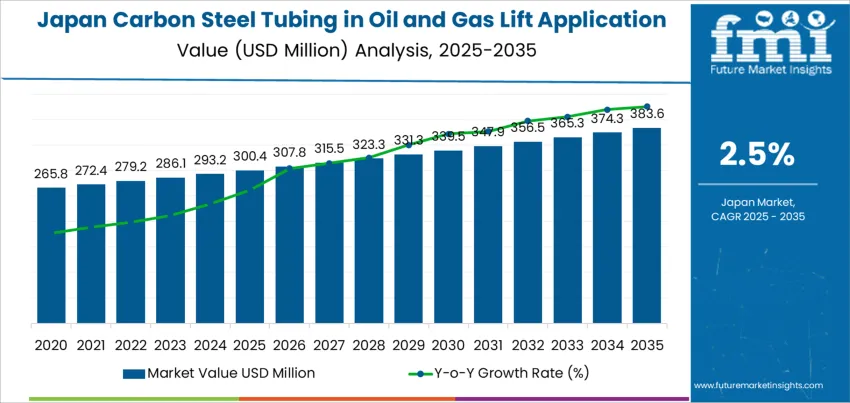

The demand for carbon steel tubing in oil and gas lift applications in Japan is expected to grow from USD 300.4 million in 2025 to USD 383.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 2.5%. Carbon steel tubing plays a crucial role in oil and gas extraction, particularly in lift applications such as pumping systems, which are essential for maintaining fluid flow. As Japan's oil and gas industry continues to require advanced materials that can withstand high pressures and extreme conditions, demand for reliable carbon steel tubing will persist, supporting market growth throughout the forecast period.

Year-over-year (Y-o-Y) growth will be gradual, with the market increasing from USD 300.4 million in 2025 to USD 307.8 million in 2026, followed by USD 315.5 million in 2027. This steady growth continues over the following years, with demand reaching USD 331.3 million by 2029. By 2035, the demand for carbon steel tubing in oil and gas lift applications is expected to reach USD 383.6 million, reflecting consistent, long-term growth driven by the need for high-performance materials in the energy sector.

The carbon steel tubing market in oil and gas lift applications in Japan is forecasted to experience steady growth through 2035. Starting at USD 300.4 million in 2025, the market will increase to USD 307.8 million in 2026, with a gradual rise each year. By 2027, the demand will reach USD 315.5 million, and by 2028, it will grow to USD 323.3 million. The market will continue to expand, reaching USD 331.3 million by 2029 and USD 339.5 million by 2030. By 2035, demand for carbon steel tubing is projected to reach USD 383.6 million, indicating ongoing, stable growth over the next decade.

The growth contribution index reveals that the market will experience incremental increases each year, with a relatively consistent contribution from the oil and gas industry’s ongoing demand for tubing in lift applications. The growth trajectory is steady, driven by continued investments in infrastructure and the need for durable materials in drilling and pumping systems. The contribution to growth will remain balanced, with each year making a consistent impact on the overall market expansion.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 300.4 million |

| Industry Forecast Value (2035) | USD 383.6 million |

| Industry Forecast CAGR (2025-2035) | 2.5% |

Demand for carbon steel tubing used in oil and gas lift applications in Japan is rising as the nation continues to maintain and upgrade its upstream hydrocarbon infrastructure. The offshore segment of Japan’s oil and gas sector is a primary driver of this demand. As companies invest in offshore drilling, maintenance of existing wells and potential new field development, they require robust, cost effective tubing that can withstand high pressures, corrosive environments, and challenging marine conditions. Carbon steel tubing remains preferred for artificial lift systems - including gas lift, rod lift, and electric submersible pump (ESP) installations - because of its strength, durability and relative cost advantage over many exotic alloy options. The reliance on imported energy and the strategic importance of secure hydrocarbon supply further motivate operators to invest in reliable lift tubing systems that support stable production and help ensure operational safety and longevity.

At the same time, improvements in tubing design and manufacturing quality boost demand growth. Japanese and global steel producers supply seamless and coated carbon steel tubing tailored for oilfield conditions to meet rising standards for corrosion resistance and fatigue performance. Advances in internal and external coatings increase resistance to saline seawater and acidic downhole fluids, extending service life of tubing systems and reducing maintenance frequency. As operators seek to optimize lifecycle costs and minimize downtime, carbon steel tubing becomes a cost efficient, dependable solution. Given ongoing upstream activity, maintenance cycles, and the need for durable lift tubing in offshore environments, demand for carbon steel tubing for oil and gas lift applications in Japan is expected to grow steadily in coming years.

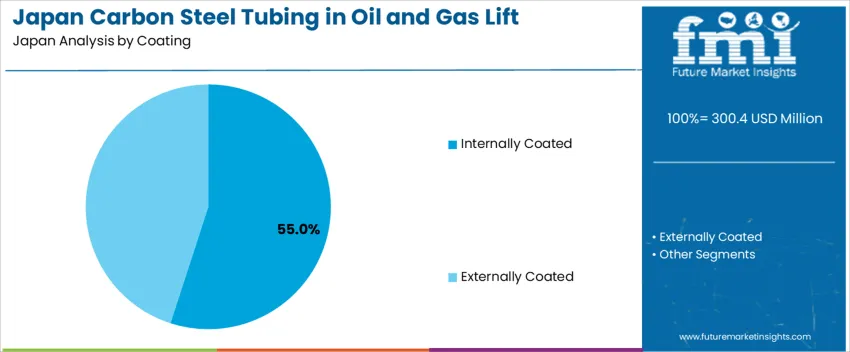

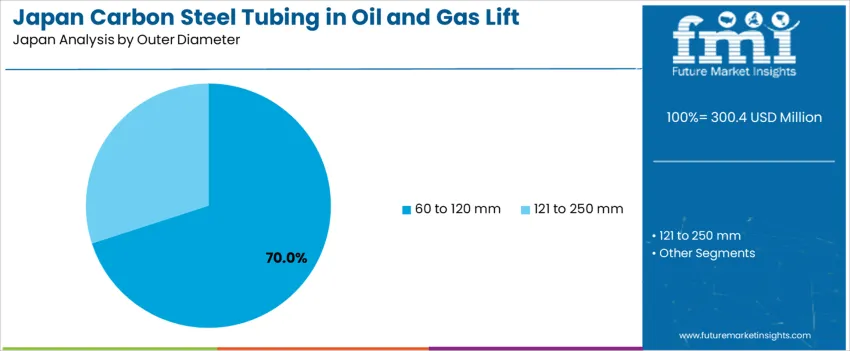

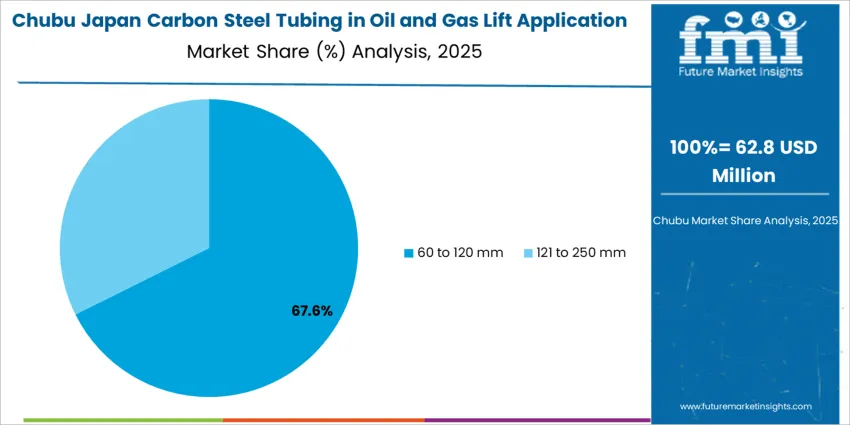

The demand for carbon steel tubing in oil and gas lift applications in Japan is driven by coating and outer diameter. The leading coating type is internally coated, which captures 55% of the market share, while the dominant outer diameter range is 60 to 120 mm, accounting for 70% of the demand. Carbon steel tubing plays a critical role in the oil and gas industry, particularly in lift operations where durability, corrosion resistance, and strength are essential for transporting fluids and gases. The continued growth of the oil and gas sector, combined with advancements in material and coating technologies, supports the strong demand for carbon steel tubing.

Internally coated carbon steel tubing leads the demand in oil and gas lift applications in Japan, holding 55% of the market share. Internally coated tubing is used to enhance the corrosion resistance of the internal surfaces of the tubes, which are frequently exposed to corrosive substances such as acids, salts, and chemicals found in oil and gas extraction environments. The coating helps protect the tubing from wear and degradation, thus extending the service life and maintaining the efficiency of the lift system.

The demand for internally coated carbon steel tubing is driven by the need for reliable, durable materials in challenging operational environments. Oil and gas lift applications require tubing that can withstand the harsh conditions found in deep wells, high pressures, and extreme temperatures. Internally coated tubing provides the necessary protection against corrosion, preventing blockages and reducing maintenance costs. With the increasing focus on reducing downtime and improving operational efficiency in the oil and gas sector, internally coated carbon steel tubing remains the preferred choice for many operators in Japan.

The 60 to 120 mm outer diameter range is the dominant size for carbon steel tubing in oil and gas lift applications in Japan, capturing 70% of the demand. This diameter range is widely used in the oil and gas industry for lifting oil, gas, and other fluids from deep wells to the surface. Tubing in this size range is strong enough to handle the pressures and stresses encountered during the lift process while remaining manageable in terms of weight and flexibility.

The popularity of the 60 to 120 mm outer diameter range is driven by its suitability for most oil and gas lift operations, where medium to high pressures are involved. Tubing in this range provides the necessary strength for deep well applications, while also being cost-effective and compatible with standard equipment used in the industry. As oil and gas extraction techniques continue to evolve and demand for efficiency increases, the 60 to 120 mm tubing range is expected to remain a key component in the sector's ongoing development in Japan.

Demand for carbon steel tubing in oil and gas lift applications in Japan is limited compared with global markets. Domestic oil and gas production in Japan remains modest and the overall upstream sector is small, which constrains large scale demand for lift tubing systems. Producers of steel tubular goods in Japan supply OCTG and other steel tubes for energy projects, but demand for lift specific carbon steel tubing is largely driven by replacement needs, maintenance of existing wells, and occasional niche projects rather than wide scale expansion. Because of these structural constraints, carbon steel tubing for artificial lift systems in Japan is expected to grow slowly and remain a minor share of global consumption.

What are the Drivers of Demand for Carbon Steel Tubing in Oil and Gas Lift Applications in Japan?

One factor supporting demand is ongoing maintenance and servicing of older wells, which requires replacement of tubing and related components. Firms producing steel pipes in Japan supply high strength, corrosion resistant tubing suited for oil well conditions, which ensures reliability under pressure and mechanical stress. Companies with capability to produce oil well casings and tubing - including seamless and coated steel tubes - serve both domestic and export markets. Such domestic manufacturing capacity helps sustain demand even when new drilling activity is low, because replacement and retrofit orders remain viable. Also, where small or mid scale hydrocarbon projects proceed - onshore or offshore - the availability of locally produced tubing reduces lead times and encourages use of carbon steel tubing for lift operations. These factors help maintain a baseline demand level in Japan despite overall limited upstream activity.

What are the Restraints on Demand for Carbon Steel Tubing in Oil and Gas Lift Applications in Japan?

Primary restraint is the limited scale of domestic oil and gas production. Japan’s crude oil output is low, which implies few new wells requiring lift tubing. This restricts fresh demand for tubing associated with new drilling or field development. Another restraint is the competition from imports and global supply: with major global producers and markets offering tubing, domestic producers face pressure both in cost and competitiveness, which may limit domestic consumption. Additionally, regulatory, environmental and economic factors may discourage large-scale drilling projects, further reducing potential demand for lift tubing. The relatively low share of oil well infrastructure work in Japan compared with other energy sectors means that carbon steel tubing demand remains constrained. Finally, since many tubular products may be directed toward other uses rather than lift specific tubing (such as line pipe, casing, or non energy uses), the segment for lift tubing remains small.

What are the Key Trends Influencing Demand for Carbon Steel Tubing in Oil and Gas Lift Applications in Japan?

A noticeable trend is continued emphasis on manufacturing high quality, corrosion resistant tubular products by local producers for oil well applications. This suggests that even in a limited domestic market, tubing used in oil and gas wells tends toward higher standards to ensure safety and durability in demanding environments. Another trend is reliance on maintenance, refurbishment, and retrofitting of existing wells rather than heavy investment in new wells. This drives demand for replacement tubing and associated services rather than large-scale new orders. Also, because the domestic market is small, many Japanese producers of steel tubing focus increasingly on export markets; this affects how domestic demand for lift tubing evolves, often tied to global market conditions. Finally, given limited upstream expansion in Japan, demand for carbon steel tubing in lift applications remains relatively stable without expecting large growth spurts, unless there is a shift toward new resource development or offshore drilling projects.

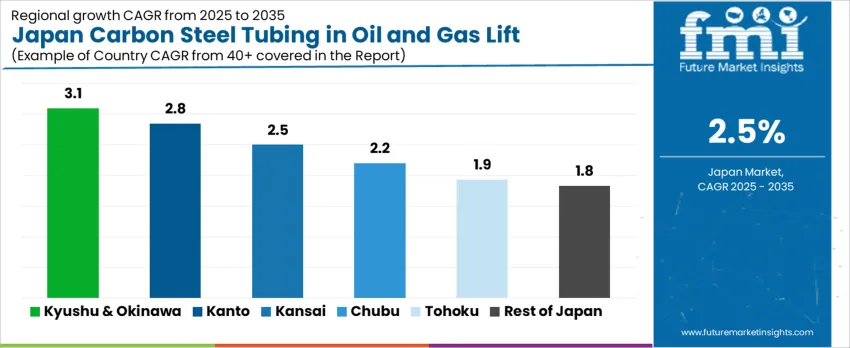

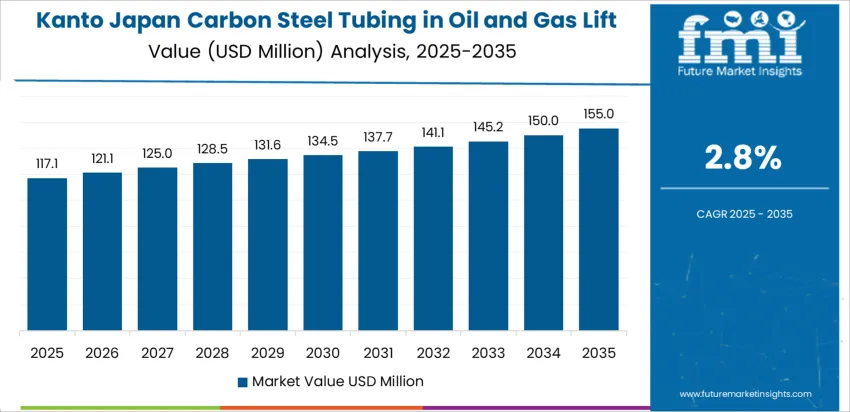

The demand for carbon steel tubing in oil and gas lift applications in Japan shows steady growth across regions, with Kyushu & Okinawa leading at a CAGR of 3.1%. Kanto follows closely with a CAGR of 2.8%, supported by the region's significant industrial base. The Kinki region shows moderate growth at 2.5%, while Chubu, Tohoku, and the Rest of Japan show slower growth, with respective CAGRs of 2.2%, 1.9%, and 1.8%. These regional differences reflect varying levels of oil and gas production activity, industrial infrastructure, and regional focus on energy production and resource management.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.1 |

| Kanto | 2.8 |

| Kinki | 2.5 |

| Chubu | 2.2 |

| Tohoku | 1.9 |

| Rest of Japan | 1.8 |

The demand for carbon steel tubing in oil and gas lift applications in Kyushu & Okinawa is projected to grow at a CAGR of 3.1%, driven by the region’s oil and gas production, especially in offshore fields. Kyushu & Okinawa are home to significant oil extraction operations that require high-performance carbon steel tubing to support safe and efficient lift systems. The region's focus on maximizing oil recovery from mature fields and offshore reservoirs is contributing to the increasing demand for reliable, durable tubing used in lifting operations. Additionally, the push toward more efficient resource management and the growing need to upgrade and maintain existing infrastructure in these fields are expected to drive continued demand for carbon steel tubing in oil and gas lift applications in Kyushu & Okinawa.

In Kanto, the demand for carbon steel tubing is expected to grow at a CAGR of 2.8%, supported by the region’s strong industrial base and energy sector. Kanto, home to Tokyo, has a well-developed energy infrastructure, with significant focus on energy production and distribution. Although the region is less known for oil and gas production compared to Kyushu, its demand for carbon steel tubing is driven by the need for infrastructure maintenance, upgrades, and the supply of energy resources for industrial and commercial use. The region’s efforts to improve energy efficiency and enhance the operational capabilities of its oil and gas lifting systems contribute to the demand for carbon steel tubing. Additionally, Kanto’s role as a hub for technological innovations in the energy sector further supports the growth of these materials in lift applications.

The demand for carbon steel tubing in the Kinki region is projected to grow at a CAGR of 2.5%, reflecting moderate growth due to its industrial infrastructure and energy demands. Kinki, including major cities like Osaka, is home to several industries that rely on energy resources, including oil and gas. However, its focus on other sectors such as manufacturing and chemicals leads to relatively slower growth in the demand for carbon steel tubing in oil and gas lift applications compared to other regions. The region's demand is primarily driven by the maintenance of existing oil infrastructure, where carbon steel tubing plays a crucial role in ensuring the safety and reliability of lift systems. As Kinki continues to modernize its energy and industrial infrastructure, demand for carbon steel tubing is expected to remain steady.

In Chubu, the demand for carbon steel tubing in oil and gas lift applications is expected to grow at a CAGR of 2.2%, driven by the region’s industrial activities and energy requirements. Chubu, home to cities like Nagoya, has a diverse manufacturing sector and a growing need for energy resources. Although Chubu’s oil and gas production is not as extensive as in Kyushu & Okinawa, the demand for carbon steel tubing is supported by the region’s continued focus on maintaining energy systems and upgrading infrastructure. The region’s need for efficient lift systems in both onshore and offshore energy production contributes to the steady demand for high-quality carbon steel tubing. However, growth in Chubu is slower compared to other regions, due to its relatively stable oil and gas production activities.

In Tohoku, the demand for carbon steel tubing is projected to grow at a CAGR of 1.9%, reflecting slower adoption compared to other regions. Tohoku, with its more rural and less industrialized landscape, has a smaller oil and gas production footprint. However, the demand for carbon steel tubing is driven by ongoing infrastructure maintenance and the need to support energy production systems in the region. While Tohoku has not seen the same level of oil and gas exploration as Kyushu & Okinawa, the region's growing focus on energy efficiency and resource management is contributing to steady but moderate growth in demand for carbon steel tubing. As Tohoku continues to prioritize the upgrading of energy infrastructure, the demand for carbon steel tubing in oil and gas lift applications is expected to rise gradually.

In the Rest of Japan, the demand for carbon steel tubing in oil and gas lift applications is expected to grow at a CAGR of 1.8%, reflecting more modest growth. This region, which encompasses areas outside of Japan's major industrial and energy hubs, has less extensive oil and gas production. However, the demand for carbon steel tubing remains steady due to ongoing energy needs, particularly in maintaining and upgrading infrastructure. As the region faces challenges related to energy security and sustainability, there is a growing focus on improving the efficiency of oil and gas production systems. The demand for carbon steel tubing is expected to continue growing in the Rest of Japan, albeit at a slower pace compared to other, more energy-focused regions.

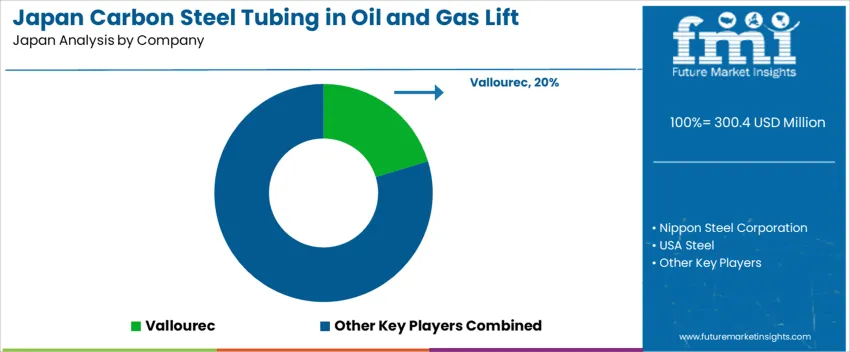

Demand for carbon steel tubing used in oil and gas lift applications is rising in Japan as operators look to maintain existing wells and support offshore or onshore hydrocarbon production. Key suppliers in this space include Vallourec (holding about 20.3 % share among the major providers), Nippon Steel Corporation, USA Steel, and Jindal SAW Ltd.. These companies supply carbon steel tubing used for artificial lift systems, gas lift tubing, and production tubing for wells. Tubing products are essential in lift operations because they must withstand high pressures, corrosive fluids, and temperature fluctuations common in oil and gas wells.

Competition in the Japanese market is shaped by material quality, manufacturing precision, and delivery reliability. Suppliers emphasise tubing that meets strict specifications for yield strength, wall thickness, internal diameter consistency, and resistance to abrasion and pressure cycling. Another important area of competition lies in coating and corrosion resistance technologies, since many wells demand tubing that can resist chemical exposure, sour gas, or seawater. Firms that offer robust quality certification, traceability, and timely supply tend to gain preference among oil field operators and service companies. Pricing and supply chain resilience also matter, particularly in projects where timely delivery can avoid costly delays. By offering durable, compliant, and reliably supplied tubing, these companies aim to maintain or expand their presence in Japan’s carbon steel tubing market for oil and gas lift applications.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Coating | Internally Coated, Externally Coated |

| Outer Diameter | 60 to 120 mm, 121 to 250 mm |

| Type | Onshore, Offshore |

| Key Companies Profiled | Vallourec, Nippon Steel Corporation, USA Steel, Jindal SAW Ltd. |

| Additional Attributes | The market analysis includes dollar sales by coating type, outer diameter, type, and company categories. It also covers regional demand trends in Japan, driven by the increasing adoption of carbon steel tubing in oil and gas lift applications, both onshore and offshore. The competitive landscape highlights key manufacturers focusing on innovations in steel tubing coatings and strength for enhanced durability in harsh oil and gas environments. Trends in the growing demand for high-performance, corrosion-resistant steel tubing for oil and gas extraction are explored, along with advancements in material composition and tubing technology. |

The demand for carbon steel tubing in oil and gas lift application in Japan is estimated to be valued at USD 300.4 million in 2025.

The market size for the carbon steel tubing in oil and gas lift application in Japan is projected to reach USD 383.6 million by 2035.

The demand for carbon steel tubing in oil and gas lift application in Japan is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in carbon steel tubing in oil and gas lift application in Japan are internally coated and externally coated.

In terms of outer diameter, 60 to 120 mm segment is expected to command 70.0% share in the carbon steel tubing in oil and gas lift application in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Carbon Steel Tubing in Oil and Gas Lift Applications Market Insights – Size, Share & Forecast 2025–2035

Demand for Carbon Steel Tubing in Oil and Gas Lift Applications in USA Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Japan Carbon Capture and Storage Market Insights – Size, Trends & Forecast 2025-2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Industry Analysis in North America Forecast & Analysis: 2025 to 2035

Carbon Steel IBC Market Demand and Forecast 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil And Gas Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA