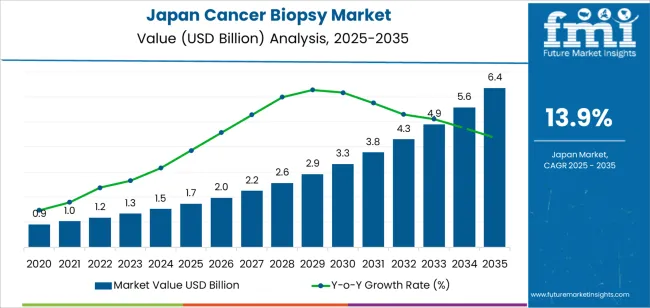

The Japan cancer biopsy demand is valued at USD 1.7 billion in 2025 and is expected to reach USD 6.4 billion by 2035, corresponding to a CAGR of 13.9%. Demand continues to rise as oncology centers adopt more rigorous diagnostic pathways, expand early-detection programmes, and use minimally invasive biopsy methods to improve clinical accuracy. Increased reliance on histopathological confirmation, integration of molecular profiling, and broader participation in screening among ageing populations also reinforce diagnostic volumes across healthcare institutions.

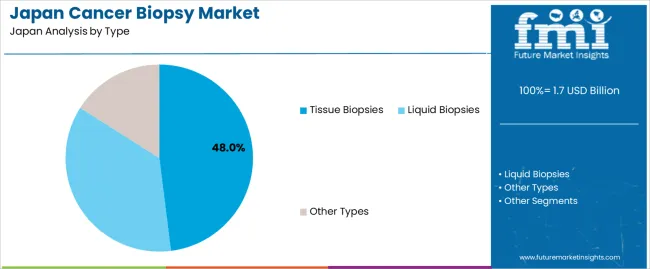

Tissue biopsies account for the largest share due to their central role in confirming malignancies, staging tumours, and guiding personalized treatment protocols. Hospitals and diagnostic laboratories continue to use tissue samples for immunohistochemistry, genomic analysis, and biomarker evaluation, supporting precise therapeutic decision-making in oncology care. The focus on improving sample quality, retrieval instruments, and workflow automation strengthens adoption of tissue-based assessments.

Kyushu & Okinawa, Kanto, and Kansai report the highest utilization levels because of their concentration of tertiary hospitals, cancer treatment centres, and advanced diagnostic laboratories. These regions maintain strong availability of specialized oncology services and established referral pathways for invasive and minimally invasive biopsy procedures. Key suppliers include Olympus Corporation, Hoya Corporation (Pentax Medical), Fujifilm Healthcare Corporation, Sysmex Corporation, and BD Japan. These companies offer endoscopic biopsy tools, imaging-guided sampling devices, histopathology systems, and cytological testing platforms widely used in cancer diagnostics.

Acceleration in Japan’s cancer-biopsy segment is steady in the early period, supported by rising screening participation, ageing demographics, and expanded use of minimally invasive diagnostic techniques. Hospitals and diagnostic centers increase biopsy volumes as imaging advances lead to earlier detection and more frequent follow-up investigations. This creates a consistent upward trajectory without sharp spikes, as utilization grows within established clinical pathways.

Mid-period acceleration remains moderate as biopsy procedures become more standardized across oncology networks. Adoption of image-guided techniques, liquid biopsy research, and improved pathology workflows adds incremental momentum. These developments support wider clinical use but move through structured approval and implementation cycles, which limit abrupt increases. Growth stays anchored in predictable diagnostic demand tied to cancer prevalence and screening rates.

Deceleration gradually appears in the later period as adoption enters a more mature phase. Procedure volumes continue to rise, but year-over-year gains narrow as capacity, staffing, and workflow efficiencies stabilize. Incremental improvements in diagnostic tools and targeted-therapy requirements sustain demand, though they do not accelerate the curve sharply.

| Metric | Value |

|---|---|

| Japan Cancer Biopsy Sales Value (2025) | USD 1.7 billion |

| Japan Cancer Biopsy Forecast Value (2035) | USD 6.4 billion |

| Japan Cancer Biopsy Forecast CAGR (2025-2035) | 13.9% |

Demand for cancer biopsy procedures in Japan is increasing because early detection and precise tumour characterization are central to national cancer-control strategies. Japan’s ageing population shows rising incidence of lung, breast, colorectal and gastric cancers, which leads hospitals and clinics to perform more tissue and liquid biopsy tests for accurate diagnosis. Advances in imaging-guided biopsy, minimally invasive sampling and molecular testing support wider use in routine oncology care. Precision medicine programmes in major cancer centers also require high-quality biopsy specimens to guide targeted therapies and monitor treatment response.

Screening initiatives for breast and colorectal cancer increase the number of suspected cases that proceed to confirmatory biopsy. Improvements in pathology infrastructure and adoption of automated processing systems strengthen capacity in urban and regional hospitals. Constraints include shortage of trained pathologists in certain prefectures, procedural risks for elderly patients and variability in access to advanced biopsy equipment in smaller facilities. Some individuals delay diagnostic evaluation due to fear of invasive procedures or limited awareness of early symptoms. Turnaround times for molecular testing may also slow clinical decision making in resource-constrained settings.

Demand for cancer biopsy procedures in Japan aligns with rising diagnostic requirements across oncology centers, hospitals, and specialist clinics. Increasing emphasis on early detection, recurrence monitoring, and precision-focused evaluation drives adoption of tissue and liquid biopsy techniques. Japan’s healthcare system supports structured diagnostic workflows that incorporate molecular profiling, histopathology, and biomarker evaluation to guide treatment planning. Hospitals rely on standardized biopsy protocols, supported by laboratory services, imaging units, and pathology departments. Demand patterns reflect growing utilization of less invasive sampling options and test kits that streamline specimen handling across clinical settings.

Tissue biopsies hold 48.0% and remain the primary diagnostic approach used in Japan. They provide direct access to tumor cells and allow detailed histological and molecular assessment essential for confirming malignancies. Liquid biopsies account for 36.0%, reflecting increasing adoption of minimally invasive sampling for mutation tracking and monitoring in situations where tissue access is limited. Other biopsy types represent 16.0%, including image-guided or specialized techniques used for select tumor sites requiring targeted sampling. Distribution across biopsy types indicates how Japanese clinicians employ a mix of traditional and emerging diagnostic approaches to support early detection, treatment planning, and surveillance across varied cancer pathways.

Key points:

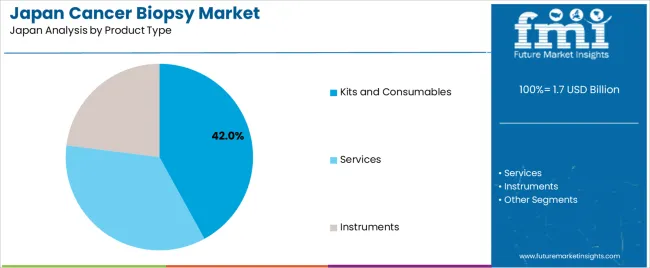

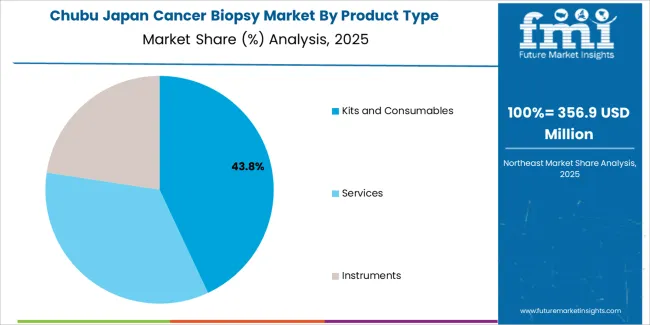

Kits and consumables represent 42.0%, forming the most used product group across Japanese pathology and oncology laboratories. These items include collection tubes, reagents, preservatives, and sample-processing tools that support high-volume diagnostic workflows. Services account for 35.0%, covering laboratory analysis, genomic profiling, and pathology reporting performed through accredited facilities. Instruments hold 23.0%, including biopsy needles, imaging-guided sampling tools, and automated laboratory equipment. Product use patterns reflect how Japan prioritizes standardized sample handling and consistent diagnostic accuracy. Demand is shaped by routine cancer screening practices, hospital laboratory capacity, and increasing integration of genomic assessment into treatment decision protocols.

Key points:

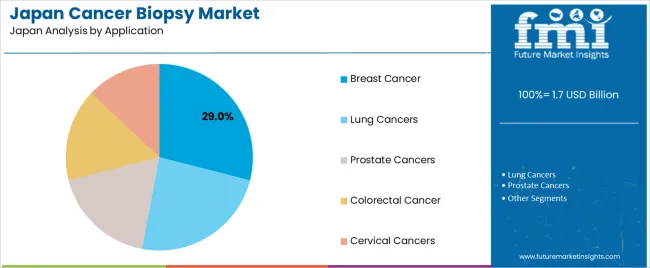

Breast cancer accounts for 29.0% of biopsy demand in Japan, supported by structured screening programs and widespread clinical surveillance. Lung cancers represent 24.0%, requiring both tissue and liquid biopsy methods due to diverse tumor characteristics and mutation-focused treatment planning. Prostate cancers account for 18.0%, reflecting established biopsy pathways in urology settings. Colorectal cancer represents 16.0%, linked to colonoscopy-guided sampling and diagnostic evaluation. Cervical cancers account for 13.0%, supported by cytology follow-up and targeted sampling for lesion confirmation. Distribution across cancer types aligns with disease prevalence, screening practices, and reliance on histological confirmation prior to treatment planning.

Key points:

Rising cancer screening participation, expansion of diagnostic capacity in regional hospitals and increased use of image-guided procedures are driving demand.

In Japan, cancer biopsy demand grows as more adults participate in municipal and employer-based screening programs for gastric, breast, colorectal and lung cancers. Prefectures with large ageing populations such as Hokkaido, Aichi and Fukuoka see higher diagnostic referrals, which increases the volume of tissue sampling across hospital networks. Regional hospitals have expanded access to CT-guided, ultrasound-guided and endoscopic biopsy services to reduce patient travel to major tertiary centers in Tokyo and Osaka. Nationwide clinical practice emphasizes early detection through structured checkups, resulting in steady biopsy utilization for confirmatory diagnosis and staging.

Workforce shortages in pathology, limited adoption of advanced biopsy devices in smaller hospitals and cautious reimbursement for novel techniques restrain demand.

Japan faces a persistent shortage of pathologists and cytotechnologists, particularly outside major metropolitan areas, which can extend turnaround times and limit biopsy throughput. Smaller hospitals may delay upgrading to vacuum-assisted or robotic biopsy systems due to cost and limited procurement budgets. The national health insurance system evaluates reimbursement for new biopsy technologies conservatively, slowing wider adoption of liquid biopsy assays or specialized sampling devices. These operational and financial constraints moderate rapid expansion despite growing diagnostic needs.

Shift toward minimally invasive biopsy techniques, increased use of liquid biopsy in academic centers and rising demand for molecular testing define key trends.

Clinicians in Japan are adopting minimally invasive approaches such as endoscopic ultrasound-guided fine-needle biopsy for pancreatic and gastric cancers, improving sampling accuracy with shorter recovery time. Academic hospitals and cancer research centers are expanding liquid biopsy use for monitoring treatment response or detecting actionable mutations in lung and gastrointestinal cancers. Demand for biopsy samples that support molecular testing is increasing as precision-medicine programs become more common, particularly for lung cancer, breast cancer and hematologic malignancies. These trends indicate a continued shift toward more advanced, integrated biopsy workflow across Japan’s oncology landscape.

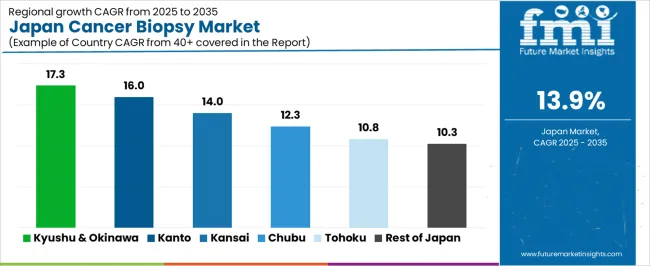

Demand for cancer biopsy procedures in Japan is increasing through 2035 as hospitals, diagnostic centers, oncology clinics, and screening programs expand the use of tissue sampling, liquid biopsies, image-guided biopsies, and molecular testing. Growth reflects regional healthcare capacity, screening participation rates, adoption of precision diagnostics, and the availability of advanced imaging systems used to guide biopsy procedures. Kyushu & Okinawa leads at 17.3%, followed by Kanto (16.0%), Kansai (14.0%), Chubu (12.3%), Tohoku (10.8%), and Rest of Japan (10.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 17.3% |

| Kanto | 16.0% |

| Kansai | 14.0% |

| Chubu | 12.3% |

| Tohoku | 10.8% |

| Rest of Japan | 10.3% |

Kyushu & Okinawa grows at 17.3% CAGR, supported by expanding oncology infrastructure, rising participation in diagnostic screenings, and strong hospital adoption of image-guided and minimally invasive biopsy methods. Prefectures such as Fukuoka, Kumamoto, and Kagoshima maintain large medical centers equipped with CT-guided, ultrasound-guided, and endoscopic biopsy capabilities. Hospitals integrate molecular pathology to support accurate cancer typing and treatment planning. Public-health programs promote early screening for gastric, colorectal, and breast cancers, increasing demand for confirmatory biopsy procedures. Okinawa shows steady growth due to rising diagnostic awareness and increased availability of advanced imaging systems in regional hospitals. Collaboration between hospitals and local clinics improves referral efficiency, ensuring timely access to biopsy services.

Kanto grows at 16.0% CAGR, influenced by high healthcare density, advanced diagnostic capabilities, and strong screening uptake across Tokyo, Kanagawa, Saitama, and Chiba. Major cancer centers in Tokyo operate full-scale biopsy units offering core-needle biopsies, endoscopic biopsies, stereotactic breast biopsies, and liquid biopsy testing. Hospitals incorporate genomic profiling to support precision oncology. Urban populations participate actively in routine screenings, increasing demand for follow-up tissue sampling. Outpatient diagnostic centers offer fast-turnaround biopsy appointments, improving early detection. Kanto’s strong medical-device presence enables rapid distribution of biopsy needles, imaging systems, and pathology equipment across hospitals and clinics.

Kansai grows at 14.0% CAGR, supported by strong regional hospital networks, university medical centers, and consistent screening participation across Osaka, Kyoto, and Kobe. Hospitals deploy endoscopic, image-guided, and surgical biopsy methods to evaluate suspected cancer cases derived from gastric, breast, lung, and colorectal screenings. University hospitals integrate advanced molecular diagnostics for precise tumor classification. Urban districts maintain high outpatient diagnostic activity, with clinics referring suspected cases to larger hospitals for confirmatory biopsy. Healthcare institutions in Osaka and Kyoto invest in updated imaging technologies to improve biopsy accuracy. Regional screening campaigns reinforce early consultation, contributing to steady demand growth.

Chubu grows at 12.3% CAGR, shaped by balanced healthcare networks, expanding diagnostic services, and rising cancer-screening participation across Nagoya, Shizuoka, and surrounding prefectures. General hospitals maintain biopsy capabilities including endoscopic, ultrasound-guided, and surgical tissue sampling. Urban centers near Nagoya show strong adoption of molecular pathology and digital diagnostic platforms. Municipal programs encourage routine screenings, increasing follow-up biopsy activity. Clinics collaborate with hospitals for rapid referral of suspected cancer cases, sustaining a consistent procedural pipeline. Logistics networks in Aichi and Shizuoka ensure reliable supply of biopsy devices and pathology consumables.

Tohoku grows at 10.8% CAGR, driven by increasing use of screening programs, expanding diagnostic capacity, and strengthened regional hospital networks across Sendai, Aomori, Akita, and Fukushima. Hospitals adopt image-guided and endoscopic biopsy methods to confirm suspected cases identified in municipal screenings. Rural areas rely on regional hospitals for advanced biopsy services, supported by clinic referrals and public-health outreach. Tele-consultation channels assist in early evaluation, directing patients toward appropriate diagnostic pathways. Seasonal and geographic challenges increase reliance on centralized hospital diagnostics, leading to steady biopsy utilization.

Rest of Japan grows at 10.3% CAGR, influenced by smaller but steadily developing healthcare facilities, increasing screening participation, and greater awareness of early cancer detection. Local hospitals perform standard biopsy procedures including endoscopic and ultrasound-guided sampling. Clinics support early identification through routine checkups and direct referrals to larger diagnostic centers. Public-health offices conduct awareness programs promoting early screening and consultation. Regional hospitals maintain pathology units capable of processing tissue samples with reliable turnaround times, ensuring timely treatment planning.

Demand for cancer-biopsy procedures in Japan is shaped by domestic endoscopy and diagnostics manufacturers that support hospitals, cancer centers, and pathology laboratories. Olympus Corporation holds an estimated 22.0% share, supported by controlled production of endoscopic biopsy forceps, stable mechanical precision, and deep integration with Japan’s gastrointestinal-screening programmes. Its devices provide consistent tissue-sampling reliability across large hospital systems. Hoya Corporation (Pentax Medical) maintains strong participation through endoscopic biopsy instruments paired with high-resolution imaging systems. These tools ensure steady sampling accuracy and predictable handling characteristics in routine and specialized procedures. Fujifilm Healthcare Corporation contributes significant volume with biopsy tools, endoscopes, and imaging technologies widely used across oncology diagnostics.

Sysmex Corporation supports downstream biopsy workflows with liquid-biopsy analysis platforms and pathology-support systems, offering dependable assay stability and integration with clinical-diagnostic laboratories. BD Japan adds depth with core-needle biopsy devices and cytology-collection systems used in breast, lung, and soft-tissue sampling, emphasizing controlled needle performance and consistent sample integrity. Competition in Japan centers on sampling precision, instrument reliability, imaging integration, pathology-workflow efficiency, and nationwide clinical-support networks. Demand remains steady as hospitals expand early cancer detection, standardised biopsy protocols, and minimally invasive sampling technologies across Japan’s oncology-care system.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Type | Tissue Biopsies, Liquid Biopsies, Other Types |

| Product Type | Kits and Consumables, Services, Instruments |

| Application | Breast Cancer, Lung Cancers, Prostate Cancers, Colorectal Cancer, Cervical Cancers |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Olympus Corporation, Hoya Corporation (Pentax Medical), Fujifilm Healthcare Corporation, Sysmex Corporation, BD Japan (Becton, Dickinson and Company) |

| Additional Attributes | Dollar sales by biopsy type, product category, and cancer application; regional adoption trends across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and Rest of Japan; growth in minimally invasive biopsy techniques, circulating tumor DNA (ctDNA) testing, and image-guided biopsy procedures; integration of biopsy tools with advanced imaging, pathology automation, and molecular diagnostics; role of early cancer screening initiatives and hospital infrastructure upgrades; competitive landscape of Japanese diagnostic device and biopsy solution providers. |

The demand for cancer biopsy in Japan is estimated to be valued at USD 1.7 billion in 2025.

The market size for the cancer biopsy in Japan is projected to reach USD 6.4 billion by 2035.

The demand for cancer biopsy in Japan is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in cancer biopsy in Japan are tissue biopsies, liquid biopsies and other types.

In terms of product type, kits and consumables segment is expected to command 42.0% share in the cancer biopsy in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Japan Biliary Tract Cancers (BTCs) Treatment Market Growth – Demand, Trends & Forecast 2025-2035

Demand for Precision Cancer Imaging in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Biopsy Guidance System Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA