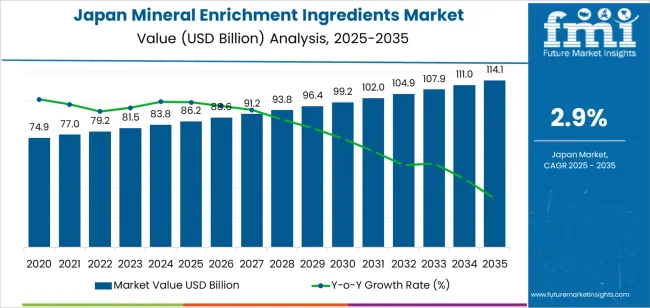

The demand for mineral enrichment ingredients in Japan is projected to reach USD 114.1 billion by 2035, reflecting an absolute increase of USD 27.9 billion over the forecast period. The demand, valued at USD 86.2 billion in 2025, is expected to grow at a steady CAGR of 2.9%. Growth is driven by Japan’s strong focus on nutrition enhancement, aging-population dietary needs, and increasing incorporation of fortified ingredients across food, beverage, and supplement applications. Mineral enrichment ingredients-such as calcium, iron, magnesium, zinc, and trace elements-play a vital role in supporting immune function, bone health, metabolic balance, and overall well-being, making them essential inclusions in Japan’s health-oriented consumption landscape.

Japan’s demographic profile, characterized by one of the world’s highest proportions of elderly citizens, is a major factor contributing to growing demand. As consumers focus more on preventive health and targeted nutritional solutions, manufacturers continue to expand fortified product offerings. The widespread use of mineral ingredients in functional beverages, fortified dairy, nutraceuticals, and dietary supplements supports increasing consumption across age groups. Innovations in mineral absorption technologies and bioavailability improvement techniques are further strengthening their adoption in Japan’s nutrition ecosystem.

Inflection point mapping reveals how shifts in consumption drivers reshape the acceleration pattern of demand over time. The first notable inflection point appears around 2028 to 2029, when demand rises from USD 86.2 billion in 2025 to USD 91.2 billion in 2029. During this period, steady momentum is supported by gradual increases in fortified food consumption and continued demographic aging. Although growth remains moderate, the structure begins transitioning as mineral-enriched products become more widely adopted across daily dietary routines.

A more substantial inflection point emerges between 2030 and 2032, when demand moves from USD 93.8 billion in 2030 to USD 99.2 billion in 2032. This phase signifies accelerated growth influenced by heightened demand for functional nutrition products, broader acceptance of mineral supplementation, and advancements in ingredient formulation that improve absorption and product performance. The role of medical nutrition and personalized dietary solutions gains prominence, amplifying the upward shift.

The strongest inflection point occurs in the 2032 to 2035 window, when demand rises from USD 99.2 billion to USD 114.1 billion. This period represents the steepest acceleration curve, driven by expanded fortification across everyday foods, greater integration of minerals in specialized nutrition products, and the rapidly growing need to support healthy aging. By 2035, demand stabilizes at a new higher-growth trajectory, reflecting a mature yet steadily expanding nutritional ingredients landscape.

| Metric | Value |

|---|---|

| Japan Mineral Enrichment Ingredients Value (2025) | USD 86.2 billion |

| Japan Mineral Enrichment Ingredients Forecast Value (2035) | USD 114.1 billion |

| Japan Mineral Enrichment Ingredients Forecast CAGR (2025 to 2035) | 2.9% |

The demand for mineral enrichment ingredients in Japan is growing due to the increasing focus on addressing mineral deficiencies and improving nutritional health. Mineral enrichment ingredients, which include essential minerals such as calcium, magnesium, and iron, are commonly used in food and beverage products, dietary supplements, and fortified foods. As consumers become more health-conscious and aware of the importance of adequate mineral intake, the need for these ingredients in various products is rising.

The aging population in Japan is a significant driver of the demand for mineral-enriched products. Older adults are more prone to conditions like osteoporosis, anemia, and other mineral deficiency-related issues, which has led to an increased focus on functional foods and supplements that help maintain optimal mineral levels. With Japan’s growing interest in preventive healthcare and wellness, there is a rising demand for fortified foods and beverages that can provide essential minerals to support overall health.

The growing popularity of plant-based diets and the increasing demand for gluten-free, organic, and natural food products are also contributing to the rise in demand for mineral enrichment ingredients. These dietary trends often require the addition of mineral ingredients to ensure that consumers receive adequate nutrients. As consumers prioritize healthier, more functional diets, the demand for mineral-enriched foods and supplements is expected to continue growing steadily in Japan.

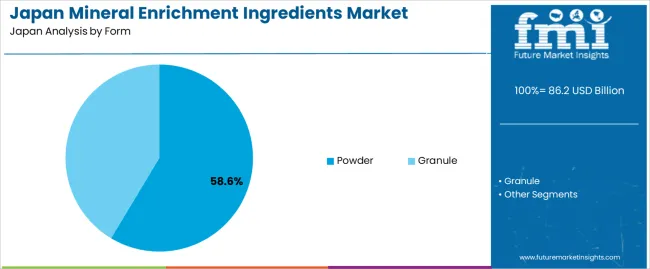

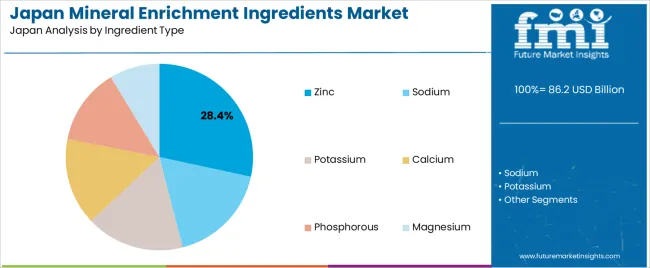

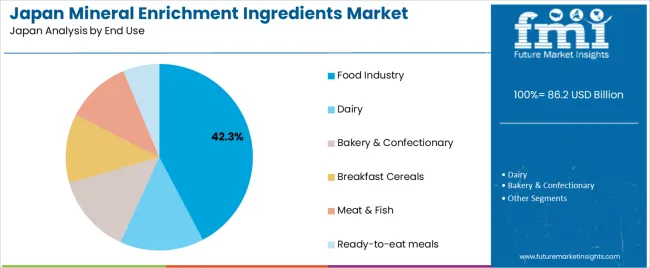

By form, demand is divided into powder and granule. Based on ingredient type, demand is categorized into zinc, sodium, potassium, calcium, phosphorous, and magnesium. By end use, demand is segmented into food industry, dairy, bakery & confectionery, breakfast cereals, meat & fish, and ready-to-eat meals. Regionally, demand is concentrated in Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Powder accounts for 58.60% of the demand for mineral enrichment ingredients in Japan. Powdered forms are preferred for their versatility, ease of mixing, and ability to be easily incorporated into a wide range of products. The powder form ensures uniform distribution of minerals in various food applications, which is crucial for maintaining consistency and quality in products like fortified cereals, beverages, and nutritional supplements. Powdered minerals have a longer shelf life and are more stable compared to granules, which makes them ideal for mass production in the food processing industry. The convenience of handling, storage, and transportation further drives the dominance of powdered mineral enrichment ingredients in Japan, particularly in sectors that require large-scale, efficient production processes.

Zinc accounts for 28.40% of the demand for mineral enrichment ingredients in Japan. Zinc is an essential micronutrient that plays a critical role in several physiological functions, including immune system support, wound healing, and protein synthesis. As health awareness continues to rise, the demand for zinc-enriched products has increased, especially in fortified foods and supplements. Zinc is commonly added to a variety of food products, such as breakfast cereals, dairy products, and ready-to-eat meals, to enhance their nutritional value. The rise in consumer preference for functional foods and the increasing focus on micronutrient deficiencies have further fueled the demand for zinc. With its proven health benefits and versatility, zinc continues to dominate the industry for mineral enrichment ingredients in Japan.

The food industry holds 42.3% of the demand for mineral enrichment ingredients in Japan. This is primarily driven by the increasing consumer demand for fortified food products that offer enhanced nutritional benefits. As consumers seek healthier and more nutrient-dense options, the food industry plays a central role in incorporating mineral enrichment into products such as ready-to-eat meals, breakfast cereals, and dairy. The growing trend towards functional foods, which are formulated to improve health or prevent disease, has contributed to the high demand for enriched food products. The aging population in Japan, along with rising health awareness, has increased the consumption of foods fortified with essential minerals like zinc, calcium, and magnesium. As the demand for healthier, more convenient food options continues to grow, the food industry remains the largest end-use sector for mineral enrichment ingredients in Japan.

Mineral enrichment ingredients such as calcium, magnesium, zinc and iron-are being incorporated into functional foods, beverages, and nutritional products. Key drivers include the strong cultural focus on health and longevity, high uptake of fortified and “food‑with‑function” products, and the desire for clean‑label, natural nutrient solutions. Restraints include strict regulatory requirements for fortification and health claims, formulation challenges related to taste, stability and compatibility with existing products, and relatively limited growth in younger demographics compared with emerging industries.

Japan’s demand is growing because manufacturers are under pressure to cater to older consumers who frequently seek nutritional support for bone health, metabolism, and immunity. The functional‑food regulatory framework enables products with designated nutrient functions, making mineral fortification a viable strategy. Food and beverage companies are incorporating mineral‑enriched variants such as fortified milk alternatives, beverages, snacks and meal replacements to differentiate. Consumer awareness of micronutrient deficiencies and desire for everyday nutritional support fuels uptake of enrichment ingredients across mainstream product lines rather than niche supplements.

Technological innovations are enabling better performance, formulation flexibility and broader use of mineral enrichment ingredients in Japan. Ingredient suppliers are developing high‑bioavailability mineral salts (e.g., chelated forms), micronised powders that mix seamlessly into beverages or bars, and coatings or encapsulations that mask metallic taste and improve stability. These advances make it easier for Japanese manufacturers to integrate mineral enrichment without compromising flavour, texture or shelf‑life. Innovations in plant‑based and vegan mineral sources support clean‑label positioning, enabling brands to align with consumer trends around natural and functional nutrition.

A major barrier is the regulatory environment: products carrying specific health claims must satisfy stringent designations and evidence under Japanese food‑function law, which raises compliance cost and complexity. Formulation hurdles remain: adding minerals can affect taste, texture, colour or solubility, especially in high‑quality ingredients or beverages, making reformulation costly or time‑consuming. Also, cost pressures exist: premium mineral forms or speciality blends tend to cost more than standard ingredients, which may reduce margin for processors or limit use to premium products. Finally, demographic trends (with a relatively stable or shrinking younger population) may limit long‑term volume growth compared with younger‑skewed industrys.

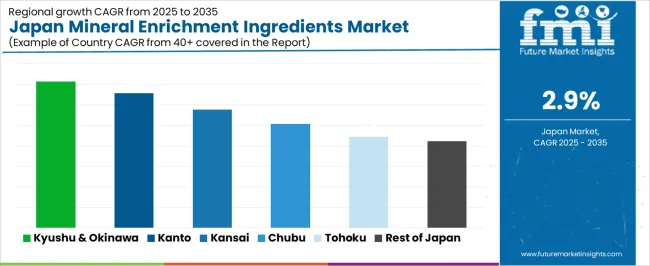

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.6% |

| Kanto | 3.3% |

| Kinki | 2.9% |

| Chubu | 2.5% |

| Tohoku | 2.2% |

| Rest of Japan | 2.1% |

The demand for mineral enrichment ingredients in Japan is growing across various regions, with Kyushu & Okinawa leading at a 3.6% CAGR. This growth is driven by increasing consumer demand for healthier, nutrient-enriched food products. Kanto follows at 3.3%, supported by the region’s strong food manufacturing and retail sectors. Kinki records a 2.9% CAGR, while Chubu experiences a 2.5% CAGR, driven by steady growth in food production and wellness trends. Tohoku and the Rest of Japan show slower but steady growth at 2.2% and 2.1%, respectively, as smaller regions adopt more nutrient-enriched food solutions.

Kyushu & Okinawa is experiencing the highest demand growth for mineral enrichment ingredients in Japan, with a 3.6% CAGR. The region's growing health-conscious population and increasing focus on wellness are key factors driving the demand for nutrient-dense food products. Kyushu, with cities like Fukuoka, has seen a rise in health food trends, including plant-based diets and functional foods, which has created a greater need for enriched ingredients to support consumer health goals.

The food manufacturing sector in Kyushu & Okinawa is also evolving to meet the rising demand for fortified foods and beverages. As consumers in the region seek foods that offer additional health benefits, such as enhanced minerals and vitamins, the use of mineral enrichment ingredients is becoming more common. With an increasing awareness of the importance of nutrition and a focus on maintaining a healthy lifestyle, the demand for mineral enrichment ingredients in the region is expected to remain strong.

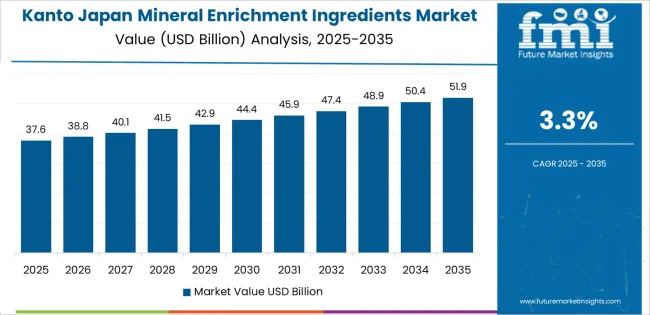

Kanto is seeing strong demand for mineral enrichment ingredients with a 3.3% CAGR. As Japan’s industrial and commercial hub, Kanto, particularly Tokyo, has a large consumer base that is increasingly focused on health and wellness. The region's food manufacturing and retail sectors are adopting more nutrient-enriched products to meet the growing demand for healthier, functional foods. Consumers in Kanto are more inclined toward foods that provide added nutritional benefits, which is driving the adoption of mineral enrichment ingredients in food production.

Kanto’s focus on innovation in food technology and consumer demand for clean-label, nutrient-rich products is further driving this growth. As the region’s food industry continues to adapt to changing consumer preferences, the incorporation of enriched ingredients into mainstream and niche food products is likely to continue, supporting steady growth in demand.

Kinki, including cities like Osaka and Kyoto, is experiencing steady growth in the demand for mineral enrichment ingredients, with a 2.9% CAGR. The region’s strong manufacturing base and focus on functional foods are key drivers of this demand. Kinki has a well-established food production sector, and as health trends gain momentum, there is an increasing focus on developing foods with added nutritional value. The adoption of mineral enrichment ingredients is becoming more common in food products aimed at improving health and wellness.

The Kinki region has a growing demand for natural and clean-label products, which has led to an increased use of mineral-enriched ingredients. As consumers continue to prioritize health and nutrition in their diets, the demand for fortified food and beverages will continue to drive the use of mineral enrichment ingredients. The region’s investment in food technology and innovation in nutritional products will ensure the continued growth of this trend.

Chubu is seeing moderate growth in the demand for mineral enrichment ingredients, with a 2.5% CAGR. The region's strong industrial and manufacturing sectors, particularly in automotive and food production, are contributing to the steady rise in demand. Chubu’s food industry is adopting more advanced ingredients as consumers look for healthier food options that offer additional nutritional benefits. As more food manufacturers in Chubu invest in the development of functional foods and fortified products, the use of mineral enrichment ingredients is increasing.

Chubu’s growing focus on improving food production methods and adopting healthier product formulations is contributing to the demand for enriched ingredients. While growth is slower than in regions like Kyushu & Okinawa, Chubu is experiencing steady growth as the region responds to consumer demand for healthier, nutrient-dense foods. As the food manufacturing sector continues to innovate and adapt to these trends, the demand for mineral enrichment ingredients will continue to rise.

Tohoku is experiencing steady growth in the demand for mineral enrichment ingredients, with a 2.2% CAGR. The region’s food and agricultural sectors are gradually adopting more advanced and nutritious food ingredients to meet the growing health-conscious consumer base. While Tohoku is more rural compared to other regions, there is an increasing focus on improving food quality and nutritional content to support local and national health trends.

The demand for mineral-enriched food products in Tohoku is also being driven by the growing popularity of functional foods and beverages that support overall health and well-being. As more businesses and consumers in the region focus on improving their nutritional intake, the adoption of mineral enrichment ingredients will continue to grow, although at a slower pace compared to urbanized regions.

The Rest of Japan, which includes rural and smaller regions, is seeing moderate growth in the demand for mineral enrichment ingredients, with a 2.1% CAGR. While the growth rate in these areas is slower, there is a noticeable shift toward healthier, nutrient-enriched food options. As smaller regions modernize their food production and manufacturing sectors, the adoption of mineral-enriched ingredients is gradually increasing.

The ongoing focus on improving infrastructure and food technology in these regions, as well as the increasing awareness of health and wellness, is contributing to the steady rise in demand for mineral enrichment. As the Rest of Japan continues to invest in sustainable and functional food production, the demand for mineral enrichment ingredients will continue to grow, albeit at a more moderate pace than in other regions.

The demand for mineral enrichment ingredients in Japan is increasing steadily as consumers place greater emphasis on wellness, nutrition, and functional foods. Japanese food and beverage manufacturers are incorporating mineral additive such as calcium, magnesium, iron, and zinc into a wide range of products including snacks, dairy alternatives, and sports nutrition. These ingredients appeal to an aging population, health‑conscious younger consumers, and brands seeking to differentiate offerings in the crowded domestic industry.

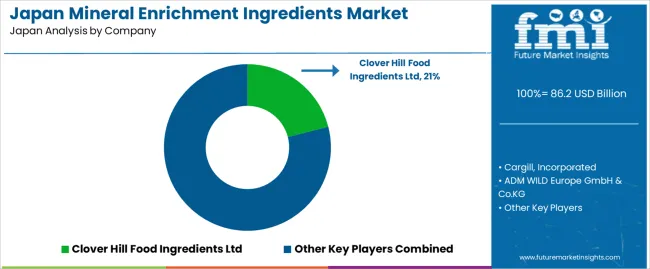

In the Japanese demand landscape, Clover Hill Food Ingredients Ltd commands approximately 21.0% of the share, reflecting its strong network and specialized supply of mineral enrichment solutions across Japan. Other key companies supporting demand include Cargill, Incorporated, ADM WILD Europe GmbH & Co.KG, Nestlé, and Wilmar International Limited, all of which supply mineral fortification technology, premixes, and support for Japanese formulators aiming to enhance products with added nutrition.

Several factors are driving the uptake of mineral enrichment ingredients in Japan: rising interest in preventive healthcare, the need for fortified nutrition for older adults, and the growth of functional food segments. In addition, stringent quality standards and advanced manufacturing capabilities in Japan mean that ingredient suppliers must offer high‑purity, bioavailable mineral solutions with minimal sensory impact. While cost pressures and regulatory labeling requirements present challenges, the overall outlook for mineral enrichment ingredients remains robust in Japan, with steady growth expected as manufacturers continue to meet evolving consumer and normative demands.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Form | Powder, Granule |

| Ingredient Type | Zinc, Sodium, Potassium, Calcium, Phosphorous, Magnesium |

| End Use | Food Industry, Dairy, Bakery & Confectionery, Breakfast Cereals, Meat & Fish, Ready-to-eat Meals |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Clover Hill Food Ingredients Ltd, Cargill, Incorporated, ADM WILD Europe GmbH & Co.KG, Nestlé, Wilmar International Limited |

| Additional Attributes | Dollar sales by form, ingredient type, and end-use categories, regional trends, competitive landscape, and innovations in mineral enrichment ingredients in Japan. |

The global demand for mineral enrichment ingredients in Japan is estimated to be valued at USD 86.2 billion in 2025.

The demand for mineral enrichment ingredients in Japan is projected to reach USD 114.1 billion by 2035.

The demand for mineral enrichment ingredients in Japan is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in Japan are powder and granule.

In terms of ingredient type, zinc segment is expected to command 28.4% share in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA