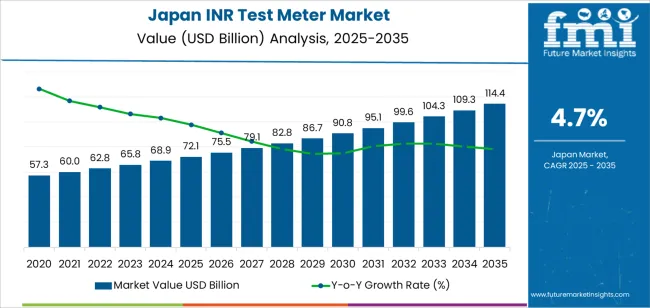

The demand for INR (International Normalized Ratio) test meters in Japan is valued at USD 72.1 billion in 2025 and is projected to reach USD 114.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.7%. The growth is driven by the increasing prevalence of cardiovascular diseases, such as atrial fibrillation, and the rising number of patients requiring anticoagulant therapy. INR meters offer a convenient and efficient method for patients to monitor their blood clotting levels at home, reducing the need for frequent visits to healthcare facilities. The growing emphasis on personalized healthcare and self-monitoring technologies contributes to the rising adoption of INR test meters in Japan.

The market shows steady growth over the forecast period, starting at USD 57.3 billion in earlier years and reaching USD 72.1 billion by 2025. As the demand continues to rise, it reaches USD 114.4 billion by 2035. The annual increments are consistent, with values moving from USD 75.5 billion in 2026 to USD 79.1 billion in 2027, and continuing through to USD 114.4 billion by 2035. This consistent year-on-year growth reflects the growing reliance on INR test meters for effective management of anticoagulation therapy, as well as the increasing shift toward home-based healthcare solutions in Japan.

Demand in Japan for INR test meters is projected to increase from USD 72.1 million in 2025 to USD 114.4 million by 2035, reflecting a compound annual growth rate (CAGR) of approximately 4.7%. Beginning at USD 57.3 million in 2020, the value rises steadily to USD 72.1 million by 2025. Between 2025 and 2030, demand will climb from USD 72.1 million to USD 90.8 million, then continue to USD 114.4 million by 2035. Growth drivers include aging population demographics, increased prevalence of anticoagulation therapies, rising adoption of home monitoring devices, and greater integration of point of care diagnostics in both outpatient and homecare settings.

The growth contribution from volume and price during this period will vary. Volume growth more devices installed in clinics, hospitals and homecare will account for a substantial portion of the increase, especially early in the decade, as new patients on long term anticoagulants uptake self testing technologies. Later in the period, price and value per device will contribute more significantly, as advanced features (connectivity, data analytics, improved user interface) become standard and drive higher average selling prices. This shift from volume driven growth to value driven growth underpins the estimated increase to USD 114.4 million by 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 72.1 billion |

| Forecast Value (2035) | USD 114.4 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The demand for INR test meters in Japan is driven by the growing incidence of cardiovascular conditions such as atrial fibrillation and venous thromboembolism, which require long term anticoagulation management. Patients undergoing treatment with medications like warfarin need frequent monitoring of their International Normalized Ratio values to avoid bleeding or clotting complications. Healthcare providers are increasing focus on self management of anticoagulation therapy, which supports the use of home or point of care INR meters by patients outside hospital settings. The aging population in Japan amplifies the need for such monitoring tools, as older adults are more likely to require anticoagulant therapies.

Shifts in healthcare delivery toward decentralized and outpatient care settings are encouraging adoption of INR test meters. Hospitals and clinics are collaborating with home care services to enable patients to monitor their INR values at home, reducing clinic visits and easing burden on facilities. These devices support remote management and timely therapeutic adjustments, improving treatment continuity for anticoagulated individuals. Cost pressures on the healthcare system and the need for efficient patient monitoring are prompting hospitals and providers to consider portable INR meter solutions as part of their anticoagulation management programs.

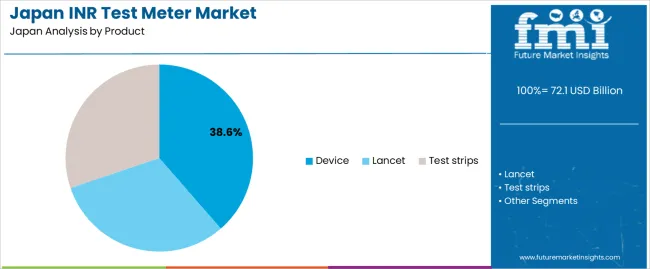

The demand for INR test meters in Japan is influenced by the types of products (devices, lancets, test strips) and the end user segments (hospitals, specialty clinics, ambulatory surgical centres, home care settings). Each product category plays a distinct role in anticoagulation monitoring, while end users determine where and how frequently such testing is deployed. The growth in Japan is supported by the rising prevalence of cardiovascular diseases and the ageing population, which drives demand for regular INR (International Normalised Ratio) monitoring.

Devices account for approximately 39% of the total demand for INR test meters in Japan. This product category includes the core meter or analyser used for measuring INR values. The strong share arises because the device is essential for conducting the test, and institutions and patients alike are increasingly adopting point of care and self testing solutions. Technological advances, such as Bluetooth connectivity, mobile app integration and compact form factors, are making these devices more appealing for both clinical and home settings. The emphasis on decentralised monitoring contributes to higher device uptake across Japan’s healthcare system.

The demand for devices is also driven by the need for rapid, accurate INR measurement in settings with high anticoagulant use, such as cardiac surgery centres and outpatient anticoagulation clinics. In Japan, where long term anticoagulation management (for atrial fibrillation, deep vein thrombosis or prosthetic heart valves) is prominent, clinicians and patients value devices that reduce dependence on laboratory testing. This clinical requirement and convenience factor reinforce the device segment’s leading position in the Japanese INR test meter market.

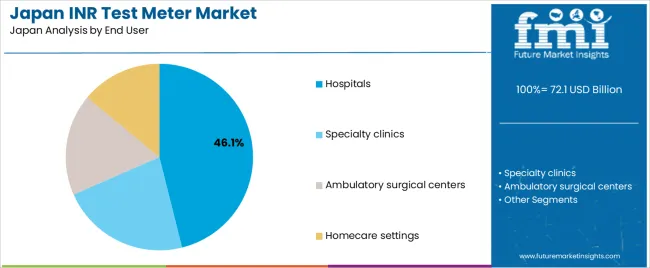

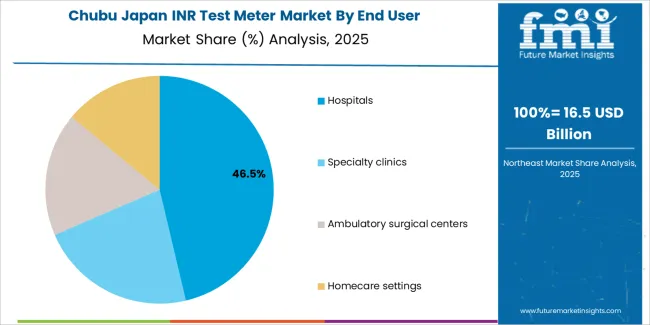

Hospitals represent roughly 46.1% of the end user demand for INR test meters in Japan. These settings dominate because they manage high volumes of patients requiring anticoagulation monitoring especially in inpatient and perioperative care, cardiology units and specialised coagulation clinics. The hospital environment offers the necessary infrastructure, trained personnel and regulatory oversight to deploy and monitor INR testing effectively. Hospitals also often serve as referral centres, increasing their share of meter usage relative to smaller clinics or home settings.

Another reason hospitals lead is their role in standardising anticoagulation protocols and implementing point of care devices within strategic care pathways. In Japan, reinforcements of care for elderly patients, cardiovascular disease burdens and surgical interventions mean hospitals are central to INR monitoring. As devices designed for self monitoring or home use continue to gain traction, hospitals remain foundational for both initial INR testing and longitudinal anticoagulation management—thus maintaining their significant share in this segment.

Japan’s ageing population and rising incidence of cardiovascular disorders such as atrial fibrillation and deep vein thrombosis are increasing the need for anticoagulation monitoring, which in turn supports demand for INR test meters. The shift in clinical practice toward home based monitoring and point of care testing also adds impetus. At the same time, budget constraints in smaller clinics, regulatory hurdles for home self testing approval and limited awareness of patient self monitoring options remain constraints on broader adoption in Japan.

Devices with Bluetooth connectivity, data sharing capabilities and compact formats are gaining traction in Japan as healthcare providers and patients favour monitoring solutions that link to mobile apps and telehealth platforms. These features enhance ease of use for older patients and support remote monitoring by clinicians. In Japan, where patient self management of long term therapies is increasingly encouraged, such innovations make INR test meters more attractive and help expand their reach beyond hospital settings.

An opportunity lies in expanding use of portable INR test meters in home care and outpatient settings across Japan. Given the country’s strong home nursing infrastructure and policy focus on reducing hospital stays, devices suitable for patient self testing and remote clinician review are well positioned. Partnerships between device manufacturers and home care providers, as well as awareness campaigns for patients on anticoagulant therapy, could promote penetration of these meters in non hospital environments.

Some obstacles remain for wider adoption of INR test meters in Japan. High device and consumable costs, especially for advanced connectivity features, can deter smaller clinics and private households. Additionally, patient familiarity with self testing is variable and some physicians may prefer traditional laboratory testing. Regulatory and reimbursement frameworks for home self testing in Japan may not yet fully support these devices, which can slow uptake in certain settings.

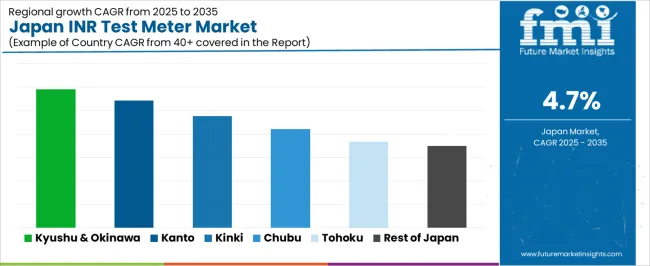

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.9% |

| Kanto | 5.4% |

| Kinki | 4.8% |

| Chubu | 4.2% |

| Tohoku | 3.7% |

| Rest of Japan | 3.5% |

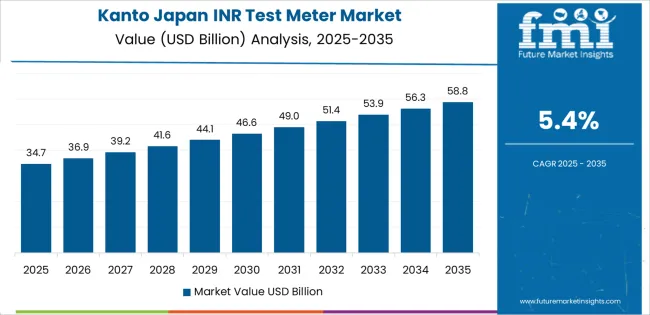

The demand for INR test meters in Japan is growing across regions, with Kyushu and Okinawa leading at a 5.9% CAGR. This is driven by the increasing need for convenient, at-home monitoring of blood clotting levels, particularly among the elderly population. Kanto follows closely at 5.4%, with high healthcare utilization rates and a large population of individuals requiring anticoagulant therapy. Kinki experiences 4.8% growth, supported by its developed healthcare infrastructure and rising awareness of home monitoring solutions. Chubu grows at 4.2%, while Tohoku records 3.7%, influenced by rural healthcare expansion. The rest of Japan shows a 3.5% growth, reflecting gradual adoption of INR test meters in less urbanized regions.

Kyushu & Okinawa is projected to grow at a CAGR of 5.9% through 2035 in demand for INR test meters. The region’s healthcare system is increasingly adopting home-based testing devices, especially in remote areas where access to healthcare facilities is limited. With an aging population and the rising prevalence of cardiovascular diseases, the demand for INR monitoring to manage blood clotting effectively is increasing. The region's healthcare providers continue to emphasize the importance of at-home monitoring, leading to growing adoption of INR test meters among patients and healthcare professionals.

Kanto is projected to grow at a CAGR of 5.4% through 2035 in demand for INR test meters. As Japan’s most populous and economically developed region, Kanto, including Tokyo, leads in the adoption of healthcare innovations. The rise in outpatient care, coupled with the increasing number of patients requiring anticoagulant therapy, drives the demand for at-home INR testing. Hospitals, clinics, and pharmacies in Kanto are increasingly offering INR test meters to facilitate patient care, allowing for more efficient monitoring of blood clotting times and improving treatment outcomes.

Kinki is projected to grow at a CAGR of 4.8% through 2035 in demand for INR test meters. The region’s robust healthcare infrastructure, particularly in Osaka and Kyoto, supports the growing use of INR meters for home-based monitoring of blood clotting. As the elderly population increases and the prevalence of conditions requiring anticoagulant therapy rises, demand for INR monitoring devices continues to expand. The region’s hospitals and clinics increasingly adopt self-testing solutions, encouraging patients to monitor their INR levels regularly and improve medication adherence.

Chubu is projected to grow at a CAGR of 4.2% through 2035 in demand for INR test meters. With a growing focus on patient-centered care, healthcare facilities in cities like Nagoya are increasingly adopting remote monitoring technologies, including INR meters. The region’s aging population and the rise of chronic health conditions requiring long-term medication and monitoring contribute to the demand for INR test meters. As patients seek more autonomy in managing their healthcare, the need for accurate, at-home blood clotting tests becomes more significant, driving market growth.

Tohoku is projected to grow at a CAGR of 3.7% through 2035 in demand for INR test meters. The region’s aging population, along with its relatively rural setting, contributes to increased adoption of home INR testing. The demand for INR meters is driven by the need for accessible healthcare solutions in areas with fewer healthcare facilities. With more patients requiring long-term anticoagulant therapy, the use of remote monitoring tools becomes essential in maintaining optimal health and reducing hospital visits.

The Rest of Japan is projected to grow at a CAGR of 3.5% through 2035 in demand for INR test meters. As healthcare systems in smaller regions and rural areas continue to expand, the need for accessible and cost-effective monitoring devices increases. The adoption of INR meters is growing, especially among patients with long-term conditions such as heart disease and thrombosis. Regional healthcare facilities focus on improving patient outcomes by enabling at-home blood clotting monitoring, which helps to reduce hospital visits and improve treatment management.

The demand for INR test meters in Japan is driven by the increase in anticoagulant therapies required for conditions such as atrial fibrillation and deep vein thrombosis. With an aging population and rising incidence of cardiovascular disease, the need for point of care and home based clotting time monitoring is growing. Technological shifts toward portable meters, Bluetooth connectivity and telehealth integration are supporting adoption outside hospital settings. Meanwhile healthcare providers and insurers are showing interest in devices that reduce clinic visits and support long term management of warfarin and related treatments in ambulatory or home care environments.

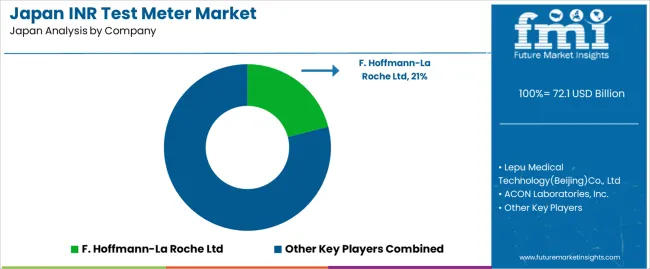

Key companies influencing the Japanese INR test meter market include Roche Coagu Chek IN Range by F. Hoffmann La Roche Ltd, Lepu Medical Technology (Beijing) Co., Ltd., ACON Laboratories, Inc., CoaguSense Inc. and Abbott Laboratories. These firms offer INR meters, consumables and associated monitoring systems calibrated for Japanese regulatory standards and local clinical workflows. They focus on user friendly designs, reliability and after sales support. Combined with expanding home based care models and clinical guidelines emphasising frequent INR monitoring, these suppliers play a central role in shaping how INR test meter usage evolves in Japan.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Use | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Homecare Settings |

| Product Type | Device, Lancet, Test Strips |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | F. Hoffmann La Roche Ltd, Lepu Medical Technology (Beijing) Co., Ltd, ACON Laboratories, Inc., CoaguSense, Inc., Abbott Laboratories |

| Additional Attributes | Dollar by sales across product type, technology, and application sectors, healthcare provider adoption rates, demographic trends, advancements in device functionality, regulatory compliance, and patient demand for early detection and preventive care. |

The demand for INR test meter in Japan is estimated to be valued at USD 72.1 billion in 2025.

The market size for the INR test meter in Japan is projected to reach USD 114.4 billion by 2035.

The demand for INR test meter in Japan is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in INR test meter in Japan are device, lancet and test strips.

In terms of end user, hospitals segment is expected to command 46.1% share in the INR test meter in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA