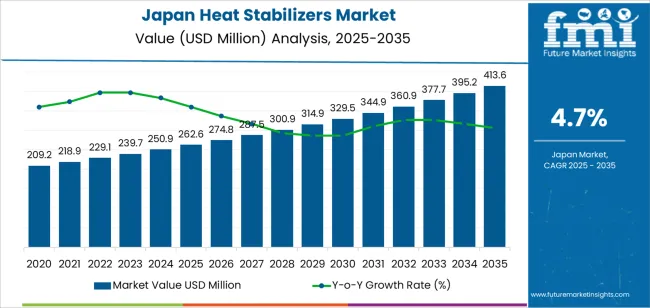

The demand for heat stabilizers in Japan is expected to grow from USD 262.6 million in 2025 to approximately USD 413.6 million by 2035, reflecting a CAGR of 4.7%. This growth will be driven by the increasing need for heat stabilizers in various industries, particularly in the manufacturing of plastics, automotive, and electrical components. As industrial sectors continue to prioritize durability and high-performance materials, the demand for heat stabilizers will rise to ensure the longevity and stability of products exposed to high temperatures. Japan’s commitment to high-quality manufacturing and materials science will further support demand for heat stabilizers, which are essential for preventing thermal degradation in polymers and other heat-sensitive materials.

The heat stabilizer industry in Japan will benefit from advancements in additive technologies, which improve the thermal stability of materials without compromising their physical properties. Growing awareness of the importance of environmental regulations regarding material sustainability will drive the adoption of more efficient and eco-friendly stabilizers. With Japan’s industrial modernization efforts, particularly in sectors such as automotive, electronics, and packaging, the demand for heat stabilizers will continue to rise to meet the evolving standards of material performance and regulatory compliance.

From 2025 to 2030, the industry will grow from USD 262.6 million to USD 314.9 million, adding USD 52.3 million in value. This phase is expected to account for a substantial portion of the industry’s total growth, driven by the increasing use of heat stabilizers in high-performance plastic components, particularly in automotive and electronics applications. As Japan’s manufacturing industry adopts more advanced materials to improve the reliability and safety of products, the demand for heat stabilizers will rise significantly. The automotive industry, in particular, will be a key driver, with growing demand for heat-resistant parts in vehicles, especially electric and hybrid models.

From 2030 to 2035, the industry will grow from USD 314.9 million to USD 413.6 million, contributing an additional USD 98.7 million in value. This period will see continued growth as Japan's manufacturing sectors incorporate more advanced, heat-resistant materials into their production processes. Innovations in stabilizer formulations will improve the efficiency and environmental performance of these materials, further supporting demand. As industries increasingly focus on the durability and sustainability of their products, heat stabilizers will continue to play a critical role in ensuring the long-term performance of materials exposed to high temperatures.

| Metric | Value |

|---|---|

| Demand for Heat Stabilizers in Japan Value (2025) | USD 262.6 million |

| Demand for Heat Stabilizers in Japan Forecast Value (2035) | USD 413.6 million |

| Demand for Heat Stabilizers in Japan Forecast CAGR (2025 to 2035) | 4.7% |

The demand for heat stabilizers in Japan is increasing as manufacturers in industries such as automotive, construction, packaging and electrical‑appliances seek additives that improve material durability and performance under high‑temperature conditions. Heat stabilizers are critical when polymers are exposed to heat during processing or during the operational life of a product. By improving thermal stability and reducing degradation, manufacturers can ensure product reliability and service life.

Growth in Japan’s automotive sector, combined with increasing use of plastics in vehicle interiors, exterior components and battery systems, is a key driver. Heat stabilizers enable plastics to meet stringent performance and safety standards in demanding automotive environments. Construction and building materials industries are also significant users of heat stabilized polymers for applications like window profiles, piping and cable insulation.

Technological innovation is also supporting increased adoption of advanced heat stabilizer formulations that offer better performance with lower additive amounts. As product lifespans increase and performance‑standards tighten, manufacturers are turning to improved stabilizer solutions for efficiency and reliability. With these conditions in place, demand for heat stabilizers in Japan is expected to grow steadily through 2035.

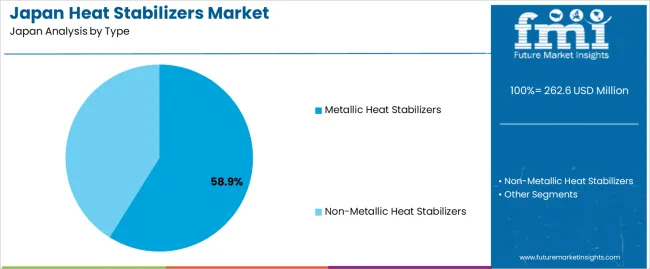

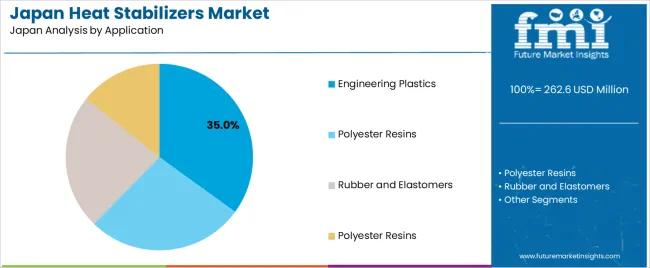

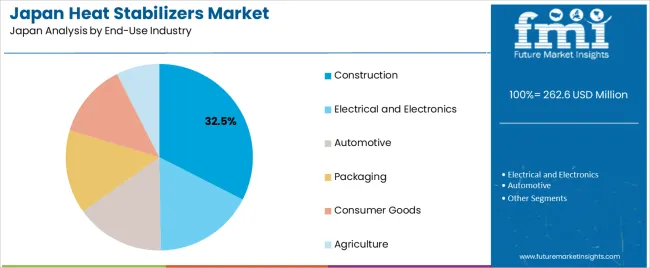

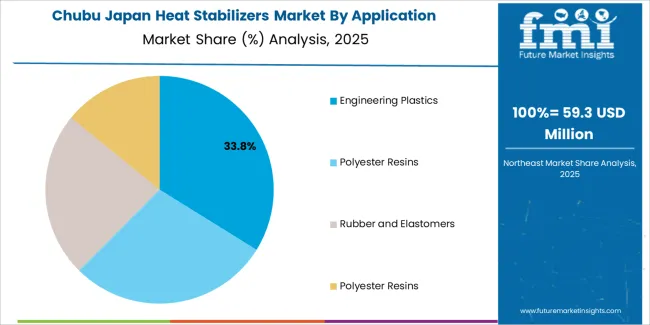

Demand for heat stabilizers in Japan is segmented by type, application, and end-use industry. By type, demand is divided into metallic heat stabilizers and non-metallic heat stabilizers, with metallic heat stabilizers holding the largest share. In terms of application, the industry is categorized into engineering plastics, polyester resins, rubber and elastomers, and polyester resins (listed twice, likely an error). The industry is also segmented by end-use industry, including construction, electrical and electronics, automotive, packaging, consumer goods, and agriculture. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Metallic heat stabilizers account for 59% of the demand for heat stabilizers in Japan. These stabilizers are widely used in the production of materials that need to withstand high temperatures during processing and throughout their lifecycle. Metallic stabilizers, such as those based on lead, calcium, and zinc, are effective in preventing thermal degradation, which is crucial in industries like plastics, rubber, and coatings.

The demand for metallic heat stabilizers is driven by their proven effectiveness in stabilizing various materials, especially engineering plastics, which require high thermal stability during processing. In sectors like construction, automotive, and electrical and electronics, materials that can withstand heat and maintain their integrity are critical for ensuring long-term performance. The cost-effectiveness and high efficiency of metallic stabilizers, particularly in mass production, further contribute to their dominance in the heat stabilizer industry. As the demand for durable and high-performance materials grows, particularly in high-temperature applications, metallic heat stabilizers will continue to lead the industry.

Engineering plastics account for 35% of the demand for heat stabilizers in Japan. These materials are used in applications where high strength, durability, and heat resistance are essential. Engineering plastics, such as polycarbonate, nylon, and polyphenylene sulfide (PPS), are widely used in automotive, electrical, and industrial applications where the material must maintain its performance even under high-temperature conditions.

The demand for heat stabilizers in engineering plastics is driven by the need to enhance the material's heat resistance during processing and its stability during use. In industries like automotive, where plastics are used in high-performance parts, or construction, where durable and heat-resistant materials are needed for long-term use, heat stabilizers play a vital role. As engineering plastics continue to replace traditional materials in demanding applications, the need for heat stabilizers to improve thermal stability and extend the lifespan of these materials will remain strong, driving the growth of the industry.

The construction industry accounts for 32.5% of the demand for heat stabilizers in Japan. This sector relies heavily on heat-stabilized materials, particularly in the manufacturing of construction products like pipes, coatings, and insulation materials, which must maintain their integrity under harsh conditions. The use of heat stabilizers ensures that construction materials can withstand elevated temperatures without degrading, thus extending their lifespan and enhancing performance.

The demand for heat stabilizers in the construction industry is driven by the growing need for durable and weather-resistant materials in the face of extreme weather conditions. The focus on sustainability and energy efficiency in construction has led to an increased demand for materials that offer both thermal stability and resistance to UV degradation. Heat stabilizers help improve the longevity of construction materials, reduce maintenance costs, and improve overall performance, contributing to the continued growth of the heat stabilizer industry in the construction industry.

Heat stabilizers help plastics retain integrity, colour, mechanical strength and durability when exposed to high temperatures during processing or in service. Key drivers include Japan’s strong presence in high-performance manufacturing (automotive parts, wiring and cables, electronic components) and robust construction activity where durable PVC products are used. Restraints include pressure from raw material and chemical feedstock cost volatility (which raises additive costs), the maturation of some end-use industries (reducing growth potential), and stringent regulatory compliance which raises development and certification costs for new stabiliser chemistries.

In Japan, the growth is driven by the need for high-quality polymers capable of withstanding thermal stress, especially in sectors such as automotive (heat-resistant wiring, under-hood components), electronics (plastics in devices, connectors) and construction (PVC pipes, profiles, cables). As manufacturing focuses on performance and reliability, heat stabilizers become essential to maintain polymer properties under extreme conditions. Japan’s ageing infrastructure and emphasis on durability push for materials with longer life-cycles. Stabilised plastics are part of that trend. Combined with an increasing shift toward eco-friendly, low-toxicity additives, Japanese manufacturers are investing in advanced stabilisers to meet both performance and regulatory demands, which enhances overall demand in the country.

Technological innovations are improving the performance and appeal of heat stabilizers in Japan by enabling more effective, safer and environmentally friendly formulations. Developments include calcium-based and mixed-metal stabilisers that offer high thermal stability with lower toxicity, and additives tailored for specific processing methods (e.g., for PVC extrusions, cable insulation). Japanese chemical firms are also advancing low-leaching stabilisers that meet stricter safety norms and consumer expectations. Stabiliser suppliers are integrating support for processing optimization (e.g., better thermal control, dispersion of additives) which helps converters produce higher quality parts. These innovations make stabiliser use more compelling, boosting demand as manufacturers upgrade materials to meet higher standards.

Despite favourable conditions, adoption of advanced heat stabilizers in Japan faces several challenges. Firstly, cost remains a barrier: premium stabiliser chemistries or eco-friendly variants often cost more than conventional ones, which can limit uptake in cost-sensitive applications. Secondly, regulatory compliance is demanding. New stabiliser systems must meet safety, health and environmental standards, adding development time and expense. Thirdly, some end-use segments are mature and growth is slower, which limits incremental demand for stabilisers unless there is material substitution or new applications. Finally, feedstock and raw material price volatility (for metals, chemicals) can squeeze margins for stabiliser makers and users, potentially slowing investment in newer stabiliser systems.

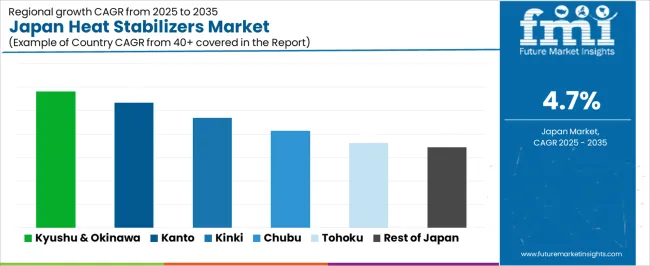

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.8% |

| Kanto | 5.3% |

| Kinki | 4.7% |

| Chubu | 4.1% |

| Tohoku | 3.6% |

| Rest of Japan | 3.4% |

The demand for heat stabilizers in Japan is growing across all regions, with Kyushu & Okinawa leading at a 5.8% CAGR. The growth is driven by increasing industrial activities, especially in manufacturing sectors like automotive and electronics. Kanto follows closely with a 5.3% CAGR, supported by its large industrial base and technological advancements. Kinki shows a 4.7% CAGR, driven by demand in the automotive and plastics industries. Chubu experiences a 4.1% CAGR, fueled by the region’s focus on industrial automation. Tohoku and the Rest of Japan show more moderate growth at 3.6% and 3.4%, respectively, as regional demand for heat stabilizers continues to rise in line with industrial activities.

Kyushu & Okinawa is seeing the highest demand for heat stabilizers in Japan, with a 5.8% CAGR. The region is benefiting from increasing industrialization, particularly in the automotive and electronics industries, where heat stabilizers are crucial to improve the durability and performance of plastic products under high temperatures. Cities like Fukuoka and Naha are emerging as key industrial hubs, driving demand for additives like heat stabilizers that can enhance material performance.

Kyushu & Okinawa’s strong focus on manufacturing and the ongoing push towards technological advancements in various sectors are contributing to the growing need for heat stabilizers. The automotive industry, in particular, is adopting these additives to ensure that plastic components perform well in harsh environments. With regional industries seeking to enhance their products' quality and longevity, Kyushu & Okinawa is expected to continue leading the demand for heat stabilizers.

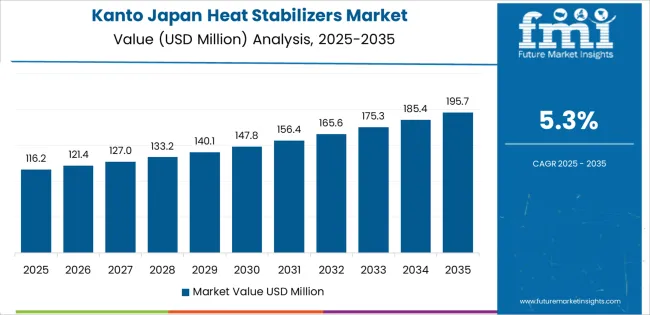

Kanto is experiencing strong growth in demand for heat stabilizers, with a 5.3% CAGR. As Japan’s industrial and technological hub, Kanto’s cities, particularly Tokyo, Yokohama, and Chiba, play a central role in driving the demand for heat stabilizers. The region’s focus on innovation, especially in the automotive and electronics industries, is creating a high need for additives like heat stabilizers to ensure materials can withstand high temperatures and maintain performance.

The automotive and manufacturing sectors in Kanto are increasingly relying on heat stabilizers for plastic parts that are exposed to extreme conditions. As industries continue to scale and evolve, there is a rising need for high-performance materials that can be used in more advanced applications. The growing awareness of the importance of material durability and product quality is driving the increasing adoption of heat stabilizers in Kanto, and this trend is expected to continue as industrial activities expand.

Kinki is seeing steady demand for heat stabilizers, with a 4.7% CAGR. The region, including cities like Osaka and Kyoto, has a well-established industrial base, particularly in automotive and plastic production. The increasing adoption of heat stabilizers in these sectors is driven by the need to improve the performance of materials used in high-temperature applications. The automotive sector in Kinki, with its focus on lightweight materials and enhanced performance, is a key driver of demand.

As manufacturers in Kinki continue to look for ways to improve the durability and efficiency of plastic components, the use of heat stabilizers is becoming more prevalent. The region’s growing focus on innovation in materials science and manufacturing techniques is contributing to the steady rise in heat stabilizer demand. As the need for advanced materials and improved industrial processes grows, Kinki will continue to experience solid growth in heat stabilizers.

Chubu is experiencing moderate growth in demand for heat stabilizers, with a 4.1% CAGR. The region, known for its strong manufacturing sector, especially in automotive and industrial machinery, is increasingly adopting heat stabilizers in the production of plastic components. As manufacturers in Chubu focus on improving the performance and reliability of their products, heat stabilizers play a critical role in ensuring that materials can withstand high temperatures and harsh environments.

Chubu’s growing emphasis on automation and advanced manufacturing techniques is further fueling the demand for heat stabilizers. The automotive industry, in particular, relies on heat stabilizers to enhance the durability of plastic components used in vehicle production. As the region continues to innovate and adopt new technologies, the demand for heat stabilizers is expected to grow steadily, supported by the region’s expanding industrial base.

Tohoku is seeing moderate growth in demand for heat stabilizers, with a 3.6% CAGR. The region, which is focusing on revitalizing its industrial sector, is increasingly adopting heat stabilizers as part of efforts to modernize manufacturing processes and improve the performance of materials. Industries like automotive, electronics, and plastics in Tohoku are beginning to rely more on heat stabilizers to ensure that their products maintain high performance under challenging conditions.

Tohoku’s growing investments in industrial development and infrastructure are supporting the increasing adoption of heat stabilizers. As regional manufacturers seek to enhance the quality and durability of their products, the demand for heat stabilizers is expected to continue to rise. While growth in Tohoku is slower compared to other regions, the region’s ongoing industrial expansion and focus on innovation will help sustain steady demand for heat stabilizers.

The Rest of Japan is experiencing moderate growth in demand for heat stabilizers, with a 3.4% CAGR. This includes rural and smaller urban areas where the adoption of advanced manufacturing solutions is gradually increasing. As businesses in these regions look to improve product performance and durability, heat stabilizers are becoming more widely adopted, particularly in the production of plastics used in automotive, electronics, and consumer goods.

The growing awareness of the benefits of using heat stabilizers to improve the reliability and lifespan of materials is helping to drive demand in the Rest of Japan. As industries in these areas continue to modernize and adopt advanced manufacturing processes, the demand for heat stabilizers will continue to grow. The Rest of Japan is expected to see steady adoption of these technologies as local manufacturers prioritize improving material performance and optimizing their production processes.

Demand for heat stabilizers in Japan is increasing due to their essential role in polymer processing, particularly in applications such as rigid and flexible PVC for infrastructure, automotive components, wires & cables, and building materials. These stabilizers enhance the thermal resistance, process stability, and color retention of polymer products, allowing them to maintain performance under high temperatures or UV exposure. As Japan's automotive, construction, and electronics sectors continue to grow, the need for durable and reliable polymer-based components is driving the demand for heat stabilizers. However, challenges such as the transition away from heavy-metal stabilizers, cost pressures on specialty chemicals, and the complexity of retrofitting legacy systems remain.

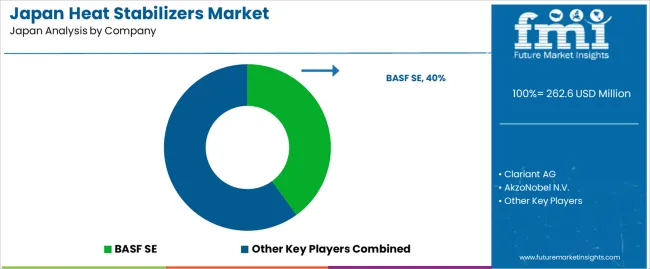

BASF SE is estimated to command around 40.0% of the heat stabilizer industry in Japan, positioning itself as a dominant player. Other significant companies contributing to the demand include Clariant AG, AkzoNobel N.V., Arkema S.A., Baerlocher GmbH, and Galata Chemicals. These companies offer a wide range of solutions, including mixed-metal stabilizers, calcium/zinc systems, and organotin-free formulations, tailored to the needs of Japan’s chemical fabricators and polymer converters. Their offerings help address the industry's demand for enhanced thermal stability and sustainability in polymer applications.

Key drivers in Japan include the increasing use of polymers in automotive lightweighting and electronics, the growing demand for PVC pipes and cables in construction projects, and stricter regulations on heavy-metal stabilizers. Despite these drivers, challenges such as high reformulation costs, competition from non-PVC alternatives, and margin pressures in the commodity additive sector continue to affect the industry’s growth prospects.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product Type | Metallic Heat Stabilizers, Non-Metallic Heat Stabilizers |

| Application | Engineering Plastics, Polyester Resins, Rubber and Elastomers, Polyester Resins |

| End-Use Industry | Construction, Electrical and Electronics, Automotive, Packaging, Consumer Goods, Agriculture |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | BASF SE, Clariant AG, AkzoNobel N.V., Arkema S.A., Baerlocher GmbH, Galata Chemicals |

| Additional Attributes | Dollar sales by type, application, and end-use industry with a focus on construction, automotive, and packaging industries |

The demand for heat stabilizers in Japan is estimated to be valued at USD 262.6 million in 2025.

The market size for the heat stabilizers in Japan is projected to reach USD 413.6 million by 2035.

The demand for heat stabilizers in Japan is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in heat stabilizers in Japan are metallic heat stabilizers and non-metallic heat stabilizers.

In terms of application, engineering plastics segment is expected to command 35.0% share in the heat stabilizers in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA