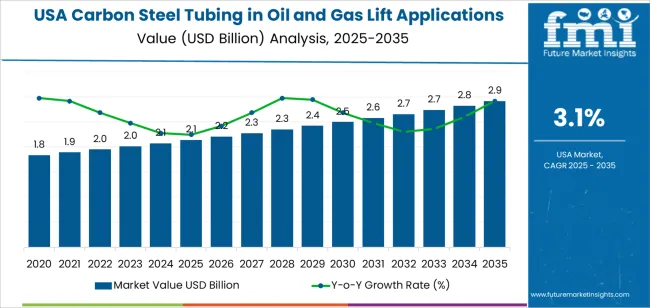

The demand for carbon steel tubing in oil and gas lift applications in the USA is expected to grow from USD 2.1 billion in 2025 to USD 2.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.1%. Carbon steel tubing is essential in oil and gas extraction, particularly in lift applications such as pumping systems, which are integral to ensuring continuous fluid flow. The demand for this tubing is primarily driven by sustained activity in the oil and gas sector, as well as the ongoing need for efficient infrastructure that can withstand high-pressure environments.

The year-over-year (Y-o-Y) growth shows a gradual increase in demand. Starting at USD 2.1 billion in 2025, the market is expected to grow slowly, reaching USD 2.2 billion in 2026 and USD 2.3 billion in 2027. In the following years, the growth continues at a steady pace, reaching USD 2.4 billion by 2028, USD 2.5 billion by 2029, and USD 2.6 billion by 2030. By 2035, the market will expand to USD 2.9 billion, reflecting steady demand driven by ongoing developments in the oil and gas industry.

The carbon steel tubing market in oil and gas lift applications in the USA is expected to experience a steady growth trajectory through 2035. Starting at USD 2.1 billion in 2025, the market will show gradual, consistent growth each year. By 2026, the market will reach USD 2.2 billion, and by 2027, it will grow to USD 2.3 billion. The rate of growth is expected to remain consistent for the first half of the forecast period, with a slight acceleration from 2028 onward. By 2035, the market will reach USD 2.9 billion, showing sustained demand in the industry.

The acceleration and deceleration pattern of growth for carbon steel tubing in oil and gas lift applications reflects a steady pace with no sudden shifts in demand. Early growth (2025 to 2028) is relatively slow, with incremental increases each year. However, from 2028 onwards, a slight acceleration is anticipated as the oil and gas industry continues to recover and expand. This pattern suggests a market that experiences stable, long-term growth, driven by continued infrastructure investment and the need for reliable materials in critical oil and gas operations.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 2.1 billion |

| Industry Forecast Value (2035) | USD 2.9 billion |

| Industry Forecast CAGR (2025-2035) | 3.1% |

The demand for carbon steel tubing used in oil and gas lift applications in the USA is increasing as domestic oil and natural gas production expands, especially via horizontal drilling and unconventional resource extraction. Domestic production growth requires reliable, cost effective tubing to lift hydrocarbons from deep wells to the surface. Carbon steel tubing remains preferred because of its strength, resistance to pressure, relative affordability, and suitability for artificial lift systems such as gas lift, rod lift, and electric submersible pump (ESP) operations. As the national oil and gas infrastructure expands, and older wells are maintained or refurbished, demand for tubing rises. The broad share of oil and gas activity in overall steel tubes demand underlines this trend.

Additional support for demand comes from ongoing investment in onshore as well as offshore upstream operations. The need for tubing that withstands high pressure, corrosion, and harsh subterranean or offshore conditions pushes oil and gas companies toward coated and high grade carbon steel tubing. Advances in protective coatings and manufacturing standards improve tube lifespan and safety, making carbon steel tubing more attractive compared to alternatives. The growth in both new well drilling and enhanced oil recovery projects increases lift tubing consumption. As long as the USA energy sector maintains robust exploration and production activity, demand for carbon steel tubing in oil and gas lift applications is likely to remain strong in coming years.

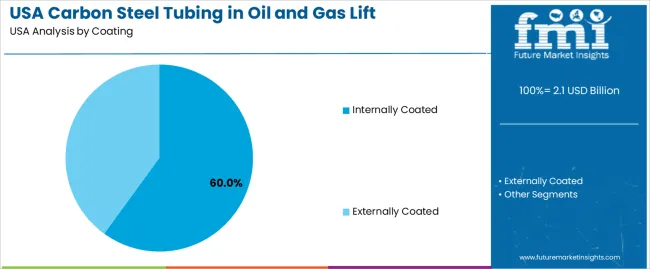

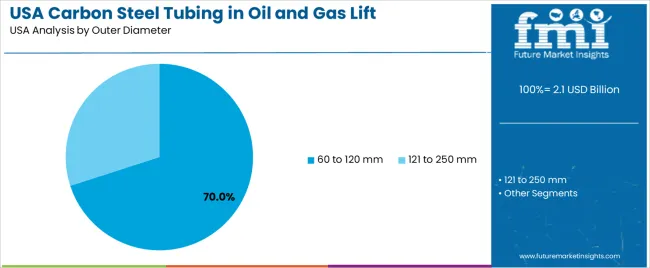

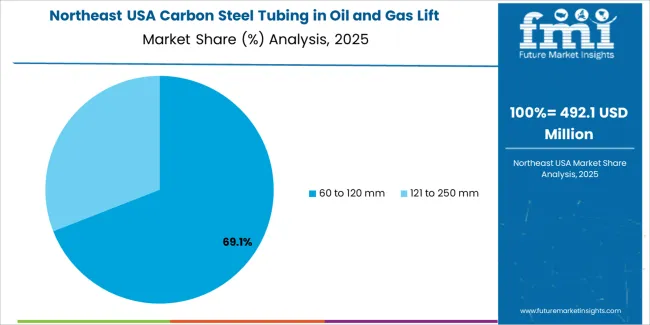

The demand for carbon steel tubing in oil and gas lift applications in the USA is primarily driven by coating and outer diameter. The leading coating type is internally coated, capturing 60% of the market share, while the dominant outer diameter range is 60 to 120 mm, accounting for 70% of the demand. Carbon steel tubing is essential in oil and gas lift applications, where durability, corrosion resistance, and high performance under pressure are crucial. These factors drive the demand for specific coatings and tubing dimensions to meet the requirements of the oil and gas industry.

Internally coated carbon steel tubing leads the demand in oil and gas lift applications in the USA, holding 60% of the market share. Internally coated tubing is used to improve the corrosion resistance of the inner surface of the pipes, especially in oil and gas applications where the tubing comes into contact with corrosive fluids. The coating helps to prevent wear and degradation caused by acidic or saltwater environments, which are common in the extraction and transportation of oil and gas.

The demand for internally coated tubing is driven by the need for more durable and long-lasting solutions in oil and gas lift operations. By providing protection against internal corrosion, these coatings extend the life of the tubing, reduce maintenance costs, and improve the efficiency of extraction and transportation processes. As the oil and gas industry continues to focus on reducing downtime and ensuring reliable production, internally coated carbon steel tubing is expected to remain a dominant choice for lift applications in the USA.

60 to 120 mm outer diameter carbon steel tubing is the leading size range for oil and gas lift applications in the USA, accounting for 70% of the demand. This diameter range is commonly used in the oil and gas industry for various applications, including lifting oil and gas from wells, managing pressure, and transporting fluids. Tubing with this outer diameter is typically chosen for its ability to withstand the high pressures and harsh conditions encountered in the oil and gas extraction process.

The demand for carbon steel tubing in the 60 to 120 mm range is driven by its balance of strength, flexibility, and ease of installation. This size range is ideal for a wide range of oil and gas operations, providing the necessary durability to handle both surface and downhole pressures. As oil and gas extraction techniques evolve and operations become more efficient, this tubing size is expected to continue meeting the needs of the industry for reliable and high-performance lift applications.

Demand for carbon steel tubing used in oil and gas lift applications in the USA has been rising in line with increasing domestic oil and gas production, including shale extraction and well lift operations. This tubing serves as a primary conduit to draw hydrocarbons from underground reservoirs to surface during artificial lift and production operations. The strength and durability of carbon steel tubing make it well suited to high pressure lift systems, making it a preferred choice in many onshore wells. As domestic exploration and production remain active, the market for such tubing is expected to expand. The combination of mature wells requiring replacements, ongoing drilling for new wells, and broad use in lift systems supports a stable and growing demand for carbon steel tubing in USA oil and gas applications.

What are the Drivers of Demand for Carbon Steel Tubing in USA Oil and Gas Lift Applications?

One key driver is the prevalence of onshore oil production, especially shale based and tight reservoir extraction in the United States. The increased number of wells requiring lift systems boosts demand for carbon steel tubing capable of handling pressure and mechanical stresses. The tubing is widely used in artificial lift methods such as rod lift, gas lift, and electric submersible pump (ESP) systems because of its mechanical strength and cost effectiveness compared to alternative materials. Growing energy consumption and steady oil and gas demand keep production levels high, supporting continued USAge of lift tubing. In addition, expansion of horizontal drilling and unconventional resource extraction increases reliance on robust tubing to manage complex well trajectories. For many operators, carbon steel tubing remains the preferred choice because it offers a balance of durability, reliability, and relatively lower cost. These factors collectively stimulate demand across the upstream oil and gas segment in the USA.

What are the Restraints on Demand for Carbon Steel Tubing in USA Oil and Gas Lift Applications?

Several factors restrain the growth of demand for carbon steel tubing in lift applications. First, alternative materials or newer piping solutions may offer advantages, such as improved corrosion resistance or lighter weight, which can challenge carbon steel’s dominance. Second, carbon steel tubing faces concerns over long term durability in corrosive environments, especially in wells with high salinity, acidic fluids, or corrosive gases; these conditions may prompt operators to choose more resistant alloy or composite tubing options. Third, volatility of raw steel prices may raise input costs and reduce adoption, especially when oil prices are weak and operators seek cost savings. Fourth, regulatory or environmental pressures may increase scrutiny over tubing materials and maintenance standards; such changes could restrict use of lower grade tubing or require frequent replacements, making alternatives more attractive. Finally, wells with decreased production or nearing end of life may not justify investment in new tubing, limiting replacement demand. These restraints can slow growth despite underlying demand for hydrocarbon lift operations.

What are the Key Trends Influencing Demand for Carbon Steel Tubing in USA Oil and Gas Lift Applications?

A prominent trend is continued preference for onshore tubing solutions given the large number of onshore wells in shale and tight oil regions within the USA. This sustains demand for medium diameter carbon steel tubing typically used in such wells. Another trend involves increased use of externally and internally coated carbon steel tubing with enhanced corrosion resistance to extend service life under harsh down hole conditions. Such coated tubing is being adopted especially in wells with corrosive fluids or high pressures. Also, as many mature wells age, replacement and maintenance cycles fuel demand for new tubing. Furthermore, drilling practices remain focused on horizontal wells and enhanced recovery techniques; these require reliable, high strength tubing suited to complex well paths. Finally, as oil and gas companies place emphasis on cost efficient lift systems, carbon steel tubing continues to hold share over more expensive material alternatives, reinforcing its role in lift related infrastructure.

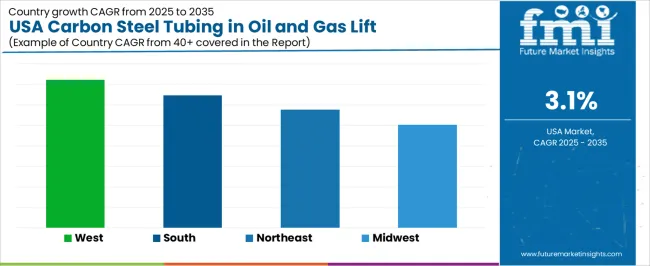

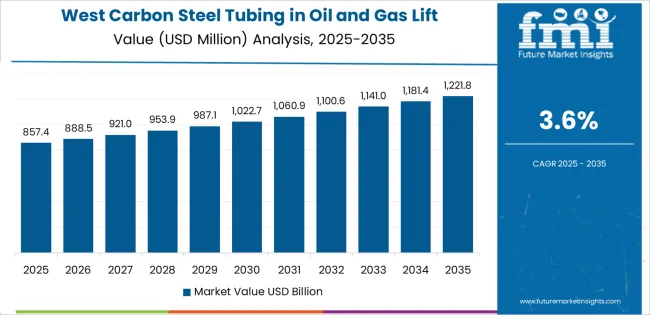

The demand for carbon steel tubing in oil and gas lift applications in the USA shows moderate growth across regions, with the West leading at a CAGR of 3.6%. The South follows with a CAGR of 3.2%, driven by the region's strong oil and gas production and exploration activities. The Northeast shows steady growth at 2.9%, supported by its established energy infrastructure. The Midwest has the lowest growth rate at 2.5%, reflecting a more stable demand for carbon steel tubing in oil and gas lift applications. These regional differences are influenced by factors such as regional oil and gas production levels, infrastructure investments, and energy sector dynamics.

| Region | CAGR (%) |

|---|---|

| West | 3.6 |

| South | 3.2 |

| Northeast | 2.9 |

| Midwest | 2.5 |

The demand for carbon steel tubing in oil and gas lift applications in the West is projected to grow at a CAGR of 3.6%, driven by the region’s strong oil and gas production, particularly in states like California, Texas, and Alaska. The West has a significant number of oil and gas fields where lift systems, such as pumps and mechanical lift systems, are critical for production. The growing need for efficient oil recovery methods, especially in mature fields, is driving the demand for reliable, durable carbon steel tubing used in these applications. Additionally, the West’s investments in energy infrastructure and ongoing exploration projects contribute to the increasing use of carbon steel tubing. As the region continues to focus on optimizing oil extraction and enhancing production rates, the demand for these essential materials will continue to rise.

In the South, the demand for carbon steel tubing in oil and gas lift applications is expected to grow at a CAGR of 3.2%, supported by the region’s extensive oil and gas production activities, particularly in states like Texas, Louisiana, and Oklahoma. The South is a major hub for oil exploration and extraction, and the region’s large number of wells and lift systems require durable, high-quality carbon steel tubing to ensure efficient performance and longevity. The increasing focus on improving oil recovery rates from existing wells and the region’s strong energy infrastructure are key drivers of this demand. Additionally, the South’s oil and gas industry’s efforts to modernize equipment and maintain production levels in mature fields further contribute to the rising demand for carbon steel tubing.

In the Northeast, the demand for carbon steel tubing in oil and gas lift applications is projected to grow at a CAGR of 2.9%, driven by the region’s established energy sector and ongoing oil and gas production. While the Northeast does not have as large a concentration of oil and gas reserves as the West or South, it still maintains significant energy infrastructure, particularly in states like Pennsylvania and New York, where shale oil and natural gas extraction is prominent. The demand for carbon steel tubing is supported by the need for reliable lifting systems in these fields, although growth is slower than in more oil-rich regions. As the region continues to invest in energy infrastructure and optimize production processes, demand for carbon steel tubing in oil and gas lift applications is expected to rise steadily.

The demand for carbon steel tubing in oil and gas lift applications in the Midwest is expected to grow at a CAGR of 2.5%, reflecting a more stable and moderate growth compared to other regions. The Midwest has a well-established oil and gas industry, but the region’s growth in oil and gas production has been more gradual, with a stronger focus on natural gas extraction in some areas. As a result, the demand for carbon steel tubing for oil lift applications is increasing more slowly. However, the ongoing need for reliable, durable tubing in oil extraction systems and the region’s focus on maintaining and optimizing existing wells contribute to steady, if slower, demand. As the Midwest continues to focus on improving oil recovery and ensuring the efficient operation of lifting systems, demand for carbon steel tubing is expected to grow at a moderate pace.

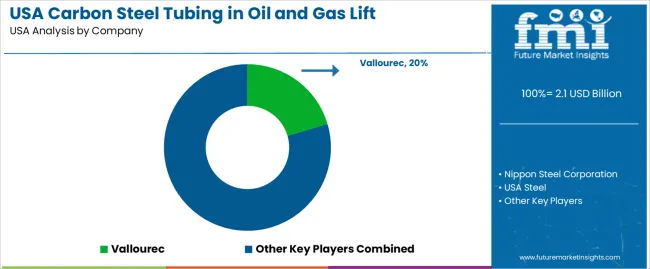

Demand for carbon steel tubing in oil and gas lift applications in the United States is driven by continued offshore and onshore drilling operations, enhanced oil recovery (EOR) projects, and a need for robust tubing that can withstand high pressure and corrosive conditions. Key suppliers in this sector include Vallourec (holding about 20.5% market share), Nippon Steel Corporation, USA Steel, and Jindal SAW Ltd. These firms provide tubing used in down hole and lift systems, such as sucker rod strings, tubing for gas lift, and production tubing for wells. The demand remains stable where operators require high strength, pressure resistant carbon steel under rigorous service conditions.

Competition in this market centers on material quality, manufacturing precision, and supply reliability. Suppliers emphasize tubing that meets strict specifications for yield strength, wall thickness, internal diameter consistency, and resistance to abrasion and pressure cycling. Compliance with industry standards and certification requirements for oilfield use is another critical factor. Logistic and delivery performance also matter because projects often rely on timely supply to avoid costly delays. Companies that offer consistent product quality, traceability, and robust supply chains tend to gain preference among well operators and service companies. Marketing information typically highlights tubing grade, pressure rating, compatibility with well fluids, and history of performance under demanding conditions. By aligning their offerings with operational needs and regulatory requirements, these firms aim to preserve or grow their share in the USA carbon steel tubing market for oil and gas lift applications.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Coating | Internally Coated, Externally Coated |

| Outer Diameter | 60 to 120 mm, 121 to 250 mm |

| Type | Onshore, Offshore |

| Key Companies Profiled | Vallourec, Nippon Steel Corporation, USA Steel, Jindal SAW Ltd. |

| Additional Attributes | The market analysis includes dollar sales by coating, outer diameter, type, and company categories. It also covers regional demand trends in the USA, driven by the increasing use of carbon steel tubing in both onshore and offshore oil and gas lift applications. The competitive landscape highlights key manufacturers focusing on innovations in steel tubing coatings and strength for enhanced durability in harsh environments. Trends in the growing demand for high-quality, corrosion-resistant steel tubing for oil and gas extraction are explored, along with advancements in manufacturing technologies and material performance in energy sectors. |

The demand for carbon steel tubing in oil and gas lift applications in USA is estimated to be valued at USD 2.1 billion in 2025.

The market size for the carbon steel tubing in oil and gas lift applications in USA is projected to reach USD 2.9 billion by 2035.

The demand for carbon steel tubing in oil and gas lift applications in USA is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in carbon steel tubing in oil and gas lift applications in USA are internally coated and externally coated.

In terms of outer diameter, 60 to 120 mm segment is expected to command 70.0% share in the carbon steel tubing in oil and gas lift applications in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Carbon Steel Tubing in Oil and Gas Lift Applications Market Insights – Size, Share & Forecast 2025–2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

USA Carbon Capture and Storage Market Growth – Innovations, Trends & Forecast 2025-2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Industry Analysis in North America Forecast & Analysis: 2025 to 2035

Carbon Steel IBC Market Demand and Forecast 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil And Gas Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA