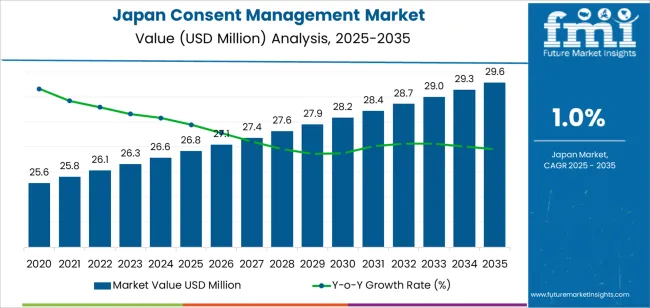

The demand for consent management in Japan is projected to grow from USD 26.8 million in 2025 to USD 29.6 million by 2035, reflecting a CAGR of 1.0%. Consent management systems (CMS) are essential tools for businesses to comply with data protection regulations, such as GDPR and Japan's Act on the Protection of Personal Information (APPI). These systems ensure that businesses obtain, store, and manage user consent in a transparent and compliant manner, especially as the use of personal data grows across various sectors, including e-commerce, healthcare, and finance. With increasing concerns over data privacy and security, the demand for robust consent management solutions will continue to grow, albeit at a more modest pace.

The regulatory environment in Japan, particularly the enforcement of stricter data protection laws, will drive demand for consent management platforms that offer automated solutions for businesses to manage their customer consent efficiently. As businesses increasingly look to build trust with consumers, they will invest in systems that not only meet legal requirements but also align with best practices in privacy management. With the growing emphasis on consumer rights and data privacy, the need for consent management solutions will remain vital for businesses aiming to stay compliant and relevant in the marketplace.

From 2025 to 2030, the demand for consent management in Japan will grow from USD 26.8 million to USD 28.2 million, contributing USD 1.4 million in value. This phase will see a moderate growth momentum, driven by increasing awareness of data privacy issues and the ongoing implementation of data protection regulations. The early-stage demand will be fueled by the rising adoption of consent management solutions across businesses that are actively working to comply with local and global privacy laws. The growth momentum will be steady but incremental, as businesses upgrade existing systems and integrate new compliance measures into their data handling processes.

From 2030 to 2035, the market will grow from USD 28.2 million to USD 29.6 million, contributing an additional USD 1.4 million in value. The growth rate in this phase will remain modest, reflecting a mature market where the core need for consent management solutions is already widely addressed. During this period, growth will be largely driven by small-scale innovations and the refinement of consent management systems to enhance user experience, data security, and integration with other enterprise systems. As businesses mature in their approach to data privacy, growth will come from refinements in the existing infrastructure rather than broad-scale adoption. The momentum in this phase will be stable as the market continues to stabilize with limited expansion due to the market's maturation.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 26.8 million |

| Industry Forecast Value (2035) | USD 29.6 million |

| Industry Forecast CAGR (2025-2035) | 1% |

Demand for consent management solutions in Japan is growing as companies operating in digital services and data intensive industries face increasing regulatory expectations and heightened consumer awareness about data privacy. Japan’s adoption of stricter privacy frameworks and cross border data handling requirements compels organisations to implement solutions that capture, manage and audit user consent across web, mobile and offline channels. The rise in digital transformation efforts among Japanese enterprises—especially in retail, finance and media sectors—further increases the need for structured consent management systems to support personalised services, compliance reporting and customer preference tracking.

Another key driver is the shift toward first party data strategies and the decline of third party cookie tracking, which pushes businesses in Japan to build direct user consent ecosystems and integrated platforms for marketing, customer experience and analytics. Cloud based consent platforms appeal to both large enterprises and mid sized firms looking to scale and standardise consent workflows across multiple jurisdictions. Challenges include the complexity of integrating consent modules with legacy systems, the need for bilingual or multilingual support in global applications, and ensuring alignment with evolving domestic and international privacy laws. Nonetheless, given the increasing pace of digital service adoption, regulatory momentum and consumer focus on data control, demand for consent management solutions in Japan is expected to expand steadily.

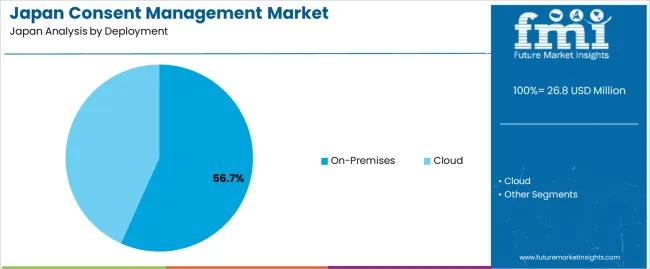

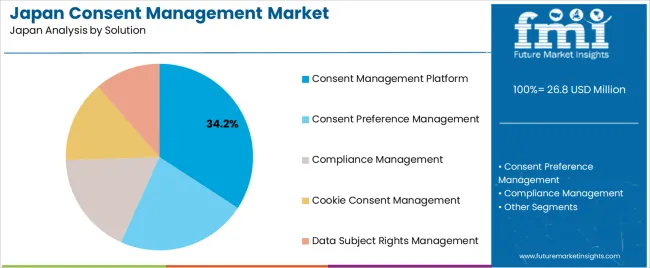

The demand for consent management solutions in Japan is driven by deployment and solution type. The leading deployment method is on-premises, capturing 57% of the market share, while the dominant solution is consent management platform, which accounts for 34.2% of the demand. With the increasing need for data privacy and protection, businesses in Japan are adopting consent management systems to ensure compliance with regulations such as the GDPR and CCPA, manage user data consent, and provide transparency in data collection practices.

On-premises deployment is the leading method for consent management solutions in Japan, accounting for 57% of the demand. On-premises solutions are installed and maintained within an organization’s own IT infrastructure, providing greater control over data security, compliance, and customization. This deployment type is particularly preferred by organizations that handle sensitive data and require strict security protocols to protect user information.

The preference for on-premises deployment is driven by the desire for organizations to retain full control over their data, especially in industries such as healthcare, finance, and government. These industries have strict regulatory requirements and need to ensure that all data processing activities comply with privacy laws. Additionally, on-premises solutions offer the flexibility to tailor the system to meet specific business needs and integrate with existing enterprise systems. As organizations in Japan continue to prioritize data protection and privacy, on-premises consent management solutions are expected to remain a dominant choice.

Consent management platform (CMP) is the leading solution for consent management in Japan, capturing 34.2% of the demand. CMPs are essential tools that allow organizations to manage user consent for data collection and processing activities. These platforms enable businesses to comply with privacy regulations by obtaining, storing, and managing consent from users in a transparent and user-friendly manner.

The demand for CMPs is driven by the increasing complexity of data privacy laws and the need for businesses to manage user consent across multiple channels and touchpoints. CMPs provide a centralized system for handling consent preferences, allowing organizations to automate the process, reduce manual errors, and maintain compliance. As businesses in Japan continue to focus on ensuring data privacy and meeting regulatory requirements, the demand for consent management platforms is expected to grow, making CMPs a key solution for organizations across various sectors.

Demand for consent management solutions in Japan is growing as organisations face rising requirements for personal data protection, consumer trust and digital compliance. As more businesses adopt cloud based services, mobile apps and IoT systems, they require systems to capture, manage and audit user consent across multiple channels. At the same time, fragmented privacy laws, cultural hesitation on data sharing and legacy on premises systems moderate the pace of full adoption. Together, these factors shape how Japanese companies deploy consent management platforms.

What Are the Primary Growth Drivers for Consent Management Solution Demand in Japan?

Several drivers support expansion. First, Japan’s regulatory environment—under the supervision of the Personal Information Protection Commission (PIPC)—is emphasising stronger protections for personal information, which prompts businesses to adopt formal consent management systems. Second, the rapid growth of digital commerce, mobile applications and cross border data sharing increases the number of consent touch points that organisations must manage. Third, consumer expectations for transparency and control over their data drive demand for consent platforms as part of customer experience strategies. Fourth, cloud based deployment models lower entry barriers for small and mid sized enterprises, expanding the addressable market.

What Are the Key Restraints Affecting Consent Management Demand in Japan?

Despite strong drivers, there are key restraints. One is the complexity of integrating consent management solutions with existing IT infrastructure, particularly in organisations still relying on legacy, on premises systems. Another restraint is the cost and resource commitment required for full implementation, including policy definition, workflow change and staff training. Additionally, Japan’s privacy regulation landscape is less unified compared to some other regions, which may reduce clarity on solution requirements and delay adoption. Finally, some smaller firms may view consent management as a non priority compared with other digital transformation needs.

What Are the Key Trends Shaping Consent Management Demand in Japan?

Notable trends include increasing adoption of AI enabled consent management platforms that support automation of consent capture, revocation and analytics across mobile, web and IoT channels. The shift toward SaaS/cloud delivery is growing, enabling faster deployment and scalability in Japan’s digital business environment. There is also greater emphasis on user interface design and multilingual support in consent solutions, aimed at improving consumer engagement and trust. Finally, vendors are increasingly offering integrated privacy governance platforms that combine consent management, identity management and data access auditing, reflecting a holistic approach to data governance adoption in Japanese organisations.

The demand for consent management in Japan is driven by the growing need for businesses to comply with data privacy regulations, such as the Act on the Protection of Personal Information (APPI) and other international standards like the General Data Protection Regulation (GDPR). With increasing concerns over data security and consumer privacy, consent management platforms (CMP) have become essential for organizations to collect, manage, and store consent from customers regarding the use of their personal data. The rise in digital transactions, online services, and data-driven marketing further underscores the importance of obtaining and managing consent in a transparent and legally compliant manner.

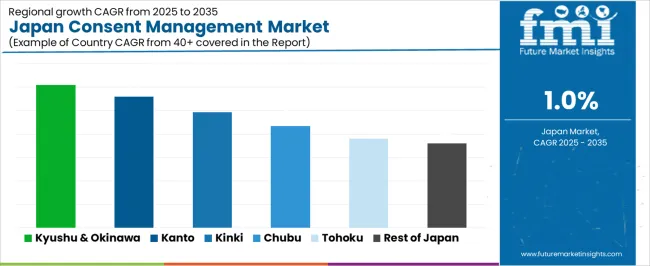

As Japan continues to strengthen its digital economy and embrace e-commerce, the demand for tools that help businesses collect, track, and manage consent has grown significantly. Regionally, the adoption of consent management tools reflects the concentration of digital infrastructure, consumer awareness, and regulatory pressure in different areas of Japan. Below is an analysis of the demand for consent management across different regions in Japan.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 1.2 |

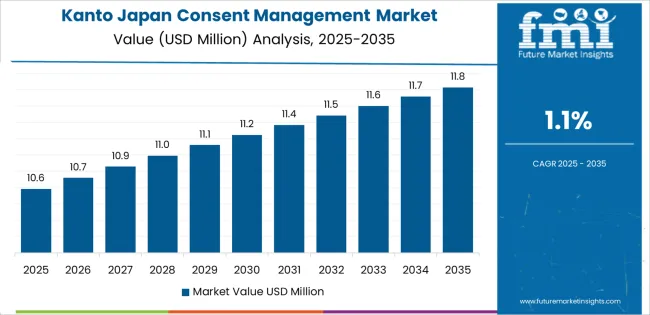

| Kanto | 1.1 |

| Kinki | 1.0 |

| Chubu | 0.9 |

| Tohoku | 0.8 |

| Rest of Japan | 0.7 |

Kyushu & Okinawa leads the demand for consent management in Japan with a CAGR of 1.2%. The region’s growing adoption of digital services and e-commerce platforms has driven the need for robust consent management systems. Kyushu & Okinawa is also home to numerous tech and digital businesses, particularly in cities like Fukuoka, which has seen significant growth in the startup ecosystem and tech-driven services. As businesses in the region expand their digital offerings and collect more user data, the importance of ensuring compliance with data protection laws has led to an increased need for consent management solutions.

Furthermore, the region’s awareness of data privacy and security, combined with its growing digital transformation, has resulted in a higher demand for consent management tools to streamline the process of obtaining, tracking, and managing consent in a compliant manner.

Kanto shows strong demand for consent management with a CAGR of 1.1%. Kanto, including Tokyo, is Japan's economic and technological center, with a high concentration of businesses, particularly in e-commerce, fintech, and digital marketing, which rely on the collection and management of consumer data. As these industries continue to grow and evolve, the demand for efficient consent management platforms has risen significantly.

Kanto’s digital infrastructure, combined with Japan’s strict privacy regulations, makes it a key region for the adoption of consent management tools. Businesses in Kanto are increasingly focused on ensuring transparency and compliance in their data collection practices, driving the need for solutions that facilitate the collection, storage, and management of customer consent for data processing.

Kinki, with a CAGR of 1.0%, shows steady demand for consent management. The region, which includes Osaka and Kyoto, has a diverse economy with a strong presence in manufacturing, commerce, and digital services. As businesses in Kinki increasingly move toward digitalization and online services, the need for consent management tools to ensure compliance with data privacy laws has grown steadily.

Although the growth rate in Kinki is slightly lower than in Kyushu & Okinawa and Kanto, the steady demand is supported by the region’s robust industrial base and the increasing adoption of e-commerce and online services. As more businesses in Kinki focus on consumer privacy and data protection, the demand for consent management tools will continue to grow at a steady pace.

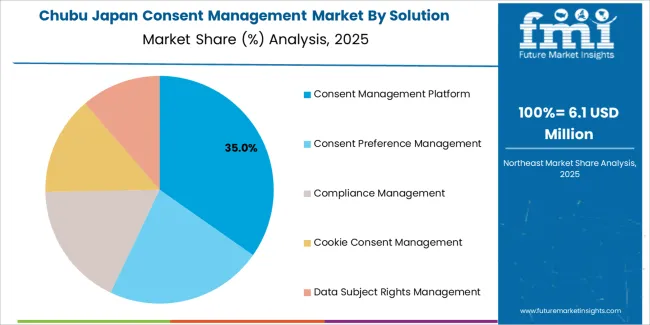

Chubu demonstrates moderate growth in the demand for consent management with a CAGR of 0.9%. The region, known for its strong industrial base, particularly in automotive and manufacturing, is also witnessing a gradual shift towards digital transformation. As businesses in Chubu embrace e-commerce and digital services, the need for compliance with data privacy regulations is increasing, contributing to a moderate rise in demand for consent management solutions.

While the adoption of consent management tools is not as rapid as in more urbanized regions like Kanto or Kyushu & Okinawa, the region’s increasing focus on data security and privacy, particularly among tech-driven industries, is fueling demand. As Chubu’s digital economy continues to grow, the demand for consent management will likely see steady expansion.

Tohoku, with a CAGR of 0.8%, and the Rest of Japan, with a CAGR of 0.7%, show slower growth in the demand for consent management compared to more industrialized regions. These areas are more rural, with a smaller concentration of businesses that rely on digital services or handle large amounts of consumer data. While data privacy is still an important issue, the adoption of consent management tools has been slower in these regions due to lower digital infrastructure development and fewer industries directly affected by stringent data protection laws.

However, as Japan's overall digitalization continues to spread across the country, awareness of data privacy and the need for consent management tools will likely increase. As businesses in these regions modernize their operations and adopt more digital solutions, the demand for consent management platforms is expected to grow at a gradual pace.

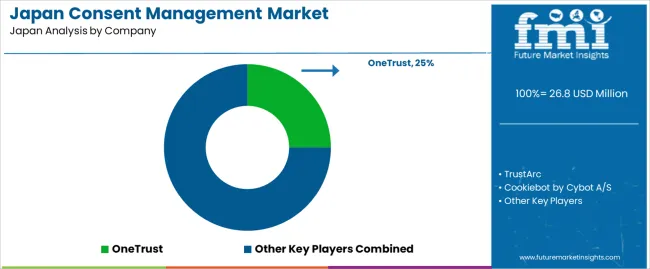

The demand for consent management solutions in Japan is increasing as businesses face mounting pressure to comply with data privacy regulations such as the General Data Protection Regulation (GDPR) and Japan's Act on the Protection of Personal Information (APPI). Companies like OneTrust (holding approximately 25% market share), TrustArc, Cookiebot by Cybot A/S, Quantcast Choice, and Crownpeak are key players in this growing market. These solutions help organizations manage user consent for data collection, cookies, and tracking, ensuring that companies remain compliant with privacy laws while building trust with customers.

Competition in the consent management industry is primarily driven by features such as ease of integration, user experience, and the ability to comply with multiple regulatory standards. Companies are focusing on providing flexible, customizable consent management platforms that can be easily integrated into websites and applications. Another competitive advantage is the ability to offer real-time monitoring and reporting tools that track consent status and allow businesses to manage user preferences effectively. Data security is also a key consideration, with companies emphasizing robust security protocols to ensure user data is protected. Marketing materials often highlight regulatory compliance, ease of use, and system integration capabilities. By aligning their products with the growing demand for data privacy compliance, transparency, and trust, these companies aim to strengthen their position in Japan's consent management industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Deployment | On-Premises, Cloud |

| Solution | Consent Management Platform, Consent Preference Management, Compliance Management, Cookie Consent Management, Data Subject Rights Management |

| Services | Consulting Services, Compliance Assessment and Audit, Policy Development and Implementation, Training and Education, Data Mapping and Inventory |

| Key Companies Profiled | OneTrust, TrustArc, Cookiebot by Cybot A/S, Quantcast Choice, Crownpeak |

| Additional Attributes | The market analysis includes dollar sales by deployment, solution, and service categories. It also covers regional demand trends in Japan, particularly driven by increasing privacy regulations and the need for businesses to manage consumer consent effectively. The competitive landscape highlights key players focusing on both on-premises and cloud-based solutions. Trends in the growing adoption of cloud technologies and the integration of advanced analytics in consent management are explored, along with innovations in data privacy, user rights management, and cookie compliance technologies. |

The demand for consent management in Japan is estimated to be valued at USD 26.8 million in 2025.

The market size for the consent management in Japan is projected to reach USD 29.6 million by 2035.

The demand for consent management in Japan is expected to grow at a 1.0% CAGR between 2025 and 2035.

The key product types in consent management in Japan are on-premises and cloud.

In terms of solution, consent management platform segment is expected to command 34.2% share in the consent management in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA