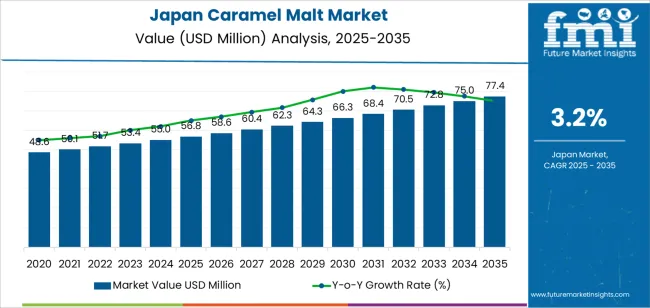

The Japan caramel malt demand is valued at USD 56.8 million in 2025 and is forecasted to reach USD 77.4 million by 2035, reflecting a CAGR of 3.2%. Demand is supported by steady activity in domestic beer production, growing interest in craft brewing, and continued use of caramel malt for flavor, color, and body enhancement in lager and ale formulations. Caramel malt contributes to sweetness, foam stability, and mild roasted notes, reinforcing its role in both large-scale brewing and small-batch craft operations across the country.

Light colour caramel malt represents the leading segment due to its versatility in mainstream Japanese beer styles, where subtle malt sweetness and controlled colour intensity are preferred. Light variants offer consistent performance across high-volume brewing systems and enable precise flavor balancing in blends that rely on restrained caramel character. Improvements in kilning uniformity, moisture management, and batch consistency continue to support reliable incorporation into regional brewing processes.

Demand is strongest in Kyushu & Okinawa, Kanto, and Kinki, where brewery density, production capacity, and consumer interest in diversified beer profiles remain high. These regions also support expanding craft operations that rely on specialty malts for product differentiation. Key suppliers include Bairds Malt Limited, Weyermann, Castle Malting, Thomas Fawcett Malting, and Great Western Malting, with a focus on grain quality, controlled caramelization, and stable flavor development.

The acceleration and deceleration pattern shows a modest early lift driven by stable demand from craft breweries and specialty beverage producers. Between 2025 and 2029, the segment will experience mild acceleration as small-scale brewers continue to expand flavor portfolios that rely on caramel malt for color modification and body enhancement. Incremental gains during this period will also come from limited new product introductions in malt-based beverages.

From 2030 to 2035, the segment will enter a gentle deceleration phase as production volumes stabilize and breweries shift toward predictable formulation cycles. Growth will rely more on replacement demand, steady sourcing of malt varieties, and incremental improvements in processing consistency rather than expansion in output. Broader consumer preference for balanced, lower-alcohol beverages will sustain baseline use but will not create strong acceleration. The pattern reflects a mature, steady-use ingredient category characterized by modest early growth followed by stable, consumption-driven performance across Japan’s brewing and specialty beverage applications.

| Metric | Value |

|---|---|

| Japan Caramel Malt Sales Value (2025) | USD 56.8 million |

| Japan Caramel Malt Forecast Value (2035) | USD 77.4 million |

| Japan Caramel Malt Forecast CAGR (2025-2035) | 3.2% |

The demand for caramel malt in Japan is growing because the craft beer sector and premium alcoholic beverages increasingly adopt specialty malts to enhance flavor, color and mouthfeel. Breweries in Japan are focusing on high-quality ingredients that differentiate their products in a competitive industry. Caramel malt offers distinct caramelized sweetness and amber hue which appeals particularly in craft ales, brown lagers and seasonal brews. The trend toward premiumization in beverages and the rising number of microbreweries and brewpubs further support steady uptake of caramel malt.

Innovation in baking and confectionery applications also boosts usage of caramel malt in the Japanese food industry where texture, color and taste matter to consumers. The Japanese industry places a premium on consistent ingredient quality and traceability, making suppliers of caramel malt that meet these criteria more attractive. Growth faces constraints such as limited availability of locally produced malt, import dependency for specialty malts and high cost compared with standard malts. The relatively modest size of the craft brewing segment compared with more mature beer industries may also moderate growth pace.

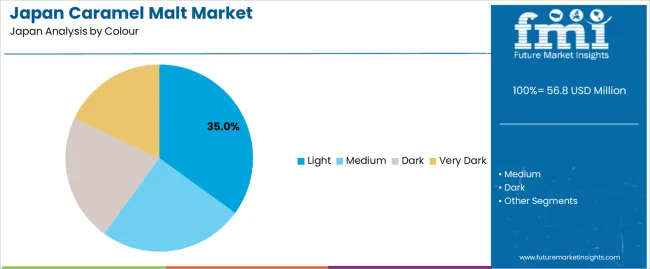

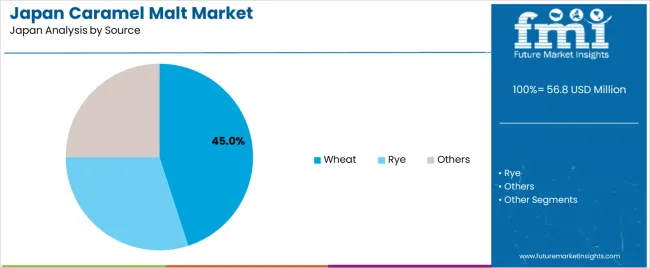

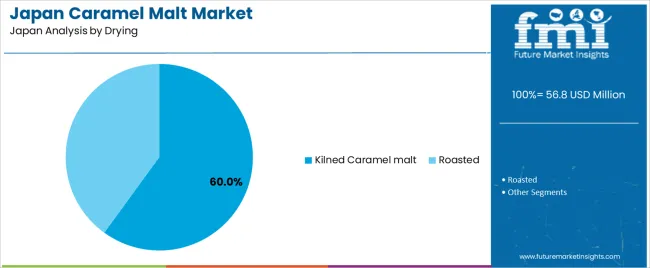

Demand for caramel malt in Japan is shaped by brewing practices, flavour requirements, and production preferences across large-scale and craft breweries. Colour selection, grain source, and drying method determine the malt profile used in lagers, ales, and specialty recipes common in the Japanese beer industry. Industry distribution across segments reflects formulation priorities, consistency expectations, and the need to balance flavour intensity with the clarity and drinkability typical of domestic beer styles.

Light caramel malt leads colour-based demand in Japan with 35.0%, reflecting its suitability for pale lagers, light ales, and beer styles that emphasize subtle sweetness and clean finish. Light variants contribute mild caramel tones, improved foam stability, and moderate body without introducing strong roasted characteristics, aligning with preferences for smooth, balanced profiles. Medium caramel malt accounts for 25.0%, supporting amber-style and mid-colour beers with slightly richer malt expression. Dark caramel malt holds 22.0%, used in fuller-bodied brews requiring deeper colour and caramelization. Very dark caramel malt represents 18.0%, supplying concentrated flavours for niche craft styles and limited seasonal releases.

Key drivers and attributes:

Wheat-derived caramel malt accounts for 45.0% of demand in Japan, driven by its contribution to smoother mouthfeel, light sweetness, and improved head stability. These traits support wheat beers, hybrid styles, and formulations focusing soft texture. Rye-based caramel malt holds 30.0%, supplying spice-forward notes used selectively in craft brewing where distinctive flavour structure enhances specialty recipes. The remaining 25.0% includes barley and other grains used in traditional Japanese lager and ale formulations. Source distribution reflects the balance between innovation in craft brewing and consistency priorities in large-scale production.

Key drivers and attributes:

Kilned caramel malt represents 60.0% of demand in Japan, reflecting preferences for controlled caramelization, predictable colour development, and consistent extraction behaviour during mashing. Kilned variants support clean malt expression suitable for lagers and balanced ales widely produced by Japanese breweries. They provide moderate sweetness and reliable performance during large-scale production. Roasted caramel malt accounts for 40.0%, used for deeper colour, stronger caramel intensity, and mild burnt-sugar notes in darker beers and limited-edition seasonal offerings. Drying-method distribution aligns with Japan’s focus on clarity, mild flavour expression, and stable production characteristics.

Key drivers and attributes:

Growing craft beer emergence, premium beer segment innovation, and increased use in specialty food applications are driving demand.

In Japan, demand for caramel malt is rising as craft breweries and premium beer producers seek distinctive color and flavor profiles for products targeted at discerning consumers. The craft-beer sector’s focus on quality and ingredient authenticity supports increased use of specialty malts like caramel malt. Food manufacturers are also incorporating caramel malt into confectionery, bakery, and snack applications to deliver toasted, caramelized, and amber-hued flavor notes that resonate with Japanese taste preferences. The combination of premium beverage trends and specialty food innovation encourages caramel-malt uptake across brewing and food processing industries.

Regulated alcohol taxation, limited growth in overall beer consumption, and competition from alternative specialty malts restrain industry uptake.

Japan’s beverage industry faces regulatory challenges including higher taxes on malt content in beer-like beverages, which influences brewery ingredient cost structures and may limit expansion of high-malt recipes. Beer consumption in Japan is relatively mature with limited volume growth, which constrains incremental demand for specialty malt varieties. Some breweries may substitute roasted or specialty malts that achieve similar sensory outcomes at lower cost or with lighter color impact, which competes with caramel malt. These factors moderate the rate of growth in the Japanese caramel-malt segment.

Shift toward ultra-premium and limited-edition beer offerings, adaptation of caramel malt in non-beer applications, and enhanced importation of specialty malts define industry trends.

Japanese craft breweries are increasingly releasing limited-edition, seasonal and high-aged beers that place stronger focus on malt profile, driving demand for higher-quality caramel malts with precise flavor and color characteristics. Caramel malt use is extending beyond beer into sweets, chocolate, malt-based beverages and premium snack lines, broadening industry scope. Local malters and international suppliers are improving traceability, sourcing claims and custom malt batches to meet Japanese brewing standards. These trends support a steady rise in demand for caramel malt in Japan, especially among premium-segment brewers and speciality food producers.

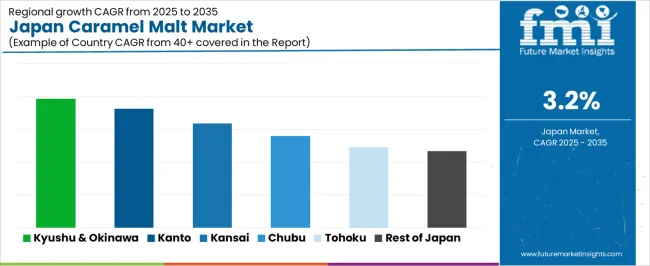

Demand for caramel malt in Japan is increasing through 2035, driven by stable production of craft beers, broader availability of specialty malt varieties, and consistent consumer interest in malt-balanced styles such as amber ales, brown ales, and select seasonal brews. Regional demand reflects brewery concentration, distribution reach, and local preferences for color, flavor depth, and body-enhancing malt components. Kyushu & Okinawa leads with a 3.9% CAGR, followed by Kanto (3.6%), Kinki (3.2%), Chubu (2.8%), Tohoku (2.5%), and the Rest of Japan (2.3%). Growth is also supported by small-batch brewery expansions, specialty-beer retail networks, and steady consumption of malt-forward seasonal styles.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 3.9% |

| Kanto | 3.6% |

| Kinki | 3.2% |

| Chubu | 2.8% |

| Tohoku | 2.5% |

| Rest of Japan | 2.3% |

Kyushu & Okinawa grows at 3.9% CAGR, supported by increasing craft-brewery activity, regional tourism, and broader production of malt-focused ales and seasonal beers. Breweries in Fukuoka, Kumamoto, Kagoshima, and Okinawa incorporate caramel malt to achieve color consistency, body enhancement, and mild sweetness in year-round and limited-edition releases. Tourism-driven consumption encourages breweries to diversify flavor profiles using multiple caramel malt grades. Retail channels, including specialty stores and local distribution networks, maintain dependable turnover for malt-forward products. The region’s climate supports steady demand for balanced ales consumed across both warm and cooler months.

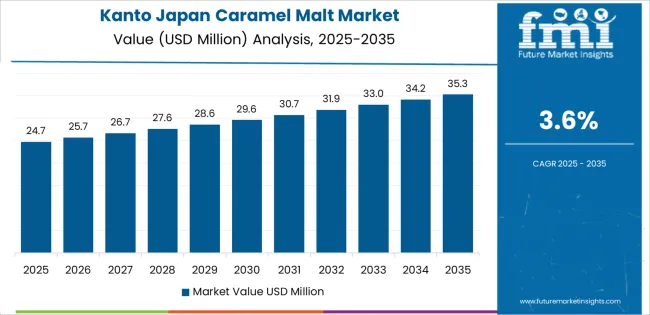

Kanto grows at 3.6% CAGR, supported by its dense population, strong retail presence, and large number of microbreweries producing specialty ales. Breweries in Tokyo, Kanagawa, Chiba, and Saitama rely on caramel malt for balanced flavor development in amber ales, red ales, and malt-forward limited releases. High consumer interest in premium craft products drives consistent adoption. Breweries use caramel malt for color stabilization and mild caramelized notes suited to urban consumer preferences. Distribution through bottle shops, taprooms, and online channels reinforces dependable movement of malt-influenced styles.

Kinki grows at 3.2% CAGR, supported by steady craft-beer consumption and increasing production of malt-focused styles across Osaka, Kyoto, Hyogo, and Nara. Breweries incorporate caramel malt for flavor depth, body enhancement, and visual consistency in ales tailored to regional taste preferences. Specialty-beer retailers support regular movement of malt-forward products, while taprooms and brewpubs maintain stable demand through diverse menu offerings. The region’s combination of tourism, food culture, and expanding craft-beer exposure contributes to steady adoption of caramel malt across new and established breweries.

Chubu grows at 2.8% CAGR, supported by small and mid-sized breweries in prefectures such as Aichi, Shizuoka, and Nagano. Breweries use caramel malt to improve beer stability, broaden flavor characteristics, and support malt-centric styles suited to regional consumer preferences. Outdoor-tourism areas in Nagano and Shizuoka contribute to sales of seasonal and specialty ale varieties. Distribution through local craft-beer outlets and regional supermarkets provides consistent demand for caramel-malt-based beers. Growth remains moderate due to smaller brewery density compared with Kanto and Kinki.

Tohoku grows at 2.5% CAGR, supported by expanding regional breweries and stable consumption in cooler climates where malt-forward beer styles maintain appeal. Breweries in Miyagi, Fukushima, and Iwate adopt caramel malt for body enhancement and deeper color tones suited to seasonal brews. Local consumers show steady interest in full-bodied ales and limited-edition winter beers. Distribution networks rely on regional retailers and tourism-driven sales, especially in hot spring and mountain destinations. Growth remains modest due to smaller production scales but stable across core brewery operations.

The Rest of Japan grows at 2.3% CAGR, supported by scattered small breweries, local specialty-beer outlets, and ongoing production of malt-forward ales in limited volumes. Caramel malt is used to diversify flavor profiles and add color complexity to beers produced in smaller prefectures and rural areas. Demand is sustained by local tourism, community-based breweries, and periodic specialty releases. Smaller distribution footprints and lower production volumes limit overall growth, though adoption remains stable due to steady interest in unique, regionally crafted products.

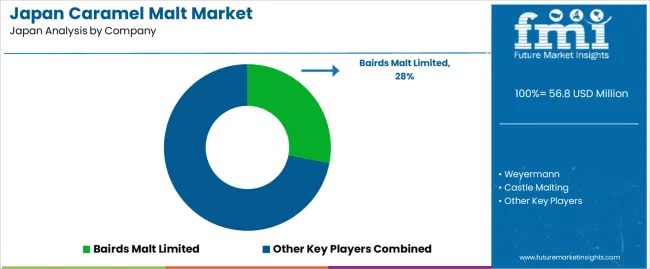

Demand for caramel malt in Japan is shaped by a concentrated group of international maltsters supplying breweries focused on craft, premium, and specialty beer production. Bairds Malt Limited holds the leading position with an estimated 28.0% share, supported by consistent color grading, reliable flavor development, and established relationships with Japanese craft breweries that require predictable sweetness and controlled roast intensity. Its position is reinforced by stable shipment schedules and uniform batch performance.

Weyermann, Castle Malting, and Thomas Fawcett Malting follow as key suppliers, each providing a wide range of caramel malt profiles suited to European-style ales, darker lagers, and specialty seasonal beers produced in Japan. Their strengths include precise roasting control, traceable raw materials, and dependable moisture and extract parameters valued by brewers seeking repeatable results across small and mid-scale production runs.

Great Western Malting contributes additional supply flexibility through North American caramel malt grades favored by selected Japanese brewers using USA-influenced ale and IPA styles. Its role is supported by steady product uniformity and logistics that align with import-based sourcing strategies. Competition across this segment centers on color stability, flavor consistency, moisture control, and dependable delivery. Demand is sustained by continued growth in Japan’s craft brewing activity and preference for malt-forward recipes that depend on reliable caramel malt characteristics for body, color, and controlled sweetness.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Colour | Light, Medium, Dark, Very Dark |

| Source | Wheat, Rye, Others |

| Drying | Kilned Caramel Malt, Roasted |

| Application | Beer, Food, Dairy and Frozen Products, Bakery and Confectionery, Others |

| End Use | Microbreweries, Large Breweries, Regional Breweries, Brewpubs, Home Brewers |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Bairds Malt Limited (28.0%), Weyermann, Castle Malting, Thomas Fawcett Malting, Great Western Malting |

| Additional Attributes | Dollar sales by colour, source, drying method, and application categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of caramel malt suppliers; developments in roasted and kilned malt varieties; integration with craft breweries, large-scale beer producers, and food manufacturing sectors in Japan. |

The global demand for caramel malt in Japan is estimated to be valued at USD 56.8 million in 2025.

The demand for caramel malt in Japan is projected to reach USD 77.4 million by 2035.

The demand for caramel malt in Japan is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in demand for caramel malt in Japan are light, medium, dark and very dark.

In terms of source, the wheat segment is expected to command a 45.0% share in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA