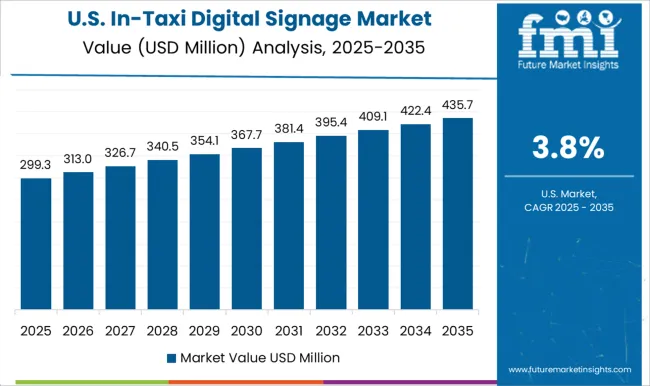

The in-taxi digital signage market in the United States is projected to grow at a CAGR of 3.8%, driven by urban mobility programs, ride-hailing services, and digital advertising demand. Major suppliers such as Verifone and Broadsign provide high-definition displays with cloud-based content management and interactive features. Growth is concentrated in metropolitan areas with high taxi and rideshare penetration. Technological improvements focus on energy efficiency, audience analytics, and integration with in-app promotions to enhance ad revenue.

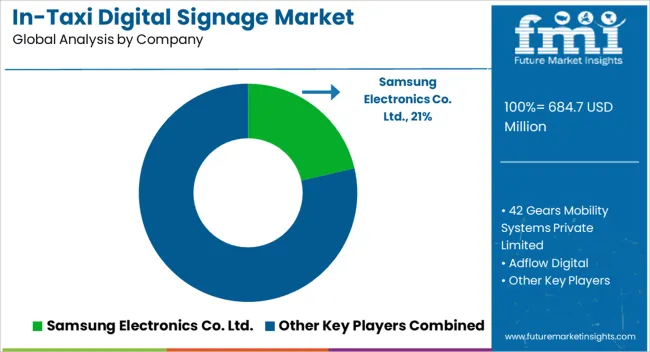

Competition in the in-taxi digital signage market is being shaped by display clarity, content management capabilities, and integration with vehicle infotainment systems. Market positions are being reinforced through advanced hardware, cloud-based software platforms, and scalable deployment networks that ensure real-time content delivery and audience engagement. Samsung Electronics Co. Ltd. and 42 Gears Mobility Systems are being represented with high-resolution displays engineered for durability, visibility, and seamless connectivity within taxi environments. Adflow Digital and Apple Inc. are being promoted with digital signage solutions structured for dynamic content updates, user interactivity, and advertising analytics. Curb Mobility LLC and LYFT are being applied with integrated platforms optimized for fleet-wide content management and passenger engagement. Navori SA and Swipe Technologies are being showcased with software-driven solutions designed for programmable content, remote monitoring, and targeted marketing campaigns. TOPAZ and VeriFone Holdings Inc. are being advanced with hardware and software systems engineered for secure payment integration, multimedia playback, and operational reliability in daily taxi service. Strategies in the market are being centered on content personalization, remote management, and operational scalability. Research and development are being allocated to improve display brightness, connectivity protocols, interactive features, and analytics capabilities. Product brochures are being structured with specifications covering screen size, resolution, connectivity options, mounting solutions, software compatibility, and power requirements. Features such as remote content updates, touch-enabled interfaces, secure payment integration, and fleet-wide monitoring are being emphasized to guide procurement and operational planning. Each brochure is being arranged to present technical performance, certification compliance, and service support. Information is being provided in a clear, evaluation-ready format to assist fleet operators, advertising partners, and procurement teams in selecting in-taxi digital signage solutions that meet reliability, visibility, and engagement requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 684.7 Million |

| Component | Hardware, Software, and Services |

| Vehicle Type | Economy/Budget Taxi and Luxury/Premium Taxi |

| Display type | LED and LCD |

| Screen Size | 10-15 inches, Below 10 inches, and Above 15 inches |

| Application | Advertising, Entertainment, Navigation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung Electronics Co. Ltd., 42 Gears Mobility Systems Private Limited, Adflow Digital, Apple Inc., Curb Mobility LLC, LYFT, Navori SA, Swipe Technologies, TOPAZ, and VeriFone Holdings Inc. |

| Additional Attributes | Dollar sales by heat pump type and residential application, demand dynamics across new constructions and retrofits, regional trends in energy-efficient heating and cooling adoption, innovation in COP, inverter technology, and smart controls, environmental impact of refrigerants and energy use, and emerging use cases in hybrid HVAC and smart homes. |

The global in-taxi digital signage market is estimated to be valued at USD 684.7 million in 2025.

The market size for the in-taxi digital signage market is projected to reach USD 1,063.3 million by 2035.

The in-taxi digital signage market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in in-taxi digital signage market are hardware, software and services.

In terms of vehicle type, economy/budget taxi segment to command 54.1% share in the in-taxi digital signage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA