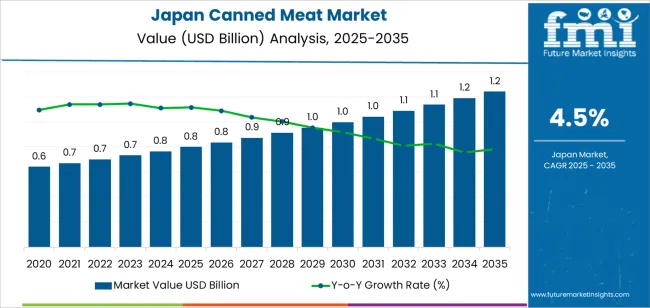

The Japan canned meat demand is valued at USD 0.8 billion in 2025 and is forecasted to reach USD 1.2 billion by 2035, reflecting a CAGR of 4.5%. Consumption is shaped by the continued use of shelf-stable protein products in urban households, remote-area provisioning, and emergency-preparedness stockpiling. Demand is supported by long shelf life, consistent product quality, and suitability for quick-meal preparation. Wider penetration of convenience stores and increased preference for ready-to-use protein sources also contribute to sustained uptake across demographic groups. Beef-based canned meat leads utilization due to its established culinary acceptance, flavour stability in retort processing, and strong presence in both retail and institutional supply chains. Product preference is reinforced by the expansion of value-added variants, controlled seasoning formats, and single-serve cans tailored for household convenience.

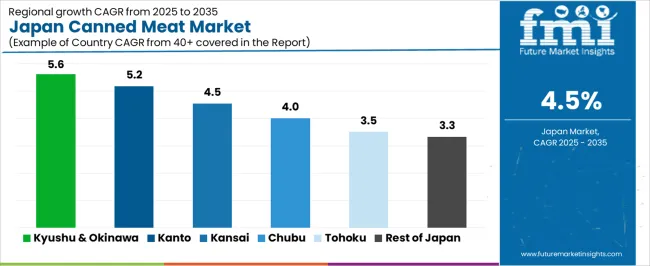

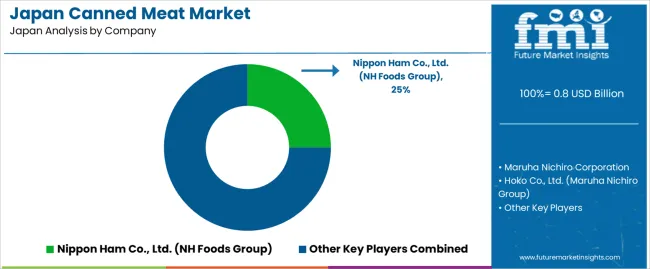

Kyushu & Okinawa, Kanto, and Kansai represent the highest-demand regions. These areas maintain dense retail infrastructure, diversified distribution channels, and substantial consumption of shelf-stable foods in both household and commercial settings. Procurement by convenience-store chains, outdoor-activity industries, and emergency-supply programmes further shapes regional demand patterns. Key suppliers include Nippon Ham Co., Ltd. (NH Foods Group), Maruha Nichiro Corporation, Hoko Co., Ltd., K&K / Hotei Foods Corporation, and CJ CheilJedang Japan / Hormel Foods. These companies provide beef-based canned products, mixed-meat variants, and ready-meal formulations distributed through supermarkets, convenience stores, wholesalers, and institutional supply networks.

Saturation in Japan’s canned-meat segment remains moderate, shaped by stable long-term consumption patterns and slow category expansion. The early period shows a steady rise driven by household stocking habits, emergency-preparedness culture, and the convenience appeal of ready-to-eat protein. Penetration levels across supermarkets, convenience stores, and online channels are already high, which keeps early growth controlled rather than rapid.

Mid-period dynamics indicate that the segment operates near a semi-mature phase. Core users, such as single-person households, elderly consumers, and outdoor-activity groups, maintain consistent purchasing, but expansion beyond these groups progresses slowly. Product formats and flavour profiles evolve incrementally, limiting opportunities for major breakthroughs. As a result, the approach toward saturation is gradual, and demand curves remain stable.

Late-period saturation becomes more visible as distribution channels reach full coverage and product familiarity is widespread. Growth relies mainly on replacement demand, modest product refinements, and periodic promotional activity. Competitive overlap with chilled and frozen ready-meals also narrows the space for faster late-stage expansion.

| Metric | Value |

|---|---|

| Japan Canned Meat Sales Value (2025) | USD 0.8 billion |

| Japan Canned Meat Forecast Value (2035) | USD 1.2 billion |

| Japan Canned Meat Forecast CAGR (2025-2035) | 4.5% |

Demand for canned meat in Japan is increasing because households value long-lasting protein options that require minimal preparation and occupy little storage space. Canned meat fits the lifestyle of single-person households, students and working adults who prefer quick meals without refrigeration requirements. It is also used widely in bento boxes, camping meals and emergency food reserves, which reinforces consistent baseline demand. Convenience stores and supermarkets stock a growing range of canned chicken, tuna, pork and regional flavours that match Japanese taste preferences.

Rising interest in ready-to-eat protein snacks and meal components supports adoption across retail formats. Domestic manufacturers also improve product quality through better seasoning profiles and cleaner labels, which encourages repeat purchases. Constraints include competition from chilled and frozen meat products that offer fresher texture, as well as rising consumer interest in low-sodium and minimally processed foods. Some shoppers limit canned meat consumption due to concerns about preservatives or taste differences compared with fresh options. Variability in global meat prices can influence retail pricing and may reduce purchase frequency in cost-sensitive households.

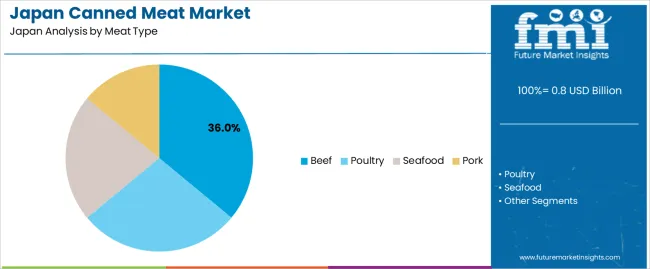

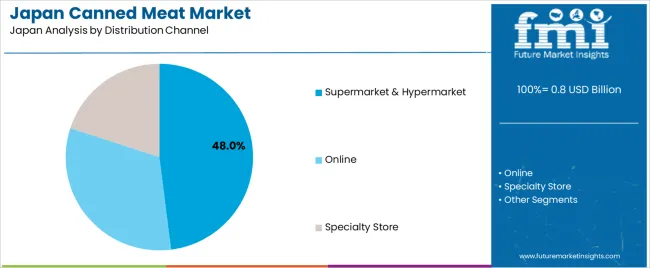

Demand for canned meat in Japan reflects the country’s preference for shelf-stable protein products suited to limited storage space, emergency supplies, and convenience-oriented meal planning. Meat-type preferences relate to flavor familiarity, cooking versatility, and compatibility with Japanese dishes such as stews, rice bowls, and mixed preparations. Distribution-channel patterns highlight how consumers purchase canned meat across supermarkets, online platforms, and specialty stores that offer imported or premium products.

Beef holds 36.0% of national demand and represents the leading canned meat type in Japan. Its flavor profile and compatibility with Japanese cooking styles support widespread use in ready meals, bento components, and emergency food kits. Poultry accounts for 28.0%, offering a lighter option used in soups, salads, and quick home preparations. Seafood represents 22.0%, aligning with Japan’s longstanding seafood consumption habits, particularly for canned tuna, mackerel, or mixed seafood items. Pork holds 14.0%, used in niche canned products such as stewed pork or luncheon-style meats. Meat-type distribution reflects Japanese consumer expectations for flavor predictability, meal versatility, and storage stability across different household segments.

Key points:

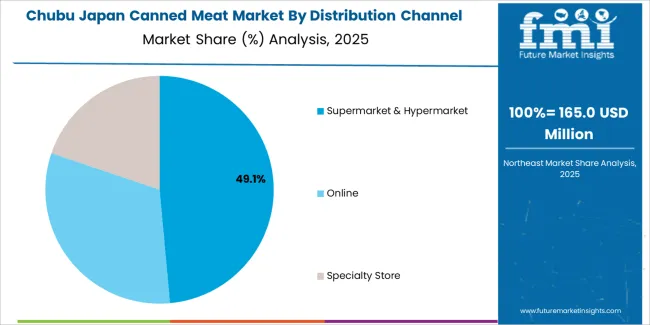

Supermarkets and hypermarkets hold 48.0% of national demand and represent the primary purchasing channel for canned meat in Japan. These outlets offer broad product ranges, private-label options, and frequent promotions that support routine household buying. Online channels account for 32.0%, reflecting increased use of e-commerce for bulk purchasing, home delivery convenience, and access to imported canned meats. Specialty stores represent 20.0%, supplying premium, region-specific, or international canned meat varieties that appeal to niche consumer groups. Channel distribution mirrors Japan’s combination of large retail chains, expanding online shopping habits, and specialty outlets that cater to specific preferences.

Key points:

Growth of disaster-preparedness stocking, increased consumption in small households and expanding use in camping and outdoor activities are driving demand.

In Japan, demand for canned meat increases as households maintain emergency food reserves recommended under national disaster-preparedness frameworks that emphasize long-shelf-life protein sources. Single-person households and elderly residents, especially in urban prefectures such as Tokyo, Osaka and Kanagawa, often choose canned meat for convenience, minimal preparation and easy storage. Outdoor recreation has grown steadily, with campers and car-travel groups purchasing canned pork, chicken and beef as reliable meal staples. Retail formats including discount stores, drugstores and home centers continue to broaden their canned-meat assortments, supporting year-round availability.

Preference for fresh and convenience-store foods, limited premium positioning and concern about sodium content restrain demand.

Japanese consumers strongly favour fresh meat, ready-to-eat meals and convenience-store bentos, which reduces frequent reliance on canned formats. Canned meat in Japan has historically occupied a budget category with fewer premium or region-specific options, limiting its appeal among shoppers seeking higher-quality meal solutions. Health-conscious consumers often view canned meat as high in sodium or preservatives, which can discourage routine consumption. These taste and health-related preferences result in stable but moderate demand, concentrated in specific usage occasions rather than daily consumption.

Shift toward regional-flavour variants, increased use in meal-prep kits and rising demand in disaster-prone prefectures define key trends.

Manufacturers are introducing canned meat seasoned with regional Japanese flavours such as miso, shoyu and yuzu pepper to appeal to consumers seeking familiar taste profiles. Meal-prep kits sold through e-commerce channels are incorporating canned meat as a stable protein option for quick home cooking. Prefectures with higher disaster exposure, such as Miyagi, Chiba and Kumamoto, show sustained interest in canned protein for stockpiling, driving stronger regional sales. Outdoor retailers are expanding assortments of compact canned meat aimed at hikers and campers. These trends support gradual diversification of canned meat consumption across Japan.

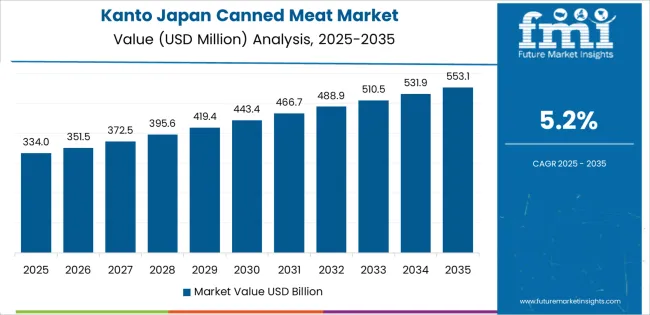

Demand for canned meat in Japan continues to rise as households, retailers, institutions, and emergency-preparedness programs prioritize long-life protein sources. Canned meat is used in bentos, simple home meals, workplace lunches, and disaster-readiness stockpiles. Regional variation reflects retail density, consumer habits, climate conditions, and the presence of tourism-linked demand channels. Kyushu & Okinawa leads at 5.6%, followed by Kanto (5.2%), Kansai (4.5%), Chubu (4.0%), Tohoku (3.5%), and Rest of Japan (3.3%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.6% |

| Kanto | 5.2% |

| Kansai | 4.5% |

| Chubu | 4.0% |

| Tohoku | 3.5% |

| Rest of Japan | 3.3% |

Kyushu & Okinawa grows at 5.6% CAGR, supported by established consumption habits, tourism activity, and strong reliance on ready-to-use protein products. Households in Fukuoka, Kumamoto, Oita, and Kagoshima regularly purchase canned meat for daily meal preparation and for maintaining household emergency supplies. Okinawa shows sustained demand due to its strong tourism base, where small retail shops, convenience outlets, and hotel stores stock canned meat for travelers seeking simple meal components. Local food culture, including dishes that incorporate processed canned meats, reinforces recurring purchase cycles. Retail distribution networks ensure widespread availability across both large cities and regional towns. Institutional buyers such as care homes, dormitories, and community facilities also store canned protein due to long shelf life and predictable inventory planning.

Kanto grows at 5.2% CAGR, driven by high urban consumption, dense convenience-store networks, and strong household reliance on shelf-stable foods across Tokyo, Kanagawa, Chiba, and Saitama. Office workers frequently purchase canned meat for quick meals, while students use it in low-effort lunches. Households maintain steady demand through routine stocking for emergencies under established preparedness practices in the region. Convenience stores exhibit rapid product turnover, ensuring constant visibility and availability. Retailers offer multiple varieties, including seasoned, ready-to-heat, low-salt, and regional-flavor formats. Supermarkets and drugstores complement convenience outlets with larger family-size assortments. Consumer purchasing patterns in Tokyo reflect preference for quick-preparation foods that fit busy daily schedules. Institutional buyers such as schools, community centers, and small facilities maintain canned proteins as part of contingency planning.

Kansai grows at a 4.5% CAGR, supported by household consumption, food-retail activity, and demand from student populations in Osaka, Kyoto, and Kobe. Canned meat is widely used in bentos, simple rice dishes, and quick home meals. Supermarkets and convenience stores supply regular assortments with stable rotation, supported by consistent demand in both urban and suburban areas. University districts in Kyoto and Osaka account for additional purchases as students rely on low-effort cooking options. Households maintain modest emergency reserves, reinforcing baseline sales throughout the year. Climate-related disruptions occasionally prompt higher stocking, sustaining stable regional demand. Retailers offer multiple product types, enabling consumers to choose between economy and premium canned meat varieties.

Chubu grows at 4.0% CAGR, influenced by mixed urban-rural demand, widespread supermarket coverage, and active food-retail distribution networks across Nagoya, Shizuoka, and surrounding prefectures. Households purchase canned meat for simple cooking, long-life storage, and inclusion in food-preparedness kits. Retailers maintain predictable inventory levels, with steady rotation across supermarkets, drugstores, and local stores. Logistics hubs in Aichi and Shizuoka support efficient distribution throughout the region, ensuring product availability in both metropolitan and smaller towns. Institutions such as care homes, dormitories, and community facilities incorporate canned protein into inventory planning because of storage stability and reliable usage cycles. Regional population diversity creates consistent demand across different household types.

Tohoku grows at 3.5% CAGR, supported by strong disaster-preparedness culture, long winters, and steady retail adoption across Sendai, Aomori, Akita, and Fukushima. Households routinely stock canned meat to support readiness for seasonal disruptions and emergency conditions. Cold seasons reinforce reliance on shelf-stable foods that require minimal preparation. Supermarkets maintain core assortments with predictable turnover driven by steady household purchasing. Community facilities, municipal centers, and local institutions include canned proteins in preparedness inventories as part of regional safety planning. Rural households show consistent use of canned meals due to long travel distances to larger retail outlets, strengthening baseline demand.

Rest of Japan grows at 3.3% CAGR, shaped by smaller population clusters, moderate household consumption, and reliable but slower retail turnover. Local supermarkets, cooperatives, and general stores supply core canned-meat varieties used for quick meals and long-term storage. Rural communities maintain steady consumption as households retain emergency reserves and rely on shelf-stable foods for convenience. Distribution networks restock products at predictable intervals despite lower population density, ensuring stable availability. Community organizations, small care facilities, and local institutions incorporate canned protein into routine inventory plans due to ease of storage and long shelf life.

Demand for canned meat in Japan is shaped by domestic producers that specialize in retort-meat dishes, canned poultry, and shelf-stable prepared foods. Nippon Ham Co., Ltd. holds an estimated 25.0% share, supported by controlled meat-processing capability, consistent sterilization standards, and wide distribution across supermarkets and convenience stores. Its canned and retort products offer stable flavour, long shelf life, and predictable texture, reinforcing its leading position.

Maruha Nichiro Corporation maintains extensive presence with canned chicken, tuna-based meat blends, and ready-to-eat retort dishes. Its products emphasize reliable protein quality and steady supply availability. Hoko Co., Ltd. contributes significant volume through canned corned beef, chicken, and mixed meat dishes, offering controlled thermal processing and uniform product consistency.

Hotei Foods Corporation holds strong category recognition with yakitori cans and meat-in-sauce products commonly purchased for bento use, emergency stockpiles, and convenience-meal occasions. CJ CheilJedang Japan, producing Spam in partnership with Hormel, supports the imported canned-meat segment with stable brand demand in Okinawa and selected retail channels. Competition in Japan centers on heat-processing stability, flavour uniformity, protein quality, packaging durability, and emergency-stock suitability. Demand remains steady as consumers favour retort meats and canned poultry for convenience, bento applications, and long-term storage.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Meat Type | Beef, Poultry, Seafood, Pork |

| Distribution Channel | Supermarket & Hypermarket, Online, Specialty Store |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Nippon Ham Co., Ltd. (NH Foods Group), Maruha Nichiro Corporation, Hoko Co., Ltd. (Maruha Nichiro Group), K&K / Hotei Foods Corporation, CJ CheilJedang Japan / Hormel Foods |

| Additional Attributes | Dollar sales by meat category and distribution channel; regional demand trends across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and Rest of Japan; consumer preference shifts toward long-shelf-life protein products, premium canned meats, and ready-to-eat emergency foods; influence of convenience, retail pack formats, and imported vs. domestic canned meat offerings; competitive positioning of major Japanese protein processors and international brands. |

The demand for canned meat in Japan is estimated to be valued at USD 0.8 billion in 2025.

The market size for the canned meat in Japan is projected to reach USD 1.2 billion by 2035.

The demand for canned meat in Japan is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in canned meat in Japan are beef, poultry, seafood and pork.

In terms of distribution channel, supermarket & hypermarket segment is expected to command 48.0% share in the canned meat in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canned Meat Market Insights - Industry Growth & Demand 2025 to 2035

Demand for Canned Pasta in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Canned Legumes in Japan Size and Share Forecast Outlook 2025 to 2035

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Meat Alternative Market Forecast and Outlook 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA