The demand for built-in large cooking appliances in Japan is estimated at USD 676.6 billion in 2025 and is expected to increase to USD 1,144.7 billion by 2035, registering a CAGR of 5.4%. Expansion is being driven by sustained residential remodeling, continued development of new condominiums, and the growing preference for sleek, integrated kitchen interiors. Builders, architects, and homeowners are prioritizing appliances that merge seamlessly with cabinetry and maximize space efficiency. As modern kitchen layouts shift toward minimalist configurations that reduce visual clutter, the integration of built-in appliances becomes more common across premium and mainstream housing. These factors collectively reinforce long-term adoption and underpin steady progression throughout the forecast period.

The growth trend maintains a clear and consistent upward slope, rising from USD 552.8 billion in earlier assessments to USD 676.6 billion in 2025 and ultimately reaching USD 1,144.7 billion by 2035. Values increase gradually year by year, climbing from USD 713.6 billion in 2026, to USD 763.8 billion in 2027, moving past USD 934.9 billion in 2032, and reaching USD 1,013.6 billion in 2034. This predictable pattern reflects strong product replacement cycles, increased placement in new residential construction, and deeper penetration of modern built-in cooking solutions across renovation-driven and lifestyle-upgraded kitchens. The trajectory illustrates reliable growth supported by continuous housing demand and sustained preference for integrated, space-efficient appliance installations in Japan.

Demand in Japan for built-in large cooking appliance is projected to increase from USD 676.6 billion in 2025 to USD 1,144.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 5.4%. Starting at USD 552.8 billion in 2020, the value rises steadily: USD 599.3 billion in 2022, USD 649.8 billion in 2024, and USD 676.6 billion in 2025. From 2025 to 2030, demand climbs to around USD 828.1 billion, and by 2035 it reaches USD 1,144.7 billion. Growth is driven by expanding applications of built-in large cooking appliances in residential kitchen renovations, new housing construction, premium apartment developments and lifestyle-oriented home improvement in Japan's housing-focused domestic context.

Over the forecast period, the value uplift from USD 676.6 billion to USD 1,144.7 billion translates into an incremental opportunity of USD 468.1 billion. Early growth (2025 2030) is primarily volume driven as more homeowners and property developers adopt built-in cooking solutions for space efficiency and aesthetic integration. In the latter years (2030 2035), value growth becomes increasingly significant: premium built-in appliances with advanced cooking technologies, smart connectivity features, energy efficiency certifications and designer finishes elevate average selling prices. Suppliers who innovate in appliance functionality, design aesthetics and installation support are best positioned to capture the full breadth of this demand growth in Japan.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 676.6 billion |

| Forecast Value (2035) | USD 1,144.7 billion |

| Forecast CAGR (2025–2035) | 5.4% |

The demand for built-in large cooking appliances in Japan has historically been anchored to the performance of domestic housing construction, where integrated kitchen layouts became the standard for new condominium developments and detached residential projects. Developers prioritized seamless spatial planning, modern aesthetics, and appliance integration, which encouraged steady adoption of built-in ovens, cooktops, and related systems from both Japanese and European brands. Renovation activity further sustained consumption as older homes underwent modernization to align with contemporary kitchen architecture. Urbanization also played a decisive role: densely populated metropolitan regions favored fixed and space-efficient installations over freestanding alternatives, creating a consistent pipeline of demand linked to new housing completions and renewal cycles across highly urban residential zones.

Looking ahead, growth momentum is expected to reflect Japan’s transition toward connected smart-home environments, tightening energy-efficiency standards, and household demographic shifts toward smaller family units. Premium induction systems with precise temperature management and safety capabilities align well with aging households while enabling compatibility with home-energy management platforms, supporting technologically progressive replacement and upgrade demand. However, market dynamics will also evolve as compact living preferences expand, pushing consumers toward multifunctional built-in systems rather than traditional full-size configurations. As a result, future demand will depend increasingly on space-saving engineering, hybrid product formats, and modular installation flexibility instead of uniform purchasing of large-format cooking suites.

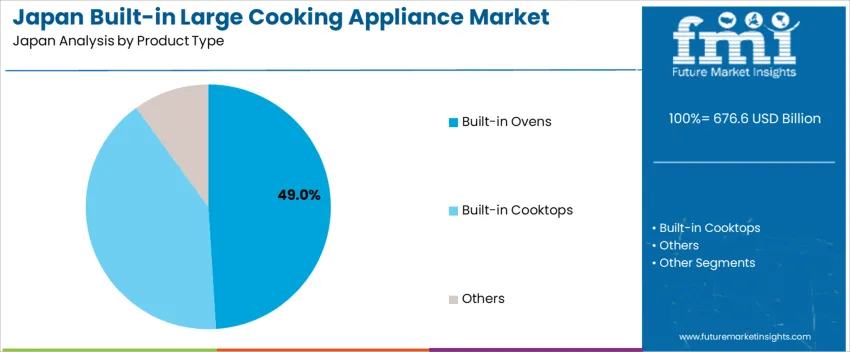

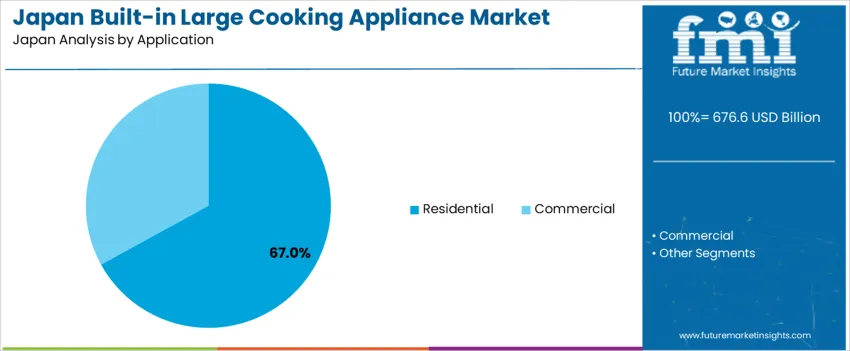

The demand for built-in large cooking appliance in Japan is shaped by the product types used for cooking tasks and the application settings that determine installation contexts. Product categories include built-in oven, built-in cooktop and others, each offering different cooking capabilities and installation requirements. Applications such as residential and commercial support varied usage patterns and performance expectations. As property developers and homeowners focus on consistent cooking performance and practical space utilization, the combination of appliance type and application setting influences purchasing decisions across Japan's housing construction, residential renovation and commercial kitchen settings.

Built-in oven accounts for 49% of total demand across product type categories in Japan. Its leading share reflects straightforward Western cooking adoption, predictable baking performance and suitability for integrated kitchen designs. Many property developers value built-in ovens for consistent aesthetic integration that supports uniform kitchen appearances across multiple housing units in condominium projects. These products offer manageable installation dimensions and easy coordination with cabinetry systems. Their enclosed cooking format suits environments that prioritize safety features and heat containment, reinforcing steady use across new housing construction operations.

Demand for built-in oven also grows as homeowners adopt Western baking practices that require enclosed heating environments. Households appreciate the reduced countertop clutter and predictable temperature control associated with these appliances. Their integrated positioning supports streamlined kitchen workflows, making them practical for contemporary cooking styles. The appliance provides sufficient capacity for typical family cooking loads, meeting expectations for weekend baking and holiday meal preparation. As Japanese households continue embracing diverse cooking methods, built-in oven maintains a strong presence in residential kitchen design.

Residential application accounts for 67.0% of total demand across application categories in Japan. Its leading position reflects clear advantages in housing construction volume, renovation activity scale and consumer purchasing power. Residential built-in large cooking appliances support housing developers' needs for standardized kitchen packages, homeowners' desires for lifestyle upgrades and interior designers' preferences for cohesive aesthetic solutions. Their installation in private homes allows customization to individual cooking preferences, family size requirements and design sensibilities. Property owners rely on these appliances for long-term use scenarios that justify premium investment in quality and features.

Demand for residential application grows as housing renovation activity targets kitchen modernization. The application context supports value-added improvements that enhance property marketability and owner satisfaction. Homeowners value the appliances' contribution to daily cooking convenience and entertaining capabilities. Real estate professionals appreciate the positive impact on property valuations that emerges from premium kitchen installations. As Japan continues to emphasize housing quality improvements, residential application remains central to built-in large cooking appliance adoption.

Demand for built-in large cooking appliance in Japan is influenced by compact urban housing formats, strong preference for space optimization and a consumer base that values integrated design aesthetics in kitchen environments. Japan's residential construction ecosystem favors solutions that offer maximized living space efficiency, seamless cabinetry integration and compatibility with standardized kitchen dimensions prevalent in Japanese housing, which positions built-in cooking appliances well for condominium developments, detached home construction and kitchen renovation projects. At the same time, appliance selection remains design-conscious, and cooking products must meet strict domestic standards for installation safety, earthquake resistance and compatibility with Japanese electrical specifications across residential installations.

How Are Japan's Housing Characteristics and Lifestyle Trends Encouraging New Adoption Patterns?

Built-in large cooking appliances gain traction because Japan's housing units emphasize efficient space utilization that eliminates wasted floor area and creates visual continuity. Property developers and homeowners rely heavily on built-in solutions for kitchen functionality without spatial compromise, and integrated cooking appliances align with this long-standing architectural preference. Japanese housing standards also favor appliances that install flush with cabinetry for streamlined appearance, making built-in cooking equipment useful in premium condominium projects, modern detached homes and comprehensive kitchen renovations. These patterns reflect Japan's emphasis on spatial efficiency and aesthetic cohesion across residential living environments.

Where Are Practical Growth Opportunities for Built-in Large Cooking Appliance in Japan?

Opportunities exist in luxury condominium developments, comprehensive home renovation projects, aging population-focused housing with safety features and smart home integration initiatives combining cooking appliances with energy management systems. Japan's established housing construction network creates openings for specialized built-in cooking products that integrate with Japanese cabinetry standards, electrical specifications and seismic safety requirements. As multi-generational households expand shared cooking spaces, demand increases for larger-capacity built-in appliances with intuitive controls suitable for varied user ages. Appliance suppliers offering Japan-specific installation specifications, local service networks and earthquake-resistant mounting systems may find strong adoption.

What Local Factors Are Constraining Wider Adoption of Built-in Large Cooking Appliance in Japan?

Constraints stem from high installation costs compared to freestanding alternatives, limited DIY installation capability requiring professional services and space constraints in older housing stock with non-standard kitchen dimensions. Some homeowners rely on existing freestanding appliances rather than investing in expensive built-in renovations, limiting replacement cycles. Integration challenges with traditional Japanese housing construction and the need for alignment with varied electrical panel capacities further delay uptake. In addition, smaller regional housing developers may hesitate due to limited access to European premium brands, creating uneven product availability across Japan.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.2% |

| Kanto | 4.7% |

| Kinki | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.2% |

| Rest of Japan | 3.1% |

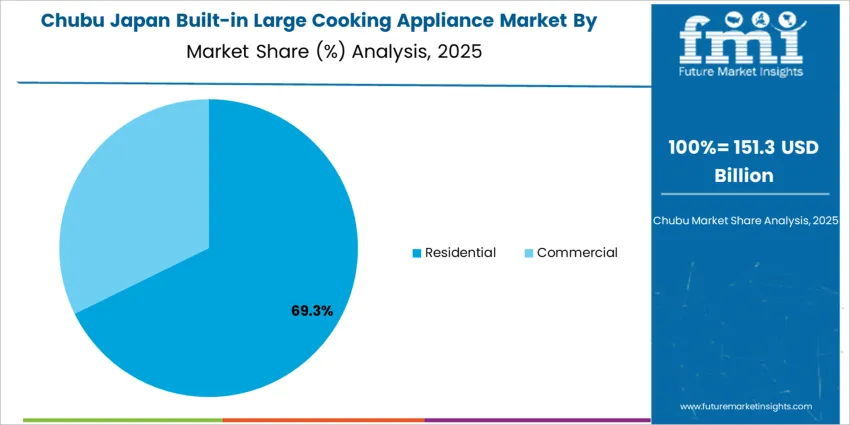

Demand for built-in large cooking appliance in Japan is rising across regions, with Kyushu and Okinawa leading at 5.2%. Growth in this region reflects expanding use of integrated kitchen designs in new residential projects, luxury housing developments and comprehensive renovation activities. Kanto follows at 4.7%, supported by dense housing construction activity and steady adoption in premium condominium developments. Kinki records 4.2%, shaped by active residential renovation operations and property developers applying built-in solutions in modern housing projects. Chubu grows at 3.7%, influenced by regional housing construction and renovation contractors integrating built-in cooking appliances into kitchen upgrade packages. Tohoku reaches 3.2%, showing gradual but consistent adoption. The rest of Japan posts 3.1%, reflecting broader interest in built-in cooking technologies across smaller housing developments.

Kyushu & Okinawa is projected to grow at a CAGR of 5.2% through 2035 in demand for built-in large cooking appliance. Fukuoka housing developments and surrounding residential construction projects are increasingly adopting built-in cooking solutions for new condominiums, detached homes and luxury housing developments. Rising demand for modern kitchen aesthetics, space-efficient design and premium housing features drives adoption. Suppliers provide high-performance, design-integrated and installation-ready built-in cooking appliances suitable for property developers and renovation contractors. Distributors ensure accessibility across urban, semi-urban and construction sites. Growth in premium housing development, comprehensive kitchen renovations and modern lifestyle adoption supports steady adoption of built-in large cooking appliance in Kyushu & Okinawa.

Kanto is projected to grow at a CAGR of 4.7% through 2035 in demand for built-in large cooking appliance. Tokyo and surrounding regions are increasingly using built-in cooking appliances for high-rise condominium construction, detached home development and extensive kitchen renovation projects. Rising focus on integrated design, smart home compatibility and energy-efficient cooking drives adoption. Suppliers provide technologically-advanced, aesthetically-refined and professionally-installed built-in cooking solutions suitable for large property developers and premium renovation contractors. Distributors ensure accessibility across urban, semi-urban and residential construction networks. Expansion in luxury housing construction, smart home integration and comprehensive renovation activity supports steady adoption of built-in large cooking appliance across Kanto.

Kinki is projected to grow at a CAGR of 4.2% through 2035 in demand for built-in large cooking appliance. Osaka, Kyoto and surrounding regions are increasingly adopting built-in cooking appliances for residential construction, housing renovation and modern kitchen upgrade projects. Rising demand for streamlined kitchen design, appliance integration and contemporary living spaces drives adoption. Suppliers provide reliable, design-compatible and professionally-supported built-in cooking solutions suitable for housing developers and renovation specialists. Distributors ensure accessibility across urban and semi-urban construction centers. Growth in residential construction activity, kitchen modernization projects and contemporary housing design supports steady adoption of built-in large cooking appliance across Kinki.

Chubu is projected to grow at a CAGR of 3.7% through 2035 in demand for built-in large cooking appliance. Nagoya and surrounding areas are increasingly adopting built-in cooking appliances for new housing construction, residential renovation and standard kitchen upgrade projects in residential areas. Rising focus on practical integration, cost-effective solutions and basic modernization drives adoption. Suppliers provide functionally-adequate, competitively-priced and installation-supported built-in cooking solutions suitable for regional housing developers and general contractors. Distributors ensure availability across urban and semi-urban residential areas. Expansion in standard housing construction, basic renovation activity and practical kitchen upgrades supports steady adoption of built-in large cooking appliance across Chubu.

Tohoku is projected to grow at a CAGR of 3.2% through 2035 in demand for built-in large cooking appliance. Sendai and surrounding residential construction operations are gradually adopting built-in cooking appliances for housing development, selective renovation and targeted kitchen improvement projects. Rising focus on basic integration, affordable modernization and gradual lifestyle upgrades drives adoption. Suppliers provide accessible, straightforward and adequately-performing built-in cooking solutions suitable for local housing developers and renovation contractors. Distributors ensure accessibility across urban, semi-urban and regional construction facilities. Expansion in regional housing construction, selective renovation activity and gradual kitchen modernization supports steady adoption of built-in large cooking appliance across Tohoku.

The Rest of Japan is projected to grow at a CAGR of 3.1% through 2035 in demand for built-in large cooking appliance. Smaller towns and rural housing operations gradually adopt built-in cooking appliances for new home construction, limited renovation and basic kitchen upgrade projects. Rising demand for fundamental integration, budget-friendly options and incremental modernization drives adoption. Suppliers provide basic, affordable and functionally-sufficient built-in cooking solutions suitable for small-scale housing developers, local contractors and individual homeowners. Distributors ensure accessibility across urban, semi-urban and rural residential areas. Expansion in local housing construction, limited renovation activity and gradual lifestyle improvements supports steady adoption of built-in large cooking appliance across the Rest of Japan.

The demand for built-in large cooking appliances in Japan is primarily supported by strong housing construction activity, rising home renovation volumes, and growing consumer preference for integrated kitchen layouts that optimize space in compact living environments. Developers increasingly adopt built-in formats to standardize kitchen packages, streamline visual design, and meet modern expectations for seamless appliance alignment with cabinetry. At the same time, the premium housing and smart home segments continue to expand, encouraging demand for appliances that incorporate advanced temperature control, energy-efficiency technologies, and compatibility with automated household systems. Ongoing innovation—including advancements in induction heating performance, intuitive touch interfaces, and safety-oriented sensor integration—further strengthens the suitability of built-in solutions across condominiums, detached homes, and renovation projects in Japan.

Key participants in Japan's built-in large cooking appliance category include Germany’s BSH Hausgeräte GmbH, Whirlpool Corporation through the KitchenAid brand, Sweden-based Electrolux AB with its Electrolux and AEG product lines, and premium German manufacturer Miele & Cie. KG. BSH Hausgeräte holds approximately 28.0% of Japan’s built-in large cooking appliance landscape, delivering high-quality ovens and cooktops through well-established distribution networks that work closely with developers, builders, and kitchen specialists. Its leadership is supported by strong engineering credentials, consistent product reliability, and alignment with Japanese kitchen design standards. Whirlpool Corporation competes in the mid-to-premium space via KitchenAid, while Electrolux AB offers European design-driven product options appealing to style-focused consumers. Miele positions itself at the luxury end, supplying high-end built-in appliances to upscale residential developments. Together, these global appliance brands and Japan-ready distribution systems form a competitive environment defined by technological quality, installation expertise, and responsiveness to the country’s unique spatial and design requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Built-in Oven, Built-in Cooktop, Others |

| Application | Residential, Commercial |

| Sales Channel | Online Retail, Hypermarket, Specialty Stores, Wholesale, Multi-Brand Store |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | BSH Hausgeräte GmbH, Whirlpool Corporation (KitchenAid), Electrolux AB (AEG, Electrolux), Miele & Cie. KG |

| Additional Attributes | Dollar sales by product type and application, regional CAGR trends, and value–volume contributions are analyzed alongside residential vs. commercial uptake, built-in oven vs. cooktop penetration, smart-home integration, renovation-driven opportunities, cost and space constraints, and competition between European premium brands and Japanese distributors. |

The demand for built-in large cooking appliance in Japan is estimated to be valued at USD 676.6 billion in 2025.

The market size for the built-in large cooking appliance in Japan is projected to reach USD 1,144.8 billion by 2035.

The demand for built-in large cooking appliance in Japan is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in built-in large cooking appliance in Japan are built-in ovens, built-in cooktops and others.

In terms of application, residential segment is expected to command 67.0% share in the built-in large cooking appliance in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Built-in Large Cooking Appliance Market Insights – Growth & Forecast 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Large-flow Horizontal Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Large Synchronous Motor Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Large Scale Bearing Market Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Large Spot Fiber Collimator Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Variable Frequency Drives Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Medium Voltage Drives Market Size and Share Forecast Outlook 2025 to 2035

Large Industrial Displays Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Large Volume Wearable Injectors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA