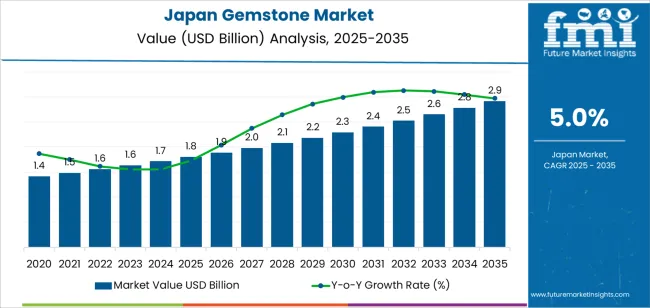

The demand for gemstones in Japan is projected to increase from USD 1.8 billion in 2025 to USD 3.0 billion by 2035, representing an absolute increase of USD 1.2 billion over the forecast period. With a steady CAGR of 5.0%, this growth is driven by the enduring popularity of gemstones such as diamonds, rubies, sapphires, and emeralds, prized for their beauty, rarity, and value. These gemstones remain highly sought after in both the jewelry industry and as investment assets. As consumer interest in luxury goods and personalized high-value products continues to rise, the gemstone industry in Japan is poised for steady expansion.

Key growth drivers include the increasing demand for luxury jewelry, particularly among affluent consumers, along with rising disposable incomes. The growing trend of gemstones being used as investment tools also supports industry growth, as people increasingly view gemstones not only as adornments but also as assets with long-term value. Japan’s deep-rooted cultural appreciation for fine jewelry and precious stones further strengthens the demand for gemstones. As the industry for high-end accessories and collectibles continues to grow, the gemstone industry is expected to benefit from this expanding interest. With innovations in gemstone certification and increased global trade, gemstones will continue to be viewed as both a symbol of status and a viable investment, contributing to their sustained popularity in Japan over the next decade.

From 2025 to 2030, the demand for gemstones is expected to rise from USD 1.8 billion to USD 2.4 billion, adding USD 0.6 billion. This period represents a moderate growth phase, marked by steady increases in both jewelry consumption and the growing trend of gemstones as investments. The growing affluent consumer base will drive demand for high-end jewelry, particularly in the fashion and wedding sectors. Increasing awareness of gemstones as alternative investment options will start to pick up momentum, with consumers seeking rare, high-value stones as stores of value. This growth phase will benefit from evolving consumer preferences, but the industry will still be in the process of maturing.

The period from 2030 to 2035 will witness a sharp acceleration in demand, with the industry growing from USD 2.4 billion to USD 3.0 billion. This rise reflects a shift towards a more mainstream adoption of gemstones, both as luxury goods and investments. As consumers increasingly view gemstones as reliable financial assets, the demand for high-quality, certified stones will surge. The introduction of improved certification technologies and the growing integration of gemstones into global investment portfolios will contribute to the industry’s rapid growth, solidifying gemstones as a mainstream investment.

| Metric | Value |

|---|---|

| Demand for Gemstone in Japan Value (2025) | USD 1.8 billion |

| Demand for Gemstone in Japan Forecast Value (2035) | USD 3.0 billion |

| Demand for Gemstone in Japan Forecast CAGR (2025-2035) | 5.0% |

The demand for gemstones in Japan is growing as consumer’s place increasing value on luxury goods and personalized, high-quality products. Gemstones, particularly in the form of jewelry, are seen not only as decorative items but also as investments and symbols of status. The growing middle and upper classes, along with a rising number of wealthy consumers, are driving the demand for gemstones in both domestic and international industries.

The increasing popularity of fine jewelry, along with a preference for unique and ethically sourced gemstones, is fueling demand in the Japanese industry. Gemstones such as diamonds, sapphires, and emeralds are increasingly being sought after for both traditional and custom-made pieces. This trend is supported by a growing number of boutique jewelers and luxury brands that are offering exclusive, high-quality gemstone jewelry to meet consumer preferences for individuality and craftsmanship.

Japan’s strong cultural and historical ties to gemstones, including their use in traditional ceremonies and celebrations, further supports industry growth. As consumers become more aware of gemstone quality, rarity, and certification, the demand for verified, high-value gemstones are expected to rise. Furthermore, technological advancements in the sourcing and trading of gemstones, along with increased awareness around sustainability and ethical sourcing, are also contributing to the growing appeal of gemstones in Japan.

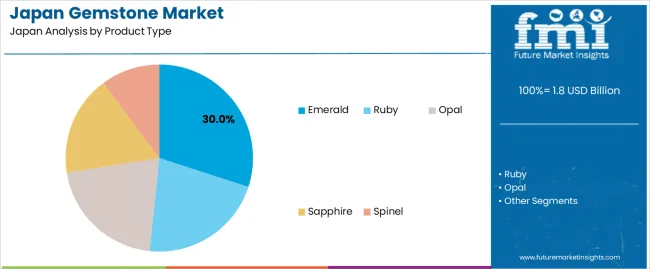

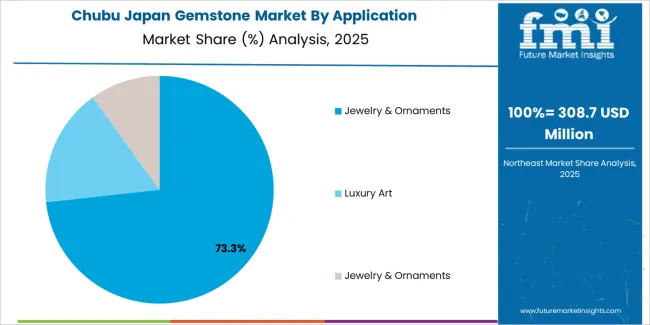

Demand for gemstones in Japan is segmented by product type and application. By product type, demand is divided into emerald, ruby, opal, sapphire, and spinel, with emerald holding the largest share. The demand is also segmented by application, including jewelry & ornaments and luxury art, with jewelry & ornaments leading the demand. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Emerald accounts for 30% of the demand for gemstones in Japan. This gemstone is highly valued for its rich, vibrant green color, which is seen as a symbol of luxury, prestige, and timeless elegance. Emeralds are primarily used in high-end jewelry, such as rings, necklaces, and bracelets, where their unique hue and rarity elevate the overall value of the piece. The demand for emeralds is fueled by their association with wealth, sophistication, and exclusivity, making them a popular choice among affluent consumers. The growing trend for bespoke and premium-quality jewelry in Japan has significantly increased the demand for emeralds. As gemstone collectors and fashion-conscious buyers seek unique, high-quality pieces, emeralds remain a preferred option due to their distinctive beauty. With the continued interest in luxurious and rare jewelry, emeralds are expected to maintain their strong position in the Japanese gemstone industry.

Jewelry & ornaments account for 70% of the demand for gemstones in Japan. The majority of gemstones are used in the creation of fine jewelry, including rings, necklaces, earrings, and bracelets, where their beauty, rarity, and symbolism add significant value to the pieces. Japan has a rich history of appreciation for luxurious, high-quality jewelry, and gemstones play a vital role in this tradition. The demand for gemstones in jewelry is driven by the increasing consumer preference for unique, customizable, and premium designs, especially in the luxury goods sector. Gemstones like emeralds, sapphires, and rubies are particularly sought after for their durability and their ability to enhance the aesthetic appeal of jewelry. As Japanese consumers continue to prioritize investment in luxury, high-end accessories, the jewelry and ornament sector remains the dominant application for gemstones. With the rise of personalized jewelry and exclusive designs, gemstones will continue to be a key element in the growing luxury jewelry industry.

Key drivers include increasing disposable incomes among affluent consumers, the cultural and ceremonial importance of jeweler (weddings, gift‑giving), rising interest in branded and custom gemstone pieces, and growth in inbound tourism boosting luxury purchases. Restraints include price sensitivity amid economic concerns, the challenge of distinguishing natural vs synthetic stones (and consumer trust issues), competition from alternative luxury goods (e.g., watches, luxury fashion), and the regulatory/quality standards that jeweler producers and importers must adhere to, which can raise cost and complicate supply chains.

In Japan, demand for gemstones is growing as jewellery becomes a vehicle not just for adornment but for personal expression, investment and gifting. Affluent consumers are increasingly seeking gemstones that are distinctive, high‑quality and carry symbolic value whether in engagement rings, special occasions or bespoke pieces. Japan’s urban centres and luxury retail locations provide consumers access to premium gemstone jewellery. International tourists visiting Japan often purchase jewellery and gemstones, boosting demand. As younger consumers show rising interest in gemstones (including coloured stones beyond the traditional diamond), the broader appeal of gemstones is expanding, contributing to growth in this segment within the Japanese jewellery space.

In Japan, innovations are impacting the gemstone jewellery segment through improved sourcing transparency, better cutting and finishing techniques, lab‑grown gemstone alternatives, and enhanced online retail/distribution channels. Jewellery brands are leveraging advanced gem certification, ethical sourcing protocols and high‑precision crafting to appeal to discerning consumers. The rise of lab‑grown or treated gemstones offers more accessible price points while maintaining attractive aesthetics, enabling a broader consumer base to adopt gemstone jewellery. E‑commerce and digital marketing also allow consumers in Japan greater exposure to diverse gemstone options and customisation possibilities, thus broadening uptake across age groups and regions.

One major barrier is consumer perception and trust many buyers are cautious about gemstone quality, origins and value retention, which can slow purchasing decisions. Another issue is the high cost of premium gemstones (natural rubies, emeralds, rare coloured stones), which limits affordability for a broader industry. Regulatory and quality‑assurance standards for gemstone jewellery imports and domestic manufacturing raise entry and supply costs. Also, competition from other luxury goods and shifts in consumer spending habits (toward experiences or technology) can dampen jewellery/gemstone purchases. Distinguishing added‑value by the retailer (brand, craftsmanship, certification) remains crucial and if consumers don’t perceive this, they may delay or forgo gemstone purchases.

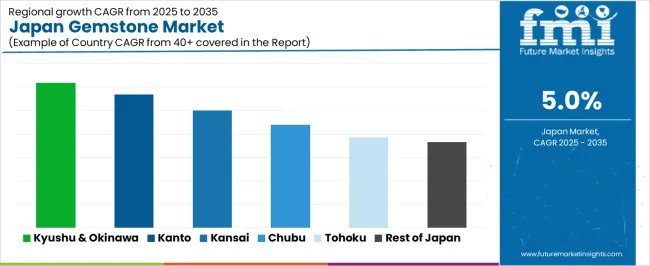

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.2% |

| Kanto | 5.7% |

| Kinki | 5.0% |

| Chubu | 4.4% |

| Tohoku | 3.9% |

| Rest of Japan | 3.7% |

The demand for gemstones in Japan is growing across all regions, with Kyushu & Okinawa leading at a 6.2% CAGR. This growth is driven by the rising popularity of fine jewelry and luxury goods. Kanto follows with a 5.7% CAGR, supported by its strong retail and jewelry industries. Kinki shows a 5.0% CAGR, fueled by its fashion-conscious consumer base and growing interest in premium gemstones. Chubu experiences a 4.4% CAGR, with steady growth driven by rising demand in luxury products and jewelry. Tohoku and the Rest of Japan show moderate growth at 3.9% and 3.7%, respectively, influenced by a growing interest in gemstone investment and aesthetic appeal.

Kyushu & Okinawa is experiencing the highest growth in demand for gemstones in Japan, with a 6.2% CAGR. This growth can be attributed to the increasing focus on luxury products, including fine jewelry, in the region. Kyushu, especially in cities like Fukuoka, has seen a rise in consumers seeking high-end gemstones for jewelry and investment purposes. Okinawa’s growing tourism industry also contributes to the demand, as visitors purchase local gemstones as souvenirs or for personal use.

The region's growing interest in unique and high-quality gemstones is further fueled by an expanding affluent consumer base and increasing awareness of gemstone investing. As gemstone appreciation and the luxury industry continue to grow in Kyushu & Okinawa, the demand for gemstones will remain strong. The cultural importance of gemstones, combined with a rise in demand for personalized, high-end jewelry, positions the region as a key driver of growth in Japan’s gemstone industry.

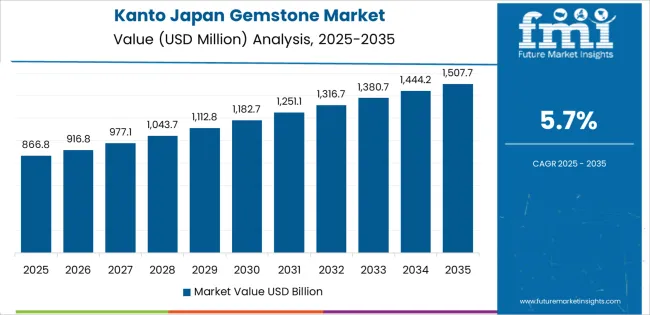

Kanto is experiencing strong growth in demand for gemstones, with a 5.7% CAGR. This growth is primarily driven by Tokyo’s status as a major global fashion hub, where gemstones are in high demand for both fine jewelry and luxury accessories. As one of Japan's most influential regions for fashion and luxury goods, Kanto’s consumer industry is increasingly leaning toward premium and investment-grade gemstones.

The region's well-developed retail infrastructure, which includes high-end department stores, luxury boutiques, and jewelry industries, makes gemstones widely accessible to affluent consumers. The growing popularity of bespoke and custom-designed jewelry, along with increasing interest in gemstone investment, has contributed to the rise in demand. As Kanto continues to lead in the luxury goods sector and as consumer interest in unique, high-quality gemstones increases, the demand for gemstones is expected to remain robust, supporting the region’s growth in this sector.

Kinki is experiencing steady growth in demand for gemstones, with a 5.0% CAGR. This growth is largely driven by the region's reputation for fashion and jewelry, particularly in cities like Osaka and Kyoto. These cities are home to a growing number of consumers who seek premium gemstones for both personal adornment and as investments. The region’s active fashion industry, including jewelry designers and fashion brands, is fueling demand for high-quality gemstones.

Kinki’s strong presence in the tourism sector contributes to rising gemstone purchases, with tourists buying gemstones as souvenirs or luxury gifts. The region’s increasing focus on personalized and high-end jewelry is further driving the adoption of gemstones, particularly in the luxury industry. As consumer interest in both traditional and contemporary gemstone jewelry rises, Kinki is expected to continue its steady growth, making it one of the key regions for gemstones in Japan.

Chubu is seeing moderate growth in demand for gemstones, with a 4.4% CAGR. This growth is driven by the region’s expanding luxury goods industry, particularly in cities like Nagoya, where there is increasing interest in fine jewelry and gemstones. As the region becomes more affluent, consumers are investing in high-quality gemstones, both for personal use and as investments.

Chubu’s strong industrial base, combined with rising disposable income, is contributing to the demand for luxury products, including gemstones. The increasing focus on craftsmanship and personalized jewelry also supports the demand for unique gemstones, with more consumers opting for custom-made pieces. As the region continues to evolve and consumer preferences shift toward more premium and investment-worthy products, Chubu is expected to experience steady growth in the gemstone industry, albeit at a more moderate pace compared to regions like Kyushu & Okinawa and Kanto.

Tohoku is experiencing moderate growth in demand for gemstones, with a 3.9% CAGR. The region's growth is primarily driven by an increasing interest in gemstones for both personal adornment and as investment options. While the region is less urbanized compared to others like Kanto or Kinki, Tohoku is seeing a rise in consumer interest in luxury goods, including gemstones, due to shifting consumer preferences and greater access to fine jewelry.

As the region's economy continues to evolve, there is a growing awareness of the value of gemstones, both for their aesthetic appeal and as assets. Tohoku’s retail sector is also becoming more diverse, offering a wider range of gemstone-based products. As more consumers in Tohoku look for premium jewelry options, the demand for gemstones will continue to rise, although at a slower pace than in more urbanized areas.

The Rest of Japan is experiencing steady growth in demand for gemstones, with a 3.7% CAGR. This growth is driven by the increasing popularity of gemstones for both aesthetic and investment purposes, especially as consumers become more aware of the long-term value of gemstones. While growth is slower compared to more industrialized regions, there is growing interest in gemstones in rural areas, where consumers are increasingly seeking high-quality, luxury items.

As the region's access to premium gemstones improves and more retail outlets offer gemstone-based products, demand is expected to grow gradually. With the rise in interest for unique and personalized jewelry, especially in rural areas, the Rest of Japan will continue to see moderate growth in gemstone demand. As the region adapts to the luxury goods trend, gemstones will remain an appealing choice for consumers seeking both beauty and investment value.

The demand for gemstones in Japan is steadily increasing as consumers seek unique, high‑end jewels, cultural and astrological symbolism, and luxury items that reflect personal identity. Japanese buyers are particularly attracted to colored gemstones such as rubies, sapphires, and emeralds for their rarity, rich hues, and prestigious value. The jewelry industry in Japan underscores the significance of gemstones within luxury accessories and sentiment‑driven purchases.

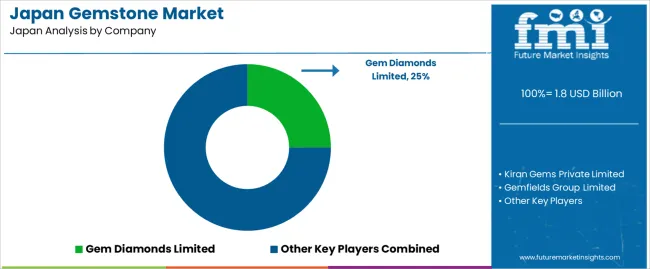

In the Japanese industry, Gem Diamonds Limited holds an estimated 25.0% share, illustrating its prominent role in supplying gemstones into Japan’s luxury and fine‑jewelry sectors. Other suppliers contributing to demand include Kiran Gems Private Limited, Gemfields Group Limited, PJSC ALROSA, and Anglo American plc, each engaged in mining, cutting, distribution, and trading of gemstones that flow into Japan’s jewelry supply chain.

Demand drivers in Japan include a consumer base with strong interest in premium, tailored, and ethically sourced gemstone pieces; an aging but affluent population with purchasing power; and a resilient luxury‑goods culture that values craftsmanship and material provenance. The rise of personalized jewelry, gemstone investment, and traceable sourcing further supports gemstone uptake. However, challenges such as competition from lab‑grown alternatives, transparency in origin, and fluctuating raw‑material pricing remain. The outlook for gemstone demand in Japan appears positive, reflecting the country’s enduring affinity for luxury gems and evolving consumer preferences.

Tasaki Co., Ltd.

Mikimoto

K-Uno Co., Ltd.

Ginza Tanaka (Tanaka Kikinzoku Jewelry K.K.)

Tiffany & Co. Japan Inc.

Cartier Japan Ltd.

Harry Winston Japan, Inc.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Product Type | Emerald, Ruby, Opal, Sapphire, Spinel |

| Application | Jewelry & Ornaments, Luxury Art |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Tasaki Co., Ltd., Mikimoto, K-Uno Co., Ltd., Ginza Tanaka (Tanaka Kikinzoku Jewelry K.K.), Tiffany & Co. Japan Inc., Cartier Japan Ltd., Harry Winston Japan, Inc. |

| Additional Attributes | Dollar sales by product type, application, and regional trends focused on luxury and jewelry sectors |

The demand for gemstones in Japan is estimated to be valued at USD 1.8 billion in 2025.

The demand for gemstones in Japan is projected to reach USD 2.9 billion by 2035.

The demand for gemstone in japan is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types are emerald, ruby, opal, sapphire and spinel.

In terms of application, the jewelry & ornaments segment is expected to command 70.0% share in the demand for gemstones in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA