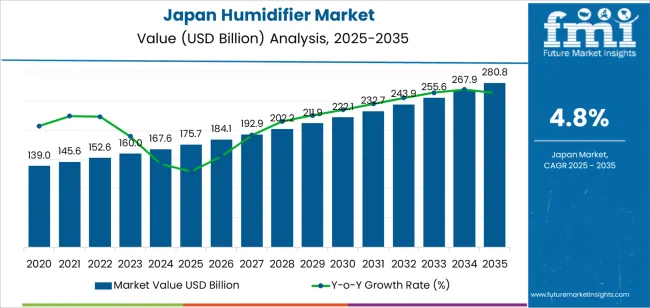

The demand for humidifiers in Japan is expected to grow from USD 175.7 million in 2025 to USD 280.8 million by 2035, reflecting a CAGR of 4.8%. Humidifiers are increasingly popular in Japan due to the country’s seasonal climate variations and the growing recognition of their benefits in indoor air quality and health. With a focus on respiratory health, allergy prevention, and skin care, humidifiers are particularly in demand during the dry winter months. As consumer awareness about the health benefits of humidified air increases, more households and businesses are incorporating humidifiers into their indoor environments.

The market is also driven by innovations such as smart humidifiers that offer better control over humidity levels, energy-efficient models, and multi-functional devices that serve as both humidifiers and air purifiers. The growing emphasis on home wellness and comfortable living environments supports the demand for advanced humidifier solutions. Additionally, with urbanization and more people spending significant time indoors, the need for air quality improvement solutions like humidifiers is set to increase throughout the forecast period.

The inflection point mapping for the demand for humidifiers in Japan reveals significant shifts in the market's growth trajectory, with notable accelerations and decelerations as the market matures.

From 2025 to 2030, the demand for humidifiers will grow from USD 175.7 million to USD 222.1 million, contributing USD 46.4 million in value. This early phase will experience rapid growth as awareness of indoor air quality and the health benefits of humidification become more widely recognized. The inflection point in this period is expected to occur around 2027, when smart humidifiers and energy-efficient models gain traction in both consumer homes and commercial settings. This acceleration will be driven by the adoption of new technologies and a growing focus on wellness and air quality in response to rising concerns about respiratory issues, dry skin, and allergies.

From 2030 to 2035, the market will grow from USD 222.1 million to USD 280.8 million, contributing USD 58.7 million in value. This phase will see moderate growth, driven by the maturation of the market and the standardization of humidifier usage in homes and offices. The inflection point in this period will occur as the market reaches saturation, where most households and businesses have already adopted humidifiers, and growth slows as a result of market saturation. The demand will continue to be driven by replacement cycles, innovations in multifunctional humidifiers, and continued consumer interest in air quality and health-conscious living, but the rate of growth will decelerate as the initial adoption phase peaks.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 175.7 billion |

| Industry Forecast Value (2035) | USD 280.8 million |

| Industry Forecast CAGR (2025-2035) | 4.8% |

Demand for humidifiers in Japan is growing steadily, with the market expected to expand at a compound annual growth rate (CAGR) of around 5 % during the mid 2020s. Rising urbanisation, increasing time spent indoors and heightened awareness of indoor air quality contribute to the growth of both portable units and whole house systems. Japanese households living in smaller apartments and using sealed air conditioned environments tend to favour compact, energy efficient humidifiers that fit into their living spaces.

Another important factor is the technology shift towards smart connected home appliances. Japanese consumers show interest in humidifiers that offer features such as ultrasonic mist, air quality sensors, voice or app control, and integration with smart home ecosystems. In addition, commercial and healthcare sectors in Japan are adopting humidification systems in offices, hospitals and data centres where controlled humidity contributes to occupant comfort, equipment reliability and health outcomes. Despite cost sensitivities and competition from multi functional air purifiers, the combination of lifestyle trends, indoor health awareness and smart home advancement indicates that demand for humidifiers in Japan is positioned for continued growth.

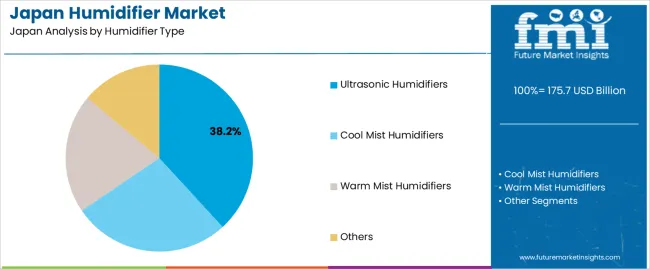

The demand for humidifiers in Japan is primarily driven by humidifier type and installation type. The leading humidifier type is ultrasonic humidifiers, capturing 38% of the market share, while portable humidifiers dominate the installation type segment, accounting for 64.5% of the demand. Humidifiers are essential for maintaining optimal humidity levels, particularly in dry winter months and air-conditioned environments. The demand for different types of humidifiers is growing due to increased awareness of the health benefits of maintaining proper indoor air quality.

Ultrasonic humidifiers lead the market for humidifiers in Japan, accounting for 38% of the demand. These devices use ultrasonic vibrations to create a fine mist, which is then released into the air to increase humidity levels. Ultrasonic humidifiers are popular for their quiet operation, energy efficiency, and ability to release a cool mist without heating the water, making them suitable for various home and office environments.

The demand for ultrasonic humidifiers is driven by their advanced technology, compact design, and user-friendly features. They are especially favored for use in bedrooms, living rooms, and offices, where noise reduction and energy efficiency are important considerations. Additionally, ultrasonic humidifiers are often equipped with features like adjustable mist settings, timers, and built-in filters, enhancing their appeal to consumers. As Japan experiences seasonal variations in humidity and air quality, ultrasonic humidifiers are expected to remain the preferred choice for consumers seeking effective and convenient humidity control.

Portable humidifiers are the dominant installation type for humidifiers in Japan, capturing 64.5% of the demand. These humidifiers are popular due to their convenience, versatility, and ease of use. Portable humidifiers can be easily moved from room to room, making them ideal for personal use in spaces like bedrooms, offices, and living rooms. They are especially favored in Japan’s smaller living spaces, where larger, fixed installation systems may not be practical.

The popularity of portable humidifiers is driven by their ability to provide targeted humidity control where it is most needed, without the need for permanent installation. This makes them highly appealing to consumers who require flexibility and portability in their home appliances. With an increasing focus on improving indoor air quality, especially in environments with dry air or during winter months, portable humidifiers are expected to maintain their leadership in the market, catering to the diverse needs of Japanese consumers seeking convenient and efficient air management solutions.

Demand for humidifiers in Japan is driven by a combination of lifestyle, health and technological factors. Rising public awareness of indoor air quality and its impact on respiratory health and skin condition supports growth. Adoption of smart home solutions and connected devices is making advanced humidifiers more appealing. On the other hand, the country’s limited space in many homes and high appliance ownership may moderate replacement demand. These dynamics together shape how humidifier demand evolves in Japan’s market.

Several drivers support demand growth in Japan. First, Japan’s aging population and higher incidence of dry air related ailments such as dry skin, allergies and respiratory discomfort encourage purchase of humidifiers. Second, increased use of air conditioners and heaters in residences and offices creates indoor conditions with low humidity, which boosts humidifier uptake. Third, smart home trends and consumer preference for connected appliances make enhanced humidifier models with app control and sensors more attractive. Fourth, the food service and plant care segments are also growing, and humidifiers help maintain optimal indoor conditions for plants and food storage.

Despite positive factors, several restraints exist in Japan. First, many households already own basic humidifiers, so replacement cycles may slow down, limiting rapid volume growth. Second, humidifier units require maintenance cleaning and filter changes and consumer concerns about hygiene or mould may reduce usage. Third, high cost of advanced models may deter consumers in more price sensitive segments. Fourth, in summer months or high humidity regions of Japan, demand may drop because ambient humidity is already sufficient.

Notable trends include the rise of smart humidifiers equipped with sensors, humidity monitoring, mobile app control and integration with other smart home systems, aligning with Japanese preferences for high function appliances. There is growing demand for compact models suited to small living spaces, including tabletop and bedside units. Manufacturers are also focusing on low noise, energy efficient designs to meet expectations for quiet and economical operation. Sustainable design and materials such as recyclable plastic components and low power motors are gaining traction as well.

The demand for humidifiers in Japan is primarily driven by the country’s climate, urbanization, and the increasing focus on health and wellness. During colder months, the air in Japan can become very dry, especially in indoor environments, leading to health issues such as dry skin, respiratory problems, and irritation of the eyes and throat. Humidifiers help alleviate these symptoms by maintaining optimal humidity levels in the home or workplace.

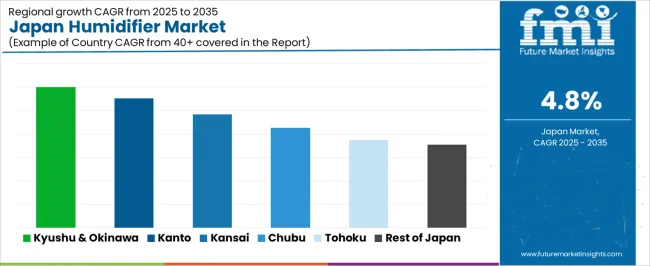

Additionally, with rising awareness of air quality and its effects on overall well-being, consumers are increasingly investing in humidifiers to enhance comfort and protect their health. The demand for humidifiers is also supported by the growing trend of indoor air purification and lifestyle improvements. Regional variations in demand are influenced by climate factors, population density, and awareness of air quality in different parts of Japan. Below is an analysis of the demand for humidifiers across different regions of Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6% |

| Kanto | 5.5% |

| Kinki | 4.8% |

| Chubu | 4.3% |

| Tohoku | 3.7% |

| Rest of Japan | 3.6% |

Kyushu & Okinawa leads the demand for humidifiers in Japan with a CAGR of 6.0%. The region experiences high humidity levels in the warmer months, but during the colder seasons, the air can become dry, making humidifiers essential for maintaining indoor comfort. Additionally, Okinawa’s tourism-driven economy also supports the demand for air quality improvement products, as tourists and residents alike seek more comfortable indoor environments.

Kyushu & Okinawa’s growing focus on health and wellness is another key factor driving the adoption of humidifiers. As consumers in the region become more health-conscious and aware of the benefits of air quality on overall well-being, the demand for humidifiers continues to rise. The region’s proactive approach to addressing indoor air quality challenges supports the strong growth in the market for humidifiers.

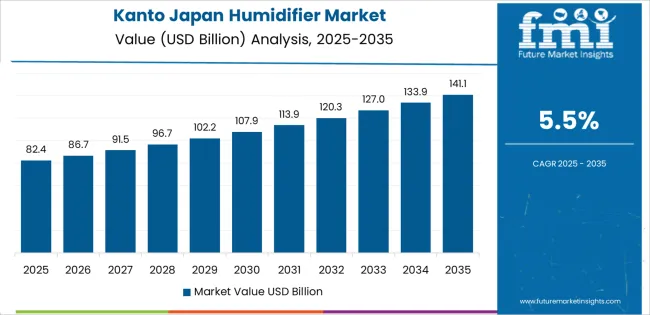

Kanto shows strong demand for humidifiers with a CAGR of 5.5%. Kanto, which includes Tokyo, is Japan's largest urban center, with a high population density and significant numbers of office buildings, apartments, and public spaces where dry indoor air is a common issue. The demand for humidifiers in this region is driven by the need to improve indoor air quality, reduce the discomfort of dry air, and enhance overall living and working conditions.

The region’s awareness of air quality and consumer health is increasing, especially as more people focus on improving their home environment and managing indoor humidity for better health. Additionally, with colder winters and dense urban environments where air circulation can be poor, humidifiers are increasingly being used in homes and workplaces to provide relief from the effects of dry air. This trend in Kanto is expected to continue growing steadily.

Kinki, with a CAGR of 4.8%, shows steady demand for humidifiers. This region includes major urban areas such as Osaka and Kyoto, where the population density and industrial activity contribute to the need for indoor air quality improvement. The demand is particularly strong during the dry winter months when indoor air can become uncomfortable.

The Kinki region's growing interest in health, wellness, and environmental consciousness also contributes to the rising demand for humidifiers. As more people seek to improve the quality of the air they breathe, particularly in offices, homes, and public spaces, the demand for humidifiers continues to grow. However, the region's demand growth is slightly lower than in Kyushu & Okinawa and Kanto, likely due to the availability of alternative air quality improvement solutions.

Chubu shows moderate growth in the demand for humidifiers with a CAGR of 4.3%. The region, which includes Nagoya and surrounding areas, has a strong industrial base, and while air quality concerns are a growing issue, the demand for humidifiers is not as strong as in the more urbanized regions like Kanto and Kinki. Nevertheless, with increasing awareness about health and wellness, residents and businesses in Chubu are gradually adopting humidifiers to improve indoor air conditions.

The demand in Chubu is also supported by the region's seasonal weather patterns, which lead to dry indoor environments in winter. As more households and companies recognize the value of humidifiers in maintaining health and comfort, the demand in Chubu is expected to continue its moderate growth.

Tohoku, with a CAGR of 3.7%, and the Rest of Japan, with a CAGR of 3.6%, show slower growth in the demand for humidifiers. These regions are more rural and have fewer urban centers where indoor air quality issues are as prevalent as in the larger metropolitan areas like Tokyo and Osaka. While there is still demand for humidifiers, particularly in colder months, the overall growth in these regions is slower due to a lower concentration of households and businesses that require such products.

However, as awareness of the benefits of air quality improves across Japan, these regions are expected to experience gradual growth in the demand for humidifiers. As residents in more rural areas begin to adopt healthier lifestyles and prioritize indoor air quality, the market for humidifiers in Tohoku and the Rest of Japan will continue to grow at a steady pace.

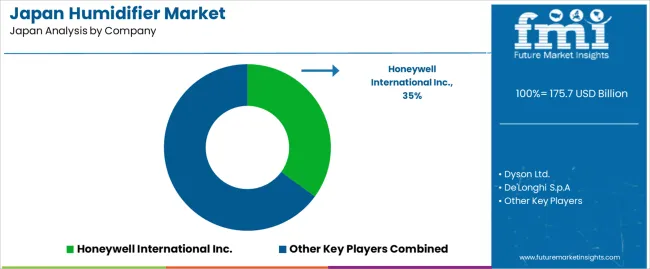

The demand for humidifiers in Japan is increasing, driven by factors such as seasonal changes, air quality concerns, and a growing awareness of the health benefits associated with maintaining optimal indoor humidity levels. Companies like Honeywell International Inc. (holding approximately 35% market share), Dyson Ltd., De'Longhi S.p.A, Condair, and BONECO AG are key players in this market. As Japan experiences cold winters with dry indoor air, especially in homes, offices, and hospitals, there is a rising need for efficient and reliable humidifiers to improve comfort and health.

Competition in the humidifier industry is focused on technology, energy efficiency, and user convenience. Companies are investing in the development of advanced features such as smart humidity controls, air purifiers integrated with humidification systems, and quieter operation to enhance the overall user experience. Another area of competition is design, with consumers increasingly seeking stylish, compact, and easy-to-use humidifiers that can blend seamlessly into their living spaces.

Companies are also emphasizing the use of antimicrobial materials, long-lasting filters, and ease of maintenance to cater to consumers’ desire for low-maintenance, hygienic products. Marketing materials often highlight features such as humidification capacity, energy efficiency, quiet operation, and the added health benefits of using a humidifier in dry indoor environments. By aligning their products with the growing demand for energy-efficient, convenient, and health-conscious solutions, these companies aim to strengthen their position in Japan’s competitive humidifier market.

Panasonic Corporation

Sharp Corporation

Daikin Industries, Ltd.

Mitsubishi Heavy Industries, Ltd.

Honeywell International Inc.

Dyson Ltd.

BONECO AG

Condair Group AG

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Humidifier Type | Ultrasonic Humidifiers, Cool Mist Humidifiers, Warm Mist Humidifiers, Others |

| Installation Type | Portable Humidifiers, Cool Mist Humidifiers, Ultrasonic Humidifiers, Warm Mist Humidifiers |

| End User | Residential Humidifiers, Commercial Humidifiers, Industrial Humidifiers |

| Sales Channel | Fixed Humidifiers, Portable Humidifiers |

| Key Companies Profiled | Panasonic Corporation, Sharp Corporation, Daikin Industries, Ltd., Mitsubishi Heavy Industries, Ltd., Honeywell International Inc., Dyson Ltd., BONECO AG, Condair Group AG |

| Additional Attributes | The market analysis includes dollar sales by humidifier type, installation type, end-user, and sales channel categories. It also covers regional demand trends in Japan, particularly driven by the increasing need for air quality control in residential, commercial, and industrial settings. The competitive landscape highlights major players focusing on innovations in humidifier technology, energy efficiency, and smart features. Trends in the growing adoption of ultrasonic and cool mist humidifiers, as well as advancements in design and functionality for various applications, are explored. |

The global demand for humidifier in Japan is estimated to be valued at USD 175.7 billion in 2025.

The demand for humidifier in Japan is projected to reach USD 280.8 billion by 2035.

The demand for humidifier in Japan is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types are ultrasonic humidifiers, cool mist humidifiers, warm mist humidifiers and others.

In terms of installation type, the portable humidifiers segment is expected to command 64.5% share in the demand for humidifiers in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA