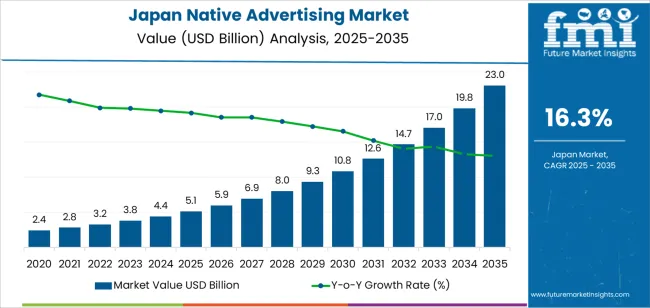

The demand for native advertising in Japan is projected to grow from USD 5.1 billion in 2025 to approximately USD 22.9 billion by 2035, reflecting a CAGR of 16.3%. This robust growth will be driven by the increasing adoption of native advertising across various digital platforms, particularly in response to rising consumer demand for more personalized and non-intrusive advertising experiences. As Japan’s digital advertising landscape continues to evolve, native advertising is expected to gain significant traction due to its ability to blend seamlessly with content, offering brands more engaging and effective ways to reach audiences. The ongoing trend towards digital transformation, combined with the growing reliance on social media, mobile platforms, and content-driven advertising, will further boost the demand for native advertising solutions.

The native advertising industry in Japan will benefit from advancements in artificial intelligence (AI) and data analytics, which enable more precise targeting and content personalization. As advertisers continue to seek innovative ways to connect with consumers, native ads will become a preferred choice due to their ability to integrate more naturally within digital content. As Japanese consumers increasingly prioritize ad experiences that are relevant, non-disruptive, and aligned with their interests, native advertising will continue to rise in prominence across various sectors, including e-commerce, entertainment, and media.

From 2025 to 2030, the industry will grow from USD 5.1 billion to USD 9.3 billion, adding USD 4.2 billion in value. This phase is expected to account for a significant portion of the total growth, driven by the increasing integration of native advertising across mobile apps, social media platforms, and content websites. The growing adoption of native ad formats, such as sponsored articles, social media posts, and video content, will continue to drive this phase. As advertisers recognize the effectiveness of native ads in engaging users, their adoption will accelerate, particularly in sectors focused on customer acquisition and brand building.

From 2030 to 2035, the industry will grow from USD 9.3 billion to USD 22.9 billion, contributing an additional USD 13.6 billion in value. This period will be marked by the further maturation of native advertising, with advanced targeting capabilities and the rise of new ad formats that integrate seamlessly with immersive media, such as video and interactive content. As digital platforms evolve and new technologies such as augmented reality (AR) and virtual reality (VR) become more mainstream, native advertising will continue to expand in scope, allowing for deeper consumer engagement. Despite a more competitive advertising environment, demand will remain strong, driven by the ongoing need for more relevant and less disruptive advertising solutions.

| Metric | Value |

|---|---|

| Demand for Native Advertising in Japan Value (2025) | USD 5.1 billion |

| Demand for Native Advertising in Japan Forecast Value (2035) | USD 22.9 billion |

| Demand for Native Advertising in Japan Forecast CAGR (2025 to 2035) | 16.3% |

The demand for native advertising in Japan is rising as brands and advertisers increasingly favour formats that integrate seamlessly into digital platforms and user‑experiences. Native ads such as in‑feed content, sponsored stories, and recommendation widgets better match the surrounding digital environment and tend to engage audiences more effectively than traditional banners. With mobile usage high and consumers spending more time on content platforms, the appeal of native advertising formats has grown significantly.

Changes in consumer behaviour are also contributing to this trend. Japanese users increasingly rely on social media, mobile apps, and streaming platforms, which provide new avenues for native ad placements with contextual relevance. Advertisers are shifting budgets toward these interactive and less intrusive formats to maintain engagement and conversion rates. The growth in demand is supported by the expansion of digital content consumption, rising influencer promoting, and changing preferences toward personalised ad experiences.

Technological advancements in targeting, analytics, and programmatic ad‑delivery systems are further driving uptake of native advertising in Japan. Dynamic creative optimisation, artificial‑intelligence‑based audience segmentation, and cross‑platform tracking enable advertisers to deliver more relevant native content across devices. As digital promoting continues to evolve and more brands allocate spend toward performance‑driven formats, the demand for native advertising in Japan is projected to increase substantially through 2035.

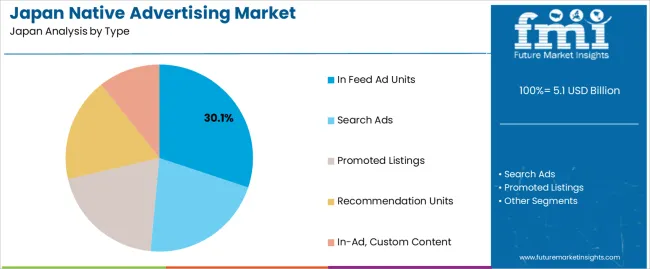

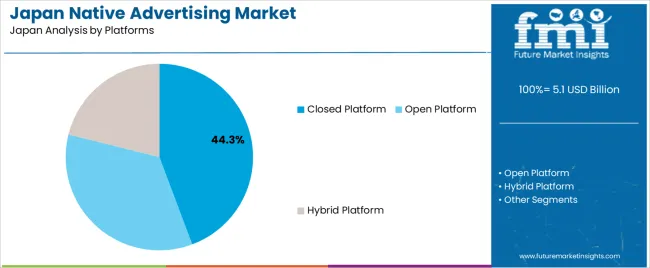

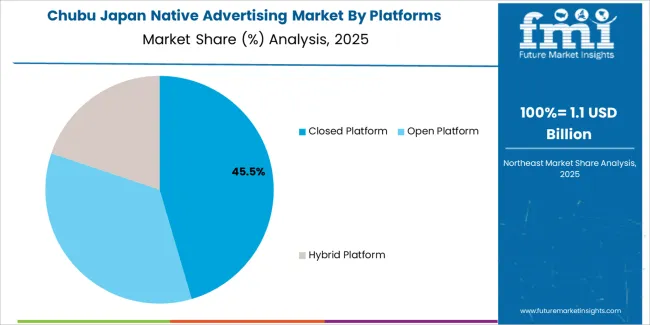

Demand for native advertising in Japan is segmented by type and platform. By type, demand is divided into in-feed ad units, search ads, promoted listings, recommendation units, and in-ad custom content, with in-feed ad units holding the largest share. In terms of platforms, the industry is categorized into closed platforms, open platforms, and hybrid platforms, with closed platforms leading the demand. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

In-feed ad units’ account for 30% of the demand for native advertising in Japan. These ad units are integrated into the content stream of a website or social media platform, making them appear as part of the organic content that users are already consuming. In-feed ads are highly effective at capturing the attention of users because they do not interrupt the user experience, blending seamlessly with other content.

The demand for in-feed ad units is driven by their ability to offer a less intrusive advertising experience while still delivering highly targeted and relevant messages to users. These ads work particularly well on social media platforms and news websites, where users expect a continuous flow of content. As consumer behavior shifts toward ad avoidance and more personalized digital experiences, in-feed ads are gaining popularity for their ability to deliver content in a non-disruptive way, increasing user engagement. As native advertising continues to evolve, in-feed ad units will likely remain the leading format due to their effectiveness in engaging users and driving conversions.

Closed platforms account for 44.3% of the demand for native advertising in Japan. These platforms, such as social media networks (e.g., Facebook, Instagram, Twitter), offer controlled environments where advertisers can target users based on specific demographics, interests, and behaviors. The demand for native advertising on closed platforms is driven by the large, highly engaged audiences that these platforms attract, as well as the detailed targeting options that allow for highly personalized advertising experiences.

The popularity of closed platforms is further fueled by their ability to deliver more relevant, personalized ad content to users, which enhances the effectiveness of native ads. These platforms provide advertisers with detailed metrics and insights, allowing them to measure the performance of their campaigns and optimize their strategies accordingly. As closed platforms continue to dominate the digital advertising landscape in Japan, particularly on mobile devices, the demand for native advertising on these platforms is expected to remain strong, ensuring their position as a dominant force in the industry.

Native advertising formats blend with editorial, social or app environments and offer a better experience than traditional display ads. Key drivers include high smartphone and internet penetration, mobile‑first consumer behaviour, growth in e‑commerce and social media channels, and the need for contextual, content‑aligned ad approaches in a media‑saturated environment. Restraints include regulatory pressure around labeling of “sponsored content”, the need for culturally‑sensitive localisation of creative, measurement and attribution challenges in differentiating native formats from regular editorial, and competition from other digital formats (e.g., video, programmatic display) which may capture budgets first.

In Japan, demand is growing because digital consumption continues to accelerate consumers spend more time on mobile, in‑app environments and on social feeds where native ad formats are particularly effective. Japanese audiences respond better to ads that match the look and feel of organic content and avoid being intrusive, which makes native advertising an attractive avenue for brands. With brand‑owners looking to build storytelling, engagement and integration rather than just clicks, native offers an opportunity to deliver messages in context, across multiple touchpoints. The growth of mobile commerce, influencer content, and content‑platform ecosystems in Japan further supports the shift toward native formats that merge advertising with user experience.

Technological innovations are bolstering demand for native advertising in Japan by enhancing targeting, measurement and creative flexibility. Advances include AI‑driven optimisation of native ad placement, programmatic buying of in‑feed and recommendation‑widget formats, improved analytics for attribution across devices, and creative formats that adapt to user context (mobile, app, social). The integration of native ads with‑in content‑discovery engines and content platforms (including video and in‑app) means that brands can deploy native campaigns at scale and with improved performance insight. These innovations make native advertising more effective, measurable and interconnected with broader digital‑promoting stacks, supporting its growing uptake in Japan.

One major barrier is the need to ensure proper disclosure and maintain trust when native ads too closely mimic editorial content without clear distinction, consumer backlash or regulatory issues can follow. Another challenge is measuring ROI, because native formats are content‑integrated, tracking direct performance and comparing with traditional formats remains complex. Localisation is also critical Japanese language, culture and media habits require ads that fit very specific aesthetic and behavioural norms, raising creative cost. Competition for ad budgets remains intense, other formats like video‑pre‑roll, influencer promoting or programmatic display may attract investment and slow the shift to native in some brands.

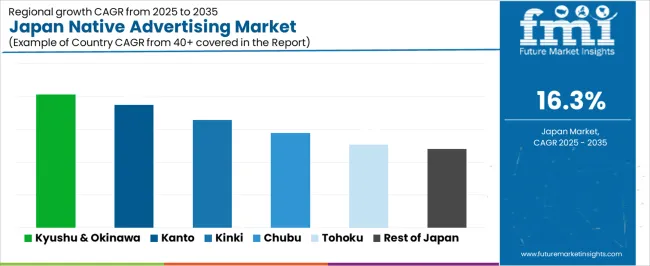

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 20.3% |

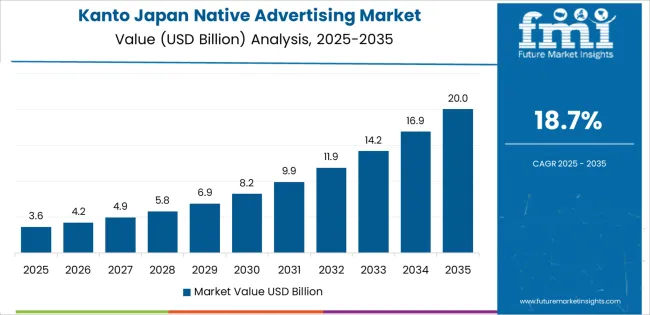

| Kanto | 18.7% |

| Kinki | 16.4% |

| Chubu | 14.5% |

| Tohoku | 12.7% |

| Rest of Japan | 12.0% |

The demand for native advertising in Japan is growing across all regions, with Kyushu & Okinawa leading at a 20.3% CAGR. This growth is driven by the increasing adoption of digital advertising solutions and a growing focus on content promoting. Kanto follows closely with an 18.7% CAGR, supported by its highly developed digital infrastructure and large consumer base. Kinki shows a 16.4% CAGR, with expanding opportunities in digital media and promoting. Chubu experiences a 14.5% CAGR, driven by the region's growing tech industry and digital adoption. Tohoku and the Rest of Japan show more moderate growth at 12.7% and 12.0%, respectively, as businesses in these regions embrace native advertising strategies to enhance customer engagement.

Kyushu & Okinawa is experiencing the highest demand for native advertising in Japan, with a 20.3% CAGR. The region’s digital transformation, particularly in cities like Fukuoka and Naha, is a key driver of this trend. As businesses in Kyushu & Okinawa continue to shift towards digital-first promoting strategies, the adoption of native advertising has surged. These regions are particularly receptive to more personalized and less intrusive forms of digital advertising, which is at the core of native advertising.

The growth of local digital media platforms and the increasing importance of content-driven promoting strategies in the region are also contributing to the rise in native advertising. Furthermore, the tourism industry in Okinawa is leveraging native advertising to target international and domestic visitors more effectively. As regional businesses continue to embrace native advertising to connect with their target audiences in a more organic way, Kyushu & Okinawa is expected to maintain its leadership in this sector.

Kanto is seeing strong growth in demand for native advertising, with an 18.7% CAGR. The region, particularly Tokyo, is Japan's hub for digital promoting, e-commerce, and technology. The concentration of digital media companies, advertising agencies, and large consumer bases in Kanto makes it a prime region for the growth of native advertising. Businesses in Kanto are increasingly adopting content promoting strategies that focus on providing value to their target audiences through seamless, relevant, and engaging advertising content.

The rise in mobile internet usage and the growing use of social media platforms in the region are contributing to the shift toward more integrated, non-disruptive advertising models, such as native advertising. As brands continue to seek innovative ways to engage consumers and build trust, the demand for native advertising in Kanto is expected to continue growing. The region’s digital infrastructure and consumer behavior make it an ideal environment for the continued expansion of native advertising strategies.

Kinki is experiencing steady demand for native advertising, with a 16.4% CAGR. The region's strong digital presence, particularly in cities like Osaka, is supporting the growth of digital advertising solutions, including native advertising. With a large number of businesses in the manufacturing, retail, and technology sectors, Kinki is increasingly turning to content-driven promoting strategies to engage customers in a more authentic and less intrusive way.

The increasing importance of e-commerce and mobile advertising in the region has driven demand for native advertising, as businesses seek to integrate their promoting efforts across multiple digital platforms. As consumers in Kinki become more digital-savvy and demand more relevant, personalized content, native advertising has become an attractive option for businesses looking to connect with their audiences. With a growing focus on content promoting and the need for subtler advertising techniques, Kinki will continue to experience steady growth in native advertising demand.

Chubu is seeing moderate growth in demand for native advertising, with a 14.5% CAGR. The region, which is known for its strong industrial and manufacturing sectors, is increasingly adopting digital advertising solutions to reach consumers in a more targeted and engaging way. Cities like Nagoya are becoming key centers for digital transformation, with local businesses leveraging native advertising strategies to promote their products and services.

The rise in e-commerce and the growing importance of content promoting in Chubu is contributing to the increasing demand for native advertising. Businesses in the region are using native ads to enhance brand visibility and improve customer engagement, particularly in industries like automotive, technology, and retail. As more companies in Chubu embrace the power of digital advertising and content-driven promoting, the region is expected to continue experiencing growth in the adoption of native advertising.

Tohoku is experiencing moderate growth in demand for native advertising, with a 12.7% CAGR. While the region has fewer large urban centers compared to other parts of Japan, there is a growing interest in digital promoting solutions as businesses in Tohoku seek to modernize their promoting strategies. As regional industries, particularly agriculture and tourism, adopt more digital-first approaches, native advertising has become an effective way to connect with potential customers in a more organic and non-disruptive manner.

Tohoku's increasing focus on regional digital infrastructure and online promoting strategies is driving the rise of native advertising. Local businesses are recognizing the value of content-driven advertising in promoting their products and services to a broader audience. As consumer behavior shifts toward online platforms and digital media, native advertising is becoming an essential tool for businesses in Tohoku looking to enhance customer engagement and drive growth.

The Rest of Japan is experiencing moderate growth in demand for native advertising, with a 12.0% CAGR. This region, which includes rural areas and smaller urban centers, is increasingly embracing digital advertising strategies as businesses look for ways to engage with their audiences more effectively. As internet usage and digital media consumption rise, native advertising has become an attractive option for businesses in the Rest of Japan looking to connect with customers in a more seamless and engaging way.

The adoption of native advertising in the Rest of Japan is being driven by the growing use of social media, mobile apps, and e-commerce platforms, which offer opportunities for content-driven promoting. As local businesses continue to recognize the potential of digital promoting and the importance of non-intrusive advertising, the demand for native advertising will likely continue to rise. With a growing focus on content promoting and audience engagement, the Rest of Japan will see steady growth in the adoption of native advertising strategies.

Demand for native advertising in Japan is growing as brands shift towards formats that integrate seamlessly with content and mobile‑first consumption. These solutions combine contextual placement, content‑style creative, and programmatic delivery to enable higher engagement and brand safety. With rising smartphone and connected‑device usage, greater e‑commerce activity, and stricter data‑privacy regulations in Japan, native formats are increasingly favoured for reaching consumers in non‑intrusive ways. Nonetheless, challenges such as measurement inconsistency, ad‑fraud risk, and fragmented platform ecosystems remain.

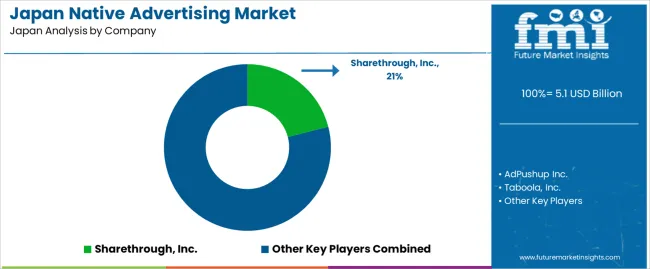

In the Japanese landscape, Sharethrough, Inc. is estimated to command a share of approximately 21.0%. Other significant players include AdPushup Inc., Taboola, Inc., IAB Playbook, Instinctive Inc., and Nativo, Inc. each offering technology platforms, publisher integrations, analytics, and content‑experience tools tailored for Japan’s publishers, advertisers and agencies.

Key drivers in Japan include: high and growing mobile‑internet penetration, growth of e‑commerce and social commerce, demand for more relevant and brand‑safe ad experiences, and regulatory updates (e.g., the Act on the Protection of Personal Information) that are steering advertisers toward contextual formats. Challenges persist, such as: difficulty in standardising attribution across native vs display formats, ensuring transparency with programmatic supply‑chains, and competition from other digital ad formats (video, search, social) which may command larger budgets.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Type | In Feed Ad Units, Search Ads, Promoted Listings, Recommendation Units, In-Ad, Custom Content |

| Platforms | Closed Platform, Open Platform, Hybrid Platform |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Sharethrough, Inc., AdPushup Inc., Taboola, Inc., IAB Playbook, Instinctive Inc., Nativo, Inc. |

| Additional Attributes | Dollar sales by ad type, platform, and regional trends focusing on digital marketing, content-driven advertising, and the growing importance of customized and interactive ad experiences. Trends in closed, open, and hybrid platforms are reshaping the landscape, with a strong shift towards in-feed units, promoted listings, and content-integrated ads across diverse regions. |

The demand for native advertising in Japan is estimated to be valued at USD 5.1 billion in 2025.

The market size for the native advertising in Japan is projected to reach USD 23.0 billion by 2035.

The demand for native advertising in Japan is expected to grow at a 16.3% CAGR between 2025 and 2035.

The key product types in native advertising in Japan are in feed ad units, search ads, promoted listings, recommendation units and in-ad, custom content.

In terms of platforms, closed platform segment is expected to command 44.3% share in the native advertising in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA