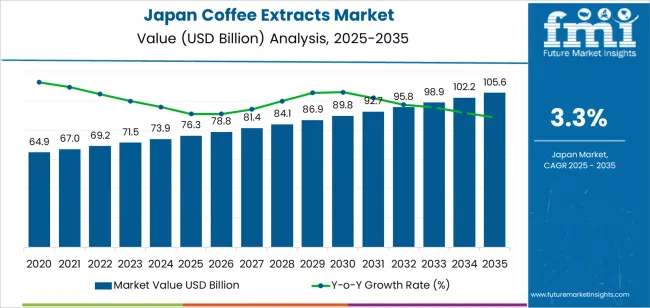

The demand for coffee extracts in Japan is projected to grow from USD 76.3 billion in 2025 to USD 105.6 billion by 2035, reflecting a CAGR of 3.3%. Coffee extracts are widely used in the food and beverage industry, particularly in the production of ready-to-drink coffee beverages, coffee-flavored products, and bakery items. The demand for these extracts is driven by rising coffee consumption across conventional and innovative formats, as well as by the growing preference for convenience in coffee preparation. Japan's strong coffee culture, coupled with the growing popularity of premium coffee products and specialty coffee beverages, is expected to continue to fuel demand for coffee extracts.

Demand is also supported by advancements in extraction technologies, which improve the efficiency and quality of coffee extracts. As consumer preferences shift towards organic and sustainably sourced coffee, there is also an increasing demand for ethically produced and environmentally friendly coffee extract solutions. Japan's growing interest in functional beverages and coffee-based dietary supplements will drive the demand for coffee extracts across a variety of applications, including health-conscious drinks and nutraceuticals.

The half-decade weighted growth analysis for coffee extracts in Japan examines the growth contributions in two distinct phases: the early and later half of the forecast period.

From 2025 to 2030, the market will grow from USD 76.3 billion to USD 89.8 billion, contributing USD 13.5 billion in value. This period will see accelerated growth, driven by the increasing demand for coffee beverages, especially ready-to-drink options, as well as coffee-flavored products in various industries. Consumer trends such as the rise in premium coffee consumption, specialty drinks, and functional coffee products will fuel this growth. Additionally, improvements in extraction techniques and sourcing from sustainable coffee-growing regions will help meet the demand for higher quality and ethically sourced coffee extracts. The growth will be weighted more heavily in this first half, as consumer preferences and innovation will contribute to faster adoption of coffee extracts.

From 2030 to 2035, the market will grow from USD 89.8 billion to USD 105.6 billion, adding USD 15.8 billion in value. The second half of the forecast period will see steady growth, as the market stabilizes and reaches maturity in terms of demand. While growth will continue due to the sustained popularity of coffee-based beverages and increasing coffee consumption, the rate of acceleration will be more gradual. Price factors and market saturation in certain sectors will lead to a more stable growth rate, with continued innovations and product diversification (such as in health drinks and functional beverages) ensuring that the market remains robust, though at a lower growth rate compared to the early period. Thus, while half-decade weighted growth will remain positive throughout, the initial period will see higher growth contributions as the market matures.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 76.3 billion |

| Industry Forecast Value (2035) | USD 105.6 billion |

| Industry Forecast CAGR (2025-2035) | 3.3% |

Demand for coffee extracts in Japan is driven by growing interest in premium and specialty coffee experiences, increased usage of coffee flavoring in food and beverages, and rising demand for functional ingredients in nutraceuticals and personal care products. As consumer preferences shift toward high quality, convenient and exotic coffee formats, extracts provide versatile solutions for manufacturers of ready to drink beverages, bakery goods and snacks. A recent forecast estimated that the import value of coffee extracts, essences and concentrates into Japan would rise from approximately USD 176.8 million in 2024 to USD 182.6 million in 2028, indicating steady growth in usage within the country.

Another contributing factor is the expanding application of coffee extracts beyond traditional drinks. Japanese formulators are increasingly incorporating coffee extracts into skincare, wellness supplements and other niche segments that benefit from coffee’s aroma and antioxidant properties. At the same time, the country’s strong café culture and interest in global coffee trends drive demand for novel coffee derived products. Key constraints include fluctuations in raw coffee bean supply, pressures on extract pricing and competition from other flavor bases or functional ingredient alternatives. Despite these headwinds, the intersection of premium coffee consumption, functional ingredient adoption, and diversified end uses suggest that demand for coffee extracts in Japan will continue to grow moderately and sustainably.

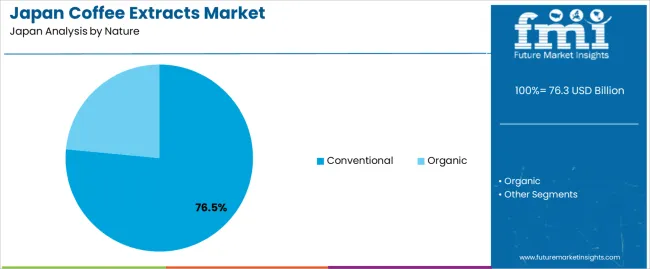

The demand for coffee extracts in Japan is primarily driven by nature and end-use segment. The leading nature type is conventional, capturing 76.5% of the market share, while the dominant end-use segment is the beverage industry, accounting for 35% of the demand. Coffee extracts are widely used in both food and beverage applications for their rich flavor, convenience, and versatility. The growth in demand is driven by the increasing popularity of coffee-flavored products across various industries, from beverages to baked goods and desserts.

Conventional coffee extracts dominate the market in Japan, accounting for 76.5% of the demand. Conventional coffee extracts are produced using standard methods, which typically involve brewing and concentrating coffee, offering a cost-effective and efficient solution for companies in need of coffee flavoring and coffee-based ingredients. These extracts are widely used in the food and beverage industries, as they provide consistent and reliable flavor profiles that consumers expect.

The demand for conventional coffee extracts is driven by their affordability and the large-scale production capabilities they offer. The beverage industry, in particular, relies heavily on conventional coffee extracts to create coffee drinks, including ready-to-drink coffee beverages, as well as in the food industry for flavoring sauces, marinades, and snacks. Given the high demand for coffee-based products in Japan, conventional coffee extracts will likely continue to hold a dominant share of the market.

The beverage industry is the leading end-use segment for coffee extracts in Japan, capturing 35% of the demand. Coffee extracts are essential in the production of coffee-based drinks, including ready-to-drink coffee, coffee-flavored beverages, and coffee syrups. The growing popularity of specialty coffee beverages, such as cold brew, iced coffee, and lattes, has significantly contributed to the demand for coffee extracts.

The beverage industry's dominance in the coffee extract market is driven by the increasing consumer preference for convenience and quality in coffee products. As more Japanese consumers opt for ready-to-drink beverages and coffee-flavored drinks, the demand for coffee extracts is expected to continue growing. Additionally, coffee extracts offer a convenient solution for manufacturers looking to standardize flavor profiles across large batches of beverages. The continued innovation in coffee-based products, along with a growing appreciation for diverse coffee flavors, ensures that the beverage industry will remain a key driver of coffee extract demand in Japan.

Demand for coffee extracts in Japan is driven by strong consumer appetite for premium coffee flavors, the expanding ready to drink (RTD) coffee market, and growth in functional food and beverage formulations that use coffee extract as an ingredient. The changing coffee culture in Japan characterised by convenience, quality and innovation supports broader usage of coffee extracts in bakery, dairy, confectionery and nutraceuticals. At the same time, dependence on imported extracts and strong competition from instant coffee products moderate the pace of growth. These forces together shape the demand environment for coffee extracts in Japan.

Several drivers underpin demand in Japan. First, coffee consumption habits are evolving with younger and urban consumers favouring speciality coffee, unique flavour profiles and premium offerings, thereby increasing demand for high quality coffee extracts. Second, the food & beverage industry is incorporating coffee extract into desserts, dairy alternatives, bakery items and beverages to capitalize on coffee flavour and associated health attributes. Third, the rise of health conscious consumers and functional beverage formulations is promoting use of green coffee extracts rich in chlorogenic acid and antioxidants. Fourth, growth in e commerce and convenience retail channels in Japan enhances access and distribution of products containing coffee extract.

Despite strong drivers, demand faces some constraints. The reliance on imported coffee extracts and raw coffee beans means cost inflation and supply chain disruptions can restrict availability and increase pricing for Japanese formulators. Also, consumer preference for fresh brewed coffee and instant coffee lines may limit substitution with extract based ingredient formats. Regulatory and labeling standards for functional ingredients and extracts in Japan remain rigorous, which can delay innovation and commercialisation. Finally, maturer segments of the coffee market may present slower incremental growth for extract based applications if adoption reaches saturation.

Important trends include growing use of organic and specialty bean derived coffee extracts in premium food and beverage products, particularly those launched for younger or affluent consumers. There is increased demand for green coffee bean extracts and health oriented formulations addressing weight management, metabolism and wellness benefits, which supports extract usage beyond flavour alone. Suppliers are also offering customised coffee extract grades liquid, powder or concentrate with enhanced solubility, aroma retention and compatibility for Japanese production lines. Additionally, the integration of coffee extracts into multiple applications (RTD beverages, bakery, dairy growth, nutraceuticals) is broadening the addressable market and deepening extract use cases.

The demand for coffee extracts in Japan is influenced by several factors, including the country’s deep-rooted coffee culture, the growing trend of ready-to-drink (RTD) beverages, and the increasing use of coffee extracts in both the food and beverage industry as well as the cosmetics sector. Coffee extracts are used to enhance the flavor of various products, such as beverages, desserts, sauces, and snacks, as well as in skin care products for their antioxidant properties.

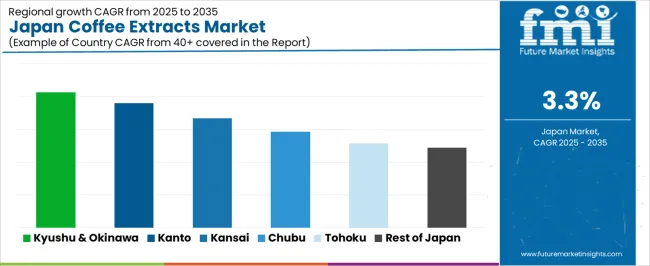

The convenience of RTD coffee products and the popularity of coffee-flavored goods drive the demand for high-quality coffee extracts. Furthermore, Japan's appreciation for premium, artisanal, and innovative food and beverage offerings also boosts the consumption of coffee extracts. Regional differences in demand are influenced by local food processing industries, beverage preferences, and cultural trends. Below is an analysis of the demand for coffee extracts across different regions in Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.1% |

| Kanto | 3.8% |

| Kinki | 3.3% |

| Chubu | 2.9% |

| Tohoku | 2.6% |

| Rest of Japan | 2.4% |

Kyushu & Okinawa leads the demand for coffee extracts in Japan with a CAGR of 4.1%. The region has a strong coffee culture, with Okinawa in particular being a popular destination for coffee lovers, known for its unique coffee blends and consumption habits. The region’s vibrant café culture, coupled with a growing demand for RTD coffee and coffee-based products, supports the increasing use of coffee extracts in both the food and beverage industries.

Kyushu & Okinawa’s focus on high-quality, locally sourced ingredients also plays a role in driving demand, as consumers in this region often prefer artisanal and premium products. As the coffee culture continues to grow in both local businesses and tourism, the demand for coffee extracts remains strong and is expected to continue growing at a fast pace.

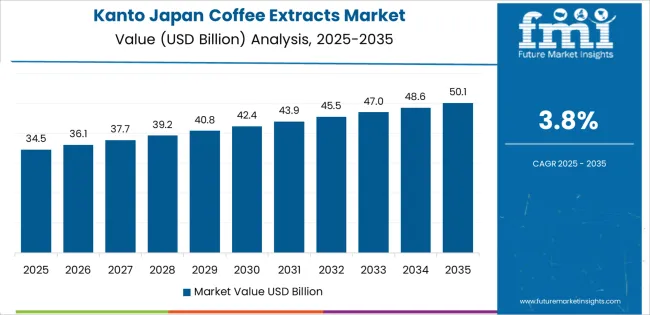

Kanto shows strong demand for coffee extracts with a CAGR of 3.8%. Kanto, particularly Tokyo, is a major consumer hub for coffee-related products, with a large population and an active food and beverage industry. The demand for coffee extracts is driven by the region’s high concentration of coffee shops, convenience stores, and beverage manufacturers that use coffee extracts to create ready-to-drink coffee beverages and other coffee-flavored products.

The rise of premium coffee brands and innovative coffee beverages, such as cold brew and nitro coffee, is contributing to the growth in demand for coffee extracts. Kanto’s diverse and rapidly evolving food scene, combined with its high rate of consumption of coffee products, supports the ongoing adoption of coffee extracts in the beverage and food sectors.

Kinki, with a CAGR of 3.3%, shows steady demand for coffee extracts. The region includes Osaka and Kyoto, both major cultural and commercial centers in Japan. Kinki’s demand for coffee extracts is driven by the region’s strong food and beverage industry, particularly in the areas of confectionery, bakery products, and beverages. The region has a rich tradition of food innovation, and coffee extracts are widely used to enhance the flavor profiles of various products.

Although the growth rate is slightly lower than in Kyushu & Okinawa and Kanto, the steady demand in Kinki is supported by the region’s focus on high-quality, artisanal food products and an expanding coffee culture. As consumer preferences continue to shift toward convenience and flavor, the use of coffee extracts in Kinki is expected to remain steady, with gradual growth as coffee trends evolve.

Chubu demonstrates moderate growth in the demand for coffee extracts with a CAGR of 2.9%. The region, including Nagoya, has a strong industrial base, and while the coffee culture is not as dominant as in other regions, the growing demand for RTD coffee and coffee-flavored products is driving the use of coffee extracts in the food and beverage industries.

The region's demand for coffee extracts is supported by an increasing awareness of the health benefits of coffee and its versatility in food applications. While the growth rate is moderate compared to regions like Kyushu & Okinawa, the rising trend of coffee consumption in Chubu’s urban centers is contributing to steady market growth for coffee extracts.

Tohoku, with a CAGR of 2.6%, and the Rest of Japan, with a CAGR of 2.4%, show slower growth in the demand for coffee extracts compared to more urbanized regions. These areas have fewer large-scale coffee consumption centers, and the market for coffee products is less saturated. However, the growing awareness of coffee's health benefits, as well as the expanding presence of coffee chains and cafes, is slowly driving demand for coffee extracts in these regions.

In these areas, coffee is often consumed in traditional forms, and the adoption of coffee extracts is growing more gradually as consumers become more familiar with innovative coffee products. The demand for coffee extracts in Tohoku and the Rest of Japan is expected to see gradual growth as the coffee culture spreads more widely and as regional consumers embrace new coffee-based products.

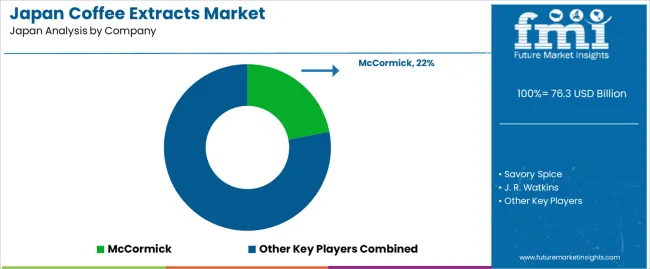

The demand for coffee extracts in Japan is growing, driven by the increasing popularity of coffee-based beverages, food products, and the health-conscious consumer's interest in functional ingredients. Companies like McCormick (holding approximately 22% market share), Savory Spice, J. R. Watkins, NatureWise, and Sports Research are key players in this market. Coffee extracts, which are used in everything from flavoring food and beverages to offering potential health benefits such as antioxidants, are becoming essential ingredients in the food, beverage, and supplement industries in Japan.

Competition in the coffee extracts industry is driven by factors such as quality, sourcing, and functionality. Companies are focusing on providing high-quality, natural coffee extracts that are free from additives and preservatives, catering to the clean-label and organic product trends in Japan. Another area of competition is the development of coffee extracts that offer specific health benefits, such as improved energy, metabolism, and antioxidant properties.

Companies are also investing in various extraction methods, such as cold brew or freeze-drying, to preserve the integrity and flavor of the coffee. Marketing materials often highlight product purity, flavor intensity, and the health benefits of the coffee extracts. By aligning their offerings with the growing demand for natural, functional ingredients, these companies aim to strengthen their position in Japan’s coffee extract market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Nature | Conventional, Organic |

| End Use | Beverage Industry, Food Industry, Desserts, Baking Goods, Savory Dishes, Pharmaceutical Industry, Others |

| Product | Liquid Concentrate, Dried Form, Capsules or Tablets |

| Formulation | Roasted, Unroasted |

| Key Companies Profiled | McCormick, Savory Spice, J. R. Watkins, NatureWise, Sports Research |

| Additional Attributes | The market analysis includes dollar sales by nature, end-use, product, and formulation categories. It also covers regional demand trends in Japan, particularly driven by the growing use of coffee extracts in the beverage, food, and pharmaceutical industries. The competitive landscape highlights key players focusing on innovations in coffee extract formulations, especially roasted and unroasted varieties. Trends in the increasing demand for organic and health-conscious coffee extract products, along with advancements in product delivery methods (liquid, dried, capsules), are explored. |

The global demand for coffee extracts in Japan is estimated to be valued at USD 76.3 billion in 2025.

The demand for coffee extracts in Japan is projected to reach USD 105.6 billion by 2035.

The demand for coffee extracts in Japan is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types are conventional and organic.

In terms of end use, beverage segment is expected to command 35.0% share in the demand for coffee extracts in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA