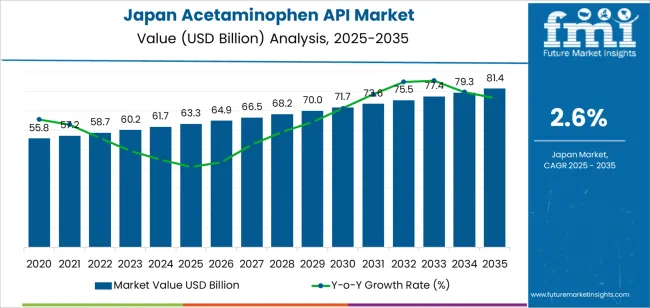

The demand for acetaminophen API in Japan is valued at USD 63.3 billion in 2025 and is forecasted to reach USD 81.4 billion by 2035, recording a CAGR of 2.6%. Demand is supported by sustained use of acetaminophen-based formulations across prescription and over-the-counter analgesics and antipyretics. Wider use of combination drugs, stable consumption in hospital settings, and continued reliance on acetaminophen as a first-line pain-relief option contribute to long-term API procurement. Growth also reflects consistent manufacturing activity and the need for a reliable domestic and imported API supply for pharmaceutical production.

Acetaminophen API with opioids represents the leading drug class, driven by its established use in controlled-dose pain-management applications. These formulations serve clinical settings that require stable analgesic performance and predictable pharmacokinetic characteristics. Demand is reinforced by structured prescribing practices and ongoing production of combination analgesics for regulated therapeutic use.

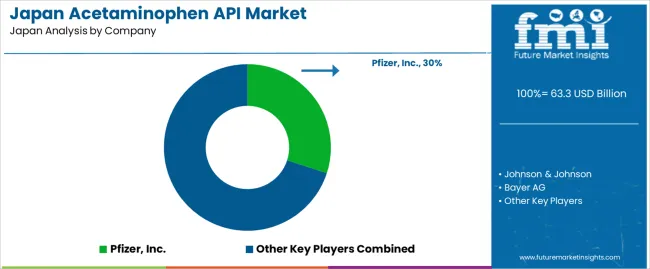

Demand is strongest in Kyushu & Okinawa, Kanto, and Kinki, where pharmaceutical manufacturing clusters, distribution networks, and hospital procurement centres are concentrated. Key suppliers include Pfizer, Johnson & Johnson, Bayer, Sanofi, and GlaxoSmithKline, providing consistent API sourcing channels for Japanese formulators.

The 10-year growth comparison shows a steady but moderate expansion shaped by stable demand for analgesic formulations, high domestic quality standards, and predictable procurement cycles among pharmaceutical manufacturers. Between 2025 and 2030, growth will be slightly stronger as companies reinforce supply-chain security, upgrade compliance systems, and adjust sourcing strategies to ensure reliability of essential medicines. Incremental investment in purification processes and traceability tools will contribute to this early uplift.

From 2030 to 2035, growth becomes more measured as consumption of acetaminophen-based products stabilises across retail and institutional channels. Production capacity and raw-material utilisation will align closely with mature demand, with expansion driven mainly by replacement of legacy equipment and process-efficiency improvements rather than volume increases. Regulatory continuity, consistent therapeutic usage, and long product lifecycles will support predictable late-period gains. The decade-long comparison reflects a transition from early supply-chain reinforcement to a mature operational phase defined by efficiency, quality maintenance, and steady output within Japan’s established pharmaceutical-manufacturing ecosystem.

| Metric | Value |

|---|---|

| Japan Acetaminophen API Sales Value (2025) | USD 63.3 billion |

| Japan Acetaminophen API Forecast Value (2035) | USD 81.4 billion |

| Japan Acetaminophen API Forecast CAGR (2025-2035) | 2.6% |

Demand for acetaminophen API in Japan is increasing because pharmaceutical manufacturers require reliable supplies of this key analgesic and antipyretic ingredient for over-the-counter and prescription drug production. The ageing Japanese population and rising incidence of chronic pain and fever-related conditions contribute to stable and sustained need for pain-relief medications. Quality standards in Japan are stringent, which prioritises high-purity API grades that meet domestic regulatory and pharmacopoeial specifications.

Japanese formulators and contract manufacturers focus on ingredient traceability, safety and stability, which supports demand for well-qualified API sources. Industry trends toward multi-ingredient formulations and convenience dosing (such as effervescent or chewable tablets) increase usage of acetaminophen API across dosage forms. Challenges include competition from import-dependent supply chains, high manufacturing and compliance costs and pressure from alternative pain-relief therapies that may limit long-term growth. Some manufacturers may delay capacity expansion until profitability and regulatory clarity improve.

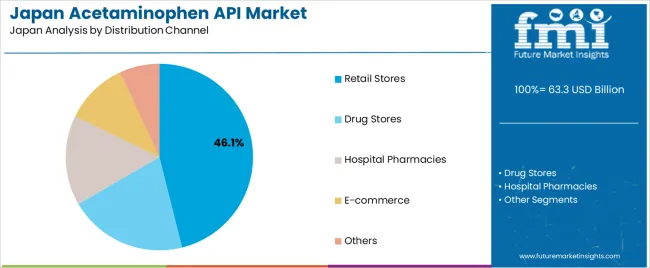

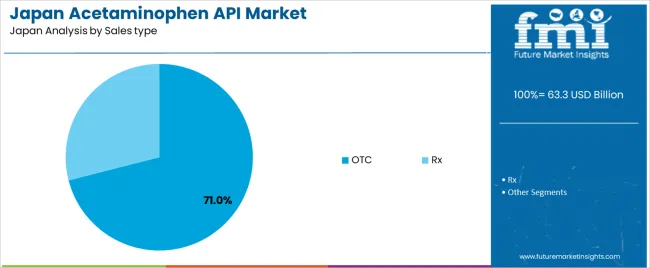

Demand for acetaminophen API in Japan reflects widespread use of analgesic and antipyretic formulations across retail, clinical, and institutional channels. Distribution across drug classes, purchasing channels, and sales types aligns with patient self-care patterns, prescription practices, and the continued presence of combination products in clinical pain-management settings.

Acetaminophen API combined with opioids holds 58.0% of Japanese demand, making it the leading drug-class segment. These formulations remain essential for controlled moderate pain management, particularly within hospital and specialist care settings. Their usage reflects clinical treatment pathways requiring paired analgesic effects. Standalone acetaminophen API represents 27.0%, supporting common fever and pain treatments available across pharmacies and retail stores. These products are widely used for routine self-care and short-duration symptom relief. The remaining 15.0% includes other mixed or specialized formulations used in select therapeutic settings.

Key drivers and attributes:

Retail stores hold 46.1% of demand and represent the largest distribution channel in Japan. Consumers rely on retail outlets for accessible OTC acetaminophen products used for fever, headaches, and minor musculoskeletal discomfort. Drug stores represent 20.5%, providing pharmacist-supported recommendations and a wide range of branded formulations. Hospital pharmacies account for 15.6%, reflecting inpatient and outpatient use of combination therapies and prescribed formulations. E-commerce holds 10.9%, supported by convenience-oriented purchasing patterns for OTC items. The remaining 6.9% covers institutional and specialty distribution.

Key drivers and attributes:

OTC acetaminophen-based products hold an estimated 71.0% of demand in Japan. Their availability and broad therapeutic use make them central to household medicine purchasing. OTC formulations support pain and fever management without clinical oversight and align with common self-care practices. Prescription (Rx) products account for 29.0%, driven primarily by acetaminophen–opioid combinations used in structured clinical settings. Rx use follows regulated prescribing pathways linked to treatment intensity and patient supervision needs.

Key drivers and attributes:

Steady demand for analgesics and antipyretics, aging population health needs and mature generic manufacturing base are driving demand.

In Japan, demand for acetaminophen API remains stable due to continuous consumption of over-the-counter and prescription analgesic and antipyretic drugs. The aging population increases incidence of chronic pain, musculoskeletal conditions and fever-related illnesses, which ensures ongoing industry need. Japan’s strong manufacturing base in generics supports usage of acetaminophen API in tablets, syrups and combination formulations. Domestic API production and import channels maintain supply stability and support pharmaceutical companies in maintaining cost-efficient formulations.

Stringent regulatory standards, limited margin growth and competition from alternative analgesics moderate growth.

Japanese pharmaceutical regulation enforces rigorous quality-control standards, impurity limits and batch documentation for APIs, which increases manufacturing and compliance cost for acetaminophen API suppliers. Being a commoditised API, acetaminophen faces price pressure and limited margin expansion, which constrains investment in capacity expansion. Some medical practitioners and consumers prefer non-acetaminophen analgesics or novel treatments, which marginally limits demand growth for standard formulations containing acetaminophen.

Development of fixed-dose combinations, growth in OTC wellness products and interest in locally-sourced APIs define future trends.

API manufacturers are supporting pharmaceutical companies in developing fixed-dose combinations that include acetaminophen with other agents to enhance therapeutic positioning. Growth in over-the-counter wellness products and consumer interest in portable dosage forms supports demand for smaller-batch or specialised acetaminophen API formats. There is growing interest in localisation of API manufacturing in Japan to reduce dependency on imports and enhance supply-chain resilience, which may drive integration of acetaminophen API production further within domestic API networks.

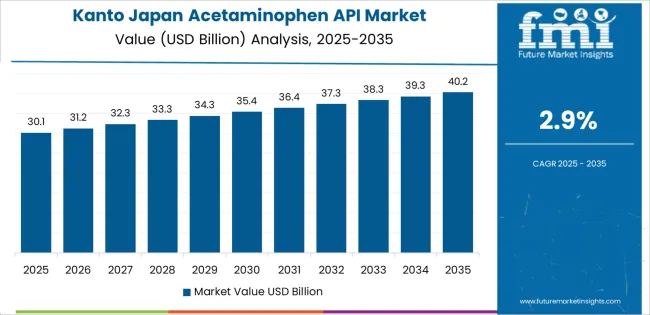

Demand for acetaminophen API in Japan is rising through 2035 due to consistent analgesic and antipyretic usage across hospitals, clinics, and retail-pharmacy networks. The API supports a broad range of formulations, including tablets, pediatric suspensions, hospital-dose packs, and combination medicines used in acute care and chronic symptom management. Demand patterns vary by region based on healthcare concentration, pharmaceutical-processing presence, and distribution-network coverage. Hospitals maintain year-round utilization for postoperative recovery and symptomatic treatment, while retail chains support continuous turnover of OTC analgesics. Kyushu & Okinawa leads with a 3.2% CAGR, followed by Kanto (2.9%), Kinki (2.6%), Chubu (2.3%), Tohoku (2.0%), and the Rest of Japan (1.9%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.2% |

| Kanto | 2.9% |

| Kinki | 2.6% |

| Chubu | 2.3% |

| Tohoku | 2.0% |

| Rest of Japan | 1.9% |

Kyushu & Okinawa grows at 3.2% CAGR, driven by steady demand from regional hospitals, clinics, and pharmacy chains that treat high volumes of routine fever and pain cases. Facilities in Fukuoka, Kumamoto, and Kagoshima depend on acetaminophen for postoperative care, pediatric dosing, and everyday acute-care needs. Regional manufacturers support selects formulation activities, ensuring stable API intake for tablet and suspension production. The widespread presence of retail pharmacies contributes to predictable OTC turnover, reinforcing regular replenishment cycles. Okinawa’s distributed population requires reliable supply through well-coordinated logistics routes, ensuring uninterrupted inventory availability across remote islands. Consistent healthcare workloads support recurring API procurement.

Kanto grows at 2.9% CAGR, supported by the country’s largest concentration of healthcare facilities, retail pharmacies, and pharmaceutical-distribution hubs. Tokyo, Kanagawa, and Chiba record strong utilization of acetaminophen for inpatient care, emergency treatment, pediatric dosing, and post-surgical recovery. Retail pharmacies maintain high consumer turnover of fever- and pain-relief medicines, reinforcing consistent API-linked replenishment cycles. The region hosts several contract manufacturers and packaging units that produce branded and generic acetaminophen formulations for national distribution. High population density contributes to stable baseline demand, while large hospital networks require continuous supply for clinical inventories. Strong wholesale channels ensure uninterrupted API availability across densely populated metropolitan corridors.

Kinki grows at 2.6% CAGR, supported by steady healthcare-system activity across Osaka, Kyoto, and Hyogo. Hospitals rely on acetaminophen for routine fever management, postoperative care, and pediatric treatment, generating consistent institutional demand. Retail-pharmacy chains maintain regular OTC sales of pain-relief medications, contributing to predictable API-related restocking patterns. Regional drug manufacturers participate in limited formulation and packaging operations, reinforcing ongoing procurement. Although Kinki’s pharmaceutical-processing density is smaller than Kanto’s, stable healthcare workloads maintain reliable demand for acetaminophen-based products. Growing outpatient care and chronic-symptom management programs also sustain consumption across urban and suburban areas.

Chubu grows at 2.3% CAGR, supported by balanced healthcare demand and moderate formulation activity across Aichi, Shizuoka, and Mie. Hospitals and clinics rely on acetaminophen for acute care, chronic symptom management, and pediatric dosing. Retail pharmacies experience predictable turnover of OTC analgesics, reinforcing consistent API-linked replenishment cycles. Several regional manufacturers produce select dosage forms within broader generic portfolios, ensuring permanent demand for API supply. Distribution centers in Aichi maintain efficient supply routes to surrounding prefectures, supporting uninterrupted clinical and retail availability. Growth remains moderate but consistent due to stable population levels and dependable healthcare utilization patterns.

Tohoku grows at 2.0% CAGR, supported by routine medical usage across hospitals, clinics, and pharmacies in Miyagi, Fukushima, and Iwate. Healthcare providers use acetaminophen extensively for fever control, pain management, and supportive care in both acute and chronic treatment cycles. Retail outlets maintain consistent turnover of OTC formulations, driving predictable API replenishment. While the region contains fewer large pharmaceutical manufacturers, regional wholesalers ensure stable supply to healthcare and retail facilities. The area’s demographic profile, including elderly populations, contributes to year-round utilization of essential analgesics.

The Rest of Japan grows at 1.9% CAGR, supported by dispersed healthcare networks, smaller hospitals, and community pharmacies across rural prefectures. Facilities use acetaminophen for routine symptom relief, postoperative care, and pediatric treatment. Retail outlets maintain steady turnover of essential analgesics, creating consistent API-based replenishment cycles. Regional supply chains ensure timely delivery despite geographic dispersion, particularly in remote and low-density communities. Although population bases are smaller, essential healthcare needs maintain ongoing demand for acetaminophen products throughout the year.

Demand for acetaminophen API in Japan is shaped by a concentrated group of multinational pharmaceutical suppliers that support domestic production of OTC analgesics and combination medicines. Pfizer, Inc. holds the leading position with an estimated 30.0% share, supported by established manufacturing capacity, consistent batch purity, and long-term supply arrangements with Japanese formulators. Its position is reinforced by adherence to Japanese pharmacopoeial standards and stable delivery performance.

Johnson & Johnson and Bayer AG follow as significant participants, providing acetaminophen API for branded and private-label formulations distributed through retail and hospital channels. Their strengths include validated analytical controls, dependable sourcing frameworks, and predictable integration with finished-dose production. Sanofi S.A. maintains a steady role through well-structured procurement and quality systems that support a wide range of analgesic and cold-relief products sold in Japan. GlaxoSmithKline plc. contributes additional capability through established supply chains and consistent API specifications aligned with Japanese regulatory requirements for both adult and pediatric preparations.

Competition across this segment centers on API purity, regulatory compliance, verification of critical quality attributes, and reliability of continuous supply. Demand remains steady due to widespread use of acetaminophen in household analgesics, seasonal increases associated with cold and flu incidence, and preference for suppliers capable of delivering pharmacopoeia-compliant API with predictable quality and dependable availability.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Drug Class | Acetaminophen API with Opioids, Acetaminophen API, Others |

| Distribution Channel | Retail Stores, Drug Stores, Hospital Pharmacies, E-commerce, Others |

| Sales Type | OTC, Rx |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Pfizer, Inc., Johnson & Johnson, Bayer AG, Sanofi S.A., GlaxoSmithKline plc. |

| Additional Attributes | Dollar sales by drug class, distribution channel, and sales type categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of analgesic API suppliers and pharmaceutical companies; developments in acetaminophen formulation, regulatory compliance, and hospital procurement; |

The global demand for acetaminophen API in Japan is estimated to be valued at USD 63.3 billion in 2025.

The demand for acetaminophen API in Japan is projected to reach USD 81.4 billion by 2035.

The demand for acetaminophen API in Japan is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types are cetaminophen API with opioids, acetaminophen API, and others.

In terms of distribution channel, retail stores segment to command 46.1% share in the demand for acetaminophen api in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA