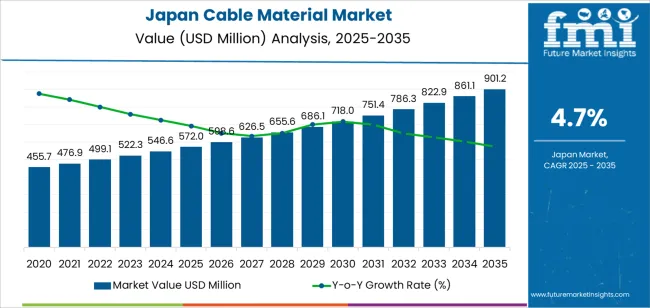

The demand for cable material in Japan is valued at USD 572.0 million in 2025 and is projected to reach USD 901.2 million by 2035, reflecting a CAGR of 4.7%. Over the forecast period, the market exhibits relatively stable growth, with demand increasing from USD 572.0 million to approximately USD 751.4 million by 2030. This period sees steady and predictable growth, driven by the expanding use of cable materials in various sectors, such as telecommunications, energy, and automotive industries. The moderate growth reflects the growing need for high-performance cables as technological advancements in these industries demand better materials for efficient transmission.

Between 2030 and 2035, the market continues to grow, reaching USD 901.2 million by 2035. The growth rate volatility index during this period remains relatively low, signaling consistent demand for cable materials despite fluctuations in industrial activity. This stability indicates that while the market grows at a steady pace, it is not overly susceptible to major fluctuations, with demand driven by long-term trends such as digital infrastructure expansion, renewable energy projects, and the automotive industry's increasing reliance on advanced electrical systems. The relatively low volatility reinforces a predictable growth trajectory through the forecast period.

Between 2025 and 2030, the demand for cable material in Japan is expected to grow from USD 572.0 million to USD 598.6 million, representing an increase of USD 26.6 million. This phase will exhibit a moderate growth rate driven by steady expansion in key sectors such as automotive, industrial, and infrastructure development. As Japan continues to focus on infrastructure upgrades and smart city initiatives, the need for advanced cable materials will increase. Cable manufacturers will focus on developing high-performance materials that meet stricter regulatory standards and customer demands for greater efficiency and sustainability. The integration of cable materials in electric vehicles and renewable energy sectors will also contribute to market expansion during this phase.

From 2030 to 2035, the demand for cable material is forecast to rise from USD 598.6 million to USD 901.2 million, marking a significant increase of USD 302.6 million. This phase will experience accelerated growth, driven by the adoption of advanced materials in emerging technologies such as smart grids, electrified transport, and automation. The growing demand for high-performance and specialized cables that meet the evolving needs of these sectors will fuel market growth. Additionally, the increasing investments in renewable energy infrastructure and the adoption of electric vehicles will continue to drive the demand for high-quality cable materials. These factors will result in robust market expansion through the second half of the forecast period.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 572.0 million |

| Forecast Value (2035) | USD 901.2 million |

| Forecast CAGR (2025–2035) | 4.7% |

The demand for cable material in Japan has been historically driven by robust growth in key industries such as construction, automotive manufacturing, and telecommunications. In particular, the infrastructure development, including the replacement and upgrade of outdated wiring systems, has fueled the need for various cable materials, including copper and aluminum conductors. The automotive sector, with its increasing demand for complex wiring harnesses, also plays a crucial role in shaping cable material requirements. Additionally, the rising focus on safety standards has spurred the use of advanced insulation materials, such as cross-linked polyethylene (XLPE) and flame-retardant plastics, which comply with Japan's stringent safety regulations.

Looking ahead, the demand for cable materials in Japan is expected to grow due to several key trends. The expansion of renewable energy projects, such as solar and wind power, will drive the need for specialized cables designed for harsh environments. Similarly, the ongoing shift toward electric vehicles and the continued development of high-speed data infrastructure will contribute to rising demand for advanced cables. Moreover, innovations in materials, such as low-smoke and halogen-free cables, are likely to see increased adoption as utility and telecommunications applications demand higher performance and reliability. However, the rising cost of raw materials and the trend toward material substitution will influence the strategies for sourcing cable materials in the future.

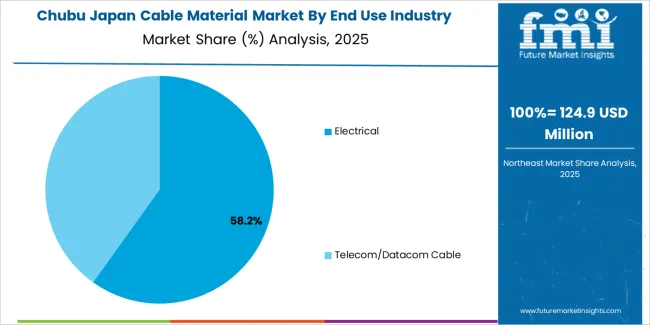

The demand for cable materials in Japan is driven by material type and end-use industry. The primary material types used include XLPE (Cross-Linked Polyethylene), PVC (Polyvinyl Chloride), HDPE (High-Density Polyethylene), and rubber, with XLPE accounting for 34% of the total demand. In terms of end-use industry, electrical cables dominate, representing 61% of the total demand. Other end-use industries include telecom/datacom cables, where materials like PVC and rubber are commonly used. These segments reflect the importance of cable materials in various sectors, with electrical applications driving the demand due to the need for durable, high-performance materials.

XLPE cable material leads the demand in Japan, representing 34% of the market. This material is highly favored for its superior electrical insulating properties, thermal resistance, and mechanical strength. XLPE’s ability to perform well under high temperatures and its resistance to moisture and chemicals make it the material of choice for electrical cables. With increasing demand for efficient and reliable power transmission, XLPE is widely used in industries such as electrical power distribution, where safety and durability are critical. The material’s robust performance characteristics also contribute to its widespread use in both residential and industrial electrical infrastructures.

The demand for XLPE cable material is further supported by Japan’s commitment to modernizing its electrical grid and expanding renewable energy sources. As Japan moves toward upgrading its power infrastructure, the demand for cables made from high-performance materials like XLPE increases. The material’s excellent long-term performance and ability to meet stringent industry standards make it the preferred choice for critical electrical applications. With growing investments in smart grids and electrical network modernization, XLPE’s position as the leading material type in Japan’s cable market is expected to remain strong.

Electrical cables represent 61% of the total demand for cable materials in Japan. This high demand is driven by the expanding infrastructure needs in the country, including residential, commercial, and industrial sectors. Electrical cables are essential for power distribution, wiring systems, and renewable energy applications, where efficient and reliable performance is paramount. The demand for electrical cables is further fueled by ongoing infrastructure development projects, as well as the need to replace and upgrade aging electrical networks. As Japan continues to invest in technological advancements and smart grids, the need for high-quality electrical cables continues to grow.

The shift toward energy-efficient systems and the integration of renewable energy sources into Japan's power grid also contributes to the increasing demand for electrical cables. With advancements in energy distribution technologies, such as electric vehicle charging stations and smart metering systems, the demand for durable and high-performance cable materials like XLPE is expected to continue rising. Additionally, Japan’s emphasis on earthquake resilience and environmental sustainability further drives the need for reliable electrical infrastructure, ensuring that electrical cables remain a significant end-use industry in the market.

The demand for cable materials in Japan is influenced by the nation’s ageing infrastructure, growth in telecommunication networks, automotive industry needs, and shift toward renewable energy systems. Drivers include the expansion of EV production, undersea data cable investments, and upgrades to older power grids. Restraints involve high raw material costs, intense competition from lower cost imports, and stringent quality and safety standards that raise barriers to entry. Trends show increasing use of advanced materials such as XLPE insulation, lightweight conductors, and high performance polymers designed for compact and high frequency applications.

Japan is investing in submarine and terrestrial data links, high speed 5G/6G networks, and retrofitting of power transmission grids. Large cable laying projects and the automotive move toward electric vehicles both place higher demands on copper, aluminium, insulation polymers, and related compound materials. Urban redevelopment and replacement of ageing wiring in commercial buildings also spur material uptake. These infrastructure and industry upgrades are creating sustained pulls for high quality cable materials in Japan’s domestic market.

Cable material producers in Japan face elevated costs for copper and aluminium due to global supply pressures and currency fluctuations. Insulation and jacketing compounds must meet strict fire safety, durability and recyclability standards under Japanese regulation, which adds processing and certification expense. Domestic producers also contend with competitive import pricing from overseas. The combined effect of raw materials cost, regulatory burden and import competition restrains faster growth of high end cable material adoption in Japan.

Japanese cable material demand is shifting toward advanced solutions such as cross linked polyethylene (XLPE) insulation, composite conductors, miniaturised high frequency cables for data centres and automotive harnesses, and materials suited to harsh environments (e.g., offshore, high voltage). Lightweight conductors, halogen free flame retardant polymers and modular cable assemblies are gaining traction to support EVs, renewable energy and smart infrastructure. These trends indicate a continuing evolution toward performance driven, specialised materials rather than simply volume based growth in Japan.

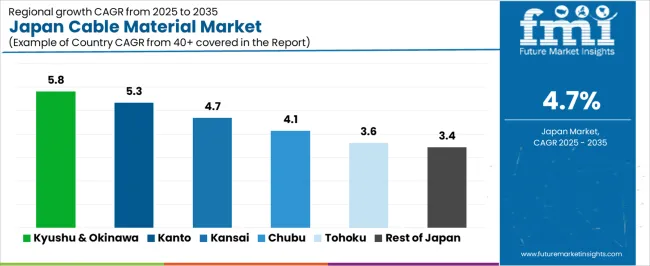

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.8% |

| Kanto | 5.3% |

| Kinki | 4.7% |

| Chubu | 4.1% |

| Tohoku | 3.6% |

| Rest of Japan | 3.4% |

The demand for cable material in Japan is forecast to grow at varied rates across regions through to 2035. In Kyushu & Okinawa the 5.8% CAGR reflects rising investment in regional data centre infrastructure and electrification of manufacturing. The Kanto region, at a 5.3% rate, benefits from concentrated industrial and telecom infrastructure growth and high volume material usage. Kinki’s 4.7% rate is supported by local automotive and electronics manufacturing hubs upgrading wiring systems. Chubu’s 4.1% growth is tied to manufacturing facilities and deployment of renewable energy connections. Tohoku’s 3.6% pace reflects slower infrastructure deployment, while the Rest of Japan’s 3.4% reflects lower density of large scale cable material demand centres.

In Kyushu & Okinawa, the demand for cable material is growing at a CAGR of 5.8% through 2035. This growth is driven by increasing industrial development and infrastructure projects in the region, especially in the power generation and telecommunications sectors. As the demand for reliable and high-quality cable materials continues to rise, local industries are adopting advanced solutions to meet both domestic and international standards. Additionally, the region's focus on renewable energy development and modernization of utility systems is further contributing to the growing demand for cable materials.

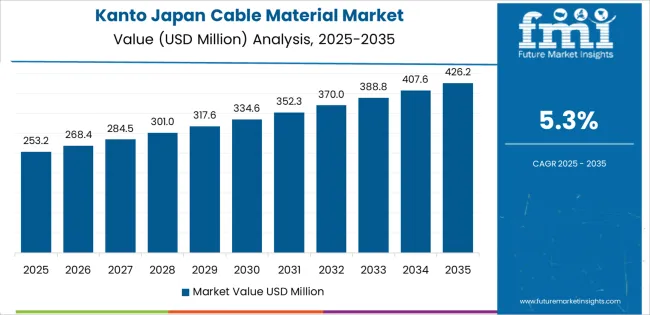

In Kanto, the demand for cable material is projected to grow at a CAGR of 5.3% through 2035. As Japan's most economically developed region, Kanto plays a significant role in the demand for cable materials across various industries, including construction, automotive, and telecommunications. The continued growth in infrastructure and technology sectors, particularly in Tokyo, is driving the need for advanced cable materials. Moreover, the ongoing investment in smart grid technologies and electric vehicles in Kanto is contributing to the rising demand for specialized cable solutions in the region.

In Kinki, the demand for cable material is expected to grow at a CAGR of 4.7% through 2035. The region’s strong manufacturing base, particularly in the automotive and industrial sectors, is a key driver of cable material demand. As Kinki continues to modernize its infrastructure and expand its telecommunications and renewable energy projects, the need for reliable and high-performance cable materials is increasing. The region's commitment to sustainable and efficient energy solutions is also contributing to the adoption of advanced cable materials for various applications.

In Chubu, the demand for cable material is projected to grow at a CAGR of 4.1% through 2035. The region’s strong industrial and manufacturing sectors are major contributors to the demand for cable materials, particularly in the power and electronics industries. As Chubu’s infrastructure develops and industrial sectors modernize, the need for durable and high-performance cables increases. The rising adoption of electric vehicles and renewable energy solutions is also driving the need for specialized cables in the region, further supporting market growth.

In Tohoku, the demand for cable material is expected to grow at a CAGR of 3.6% through 2035. Although Tohoku is less industrialized compared to other regions, the increasing focus on infrastructure projects, particularly in renewable energy and telecommunications, is driving the demand for cable materials. The development of smart grid systems and investment in electrical infrastructure are also contributing to market growth. As the region continues to modernize its utilities and expand its energy generation capacity, the adoption of high-quality cable materials is expected to rise.

In the rest of Japan, the demand for cable material is projected to grow at a CAGR of 3.4% through 2035. As regional markets continue to develop, the need for reliable and high-quality cable materials is rising across various industries, including construction, power, and telecommunications. The increasing focus on energy efficiency and infrastructure improvements in these regions is contributing to the growing demand for cable materials. Local industries are increasingly investing in advanced cable solutions to meet both domestic and export market needs.

The demand for cable material in Japan is rising because the power transmission, telecommunications and automotive sectors are all expanding. Investment in electricity grid upgrades and high voltage transmission lines is elevating demand for durable conductor and insulation materials. The rollout of next generation network infrastructure and the growth of vehicle electrification are increasing the need for flexible, high performance wiring and cabling. Also, industrial automation and robotics in Japan’s manufacturing base require advanced cable materials that offer high reliability and compact form factors. These trends create sustained pressure for quality raw materials, insulation compounds and conductor alloys.

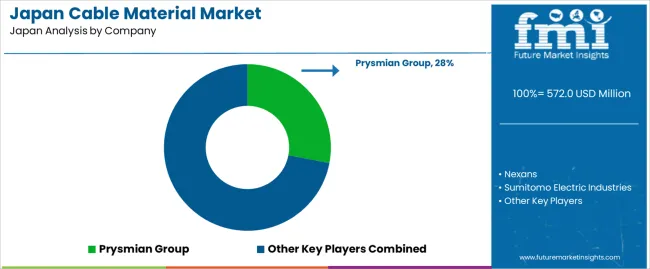

Major companies active in Japan’s cable materials market include Prysmian Group, Nexans, Sumitomo Electric Industries, LS Cable & System and Southwire Company, LLC. Sumitomo Electric Industries, being a Japanese firm, has strong domestic production and well established supplier relationships. Prysmian and Nexans bring global scale, capability in high voltage and submarine cable systems. LS Cable & System and Southwire provide advanced conductor and insulation technologies suited for Japan’s premium manufacturing and infrastructure segments. These firms are shaping the industry by aligning product portfolios with Japan’s evolving requirements for performance, longevity and regulatory compliance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Material Type | XLPE (Cross-Linked Polyethylene), PVC (Polyvinyl Chloride), HDPE (High-Density Polyethylene), Rubber, Others |

| End Use Industry | Electrical, Telecom/Datacom Cable |

| Application | Power Cable, Fiber Optic Cables, LV Energy, Ext & Int. Telecom, Winding Wire |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Prysmian Group, Nexans, Sumitomo Electric Industries, LS Cable & System, Southwire Company, LLC |

| Additional Attributes | Dollar by sales by material type, application, and region; regional CAGR and adoption trends; volume and value growth projections; innovations in cable materials for emerging technologies (smart grids, electric vehicles, renewable energy); regulatory compliance in infrastructure projects; technological advancements in conductor alloys and insulation compounds; supply chain dynamics and cost pressures for raw materials like copper and aluminum; growing demand for high-performance, flexible cables in automation, telecommunications, and power sectors. |

The demand for cable material in Japan is estimated to be valued at USD 572.0 million in 2025.

The market size for the cable material in Japan is projected to reach USD 901.2 million by 2035.

The demand for cable material in Japan is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in cable material in Japan are xlpe, pvc, hdpe, rubber and others.

In terms of end use industry, electrical segment is expected to command 61.0% share in the cable material in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Material Market Growth - Trends & Forecast 2025 to 2035

Submarine Cable Market Insights - Growth & Forecast 2025 to 2035

Demand for Biomaterial in Japan Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Material-Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA