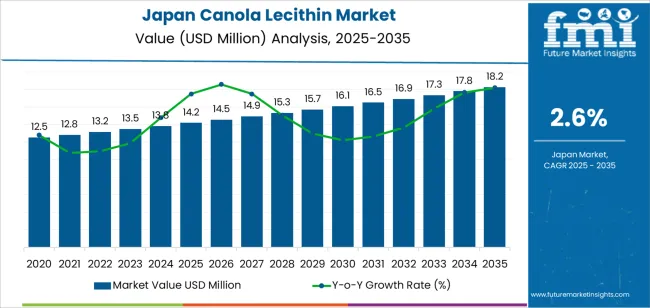

The demand for canola lecithin in Japan is expected to grow from USD 14.2 million in 2025 to USD 18.2 million by 2035, reflecting a CAGR of 2.6%. Canola lecithin is widely used in the food, pharmaceutical, and cosmetic industries for its emulsifying and stabilizing properties. It is particularly popular in food products such as margarine, baked goods, and chocolates, where it helps improve texture and extend shelf life. The increasing demand for health-conscious and natural ingredients in food products is driving the growth of canola lecithin, as consumers become more aware of the health benefits of plant-based lecithins compared to synthetic emulsifiers.

The market for canola lecithin in Japan will continue to benefit from the rising popularity of plant-based and organic foods, as well as the growing preference for clean-label products with minimal additives. Additionally, the demand for canola lecithin in cosmetics and personal care products will support its market growth due to its moisturizing and emulsifying properties. The increasing demand for functional foods and dietary supplements in Japan will further contribute to the expansion of the market for canola lecithin, as it is used in the formulation of nutraceuticals and fortified food products.

The compound absolute growth analysis for canola lecithin in Japan shows steady growth over the 2025 to 2035 period, with a consistent increase in market value driven by expanding demand in key sectors such as food processing, pharmaceuticals, and cosmetics.

From 2025 to 2030, the market will grow from USD 14.2 million to USD 16.1 million, contributing an absolute increase of USD 1.9 million in value. During this period, the growth is expected to be moderate but steady, supported by the increasing preference for natural emulsifiers and plant-based ingredients in food products. The demand for clean-label products, organic food, and functional ingredients will drive the adoption of canola lecithin, with the food and beverage industry being a major contributor. The growing health-consciousness among consumers, coupled with the shift towards plant-based diets, will play a crucial role in this early-stage growth.

From 2030 to 2035, the market will grow from USD 16.1 million to USD 18.2 million, adding USD 2.1 million in value. The growth rate will remain steady but will experience a slight deceleration as the market matures. The continued demand for canola lecithin in processed foods, cosmetics, and pharmaceuticals will sustain market expansion. Additionally, the increasing integration of natural and sustainable ingredients in consumer goods will further support the growth of canola lecithin, ensuring that its market value continues to rise despite a slower acceleration. The compound absolute growth analysis indicates that the market will experience consistent growth driven by long-term trends in health-conscious eating, sustainability, and natural product formulations.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 14.2 million |

| Industry Forecast Value (2035) | USD 18.2 million |

| Industry Forecast CAGR (2025-2035) | 2.6% |

Demand for canola lecithin in Japan is increasing due to the country’s strong emphasis on food safety, clean label products, and high quality ingredients in processed foods and dietary supplements. Many Japanese food processors are shifting to plant based emulsifiers that deliver functionality and align with consumer preference trends, making canola lecithin an attractive alternative. The broader lecithin market in Japan, including rapeseed based lecithin (of which canola is a source), is projected to grow at a compound annual growth rate of around 10.6% from 2025 to 2030.

Another factor supporting demand is the expansion of end use applications beyond food, such as in cosmetics, pharmaceutical formulations and functional ingredients, where canola lecithin offers benefits such as allergen free status, plant origin and good emulsification properties. Companies in Japan are increasingly adopting formulations that cater to wellness oriented consumers and premium segments, which enhances the consumption of high purity and specialty lecithin grades. Nonetheless, constraints include competition from soy and sunflower derived lecithin, raw material cost fluctuations and stringent regulatory requirements. Despite these challenges, the convergence of clean label demand, plant based trends and functional formulation needs suggests that demand for canola lecithin in Japan will continue to grow.

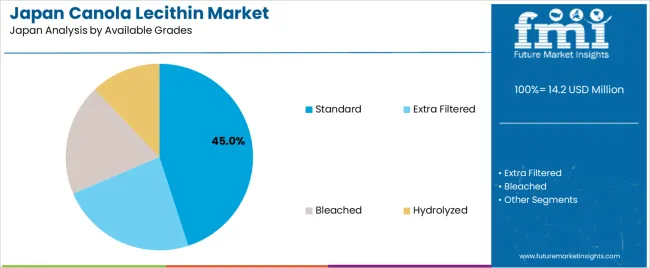

The demand for canola lecithin in Japan is primarily driven by form and available grades. The leading form is powder, holding 60% of the market share, while standard grade lecithin is the dominant available grade, accounting for 45% of the demand. Canola lecithin is a versatile emulsifier and stabilizer used in a wide range of food products, nutraceuticals, and industrial applications. As the food industry in Japan increasingly seeks healthier and more functional ingredients, the demand for canola lecithin continues to rise, particularly in its powdered form and standard grade.

Powder form leads the market for canola lecithin in Japan, accounting for 60% of the demand. The powdered form is preferred for its ease of handling, storage, and incorporation into food and industrial applications. Powdered lecithin offers convenience and flexibility in manufacturing, particularly in dry mixes, baked goods, and powdered supplements, where the ingredient can be easily dispersed and absorbed.

The popularity of powdered canola lecithin is driven by its widespread use in various food products such as bakery goods, margarine, and chocolate, where it functions as an emulsifier to improve texture and consistency. The growing demand for healthier food options with plant-based emulsifiers has also contributed to the rise of powdered lecithin. As consumer preferences shift toward cleaner, more natural ingredients, powdered canola lecithin is expected to remain the preferred form in the Japanese market.

Standard grade canola lecithin is the most popular grade, capturing 45% of the demand in Japan. This grade is widely used in food processing due to its balanced functionality and cost-effectiveness. It offers sufficient emulsifying and stabilizing properties for a variety of applications, such as in baked goods, confectioneries, beverages, and dairy products.

The demand for standard grade lecithin is driven by its versatility and affordability compared to more specialized grades like extra filtered or hydrolyzed lecithin. As food manufacturers continue to seek functional ingredients that improve texture, shelf life, and consistency, standard grade canola lecithin remains a staple in both the food and nutraceutical industries. Given its widespread use and balance of functionality and cost, the demand for standard grade lecithin is expected to remain strong in Japan’s growing food ingredient market.

Demand for canola derived lecithin in Japan is supported by growing consumer preference for plant based and non GMO food ingredients, rising emphasis on clean label formulations, and the need for natural emulsifiers in processed foods and dietary supplements. Japanese food processors seeking alternatives to soy based lecithin are increasingly open to rapeseed derived solutions. At the same time, limited domestic rapeseed production and competition from other lecithin sources moderate the pace of uptake. These dynamics shape the opportunity for canola lecithin in Japan’s ingredient market.

What Are the Primary Growth Drivers for Canola Lecithin Demand in Japan?

Several factors underpin growth. First, Japan’s food and beverage industry is placing more weight on natural, plant derived ingredients in bakery, confectionery, dairy alternative and snack formulations, creating demand for lecithin emulsifiers. Second, consumers in Japan have high levels of health awareness and tend to favour non allergen, non GMO and clean label products—attributes that canola lecithin aligns with compared with soy. Third, growth in functional foods and supplements in Japan boosts use of lecithin for emulsification, nutrition (phospholipids) and formulation stability. Fourth, increasing use of lecithin in cosmetics, skin care and nutraceuticals provides further application areas in Japan’s mature market.

What Are the Key Restraints Affecting Canola Lecithin Demand in Japan?

Despite favourable conditions, several constraints exist. The relatively small scale of domestic rapeseed processing and dependency on imports for canola lecithin may raise costs, reducing cost competitiveness against soy or sunflower lecithin. Japanese ingredient buyers may favour well established soy lecithin suppliers and may perceive technical or supply chain risks when switching to newer sources. Regulatory standards, certification for food grade ingredients and compatibility with Japanese formulations may add complexity. Finally, in cost sensitive sectors of food processing, price premiums for speciality lecithin grades may limit rapid adoption.

What Are the Key Trends Shaping Canola Lecithin Demand in Japan?

Emerging trends include an increasing shift from soy and sunflower lecithin toward canola lecithin specifically for its non GMO positioning and low allergen potential. Ingredient suppliers in Japan are offering high purity, specialty grades of canola lecithin tailored for bakery, snack and beverage applications, with improved emulsification, solubility and minimal flavour carryover. There is growing synergy between clean label reformulation efforts and the use of plant based emulsifiers like canola lecithin. Also, Japanese manufacturers are combining lecithin with other functional phospholipids and offering blends for nutrition enhanced products, which further supports demand for canola lecithin.

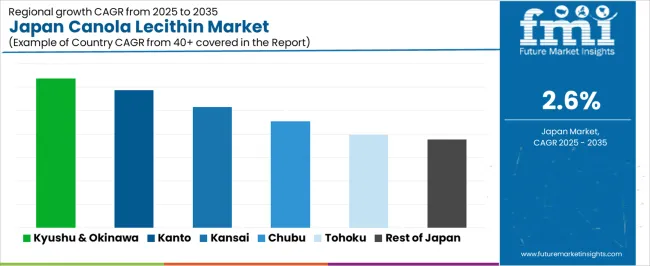

The demand for canola lecithin in Japan is growing due to its wide range of applications in the food, pharmaceutical, and cosmetics industries. Canola lecithin is primarily used as an emulsifier, stabilizer, and surfactant in processed foods, such as margarine, bakery products, and chocolates, as well as in dietary supplements and skincare products. The rising consumer preference for natural ingredients in food and cosmetics, along with increasing awareness of health and wellness, contributes to the growing demand for canola lecithin. Japan’s strong food processing industry and the growing trend toward healthier, cleaner-label products are key factors driving the market. Regional variations in demand are influenced by local industrial activity, population health trends, and the availability of canola lecithin in different regions. Below is an analysis of the demand for canola lecithin across different regions in Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.2% |

| Kanto | 2.9% |

| Kinki | 2.6% |

| Chubu | 2.3% |

| Tohoku | 2% |

| Rest of Japan | 1.9% |

Kyushu & Okinawa leads the demand for canola lecithin in Japan with a CAGR of 3.2%. The region’s strong agricultural sector and focus on food production, particularly in processed foods, contribute to the high demand for canola lecithin as an emulsifier and stabilizer. Okinawa’s popularity as a tourist destination has also driven demand for local food products, many of which use canola lecithin to improve texture and shelf life.

Additionally, Kyushu & Okinawa’s focus on health-conscious living, particularly in the food and cosmetics sectors, supports the demand for natural and non-GMO ingredients like canola lecithin. The region’s increasing adoption of cleaner-label products that align with the growing trend for healthier food choices is fueling the market for canola lecithin.

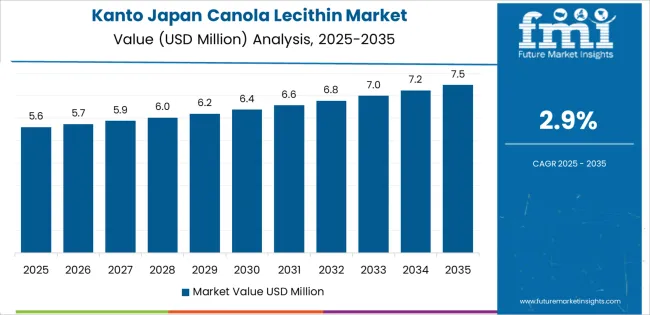

Kanto shows strong demand for canola lecithin with a CAGR of 2.9%. As Japan’s economic and industrial hub, Kanto, which includes Tokyo, has a large food processing and manufacturing base. The region's demand for canola lecithin is driven by its significant number of food producers, bakeries, and confectionaries that use it in a variety of products, from baked goods to chocolates and snacks.

Kanto’s large population, along with its growing consumer awareness of health and wellness, supports the rising demand for natural and healthier food ingredients like canola lecithin. As more food manufacturers in the region adopt cleaner and more sustainable production methods, the use of canola lecithin as a plant-based emulsifier and stabilizer continues to rise, driving strong demand.

Kinki, with a CAGR of 2.6%, shows steady demand for canola lecithin. The region, which includes Osaka and Kyoto, is a major center for food production, particularly in the areas of processed foods, sauces, and bakery products. The demand for canola lecithin in Kinki is driven by the region’s significant food processing industry, as well as the increasing popularity of plant-based and health-conscious ingredients.

Although the growth rate in Kinki is slightly lower than in Kyushu & Okinawa and Kanto, the steady demand for canola lecithin is supported by the region’s growing emphasis on cleaner-label, natural ingredients. The rising trend of healthier eating, as well as demand for non-GMO and plant-based alternatives, ensures continued growth for canola lecithin in Kinki.

Chubu demonstrates moderate growth in the demand for canola lecithin with a CAGR of 2.3%. The region, which includes Nagoya and surrounding areas, has a strong industrial and manufacturing base, particularly in automotive and machinery. However, Chubu’s food processing sector is also growing, with an increasing number of manufacturers adopting plant-based emulsifiers like canola lecithin.

The demand for canola lecithin in Chubu is driven by the region’s shift towards healthier food ingredients, as well as the increasing popularity of plant-based diets. The use of canola lecithin in processed foods, supplements, and personal care products in Chubu’s growing food sector contributes to steady market growth, although it remains slower compared to more industrialized regions like Kyushu & Okinawa and Kanto.

Tohoku, with a CAGR of 2.0%, and the Rest of Japan, with a CAGR of 1.9%, show slower growth in the demand for canola lecithin compared to other regions. These areas are more rural and have fewer large-scale food processing operations compared to urbanized regions like Kanto and Kinki. While there is still demand for canola lecithin, it is primarily driven by smaller local producers and niche markets that use it in specialty food products.

The slower demand in these regions can also be attributed to lower awareness of plant-based and clean-label food trends, as well as fewer large food manufacturing hubs. However, as consumer awareness of health and wellness continues to rise, the adoption of plant-based ingredients like canola lecithin is expected to gradually increase, particularly as regional food production expands.

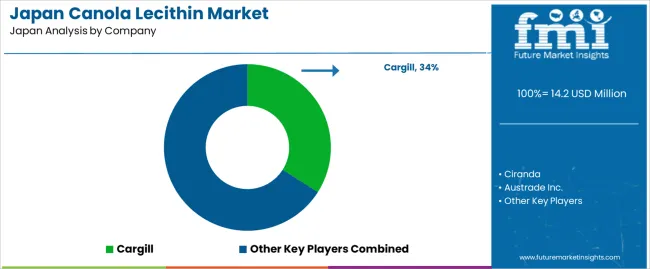

The demand for canola lecithin in Japan is increasing, driven by the growing popularity of plant-based, clean-label ingredients in the food, beverage, and pharmaceutical industries. Companies like Cargill (holding approximately 34% market share), Ciranda, Austrade Inc., Lecico, and American Chemie are key players in this market. Canola lecithin, known for its emulsifying properties, is widely used in products such as baked goods, margarine, chocolates, and dietary supplements. Additionally, it is gaining traction in the production of personal care products, given its ability to stabilize formulations and improve texture.

Competition in the canola lecithin market is largely driven by product quality, sourcing, and sustainability. Companies are emphasizing the use of non-GMO and organic canola sources to meet the growing consumer demand for natural and sustainable ingredients. Another key area of competition is the ability to offer a variety of lecithin formulations, such as liquid, powder, and granule forms, that cater to specific industry needs. Firms are also focusing on technological advancements in lecithin processing to enhance purity and functionality. Marketing materials often highlight product features like emulsification efficiency, shelf-life stability, and clean-label compatibility. By aligning their offerings with the increasing demand for sustainable, high-quality, and versatile ingredients, these companies aim to strengthen their position in Japan's canola lecithin market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Form | Powder, Liquid |

| Available Grades | Standard, Extra Filtered, Bleached, Hydrolyzed |

| End Use | Food and Beverages, Bakery, Confectionery, Convenience Foods (soups, sauces, etc.), Dairy |

| Functionality | Wetting, Emulsification, Softening, Stabilization |

| Key Companies Profiled | Cargill, Ciranda, Austrade Inc., Lecico, American Chemie |

| Additional Attributes | The market analysis includes dollar sales by form, available grade, end-use, and functionality categories. It also covers regional demand trends in Japan, particularly driven by the growing need for canola lecithin in the food and beverage sector. The competitive landscape highlights key manufacturers focusing on innovations in lecithin processing, functionality, and sustainability. Trends in the increasing demand for lecithin in bakery, dairy, and convenience food applications are explored, along with advancements in emulsification, stabilization, and softening properties. |

The global demand for canola lecithin in Japan is estimated to be valued at USD 14.2 million in 2025.

The demand for canola lecithin in Japan is projected to reach USD 18.2 million by 2035.

The demand for canola lecithin in Japan is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types are powder and liquid.

In terms of available grades, the standard segment is expected to command a 45.0% share of the demand for canola lecithin in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA